What is RACE Energy?

RACE Energy Founders

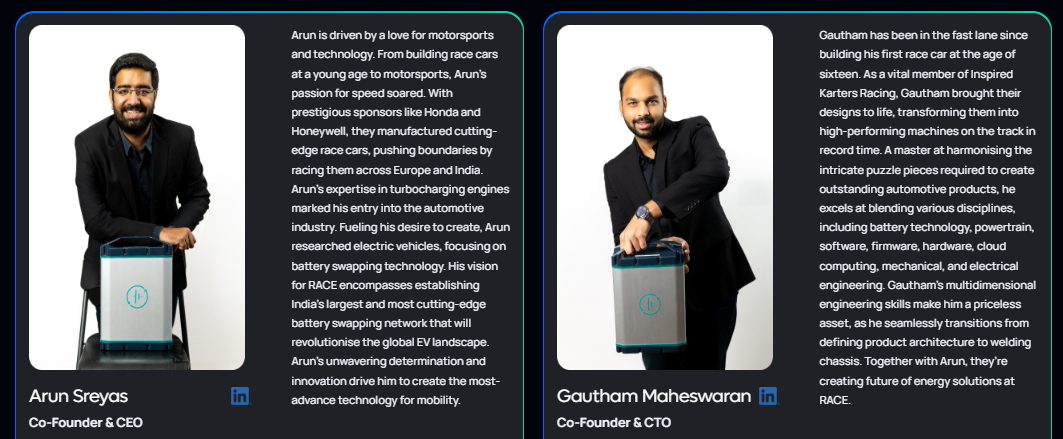

Arun Sreyas: Co-Founder & CEO

Arun is passionate about motorsports and technology. Arun started constructing race cars years ago and loves innovation. His innovation was fueled by sponsors such as Honda and Honeywell. He led the manufacturing of state-of-the-art race cars, which took them to Europe and India. Soon, he entered into the innovation of electric vehicles, and then he entered into battery-swapping technology. Now, he aims to establish India’s largest and most advanced battery-swapping network.

Gautham Maheswaran, Co-Founder & CTO

Gautam’s journey started when he designed his first race car at sixteen. His passion was quickly noticed by Karters Racing, where he began designing. He also excels in blending various disciplines, such as battery technology, powertrain, software, firmware, hardware, cloud computing, and mechanical and electric engineering. Gautham and Arun are working together to create a battery-swapping solution .

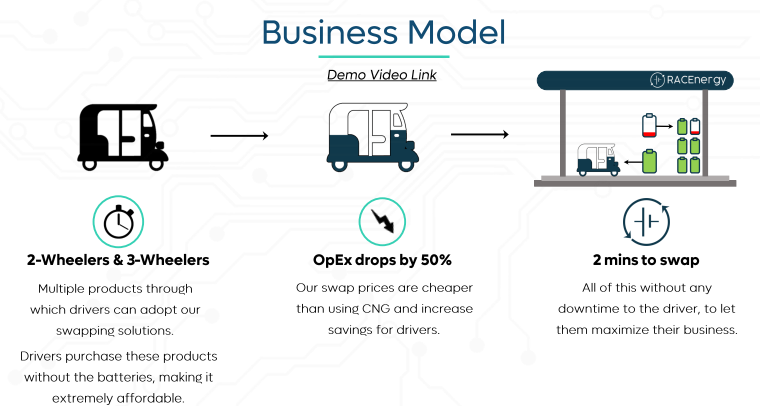

What is RACE Energy’s Business Model?

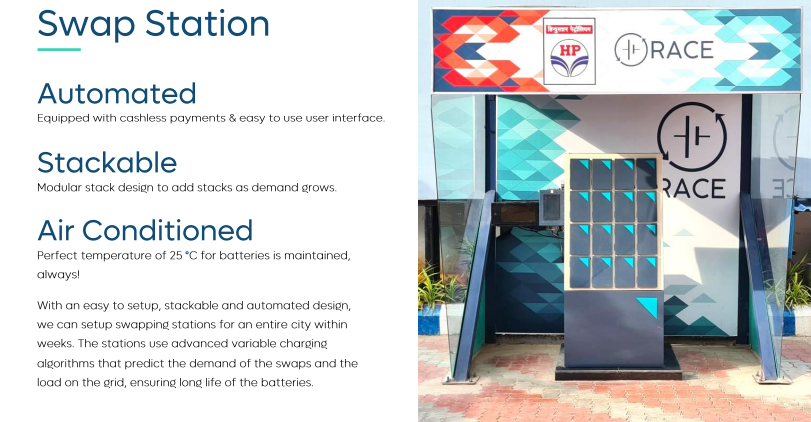

Battery Swapping

RACE Energy provides convenient and quick battery-swapping services for two- and three-wheeler vehicles. The company’s primary business model is to establish and operate battery swapping stations strategically located in cities and on major routes of these vehicles. The company is responsible for procuring, maintaining, and charging the batteries and provides digital platforms for user registration, battery tracking, and payments.

Target Audience

- Two-wheeler owners such as electric scooters and motorcycles.

- Three-wheeler owners such as e-rikshaws, delivery vehicles, etc.

Revenue Model

The company charges battery swap fees from the vehicle owner and also offers subscription-based models for frequent users. Investors can also buy batteries and give them on lease to RACE Energy.

Race Vault – Asset Leasing Offered by RACE Energy

What is Asset Leasing

Asset leasing entails the acquisition and subsequent leasing of assets, such as machinery, equipment, or vehicles, to businesses. In contrast to conventional investments, asset leasing provides investors with a consistent income stream through lease payments, presenting a fixed-income cash flow model. This approach is particularly attractive to individuals seeking stable returns beyond the fluctuations typically found in traditional markets.

Race Vault

Summary

- Purchase RACE’s Batteries

- Race Deploys the Batteries in 2- Wheelers and 3- Wheeers swapping stations.

- Batteries Generate Revenue through their swapping services.

- RACE Pays fixed leases to you for the pre-determined tenure; you can select between different tenures.

- Finally, RACE buys back the batteries when the tenure ends.

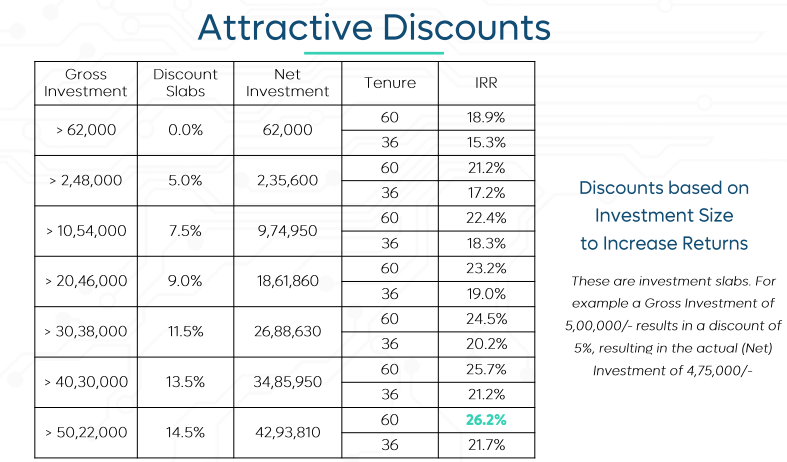

Product Details

- Product – Race Vault

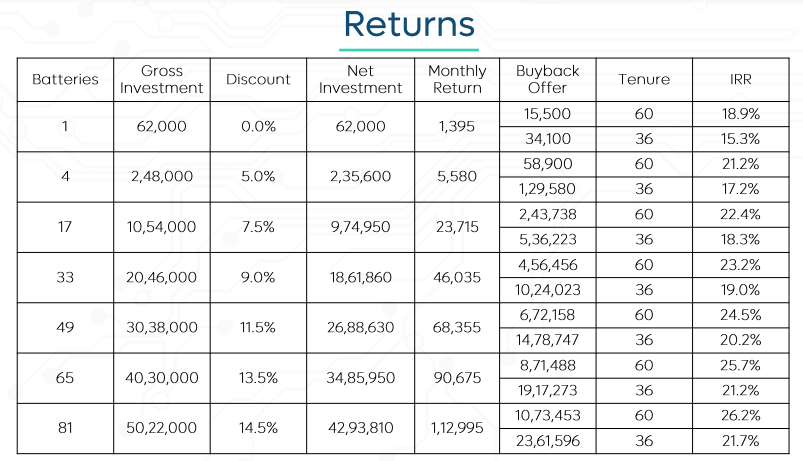

- Returns – 17% to 26% IRR

- Tenure – 3 years / 5 years

- Minimum Investment – Rs.62000

You can invest in RACE Vault batteries and lease them to the company for battery-swapping deployment. The investment amount starts from Rs. 60,000, and the expected return is 26% IRR, as claimed by the company, one of the highest returns in the market.

How does Race Vault program work?

Race Energy gives the option to buy and lease batteries that are used in swapping stations. These batteries are bought back by Race energy at the end of the tenor. The IRR can range from 17-26% depending on the tenor and investment amount.

How to invest in Race Vault?

Step 1: Click the link provided here.

Step 2: Fill out the form. Enter your Name, Email ID, and Phone number.

Step 3: Select your investment range from the dropdown menu, which can be less than 1 lakh, 1-10 lakh, 10 lakh- 1 Cr, or more than 1 Cr.

Step 4: Submit the form, and you will be all set. You will get a call from RACE Energy shortly.

Pros of Investing in Race Vault

Income Stream

You can develop an additional source of income by leasing out batteries to electric vehicle (EV) owners, and the company claims to provide up to 26% IRR, one of the highest returns in the market.

Non-Market Linked

The returns in RACE Vault are guaranteed and are secured even in volatile market conditions because this investment option is non-market linked.

Depreciation Benefits

The batteries depreciate yearly, but you can claim depreciation benefits in your taxable income yearly.

Diversification

Investing in batteries allows you to diversify your portfolio from the stock market, and you can start investing in batteries as low as Rs. 60,000.

No Maintenance Costs

As an investor, you are not responsible for maintaining the batteries directly, as RACE Vault takes care of the maintenance and operational aspects of the batteries.

Environmental Aspects

Investing in batteries is one step ahead of promoting electric vehicles in the country as it leads to environmental sustainability, which can be an act of being socially responsible as an investor.

Cons of Investing in Race vault

Initial Investment

The minimum investment amount for batteries is Rs. 60,000, which can be high for some investors with limited capital.

Less Resale Value

Over time, the battery technology may change, which depreciates the value of older batteries significantly and could impact the resale value of the batteries in case Race Energy is not able to honor buyback.

Volatility in the EV Market

The electric vehicle market is regulated by government regulations, technical advancements, and the preferences of the consumers, which may change over time.

Concentration Risk

You should allocate money prudently as large exposure to one company is not advised.

RACE Energy Alternatives

Sun Mobility Private Limited

Started in 2017, Sun Mobility Private Limited is a big name in India’s battery-swapping space for electric three-wheelers and e-buses. The company aims to power 1 million EVs by 2025 and save 8.5 million tons of CO2.

ChargeUp

Started in 2019, E-Charge Solutions operates battery swapping stations for electric three-wheelers. The company offers battery service to electric three-wheel drivers.

Battery Smart

Battery Smart was founded in 2019 and has a vast network of battery-swapping for electric two and three-wheelers. The company has 650+ live swap stations in 25 cities.

VoltUp

VoltUp provides a battery-swapping and smart charging technology platform for EV owners, logistic players, and OEMs, and they are working on a pay-as-you-go model.

Personal Experience

I found RACE while exploring investment opportunities in the clean-tech sector. The company claims a return of 26% IRR, which is higher than any return in the market. I believe this investment can be futuristic as EVs are the future, and the market is increasing.

My experience using the platform was smooth; when I filled out the investment application form, I received a call from the company within 48 hours, which helped me proceed with the investment. However, the future will decide the actual return of this investment as any change in the EV market or introduction of a better technology can disrupt this market.

Tapinvest and Gripinvest are a few platforms where you can lease across multiple assets.

Frequently Asked Questions (FAQs)

-

Is there a lock-in period for investment in RACE Vault?

Yes, you can select from various tenure options while investing, and when the tenure ends, RACE buys back the batteries.

-

Are there any tax benefits for investing in RACE Vault?

Yes, you can claim depreciation benefits on your taxable income for the depreciation of batteries.

-

How does RACE Energy ensure the safety and maintenance of batteries?

RACE Energy maintains its protocols and conducts regular inspections to ensure the safety and optimal performance of the batteries. Moreover, investors are not responsible for the maintenance of the batteries.

Thanks for detail infor but folling main points are missing from above artical

1. is my investment safe. what will happen in case of defalut? like happen in Aarzoo from Altgraf

2. 26% IRR is per anum or at matuatiry.

3. How safe is principle amount, any guarantee or security cover in case of defaul or delay.

I would request please consider above points, it helps to decide on investment, because i did investment with Altgraf i have burned my fingered with Arzoo deal.

10 months of investment with different deals what i have earned as interest with Altgraf, lost in signle deal with Aarzoo. At end no profit at all from investment for 10 month. Note- It seems Aarzoo denied to refund amount and Altgraf had not done enough as security cover for investor and as always investor is looser only.

Hi Kamlesh,

Good points, unlike altgraaf which list asset deals ,in this case race energy has created this plan to fund their batteries so the biggest risk and only risk is race energy business sustainability.

1) battery is the asset

2) 26irr is calculated based on the monthly cashflow

3) at maturity race would do buyback of the battery.i have provided buyback value in the post

Race energy is not an investment platform , this deal is like blue smart assure but irr is higher, but the risk is that race energy fails to grow then how will it do the buyback.

I will ask their team to share more details with you along with answers to any specific queries you have.

thanks for quick response

1. would it possible to tell in term of % return per anum, instead ( 26irr), its always confusing people who are basicaly from FD holder

2. how is my priciple protect in worst case scenario

Hi Kamlesh,

1) I think its 17% yield if you consider no reinvestment at all.

2) Worst case is Race energy company going bust. I feel you will lose a significant part of principle in that scenario as it will be a distressed sale at best, hence the high IRR for this opportunity.

Thanks