Last Month we discussed the forthiness in the midcap and small-cap space. This month, the market fell sharply due to various global negative cues and the overheated market was already on the lookout for an excuse to correct.

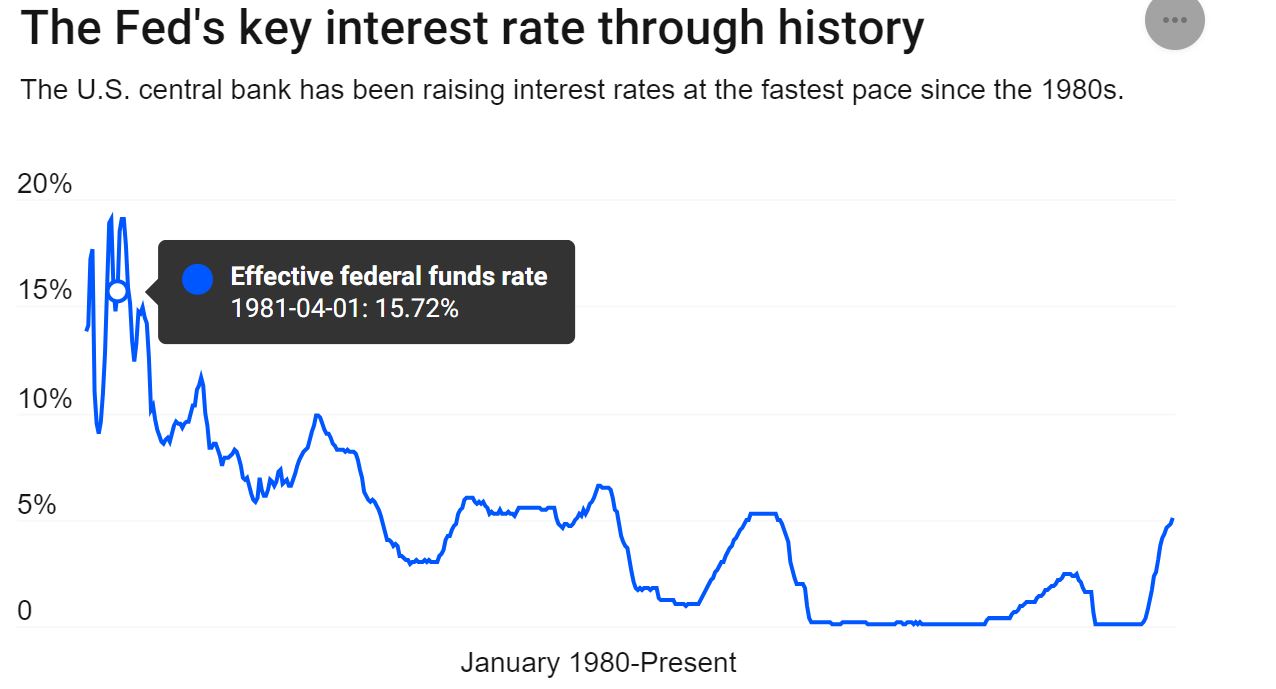

Global equity markets are currently experiencing a “risk-off” sentiment due to a combination of economic and geopolitical factors. The ongoing Israel-Hamas conflict remains a significant concern for these markets. If this conflict persists, it has the potential to negatively impact global economic growth, especially as the global economy is already going through a period of slowdown. In the short term, the primary challenge for the market is the persistently high US bond yields, with the 10-year bond yield approaching approximately 5%. This is likely to lead to Foreign Portfolio Investors (FPIs) adopting a selling stance. Sectors like banking and information technology (IT), which make up a significant portion of FPI assets under management (AUM), are expected to come under pressure. Nevertheless, this situation could present attractive opportunities for long-term investors to purchase quality stocks, particularly in the banking sector, at favorable prices.

Telegram channel for the Latest Alternative Investment News

Alternative Investment Portfolio Performance

This month’s alternative investment allocation in the portfolio allowed us to be impacted less by the stock market volatility. I was more focused on shorter-dated products like Jiraaf platform invoice discounting that is currently offering higher yields as a Diwali offer.

Jiraaf has recently raised a large funding round that will bolster the capabilities of the platform

Leafround has also raised new funding and has rebranded itself as Tapinvest!

Updated NPA Details

To provide more comprehensive information on deals performance on platforms, I have collected the performance of multiple users of these platforms and created an NPA statistic. The benefit of this is that even though my deals are going well in a platform, this will give the overall performance of the other deals on the platform that I might not have invested in.

Please note NPA does not mean that a platform is bad. NPA can be due to 2 factors

- Higher vintage or transaction volume

- High yield or higher risk opportunity

Investors should evaluate the NPA along with Gross returns on the platform to make investment decisions.

Eg a platform with a 20% return and 2% NPA is better than a 10% return and 1% NPA.

Lending Investment

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.00% | 0.80% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf | 12-15% | 0.00% | 0.00% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | 12%(Tax Free) | 0.00% | 0.00% |

| Leafround | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

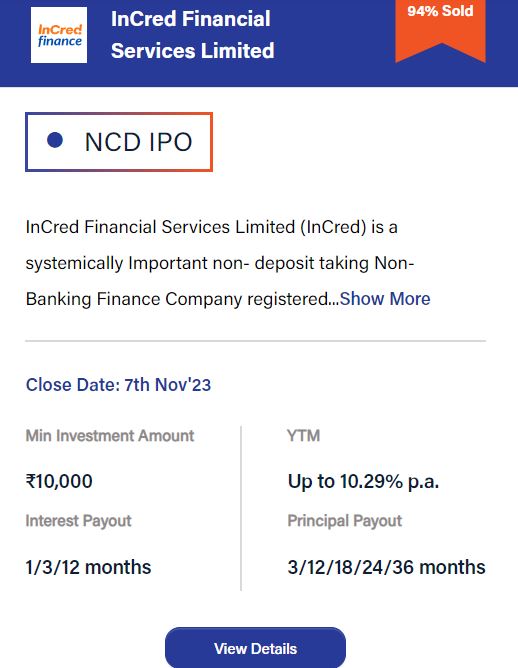

| Incred Money | 11.0% | 0% | 0% |

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are per schedule.

- Invested in Kebapci on Klubworks as it is profitable and Klub is the only debt investor

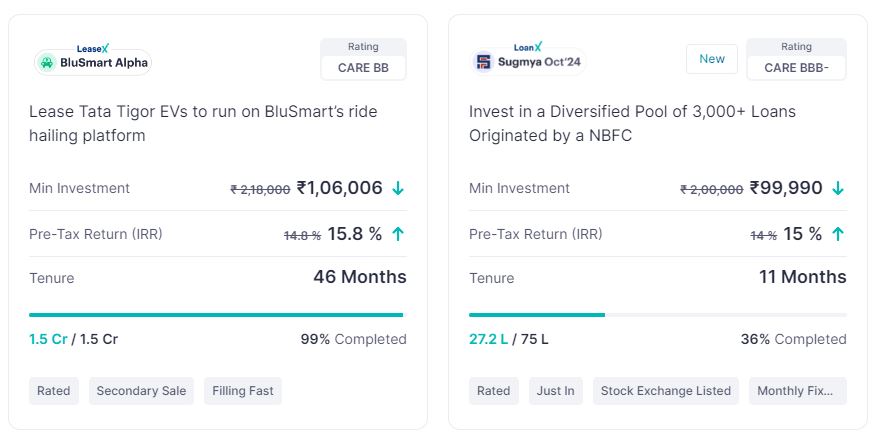

- Invested in Sugmyal SDI deal on Grip offering 15% for 11 months.

- Invested in a Few Invoices on Leafround ( )

- Received my Jiraaf Stashfin Commercial Paper repayment.

- Betterinvest also has a new deal offering 18% IRR for 6 months that I intend to participate in.

Randomdimes Youtube

Top Deals Live

Invoice Discounting and Pooled Loans

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Liquid Fund Substitute) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox (Per Annum Liquid Fund Substitute) | 11.50% | 0% | 0% |

| Lendzpartners | 13.00% | 0% | 0% |

| IndiaP2P | 16% | 0.30% | 0.1% |

| KredX | 12% | 0% | 0.75% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.7%

- Using Liquiloans/Per Annum to Park Short-term Capital.

- Tradcred has launched some good deals such as log9 which I participated in.

- Have invested in 5 deals to date on Lenderpartnerz

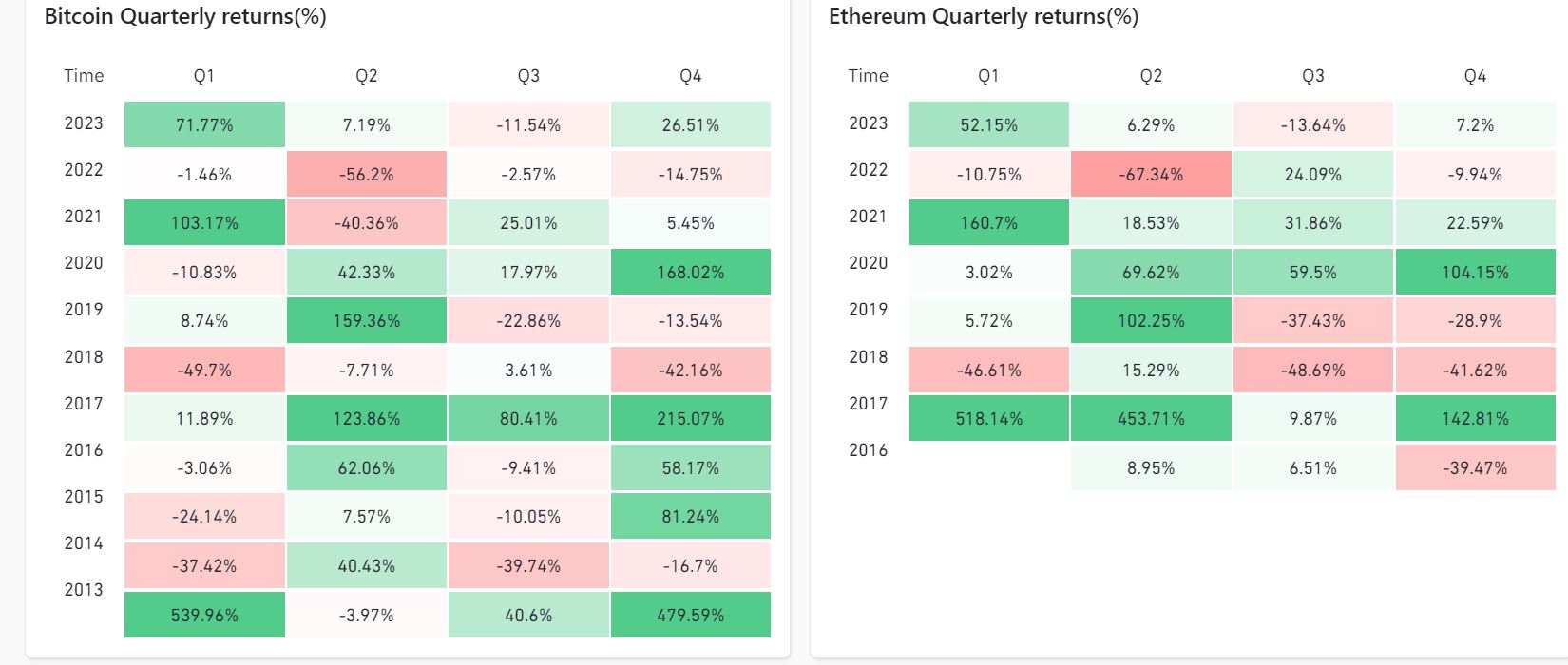

Crypto Investing

Crypto has finally started moving out of hibernation from the long winter. Bitcoin has jumped approximately 40% in the last few months. It is still one of the best-performing asset classes of the year.

Bitcoin has surged 14 percent in the last seven days amid optimism around Bitcoin Exchange-Traded-Fund (ETF). Several investment firms, including BlackRock and Fidelity Investments, have pending applications for bitcoin ETFs in the US, and speculation on their likely approval was fuelled by BlacRock’s iShares ETF listing on the website.

In the long run, BTC, Ethereum, etc have rewarded people who have shown the temperament to hold it through long periods of volatility and drawdown

You can buy Hardware Wallets on Etherbit

P2P Investment

Current allocation:

- India P2P – 55%

- 12Club – 5%

- I2IFunding- 15%

- Finzy-10%

- Faircent Pool Loan -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Paused) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.8% |

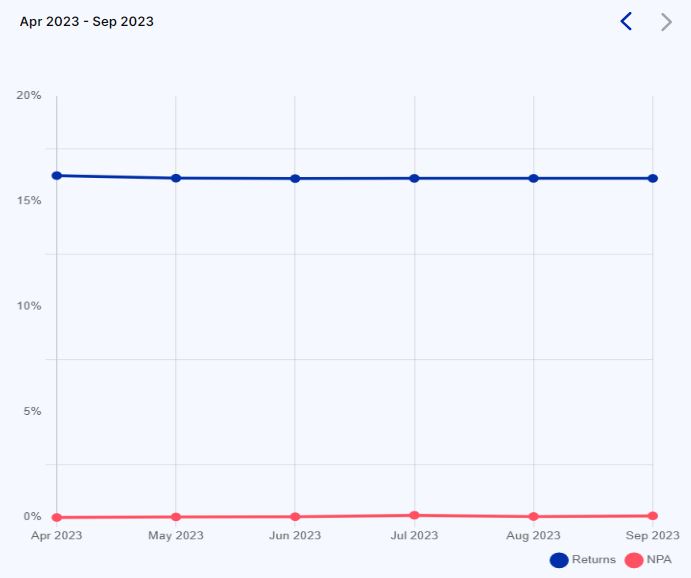

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club | Only Minimum amount | 12% | 0% |

- I have completed 1 year of using IndiaP2P with steady performance. I am steadily increasing my capital on this platform.

- I2Ifunding and Finzy have a very low volume of loans and I haven’t added any new capital in the last 5 months.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

Equity Market

PreIPO Stocks

Based on analysis by Prabhudhas Liladhar, The National Stock Exchange has the potential to become a multi-bagger stock, boasting a near-monopoly status, 35% plus CAGR in revenues, and clean promoters at the helm. The exchange’s PE ratio stands at 22, versus 50 times for MCX and 37 times for BSE Limited. While the initial public offering remains elusive, the public issue could be launched next year. However, options trading could pose a risk, with close to INR51,000 crore in government revenue generated by the sector. Delayed IPO and a pending Supreme Court case against the NSE are also risks.

Listed Stocks

October proved to be a disaster for the equity markets. Experts don’t rule out further correction amid a slew of headwinds, such as rising US bond yields and crude oil prices, geopolitical uncertainties, and earnings disappointments. Additionally, India’s general elections could emerge as another uncertainty if state election results are not favorable.

The yield on the 10-year US benchmark bond rose to over 5 percent for the first time since 2007 on Monday, weighing on equity market sentiment globally. Although the yield has receded slightly below 5 percent, it remains at a multi-year high, which will continue to exert pressure on capital flows.

I am adding investment in a staggered manner. A psychological reason for doing that is in case of marketing going further down we would have more cash to buy equity and would not create panic even during a longer drawdown.

Algo Trading

Our Algo and Manual Option trading gave a 1.5% return in October. We were up 3.5% for the first half but suffered back-to-back losses of 2% due to market volatility. We are currently close to a 20% return for this financial year. Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to coy traders.

| Month(2024) | April | May | June | July | Aug | Sep | October |

| Return | 2% | 1.30% | 1% | 4% | 5% | 4.50% | 1.50% |

Other Alternative Investment Assets and Platform Updates

Alyf is an upcoming platform that provides fractional ownership of holiday homes in tourist destinations. Interested people can register and get a call from their team.

Growpital Investment – The performance of the platform has been satisfactory till now as the payments have been on time to date. They have recently shared their audited financials. what are your views on that? Investors who have visited farms please share your experience.

Growpital(Promo code GROWRDIMES)

Leasify Investment – Leasify has recently started repayment for Bhadepay and Sharepal Leasing Deal. I will be soon publishing an interview with the founder.

Yieldwisex- My investment in MYRE Capital has been performing as expected. It is now called Yiedlwisex. I have been exploring other real estate platforms like Alyf. We are also in the process of shortlisting a couple of platforms for land ownership.