Iconomi is a cryptocurrency investment platform that allows users to invest in professionally managed index funds tracking the performance of various cryptocurrencies. It aims to make crypto investing easy and accessible for beginners while also providing useful portfolio management tools for experienced investors.

Iconomi essentially serves as a one-stop shop for crypto asset allocation, portfolio management, and passive cryptocurrency investing. Users can invest in ready-made diversified index funds without needing extensive blockchain knowledge or actively trading themselves.

In this detailed Iconomi review, we will cover:

- What is Iconomi and how it works

- Creating a portfolio on Iconomi

- Choosing among various crypto index funds

- Key features and functionalities

- Security and regulation

- Customer support and user experience

- Performance and returns over the years

- Pros and cons of investing via Iconomi

So whether you are new to crypto investing or looking to simplify portfolio management, read on for a comprehensive guide on using Iconomi.

Iconomi Platform is a one-stop-shop for all crypto-related investments across altcoins. Most people think of Bitcoin when they talk about crypto as an investment class. Over the last few years, blockchain technology has made rapid progress and so has the crypto market evolved.

It becomes a daunting task to invest because it is something with which most people are not very conversant and secondly the asset class is very volatile.

Let’s put down some tenets for investing in crypto?

- Bitcoin is just one part of the cryptocurrency universe

- It’s a very volatile asset class

- We should add only a small portion of our wealth to it.

What are the various alternative to Bitcoin?

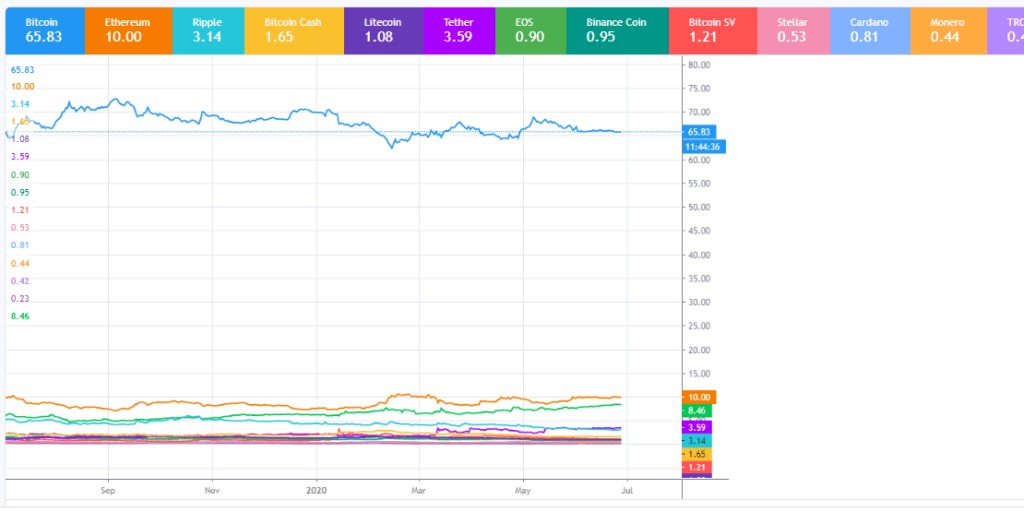

In terms of market, capitalization Bitcoin is a heavyweight if you own that you are invested in 65% of the market, but in terms of number, there are more than 3000 alternate currencies. Some of them have great utility and hence they are increasing in value while some are duds going up on speculation.

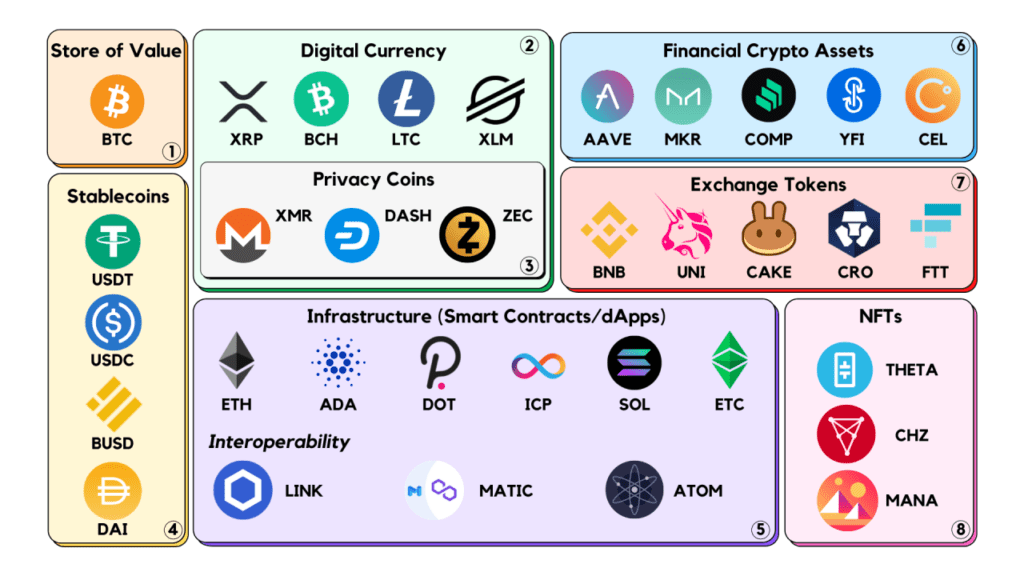

What we are often exposed to and aware of in general is the currency which comes under the category of Cryptographic Assets

Cryptocurrency can be grouped into four main classes which are; transactional cryptocurrency, utility cryptocurrency, platform cryptocurrency, and application cryptocurrency.

- Transactional Cryptocurrencies

This is the category that cryptocurrency is originally intended for. The most popular of them all is without a doubt Bitcoin. The intention of this cryptocurrency is to remove the control of central authority and cut out the middleman in our day-to-day transactions. - Platform Cryptocurrencies

This category creates a form of bedrock that facilitates the operation of other decentralized applications. Examples include Ethereum and NEO. Ethereum & NEO allow the creation of smart contracts, with Ethereum being the most widely used smart contracts platform to date. Platform cryptocurrencies provide the foundation as well as buildings blocks that allow the swift development of other decentralized apps/cryptocurrencies - Utility Cryptocurrencies:

A utility cryptocurrency is a cryptocurrency designed for a specific purpose. Siacoin is one of the notable examples. Siacoin is designed to facilitate a decentralized storage network which is a fairly unique concept and novel application of blockchain technology. - Application Cryptocurrencies

Application Cryptocurrencies refers to the class of cryptocurrencies that were based upon the platform cryptocurrencies

What is Iconomi and How Does it Work?

Iconomi is a FinTech company founded in 2016 that allows users to invest in professionally created cryptocurrency index funds with an easy-to-use platform. The index funds available for investment in Iconomi are called Crypto Strategies. Each crypto strategy consists of a basket of cryptocurrencies carefully selected and weighted by experienced portfolio managers known as Iconomi Experts. Iconomi Experts research the crypto market conditions, trends, and various blockchain projects to determine the allocation mix of cryptocurrencies for each Crypto Strategy they create.

As an Iconomi user, you simply browse the various ready-made Crypto Strategies, select one aligned to your investment goals and risk appetite, and invest any amount starting from $10.

Your chosen expert will then actively manage the crypto index fund going forward, adjusting allocations across cryptocurrencies over time. You as an investor can track overall portfolio performance daily with complete transparency into holdings.

So in essence, Iconomi allows even crypto beginners to get managed exposure to the evolving blockchain space without the complexities of directly buying, securing, and monitoring a range of cryptocurrencies themselves.

It democratizes efficient crypto investing as an index mutual fund does for stocks but with the high growth potential of this emerging digital asset class.

Iconomi Platform Features and Functionalities

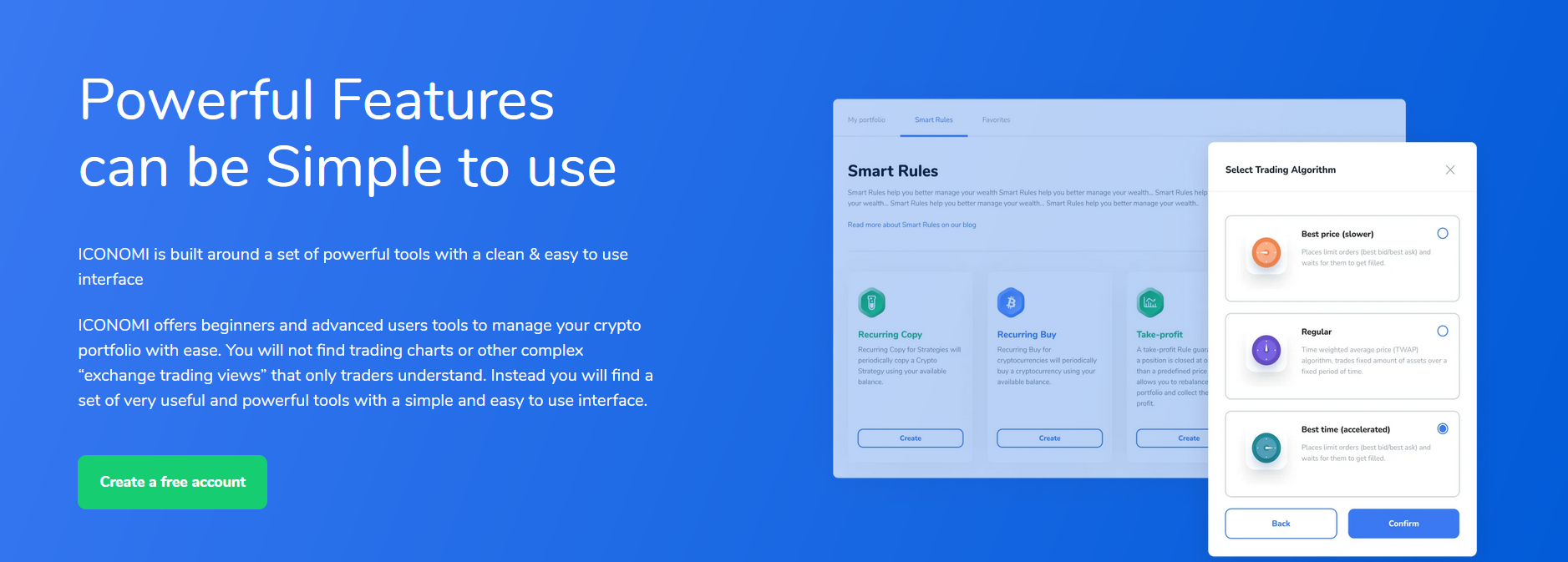

Beyond just accessing ready-made index funds, Iconomi also provides a suite of useful features for simplified crypto portfolio management:

-

Recurring Investments

You can easily automate periodic investments in your chosen Crypto Strategies on Iconomi based on dollar-cost averaging. Simply set a recurring buy order for any strategy specifying investment frequency and amount. This steadily builds allocation even during market volatility.

-

Automatic Rebalancing

For hands-off maintenance, you can configure intelligent rules to automatically rebalance holdings upon certain triggers. For example, allocate profits to stablecoins when your portfolio gains 10% or exit collapsing positions if values decline 20%.

-

Multiple Funds and Structures

Unlike simple index robo-advisors, Iconomi enables creating a diversified portfolio combining multiple Crypto Strategies in any ratio you want. You can allocate across different risk types, market segments, trading strategies, and return profiles based on personal preference.

-

Tax Management

Iconomi provides easy-to-interpret performance reports and capital gains tax calculations for preparing crypto tax returns. It tracks buy/sell history, trading volumes realized and unrealized gains all in one place for simplifying compliance.

-

Secure Storage

User assets on Iconomi are stored in partnership with industry-leading custody provider BitGo for security.BitGo provides $100 million in insurance protection and replicates keys across multiple locations to prevent loss.

How to start investing via ICONOMI?

2 things I consider while investing in crypto

- To be able to diversify across multiple crypto assets

- Reduce loss if a market crash happens.

To address the first part I have decided to put 30-40% in Bitcoin and the rest in another cryptocurrency that has huge upside potential. How do I find that?

As of now, I am investing in Iconomi Platform. It is one of the first platforms where multiple crypto portfolios are available where retail people can start investing from as low as 10$.

Crypto Strategies are managed by experienced investors – ICONOMI Crypto Strategies Experts. You can add funds to your account and follow the Iconomi crypto strategy with just a few clicks.

While Iconomi is taking care of the complexity behind the technology, users can add funds/follow (invest) in or create their own Crypto Strategies in just minutes.

Iconomi Platform provides a simple and elegant user interface while relieving the users of the complexities that dealing with multiple exchange accounts, setting up complex orders, transferring cryptocurrencies from one exchange to another, trading, storage, pricing, etc., thereby providing a superb user experience. Everything is done on ICONOMI platform, with you owning only one account

Creating a Portfolio on Iconomi

Creating an investment portfolio on Iconomi takes just a few simple steps:

-

Sign Up and Complete KYC

First, you sign up on the Iconomi platform by providing your email ID and setting a password. You then complete a standard Know-Your-Customer (KYC) process to verify your identity. This involves submitting details like full legal name, contact information, date of birth, citizenship, and address proof. You may also need to upload a clear photo ID.

-

Fund Your Iconomi Account

Once your identity is verified per regulatory requirements, you can deposit funds into your Iconomi account wallet using cryptocurrency or fiat currency. Iconomi supports deposits in stablecoins like USDT as well as wire transfers and credit/debit cards for several countries. There are no deposit fees charged.

-

Browse and Select Crypto Strategies

You can then explore the various ready-made crypto index funds called Crypto Strategies created by Iconomi Experts based on your interests. Each Crypto Strategy displays historical performance data, current coin allocations, risk metrics like volatility and maximum drawdown, the expert manager’s bio, and investor reviews.

-

Invest in Chosen Crypto Strategy

When you decide on a suitable Crypto Strategy, you simply specify the investment amount and place the order. The funds will withdraw from your Iconomi wallet to purchase units in that index.

You now have exposure to the underlying basket of cryptocurrencies through the Crypto Strategy you picked. You can track overall portfolio performance and returns conveniently within your Iconomi dashboard.

Choosing Among Iconomi Crypto Strategies

Iconomi platform currently offers around 50 ready-made Crypto Strategies catering to different risk appetites and crypto investing styles.

When selecting a crypto index fund, you can filter strategies based on return potential, risk category, or diversification approach. Let us examine some of the common strategy types available:

-

Broad Crypto Market Exposure

Several Crypto Strategies on Iconomi offer broad diversified exposure resembling an index mutual fund for cryptocurrencies. These invest across a basket of leading cryptocurrencies by market capitalization, essentially tracking the overall crypto market. Allocation rebalancing maintains index weighting. For example, CC Crypto Market Index aims to replicate the returns of top 20 cryptos. Another index called CCI 30 focuses on the top 30 digital assets by market cap.

Such crypto index funds provide easy access to the blockchain space for beginners similar to holding an altcoin ETF.

-

Thematic Exposure

Some Crypto Strategies have a concentrated theme focusing on specific crypto sectors expected to outperform. These allow targeted exposure if you have a bullish view on areas like decentralized finance (DeFi), metaverse, Web 3.0, gaming/NFTs, etc. based on trends.For instance, Crypto Future invests solely in next-gen blockchain platforms and apps. Another fund named Moonshot bets on smaller cap altcoins with big growth potential.

-

Active Trading Strategies

In contrast to passive index Crypto Strategies, some Iconomi funds pursue more active allocation management. For example, Crypto Trends dynamically adjusts holdings attempting to ride market swings through technical analysis. Another strategy named Coin Alpha makes short-term trades aiming to outperform bitcoin based on momentum signals.

-

Stablecoin Funds

Finally, there are ultra-low-risk Crypto Strategies allocating fully or predominantly to stablecoins. For instance, EUR Stable Fund holds Euro-backed stablecoins giving euro currency exposure. Another called USDC Coin only purchases the USD Coin stablecoin accruing yield from lending markets. So conservative investors can still earn from crypto without direct cryptocurrency price exposure.

Iconomi Security and Regulation

Iconomi utilizes robust security measures to keep user assets and data protected:

- Two-factor authentication prevents unauthorized account access

- Role-based access restrictions control employee data touchpoints

- Regular penetration testing and infrastructure monitoring detect threats

- As mentioned earlier, crypto assets custody partner BitGo has top-tier insurance cover

Further, Iconomi maintains legal compliance by applying KYC and transaction monitoring per stringent EU regulations. Frequent audits validate financial reporting accuracy as well.

Iconomi Customer Support and User Experience

The Iconomi platform interface offers a seamless user experience even for crypto investment first-timers with its clean, intuitive design across web and mobile apps.

Simplified portfolio dashboards present just core position data required for everyday passive investors. Yet, seasoned traders also have access to detailed holdings, transactions history, and tax reports by just toggling additional menu options. Iconomi also provides prompt email assistance during EU business hours for any investor queries. Support guides and an FAQ knowledge base allow self-serving simple issues.

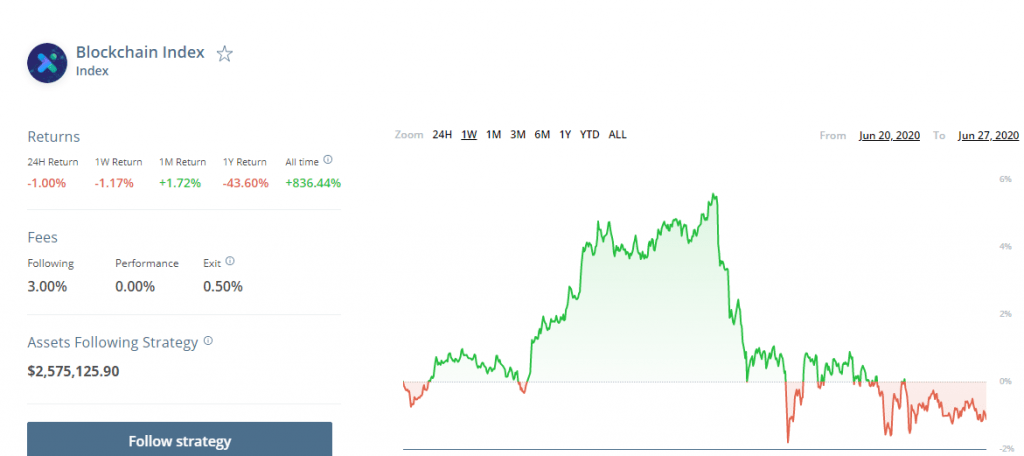

Iconomi Historical Performance and Returns

As a pioneering crypto investment platform operating since 2016, Iconomi indices have produced stellar returns over the years – often dramatically outperforming bitcoin.

For instance, their flagship index tracking large market cap cryptocurrencies has delivered over 3000% cumulative returns since 2017 inception compared to 600% gains for Bitcoin over the same period. Even during peak crypto bear market drawdowns, several Iconomi index strategies managed to provide strong positive returns or at least mild single-digit losses – shielding investors effectively from downside stormy moves plaguing individual altcoins.

While historical success does not guarantee future earnings, it does validate Iconomi’s index fund construction methodologies and risk management rigor developed through years of managing crypto allocations.

Pros of Investing through Iconomi

Here are the major benefits of using Iconomi platform:

-

Managed Crypto Exposure

Iconomi provides easy hands-off exposure to a dynamically managed basket of cryptocurrencies based on professional research. This avoids the complexities of directly handling altcoins for passive investors.

-

Broad Diversification

With a single Iconomi account, users can spread holdings across various crypto assets, sectors, risk types, and fund strategies to minimize portfolio volatility.

-

Low Investment Minimum

You can start investing in Iconomi indices with an initial amount as low as $10. This opens efficient crypto allocation even for small retail players.

-

Index Fund Cost Savings

Iconomi’s pooled fund structure keeps expense ratios lower than actively trading yourself across multiple exchanges while still benefiting from expert management.

-

Portfolio Automation

Auto-rebalancing, tax-harvesting, and dollar-cost averaging rules simplify maintaining allocations aligned to targets over time with no manual effort.

-

Regulatory Compliance

As an EU-regulated company, Iconomi provides the security and legitimacy assurances required for conservative institutional crypto adoption.

Cons of Iconomi Crypto Investment

However, Iconomi does have some limitations to factor as well:

-

Indirect Crypto Ownership

Iconomi users do not directly own the underlying cryptocurrencies. You simply own shares in index funds tracking crypto prices. This can limit flexibility for experienced traders.

-

Limited Fund Choice

While Iconomi offers approximately 50 Crypto Strategy indices presently, the options are still quite restricted compared to the thousands of cryptocurrencies available. Niche sector-specific exposure may be lacking.

-

Higher Fees Than Direct Purchase

The fund pool approach entails additional management fees up to 2% charged by Iconomi experts on gains beyond just blockchain network costs. But easier investing often outweighs slightly higher expenses.

Ionomi Crypto Strategy- Which one to choose?

Crypto Strategies are a great entry point for beginners, for those who would like to invest their money into cryptocurrencies, but are not sure where to begin. That is where Crypto Strategies managed by ICONOMI Experts come in handy. ICONOMI Experts choose the cryptocurrencies and adjust the strategies depending on market conditions, while followers (investors) can sit back and track their investments anytime and anywhere. It’s like a mutual fund for crypto.

You can choose to invest in a passive index: Like a top 20 crypto or a more active index.

I have invested in the Crypto Crush fund by Victor Lai, crypto researcher, and owner of a very popular crypto blog. I also have some portion allocated to CARUS AR Iconomi Crypto Strategy.

You can register for Free here: Iconomi Platform

Iconomi Platform accepts: USDT

Iconomi Review- Experience of 3+ Year

I have completed almost 3 year with Iconomi. I am happy with the performance. My current portfolio is close to 1000% up without me putting any effort in researching altcoins!!

Conclusion

Conclusion

In summary, Iconomi deserves consideration for any type of cryptocurrency investor – whether a total beginner or an advanced trader grappling with complex portfolio tracking across dispersed exchanges. The platform simplifies owning a diversified, professionally managed basket of crypto assets tailored to varying risk appetites with minimal upfront investment needed.

And hands-off automation features make maintaining allocations extremely convenient as well. With crypto adoption still in early phases, Iconomi strategies could turbocharge portfolio returns over the coming decade.

So if you are looking for convenient guided access to this transformative digital asset class, Iconomi enables just that. It lets you tap crypto’s wealth creation potential without the learning curve or hassles of direct coin ownership and trading.

- Allocate small amounts to crypto funds to take exposure to crypto other than bitcoin. You can take a passive approach(Index) or active(Fund).

- Bitcoin hedges can be taken from Deribit platform where bitcoin is used as a margin.

- We tried looking for Iconomi alternative but couldn’t find reliable platforms. Hence, it is a one-of-a-kind platform that is a must-try option for any crypto investor.

can u tell about crypto mining investment. Recently i came to know about crypto mining investing site Marvellous Infosoft through FB (https://marvellousinfo.com/index.html). Where they are offering up to 45 % p.a. fixed interest. As a experiment I had invested little amount because I feel cautious as its an new kind of investment, interest they are offering compared to other investment option. So could u guide please whether its real or scam ?

I recommend people to stay away from most mining related investments as most turn out to be fraud or ponzi scheme.

No mining can offer high return in these volatile environment.

The company link has placeholders for testimonials, a big red flag!

Is Iconomi registered with FIU? Recently GOI banned several exchanges for not being FIU compliant (although its questionable how effective the ban is).

Also how do you withdraw INR from Iconomi? Also just wanted to check considering all the costs involved – of reusing strategies, deposit charges, exchange fee, txn fee (for trading as well if you have to move coins to other exchange for cashing out) and finally income tax, how much profit we can expect ?

Hi Rahul ,

1) Currently the FIU ban is not on Iconomi but you need to deduct TDS while investing in Iconomi hence its not a convenient option for India based investors

2) You can withdraw in USDC , bitcoin etc to any platform in India like Coindcx

3) The strategy are profitable (some 100%+ returns )even after transactions but it depends at what time you are investing. The platform does well in long horizon (adding more in crypto winter) as it has strong altcoin focus making it high beta play on crypto . deposit and withdrawal charges generally onetime

Thanks a lot. Have you tried coin sets feature on Mudrex? Although it doesn’t come across as smart as Iconomoi strategy feature, seems like maybe next best option for FIU compliant exchange and doing INR trxns. Any views on that?

Hi Rahul,

I have tried mudrex in the past. My only reservation has been it is more of a trading platform and the maximum returns in crypto have come through long term investment. Do the trading fees etc make up with superior returns for you?