Investing in bonds has historically been perceived to be full of intricacies and hurdles. Navigating through paperwork, understanding market intricacies, and grappling with opaque processes deterred many potential investors. That’s one of the major reasons why investing in bonds was not popular among retail investors in India – compared to other mediums like FDs or even debt funds. However, the financial landscape in India is witnessing a paradigm shift, and the advent of technology has given rise to several platforms that aim to simplify and democratize the world of bond investments in India.

One such player making waves in this domain is IndiaBonds, a SEBI-registered and licensed Online Bond Platform Provider (OBPP). This IndiaBonds Review delves into the features, benefits, and simplified process of investing in bonds through this platform. Before we move further, let us first understand the importance of savings bonds in a portfolio.

Why should one invest in bonds?

- Stability: Bonds provide stability to a portfolio, acting as a counterbalance to the volatility of equities.

- Predictable Income: Regular interest payments from bonds offer a predictable income stream, ideal for income-oriented investors.

- Diversification: Including bonds diversifies a portfolio, reducing overall risk by balancing exposure to different asset classes.

- Lower Risk Profile: Bonds generally have lower risk compared to equities, with government bonds offering minimal risk of default.

- Capital Preservation: Bonds return the principal at maturity, ensuring capital preservation and more secure investment.

- Variety of Options: The bond market offers diverse options, allowing investors to tailor their allocation based on risk tolerance and preferences.

- Tax Benefits: Certain bonds offer tax benefits, enhancing after-tax returns and making them attractive for tax-conscious investors.

- Liquidity: Bonds can be traded in the secondary market, providing liquidity for investors needing to adjust their holdings.

What is IndiaBonds?

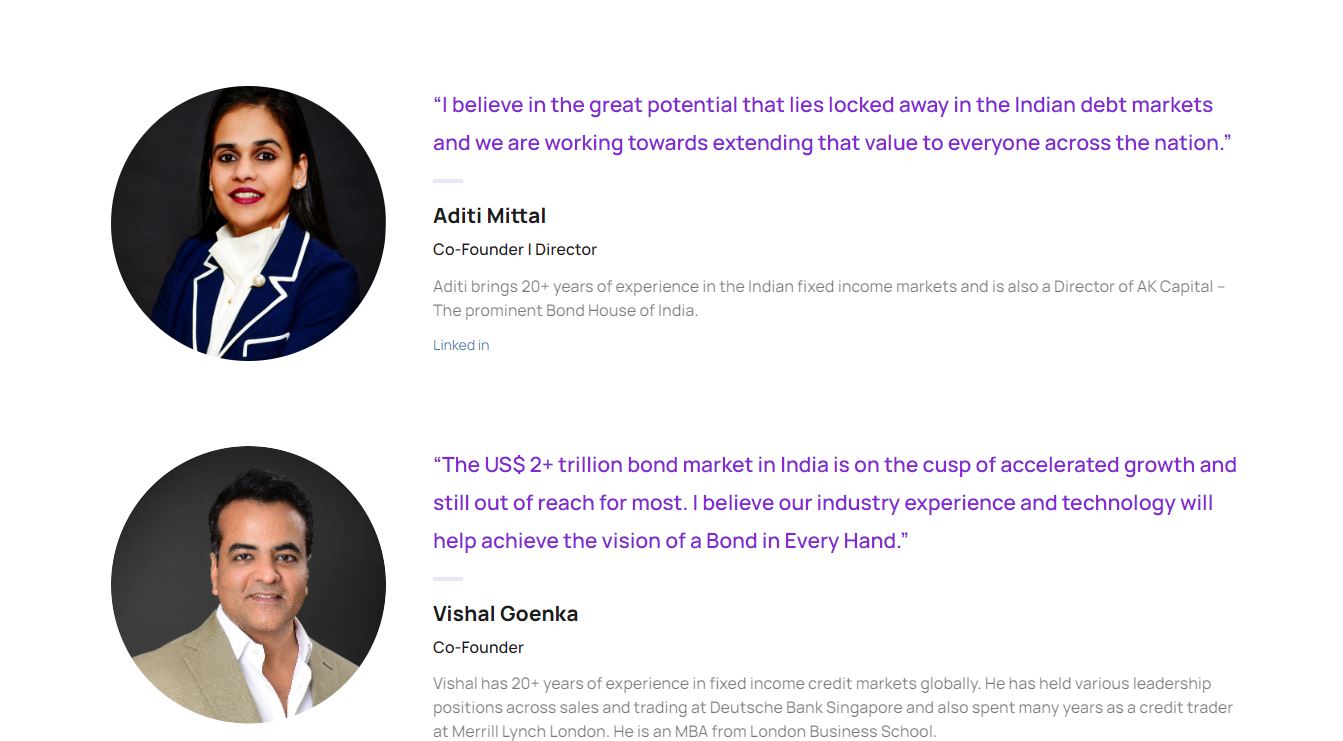

IndiaBonds, established in 2021, is an Online Bond Platform Provider (OBPP) registered with SEBI. It is an initiative by AK Capital which is one of the largest bond broker in India.Driven by a blend of financial expertise and technology, IndiaBonds seeks to streamline access to the fixed-income market. The core management team, boasting decades of experience in finance and technology, aims to lead the digital revolution in the Indian corporate bond market. Their mission is to provide a holistic solution for bond investing, offering stability and good returns to help investors meet their financial objectives.

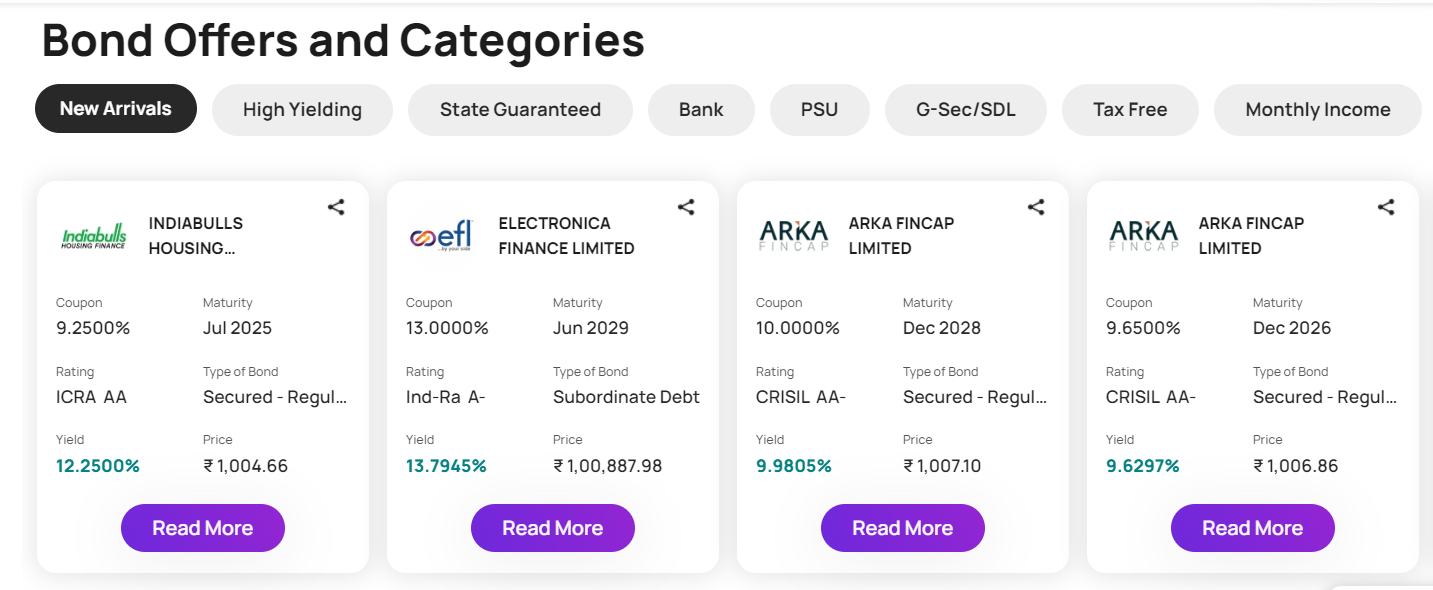

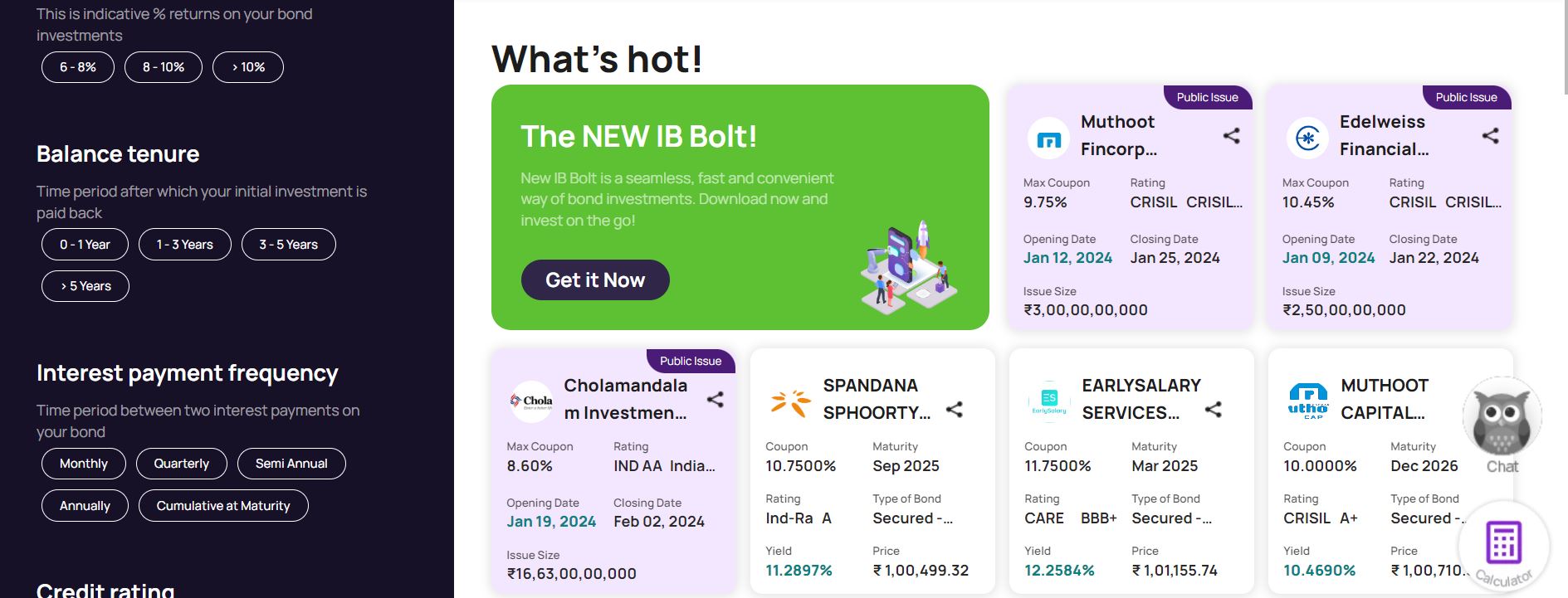

Features of IndiaBonds

- Bond Trading: Facilitating the buying and selling of bonds on a user-friendly platform.

- Apply for Public Bond Issue: Providing opportunities to participate in public bond issues.

- Apply for G-Sec/SDL: Accessing Government Securities and State Development Loans.

- Bond Calculator: Instantly calculating bond yield and price for transparent investment decisions.

- Apply for Sovereign Gold Bonds: Diversifying investment options with gold-linked bonds.

- Capital Gain 54EC: Offering tax-saving mechanisms through fixed-income instruments.

- Debt Portfolio Management Service: Managing debt portfolios for investments starting from 50 lakhs.

How to Buy/Invest in Bonds with IndiaBonds

- Login / Sign Up: Access the IndiaBonds platform by creating an account.

- Select a Bond: Choose a bond based on your preferences.

- KYC (Paperless): Complete the online KYC process in under 3 minutes.

- Online Payment: Directly make payments to the Clearing Corporation.

Information required for KYC

- PAN Card Number

- Aadhaar Card Number

- Demat Account Details

- Bank Account Details

Do You Need a Demat Account to Buy Bonds?

Yes, it is mandatory. Use your existing demat account or let IndiaBonds assist you in opening one effortlessly.

How to Sell Bonds with IndiaBonds

- Choose a Bond and Apply: Submit a request with bond details.

- Connect with Bond Manager: Receive a call from the Bond Manager to explain the process.

- Bond Verification: IndiaBonds verifies your bond details.

- Get a Quote: A quote for the bond sale is shared with you.

- Sell Bond: Facilitation of the bond sale process.

KYC Process of IndiaBonds & Things Required

IndiaBonds simplifies the KYC process, requiring the following information:

- PAN Card Number

- Aadhaar Card Number

- Demat Account Details

- Bank Account Details

Benefits of IndiaBonds

- SEBI Registered OBPP: Ensuring regulatory compliance and trust in the platform.

- Simple KYC Process: Completing KYC online in under 3 minutes, eliminating paperwork.

- Zero Brokerage: No hidden charges or commissions on secondary market bonds.

- Transparent Pricing: Providing a breakdown of the investment price for clarity.

Alternatives to IndiaBonds

While IndiaBonds is a pretty decent platform for investing in bonds in India, there are many other players in the bond market. Following are a few of them:

- GoldenPi: One of the oldest platforms to buy bonds. They also have debentures and other fixed income assets on their platform. Generally rates are not very attractive here.

- Grip Invest: One of the most popular platforms for alternative investments. Has NCDs, securitized debt instruments, asset leasing opportunities along with bonds.

- The Fixed Income : One of the leading platforms dedicates. Backed by Tipsons Group– one of the most prominent bond houses in the country with decades of experience.

- Altifi: Typically has high-yield bonds listed on the platform. Part of Northern Arc- a leading diversified NBFC in India.

- Wint Wealth – Provide selected bonds that have been shortlisted by them,hence much lower risk.

We like Altifi, Grip, and Wint for purchasing bonds. You can check the performance of these platforms in our monthly review

Conclusion

We have tried to cover all aspects of the platform in this IndiaBonds review. IndiaBonds does emerge as a catalyst in simplifying bond investments, offering a seamless and transparent platform for both new and seasoned investors. With its commitment to technology, regulatory compliance, and user-friendly features, IndiaBonds stands out in the evolving landscape of bond investments in India. In case you invest in bonds, India Bonds is a good platform to explore & invest in various bonds with different yields.

Frequently Asked Questions

Q: Is IndiaBonds a regulated platform?

A: Yes, IndiaBonds is a SEBI registered and licensed Online Bond Platform Provider.

Q: Can I invest without a demat account?

A: No, having a demat account is mandatory for bond investments. IndiaBonds can assist you in opening one if needed.

Q: Are there any hidden charges on IndiaBonds?

A: No, IndiaBonds charges zero brokerage and ensures transparent pricing.

Q: Can I sell bonds on IndiaBonds?

A: Yes, you can sell bonds by choosing a bond, applying, connecting with the Bond Manager, verifying details, receiving a quote, and facilitating the sale.

Q: Can I apply for G-Sec/SDL on IndiaBonds?

A: Yes, IndiaBonds allows users to apply for Government Securities (G-Sec) and State Development Loans (SDL) through the platform.

Q: What do online IndiaBonds reviews suggest? Is it safe to use & buy bonds?

A: Yes, IndiaBonds reviews online from customers seem to be very positive and encouraging. I have personally used the platform to buy a few bonds and the