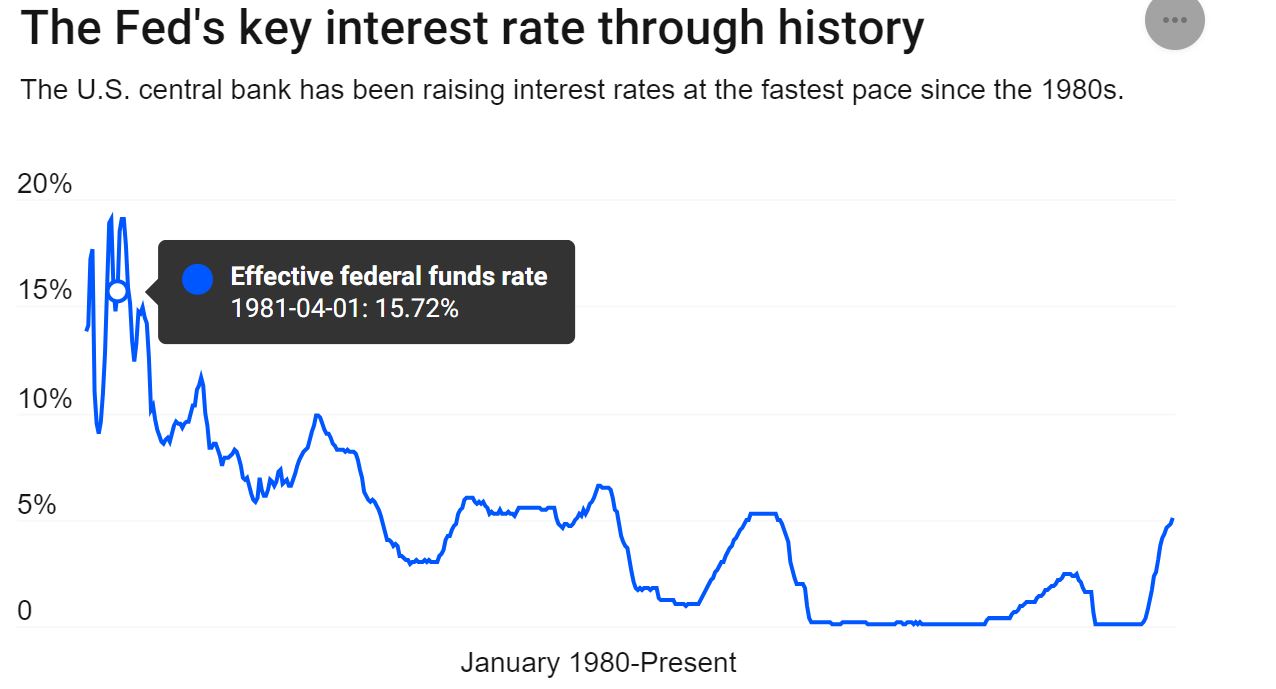

The Nifty50 rose 6.77 percent during the November month F&O expiry. During the same period during S&P 500 has risen 11 per cent from its October lows. We put it in familiar, fundamental terms: investors believe we’ve seen the peak in rates, inflation is slowing, profits are rising, and sentiment is improving.

The recent rally has left some hedge funds with an estimated $43 billion in losses after betting on equities to move lower, Some institutional investors had built up short-bets against companies they thought would buckle amid the higher-rate environment. However, with confidence returning to markets, some of those trades aren’t panning out. Some hedge funds have had to repurchase stocks to cover their short bets as a “short squeeze” pushed share prices even higher.

The Goldman Sachs index that tracks the S&P 500 names with the highest total dollar value of short interest outstanding is on pace for its best month since last October.

Telegram channel for the Latest Alternative Investment News

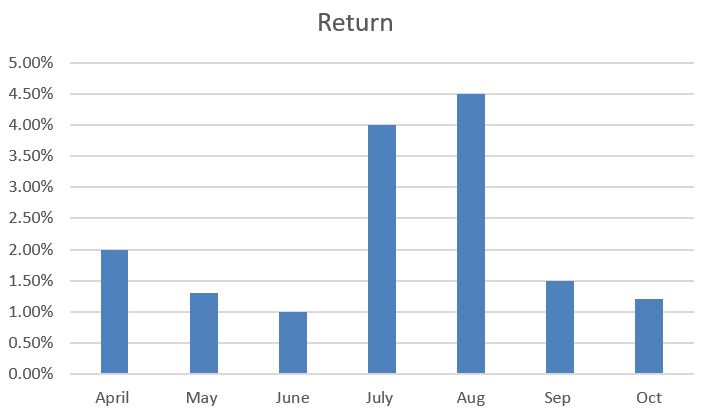

Alternative Investment Portfolio Performance

This month we have explored 2 platforms :

We have invested a small amount in 13 karat and will be sharing monthly reviews. I expect the platform to do well as it is backed by Cashe and utilizes its credit underwriting and borrower pool. Cashe has been in business for more than 5 years has had a very low NPA and has shown good profitability.

Hecta is a platform focused on repossessed properties. It is a great platform for someone looking to purchase a real estate property for investment or ownership as some of the properties can be purchased at a 20-30% discount from the market rate.

*Updated NPA Details

To provide more comprehensive information on deals performance on platforms, I have collected the performance of multiple users of these platforms and created an NPA statistic. The benefit of this is that even though my deals are going well in a platform, this will give the overall performance of the other deals on the platform that I might not have invested in.

Please note NPA does not mean that a platform is bad. NPA can be due to 2 factors

- Higher vintage or transaction volume

- High yield or higher risk opportunity

Investors should evaluate the NPA along with Gross returns on the platform to make investment decisions.

Eg a platform with a 20% return and 2% NPA is better than a 10% return and 1% NPA.

Lending Investment

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.00% | 0.70% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

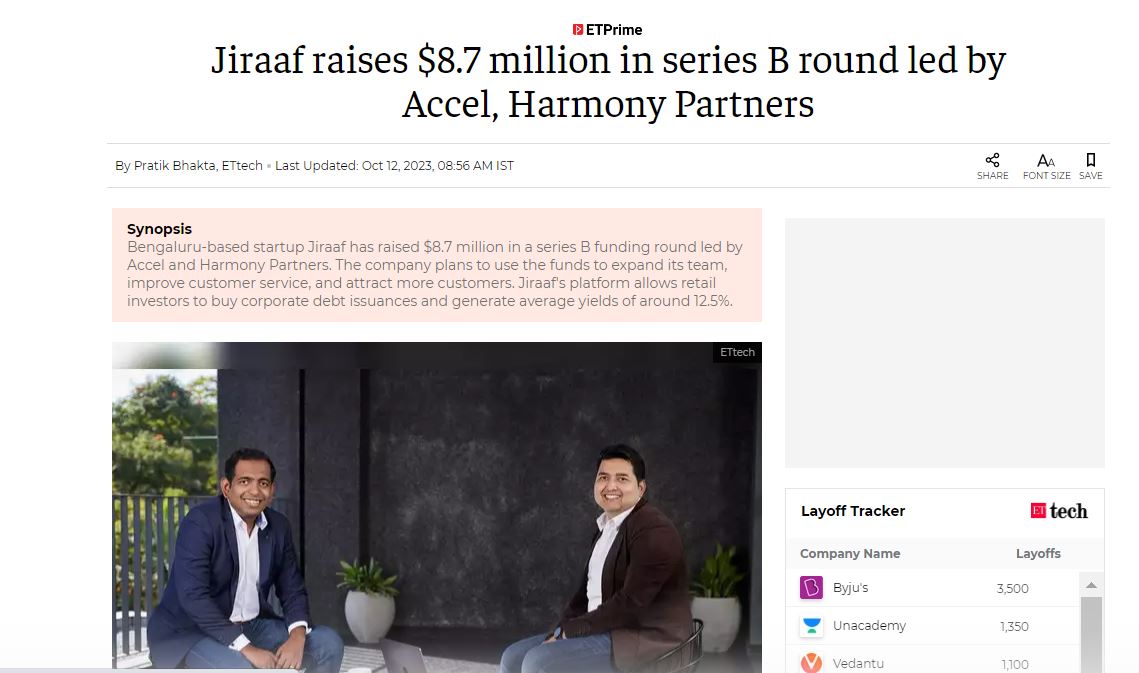

| Jiraaf | 12-15% | 0.00% | 0.00% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | 12%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

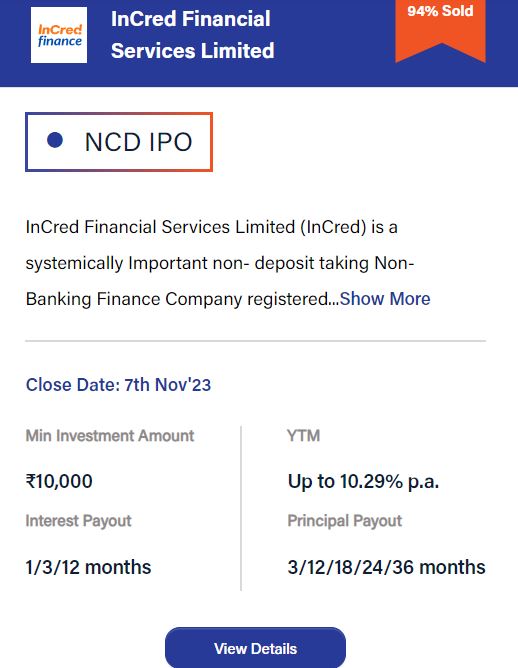

| Incred Money | 11.0% | 0% | 0% |

- All my cash flows in Klubworks, WintWealth, Jiraaf, TapInvest, and GripInvest are per schedule.

- Participated in the new Betterinvest deal

- Invested in 3 invoices and 1 Asset leasing opportunity on TapInvest

- Invested in 1 invoice on Jiraaf.

- Sustvest had a new opportunity recently.

Randomdimes Youtube

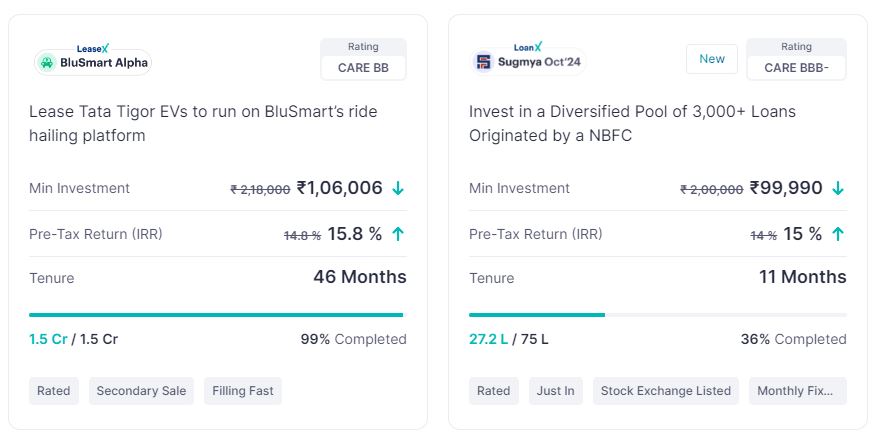

Top Deals Live

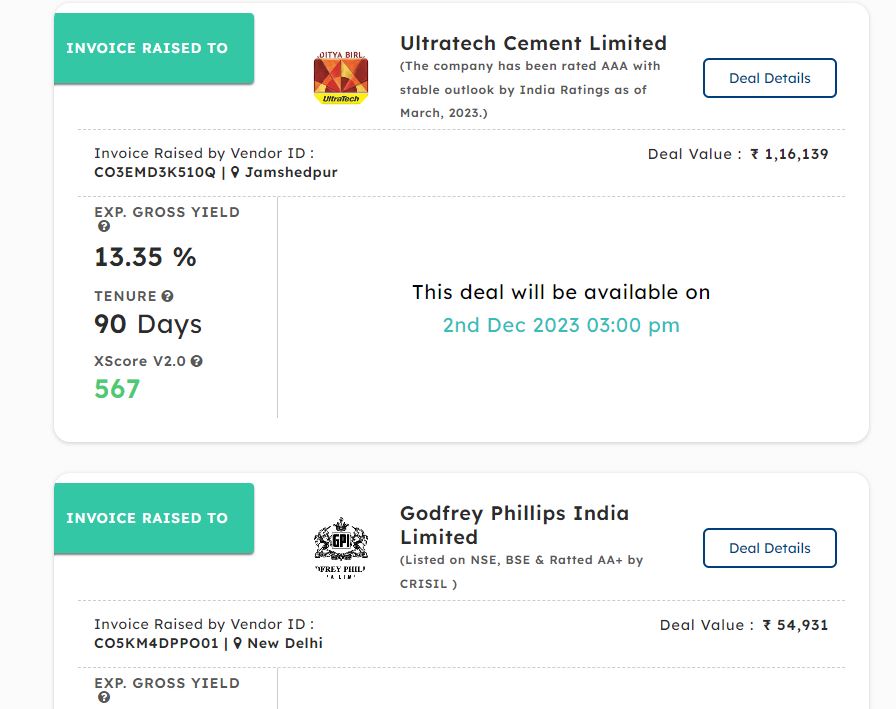

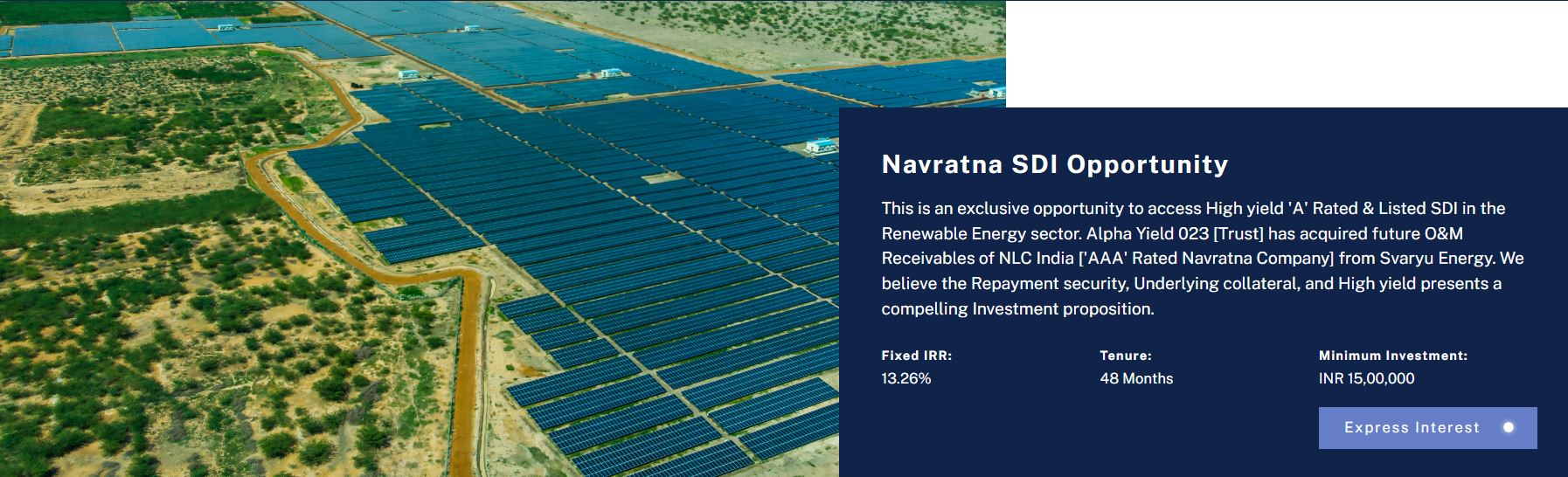

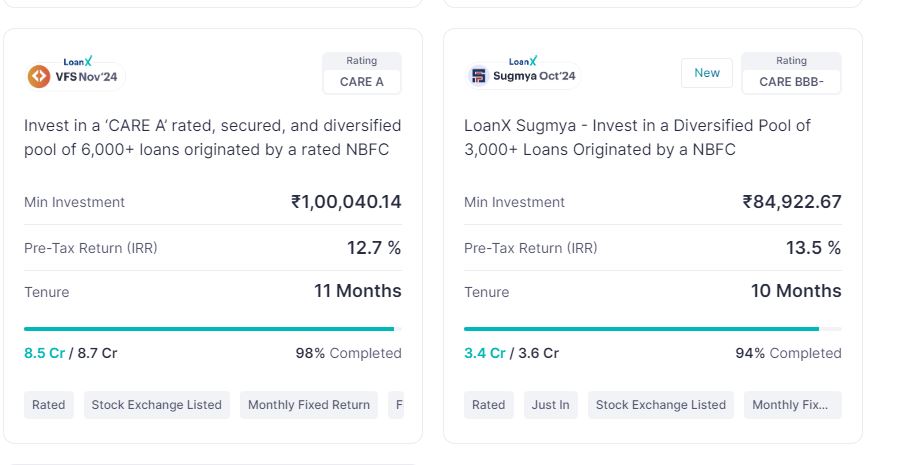

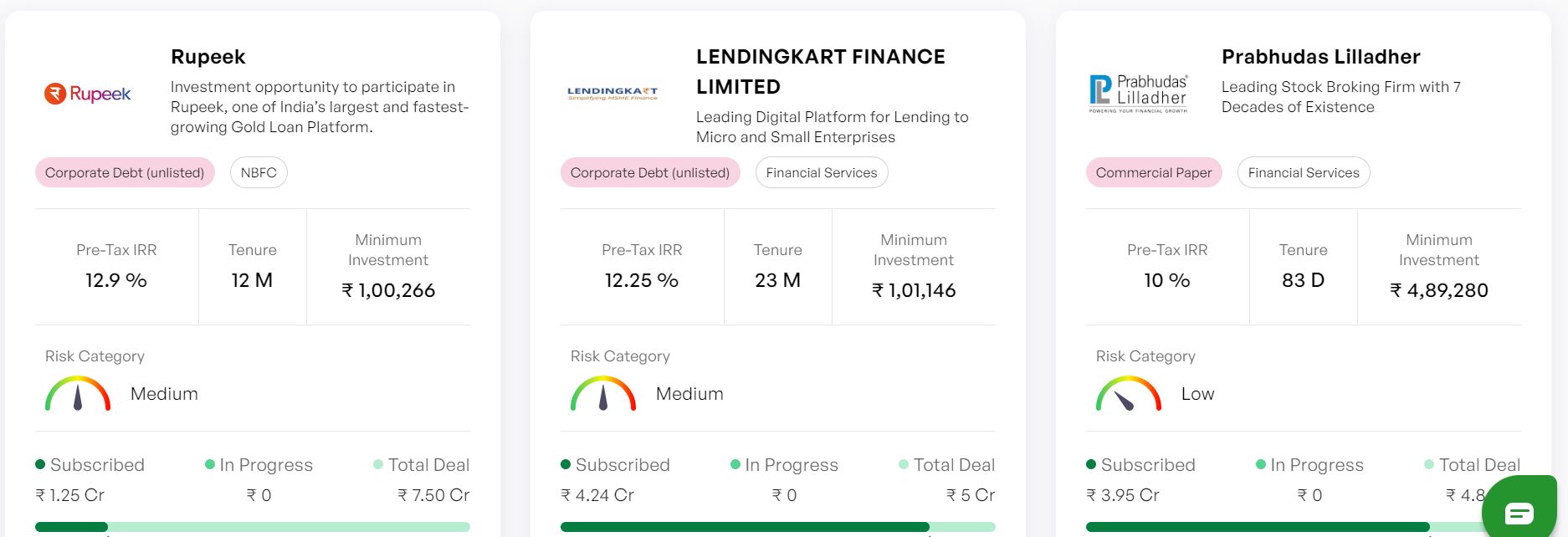

Invoice Discounting and Pooled Loans

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Liquid Fund Substitute) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox (Per Annum Liquid Fund Substitute) | 11.50% | 0% | 0% |

| Lendzpartners | 13.00% | 0% | 0% |

| IndiaP2P | 16% | 0.25% | 0.10% |

| KredX | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.65%

- Using Liquiloans/Per Annum to Park Short-term Capital.

- Have invested in 7 deals to date on Lenderpartnerz. The latest investment was in French Connection invoice.

- Started investment journey with 13 Karat P2P

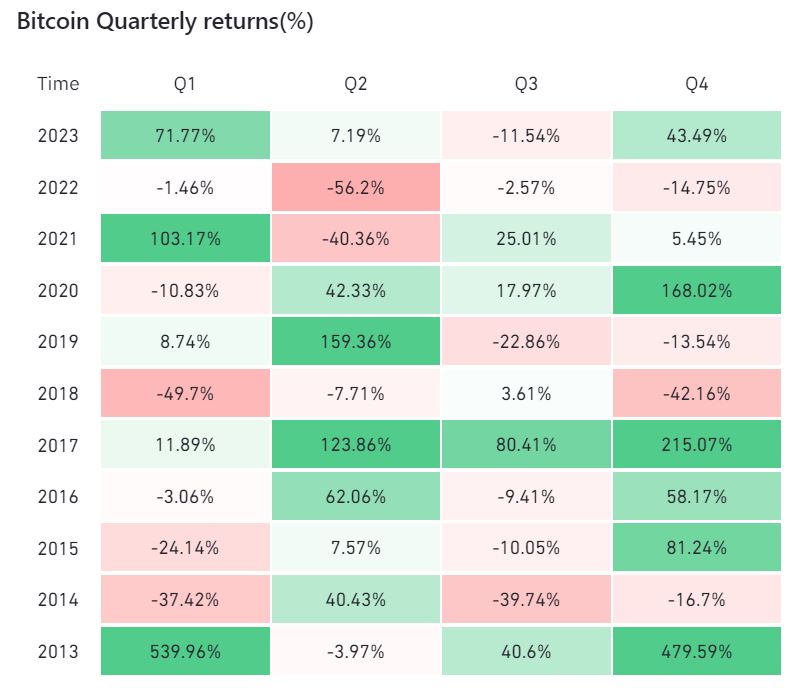

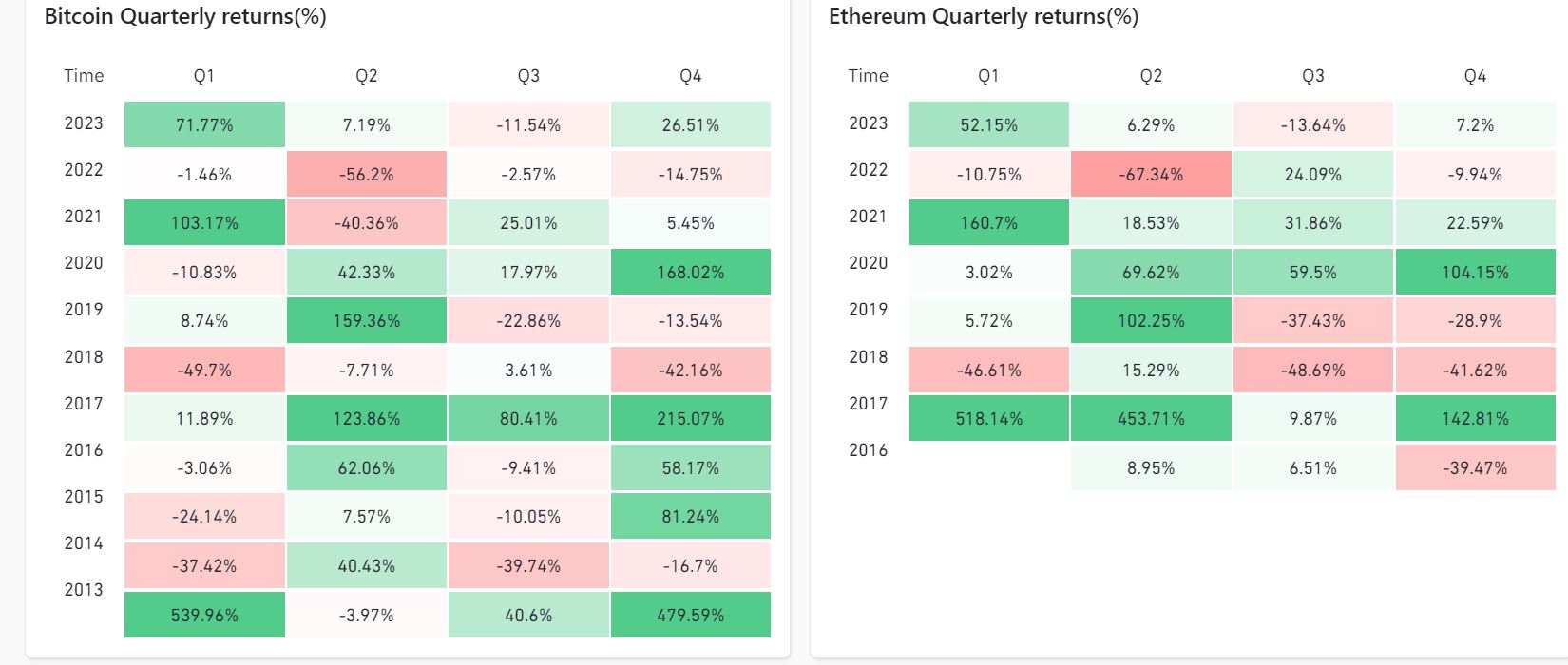

Crypto Investing

Bitcoin’s bull run has sustained during the last couple of months. My crypto portfolio is now higher than Bitcoin’s peak value because I had brought more crypto when the market was going through a prolonged winter.

On November 28, Binance.US announced the resignation of Changpeng Zhao, the founder and former CEO of Binance, as chairman of the Binance. The move comes after Zhao pleaded guilty to federal charges imposed by the US Department of Justice (DoJ) and agreed to pay a $4.3 billion fine. In the same case, Binance agreed to pay $4.3 billion settlement charges for failing to adhere to anti-money laundering (AML) regulations and violating sanctions law.

Interestingly unlike in 2021 when crypto crashed after Sam Bankman’s news, the market did not show much nervousness indicating more maturity.

You can buy Hardware Wallets on Etherbit

P2P Investment

Current allocation:

- India P2P – 55%

- 12Club – 5%

- I2IFunding- 15%

- Finzy-10%

- Faircent Pool Loan -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Paused) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.8% |

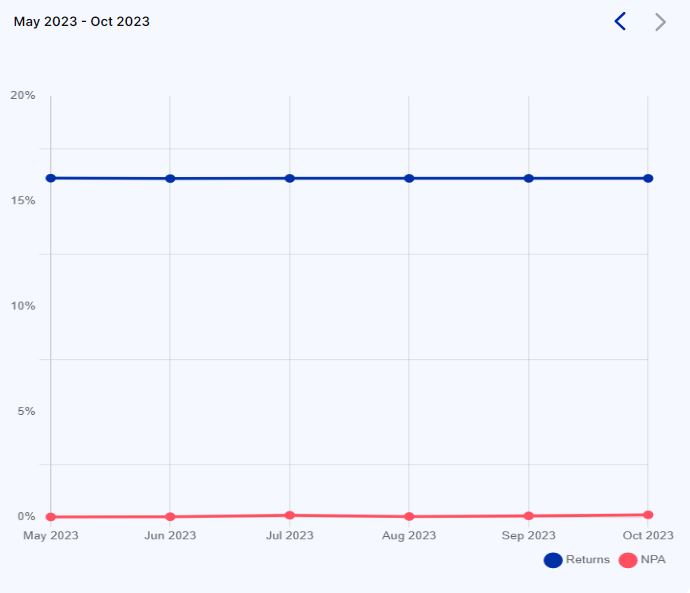

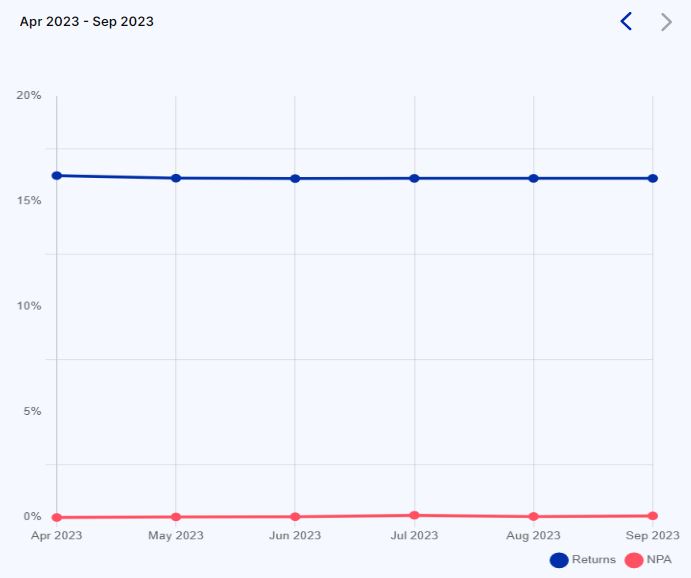

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club | Only Minimum amount | 12% | 0% |

- I have completed 1 year of using IndiaP2P with steady performance. I am steadily increasing my capital on this platform.

- I2Ifunding and Finzy have a very low volume of loans and I haven’t added any new capital in the last 5 months.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

Equity Market

PreIPO Stocks

Tata Technologies made a bumper debut, listing at a 140 percent premium and then rising nearly three-fold the IPO price. The stock opened at Rs 1,200 on the NSE and at Rs 1,199.95 on the BSE, while its issue price was Rs 500. It jumped 180 percent over the IPO price to Rs 1,400 within minutes.

*Altius Investech* had first invested in TATA tech @ 13/sh back in 2014. Since then the company has grown steadily with the share price increasing progressively.

2015 – 20

2017 – 80

2019 – 160

2021 – 430

2023 – 850

From the first investment – that’s a 100X return! This does not mean that all stocks will have similar performance but a strong portfolio of well-researched unlisted shares can deliver strong returns as price discovery is less in unlisted space compared to listed.

Waree Energy is another stock that is in demand in the unlisted market.

Listed Stocks

The market took a complete reversal in November and NSE reached an all-time high! The mid-cap sector is also on fire.

Indian stock market achieved a milestone, touching $4 trillion in market capitalization (m-cap) for the first time. The optimism on Dalal Street has its roots in the way India is uniquely placed among global economies. At a time when the global economy is facing the twin problem of high inflation and slowing growth, with even the world’s growth engine China not showing a sign of recovery, India has taken center stage. Many global agencies have upped the FY24 GDP forecast for India and several global brokerages retained India ‘overweight’ in their model portfolios despite strong gains.

However, when everybody is greedy it’s good to show some restraint and avoid adding large positions at these levels.

Algo Trading

Our Algo and Manual Option trading gave a 1.3% return in November. Due to large intraday moves, it was tough to make money in non-directional strategies. Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30 Lakh deployable capital can reach out here for inquiry on more sophisticated algos

Other Alternative Investment Assets and Platform Updates

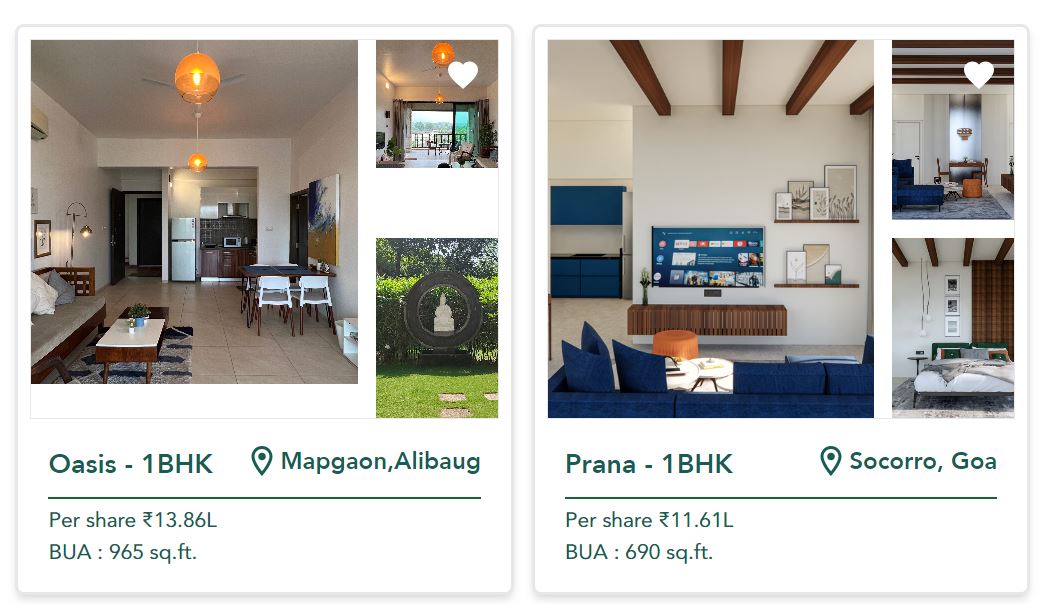

ALYF – Alyf is an upcoming platform that provides fractional ownership of holiday homes in tourist destinations. Currently 2 opportunities with < 15 Lakh investment are available in Alibaug and Goa.Interested people can register and get a call from their team.

Growpital Investment – The performance of the platform has been satisfactory till now as the payments have been on time to date. Of late the platform is becoming more popular with frequent coverage in media!

Growpital(Promo code GROWRDIMES)

Leasify Investment – Leasify recently launched the 3rd tranche of Bhadepay on the platform.