In the dynamic realm of real estate investing in India, a transformative shift is underway, reshaping traditional approaches and democratizing access to lucrative opportunities. With the evolving economic landscape and changing investor preferences, the real estate sector is experiencing a notable surge in innovative investment models. Investors are steering away from conventional full-property ownership and embracing new ways of real estate investing, a trend that reflects the broader global movement towards asset tokenization and increased liquidity in traditionally illiquid markets.

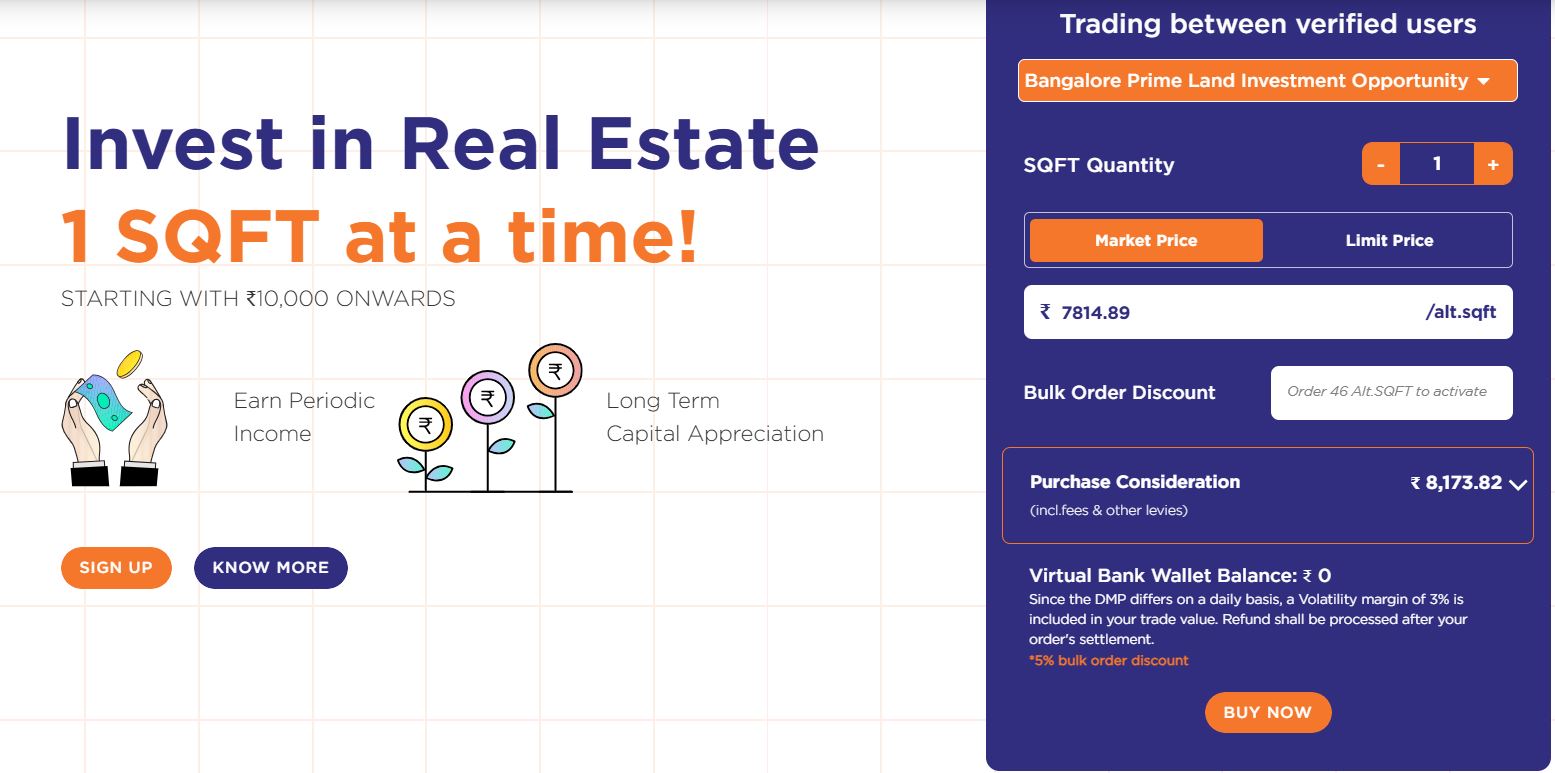

In this post, we cover Alt DRX which claims to be the world’s first digital real estate platform- allowing people to invest in real estate- 1 sq.ft at a time. Let us dig deeper into what this platform has to offer, how it works, how it is different from other fractional real estate investing platforms and more.

What is Alt DRX?

Alt DRX, short for Alt Digital Real Estate Exchange, claims to be the world’s first digital real estate exchange. Founded by industry veterans Anand Narayanan and Avinash Rao, Alt DRX is on a mission to address the challenges associated with real estate investments, making it accessible and liquid for a broader audience.

How does it work?

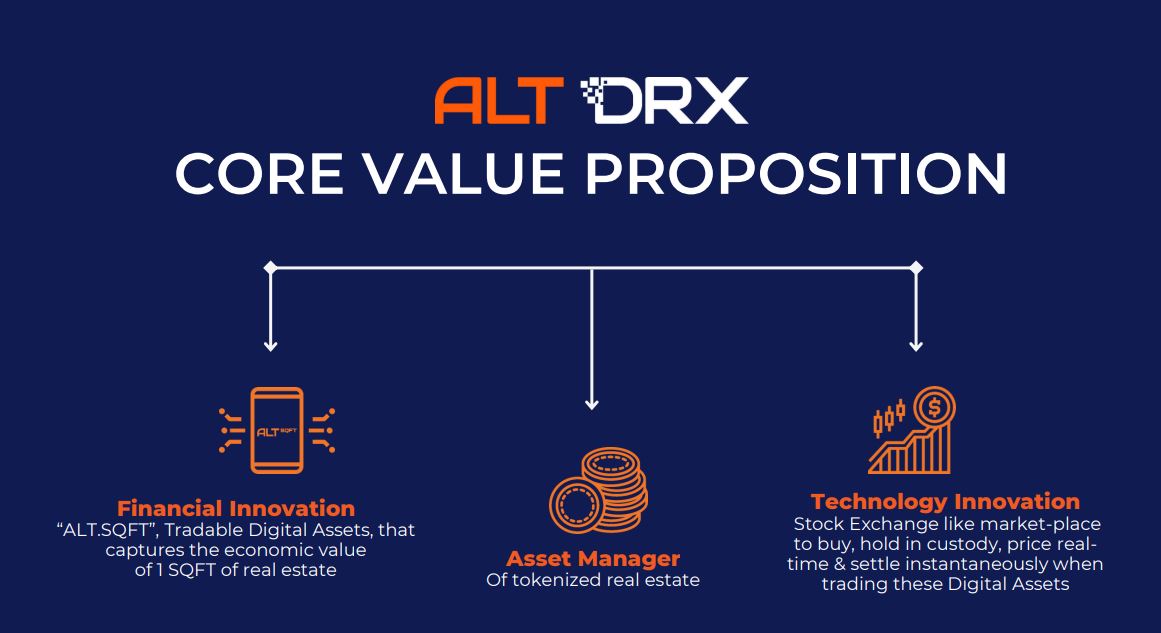

Alt DRX operates on the principle of fractional ownership, breaking down real estate assets into smaller, tradable units known as ALT.SQFT. This approach allows investors to buy and sell fractions of real estate, making it possible to invest in as little as 1 square foot of property. The platform leverages advanced technology, including a proprietary machine learning algorithm, to determine real-time Net Asset Value (NAV) and facilitate peer-to-peer trading in ALT.SQFT.

Different opportunities in Alt DRX

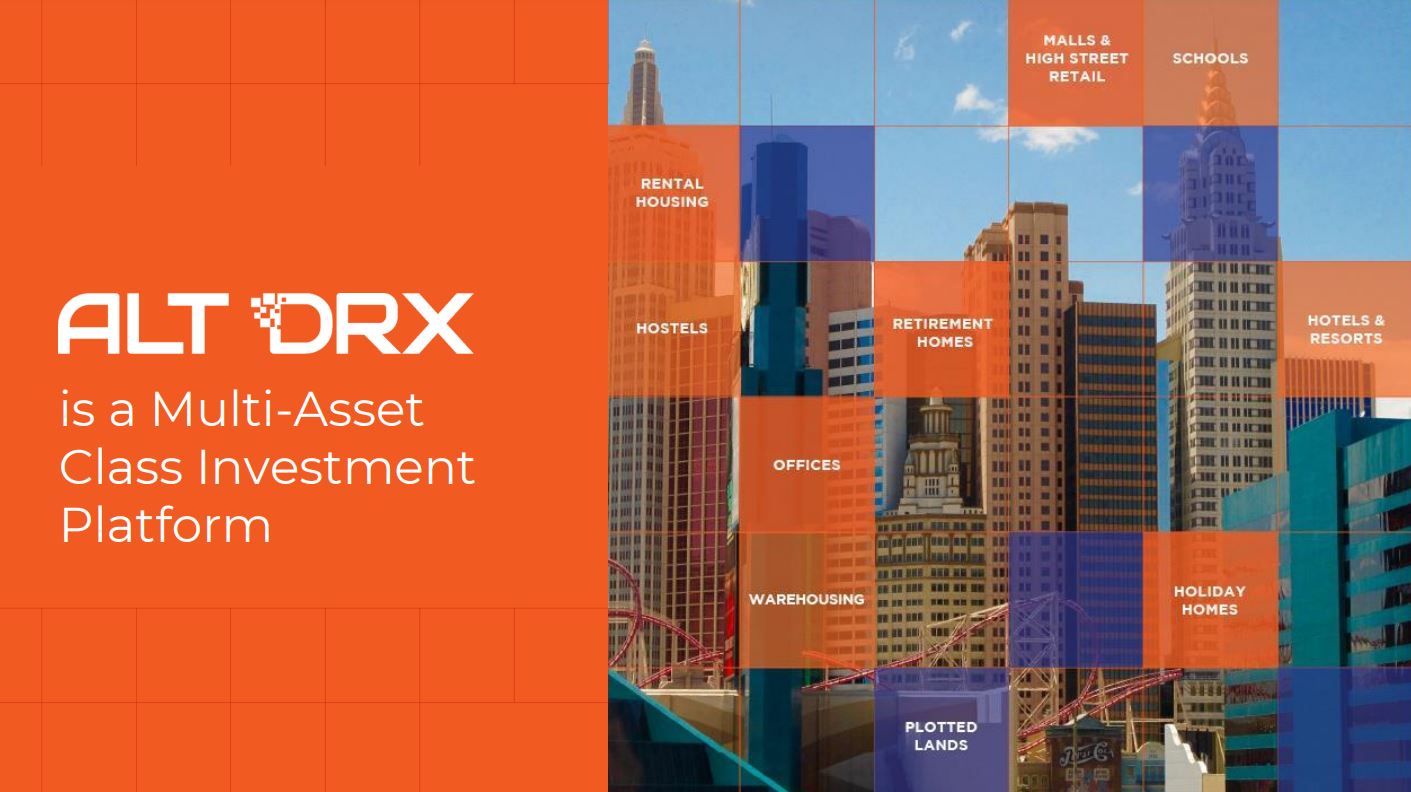

Alt DRX targets different types of opportunities at different stages of investment. The asset class in Real estate targeted by Altdrx comprises a variety of real estate such as

- Land

- Residential Flate

- Commercial Properties

- Hostels etc

The various opportunities available are

- Private Opportunities – These opportunities are like PreIpo stocks available through the Sebi registered AIF route for higher investment tickets and investment is done at an early stage for maximum gain

- FSO – This comprises the first square opportunity where an investor can purchase even 1 square foot asset.

- Tradex – This is the part where people can trade these square feet opportunities like stock on Alt DRX

Current Opportunities on Altdrx

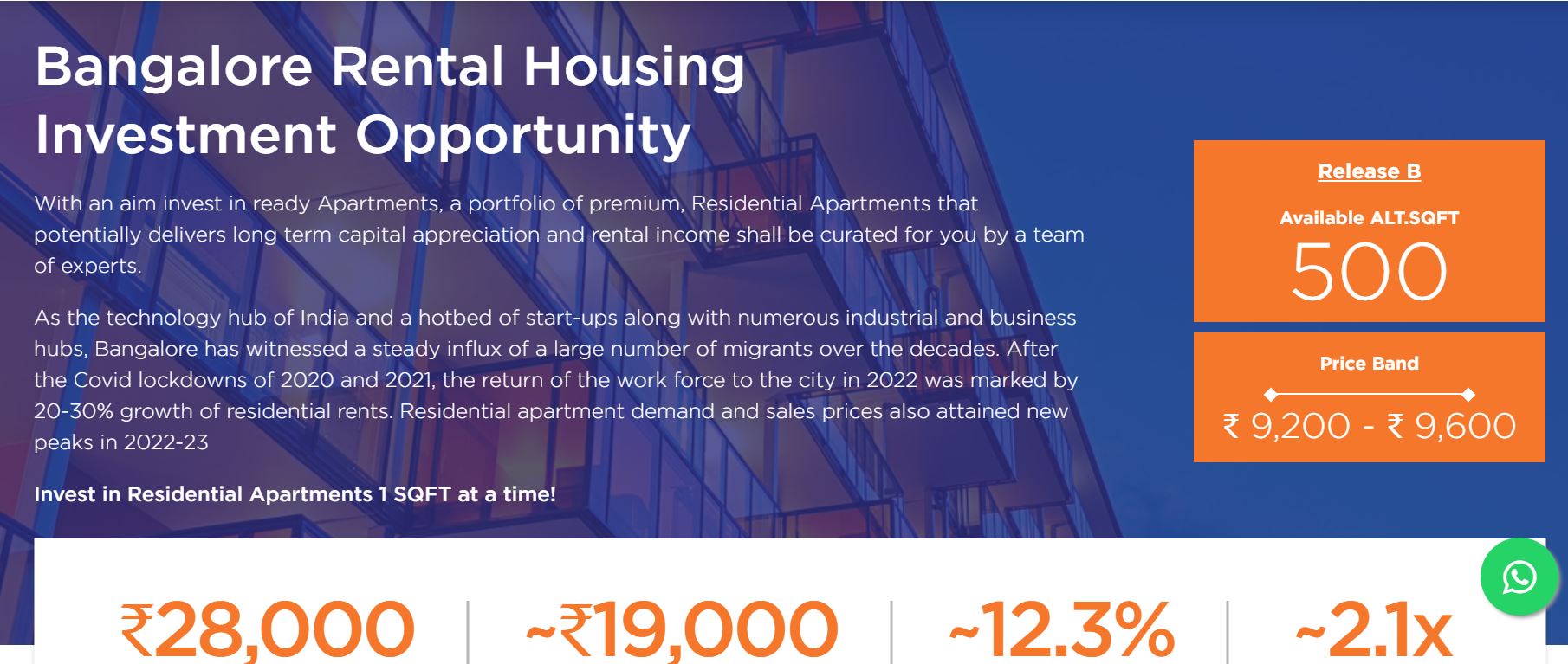

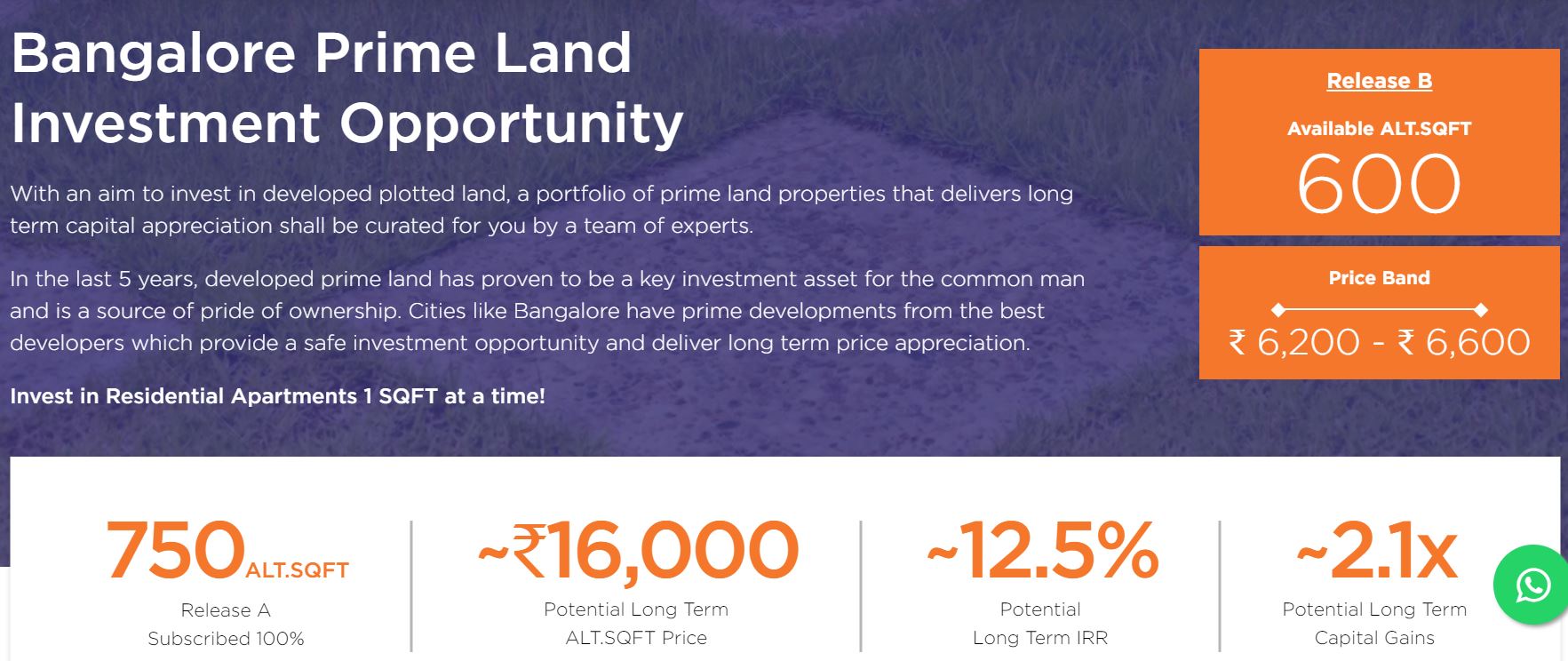

Currently, 2 opportunities are listed on Altdrx highlighted below both targeting 12%+ returns to the investors.

- Land Opportunity

- Residential Flat

Why invest with Alt DRX?

- Low minimum investment: Invest in as low as Rs.10000.

- Diversify your investments across asset classes and take a position in the real estate asset class

- Get regular income in terms of rental income and appreciation

How does it differ from Fractional Real Estate Investing Platforms?

Alt DRX stands out in the crowded space of real estate investing platforms through several key differentiators:

- Innovation in Technology: Alt DRX employs cutting-edge technology to tokenize real estate assets, creating tradable digital assets that capture the economic value of 1 square foot of property. This sets it apart from traditional fractional real estate platforms.

- Marketplace Dynamics: Unlike other platforms, Alt DRX operates as a digital marketplace similar to a stock exchange. Investors can buy, hold, and trade ALT.SQFT in real-time, introducing liquidity and flexibility to the real estate market.

- Investment Stages: Alt DRX follows a structured investment approach with stages like Private Opportunity (PO) and First SQFT Opportunity (FSO), offering investors various entry points into real estate investments.

- Low Minimums: Investing in fractional real estate requires an investment of upwards of Rs.1 Lakh at a bare minimum (most platforms seek 10-25 Lakhs). Here you can invest in units starting from as low as Rs.10000

Alt DRX Team

The success of any platform relies heavily on the expertise and dedication of its team. Alt DRX boasts a seasoned team with leaders like Anand Narayanan and Avinash Rao, who bring a wealth of experience from their roles at prominent organizations like Damac Group, Puravankara, Knight Frank, and ICICI Bank. Additionally, the diverse founding team, including experts in land assets, hospitality, technology, and more, contributes to the platform’s comprehensive approach.

Alt DRX Funding

Alt DRX has successfully secured $3.6 million in its seed funding round. This funding surge attracted notable participation from high-profile individuals associated with the Development Bank of Singapore, Ernst & Young, HSBC, Volvo, and Salesforce. Furthermore, the round saw involvement from an Indian law firm, several startup founders, and family offices. The company’s funding structure included $1.6 million in equity and an additional $2.0 million in callable mezzanine debt, earmarked for co-investment in real assets. This funding injection positions Alt DRX for further advancements in its innovative approach to real estate investing.

Alt DRX Alternatives

There are no direct alternatives to Alt DRX at the moment in India as far as my knowledge goes. The closest alternatives would be the following:

- Fractional real estate investing platforms (High minimum investments and low liquidity). A few platforms I have used are Yieldwisex and Alyf

- Real Estate Investment Trust (Low minimum investment. High liquidity. At the moment, they invest only in commercial real estate and pay regular dividends + the probability of capital appreciation.

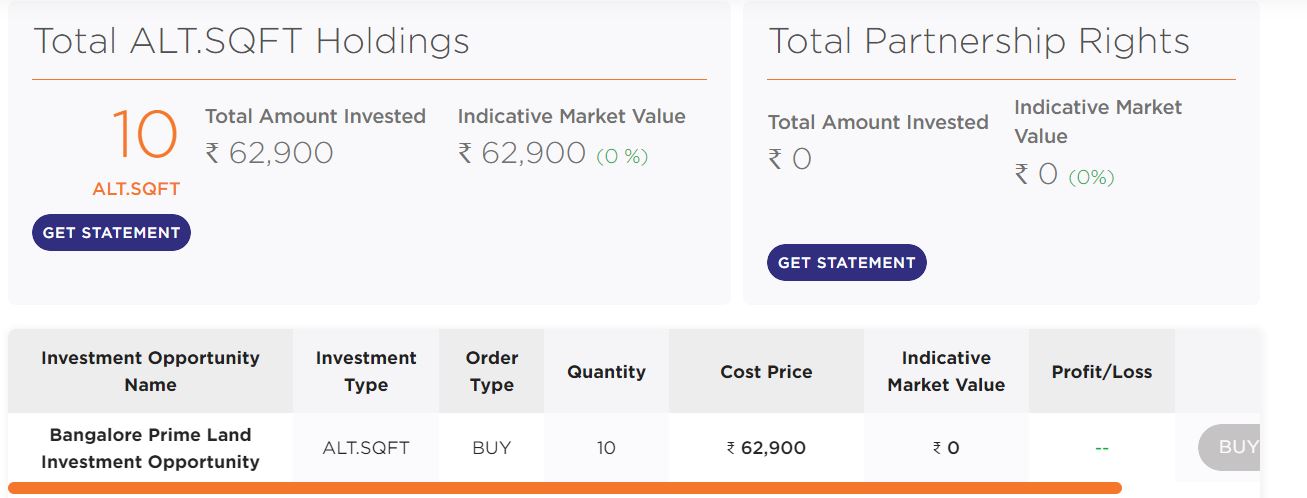

Randomdimes Experience of Investing in Altdrx

We have participated in the land opportunity on Altdrx to test the platform. The investment process was smooth and they have a dedicated team to explain the product. We will be sharing updates on the performance of my investment when we get the next round of valuation.

As of February 2025, we have made 25% IRR on our investments and partially exited!

Conclusion

In conclusion, Alt DRX emerges as a groundbreaking platform reshaping the landscape of real estate investments. Its innovative approach, leveraging technology and a digital marketplace, brings liquidity and accessibility to an asset class traditionally known for its illiquidity. The experienced team, strategic funding, and distinct features position Alt DRX as a noteworthy player in the market, offering investors a new and exciting way to engage with real estate. It is a new platform and thus requires more due diligence before allocating larger capital. You can invest with Alt DRX based on your asset allocation and personal research.

Frequently Asked Questions on Alt DRX

Q: Is Alt DRX suitable for retail investors?

A: Yes, Alt DRX is designed to cater to both UHNIs (Ultra High Net Worth Individuals) and retail investors, making real estate investments accessible to a broader audience.

Q: How does Alt DRX determine the value of ALT.SQFT?

A: Alt DRX uses a proprietary machine-learning algorithm based on multiple variables to determine the real-time Net Asset Value (NAV) of ALT.SQFT, ensuring transparency and accuracy in pricing.

Q: What sets Alt DRX apart from other fractional real estate platforms?

A: Alt DRX distinguishes itself through technology innovation, marketplace dynamics, and a structured investment approach with unique stages like Private Opportunity (PO) and First SQFT Opportunity (FSO).

Q: Can I trade ALT SQFT at any time?

A: Yes, Alt DRX operates as a digital marketplace that allows investors to trade ALT.SQFT in real-time, providing liquidity and flexibility in real estate investments.

Q: How secure is Alt DRX?

A: Alt DRX ensures security through a process patent, utilizing IPFS/Blockchain for ledger credibility, creating a zero-trust architecture. Additionally, FIAT wallets are held in escrow for added security.

Thanks Rohan for providing updates on the new platforms and the way you explain for each of them are nice…have a good day!

Hi Ashok, glad you found the alternative investment reviews helpful!

Thanks Rohan for the review. Can you share review/findings on “ashtongray”. Thanks.

~ Madan

Hi Madan,

Prima facie, ashton gray has not shared enough information to make it transparent, So i will avoid investment at the moment. They are based out of India and offering investments in Texas makes it really complicated for a retail investor.

Hi Rohan, Thanks for keeping us informed on the alt investment platforms. My request to you is to do a deep dive into the platform to ensure that even the critical aspects are covered. I explored Alt Drx but was not comfortable with the valuation of the Alt Drx unit. The underlying asset is real estate and when I asked them for documents to prove the acquisition price, they were very cagey. When they are raising funds at inception, they should be transparent about the acquisition price of the asset. In my case, when I made some enquiries in the market, I figured out that their acquisition price was almost 30% more than the current market price. I was not comfortable with such a large gap and had to do a raincheck on the investment.

Hi Krishna,

I have invested in private opportunity on Altdrx at 5700 and I was also shared the valuation report. The price seemed correct factoring in the stamp duty etc.

The price in FSo would be slightly higher as they do not get benefit of investing in larger amount.

I have asked them to share with you all the details! Hope that will give you more insights.

Thanks sir for providing update on alternative investment platform.