Lendbox Per Annum is one of the leading alternative investment platforms in India that allows investors to earn high returns by investing in retail loans. Founded in 2015, Lendbox has carved a niche for itself as a reliable peer-to-peer lending platform regulated by the Reserve Bank of India.It was started by 3 founders Ekmeet, Jatin and Bhuvan.

Over the years, Lendbox has scaled its operations and today boasts of servicing over 5.2 lakh investors and facilitating disbursements worth more than Rs. 8300 crores through its tech-driven platform. Backed by experienced founders and continuously innovating to provide a seamless investment experience, Lendbox is emerging as the preferred investment destination for discerning investors looking for lucrative yet safe fixed-income opportunities.

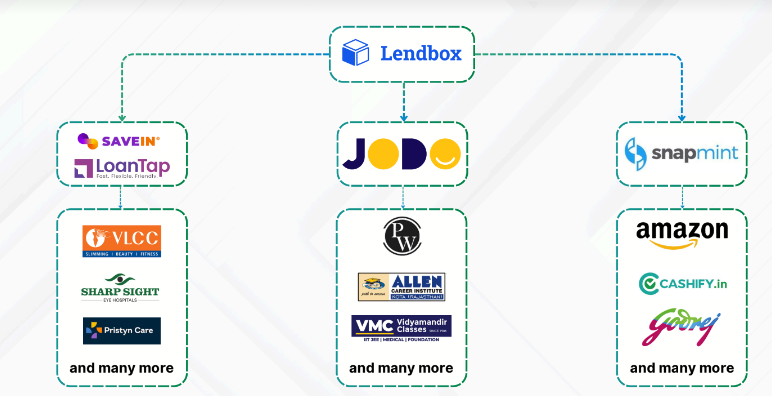

Recently Lendbox has launched a new platform called Per Annum, to offer premium debt-based

alternative investment products in collaboration with multiple leading fintech companies like

Snapmint, Mobikwik, Rapipay and UNI Cards.

In this in-depth review, we deep dive into Lendbox’s Per Annum investment program to understand what it has to offer. We will look at Lendbox’s lending partners, the benefits of investing through Per Annum, how the investment process works and provide step-by-step guidelines on getting started. By the end, readers will have a clear picture of whether Per Annum is a worthwhile investment option to consider. So let’s get started!

What is Lendbox Per Annum?

PerAnnum Free Signup

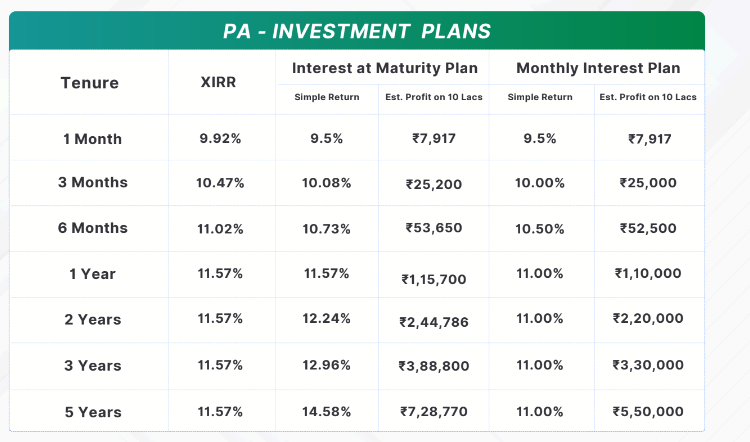

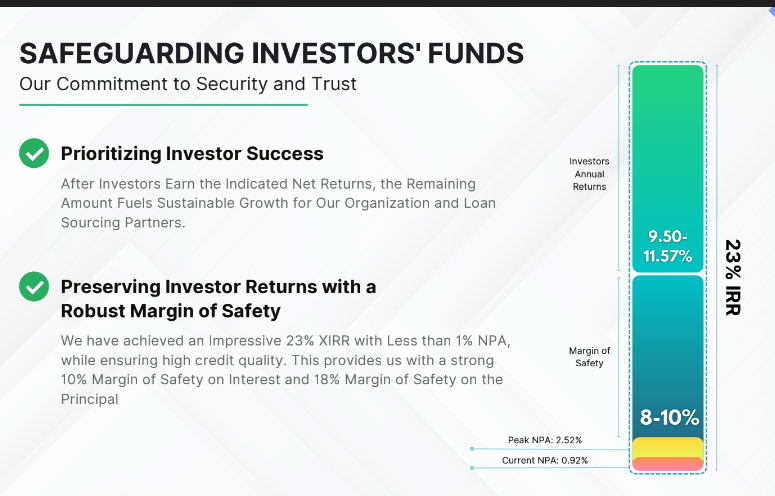

Lendbox Per Annum is an investment program launched by Lendbox that allows investors to earn attractive returns of up to 11.57% by capitalizing on the burgeoning retail lending opportunity in India.

As the name suggests, Per Annum refers to the annualized return projected on investments. Through its Per Annum program, Lendbox pools capital from investors and on-lends it to qualified retail borrowers sourced from its lending partners. Investors can earn interest by investing for tenors ranging from 1 month to 5 years while also achieving portfolio diversification with their money spread across hundreds of loans.

Per Annum is an alternative investment product by Lendbox that enables vastly diversified lending to the top 2% of India’s most creditworthy people. Loans on Per Annum are sourced through Tier 1 fintech partners like Rapipay, Snapmint, Mobikwik, and UNI Cards. These companies are top-order credit risk managers catering to those with unblemished repayment histories. Capital invested through Per Annum is automatically divided into thousands of chunks for maximum diversification.

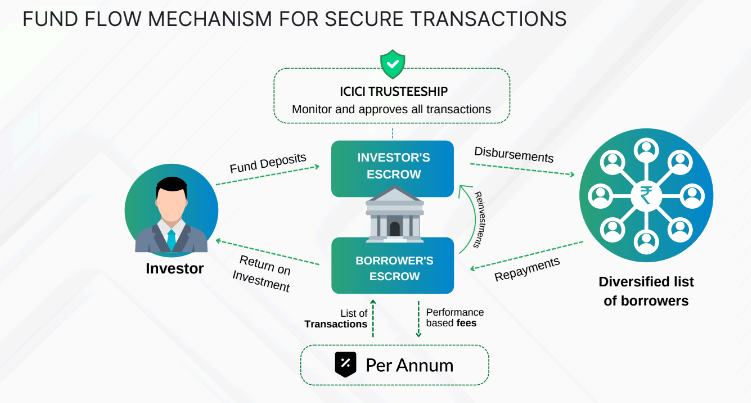

The capital is deployed through Lendbox’s robust risk management framework comprising stringent borrower selection filters, regular audits, and escrow account protection. This ensures investments carry minimal credit risk. Returns are fixed throughout the investment cycle providing repayment certainty. Overall, Per Annum stands apart as a one-stop investment solution delivering inflation-beating yields in a fuss-free manner.

Who are Lendbox Per Annum Partners?

Per Annum has implemented a distinct method of sourcing to minimize risk and promote diversity. Collaborating with multiple digital lending companies, the organization has established partnerships to source credit seekers for their investors. This approach has facilitated lending to a broad spectrum of credit seekers, resulting in a well-diversified portfolio and a gross NPA of less than 1% over the last two years. To select the most suitable borrowers, Per Annum employs a two-level credit assessment process combining the expertise of their partners with a modern AI-based assessment model. Currently Per Annum sourcing borrowers from leading and well-funded fintech platforms like Mobikwik, Snapmint, Rapipay and UNI cards and facilitating credit for multiple products such as short-term loans, revolving credit lines and a few

more.

As a regulated platform, Lendbox relies on established lending companies for sourcing qualified borrowers. Some of its marquee lending partners include:

- Navi Finserv: A Crisil A-rated NBFC focused on consumer and small business lending. It has facilitated disbursements of over Rs. 7500 crores so far with 90% customer repeat rate.

- ZestMoney: A leader in EMI financing solutions, ZestMoney is one of India’s largest zero-cost EMI providers. It has over 8 million customers.

- FlexPay: Specializes in flexible payment solutions for the underbanked. It serves over 2 million customers across 2000+ cities.

- Paytail: Focused on merchant working capital loans using data from PoS terminals. It works with over 100,000 merchants.

- KreditBee: A digital lending platform catering to the credit needs of middle-income groups. It has disbursed loans worth Rs. 8000 crores so far.

This blend of established and new-age lending partners ensures Lendbox has access to a steady pipeline of qualitatively assessed loans for its investors. Their scale, expertise, and technology-led operations also translate to efficient loan servicing.

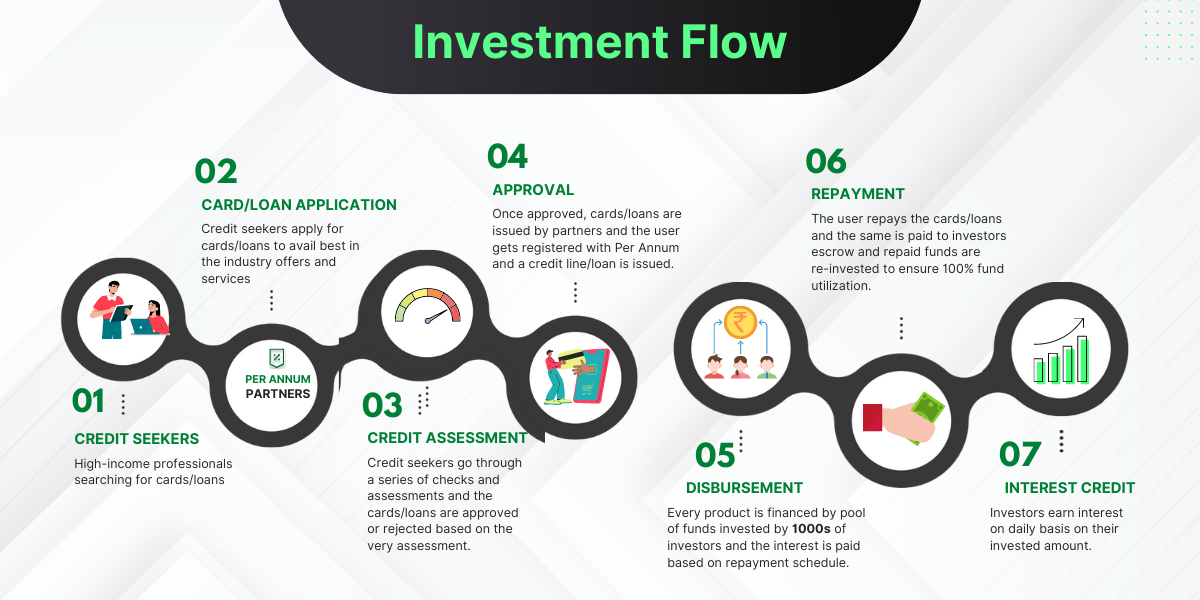

How Does Per Annum Work?

Per Annum allows retail investors to finance the credit requirements sourced through the fintech companies listed above. Per Annum adds multiple layers of technology and risk mitigation for a hassle-free and diversified distribution of invested capital. The returns earned on your money are credited on a daily basis and can be easily tracked on the Per Annum web or app dashboard.

Per annum follows best-in-industry underwriting practices with stringent cut-offs for credit scores as well as repayment history. On average, borrowers accepted for financing via Per Annum have a credit score of 780 or above with regular repayment histories spanning 5+ years. Alternative data, income, and spending behavior are other important parameters while assessing borrowers for Per Annum.

Per Annum follows best-in-industry underwriting practices with stringent cut-offs for credit scores as well as repayment history. On average, borrowers accepted for financing via Per Annum have a credit score of 780 or above with regular repayment histories spanning 5+ years. Our Partners, who aid us with loan collection in addition to risk assessment, also have on-ground fleets of collection agents in all cities where their borrowers reside. Alternative data, income, and spending behavior are other essential parameters while assessing borrowers for Per Annum.

When you invest with Per Annum, your money is deployed directly to highly creditworthy borrowers sourced through our Partners, after our P2P algorithm divides it into thousands of little chunks. People repay in installments of 3, 6, 12, or 18 months. You earn interest for as long as your money remains invested with them.

Below are the products being offered in Per Annum:

Benefits of Lendbox Per Annum

Lendbox’s Per Annum program provides investors with a multitude of benefits making it an attractive investment option. Here are some key advantages:

- Inflation-beating returns: Investors can earn returns in the range of 9.92% to 11.57% per annum on various tenors, comprehensively beating inflation and other traditional income instruments.

- Fixed returns: The interest rate remains fixed for the tenor selected, eliminating interest rate risk. Investors enjoy return certainty.

- Liquidity and flexibility: Monthly interest payouts are available if opted for else investors can withdraw funds within 24 hours of maturity.

- Low minimum investment: Investors can start with as low as Rs. 10,000 making it suitable for all budget sizes.

- Diversification: Exposure is spread across 500-1000 loans each ranging from Rs. 40,000 to Rs. 1 lakh, minimizing concentration risk.

- Transparency: Investors can monitor their portfolio in real time using Lendbox’s investor app and website dashboards.

- Robust regulation: As an RBI-regulated NBFC platform, Lendbox follows strict KYC and due diligence protocols.

How To Invest in Lendbox Per Annum?

You can use the above Lendbox Link and register. Joining fees are waived for the people using the link. Once you have registered you can choose Per Annum in the Loan Category

Let’s explore the step-by-step process of how investments are facilitated on Lendbox’s Per Annum platform:

- Investor Sign Up: Interested individuals complete Lendbox’s online KYC process to open an account.

- Investment Options: The investor chooses between Monthly Interest and Maturity payment modes and selects a suitable tenor e.g. 1 year.

- Fund Deposit: The investment amount is transferred to Lendbox’s designated escrow account using UPI, NEFT etc.

- Loan Disbursal: Funds pooled from multiple investors are disbursed as loans to retail customers of Lendbox’s lending partners basis their credit evaluation.

- Repayment Collections: Borrowers repay loans through EMIs directly to Lendbox which are then transferred to the investor’s escrow account.

- Payouts: On maturity, the entire proceeds including interest are paid back to the investor in 24 hours. In the case of the Monthly Interest option, payout is made at the end of every month.

- Reinvestment: By default, maturing funds get reinvested for the same tenor unless the Investor specifies otherwise.

This process powered by Lendbox’s proprietary tech platform ensures a transparent and seamless experience for investors all through the investment lifecycle.

Benefits of Lendbox Per Annum

Lendbox’s Per Annum program provides investors with a multitude of benefits making it an attractive investment option. Here are some key advantages:

- Inflation-beating returns: Investors can earn returns in the range of 9.92% to 11.57% per annum on various tenors, comprehensively beating inflation and other traditional income instruments.

- Fixed returns: The interest rate remains fixed for the tenor selected, eliminating interest rate risk. Investors enjoy return certainty.

- Liquidity and flexibility: Monthly interest payouts are available if opted for, or else investors can withdraw funds within 24 hours of maturity.

- Low minimum investment: Investors can start with as low as Rs. 10,000 making it suitable for all budget sizes.

- Diversification: Exposure is spread across 500-1000 loans each ranging from Rs. 40,000 to Rs. 1 lakh, minimizing concentration risk.

- Transparency: Investors can monitor their portfolio in real time using Lendbox’s investor app and website dashboards.

- Robust regulation: As an RBI-regulated NBFC platform, Lendbox follows strict KYC and due diligence protocols.

Conclusion

To summarize, Lendbox Per Annum presents a compelling investment alternative for individuals seeking an avenue to beat inflation and grow their wealth in a safe yet lucrative manner.

Backed by strong regulation, trusted partners, sophisticated technology, and risk management frameworks, Per Annum ensures minimal credit risk exposure combined with high post-tax returns.

The seamless online investment process, minimum entry barrier, and transparent reporting interfaces make it an investor-friendly program. With its consistent track record so far, Per Annum seems well-placed to emerge as the preferred investment destination for fixed-income needs, especially for goals 3-5 years away.

At nominal charges and by offering liquidity unlike other debt instruments, Per Annum scores high on suitability too. However, Investors should do their due diligence and invest as per their risk appetite as risk is higher than bank FD, government bonds, etc.

Check out other Investment Options

PerAnnum Free Signup

Hi – I don’t see this Per Annum Plan on Lendbox website. Has it been discontinued?

Hi Ankur,

It is available on their website! Link below

https://www.lendbox.in/perannum?referralCode=1UOF