Having started my investment in 2018, it’s almost close to 3 years of investing in TradeCred (Free Link).I started at the same time as Kredx investment

TradeCred has been a very good experience for me and I have to applaud the platform for it, considering we faced Covid-19 which was 6 sigma risk event for most investments. Interestingly I never faced any delays in my invested Invoices during that period. My portfolio yield has been over 12%

Some other invoice discounting platforms like Kredx did not do that well and delays were reported for some invoices. The major reason for this is that few platforms were desperate to do a lot of volumes to increase valuation at the cost of the credit quality of invoices!

TradeCred Background

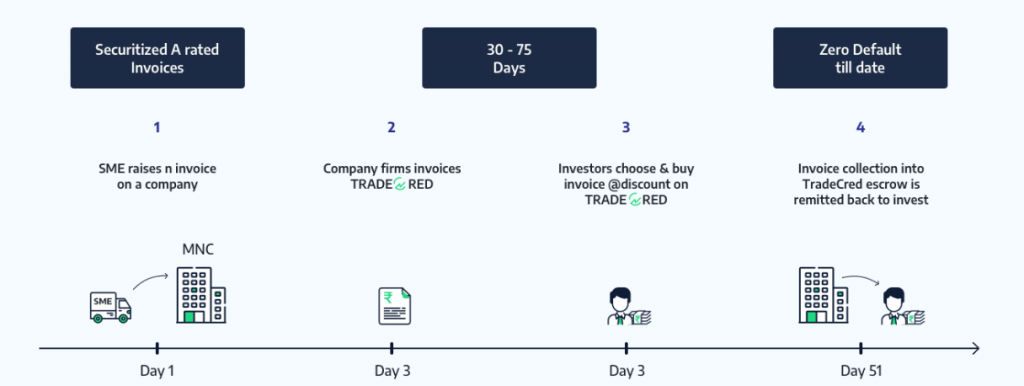

Invoice Discounting provides a unique opportunity of discounting invoices raised on big players in the consumer space. The vendors have to wait for 30-90 days to receive the money from the companies, so you can provide liquidity to vendors and earn an attractive yield.

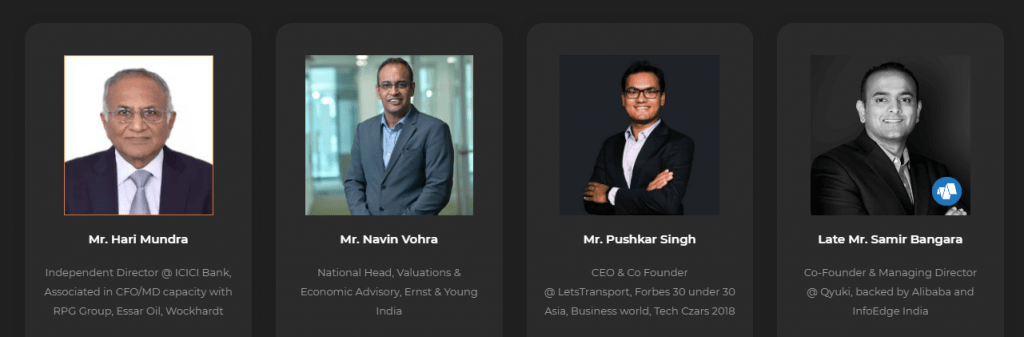

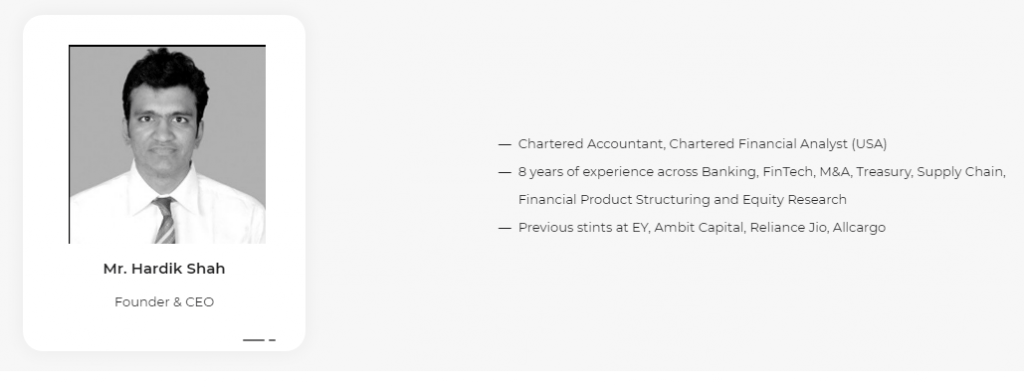

Key People

Top TradeCred Partner for Invoice Discounting

Some of the top corporates available on TradeCred for investment are:

- Amazon

- Flipkart

- Reliance

- ITC

- KPMG

- Axis Bank etc

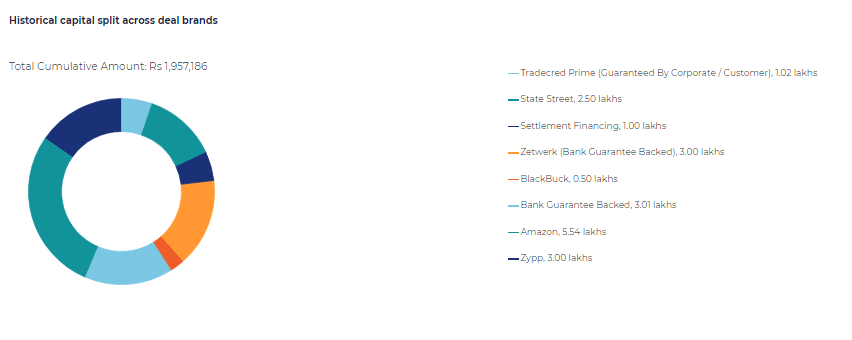

My Portfolio Performance and Analysis

Few Deals I had Invested in last year

Average Yield 12.3%

Average Tenor 80 Days

In my three year experience I never faced delay of more than 4-5 days which is commendable.

Some interesting products they had come up during last few months

- Instant Liquidity Options

- Bank Guarantee

- Insurance cover for Default

- TradeCred Minimum Investment for few deals reduced to INR 50000

I am targeting primarily 3 types of invoices on this platform

TradeCred Bank Guarantee Deal

A bank guarantee is an assurance that a bank provides to a contract between two external parties, a buyer and a seller, or in relation to the guarantee, an applicant and a beneficiary. The bank guarantee serves as a risk management tool for the beneficiary, as the bank assumes liability for completion of the contract should the buyer default on their debt or obligation. TradeCred has deals that have bank guarantees by Federal Bank,Union Bank etc

Settlement Finance Deal on TradeCred

Settlement Financing is a unique product that addresses a specific trade credit use case in India. When a consumer swipes a credit/debit/atm card, the amount is deducted from his/her account immediately. However, the merchant (receiver) has to wait 1 day for these funds to reach their account from the bank. This 1-day capital gap causes cash flow issues in businesses. Settlement financing provides 1-day loans to business that want to reduce their cash flow impact while waiting for transactions to settle from the day prio

Prime/ Blue Chip Company Invoices on TradeCred

These are the companies or business which have strong balance sheet or have great valuation . Blue chip companies are easy to identify. To identify good startup it’s important to read about lastest funding and growth reports

Regardless of the type of deal two parameters to keep in mind are:

- The vendor should have done multiple deal on the platform.This ensure chances of fake invoice is low.

- Check online to ensure that there is no adverse news about the company. Recently in one of the platform Future group delayed repayment. Future group was already struggling with high debt and people could have avoided investing in it if they had done some due dilligence.

TradeCred vs Kredx

I find Tradecred superior to Kredx in the following departments:

- There is always a shortage of deals on Kredx which means more money lying idle which cause interest drag.Also in this case investor gets to invest only in invoice which others choose to avoid.

- Kredx had a few defaults in the past while Tradecred has a clean history even during Covid-19 lockdown

- TradeCred has credit enhanced deals like Bank Guarantee or Instant Liquidity which are value adds.

Conclusion

TradeCred (use link to get early access to deals) has consistently delivered 12% + return without delays. Considering the short nature of this investment it is a good place to park money along with other platform like Finzy , GrowFix , Grip Invest and wait for equity correction considering that equity is unlikely to give 13-14% return from current level ( i.e 17000 by jan 2022!) but has high probability of correction to lower level

Thank you Rohan for your great investment research and sharing with others. I started to invest on tradecred almost a year ago based on your blog. Feel happy about it

Thanks a lot. I find it very useful. Also I had same thought process that I want use these platform to get 11-12% earning till I get major correction/opportunity in equity market. Though could you please some details about account opening, like how much they take to approve from, and any other formalities.

Hi, process is quite fast.you can use the referral link and I can help you get early access to upcoming deals! tradecred ,gripinvest and growfix are some platforms you can explore

Most platforms are quite fast in reference to account opening. Most have similar requirements. International platforms require passports.

I suggest you keep your account ready across multiple platforms as it gives you more choice when you select deals.

If you face any issue in the opening, I can share my touchpoint with the platform!

Thanks, Rohan

Please share your experiences and returns with Gripinvest

Hi I have an article on grip invest.

As the platform is new my experience is limited to 6 months, though I don’t have any complains as of now

Please share about Invoice Discounting Platform – https://www.falconsgrup.com/.

I had invested in it in past. Got returns on time. But i have my reservations. They don’t provide vendor details.It is a bit of a slippery slope right now!

Thanks for the useful article.I have opened an account with Tradecred using your referral link.I am considering the options mentioned by you a) TradeCred Bank Guarantee Deal b)Settlement Finance Deal c)Prime/ Blue Chip Company Invoices.As I am new to the platform I am unable to figure out how to identify these deals.Can you please write a detailed article about how to identify these deals in Tradecred ?

Hi Senthil,

Each of these deals have the details of the feature in the description. However off late I have noticed there are very few settlement finance deals maybe due to increased demand.

I prefer to choose the best deals between Tradecred,Jiraaf and Kredx. Sometimes you get same enterprise with much higher yield in a different platform. You can find the details for those in my posts

Please write a review on Invoice Trade platform.

It Seems like someone from Falconsgrup has started it. Falcons never disclosed about its vendors hence i decided to avoid for the time being

have you come across any assurance from TradeCred that our money lying in the TradeCred wallet and the live deals is safe ? what if TradeCred closes its business and runs away ?

Hi Sarang, Tradecred wallet is an escrow account under your name. You can check the details in the wallet address.

The bigger risk is deal specific risk which needs to be controlled by due diligence of the vendor and enterprise

Currently the Bzingo deal investors are in trouble. They are not repaying. Its in a default position. My lot of money is blocked.

Hi Nilesh,

Yes bizongo is in delinquency for some time.They communicated by june they should be able to resolve and payment is stuck due to funding delay.

Did you get any formal communication from TradeCred on Bizongo?

Startups are becoming very risky nowadays after hearing about BluSmart.

Hi, there seems to be issue with bizongo deal on tradecred. They recently filed a complaint!

https://economictimes.indiatimes.com/tech/startups/tradecred-files-criminal-complaint-against-bizongo-alleges-rs-69-crore-fund-misappropriation/articleshow/122228986.cms?from=mdr

Hello, what is the current ground reality with Bizongo. I know TradeCred is trying all legal options and have taken legal consent from its investors too, but no one is giving any clear picture whether investors will be able to get their money back or not. Are there any legal actions initiated directly from any/group of investors?

Hi, there seems to be issue with bizongo deal on tradecred. They recently filed a complaint!

https://economictimes.indiatimes.com/tech/startups/tradecred-files-criminal-complaint-against-bizongo-alleges-rs-69-crore-fund-misappropriation/articleshow/122228986.cms?from=mdr