The world of personal finance is an intricate maze with a multitude of investment options, each offering unique benefits and risks. In India, recent changes in taxation rules have illuminated a previously overlooked gem in the realm of mutual funds: Arbitrage Mutual Funds. These funds have surged in popularity as a viable alternative to traditional choices like debt funds and fixed deposits, thanks to the changes in tax regulations. In this article, we will delve deeper into Arbitrage Mutual Funds, exploring what they are, the impact of recent tax reforms, why they outshine debt funds and fixed deposits, the associated risks, and the potential benefits they offer.

What are Arbitrage Funds?

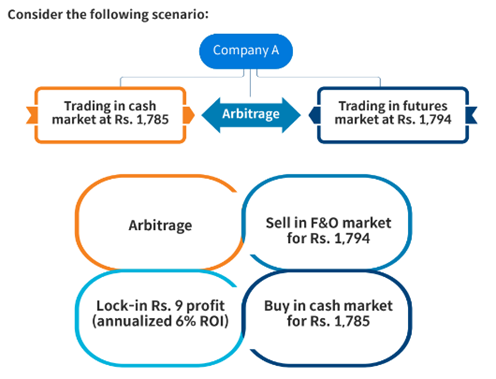

Arbitrage Mutual Funds fall into a distinctive category within the mutual fund universe. These funds are designed to capitalize on price differences between the cash (spot) and derivative markets. How do they achieve this? By simultaneously buying and selling securities, often stocks or their derivatives, to profit from short-term market inefficiencies and future premium due to holding costs etc.

One critical aspect that sets arbitrage funds apart is their tax treatment. In the past, debt funds enjoyed indexation benefit and LTCG . However, with the introduction of new tax regulations in India debt funds are taxed at slab ratee while, arbitrage funds are categorized as equity-oriented funds, bringing forth a host of advantages.

Recent Taxation Changes for Debt Mutual Funds

The taxation landscape for debt mutual funds (MFs) in India underwent a significant transformation starting from the financial year 2023-24. The amended income tax laws have introduced changes that impact the taxation of investments in specified debt mutual funds made on or after April 1, 2023.

For investments made before this date, the taxation of redemptions from these specified mutual funds was based on the holding period of the mutual fund schemes. This created a clear and structured tax framework:

- Short-term Holding (Up to 3 years): If the holding period of specified debt mutual funds was less than or equal to three years from the date of investment, it was taxed at the income tax slabs applicable to the investor’s income. This meant that the returns were subject to tax based on the individual’s prevailing tax rate, potentially leading to higher tax liabilities.

- Long-term Holding (Over 3 years): On the other hand, if the holding period exceeded three years from the date of investment, it was taxed at a flat rate of 20% with the benefit of indexation. Indexation allowed investors to adjust their purchase price for inflation, thereby reducing their tax liability. This provision made long-term investments in specified debt mutual funds more tax-efficient.

However, the scenario has evolved for investments made in specified debt mutual funds on or after April 1, 2023. The amended tax laws now mandate that these investments will be taxed at the income tax slabs applicable to the investor’s income at the time of redemption. This change implies that the tax liability on redemptions from specified debt mutual funds made after April 1, 2023, will be contingent on the individual’s prevailing income tax rate at the time of withdrawal.

The introduction of this new tax framework makes it crucial for investors to consider the potential tax implications when planning their investments in debt mutual funds. It may alter the tax-efficiency of these investments, particularly for those who had previously benefitted from the favorable tax treatment of long-term holdings in specified debt mutual funds.

Why Arbitrage Funds Are More Attractive Than Debt Funds and Fixed Deposits

The allure of Arbitrage Mutual Funds compared to traditional investments like debt funds and fixed deposits is underpinned by their tax-efficient structure and other inherent advantages:

- Tax Efficiency: Arbitrage funds have gained a significant tax advantage over debt funds and fixed deposits. Debt funds and fixed deposits continue to be taxed based on the investor’s income tax slab, leading to higher taxation. On the contrary, the tax benefits offered by Arbitrage Mutual Funds can result in higher post-tax returns. Since this is a very important aspect, we’ll cover it at length in the sections furthereon.

- Lower Risk: While arbitrage funds are considered compartitively lower-risk investments, debt funds do carry credit and interest rate risk. Fixed deposits, while safe, may struggle to outpace inflation over long periods. Arbitrage funds strike a balance between risk and return potential, making them an appealing option for conservative investors.

- Liquidity: Arbitrage funds offer better liquidity compared to fixed deposits, which often come with lock-in periods. Investors can redeem their units from arbitrage funds at any time, providing flexibility in managing their funds.

- Diversification: Arbitrage funds inherently offer diversification as they hold a mix of equity, derivatives, and fixed-income securities. This diversification can help reduce overall portfolio risk.

- Inflation Hedge: In an inflation-prone economy like India, arbitrage funds have the potential to provide better real returns compared to fixed deposits, which often struggle to keep up with inflation.

Tax Benefits of Arbitrage Funds over Debt Mutual Funds or Fixed Deposits or Savings Account

Few Pointers:

- Taxation of Arbitrage funds would be 0% upto 1 lakh if LTCG and 15% if STCG. Still its half compared to the 30% applicable if kept in fixed deposits savings interest.

- Savings bank account interest upto Rs 10,000 is tax exempted under section 80TTA. Amount after that is taxed as per slab.

- FD interest upto Rs 50,000 is tax free for senior citizens under section 80TTB. Hence, many people prefer to invest in senior citizens name. However, in most cases, it might not be of much use as they may already would be having FDs of their own. Moreveover, if you have a high corpus, the 50000 exemption might not be sufficient.

- Debt mutual funds are taxed only on redemption. This is a slight saving grace compared to fixed deposits & savings account where you need to pay taxes on the interest every year- issrecpective of the maturity.

These are approximate calculations for an individual in 30% income tax slab. These calculations are in no way any investment advice and have many assumptions. Do your own research before making an investment decision.

Risks Associated with Investing in Arbitrage Funds

While Arbitrage Mutual Funds offer numerous advantages, it’s essential to consider potential risks and caveats:

- Time Horizon: Investors in arbitrage funds should have a time horizon, preferably a month or longer. This is because the cash-futures spread may shrink under certain market conditions, leading to adverse mark-to-market consequences. We have considered a conservative scenario as normally in 7-10 days redemption horizon also you are unlikely to get a negative return. In case you are using arbitrage funds to park money only for a few days or overnight, these might not be the best suitable option.

- Not Liquid Fund Substitutes: It’s important to note that arbitrage funds are not complete substitute for liquid funds, which are designed for very short-term parking of funds, sometimes as short as one week. Arbitrage funds are better suited for slightly longer tenures- at least a month or more. Also, many arbitrage schemes have an exit load applicable- if you redeem your units within 30 or 60 days of purchase. However post 30-60 days you can redeem any time without incurring any cost. You can shift 80-90% of liquid fund allocation for best result.

- Choosing the Growth Option: It’s advisable to opt for the growth option in arbitrage funds. The dividend option, now known as the income distribution cum capital withdrawal option, is taxable in the hands of the investor at their marginal tax rate, which is usually higher.

- No Instant Liquidity: In case you want to redeem your arbitrage fund holdings for quick use, you cannot. While savings accounts, fixed deposits & even some liquid funds (offering partial instant redemption within 30 mins) offer almost instant liquidity, arbitrage funds redemption proceeds are generally transferred on a T+2/ T+3 basis.

- Portfolio Holding : Some funds have gold and debt also along with arbitrage fund to enhance yield hence investor should review the portfolio holding before investing.

Comparison Chart: Arbitrage Funds vs. Debt Mutual Funds vs. Fixed Deposits

Here’s a simple comparison chart to help you understand the differences among these investment options:

| Criteria | Arbitrage Funds | Debt Mutual Funds | Fixed Deposits |

| STCG Taxation | 15% (short-term gains) | As per investor’s slab | As per investor’s slab |

| LTCG Taxation | 10% (beyond 1 year) | – | – |

| Liquidity | High | Moderate to High | High |

| Risk | Low to Moderate | Low to Moderate | Low |

| Returns Potential | Moderate | Moderate to High | Low to Moderate |

| Investment Horizon | Short to Medium Term | Short to Long Term | Medium to Long Term |

| Market Dependency | Dependent on Market | Less market-dependent | Not market-dependent |

| Tax Efficiency | Yes | No | No |

| Inflation Protection | Moderate | Limited | Limited |

Best Arbitrage Mutual Funds in India

- Axis Arbitrage Fund

- Kotak Equity Arbitrage Fund

- Invesco India Arbitrage Fund

- Aditya Birla Sun Life Arbitrage Fund

- Nippon India Arbitrage Fund

It’s important to note that the performance of mutual funds may vary over time, and past performance is not always indicative of future results. Therefore, it’s advisable to consider your investment goals, risk tolerance, and time horizon when selecting the most suitable Arbitrage Mutual Fund for your portfolio.

Before making any investment decisions, consult with a financial advisor or expert who can provide personalized guidance based on your unique financial circumstances and objectives.

Conclusion

In the ever-evolving financial landscape of India, Arbitrage Mutual Funds have seized the spotlight due to recent tax reforms. Their tax-efficient structure, low risk, better liquidity, market participation, and diversification make them a compelling choice. Although categorized as equity funds, they function more like debt funds with no directional call on equities.

For a well-rounded portfolio, equity investments provide growth, while debt investments offer stability and funds for short-term cash flow planning. Arbitrage funds can be a valuable addition to the debt component of your portfolio, especially when their performance surpasses the break-even point with debt returns. However, it’s essential to maintain diversification and consider your investment horizon to maximize the benefits of arbitrage funds.

Investors have recognized the potential of arbitrage funds, pouring substantial funds into them. The high returns and tax advantages these funds offer compared to debt plans have made them a prominent choice in the Indian investment landscape. It’s a testament to the changing financial dynamics and the smart choices that investors are making in their pursuit of financial growth.

If you want to explore options beyond conventional investments with 12-30% returns check the below list –

How about senior citizens keeping a part of their corpus in an arbitrage fund, and after a year, they can systematically withdraw from it for their need? The withdrawal becomes tax free up to 1 lakh. and above that, it becomes 10% tax rate which is much less than keeping big corpus in bank FD with 20-30% tax rate. What is your opinion on this? In such a case, would you recommend putting in multiple arbitrage funds or one fund only?

Hi Rupesh,

Arbitrage funds are perfect for that If someone is in higher income bracket.

Multi asset funds can have better taxation but with minimum window of 3 years!