Wishing everyone a prosperous 2024!

After starting the year with whispers of a crash, Wall Street surprised everyone with a dramatic bull market. Even unexpected events like the US banking crisis and the Israel-Hamas conflict couldn’t derail the rally. Major US indexes not only recovered from 2022 losses but reached all-time highs, fueled by:

- Brighter economic forecasts: Recession fears faded, replaced by optimism about a “soft landing” and promising progress on inflation.

- Shifting Fed policy: The Federal Reserve’s easing tone hinted at potential rate cuts in 2024, boosting investor confidence.

- Risk-taking frenzy: Investors embraced riskier assets, leading to skyrocketing returns in cryptocurrencies and semiconductors. The S&P 500 surged over 25%, bolstered by gold’s 13% gain and a weaker dollar.

However, not all was sunshine and rainbows:

- Chinese stocks lagged: Investors remain wary of China’s bumpy recovery, causing the Hang Seng Index to plummet 17%.

- Oil prices fell back: After a stellar 2022, oil prices retreated due to softened demand and easing supply constraints.

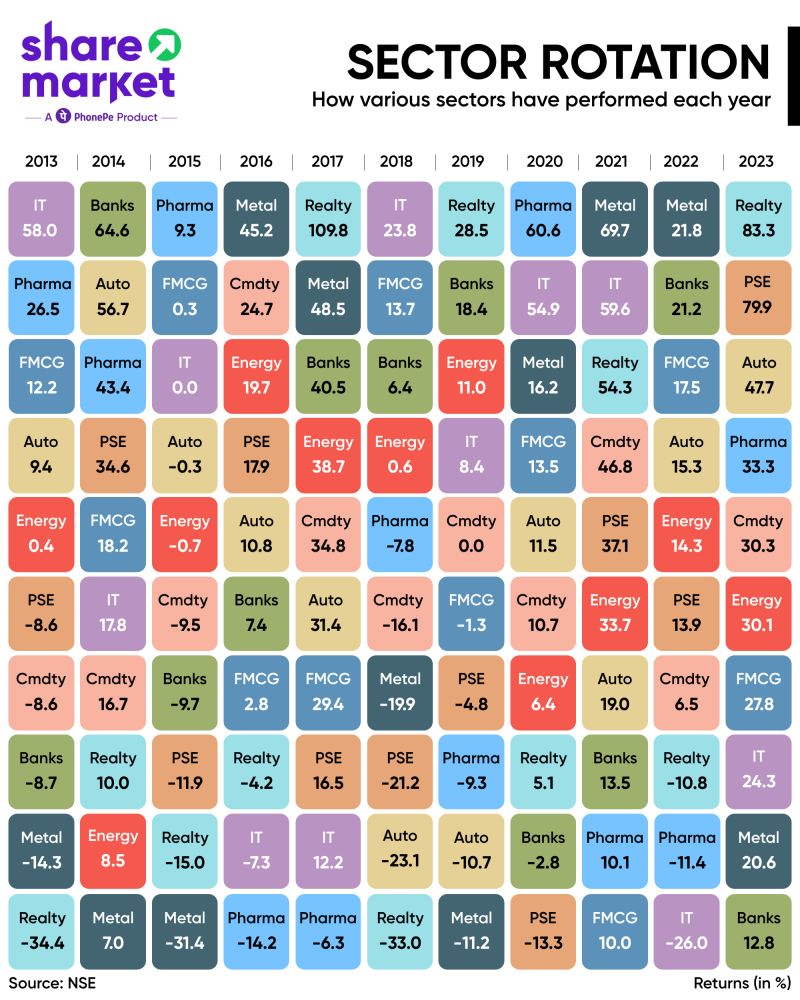

The Indian market was the second-best performer in the world after Brazil propelled by strong BJP performance in the state elections hinting at a strong majority in the 2024 national elections.

Telegram channel for the Latest Alternative Investment News

Alternative Investment Portfolio Updates

- This month I added a new platform and also invested in it. The platform is called Altdrx which allows fractional ownership of real estate. The platform currently has 2 types of opportunities

Private and FSO( First Square Offer) that can be compared to venture investment and IPO for real estate. I am investing in the private opportunity as expected IRR can be up to 20% for 2 to 3 years of investments.

Unlike real estate debt here you own the underlying asset hence, there is no default risk. The biggest risk of investors is illiquidity which has been lowered through creating the secondary investment and trading market.

I have invested in the Private Opportunity with an expected yield of 15-25% in 2 years.Will be sharing updates on my investment portfolio over the next few months.Generally, I avoid investing large amounts in new platforms but I found the deal and platform quite exciting! Our review of AltDRX

- I have also created a new section in the Website “Blacklist” that contains the table of platforms I am avoiding due to bad past performance or being skeptical about their structure. Request all to comment and add platforms based on your diligence and research. I feel many platforms have mushroomed under the guise of ALternative investment and may be fraud or ponzi schemes hence it is important to do more research before deploying capital.

Latest NPA/Delay Details

To provide more comprehensive information on deals performance on platforms, I have collected the performance of multiple users of these platforms and created an NPA statistic. The benefit of this is that even though my deals are going well in a platform, this will give the overall performance of the other deals on the platform that I might not have invested in.

- Arzoo has delayed the repayment of its invoice on Jiraaf. It is expected to be paid in January. I will update the NPA status post-January and share the progress

- Exapmur has delayed payment on Tapinvest for a few days. They have already shared updates and payment is expected this month.

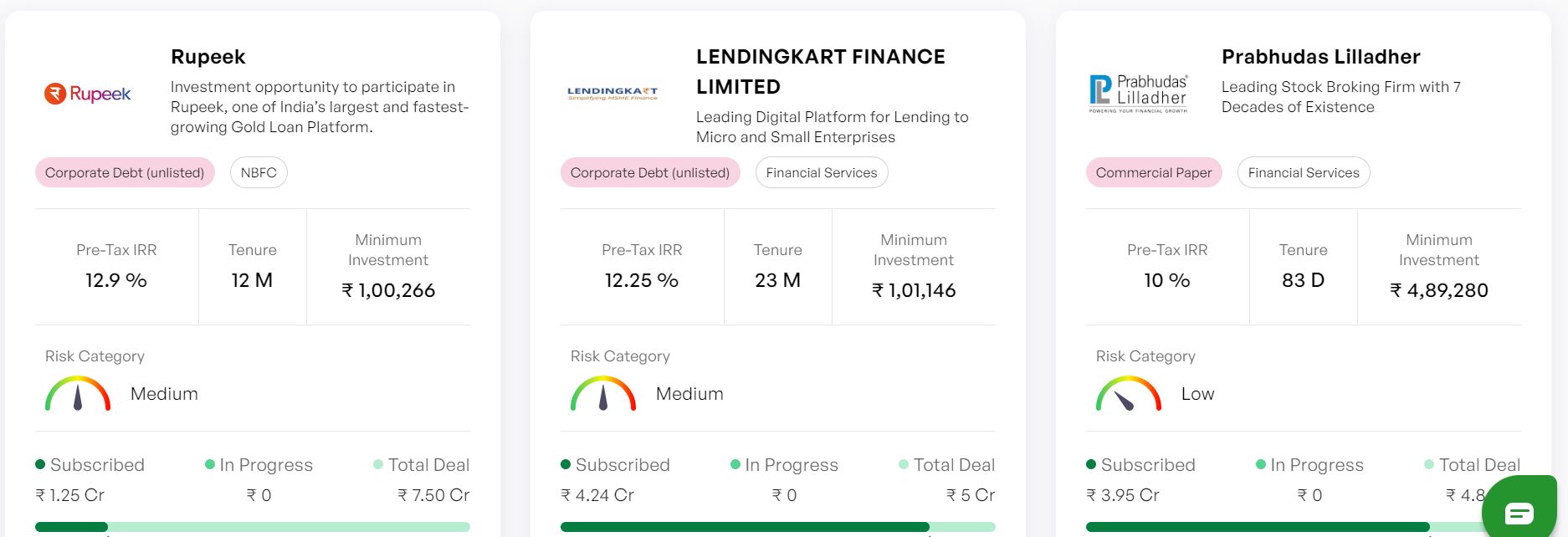

Lending Investment

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.00% | 0.70% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf | 12-15% | 0.00% | 0.00%* |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | 12%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- All my cash flows in Klubworks, WintWealth, Jiraaf, TapInvest, and GripInvest are per schedule.

- Participated in the new Betterinvest deal

- Participated in Leasex Cherise on Gripinvest

- Invested in 2 invoices and 1 Asset leasing opportunity on TapInvest

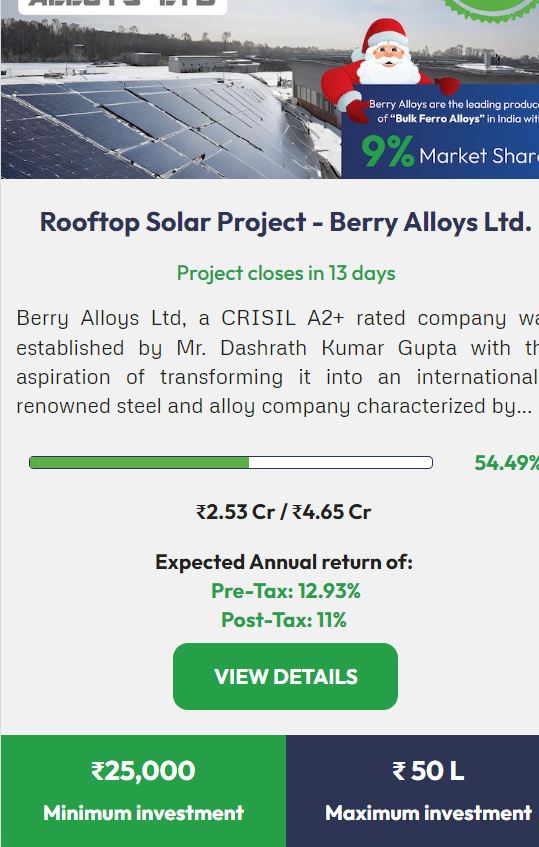

- Sustvest had a new opportunity recently with post-tax returns of 11%. My sustvest opportunity is paying on time.

Randomdimes Youtube

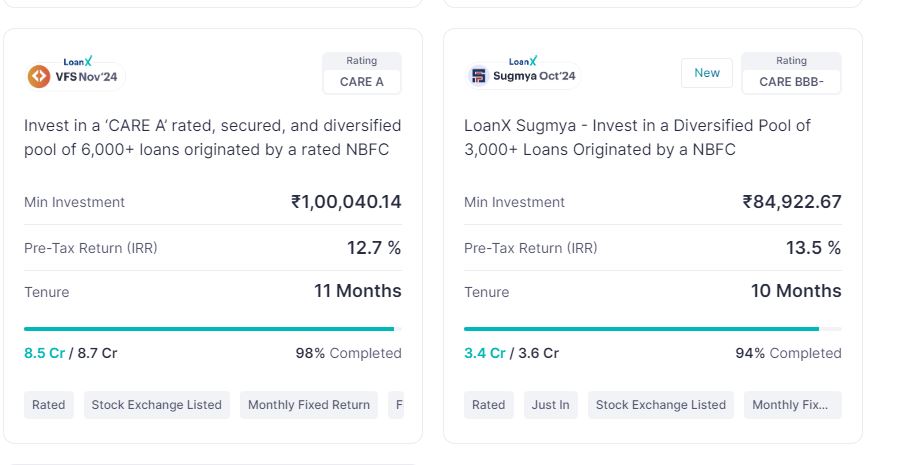

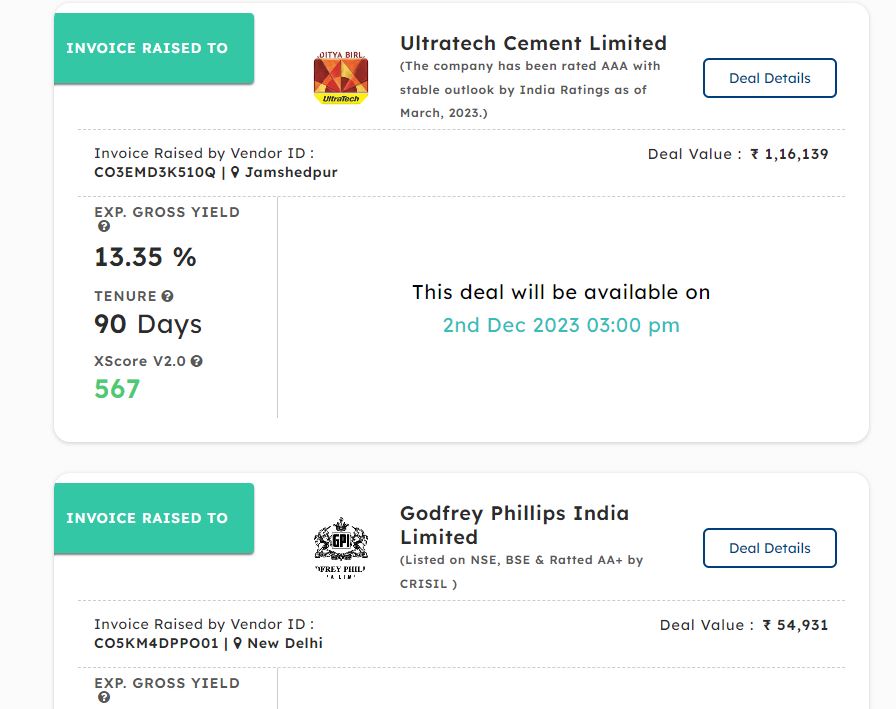

Invoice Discounting and Pooled Loans

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Liquid Fund Substitute) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox (Per Annum Liquid Fund Substitute) | 11.50% | 0% | 0% |

| Lendzpartners | 13.00% | 0% | 0% |

| IndiaP2P | 16% | 0.25% | 0.10% |

| KredX | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.69%

- Using Liquiloans/Per Annum to Park Short-term Capital.

- Participated in Boehringer Ingelheim deal on Lendpartnerz

- Started investment journey with 13 Karat P2P

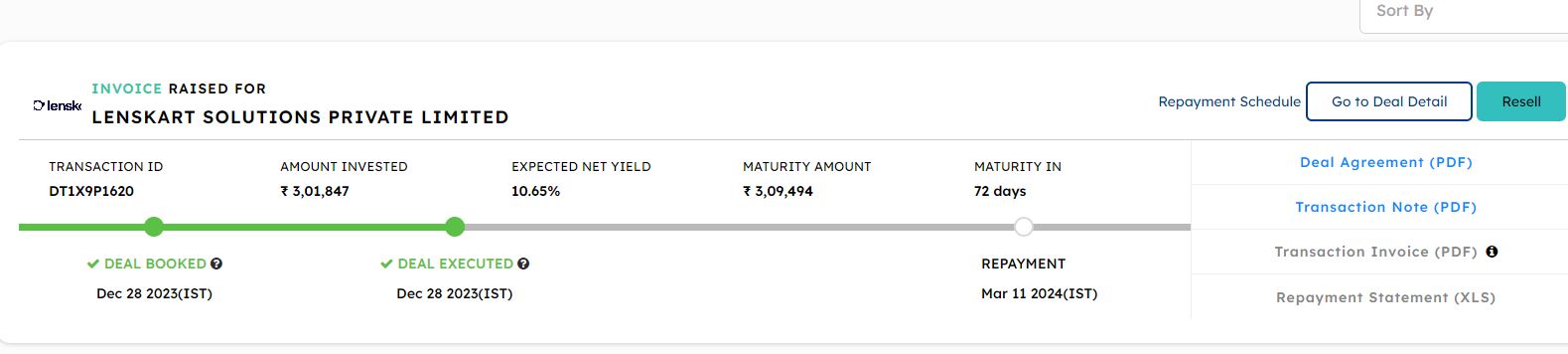

- Invest in 2 Kredx Deals – Lenskart and Nayara Energy

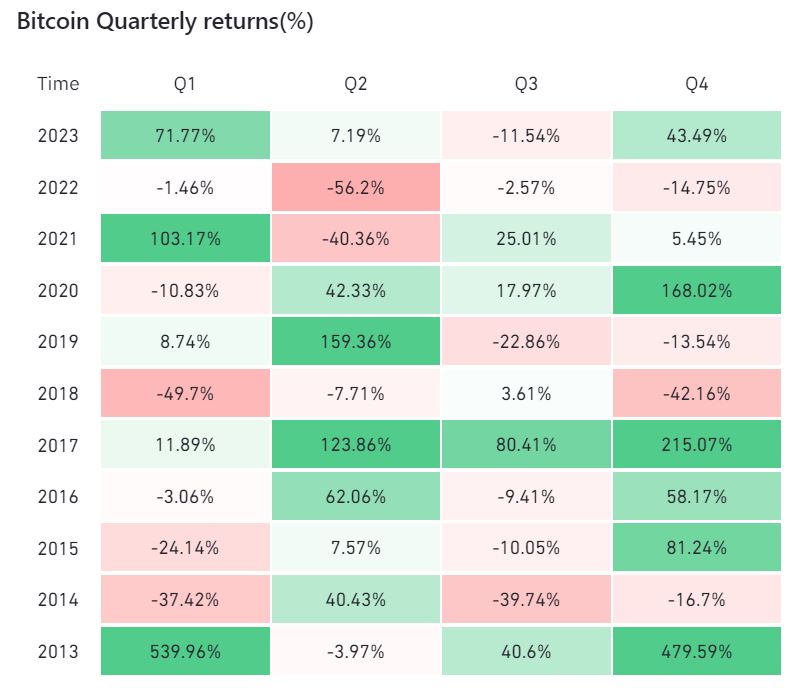

Crypto Investing

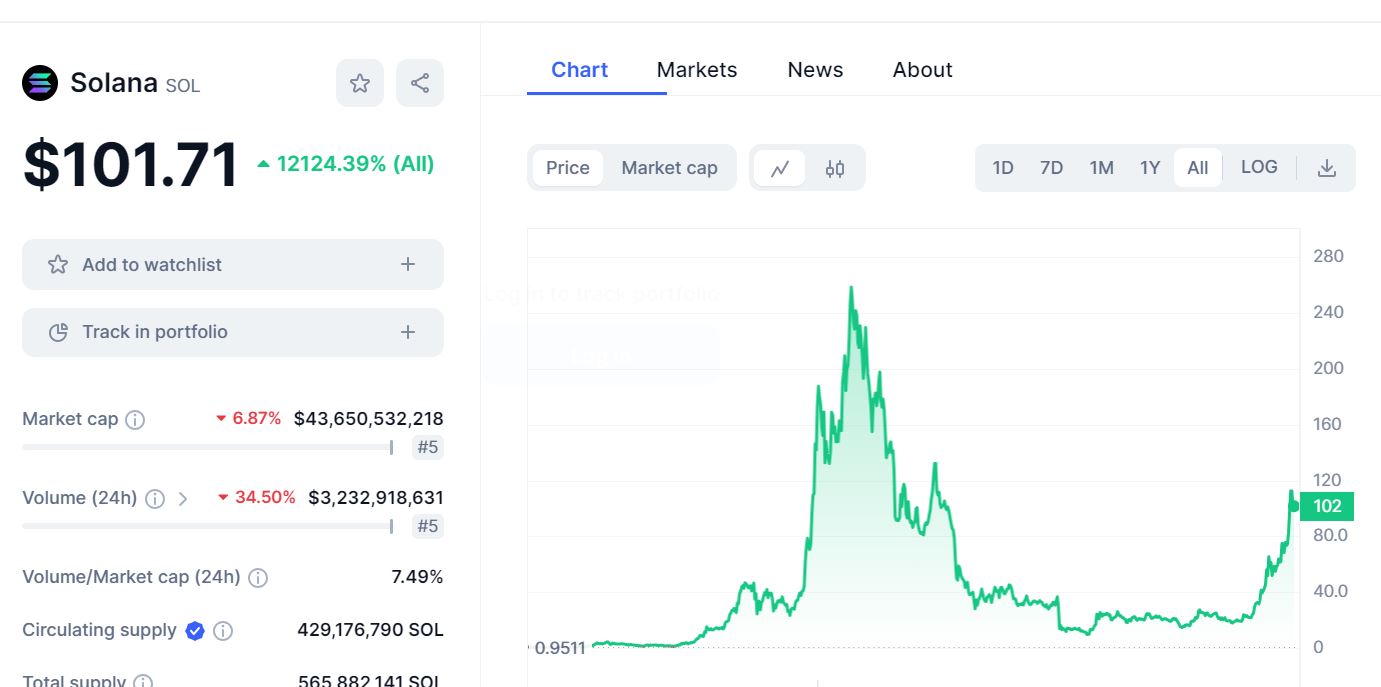

Crypto Investment during the winter has finally fructified! The performance of Crypto is nothing short of stellar. Below is the performance crypto from 2022 when the Crypto crash happened.

At this level, I am risking off and cutting my position in half mostly from Solana which has gone 5x from my buying level though some people were able to bottom fish and got 10X in a year. Will be adding some small-cap Crypto that has not moved much as they can provide high beta exposure in a bull run!

You can buy Hardware Wallets on Etherbit

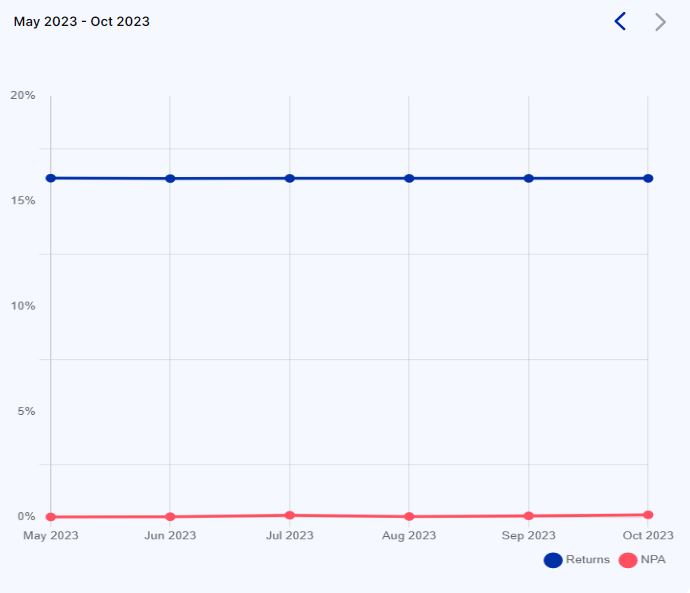

P2P Investment

Current allocation:

- India P2P – 50%

- 12Club – 5%

- I2IFunding- 20%

- Finzy-10%

- Faircent Pool Loan -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.8% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club | Only Minimum amount | 12% | 0% |

- I got the opportunity to interview IndiaP2P founder Neha Juneja. It was insightful. Interview Link

- I2Ifunding (get 50% off) has again started doing more volume. I have deployed some capital. I have been using the platform since 2017 and is the only platform that was able to get investors positive returns after Covid! Will be doing a 5 year review soon and try to have an interview with the founder.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing fine. Not adding more capital at the moment.

Equity Market

PreIPO Stocks

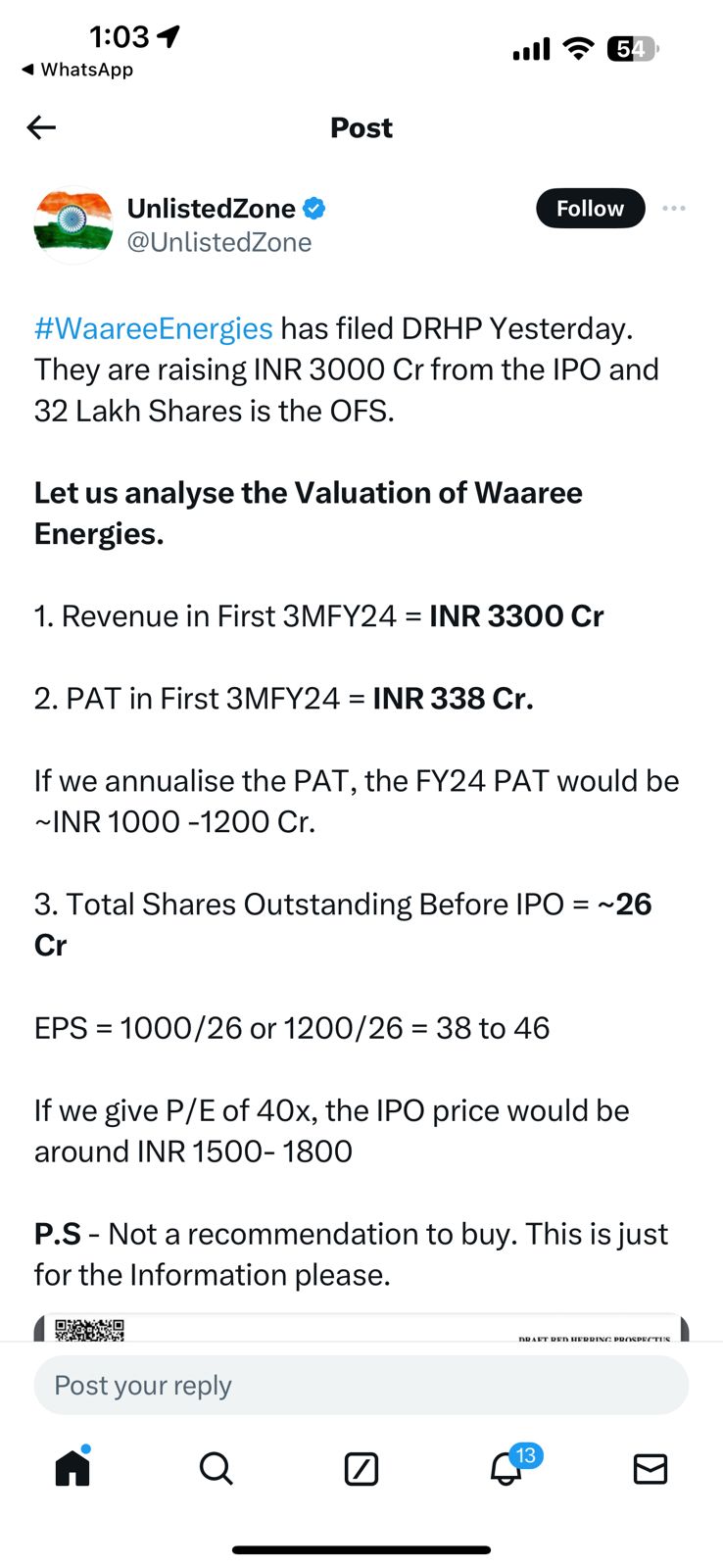

A few months back we highlighted that Waree Energy has been in a lot of demand in the gray market. They have recently filed for an IPO. Based on the valuation 1500+ level of listing is expected. Investors who we able to enter at 800-1000 levels this year might get windfall profits.

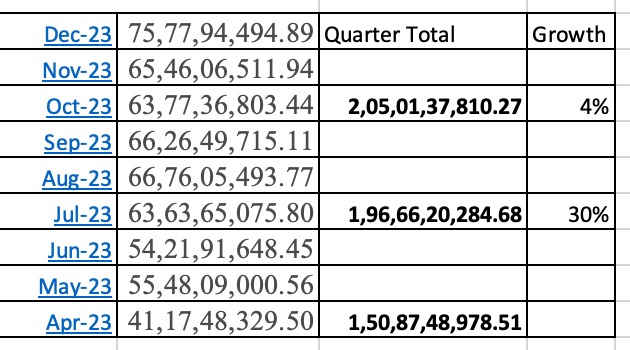

NSE has been consistently increasing profits every quarter. The uncertainty of the listing date is the only reason that has not allowed to price to cross 4000 in the unlisted market

Listed Stocks

The market has been on steroids with every week bringing new highs. The election rally may take it to further heights but I am avoiding taking any large incremental investments at these levels. The US market has hit an all-time high with Nasdaq giving almost 50% returns from the bottom. I was able to invest in Nasdaq at those levels but could not take a large bet.

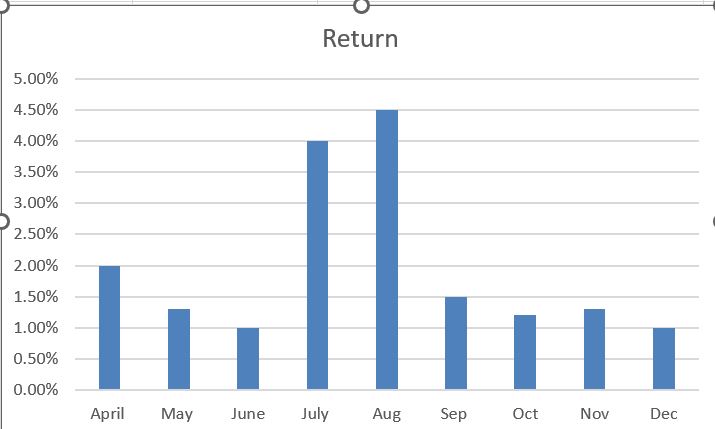

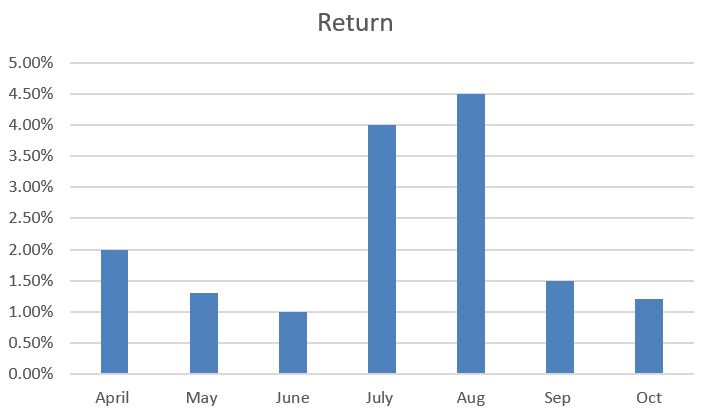

Algo Trading

Our Algo and Manual Option trading gave a 1% return in November. The trending market prevented us from making higher returns. Hopefully, January will help us to deliver higher returns. Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

It is evident from returns that’s hard to predict the distribution of returns as that is the function of market behavior. On an annualized basis 20-30% is a decent target.

Investors with INR 30+ Lakh deployable capital can reach out to inquire on more sophisticated algos

Other Alternative Investment Assets and Platform Updates

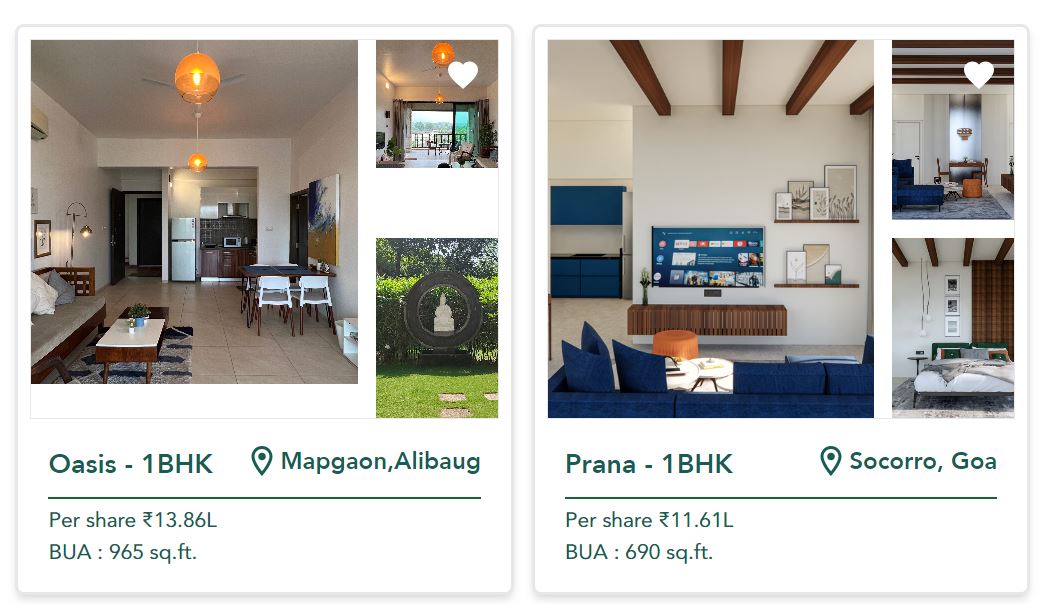

ALYF – Alyf is an upcoming platform that provides fractional ownership of holiday homes in tourist destinations. Currently 2 opportunities with < 15 Lakh investment are available in Alibaug and Goa.Interested people can register and get a call from their team.

These opportunities make even more sense for that investor who would also like to spend time in this rather than just being a passive investor.

Growpital Investment – Growpital payments have been on time. They have recently created a WhatsApp group for partners that is very helpful for investors to discuss queries.

Growpital(Promo code GROWRDIMES)

Leasify Investment – Leasify generally has low volume as they are bootstrapped hence I do not expect to see many deals on the platform for a couple of months. The current deals are doing fine.