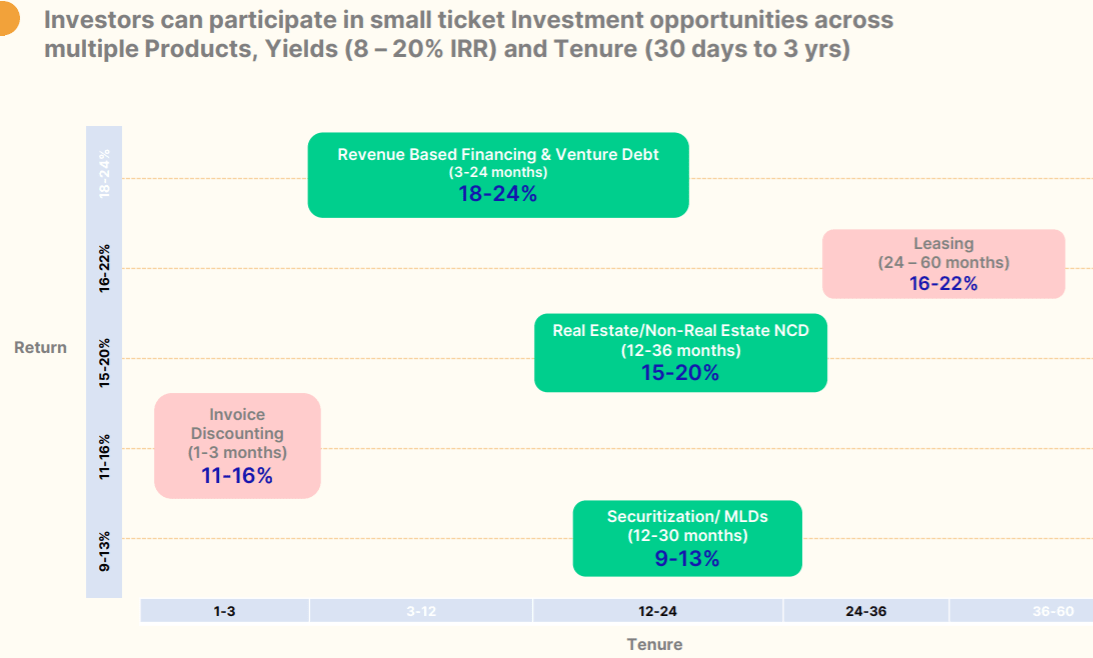

Jiraaf is a platform for alternative investment in India. What makes this platform different from others is that it lists assets across the yield curve rather than sticking to one kind of deal. In this Jiraaf review, let us know about the platform in detail, various types of products and investment opportunities available, Jiraaf team, and more.

Jiraaf Investment Opportunities

Jiraaf is a new platform for alternative investment in India. Opportunities which one can expect to invest in through the platform are:

- Invoice Discounting

- Revenue-Based Financing/Venture Debt

- Real Estate NCD/Non-Real Estate NCD

- Securitized MLD

- Leasing

Invoice Discounting

Invoice discounting is the practice of using a company’s unpaid accounts receivable as collateral for a loan, which is issued by a finance company. This is an extremely short-term form of borrowing

Revenue Based Financing

Revenue-based financing is a way that firms can raise capital by pledging a percentage of future ongoing revenues in exchange for money invested.A portion of revenues will be paid to investors at a pre-established percentage until a certain multiple of the original investment has been repaid.

Real Estate NCD

Real Estate NCDs are Non-Convertible Debentures that provide debt to developers which adds value in the early stages of development. Such structures are used to raise short-term secured loans from investors. The developer in turn ensures a regular flow of income to the investor through monthly/quarterly interest pay-outs.

Securitized MLD

Securitized Covered bonds are debt securities in which issuers transfer collateral backing bonds to a Special Purpose Vehicle (SPV). This allows the collateral to be ‘bankruptcy remote’ in the event that the issuer goes under. These are issued as MLD for better tax benefits for investors

Leasing

Equipment leasing is a type of financing in which the small business owner rents the equipment rather than purchasing it. Business owners can lease expensive equipment such as machinery, vehicles, computers, and other tools needed to run a business. The equipment is leased for a specific period.

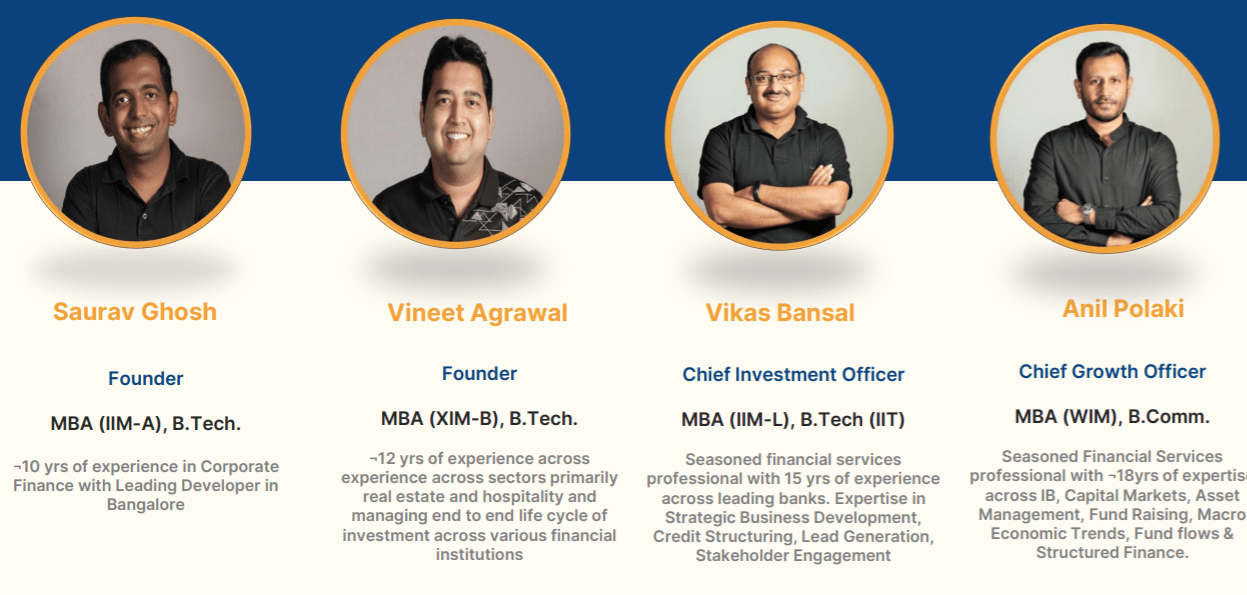

Jiraaf Team

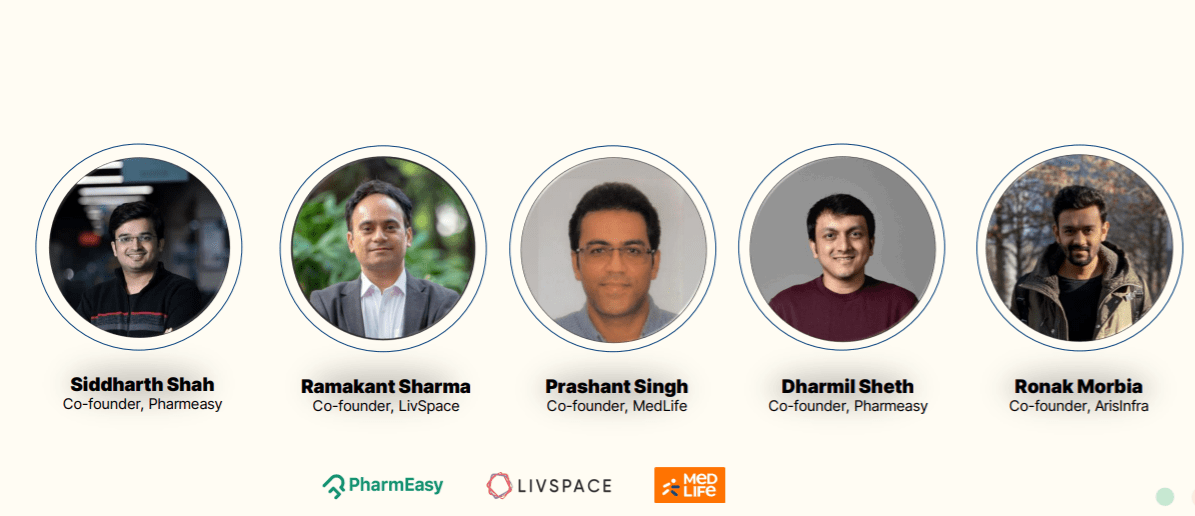

One of the strong features of Jiraaf is that its team has a strong background in deal structuring and risk management, The other USP is that is backed by some of the top founders in various industries. This adds a lot of credibility to the platform

Some of the names who have invested in the firm include cofounder of Pharmeasy and Medlife

Risk Management

Jiraaf only lists opportunities that pass a thorough internal credit & risk assessment process. It has a Strong focus on post-investment monitoring, audit & compliance by – the house asset management team. They have partnered with strong companies for all the support functions.

Opportunities on Jiraaf

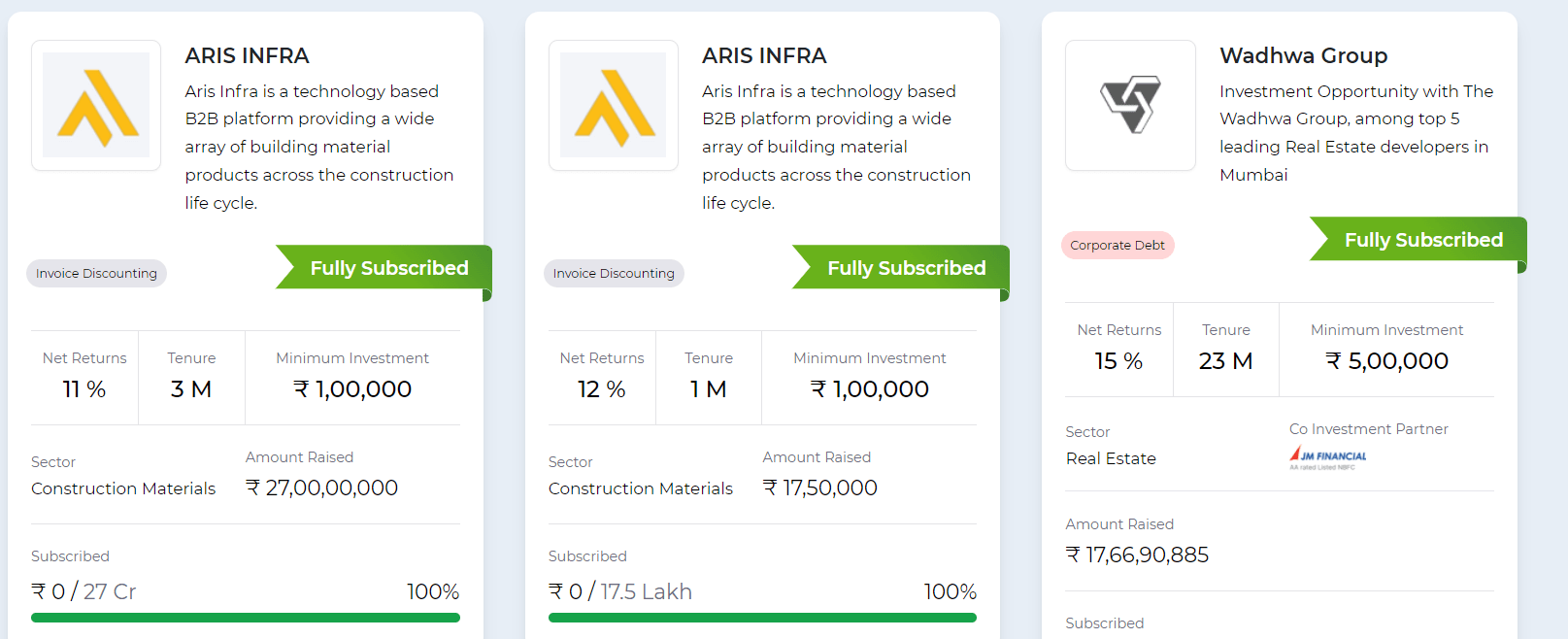

Past opportunities on Jiraaf include invoice discounting and corporate debt

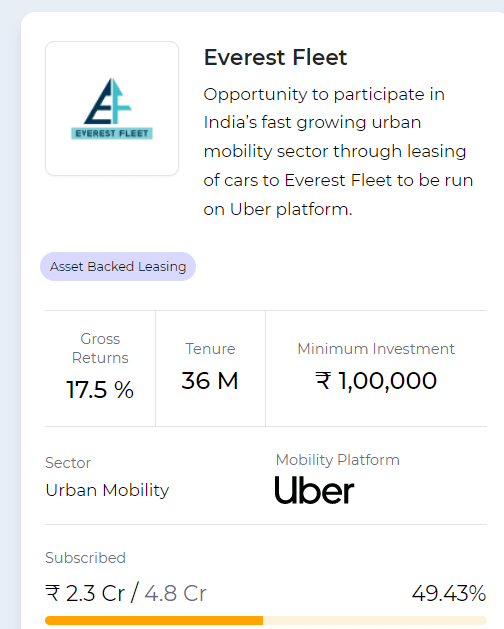

The current Everest Fleet Lease Finance opportunity is live on Jiraaf

Jiraaf vs Grip Invest vs Upcide

There will be many overlapping opportunities for leasing on Gripinvest, Upcide, and Jiraaf. Just by looking at the post-tax IRR might give an incomplete picture. The points to compare similar lease deals are below.

1. Pre-tax return & Post-tax return should be compared. For example, for the Jiraaf deal, it is 17.5% and 12.4% while the pre-tax / post-tax return for Grip was 22.2% / 10.5% respectively.

Jiraaf Alternatives

There are many platforms that cater to specific alternative investment asset classes. If you are looking for a one-stop shop kind of platform for multiple alternative investment options, the following are the closest 2 options:

Leaf: This platform was earlier (and even now) predominantly focused on equipment leasing. However, they have started bringing a considerable number of invoice discounting opportunities and even a few NCDs on its platform.

Grip Invest : This is by far one of the most popular and fastest-growing alternative investment platforms in India. They have opportunities across invoice discounting, asset leasing, NCDs, corporate bonds, securitized debt instruments, etc.

How to Register on Jiraaf

You can register on the platform using the below link to avail future benefits and fast access to deals using the link

Conclusion

This is the Zomato/Swiggy moment for Indian Alternatives as more platforms are going to drive the competition up and they will have to provide the best deals to investors. Jiraaf seems to be an interesting player. If they are able to manage a good deal flow we can expect to have a higher allocation to the platform.

We hope you liked our in-depth Jiraaf review and we hope it will help you make a prudent investment decision. Incase you have already tried their platform, share your experience via comments.

Frequently Asked Questions about Jiraaf

Is Jiraaf safe?

Every alternative invetsment opportunity comes with its share of risks associated with it. It is the investors job to evaluate the risks associated and take a decision accordingly. The platform claims to have close to 1.5 Lakh investors with INR 2400 crore worth of capital deployed through it. The founders, team and investors behind the platform also are trustworthy and experienced in their respective domains- which adds to the trust!

What’s the minimum investment on Jiraaf?

The minimum amount of money to invest varies according to the type of investment option you intend to invest in. As a ballpark figure, the minimum investment ranges around 1 Lakh.

What are customers’ Jiraaf reviews?

My personal experience with Jiraaf (as a customer) has been excellent as of now with all my repayments happening on time. Most customers also resonate with the same opinion if you look at online Jiraaf reviews.

Can i invest in this platform with my family fund trust as a company? any differences in individual vs company?

You can use both company or individual as per your preference. No difference in returns!

Hello sir, what’s the fee charged by Jiraaf?

I couldn’t find it on the site.

Hi Mel,

For the current lease finance deal, investors are not charged anything as fees are paid by Everest. For the upcoming bond deal no fees for investors. The yield mentioned in the bond is what you will get. Thanks

what is security of my hard earn money ? are you give any bank guarantee ?

What is the context of the question? you mean Jiraaf will provide guarantee?

Jiraaf does its due diligence and then lists the deals however ,the risk is borne by investor!

You should avoid such deals if

1) you do not understand the risk

2) you do not have the risk appetite

Any deal (stock,bonds,alternative) has risk and only those who can make a calculated decision based on risk reward should invest

Is there any trusteeship appointed to overview the functioning

Hi Swapnil, It will be dependent on deal. For all Debt/NCD-related deals you will find the details of the Trustee in the deal description. For leasing details of SPV will be formed.

what is Income tax on income arise from investment? do I need to file ITR2 or ITR3 form

If you are investing in tax-exempted or SPV-based products then ITR3 .It makes more sense to use ITR3 as you will eventually invest in such products

I would like to invest but my lack of knowledge in this is a deterrent. Any pointers on how to evaluate the products? How to choose out of the 2 or 3 listings?

Hi Priya,

It is important to do some research on the products before you start investing. Once you understand the product, then you can check platform reviews.Always start with the minimum possible amount and once you are more confident then increase investment.

Coming to the deal part I try to do research on the listed deal which include

1) Funding or financials of the company

2) Past performance on the platform

3) Founders’ background

4) Current macroeconomic cycle

You also need to be cognizant something that is giving a higher return than a liquid fund does have a higher risk but once you develop a good understanding you can make a better judgement

2)

pls share your investment portfolio on jirraf

I have shared insights on my portfolio here

https://www.youtube.com/watch?v=39vd1BS4hog