Macroeconomic cues were mixed this month. India’s GDP grew by 7.8% in the April-June quarter, as per government data. The official GDP data for the Indian economy for the April-June(Q1) quarter. While the Indian economy showed signs of strength, China is facing an impending recession.

The past six months have brought a stream of bad news for China’s economy: slow growth, record youth unemployment, low foreign investment, weak exports and currency, and a property sector in crisis. US President Joe Biden described the world’s second-largest economy as “a ticking time bomb”, predicting growing discontent in the country.

Telegram channel for details on new deals

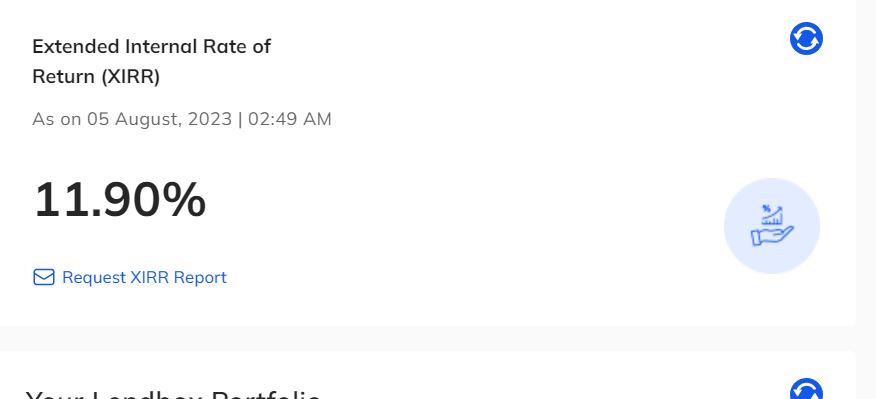

Alternative Investment Portfolio Performance

This month we explored 2 new platforms

- Incred Money

- Alyf

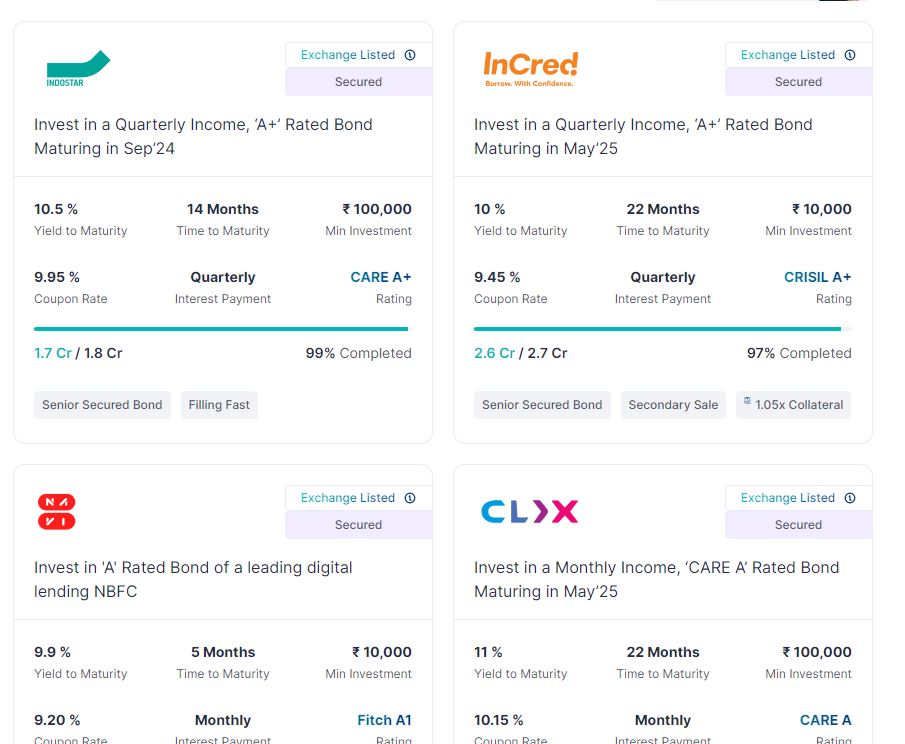

Incred Money

Incred Money is an investment platform focussed on products like bonds and Structured products. It is the first platform in India to introduce Market Linked Debentures for retail investors. The product is ideal for those looking to participate in the market without wanting to take the downside risk of market volatility.

The best feature I liked about the product is that it provides liquidity to investors and thus makes it more attractive.

I have also invested in one bond on Incred Money.

Alyf

Alyf is a platform through which investors can buy fractional holiday homes. The differentiating factor for Alyf is that it focuses on homes and flats rather than commercial properties which means that it would be easy to exit the opportunity at a future date if required. Investors also get timesharing in the properties they purchase. These properties are in holiday destinations like Goa and get good Airbnb revenue!

I will continue to test the platform with limited exposure before allocating a much higher capital.

We are facing a startup winter which can affect some of the deals in the alternative portfolio. To create more information dissemination about deals I encourage people to share their experiences on the Randomdimes forum. You can also create new topics to share opinions and views.

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 13% | 0% |

| Klubworks | 15-17% | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post Tax) | 0% |

| Growpital | 16%(Tax Free) | Blended Yield |

| Leafround | 15-18% | 0% |

| Altifi | 12.50% | 0% |

| Better Invest | 16-18.00% | 0% |

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are per schedule.

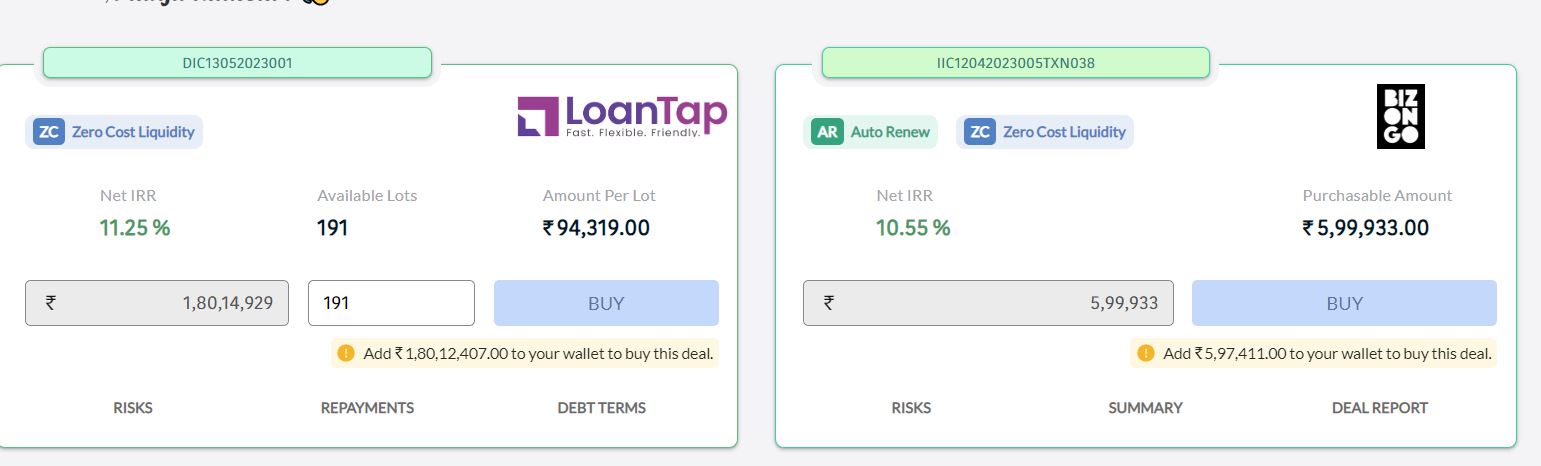

- Invested in Vedika LoanX deal on Grip offering 13%.

- Invested in a Couple of Invoices on Leafround ( Peelworks,

- Received my Bhanix NCD coupon and KNS infra repayment as per schedule.

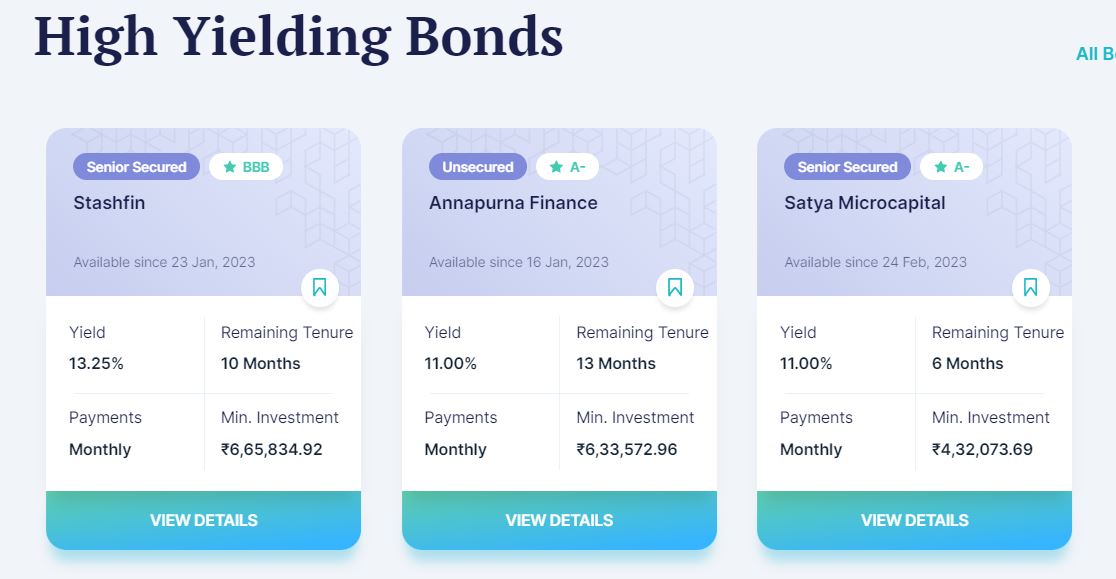

- Invested in Satya Microcapital for 13.25% on Altifi

Grip Bigspoon Update – Grip recently shared an update on a leasing deal that had some repayment pending and the company is going through stress. Below is the excerpt of the deal. Grip has been quite proactive and transparent in handling challenges related to the investment portfolio.

Securitized investment vs. bond

In securitization, the originator packages a pool of loans and assigns his interest therein, including the underlying security, to a bankruptcy remote & tax neutral entity which, in turn, issues securities to investors. The idea of such an exercise is to completely transfer the interest in a pool of loans to the investors.

Securitization allows investors to improve their yields while keeping intact or even improving the quality of investment because :

- Direct investment in a pool of loans and not indirectly through bonds, which means even if the company defaults investor is protected.

- Higher Yield compared to High Rated bonds

- Extra protection through Extra Interest spread and FD etc to make up for any defaults in the pool.

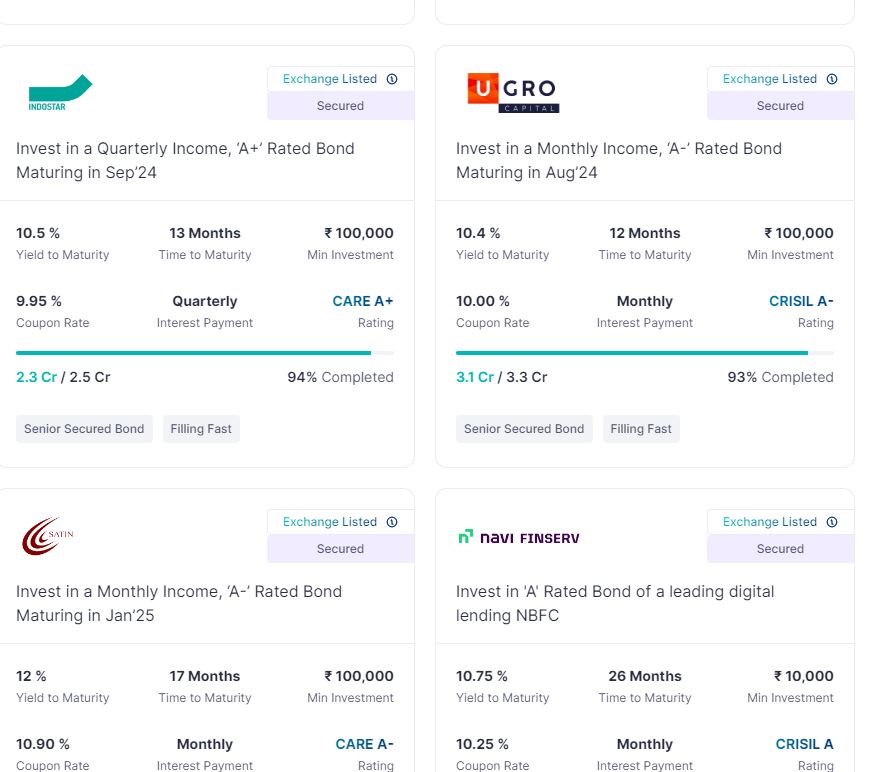

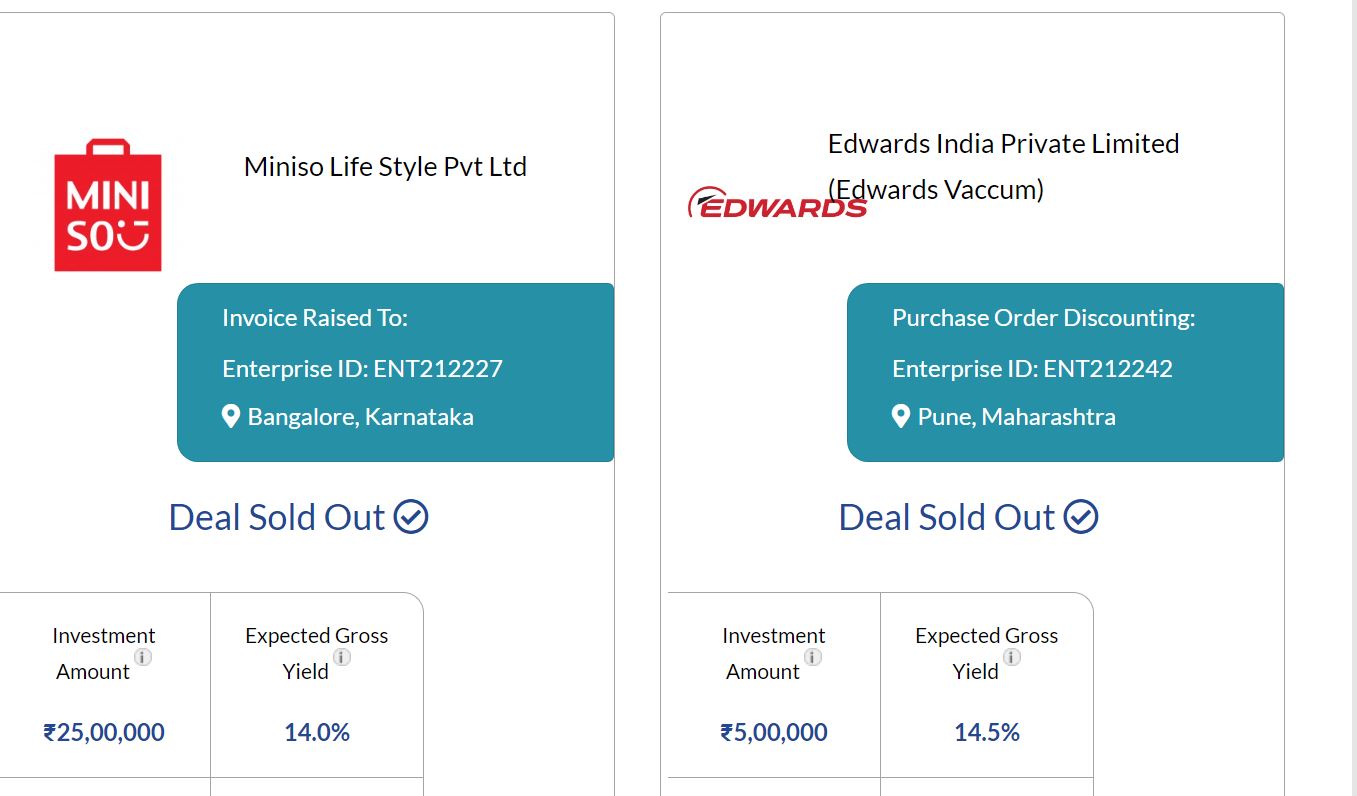

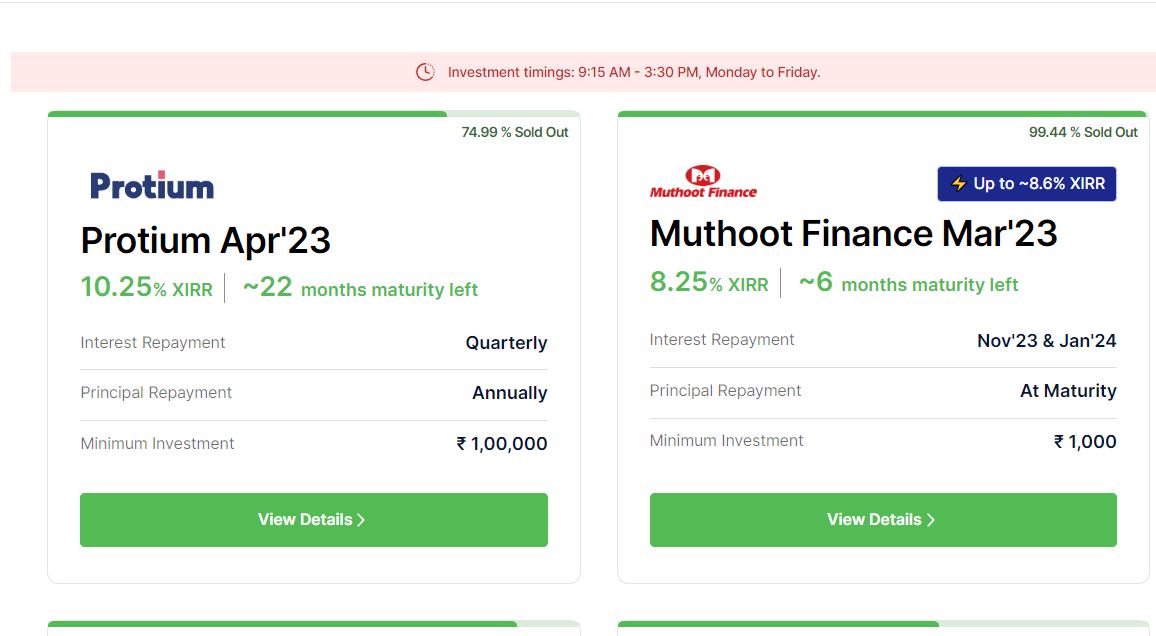

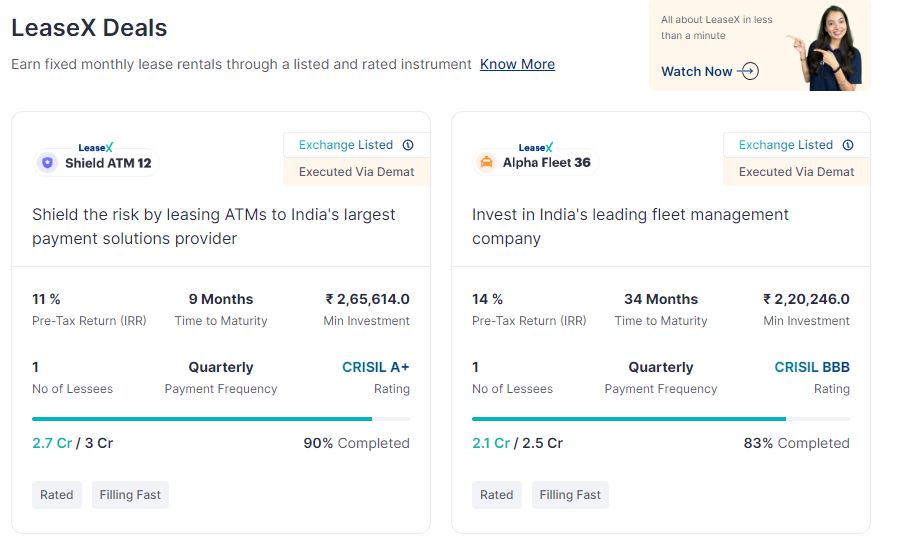

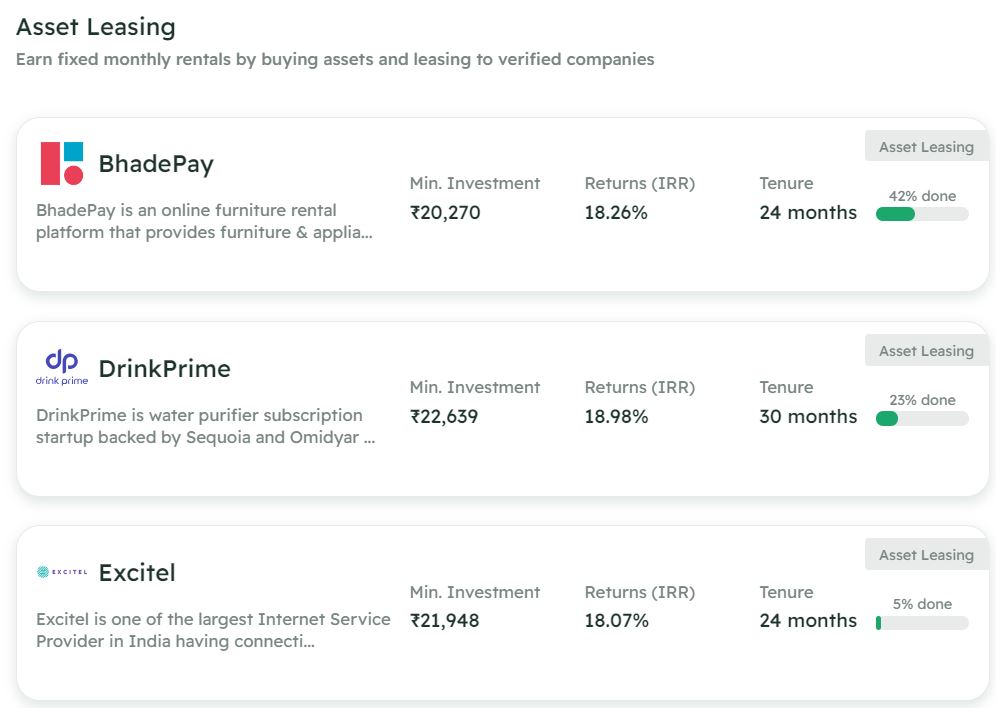

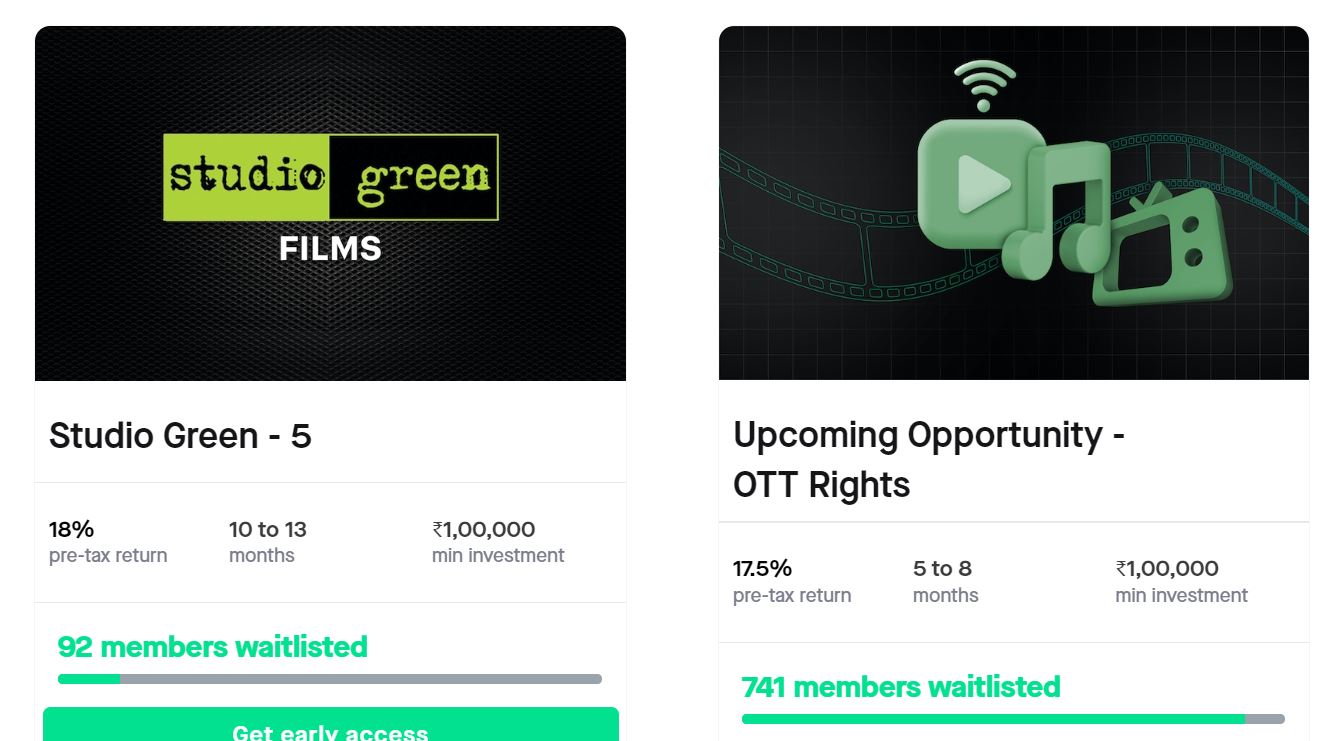

New Deals

Gripinvest

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans | 9-10% | 0% |

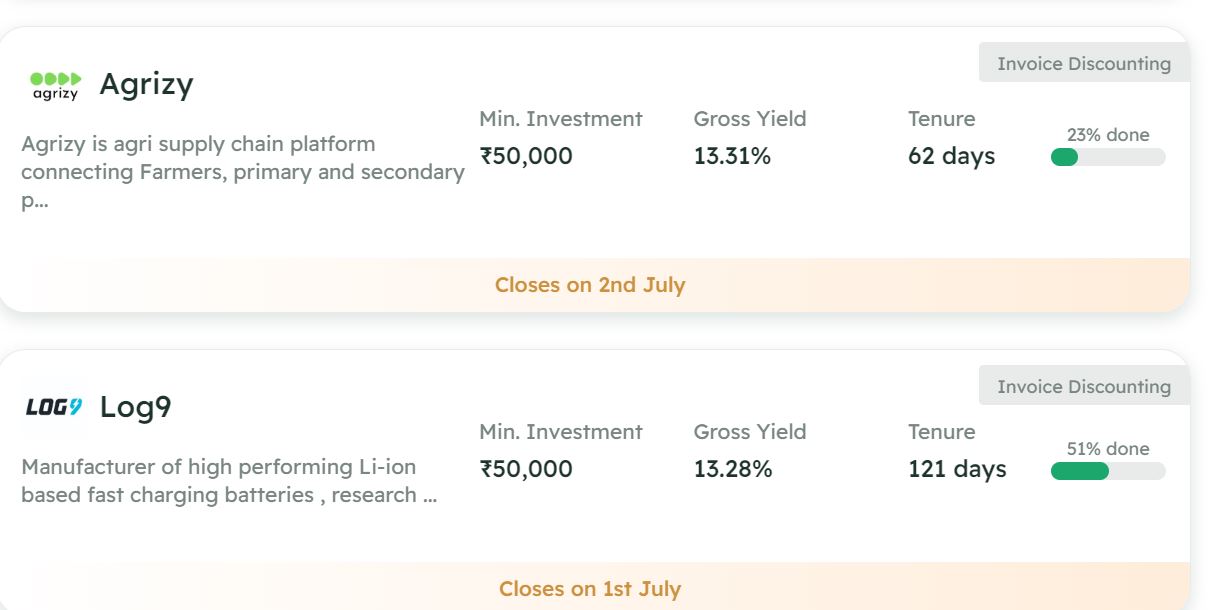

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | paused | Paused |

| KredX | 12% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.9%

- Using Liquiloans/Per Annum to Park Short term capital

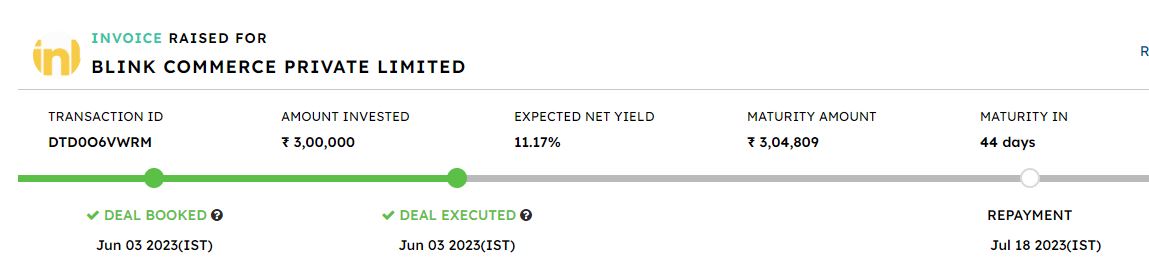

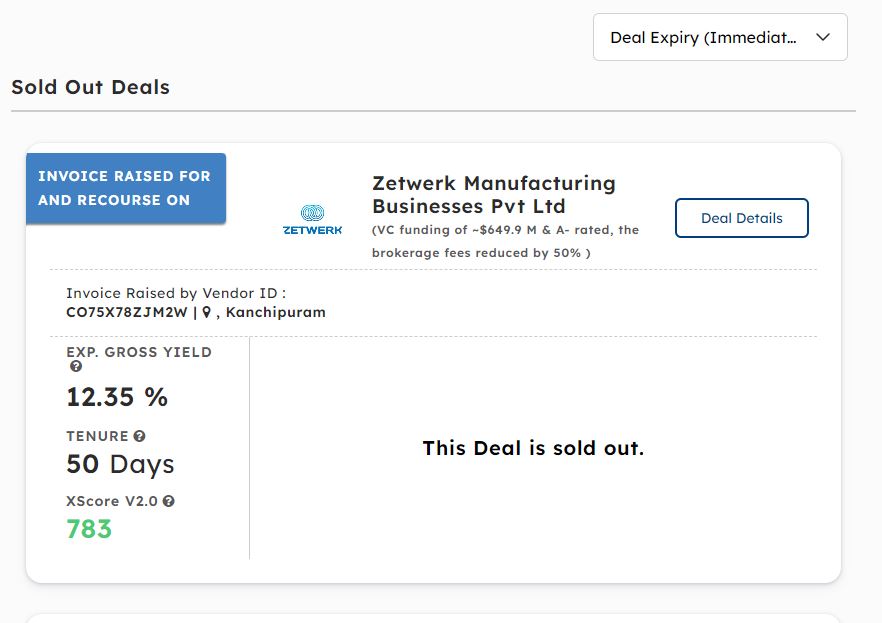

- Blinkit and Indus Tower on Kredx Matured and got repayment before schedule. Investing in Zetwerk .

- Avoid Dunzo deals for invoices as the company going through stress.

- Invested in Log9 on Tradecred

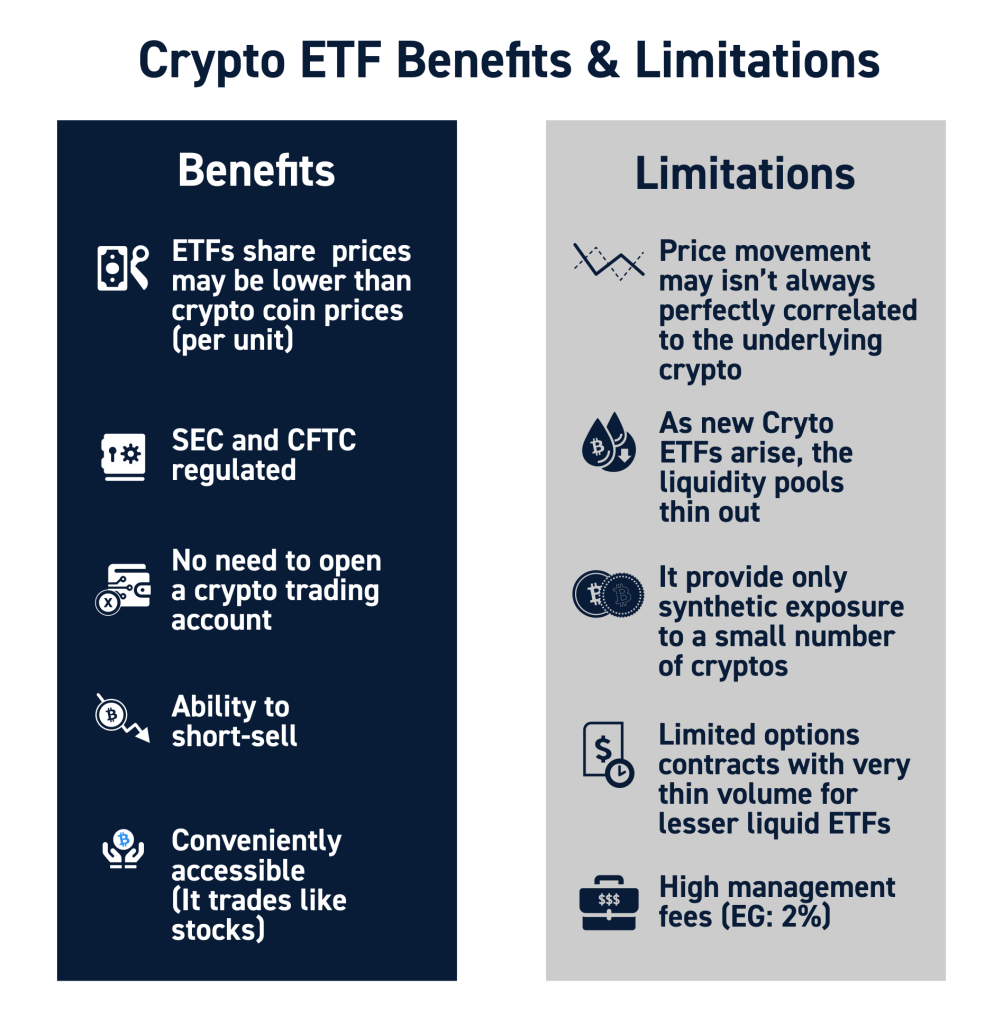

Crypto Investing

Crypto investors would have had a tough time declaring tax due to the numerous TDS deducted for each transaction. It makes more sense to buy and hold in India rather than trade.

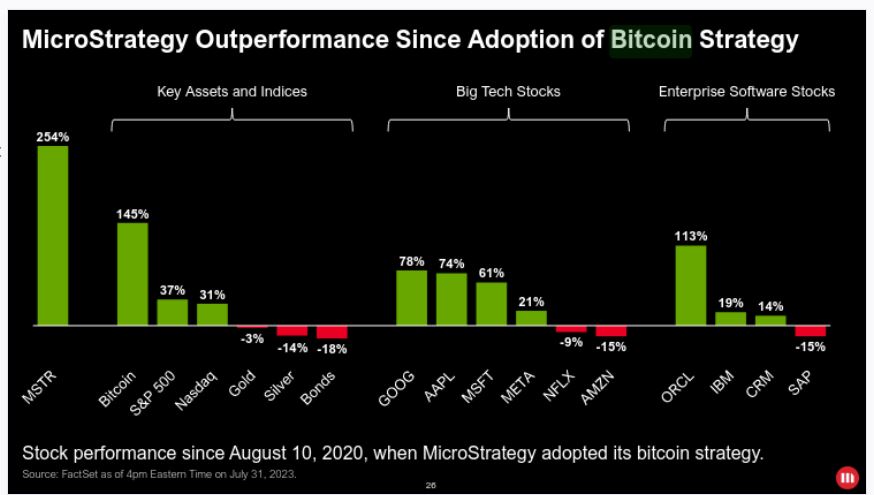

MicroStrategy said that, as of July 31, 2023, it had acquired 152,800 BTC for $4.53 billion or $29,672 per Bitcoin. It is the largest private holding of Bitcoin by any corporate. Bitcoin buying strategy has turned out well for the company as the stock has gone up since the Bitcoin purchase!

You can buy Hardware Wallets on Etherbit as it is highly advised not to keep large amounts on exchanges.

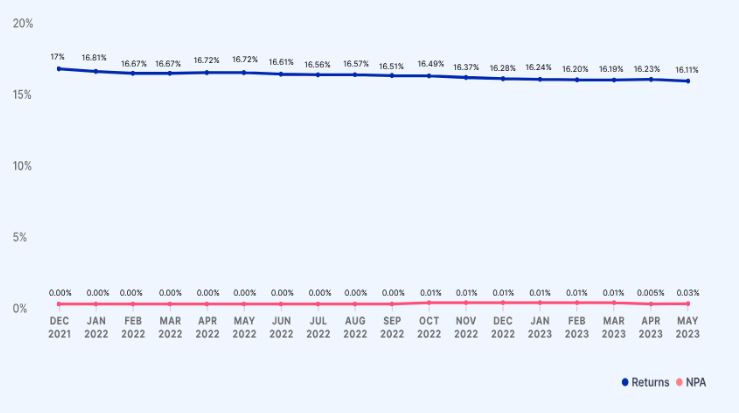

P2P Investment

Current allocation:

- India P2P – 50%

- 12Club – 5%

- I2IFunding- 25%

- Finzy-10%

- Faircent Pool Loan -10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Paused) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.75% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- I have completed 1 year of using IndiaP2P with good performance. I am awaiting an interview with the founder

- I2Ifunding and Finzy have a very low volume of loans

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

Blacklisted Platform- Platform which had poor performance in the past

- Rupeecircle

- Lendenclub

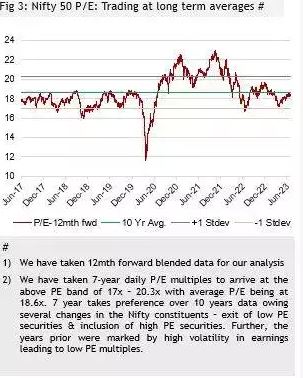

Equity Market

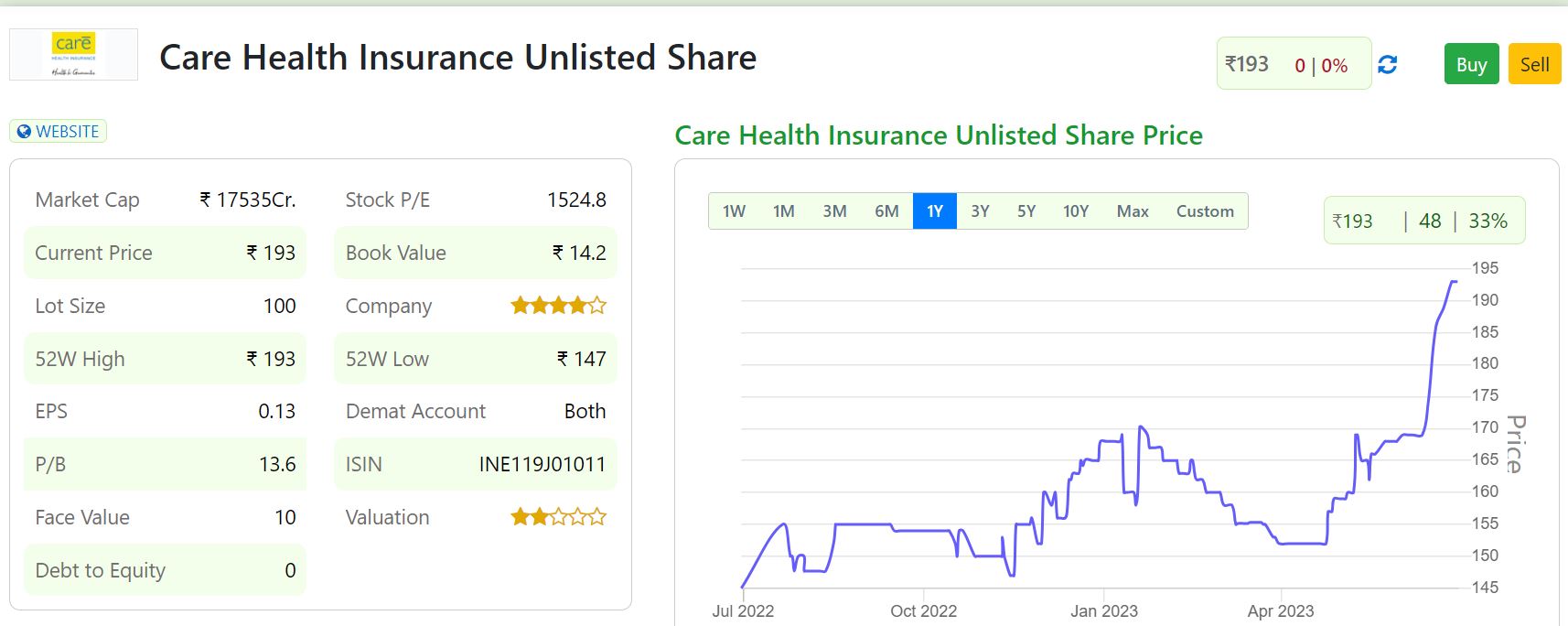

PreIPO Stocks

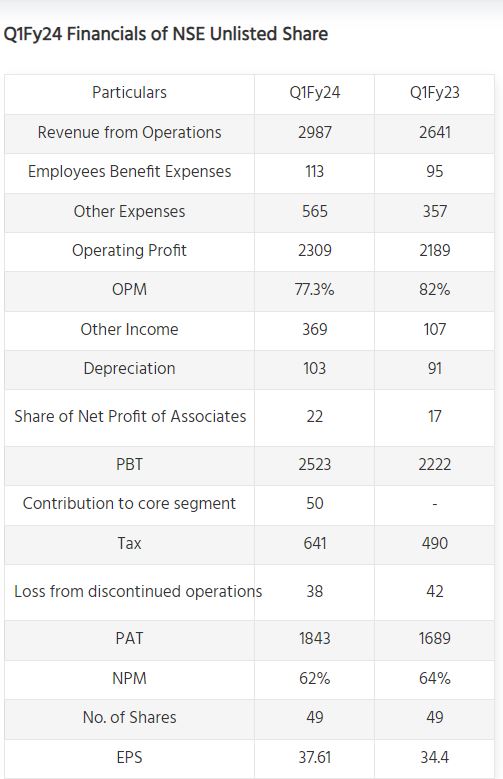

NSE posted a stellar performance this quarter. I feel the only thing stopping NSE’s price from shooting much higher is the litigation for the colocation case which is still not closed.

The current price for NSE has gone over INR 3300-3350 based on the quotes some brokers are offering for a minimum ticket size of 500.

Listed Stocks

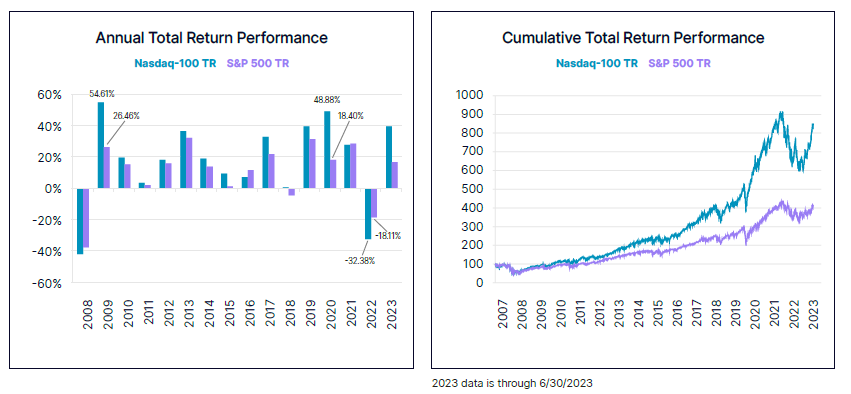

A few sectors which we have invested in the start of this year are more than 30% include

- Nasdaq

- Hangseng

- IT ETF

- Pharma ETF

The broad market has also been very kind. The equity market is full of regrets. If you invest a lot and the market corrects you feel disappointed, if you invest less and the market goes up you feel bad, so a balance approached without reading too much about market behavior is essential.

Other Alternative Investment Assets and Platform Updates

Growpital Investment – The performance of the platform has been satisfactory till now. They have been doing regular meetings with investors along with webinars. I request investors to share their experience of attending their farms etc on the forum, which will help us to develop more confidence on the platform.

Growpital(Promo code GROWRDIMES)

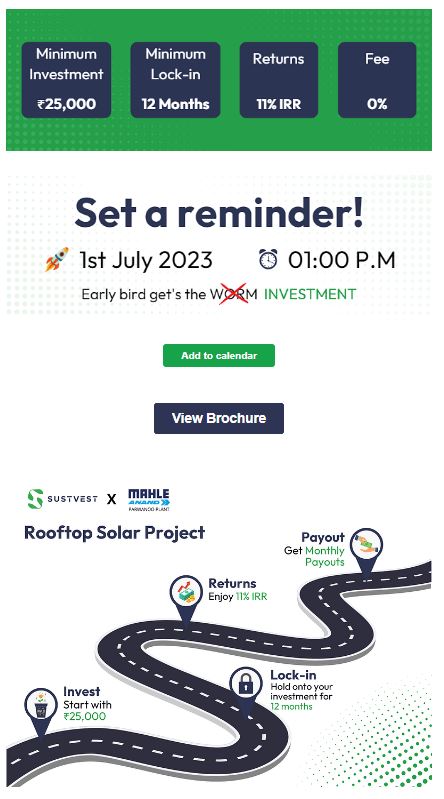

Sustvest Investment – My Sustvest Portfolio has been doing fine and repayment is on time.

Fractional Real Estate Update- My investment in MYRE Capital has been performing as expected. It is now called Yiedlwisex. They Lease rental discounting opportunity backed by real estate is 99% funded.