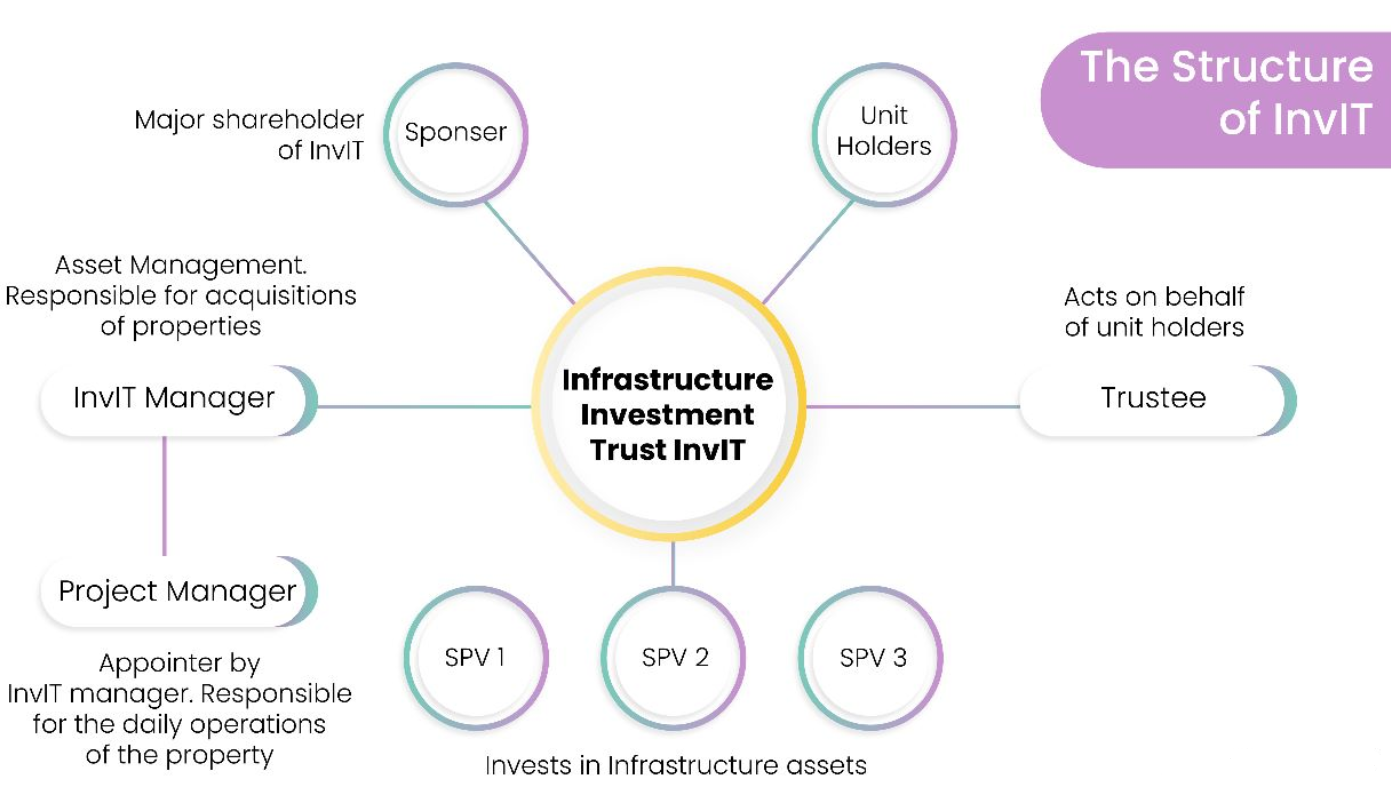

What is an InvIT?

An InvIT, or Infrastructure Investment Trust, is a type of investment vehicle that allows individual investors to participate in the ownership of infrastructure assets. InvITs are listed on stock exchanges, and their shares can be bought and sold just like any other stock.

Why invest in InvITs?

There are several reasons why investors might want to consider investing in InvITs. First, InvITs offer the potential for attractive returns. Infrastructure assets tend to generate stable and predictable cash flows, which can provide a good source of income for investors. Second, InvITs offer diversification benefits. By investing in InvITs, investors can gain exposure to a variety of infrastructure assets, such as roads, power plants, and telecommunications networks. Third, InvITs can be a good way to access infrastructure assets that are not typically available to individual investors.

What should you look for in an InvIT?

When choosing an InvIT, there are several factors that investors should consider. These include:

- The underlying assets: The quality of the underlying assets is one of the most important factors to consider when choosing an InvIT. Investors should look for InvITs that own assets that are well-maintained and have a long lifespan.

- The sponsor: The sponsor is the entity that sets up and manages the InvIT. A strong sponsor with a good track record is important for ensuring the success of an InvIT.

- The valuation: The valuation of an InvIT is another important factor to consider. Investors should look for InvITs that are trading at a fair valuation or at a discount to their NAV.

- The dividend yield: The dividend yield is the amount of income that an InvIT pays out to its shareholders each year. Investors should look for InvITs that offer a competitive dividend yield.

- The regulatory framework: The regulatory framework governing InvITs is still evolving, so it is important to consider the risks associated with this investment.

Benefits of Invits in India

Infrastructure Investment Trusts (InvITs) are a relatively new investment product in India, but they have quickly gained popularity among investors. There are three main reasons why investors should consider InvITs as an asset class:

- Predictable cash flows: InvITs are required to invest at least 80% of their assets in completed and revenue-generating projects. This ensures that InvITs have a steady stream of income, which can be distributed to investors in the form of dividends.

- High DPU: InvITs are required to distribute at least 90% of their net distributable cash flows to investors. This means that InvITs typically have a high dividend yield, which can provide investors with a reliable source of income.

- A blend of debt and equity: InvITs are a hybrid of debt and equity investments. This means that investors get the predictability of a debt investment, as well as the potential for growth of an equity investment.

In addition to these three reasons, InvITs also offer a number of other benefits, such as:

- Liquidity: InvITs are listed on stock exchanges, which means that investors can buy and sell units in the trust just like they would shares in a company. This makes InvITs more liquid than other types of infrastructure investments, such as direct ownership of infrastructure assets.

- Diversification: InvITs typically invest in a diversified portfolio of infrastructure assets, which can help to reduce risk.

- Tax benefits: InvITs offer a number of tax benefits to investors, such as the ability to claim long-term capital gains tax exemption.

How to invest in InvITs

InvITs are listed on stock exchanges, so investors can buy and sell their shares just like any other stock. Investors can buy InvITs through a broker or through a self-directed investment account.

Best Invits in India

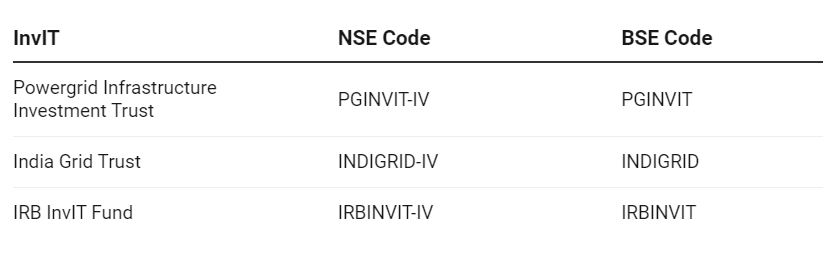

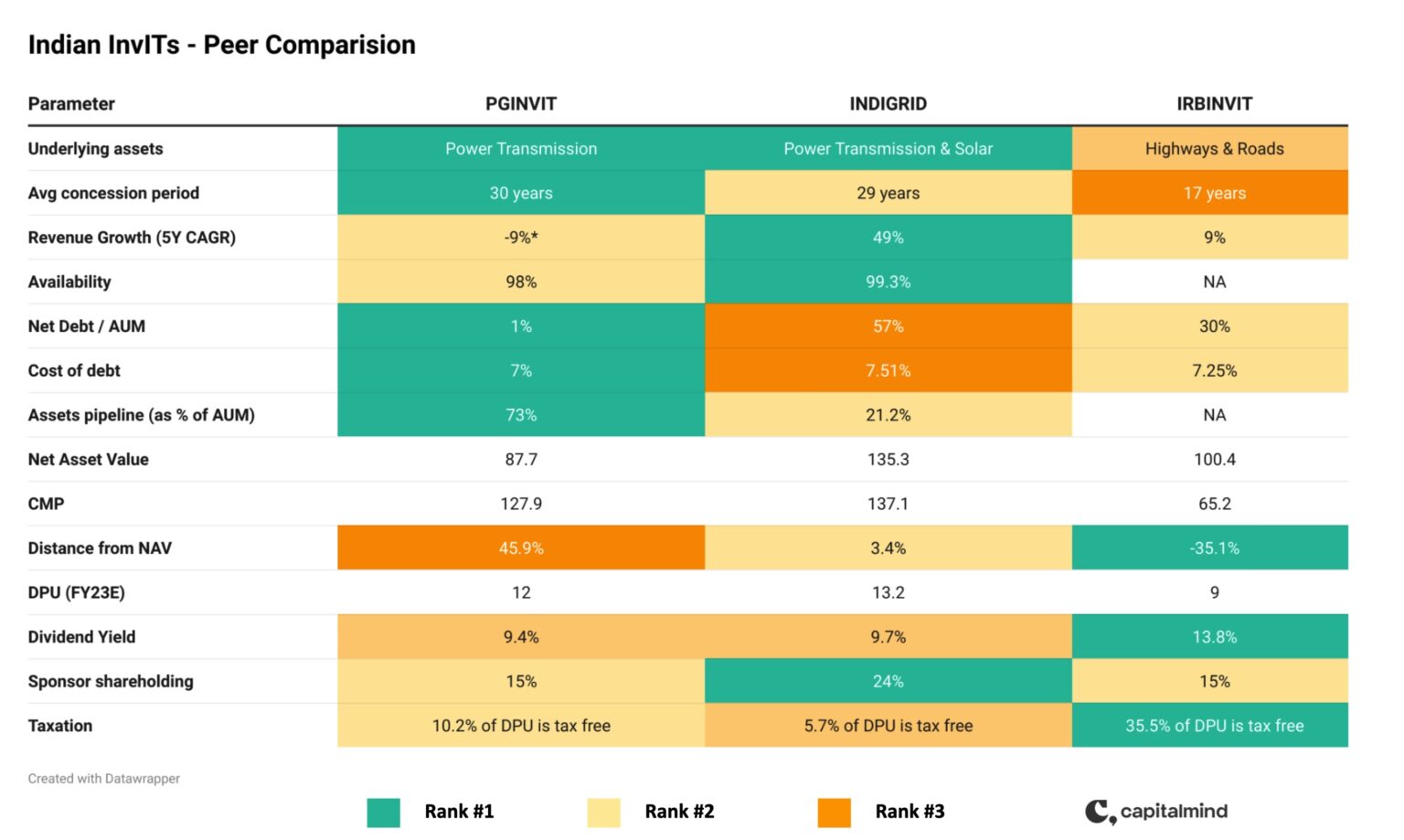

Out of the 3 Invits in India, IRB is infrastructure focussed, while the other 2 are power distribution. We will exclude IRB as the performance has been below par since inception.

PowerGrid InvIT

PowerGrid InvIT is a power transmission infrastructure investment trust (InvIT) that is sponsored by PowerGrid Corporation of India (PGCIL). PGCIL is a Maharatna PSU and the largest power transmission company in India.

PowerGrid InvIT owns, constructs, operates, and maintains five transmission lines in India. The total asset under management (AUM) of the trust is ₹10,384.8 crore.

The trust has a number of attractive features, including:

- No development risk: The initial portfolio assets of the trust are fully operational and revenue-generating, which means that there is no development risk associated with the trust. This is a key advantage for investors, as it reduces the risk of the trust not generating any income.

- High availability: The trust has historically maintained an availability of above 98%, which means that the assets are available to generate income for the trust most of the time. This is another key advantage for investors, as it ensures that the trust will be able to generate a consistent stream of income.

- Consistent cash flows: The tariffs for the trust’s assets are not linked to the power transmitted but to the availability of the grid. This means that the trust will be able to generate a consistent stream of income, even if the demand for power fluctuates.

- Perpetual ownership: The assets of the trust are built under the BOOM model, which gives the trust perpetual ownership of the assets. This means that the trust will be able to generate income from the assets for the long term.

- Long tenure: The average tenure of the TSAs for the trust’s assets is 30 years, with an option to extend up to 50 years. This means that the trust will be able to generate income from the assets for the long term.

- Low counterparty risk: The transmission charges for the trust’s assets are pooled by the CTU and paid to the licensee. This reduces the counterparty risk, as the trust is not exposed to the risk of the licensee defaulting on its payments.

- Strong credit rating: The trust has a strong credit rating of AAA, which means that it is considered to be a very safe investment. This is another key advantage for investors, as it reduces the risk of the trust defaulting on its payments.

Overall, PowerGrid InvIT is a well-diversified and attractive investment option for investors who are looking for exposure to the power transmission infrastructure sector in India.

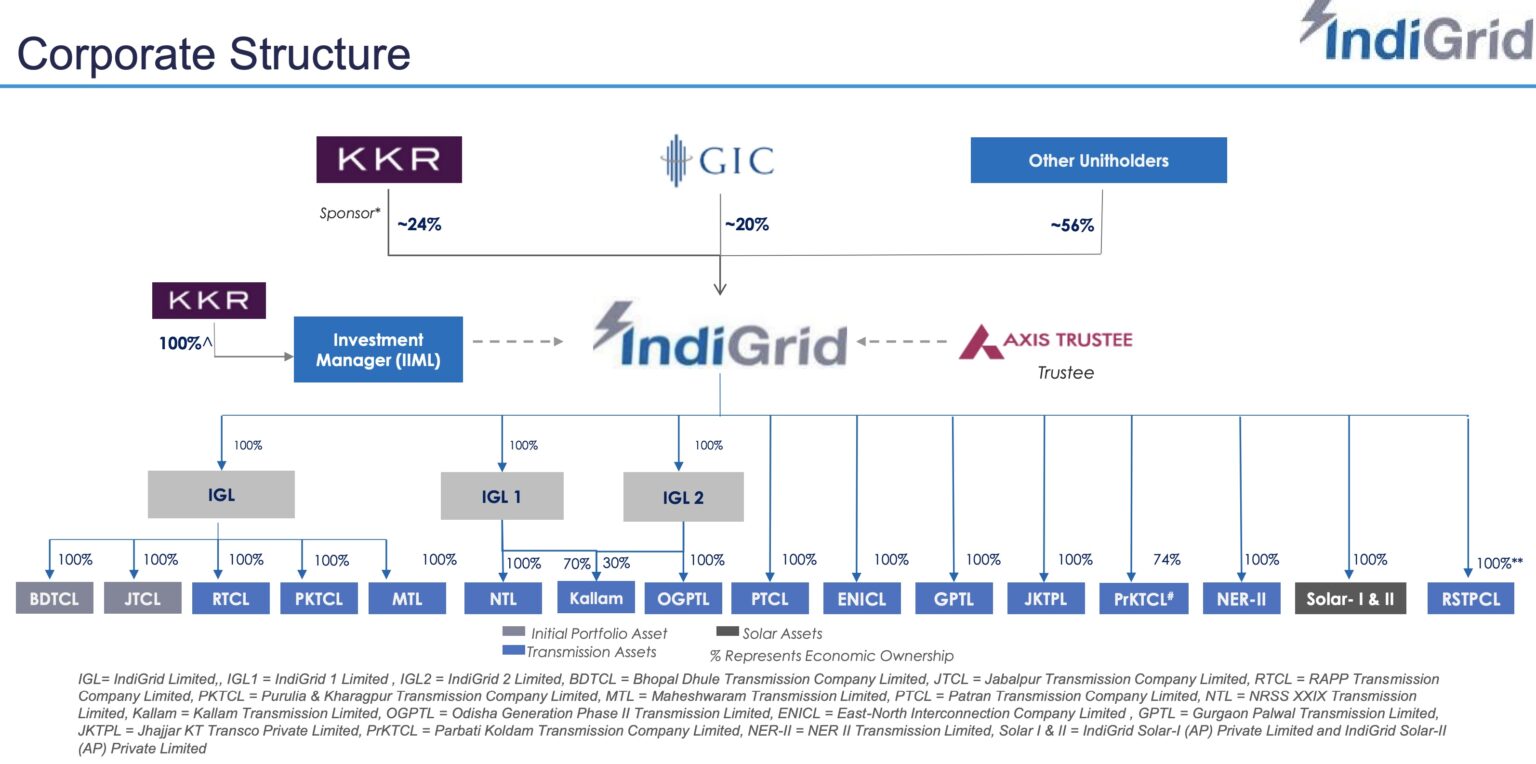

IndiGrid InvIT: The fastest-growing InvIT in India

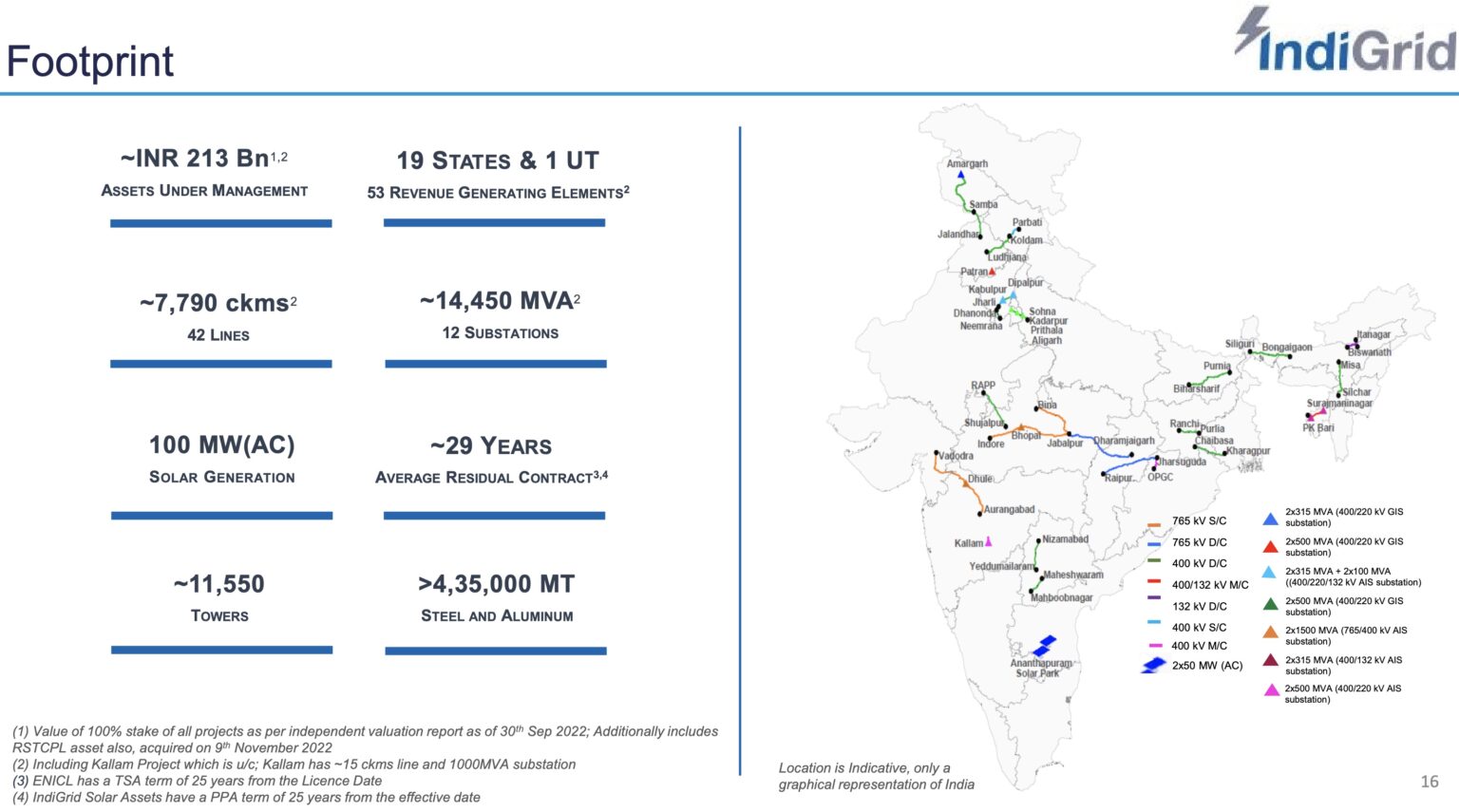

IndiGrid InvIT is one of the fastest-growing InvITs in India. It is sponsored by KKR & GIC and has a portfolio of 42 transmission lines with ~7,790 km in length, 12 substations with ~14,450 MVA transformation capacity, and 100 MW (AC) solar generation capacity.

Since its listing in 2017, IndiGrid has grown from 2 power transmission projects to 14 power projects. The AUM had increased 5x from 3600 Cr to 21,100 Cr as of FY22.

Here are some of the key features of IndiGrid InvIT:

- Fastest-growing InvIT: The revenue of IndiGrid InvIT has grown by a CAGR of 49% in the last five years.

- High total returns: IndiGrid InvIT has generated a total return of 16% CAGR since listing and the DPU has grown by 4% yearly.

- High availability: The company has historically maintained availability of above 99.5%.

- Long tenure: The average tenure of the TSAs for the trust’s assets is ~29 years.

- Strong asset pipeline: IndiGrid InvIT has a strong asset pipeline and is looking to increase its AUM to 300,000 Cr in the next few years.

- Diversification into solar: The company is slowly diversifying into other power sources like solar. In 2021, it acquired its 100% stake in two solar assets with a cumulative capacity of 100 MW.

If you are looking for an InvIT with high growth potential, IndiGrid InvIT is a good option to consider. The company has a strong track record of growth and a long runway for future growth.

Why invest in IndiGrid InvIT?

There are several reasons why investors should consider investing in IndiGrid InvIT:

- High growth potential: IndiGrid InvIT is one of the fastest-growing InvITs in India. The company has a strong track record of growth and a long runway for future growth.

- Attractive yields: IndiGrid InvIT offers attractive yields. The DPU has grown by 4% yearly and the company has a strong asset pipeline.

- Strong credit rating: IndiGrid InvIT has a strong credit rating of AAA. This means that the company is considered to be a very safe investment.

- Diversification: IndiGrid InvIT is a diversified investment. The company’s portfolio includes transmission lines, substations, and solar assets. This helps to reduce risk.

Overall, IndiGrid InvIT is a good investment option for investors who are looking for high growth potential, attractive yields, and a strong credit rating.

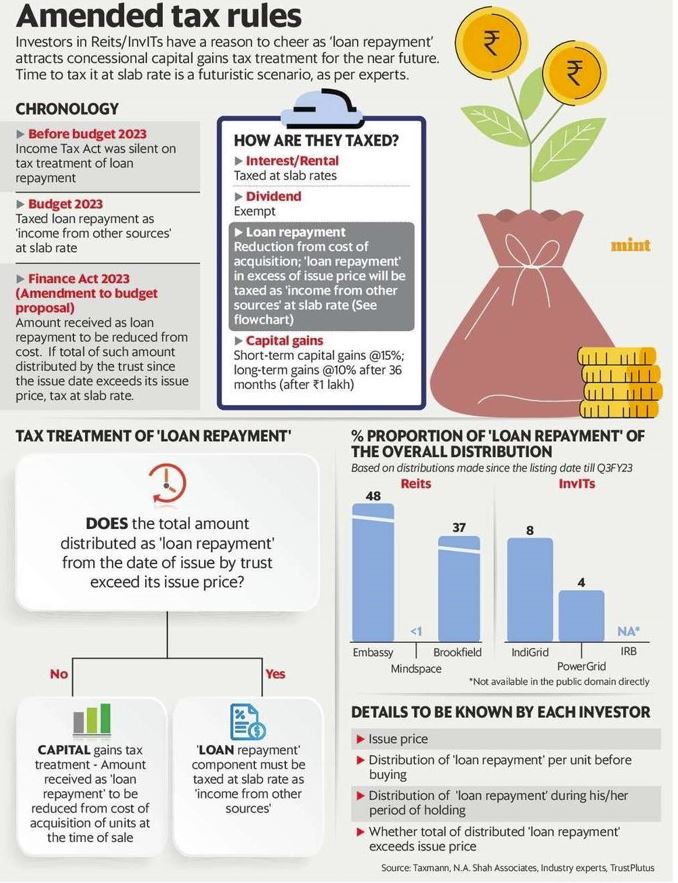

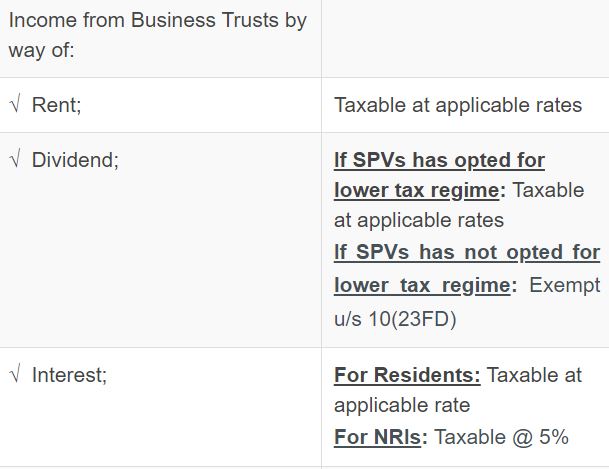

InvITs Taxation in India

InvITs make distributions to their unit-holders in the form of interest, dividends, and rental all of which are pass-throughs and are taxed in the hands of unit-holders. The dividend has a tax-exempt component also.

Let’s take the case where Mr. X had invested in the PGInvIT at the start of the current financial year.

The investment manager of PGInvIT has announced a payout of Rs 3 per unit, to be made on November 9, 2022. This is PGInvIT’s second payout for the financial year 2022–2023.

The breakdown of the Rs. 3 payout per unit is as follows:

Rs 1.98 in interest

Rs 0.62 in taxable dividends,

Rs 0.20 in tax-exempt dividends,

Rs 0.19 by way of repayment of SPV debt, and

Rs 0.01 in treasury income in the unitholder’s hands

Now as per Finance Ministry’s latest amendment debt repayment would be taxed over the acquisition cost only. Assume that an InvIT had a Rs 100 issue price and disbursed Rs. 10 towards debt repayment. There would be no tax on this sum because it is less than the issue price, which is Rs. 100.

Approx taxation on distribution is around ~18% for investors in a 30% tax slab. For REITS amount would be ~10%

Powergrid vs Indigrid

While both InvITs are good, investors can choose based on their preferences.

PowerGrid InvIT: A good investment for debt investors with a conservative approach

PowerGrid InvIT is a good investment for debt investors who are looking for a conservative investment with stable cash flows. The trust owns a portfolio of fully operational and revenue-generating transmission assets, which means that there is no development risk associated with the trust. The trust also has a strong credit rating of AAA, which means that it is considered to be a very safe investment.

However, it is important to note that the trust will have to raise debt to fund the acquisition of the remaining 26% stake in the SPVs. This will increase the finance costs and decrease the net distributable cash flow (NCDF). As a result, the trust’s yields may not be as high as some other InvITs.

Overall, PowerGrid InvIT is a good investment for debt investors who are looking for a conservative investment with stable cash flows. However, investors should be aware of the fact that the trust will have to raise debt to fund future growth, which could impact yields.

IndiGrid InvIT: A good investment for growth investors

IndiGrid InvIT is a good investment for growth investors who are looking for an InvIT with high growth potential. The trust has a strong track record of growth, and it is well-positioned to continue to grow in the future. The trust’s portfolio includes a diversified mix of transmission assets, which gives it exposure to the growing power sector in India.

IndiGrid InvIT also has a strong management team with a proven track record. The management team is focused on growing the trust’s assets and increasing its distributable cash flow. As a result, the trust is well-positioned to deliver attractive returns to investors over the long term.

Overall, IndiGrid InvIT is a good investment for growth investors who are looking for an InvIT with high growth potential and a strong management team.

Conclusion

Both PowerGrid InvIT and IndiGrid InvIT are good investments, but they have different risk-reward profiles. PowerGrid InvIT is a good investment for debt investors who are looking for a conservative investment with stable cash flows. IndiGrid InvIT is a good investment for growth investors who are looking for an InvIT with high growth potential.

Taking a holistic view, IndiGrid InvIT is better placed to capture the growth and provide decent stability in the cash flows. The trust has a strong track record of growth, a diversified portfolio of assets, and a strong management team. As a result, IndiGrid InvIT is a good investment for investors who are looking for a long-term investment with the potential for attractive returns.

For investors looking to diversify across other alternative Investments check out the below list

Hi Rohan

Can you confirm if LTCG arising out of sale of property can be invested in InvITs and exemption claimed ?

No , the capital gains on sale of property can be put in either residential house construction or few Tax free bonds to avail benefit

good and eloberatef article. thanks

Thank you for the positive feedback!