March has been a volatile month for Equity and Crypto markets as both these assets are hovering around their all-time high levels and waiting for the next trigger to pick up a direction.

On the Alternative Investment front, there has been an increase in the overall yield of invoice discounting due to the current year-end demand. In the P2P segment, after the RBI intervention platforms have stopped the instant liquidity plan and replaced it with short-term products.

There has been a positive change with SEBI focussing on REITs and soon there could be guidelines governing fractional real estate platforms in the future.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon AGS | Partial Repayment Partial Repayment | - 25% asset recovery pending. - 90% recovery through asset redeployment |

| kredx | Multiple deals BIRA bonds | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap downgrade to BBB- Stable AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Coupon increased to 13% ,5 months remaining for repayment. - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital SEBI Order

- Tapinvest Melorra Buyback

- Kredx Invoice Default

Growpital SEBI Order

Below are the latest updates on the Growpital Freeze. They had initially put a petition in the Rajasthan High Court that was rejected, thus they have moved SAT to put a stay on the SEBI order.

- SEBI Hearing:

SEBI has provided them with a hearing scheduled for 12th April 2024. This represents a significant step in the ongoing SEBI Ordeal.

- SAT Hearing

Securities Appellate Tribunal (SAT) has given them 8th April for the hearing. Below are the details of the Quorum

- Justice (Retd.) Shri P.S. Dinesh Kumar* (Former Chief Justice, High Court of Karnataka) appointed as Presiding Officer, SAT

- Shri Dheeraj Bhatnagar*, Retd. Principal Chief Commissioner of Income Tax, Delhi appointed as Technical Member, SAT

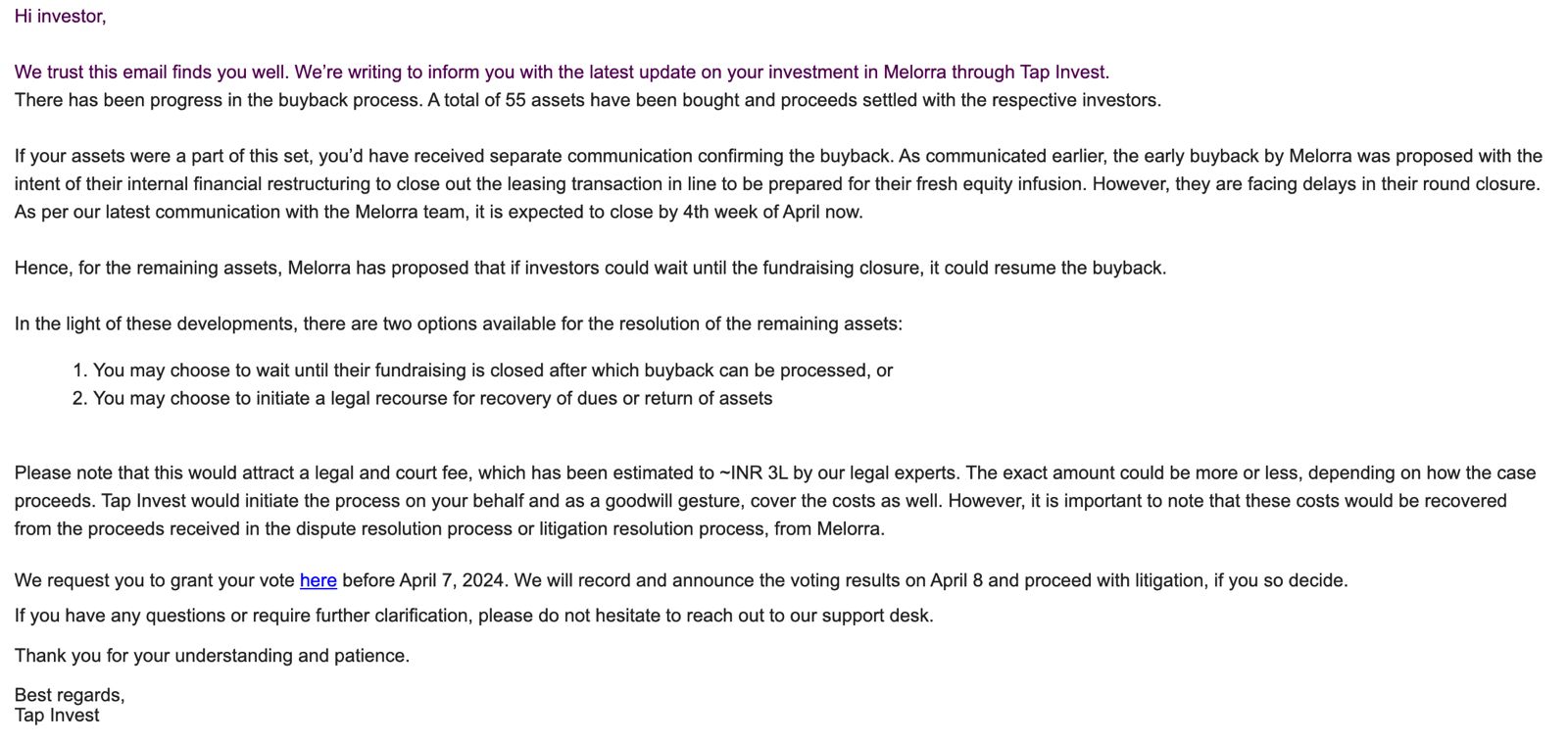

Tapinvest Melorra Buyback

Tapinvest is in talks with Melorra to process buyback for all the laptops after the fundraiser. There can be various scenario

- Melorra buyback, but not at the correct IRR

- Melorra refuses to buyback all laptops.

In both cases, Tapinvest will try to ensure that investors get the promised IRR. The team said they are confident that investors will not lose in the deal and expect a resolution soon.

Seems the more prudent decision is to allow buyback and then evaluate the IRR impact if any.

Kredx Dairy Power

The dairy power invoice had been delayed for a long time. Kredx was able to recover around 70 % in the first tranche and 23% in the second tranche out of the total 100%. Kredx had a few instances of default in the past but they have also been more aggressive than a few platforms in recovering the money.

However, it is important to keep exposure on invoices low to avoid getting stuck with large capital

Alternative Investment Portfolio Updates

This month I added a couple of platforms namely:

- Earnnest.me

- Goldenpi

While Earnnest is a platform that focuses on high-yield Real Estate NCD, Golden Pi is a debt marketplace that has options from low to high yield.

Earnnest has a strong team and investors who want to have exposure to Real Estate NCD can explore this option. I think it is super important to have a highly experienced team in these products as it requires a granular level of intricacy in deal structuring and drafting legal documents with strong recourse apart from knowing the property and collateral.

Earnnest Code PX64XW to get 0.5%

Lending Investment

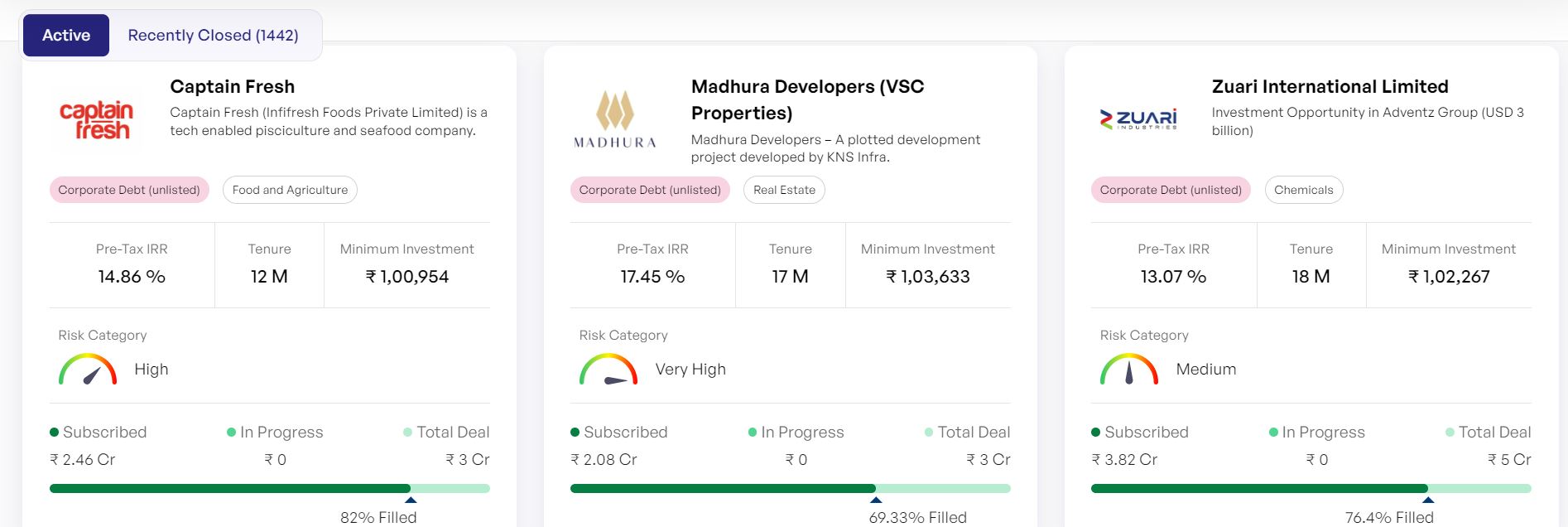

Some of the investments for this month include High Yield Bonds and Real Estate NCD

- Madhura Developers -17.45% Altgraaf

- Zuari -13.07% Altgraaf

- Lendingkart -12.71% Goldenpi

- Muthoot Mini – 10.7% Altifi

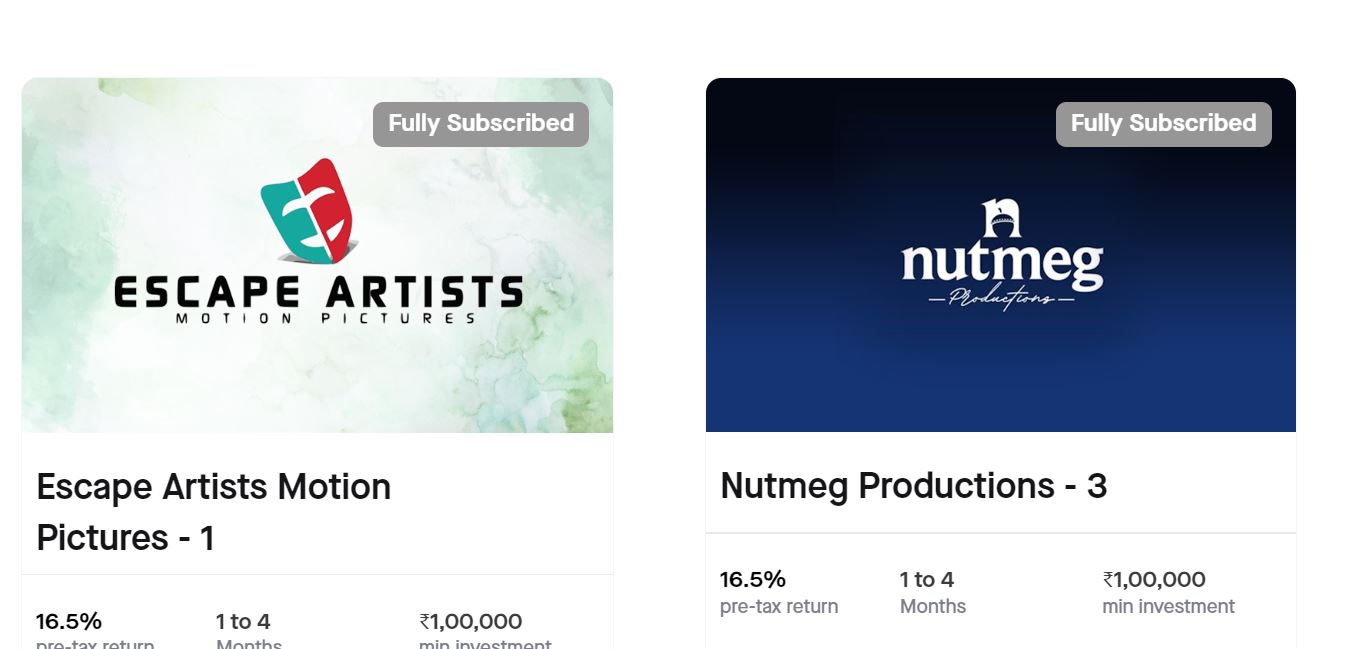

- Rusk Media -16.5% Betterinvest

I generally prefer bonds with a yield of 12% and above as post-tax returns should be close to 8.5%+ minimum else we are better off investing in an arbitrage fund at a lower tax rate.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.00% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | SEBI Pause | SEBI Pause | N.A. |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

The RBI order on p2p lending platform to stop liquid funds model has made all platforms stop the instant liquidity model

- Lendbox Per Annum returns are as per expectations. I am not investing in other p2p products on Lendbox. I will explore the bonds they plan to list soon.

- Have completely closed liquiloans as the current yield does not make any sense to invest.

- Invested in Amazon on Wonderchef on Kredx. Have also invested in a few invoices on Tradecred, Lendpartnerz, and Tapinvest too as yields are good.

There have been a few delays on Tradecred due to year-end volume. They have updated that the backlog will be cleared by 15-20th April.

Crypto Investing

There has been a lot of interest in Bitcoin and crypto after the bitcoin spot ETF approval. In India due to the TDS rule of 1% lot of people lack interest in crypto exchanges. Another reason is the risk of hacking or exchange going down. There are 2 options for such investors

- Hardware Wallets on Etherbit

- Bitcoin ETF

Investors can buy Bitcoin ETF on Stockal. We will be doing a detailed post on the same soon. It is one of the best way to have an allocation to Bitcoin.

P2P Investment

Current allocation:

- India P2P – 50%

- I2IFunding- 20%

- Finzy-10%

- Faircent Pool Loan -15%

- 13 Karat – 5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.7% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.7% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- I Have completely stopped 12Club now as the yields are not attractive anymore.

- There have been some delays in the last month’s repayment for Indiap2p. As per management the collection delay was due to operational issues due to floods and collections will improve next few months.

- I2Ifunding (get 50% off) has been a low-profile platform but surprisingly has consistently delivered decent returns for me.

Equity Market

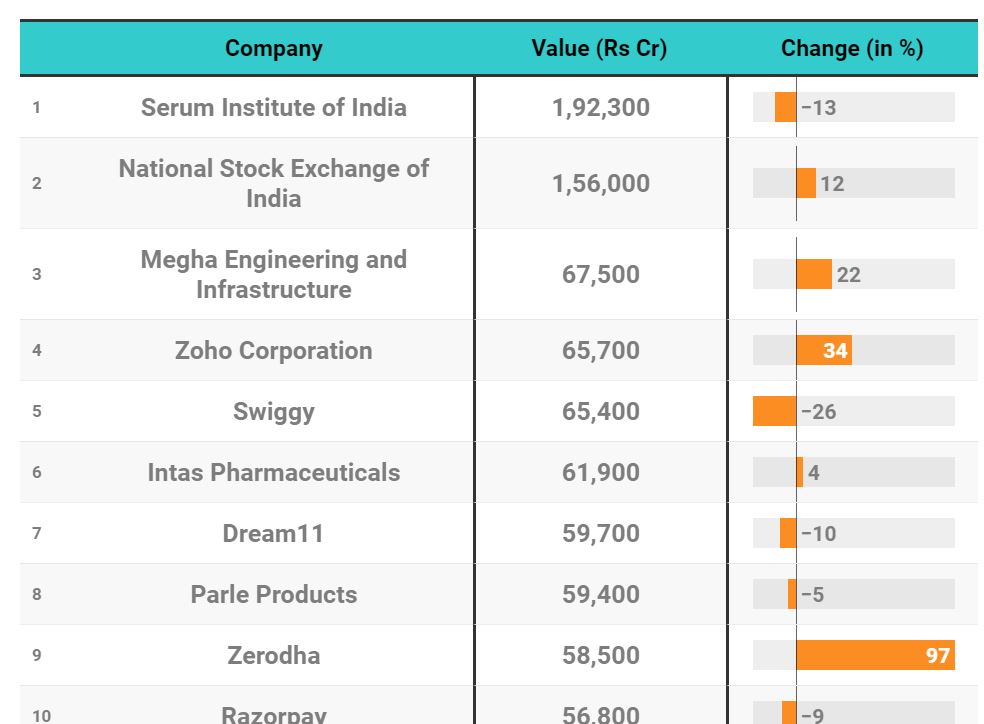

PreIPO Stocks

NSE is currently trading at 4200-4500 in the private market and investors who had bought it below 3500 have made decent gains considering that the stock provides a decent dividend yield also. Serum Institute of India Pvt., National Stock Exchange of India Ltd., and Megha Engineering and Infrastructures Ltd. are the most valuable companies in the unlisted space.

Listed Stocks

Currently, the market is in overbought space but the moment looks pretty strong and I expect the rally to sustain. I am not too keen on index investing right now as the upside can be only 10-15% from current levels. At this level, I’m investing in 2 categories.

- Individual stocks with momentum (mostly midcap and small-cap)

- Beaten down global markets like China (Doing SIP as i expect the bearishness to persist). Stocks in China and Hong Kong sold off a massive $4.8 trillion in market capitalization since 2021, which according to HSBC, is more than the value of the Indian stock market.

Algo Trading

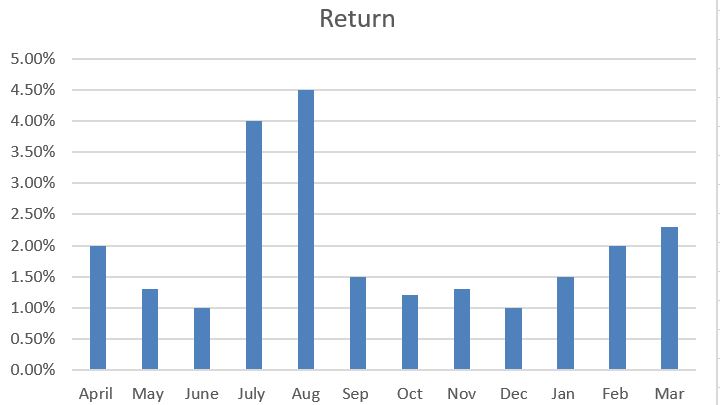

I have recently started momentum and mean reversion strategies along with Market Neutral to create a more diversified basket. March has been a decent month

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30+ Lakh deployable capital can reach out to inquire on more sophisticated algos

Other Alternative Investment Assets and Platform Updates

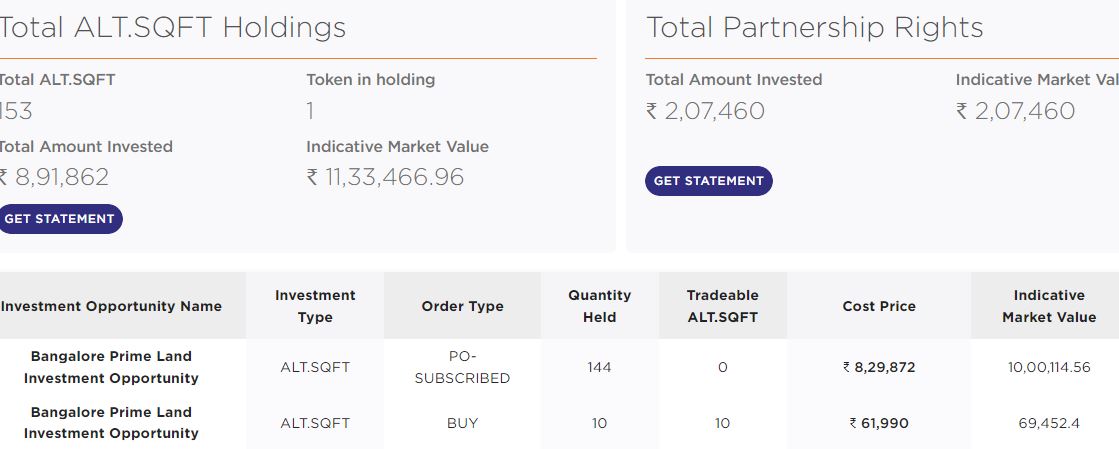

ALTDRX – My current investment in ALT DRX has been deployed in prime land assets. The investment has already gained approximately 15% in the last 3 months. I tried liquidating a few units on the exchange. The actual price would be realized when I can liquidate the entire position. I will be liquidating a few units every month and also participating in the next project. The team behind the project is quite strong. The next opportunity is in Hyderabad.

The real alpha is being generated by investing at the Private opportunity level as can be seen in my investment. The PO opportunity had gone up 20% compared to the FSO which is up around 10%

Wisex- My investment in Wisex has been performing as expected. The Sky opportunity in Pune is still live on the platform.

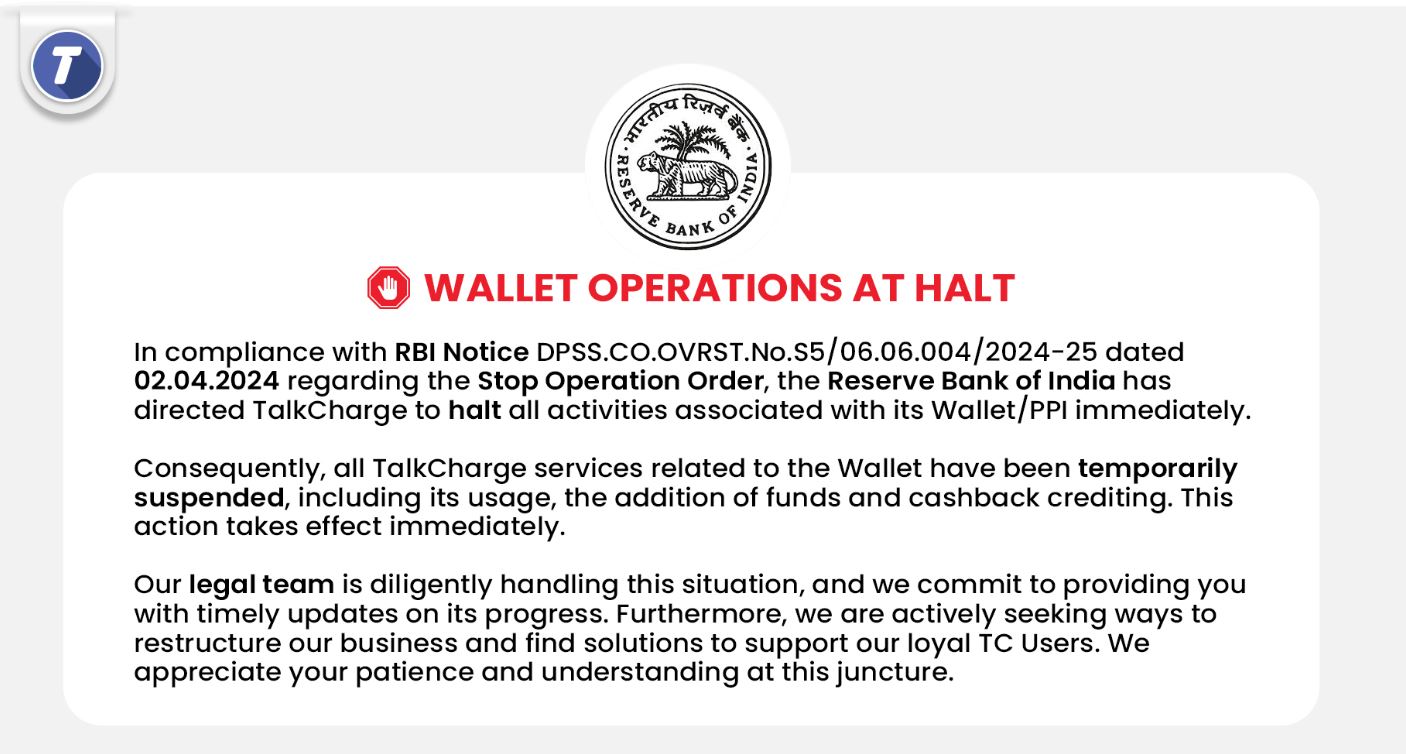

Flagged Alternative Investment Platforms

Have added “Talkcharge” to the list of “Flagged” platforms. Talkcharge App has induced thousands of people to fill their wallets with various schemes of cashbacks etc All of a sudden operations halted, the office closed, & no recharge/bill payments were allowed in the app. Recently RBI has asked them to halt all operations.

Investors should be wary of too-good-to-be-true opportunities offering very high returns without providing details of the business model or the risk being taken to provide those returns.

If there are other platforms that you feel might be too risky to invest in, please do comment and we will explore and add them to the list