Multi-asset allocation funds (MAFs) have been around for a while, but they have recently gained popularity as investors seek to diversify their portfolios and reduce risk. MAFs invest in a mix of asset classes, such as equity, debt, and commodities, which can help to reduce volatility and improve risk-adjusted returns.

There are a number of different types of MAFs, each with its own unique investment strategy. Some MAFs are actively managed, while others are passively managed. Some MAFs invest in a static mix of asset classes, while others dynamically adjust their asset allocation based on market conditions.

The benefits of investing in MAFs include:

- Diversification: MAFs can help to reduce risk by investing in a mix of asset classes. This can help to smooth out returns and reduce the likelihood of large losses.

- Tax efficiency: Some MAFs are structured in a way that can be tax-efficient for investors. This is especially important for investors in high tax brackets.

- Professional management: MAFs are typically managed by experienced investment professionals. This can give investors peace of mind knowing that their money is being managed by experts.

Top Multi Asset Funds in the Market

Currently, there are 11 Multi Asset Allocation Funds available in the market, while one is in the new fund offer (NFO) stage. The top funds include

-

Edelweiss Multi Asset Allocation Fund:

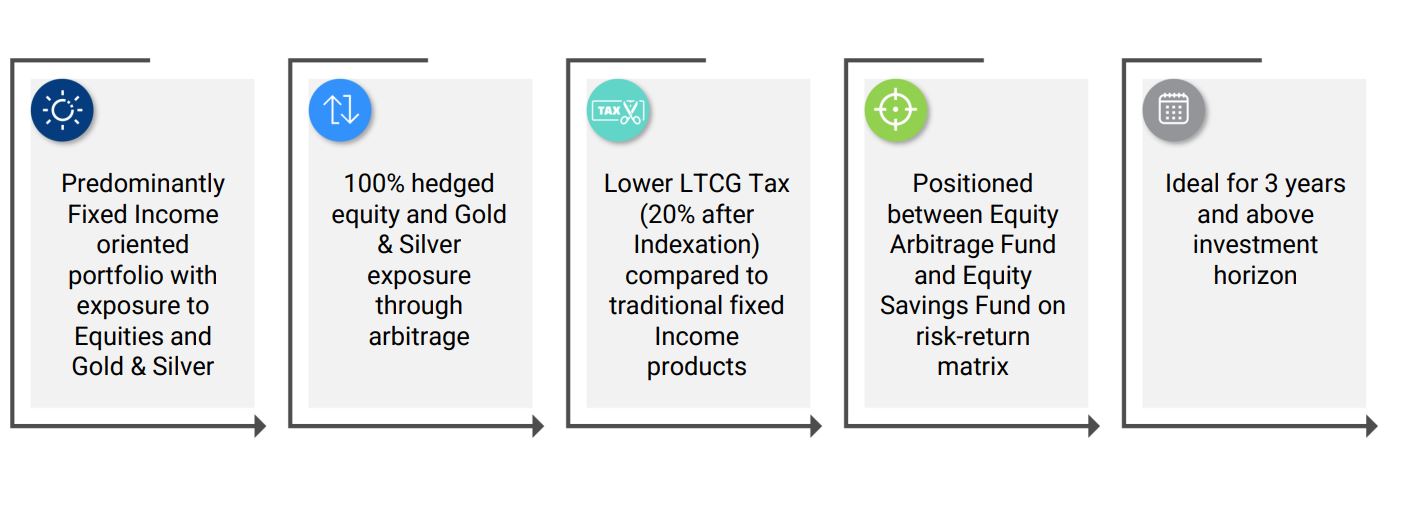

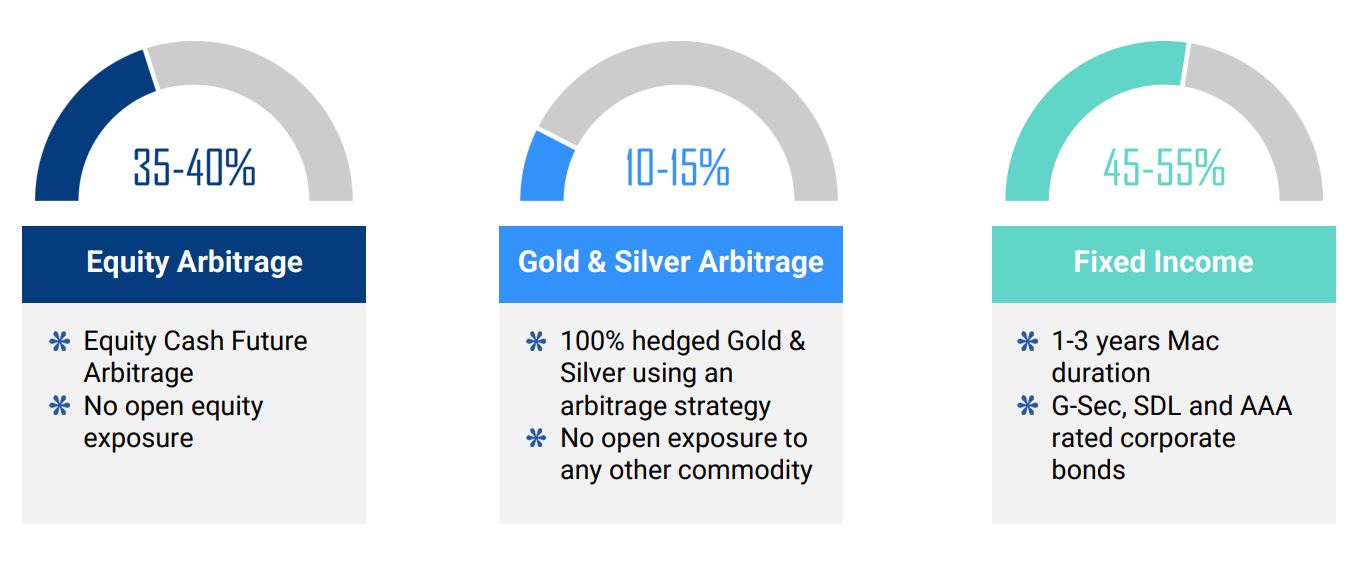

This fund invests in a mix of equity, debt, and commodities, with a target allocation of 45-55% in fixed income, 35-40% in equity arbitrage, and 10-15% in gold and silver arbitrage. The fund’s goal is to generate single-digit returns with moderate risk.

Axis Multi Asset Fund

- This fund invests in a mix of equity, debt, and money market instruments, with a target allocation of 60-70% in equity, 20-30% in debt, and 0-10% in money market instruments. The fund’s goal is to generate long-term capital growth.

ICICI Prudential Multi Asset Fund:

This fund invests in a mix of equity, debt, and money market instruments, with a target allocation of 50-60% in equity, 30-40% in debt, and 0-10% in money market instruments. The fund’s goal is to generate long-term capital growth.

- Franklin India Dynamic Asset Allocation Fund: This fund invests in a mix of equity, debt, and money market instruments, with a target allocation of 50-70% in equity, 20-40% in debt, and 0-10% in money market instruments. The fund’s goal is to generate long-term capital growth.

- Quantum Multi Asset Fund: This fund invests in a mix of equity, debt, and money market instruments, with a target allocation of 60-70% in equity, 20-30% in debt, and 0-10% in money market instruments. The fund’s goal is to generate long-term capital growth.

Here are some of the factors to consider when choosing a multi-asset fund:

- Your investment goals: What are your investment goals? Are you looking to generate income or capital growth?

- Your risk tolerance: How much risk are you comfortable taking? It can be a good way to reduce risk, but they still carry some risk.

- Your time horizon: How long do you plan to invest? Multi-asset funds are a good option for investors with a long-term time horizon.

- Your investment experience: How much investment experience do you have? If you are a beginner investor, you may want to consider a multi-asset fund that is managed by a professional fund manager.

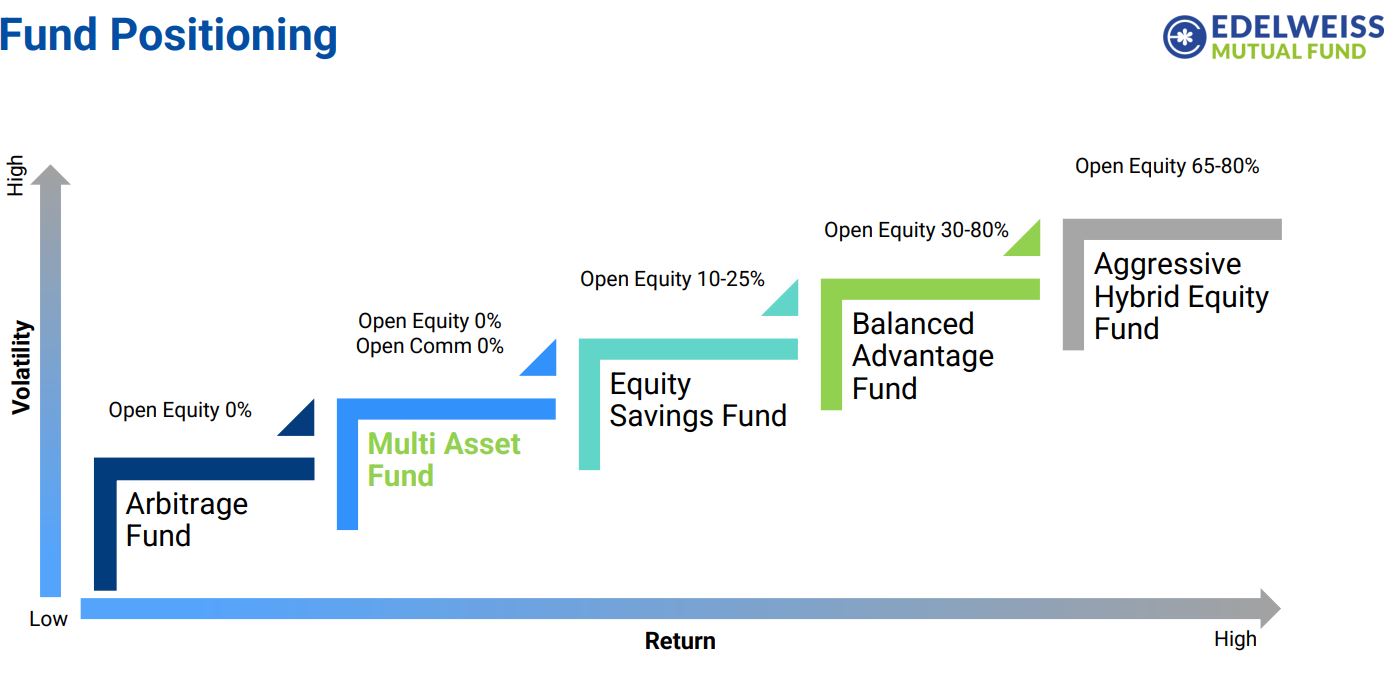

Type of Multi-Asset Funds

All Multi-asset funds are not the same. Some are more focused on Equity returns while others target income. Based on the return targeted they can be divided into 2 categories

- Equity Focussed – Replacement for Equity+ Debt MF portfolio

- Debt Focussed – Replacement for Arbitrage funds

Most funds in the market currently are Equity Oriented while Edelweiss Multi Asset is the only one targeting to beat Arbitrage Fund Returns.

Edelweiss Multi-Asset Fund

Edelweiss Multi Asset Allocation Fund is a new fund offer (NFO) that was launched in July 2023. The fund invests in a mix of equity, debt, and commodities, with a target allocation of 45-55% in fixed income, 35-40% in equity arbitrage, and 10-15% in gold and silver arbitrage.

The fund’s goal is to generate single-digit returns with moderate risk. It is a good option for investors who are looking for a way to diversify their portfolios and reduce risk.

What is Edelweiss Multi Asset Allocation Fund?

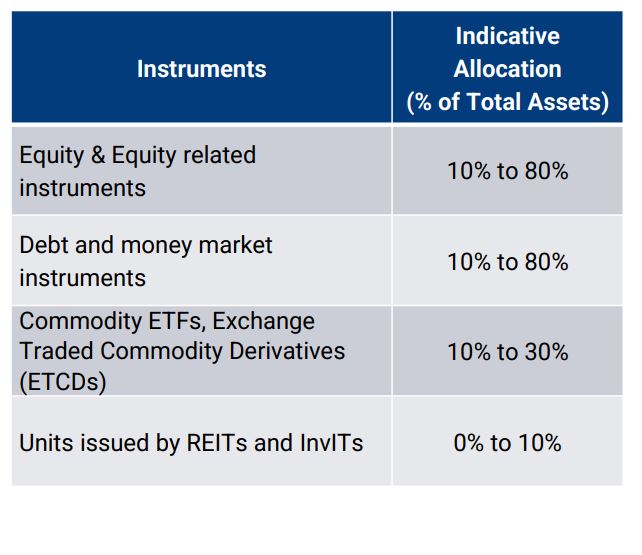

Edelweiss Multi Asset Allocation Fund is a multi-asset allocation fund. This means that it invests in a mix of different asset classes, such as equity, debt, and commodities. This helps to reduce risk by diversifying the fund’s exposure to different market conditions.

The fund’s target allocation is as follows:

- Fixed income: 45-55%

- Equity arbitrage: 35-40%

- Gold and silver arbitrage: 10-15%

Equity arbitrage is a strategy that involves buying and selling stocks at the same time in order to profit from the difference in prices. This can be a way to generate returns without taking on too much risk.

Gold and silver arbitrage is a strategy that involves buying and selling gold and silver at the same time in order to profit from the difference in prices. This can be a way to generate returns without taking on too much risk.

Why invest in Edelweiss Multi Asset Allocation Fund?

There are several reasons why you might want to consider investing in Edelweiss Multi Asset Allocation Fund. These include:

- LTCG taxation: The fund qualifies for long-term capital gains (LTCG) taxation, which is a major advantage. LTCG taxation was withdrawn for debt mutual funds in the last budget, so this is a major advantage..

- Diversification: The fund invests in a mix of equity arbitrage, debt, and commodities, arbitrage which helps to reduce risk. This is important for investors who want to protect their money from market volatility.

- Professional management: The fund is managed by a team of experienced professionals at Edelweiss Mutual Fund. This means that the fund is likely to be well-managed and that your money is in good hands.

- Low expense ratio: The fund has a low expense ratio, which means that you keep more of your money. This is important for investors who want to maximize their returns.

What are the risks of investing in the Edelweiss Multi Asset Allocation Fund?

There are also some risks associated with investing in Edelweiss Multi Asset Allocation Fund. These include:

- New fund: The fund is a new fund, so there is no track record to go on. This means that it is difficult to predict how the fund will perform in the future.

- Market volatility: The fund’s performance can be volatile, depending on the performance of the underlying asset classes. This means that your investment could lose money in the short term.

- Management risk: The fund’s performance depends on the skill of the fund manager. If the fund manager makes bad decisions, your investment could lose money.

The Future of Multi-Asset Allocation Funds

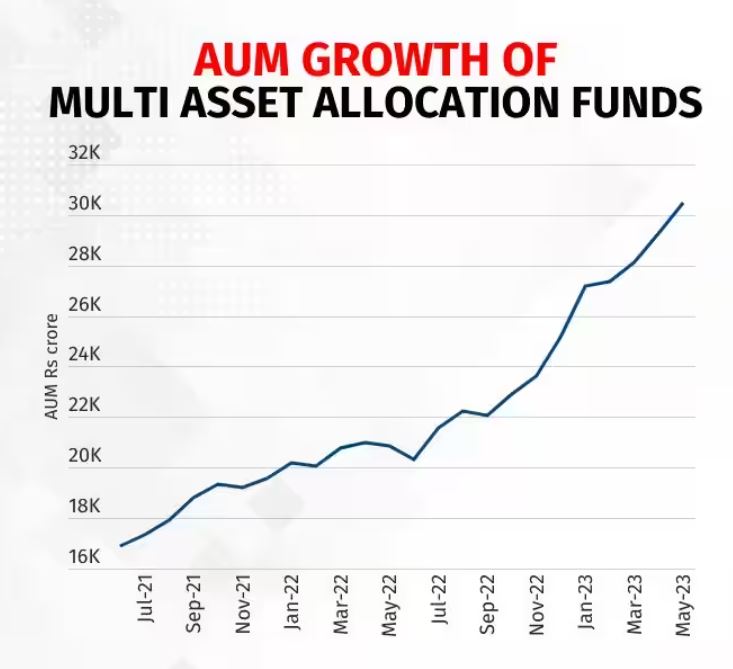

The future of MAFs is bright. As investors continue to seek diversification and tax efficiency, MAFs are likely to become even more popular. In addition, the evolution of MAFs is likely to continue, with new and innovative MAFs being developed to meet the needs of investors.

Conclusion

MAFs are a versatile investment tool that can be used to meet a variety of investment goals. They can help to reduce risk, improve risk-adjusted returns, and provide tax benefits. As investors continue to seek diversification and tax efficiency, MAFs are likely to become even more popular in the years to come.

Looking beyond mutual funds to Invest. Explore Alternative Investments

Dear Sir,

Can you give the information regarding ETF and how can we invest in Global ETF?

Hi,

ETF are passively managed investment vehicle which track index like Nifty 50 index ,hence expense ratio is low.

For investing in Global ETf which track foreign index such as S&P you can either

1) go for Index Funds in India which have exposure to global ETF such a NAVI nasdaq etf etc or

2) You can buy international ETF and stocks through platforms like Stockal(https://platform.stockal.com/signup?&refcode=RANDOMDIMES)