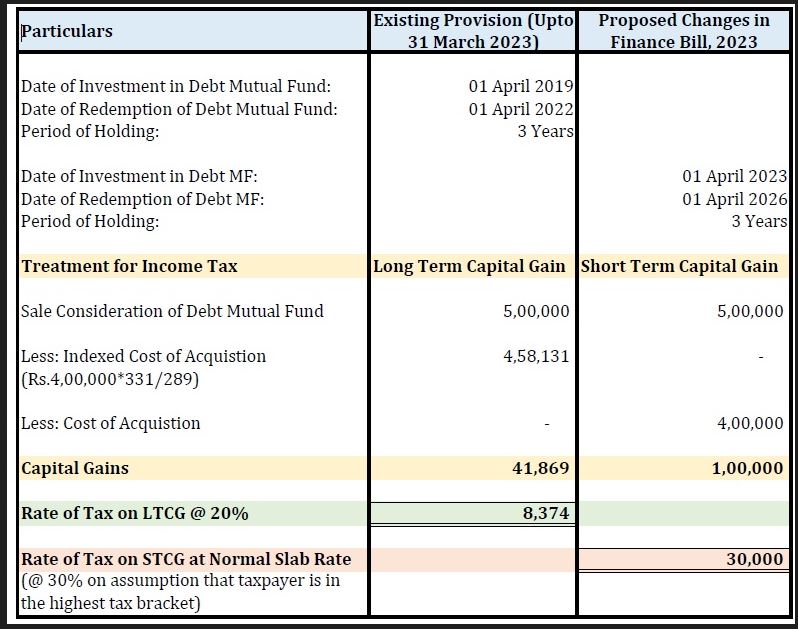

Tax saving options for retail investors have been far and few. With the latest finance bill that has taken away LTCG’s benefits from Debt Mutual Funds, Gold, and International Equity, investors are hardly left with many choices.

Debt mutual funds are on the verge of losing their tax advantage as the first choice of investment option within fixed-income products among investors falling in the higher tax brackets. Capital gains arising from investments made in any debt mutual fund scheme will be added to the total taxable income and taxed in line with the income tax slab rate, as per an amendment in the Finance Bill 2023 coming into effect on April 1.

The indexation benefit in debt mutual funds, which lowered the tax outgo for investment will no longer be applicable. Investors who want to increase fixed income allocation should immediately buy debt mutual funds before 31st March 2023.

- All Debt Mutual Funds

- Market Linked Debentures

- Gold and Silver ETF and Mutual Funds

- International Equity Mutual Funds and ETF

There are still few tax saving options available for investors apart from the 80 C products which investors can evaluate based on their risk appetite apart from Equity Mutual funds.

Best Tax Saving Options in India

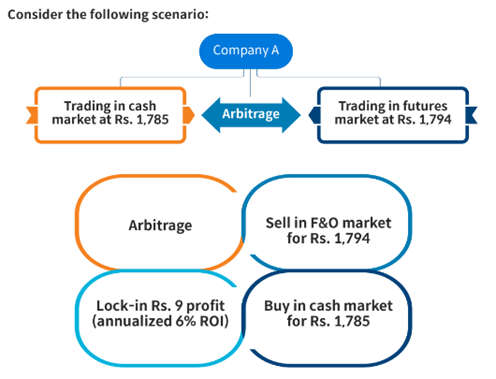

Arbitrage funds

Arbitrage funds are hybrid mutual funds that generate returns by using the arbitrage between the cash and the future market. They continuously exploit this difference to generate yield which is at par with most debt funds.

Returns

| Fund | 1 Year Return |

| Invesco India Arbitrage | 7.04% |

| SBI Arbitrage Opportunities Fund | 6.59% |

| Kotak Equity Arbitrage | 6.58% |

| Tata Arbitrage | 6.53% |

| Edelweiss Arbitrage | 6.51% |

Tax structure

If held below 1 year, 15% Tax, Post 1 year 10% for gains higher than INR 1 lakh in a year

Tax-Free bonds

Tax-Free Bonds in India refer to the bonds or securities issued by the government or public sector undertakings exempt from paying income tax on the interest earned from such bonds. They provide fixed income to investors, and the interest earned is exempt from taxation, hence the name “tax-free.”. However, the yields of these bonds are generally lower as they are adjusted for tax benefits. In the current high interest rate scenario these make sense only for people in the highest income tax bracket as other people can go for Gsec which will give similar returns even after tax.

Returns

| Issuer | Symbol | Coupon | Residual Maturity (Years) | Yield to Maturity (%) | Pre Tax Return (%)(31.2% income tax bracket) | Pre Tax Return (%)(42.7% income tax bracket) |

| NHAI | NHAI NE | 7.69 | 10.4 | 4.90 | 7.12 | 8.55 |

| IRFC | IRFC NJ | 7.53 | 10.2 | 4.82 | 7.01 | 8.41 |

| REC | RECLTDN9 | 8.71 | 8 | 4.82 | 7.01 | 8.41 |

| NHAI | NHAI NA | 7.6 | 10.2 | 4.63 | 6.73 | 8.08 |

| PFC | PFCN8 | 8.92 | 13.1 | 4.63 | 6.73 | 8.08 |

| HUDCO | HUDCON2 | 8.2 | 6.4 | 4.59 | 6.67 | 8.01 |

| HUDCO | HUDCON3 | 8.1 | 1.4 | 4.29 | 6.24 | 7.49 |

| PFC | 820PFC2022 | 8.2 | 1.3 | 4.21 | 6.12 | 7.35 |

| NHAI | NHAIN2 | 8.3 | 6.3 | 4.13 | 6.00 | 7.21 |

| IRFC | IRFCN1 | 8 | 1.4 | 3.87 | 5.63 | 6.75 |

Growpital

Growpital is an alternative investment platform that focuses on investment in farmland hence the returns from the platform are considered agricultural income and are tax-exempt at the hands of investors. The returns are very high and can go up to 17% and considering these are tax-free, making it even more lucrative. However, this is considered a new platform and investors should exercise more caution while investing. Investors can use (Referral Code GROWRDIMES) to get benefits

Returns

| Plan | Investment | ROI | Tenure | Lock-in Period | Payout |

|---|---|---|---|---|---|

| Baby Farming | Rs. 5000/ unit | 10% | 36 months | 12 months | Quarterly |

| Planty Returns | Rs. 20,000/ unit | 12% | 36 months | 12 months | Quarterly |

| Harvest Premium | Rs. 2,00,000/ unit | 16% | 36 months | 12 months | Quarterly |

| Banyan Tree | Rs. 10,00,000/ unit | 17% | 36 months | 12 months | Half-yearly |

Tax Structure

Tax-exempt due to Agriculture income, but an investor needs to declare LLP in ITR3

Grip Invest

Grip Invest is an innovative platform that was launched in 2020 to offer an opportunity for investors to invest money in leasing assets, such as electric vehicles, furniture, EV batteries, cloud kitchen equipment, etc. do the due diligence on the companies and list the assets. The investors buy those assets which are leased and fixed monthly returns are provided.

The companies also benefit as they can access new forms of capital without raising equity or debt but using leasing as a form of growth capital.

Returns

The platform provided post-tax returns of 11-13%

Tax Structure

Investors do not need to pay additional tax but they have to declare the LLP details in ITR3

Sustvest

Sustvest is another asset leasing platform that lists investment opportunities across various renewable energy projects- primarily solar or EV projects.

The platform connects investors and companies/industries looking to consume renewable energy for their use. The money invested is used to set up renewable energy projects at zero up-front cost for the consumers who sign either a lease agreement or power purchase agreement (PPA) with the group of investors & the platform. Consumers pay monthly as per their usage and investors get returns as per their share of ownership in the entity. Sustvest has planned other projects in the future which include carbon credit investing, EVs, etc

Returns

11-14% Post Tax Returns

Tax Structure

Investors do not need to pay additional tax but they have to declare the LLP details in ITR3

Leafround

Leafround is an Indian investing platform where people can easily invest in alternative assets. The platform offers Asset leasing and Invoice discounting products. Unlike Gripinvest this platform provides pre-tax returns which means it is suitable for investors in the low tax bracket also as they can get higher pretax returns where they do not have to pay any incremental tax.

Returns

12-25% IRR

Tax Structure

By investing in asset leasing through Leaf Round, the individual is essentially starting his/her own rental business as you are buying an asset and giving it to a company that uses it and pays him monthly lease/rent.

One can opt for presumptive taxation for income earned through leasing from Leaf Round as per Section 44AD in the Income Tax. In order to do so, one needs to fulfill these requirements:

- A person should be a resident of India (NRI can’t opt for this)

- Turnover Limit – The total amount earned through lease rent should not exceed Rs 2 Cr

A flat 6% of the Business Income (rentals) is considered taxable income. The investor has to pay income tax on the taxable income calculated above as per the tax slab rate they fall under.

Individuals can choose the other route also where they take depreciation benefits to set off income and pay tax on the extra amount.

Conclusion

We have covered some of the above products that provide good post-tax returns to investors. Investors should assess the viability of these products based on factors such as; Tax bracket, Investment Corpus and Risk Appetite. Tax should not be the sole reason to invest. One should analyze the opportunity in totality and then decide if it makes sense to invest. People who are interested in other high-yielding assets can check out the list below

Please explain the tax structure for leaf round.

If I’m in 30% slab and pre tax irr in leaf is 20% then effectively what will be the post tax returns? Since you explained 2 tax methods which would be better for above scenario?

Hi Karthik,

You can compare the tax by comparing both methods. Please note that ITR4 allows only up to INR 50 lakh income for presumptive income. Secondly, if you move from ITR4 to ITR3 you cant go back. If you have less investment and no other LLP investments like GRIP then you can go for ITR 4

Can you contrast the grip investment vs leaf round situation? I don’t understand why GRIP invest does not be used as a 44AD and only leafround?

Hi Ravi,

Grip invest investments were being done through LLP which means everything is already taxed at the LLP level hence you do not need to pay taxes again. Leafround does not have an LLP structure and you are the direct owner of assets, hence eligible for tax declaration under presumptive income

Please flag this article for updating whenever applicable.

Thanks Nitin, good feedback. I will update it periodically