In the Indian financial landscape, high-yield bonds play a significant role in offering investors the potential for enhanced returns. These bonds, carry higher risk but also promise higher yields. In this guide, we will explore the nuances of high-yield bonds in the Indian context, focusing on BBB bonds, real estate bonds, and venture debt, which are gaining traction among investors seeking alternative avenues for portfolio diversification and higher income.

Understanding High-Yield Bonds in India

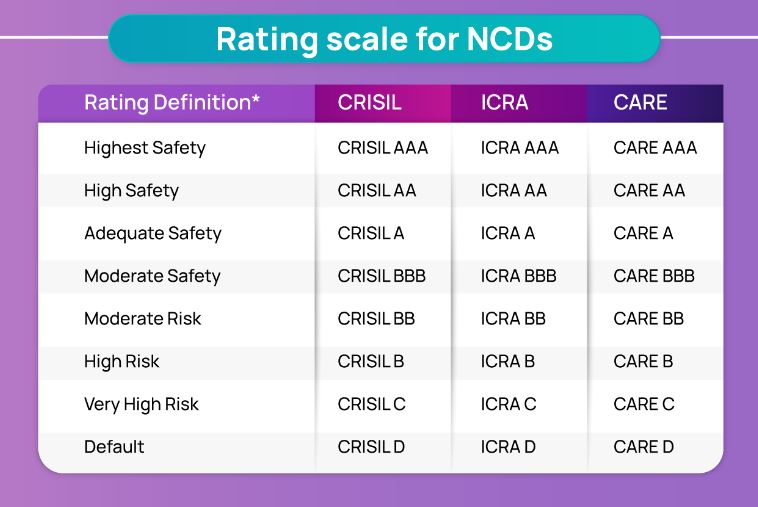

High-yield bonds in India are debt instruments issued by companies or governments with credit ratings below investment grade. This typically includes bonds rated below BBB by credit rating agencies such as CRISIL, ICRA, or CARE. These bonds offer higher yields to compensate investors for the increased credit risk associated with the issuing entities.

Characteristics of High-Yield Bonds in India:

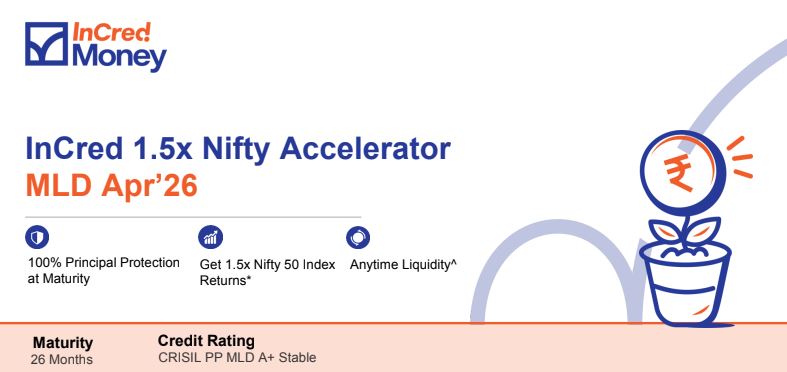

- BBB Bonds: BBB bonds represent a significant segment of high-yield bonds in India. These bonds are issued by companies with lower credit ratings, implying a higher default risk compared to investment-grade bonds. Despite the slightly higher risk, BBB bonds offer attractive yields, making them popular among income-seeking investors. The expected Yield from BBB is 12-13.5%

- Real Estate Bonds: Real estate bonds are debt securities issued by real estate developers to raise capital for property development projects. These bonds typically offer higher yields than traditional corporate bonds, reflecting the inherent risks associated with the real estate sector, including market cyclicality, regulatory changes, and project-specific risks. Expected Yield from Real Estate Bonds is 15-18%

- Venture Debt: Venture debt is a form of financing provided to early-stage or growth-stage startups, often in conjunction with equity financing. Venture debt offers higher yields compared to traditional corporate bonds, compensating investors for the higher risk associated with startups. Venture debt providers may include specialized funds, HNI,banks, or non-banking financial companies (NBFCs) with expertise in evaluating startup business models and risk factors. Expected Yield from Venture Debt is 15-20%

Benefits of High-Yield Bonds in India

- Enhanced Yield: High-yield bonds offer investors the potential for higher income compared to investment-grade bonds, making them attractive.

- Portfolio Diversification: Including high-yield bonds in a diversified investment portfolio can help enhance overall portfolio returns and reduce correlation with other asset classes such as stocks and traditional bonds.

- Exposure to Alternative Sectors: Real estate bonds and venture debt provide investors with exposure to alternative sectors such as real estate and startups, offering diversification benefits and potential for capital appreciation.

- Counter-Cyclical Characteristics: High-yield bonds in India have historically exhibited counter-cyclical characteristics, performing well during economic recoveries and outperforming other fixed-income assets during periods of economic expansion.

Risks of High-Yield Bonds in India

- Default Risk: High-yield bonds are susceptible to default risk, particularly BBB bonds issued by companies with weaker credit profiles. Investors should carefully assess the creditworthiness of issuers and conduct thorough due diligence to mitigate default risk.

- Sector-Specific Risks: Real estate bonds and venture debt are exposed to sector-specific risks, including market cyclicality, regulatory changes, and project-specific factors. Investors should consider the unique risks associated with these sectors before investing.

- Liquidity Risk: High-yield bonds in India may have lower liquidity compared to investment-grade bonds, making it challenging to buy or sell them at desired prices, particularly during market downturns or periods of heightened volatility.

Strategies for Investing in High-Yield Bonds in India

- Active Management: Active management strategies involve conducting fundamental analysis, credit research, and issuer-specific due diligence to identify attractive high-yield opportunities and manage default risk effectively.

- Diversification: Diversifying across a broad range of high-yield bonds, including BBB bonds, real estate bonds, and venture debt, can help mitigate individual issuer risk and enhance portfolio stability.

- Duration Management: Managing portfolio duration and interest rate sensitivity can help investors navigate interest rate risk by adjusting the average maturity of high-yield bonds to align with market conditions and investment objectives.

- Credit Quality Assessment: Conducting thorough credit analysis and due diligence on high-yield issuers is essential for assessing default risk and selecting bonds with attractive risk-adjusted returns.

- Sector Allocation: Allocating investments across various sectors, including real estate and startups, can help spread risk and capitalize on sector-specific opportunities while avoiding concentration in high-risk sectors.

Does High Yield Mean More Risk Too?

Having seen the different types of bonds, investors are often faced with the dilemma of risk if they chase high yield bonds. Its very understandable that the potential of higher return for

high-yield assets is accompanied by the chances of greater default risk than the corporate and government debt securities. However, that’s not the case to be understood in a universal sense. For instance, corporate bonds are provided with the rating of AAA to default by credit rating agencies. Here, AAA is considered as the highest rating. Companies tend to invest in AAA-rated bonds due to the regulatory and internal mandates that come with them. Hence, such bonds tend to have higher demand which results in lower yield. AAA-rated bonds come with a very high degree of creditworthiness. This is because the issuers succeed in meeting the financial commitments easily along with a lower risk of default. On the other hand, bonds that come with a slightly lower rating offer high yields due to lower demands. Further, these have a lower risk factor.

This goes without saying that investors prefer to invest in high-rated instruments. Further, regulators do not allow investments into instruments with a below A rating. Hence, the demand for such instruments drops automatically despite the low-risk factor.

Best Platform to Buy High Yield Bonds In India

Below is the list of some of the platforms that we use to buy Yield Bonds

Altifi

Altifi is part of Northern Arc Group and has some of the top High Yield Bonds. The platform boasts of zero default to date. They list only those bonds that have been reviewed by their team. Their experience in credit writing gives more credibility to the bonds available in the platform. Microfinance companies is the forte of this platform

Gripinvest

Grip Invest offers multiple High Yield Bonds that are popular in the market. They also provided Securitized debt instruments that can provide a yield as high as 16% to the investors. Read about Securitized debt instruments here

Altgraaf

Altgraaf is a platform that specializes in Alternative Investments. Apart from other products it also lists Real Estate NCDs and Venture debt that can offer upto 18% IRR to investors.

Wint wealth

Wint Wealth is a bond-only platform. They list a couple of bonds every month. Unlike other platforms, they work with the issuer and create customized payment schedules for the bonds. The focus is on due diligence and optimum repayment structure to reduce risk

Tapinvest

Tapinvest provides access to unlisted bonds. These are bonds of generally Fintech companies or Startups and have yields ranging from 13-17%.

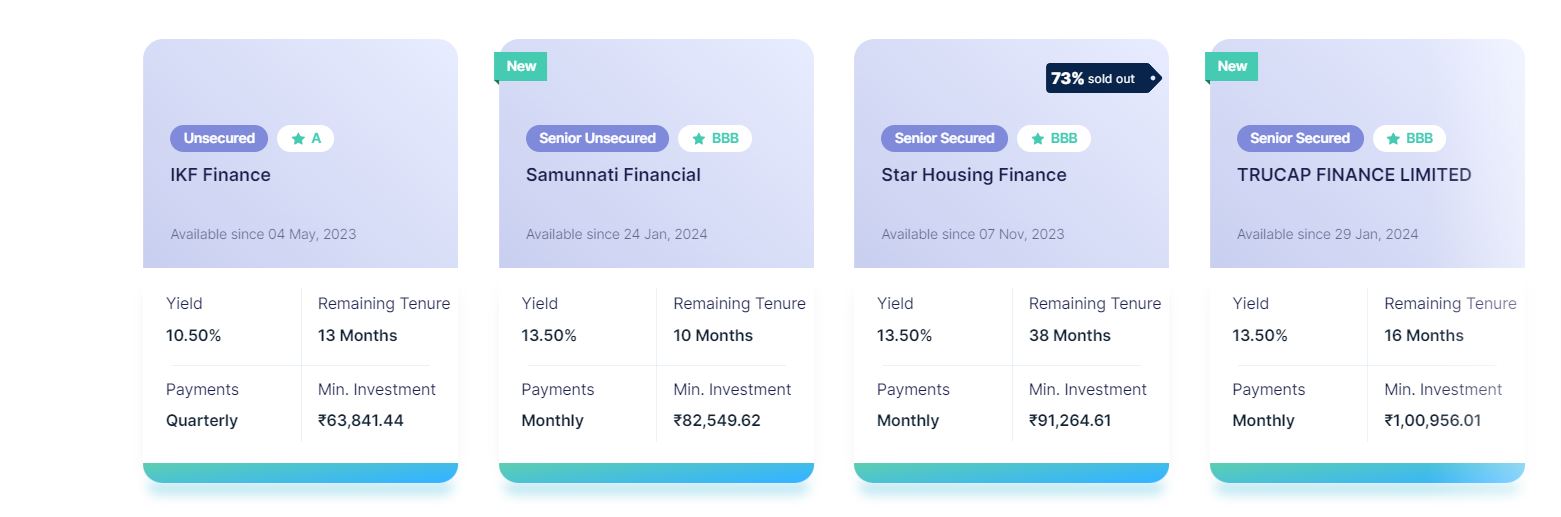

Incred Money

The platform is backed by Incred Group. Apart from listing high-yield bonds, the platform also lists unique products like Market Linked Debentures that are linked to Nifty Performance and can also provide principal protection.

Conclusion

High-yield bonds, including BBB bonds, real estate bonds, and venture debt, offer investors the potential for enhanced returns in the Indian market. By understanding the characteristics, benefits, and risks of high-yield bonds and employing sound investment strategies, investors can effectively harness the potential of these alternative fixed-income instruments to enhance portfolio returns while managing risk. However, it’s crucial to conduct thorough due diligence before investing in high-yield bonds or any other asset class, considering individual investment objectives, risk tolerance, and time horizon.

If you wish to explore alternative investments beyond high yield bonds go through the below list