Wint Wealthis an innovative fintech firm which is providing an avenue for investors to buy high yield (9% +) Debt products (like Covered Bonds/MLD) with enhanced security for investors and can compliment other alternate investment platforms like Finzy , Tradeced and Grip Invest

What are these securitized debt investment(MLD, asset backed securities) created by Wint Wealth (Growfix)?

Let’s take a step back and understand what happens when we buy a Bond or NCD ! In any financial ecosystem there are multiple parties,few which have excess capital and others which require capital. To achieve this ,renting of capital by one party to another has been made possible through various Financial instruments like Loans, Bonds etc

You are basically giving money to someone when you invest in a bond . Most of these bonds are issued by NBFC because they are in the business of lending and money is the raw material for that.

Resolution of NBFC Default Risk?

The problem with conventional bonds is that if the NBFC goes bankrupt, even if you have an exclusive pool of loans as security/collateral, your money is stuck in the complex resolution process.

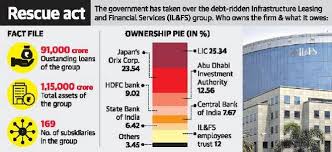

Resolution of default is long and tedious process with lot of legalities. This is because Firstly ,Each lender is fighting to get their money back which can take years . Secondly ,Some process get stuck in fraud investigation . As it is evident from some of the latest defaults

- ILFS

- DHFL

- Sintex

For instance In the ILFS default It’s more than a year and lender are clueless on how much more time will it take and what will they get after that!!. To make it worse some of the investor with deep pocket want to get preferential treatment on asset monetization proceeding. To tackle this problem Wint Wealth(Growfix) has created credit enhanced products

Wintwealth Securitized products explained

Wint Wealth has introduced covered Bonds/MLD for the retail investors

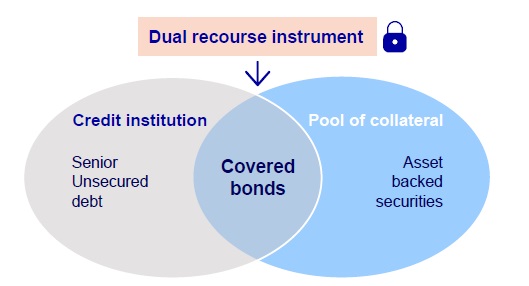

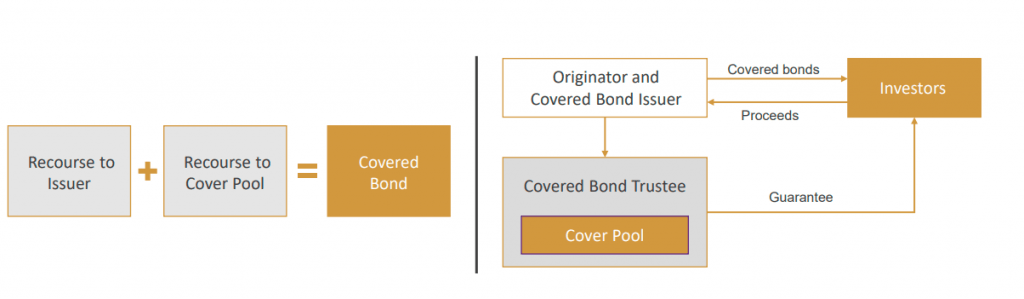

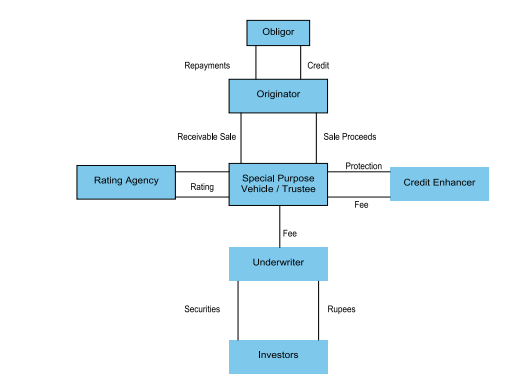

Covered bond is a form of debt instrument secured by a cover pool of assets/ receivables. In the case the issuer is solvent, it will repay its covered bonds in full on its scheduled maturity date. However in the other case if the issuer is insolvent, the Investors have recourse to a cover pool of assets that are bankruptcy remote from the Issuer (akin to securitisation transaction)

Credit Enhance MLD (Market Linked Debenture) created by Wintwealth(Growfix)are products which have an additional level of credit protection for investors and generally have higher rating compared to the Issuer Rating. By using MLD instead of NCD your investment is also treated as equity which means after 1 year you have to pay only 10% Tax on selling!

The Issuer provides a cover pool of secure loans or assets to a an SPV. If the Issuer fails to repay the loan amount can be recovered from the cover pool

Identified assets for pool can be:

- Gold Loans

- Vehicle Loans

- MFI Loans

- Consumer Loans etc

Credit Enhancement Feature created by Wint Wealth

- Normal cashflow of Issuer will service the MLD.

- Cashflow from Securitized pool will be utilized for payment if predefined trigger events occur

- Based on predefined investment criteria until the start of the principal amortization the cashflow from the pool will be used to acquire additional loan assets from issuer

- FD may be required in some cases for Additional collateral

How Wint Wealth(GrowFix) provides such Security?

At Wint Wealth, products created are based on an investment philosophy to provide

- Fixed/ steady returns.

- Physical collateral like gold, real estate, or vehicles used as collateral

- Bankruptcy protected framework

Wint Wealth Latest Product Analysis

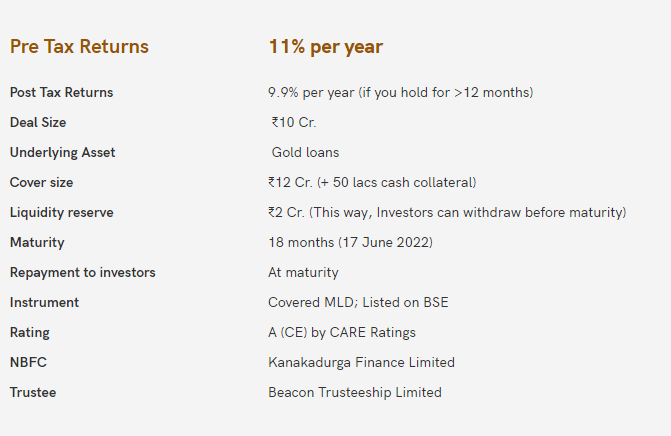

The latest Wint Wealth(Growfix) product is a covered bond(in MLD form for tax efficiency) of ₹ 10 Cr. NBFC goes one step further from just giving an exclusive pool of gold loans worth ₹ 12 Cr as security (120%cover).

It sells that pool to a special purpose vehicle(SPV) only created to hold those loans.

Now after let’s say one month, out of 12 Cr initial loans pool, 1 Cr is paid back by borrowers, then NBFC will give new gold loans of 1 Cr to the SPV.

So at any point in time, SPV and the investors will have 12 Cr loans pool for 10 Cr Covered Bond.

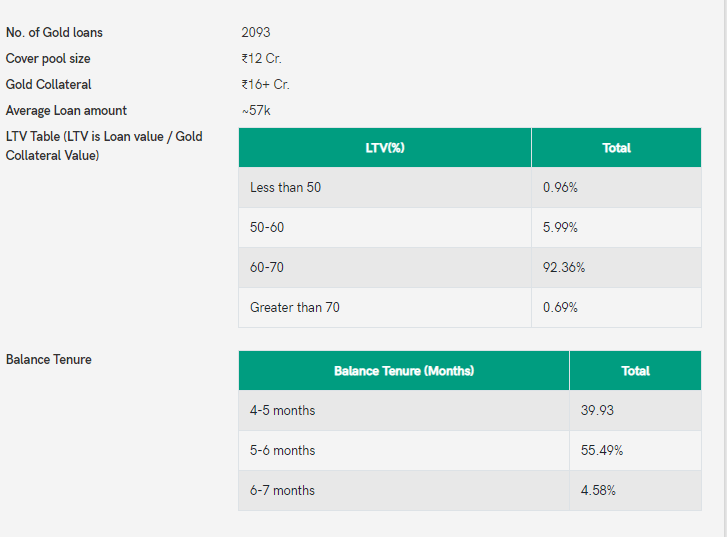

Wintwealth(Growfix) cover pool chosen based on multiple criteria

- Number of Loans in the pool

- Collateral available for the pool

- Average loan LTV

- Balance Tenor of the pool

- Loan contracts should be free from any encumbrance.

- Diversification of pool

Note that the SPV and investors are legal owners of those pool of loans. Even if the NBFC goes bankrupt, the repayments from borrowers flow to the SPV and investors.

The NBFC will pay back the whole amount and take back the loans from the SPV at the maturity date.

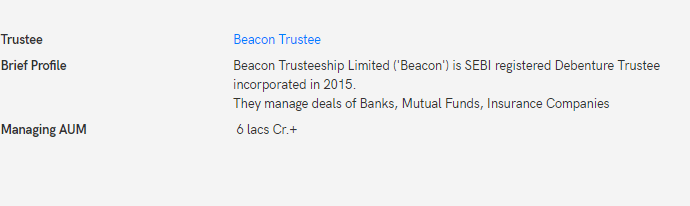

The Trustee in charge of the pool is a reputed firm

In a nutshell, the Covered bond is a bankruptcy protected bond, and it would be one of the many instruments that will be available on Wintwealth(Growfix)

Salient Features of investing on Wintwealth?

- Simply register on Wint Wealth(Growfix) (to get early access to deals),provide demat details and buy deals which will be credited in your demat

- Low Minimum of INR 10,000

- Instant Liquidity Option

- RBI and SEBI regulate it and the coverpool is managed by a professional third party

- High Yield 9-11%

- Tax Efficient through MLD wrapper

- Higher Safety than bonds and P2P

- It can be a good portfolio addition to diversify along with TradeCred and Grip Invest

Thanks for post and detailed Analysis Rohan.

Can you please also add details about this disclosure – “If Sensex drops to 9,000 then you earn 0%. Otherwise you earn as is”.

How are covered bonds linked to equity markets?

Hi,

Basically the structure of covered bond is wrapped in a tax efficient product called Market Linked Debenture (MLD) which is treated and taxed like equity.

Now SEBI has mandated the payoff has to be linked to market. Therefore issuer creates a highly improbable loss condition in the structure to lose coupon (i..e 75% fall insensex). This is done just to be listed as MLD and investor can get tax benefit !

Can we discuss? my number is 7021248256

Is it not MLD out of Tax benefit from this year April 23 onwards?

Hi Dayananda, You are correct this is an old article, and post 31st March 2023 MLD tax benefit is gone. You can explore Zero coupon bond instead as they have LTCG benefit!