What makes Grip Invest Leasing Finance Special? How is it different from a traditional investment like FD? We will cover all these points and more in this exhaustive Grip Invest Review.

When the topic of investing springs up in India, an elder in your family will advise you to put your money in a fixed deposit, saying, “Beta, FD sahi rahega” but none would talk of new-age investment avenues like Grip Invest, Leasing Finance, Invoice Discounting, etc.

Signup for FREE on Grip Invest

How Grip Invest Works?

Through certain leasing finance platforms, you can invest in assets like vehicles, furniture, and electronic equipment which are leased to corporates, and earn pre-tax returns in the range of 20%. What’s more, the process is completely online and hassle-free.

Through these platforms like Grip Invest, you can co-invest and become a partial owner of the asset, and earn monthly returns for the same. Let’s take an example, suppose three friends, A,B, and C decide to invest in an asset. Each of them contributes Rs. 20,000 towards the investment, which means each of the friends is a partial owner of the asset. Lease income earned on that asset is then distributed to each of the friends. Therefore, when an investment opportunity is listed on these platforms, you can co-invest small amounts with many other investors. Your investment will then be managed by the investment platform as depicted in the illustration below.

There are other alternative investments that provide such exciting returns like Tradecred. Read my 3-year experience investing on TradeCred

Grip Invest Benefits

Now that you’re aware of how Grip Invest, works, let me give you 4 reasons why you should seriously consider investing in it:

- Managed Risk: When it comes to leasing, the companies that are chosen by the investment platforms are steadfast and growing rapidly in their respective fields. As an investor, you would have heard of these companies or may even be using their products and services. Now you can lease to them and actually make returns!

- Strong Collateral: When you invest your money, you are investing in buying an asset like a vehicle, laptop, etc. In a worst-case situation, the investor can sell or re-lease the asset to recover their invested value.

- Substantial Returns: Like most of you, I was also advised to invest in instruments that were absolutely safe and backed by government security. While I do agree that avenues like fixed deposit and government bonds are safe, leasing provides a brighter prospect to earn more returns – Leasing can comfortably give you an IRR of 20% on a pre-tax basis.

- Monthly Returns: Lease payments are made every month and hence as an investor you receive income every month that can then be re-invested in other investment opportunities.

My Personal Experience with Grip Invest

My Portfolio has a decent allocation to alternate investments. I have been investing with Grip Invest for more than a year now. I have shared my detailed experience on this follow-up post on 1 Year Experience of Grip Invest

Signup for FREE on Grip Invest

Deal : E-Scooter Leasing for Zypp on Grip Invest

Key Lease Terms

- The title of the bikes will not transfer to Zypp and the bikes will be handed back in case of termination

- The purchase price for the bikes is reduced by subsidy received under Govt. of India’s promotion scheme for electric vehicles

- Complete compensation in case of loss of the e-two wheeler will also be the responsibility of Zypp

- Zypp will be responsible for:

- Valid registrations, consents, or approvals are required under all applicable laws, including the Motor Vehicles Act, and is solely liable for any liability arising under these laws,

- All repair (whether routine or resulting from any damage or accident), maintenance, and running costs of the bikes

- Zypp will pay a security deposit equal to 3 months of lease income in the form of a bank guarantee. The same will be returned to Zypp at the end of the lease term or settled against the residual value paid by Zypp to purchase the vehicles

- 0.5% of rental income earned is retained for management expenses and insurance costs of the lease. An additional 0.5% of the rental income earned is retained as advisory fees.

Cashflow Analysis:

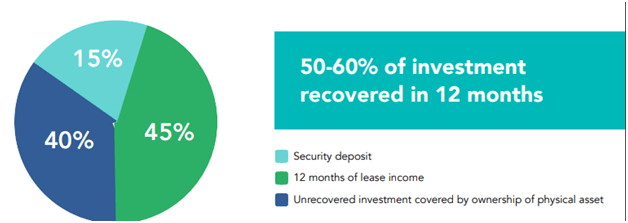

- Net IRR =12%~

- Money Recovered in1 year = 50%~

- Security = 3 Months Cashflow

- Tax on Cashflow= 0%

Yield of Someone at 30% tax rate (factoring tax saving)= 12%/69% = 18%~

| Month | Cashflow | IRR | Security | Cashflow Recovered | Percentage Recovery |

| 8/1/2020 | -20000 | 12% | 1800 | ||

| 9/30/2020 | 600 | 2400 | |||

| 10/31/2020 | 600 | 3000 | |||

| 11/30/2020 | 600 | 3600 | |||

| 12/31/2020 | 600 | 4200 | |||

| 1/31/2021 | 600 | 4800 | |||

| 2/28/2021 | 600 | 5400 | |||

| 3/31/2021 | 600 | 6000 | |||

| 4/30/2021 | 600 | 6600 | |||

| 5/31/2021 | 600 | 7200 | |||

| 6/30/2021 | 600 | 7800 | |||

| 7/31/2021 | 600 | 8400 | |||

| 8/31/2021 | 600 | 9000 | |||

| 9/30/2021 | 600 | 9600 | ~50% | ||

| 10/31/2021 | 600 | ||||

| 11/30/2021 | 600 | ||||

| 12/31/2021 | 600 | ||||

| 1/31/2022 | 600 | ||||

| 2/28/2022 | 600 | ||||

| 3/31/2022 | 600 | ||||

| 4/30/2022 | 600 | ||||

| 5/31/2022 | 600 | ||||

| 6/30/2022 | 600 | ||||

| 7/31/2022 | 600 | ||||

| 8/31/2022 | 600 | ||||

| 9/30/2022 | 600 | ||||

| 10/31/2022 | 600 | ||||

| 11/30/2022 | 600 | ||||

| 12/31/2022 | 600 | ||||

| 1/31/2023 | 600 | ||||

| 2/28/2023 | 600 | ||||

| 3/31/2023 | 600 | ||||

| 4/30/2023 | 600 | ||||

| 5/31/2023 | 600 | ||||

| 6/30/2023 | 600 | ||||

| 7/31/2023 | 600 | ||||

| 8/31/2023 | 600 | ||||

| 8/31/2023 | 2922 |

Grip Invest Review- A substitute for FD?

The answer is simple. The average Indian investor believes that bank deposits and government-backed bonds are safer than other market-related investments and therefore probably a recurring deposit or a fixed deposit is the right fit for their portfolio. However, this means that their returns are just 5-6% per year which are taxed at a marginal tax rate

What if I told you that there are now investment options that have a lower risk because they are not as heavily impacted by market forces and don’t have the same volatility of stocks yet are monetarily gratifying.

Signup for FREE on Grip Invest

How to invest via Grip Invest?

1. Click Here to visit Grip Invest and register for free

Add referral code 113 while signup for free registration and additional benefits

2. Browse various investment opportunities present in the form of deals on the platform.

3. Once you shortlist a deal, make the payment and you have become a partner in the asset.

Conclusion:

Leasing Finance is a popular medium in western countries and it is slowly gaining momentum in India. The above points covered in this Grip Invest Review make this instrument competitive in the present scenario and perfect to reach certain financial goals. It is an interesting platform to provide exposure to asset-backed lending.

I heard though initially one can invest minimum amount, he MUST scale up his investment to 25 lakh rupees by fifth year and refund is at discretion. Is it so?

Hi , You are correct according to SEBI rule you need to invest upto INR 25 lakhs over a period of 5 years