Buying fixed-income securities (especially government securities) is considered complex & tricky. That’s exactly the reason why many retail investors stay away from them. However, that’s not the case any longer. What if I tell you that there is a direct platform fr

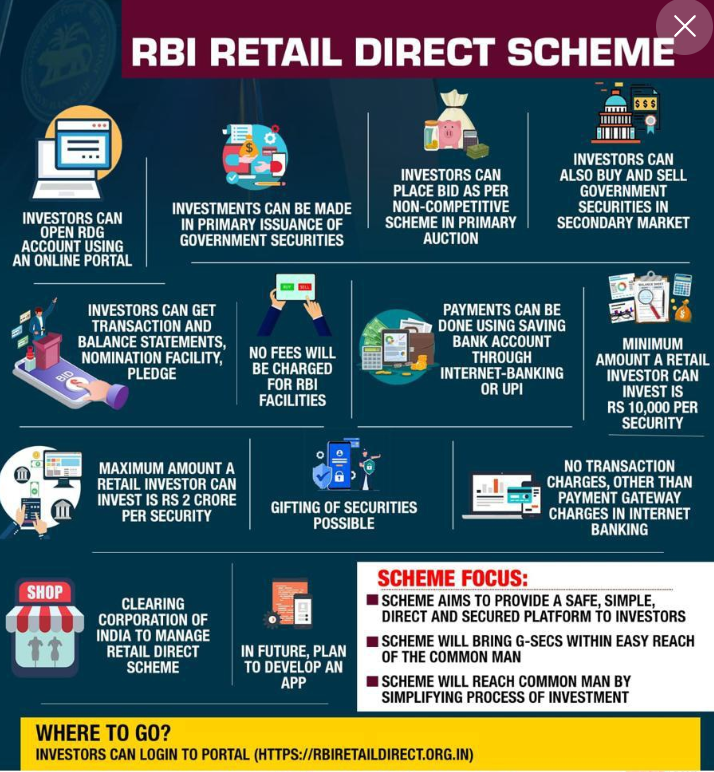

The Reserve Bank of India (RBI) has introduced the Retail Direct Scheme to make investing in government securities more accessible for retail investors. This scheme provides an avenue for everyday investors to participate directly in the government securities market. In this post, let’s explore the RBI Retail Direct Scheme in depth to understand how it works and the benefits it offers to investors.

What is the RBI Retail Direct Scheme?

RBI Retail Direct is a platform launched in November 2021 by the Reserve Bank of India (RBI) to simplify investing in government securities (G-Secs) issued by central and state governments and Sovereign Gold Bonds (SGBs) for common investors like us.

Previously, retail investors could buy G-Secs only through channels like brokers or mutual funds. However, with this scheme, there is no longer a need to buy it only through them instead you can buy directly- thereby making it simpler and more affordable for everyday people to invest in government debt.

Features of RBI Retail Direct Scheme:

Following are some of the salient features that the RBI Retail Direct scheme offers:

- Direct Access: Open a Retail Direct account online on the platform and invest in G-Secs directly through the RBI. This helps remove broker charges and keeps the process transparent.

- Safety and Security: Government securities are considered one of the safest investment options in India, as they are backed by the sovereign guarantee of the Government of India.

- Investment Options: The scheme offers a variety of government securities by central and state governments with different maturities to suit your investment goals. You can also invest in Sovereign Gold Bonds (SGBs), a great way to invest in gold.

- Participation in Primary Auctions: For the first time, retail investors can participate in the primary issuance of government securities through a non-competitive bidding process.

- Secondary Market Trading: You can buy and sell G-Secs in the secondary market through the NDS-OM platform, providing easy access to the secondary market.

- Convenience & Transparency: The portal offers a user-friendly interface for account management, bidding, and transactions- thus offering convenience and transparency.

Government Securities Available through RBI Retail Direct Scheme

Treasury Bills (T-Bills): These are short-term debt instruments with maturities ranging from 91 days to 364 days. T-bills are a good option for parking your money for a short period with no credit risk.

Government of India (GoI) Bonds: These are medium to long-term bonds (debt instruments) issued by the government with maturities ranging upto 40 years. They offer competitive interest rates and are suitable for long-term investment goals.

State Development Loans (SDLs): State Development Loans are debt instruments issued by state governments to fund development projects in their state. These securities offer varying interest rates and maturities, depending on the issuing state.

Sovereign Gold Bonds (SGBs): These are government-backed bonds backed by gold. They offer a safe and convenient way to invest in gold without worrying about purity since they come with a sovereign guarantee and earn interest on your investment (which is impossible with typical gold investments).

How to buy government securities through the RBI Retail Direct Scheme?

The process of signing up on the RBI Retail Direct portal & buying securities is very easy. The following are the steps:

- Open an RDG Account: Visit the RBI Retail Direct website (https://rbiretaildirect.org.in/) and register online to open your RDG account. You’ll need the following things to open your account:

- The mobile number linked to your Aadhaar

- Active Saving Bank Account with net banking/UPI facility

- Signature image of Account Holder(s)

- Original PAN Card (For Video KYC)

- Bank account number and IFSC code

- Address proof in case of address change

- Complete KYC: Complete KYC as per the prompt received during the signup process.

- Explore Investment Options: Research the different G-Secs and SGBs available and choose the ones that best suit your investment goals and risk appetite.

The RBI website provides detailed instructions and FAQs to guide you through the process. You can check it here.

Comparison- Buying Government Securities through RBI Retail Direct vs Agents & Brokers

| Feature | RBI Retail Direct Platform | Agents & Brokers |

| Account Opening | Online account opening through the RBI website | Requires visiting agent/broker’s office and filling out forms |

| Minimum Investment | The minimum investment amount can vary depending on the security

(generally lower) |

Minimum investment amounts can be set by the agent/broker |

| Investment Options | Limited to G-Secs, State Loans, and SGBs offered by RBI | A wider range of investment options including G-Secs, corporate bonds, mutual funds, etc. |

| Account Fees | No account opening or maintenance charges | May have account opening fees and annual maintenance charges |

| Transaction Fees | No transaction fees for buying/selling in the secondary market | May have brokerage fees for buying/selling in the secondary market |

| Bidding in Primary Auctions | Allows participation in non-competitive bids for primary issuances | Does not allow direct participation in primary auctions |

| Investment Guidance | Limited investment guidance is available on the RBI website | May receive personalized investment advice from agent/broker |

| Platform | User-friendly online platform | May require interacting with agent/broker over phone, email, or in-person |

| Convenience | Convenient online access and management of investments | May require more time and effort to communicate with agent/broker |

Alternatives to Govt Securities- High Yield Securities

While there is no better & low-cost platform available for buying govt-securities other than RBI Retail Direct in my opinion, if one is looking for higher yield bonds, there are quite a few platforms available. Listing some of them below.

Altifi

Altifi is a platform from the Northern Arc group that focuses on high-yield bonds and debt securities. Check our detailed Altifi Review.

Incred Money

Incred Money is another new but popular platform to invest in fixed deposits, bonds, and market-linked debentures. Check our detailed Incred Money Review.

Grip Invest

One of the most popular alternative investment platforms which also has bonds and securitised debt instruments. This is a must-try platform for anyone interested in debt & alternative investing. Check our detailed Grip Invest review.

Some other platforms worth looking at are below

Below is a complete list of alternative investment platforms

However, it is important to note that these high-yield securities are from corporate companies and the high returns come at the cost of added risk. Govt securities have the lowest credit risk possibilities.

Conclusion

The RBI Retail Direct Scheme revolutionizes government securities investment for retail investors, offering a gateway to a diverse range of investment options like government securities, SDL & even sovereign gold bonds. With its user-friendly interface & simplified processes, the scheme empowers investors to build a diversified portfolio while contributing to the nation’s development. If you ever want to invest in government securities, the RBI Retail Direct platform is a no-brainer must-use option.