Box Spread is a strategy to get good returns with low Risk.

Have you ever wondered while bank are giving you 3-4% return on saving account, the cost of borrowing is still at 11-12% for most which means the banks are making a killing on the Net Interest Margin

Money can either be put to rent if it is in excess or can be rented if there is a requirement. I will tell a strategy where you can put your capital at 10% risk free rate for short term or you can borrow at 8% long term.

Box Strategy Lending or Borrowing Benefit

Lending can be used for

- Parking money for short term

- To lock attractive low risk yield

Borrowing need can be for multiple reasons such as

- Meeting some contingency expense

- To get Leverage

- Repayment of Debt

Box Spread Strategy

Borrowing rates for personal loans in India are not very cheap. For a moderate Cibil score you can expect to pay 12-13% for a personal loan or 20%+ for credit card loans. There is another way through which you can raise low cost loan to invest in some attractive opportunities or use it as a substitute for your high cost loans! Or you can lend your money at 10% with very low risk!

If you have a Broking account, you can borrow money on the open market at 7% Per annum and put it in a portfolio of 10%. For a portfolio of 20 Lakhs that is equivalent of 60,000 extra in a year.

Requirements for Box Spread

Before actually performing the trick, there are a few things you need:

- Broking Account with Shares, Debt Funds and Liquid Funds ( Zerodha etc)

- You should be able to pledge your securities to get Margin

- Once you have the margin ,you need to execute the box spread

What is a Box Spread Strategy?

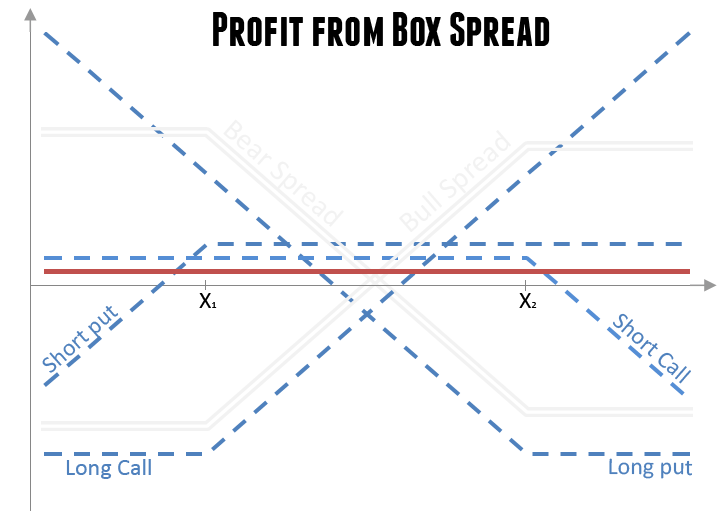

A box spread is a combination of four options which cancel each other out so there is no risk from market movements. This allows parties to lend each other large sums of money: one party sells the box spread for a premium, and pays the loan back on the exercise date

To perform the trick, sell Nifty box spreads in a total amount that’s 30-65% of the value of your account depending on how frequently you want to monitor it. The legs should be 500-1000 points apart to minimize commissions cost, and the upper strike price should be near-the-money (near the current value of the Nifty) to maximize liquidity. In current market conditions, the trade looks like this

SELL 1 DEC 2021 15000/16000Nifty BOX

Ensure

- You’re using a LIMIT order (not market). Bid-ask spreads can be wide

- You typed in the price correctly.

- You’re doing a single trade, not four separate trades.

Example -Borrowing Using Box Spread

Let’s say you have INR 25 Lakh worth of shares,debt fund and are able to avail margin of INR 20 Lakh by pledging.

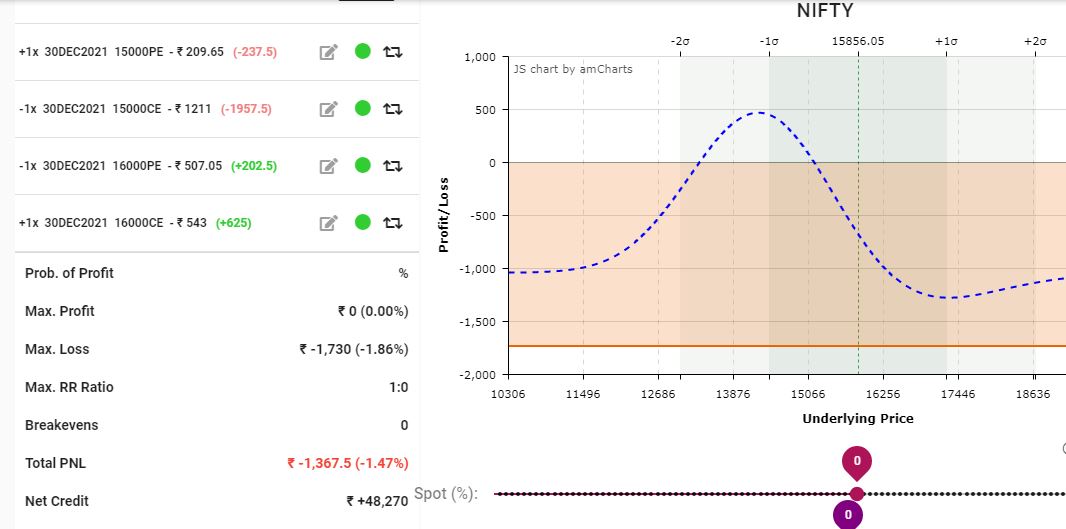

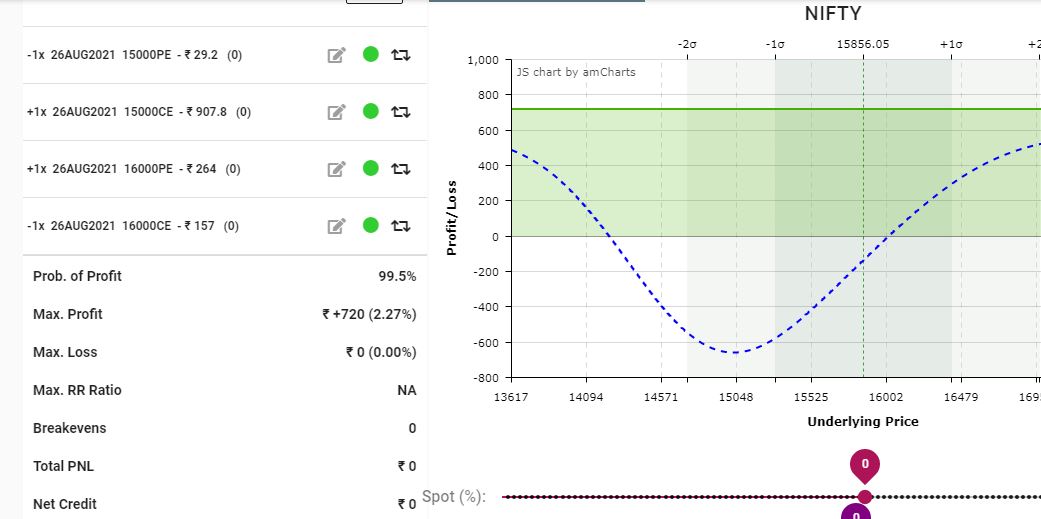

For 1 Lot of Nifty, we create Box spread for 15000-16000 Dec strike

Based on current Nifty Spot below are quotes for the Box Spread for Dec’21 .

It is Evident that the loss at maturity in Dec = 1730

We get INR 48,270 Premium as credit upfront.

What is our cost for the strategy ?

Cost of strategy is simple calculation. I have used compounded interest rate using the below formula

( Future Value/Principal)^(365/Time to Maturity)-1

= (48270 +1730)/48270)^(365/160) -1 = 8.3%

In December 2021, the options are about to expire, so you buy them back or let them be exercised for 50,000. By then your investment has accumulated more than INR 50,000. You then sell another box spread expiring in Dec 2021, repeating the process.

Example -Lending Using Box Spread

For lending using box spread you need to make exact opposite Trades. You can check box spread return for various months. I suggest using box spread to lend by using near dated Expiry (Eg 1 month) as you get higher yield mostly.

In this Strategy you pay 49280 on 23rd July and get 50000 on 26th Aug

What is Interest Rate for the strategy ?

(50000/49280)^(34/365) -1 = 16.85%

16.85 % almost risk free rate is better than any bank FD!

You can actually borrow long term at 8% and lend at 12% using this strategy.

Conclusion

Box Spread Strategy is a great way to park money at high yield or borrow at low rates. It can be used along with high yield platform like Finzy , GrowFix , Grip Invest , TradeCred ,Klubworks. Some of the risk you need to be cognizant of are: (a) doing the setup wrong, and (b) having your options partially liquidated if the market plummets by 30%+ before you notice ,when you are borrowing using the spread. Hence you need to keep decent margin. Recommend to start with small capital and then scale up!