Introduction Policy Exchange

What is Policy Exchange ?

The “fintech revolution” is a phrase that has been in the headlines for much of the previous decade and continues to be an exciting landscape in this decade. Technology-driven fintech companies have revolutionized the way people think of money and finances. Everything from day-to-day transactions to real estate investments, stocks, bonds, and gold is now accessible on your smartphone.

Insurance technology, or insure-tech in short, is a subset of the fintech space that uses technological advancements to digitize the insurance industry and introduce innovative products. In this article, we will review one such new-age startup in insurance technology that allows users to invest in pre-owned insurance policies. However, before we review “the Policy Exchange”, an insure-tech platform offered by Fairvalue Insuretech Pvt. Ltd., let us first understand what the assignment of insurance policies means and how big this industry is.

What is Assignment of Insurance Policies?

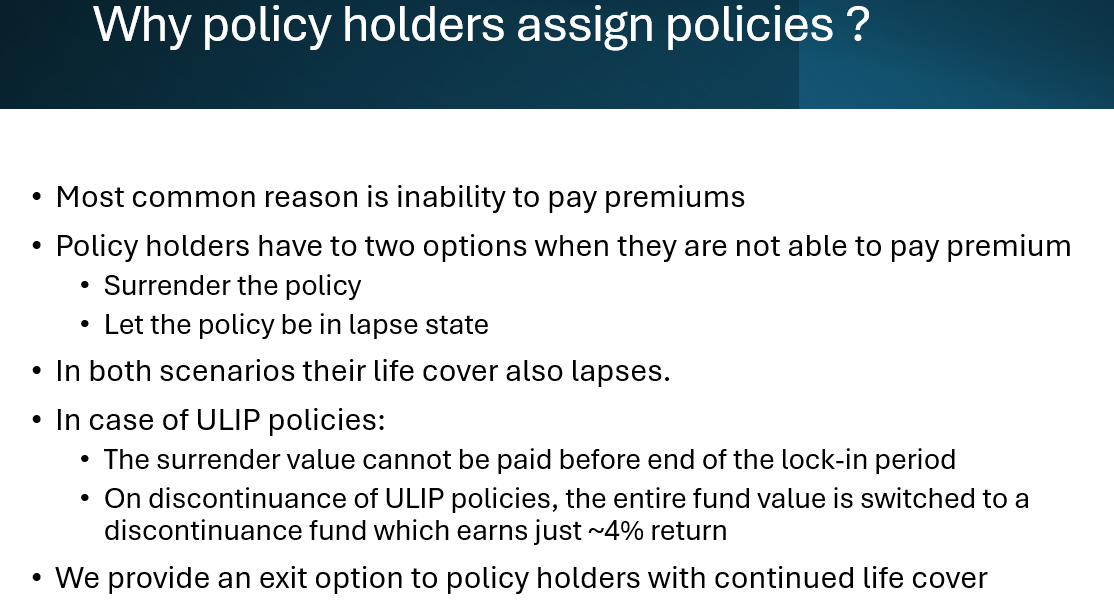

In simple terms, the key transaction in the process of investing in a pre-owned insurance policy is called the assignment of an insurance policy. Millions of insurance policyholders in India surrender or lapse their insurance policies during their tenure, i.e. before maturity. There can be several reasons for this, including financial constraints and personal exigencies due to which they are unable to continue their premium payments. Investing in pre-owned insurance policies involves investing in such policies where the original policyholder wants to surrender or lapse his/her policy. This takes place through a transaction, legally known as an assignment, where the ownership of the policy changes from the original owner to the person investing. An “assignment” is when the transfer of an insurance policy ownership takes place – from the original owner (“assignor”) to the new owner (“assignee”).

Section 38 of the Insurance Act of 1938, as amended by the Insurance Laws (Amendment) Ordinance Act of 2015, governs the transfer and assignment of insurance policies. This section allows for the transfer or assignment of an insurance policy, in part or its entirety, with or without consideration.

On successful assignment of an insurance policy, all rights and benefits associated with policy ownership are transferred to the investor. Now that we’ve covered what the assignment of insurance policies means let’s look at a detailed review of “the Policy Exchange” offered by Fairvalue Insuretech Pvt. Ltd.

What is the Policy Exchange?

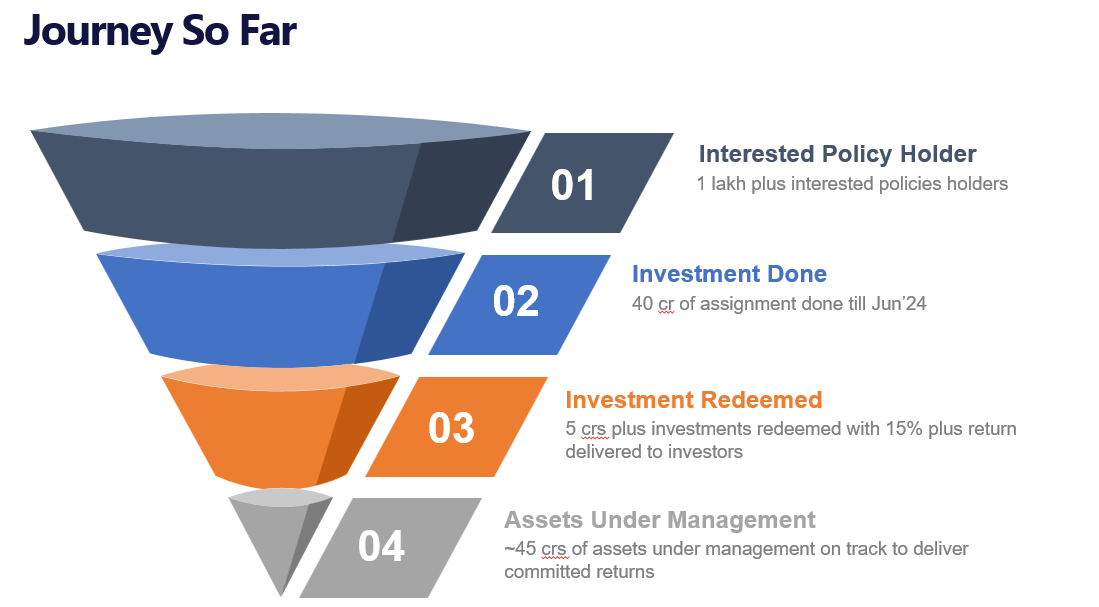

The Policy Exchange is an insure-tech platform offered by Fairvalue Insuretech Pvt. Ltd., which lets users invest in pre-owned life insurance policies. The company aims to address a major challenge faced by the insurance industry- mid-term policy termination. The Policy Exchange seeks to address this challenge by bringing together policyholders who are looking to surrender or discontinue a life insurance policy due to financial or personal constraints and an investor who is looking to invest in a safe instrument that gives a commendable high return.

Team Behind the Policy Exchange

Policy Exchange is run by industry veterans who collectively have more than 50 years of experience in the Banking, Financial Services, and Insurance (BFSI) sector. Naveen Gupta, co-founder and CEO of Fairvalue Insuretech Pvt. Ltd., the company behind the Policy Exchange, has over 25 years of rich experience in the consumer banking and telecom space.

He has previously managed large-scale outsourcing operations at Bharti Airtel, SBI Cards, and Citibank and started his entrepreneurial journey in 2013 with a couple of colleagues from Airtel.

Co-founder and COO Safia Anwar also has over 25 years of diverse experience in the telecom and social sector. She has handled important roles in Sales, Service Marketing, Operations & and credit control in Koshika Telecom, Global Telesystems, and Bharti Airtel.

How Does the Policy Exchange Work?

The Policy Exchange platform brings together policyholders, investors, as well as insurance agents. The platform offers a database and a transaction workflow of previously owned insurance policies that the existing policyholders are looking to sell. The platform enables a policyholder to assign his/her policy to an investor in exchange for the policy’s surrender value. On successful assignment, the rights and benefits of ownership of the policy are transferred to the investor. The investor is now required to pay the insurance company for future policy renewal premiums. The investor, being the new owner of the policy, gets the maturity amount and all other benefits of the policy.

Let’s understand this with an example:

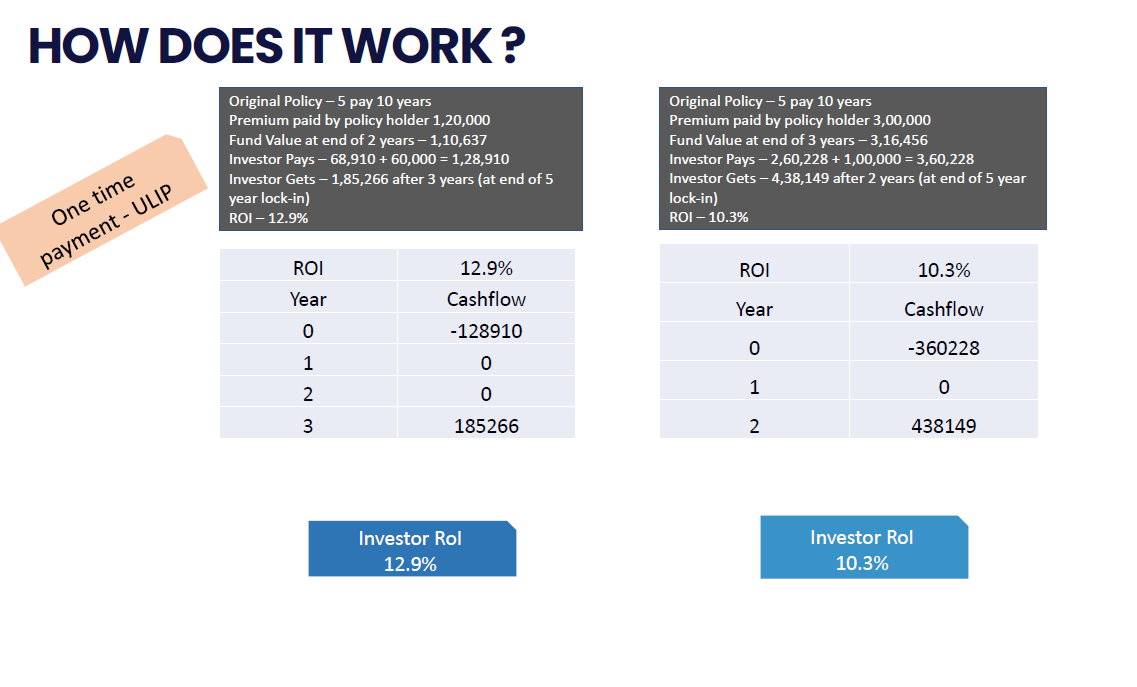

Consider an insurance policy for 15 years with 10 premiums to be paid, wherein the original policyholder is looking to sell at the end of 7 years, having paid a premium of INR 6,31,578, and the surrender value at the end of the 7 years comes to INR 4,37,642. Now, the investor has to pay a total of INR 7,53,431, comprising the surrender value at the end of 7 years and a premium for the remaining three years. In return, the investor gets INR 1,31,251 every year for the 5 years remaining from the 10th year and a lumpsum of INR 8,75,005 at the end. Thus, for a total investment value of INR 7,53,431, the investor gets a return of INR 15,31,260, achieving an ROI of 11.99%.

There can be other types of insurance policies as well that you can choose from as an investor. For example, policies that give lumpsum returns at the end of the maturity period. Consider a ten-year policy with five premium payments of INR 1,00,000 each. If the original policyholder is looking to exit at the end of the 4th year, having paid 4 premiums totaling INR 4,00,000, the surrender value at the end of the 4th year comes to INR 2,48,242. The investor has to pay a premium for one more year and the surrender value at the end of the 4th year, which totals INR 3,48,242. In return, the investor gets a lumpsum return of INR 8,66,425 at the end of 6 years, which gives an ROI of 12.52%.

Benefits of Investing in the Policy Exchange

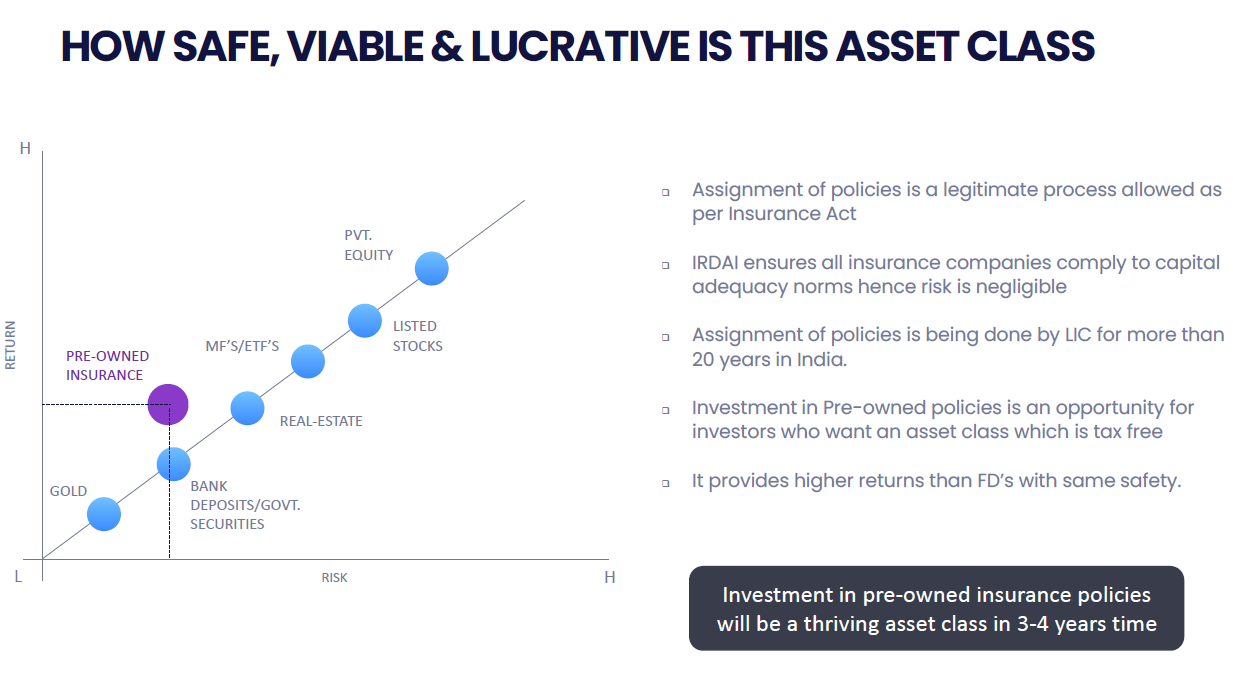

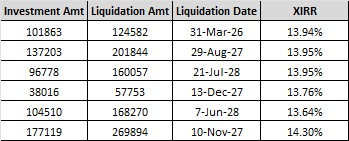

Investing in pre-owned insurance policies is a unique alternative investment; it offers higher returns than traditional fixed-income asset classes such as fixed deposits, government securities, gold, etc. Buying an existing insurance policy on the Policy Exchange can offer an assured tax-free return of 10-14%. When you buy the policy from the customer, you buy it at a surrender value, which is lower than the premium amount paid in the policy. Hence, your overall returns will be higher than the original yields.

Investing in pre-owned insurance policies is assured by insurance companies such as Max Life,HDFC Life Insurance Company, SBI Life Insurance Company, etc. Besides, the Insurance Regulatory and Development Authority of India (IRDAI) ensures all insurance companies comply with capital adequacy norms hence minimizing the risk. The average investment tenure offered on the platform is in the range of 3 to 10 years.

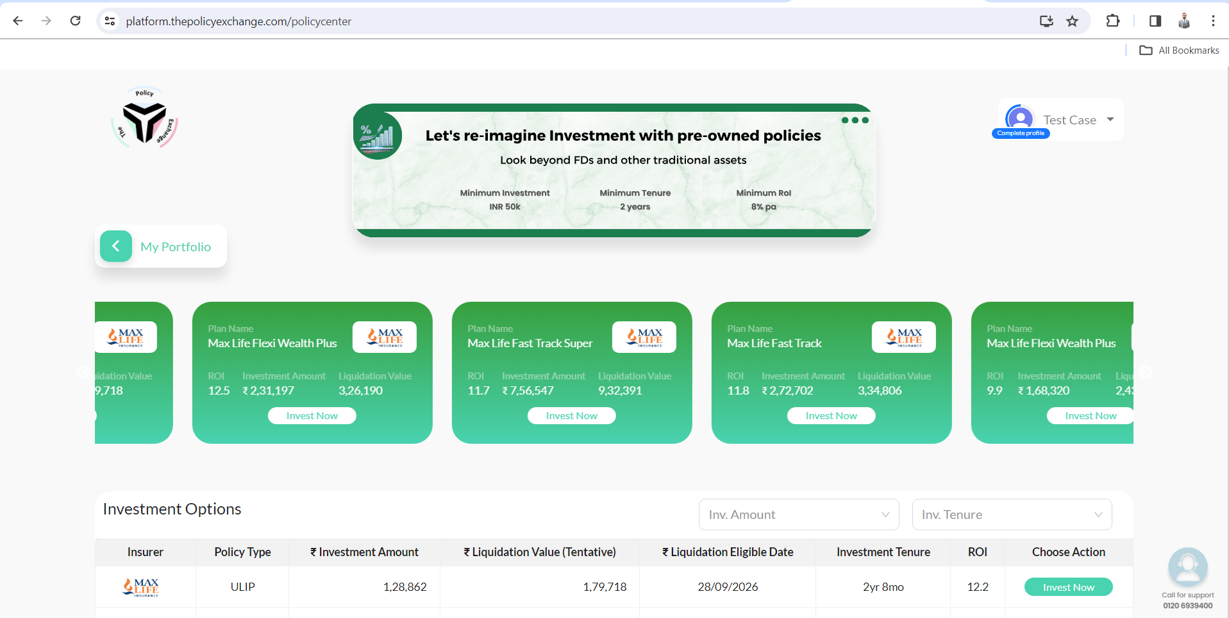

The Policy Exchange offers a mobile application with real-time dashboards, making tracking and managing your investments easier. All transactions on the platform, along with the legal aspects of assignment, including documentation, are digitally enabled. The platform also offers assistance through call and chat facilities to help you make informed investment decisions. The Policy Exchange’s AI engine segregates the policies and creates a bunch of homogenous investment themes. The platform curates a list of policies that allow investors to earn the maximum return in the shortest time frames.

Other Products on the Policy Exchange

Besides policy assignment, which allows investors to invest in pre-owned insurance policies, the Policy Exchange also offers several other investment products and services in the insurance sector.

The platform offers options for premium financing, which offers short-term loans or overdraft facilities to policyholders to fund their premiums and continue coverage protection. In simple terms, Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.

The Policy Exchange also offers loans against insurance policies, allowing you to avail of a quick loan or overdraft facility against your insurance policy to fund financial needs. The loan amount will vary depending upon the type of policy; however, generally, the loan amount is in the range of 50-90% of the surrender value of the insurance policy.

Tax Treatment of Policy Assignment

As we have mentioned above the returns offered on investing in pre-owned insurance policies range between 10 to 14%. Let’s understand why we are calling this a tax-free return. If you are buying a traditional policy that was issued before 1st April 2023 and your annual premium is less than or equal to INR 5 Lakh, your maturity amount is tax-free. Similarly, for Unit Linked Insurance Plans (ULIPs), the cut-off date for policy issues is 1st February 2021, and the premium amount is INR 2.5 Lakh for a tax-free maturity payout.

Our Personal Investment Experience on Policy Exchange

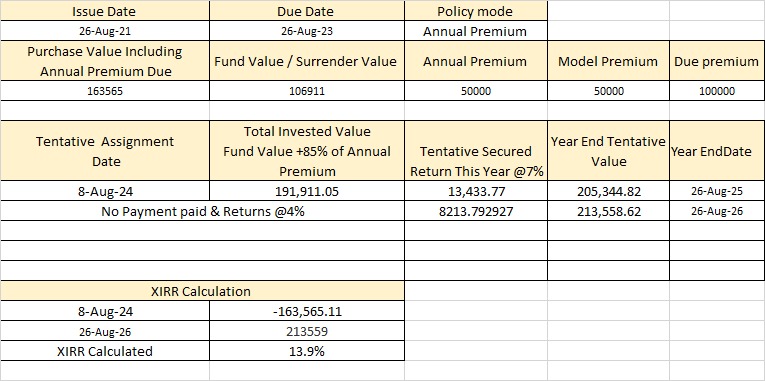

We decided to test the Policy Exchange Platform. We talked to the team and chose to invest in the below Policy.

Specification of the policy is

- Maturity – 2026

- IRR -13.9%

- Company – Max Life

- Investment – INR 1.6 Lakh

- Redemption Value – 2.1 Lakh

Once you invest the money, it is used to pay the surrender value of the original policyholder. As can be seen INR 1.6 lakh is being paid, and the current value of the policy is INR 2 Lakh. If we deduct ULIP charges, processing fees, etc it amounts to INR 1.9lakh.

This money is invested at 6% till the next premium date. As we do not wish to keep the policy, the premium is not paid and then the policy is invested in the Discontinued Policy (DP) fund at 4%. On the surrender date, we inform the insurance company and they pay us the surrender value equalling 13.9%.

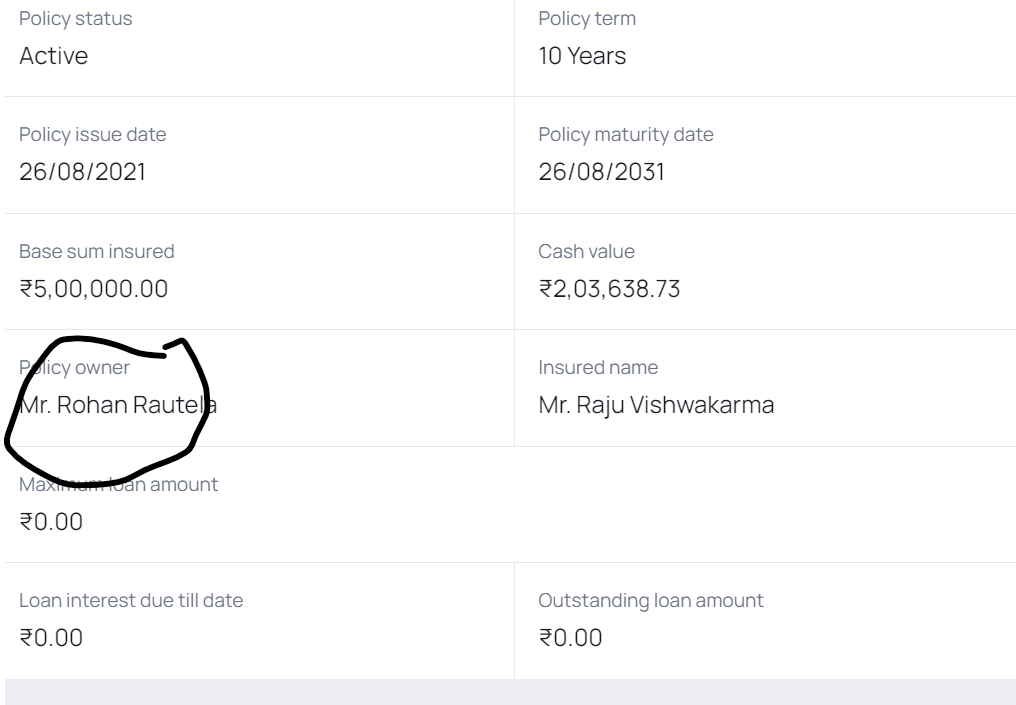

The transfer process takes approx 10 days where first the policy owner signs the transfer documents and then we apply for the policy assignment.

The details of the policy ownership were available on Max’s website after the policy was transferred to me.

How to Invest in Policy Exchange

The process of investing is quite simple.

- Register on the platform as an investor using the above link

- You need to complete the basic KYC requirements

- You can scroll through various policies listed as per your preference

- RM will connect and answer your queries.

- Once you have shortlisted the policy, the process will be initiated

- Once Max approves the policy assignment and shares the letter you will have to pay the amount.

- Within 10 days policy will show in your Max Life account.

- You can also see your policy investment on the Policy Exchange website.

Below is a video to understand the process

Conclusion

According to the Policy Exchange, the total surrender or lapse value in the insurance policy industry is currently touching INR 1.5 lakh crore, with a 15% CAGR. At this rate, it will be touching INR 4.5 lakh crore by 2027. Surrendering or lapsing of insurance policy hurts multiple stakeholders, including policyholders, agents, and insurance companies. This is why mid-term termination of policies is a big and growing problem for the insurance industry. It will also back-peddle the government’s efforts to increase life insurance penetration in India.

This is the problem that the Policy Exchange seeks to address by allowing investors to invest in pre-owned insurance policies by paying the surrender value to the original policyholder and future premiums to the insurance company. This way, the original policyholder doesn’t lose the value and protection, the insurance company gets to earn from the future premiums, and the investor gets a comparatively higher tax-free return since he is only paying the surrender value in consideration and not the premiums already paid by the original owner.

Policy assignment can be a lucrative alternative asset class, however, you should read all the documentation associated with such a transaction carefully to understand the nature of the assignment, before making a decision and evaluate the risk.

We will be sharing the performance of our investment in our monthly portfolio review.

Frequently Asked Questions on Policy Assignment

What is Assignment?

Assignment is a process through which the owner of a policy can transfer its rights and benefits to another individual.

Who can invest in a pre-owned policy?

Any individual can invest in a pre-owned policy

What is the tax treatment of insurance proceeds?

The process from an insurance policy is tax-free provided the underlying policy is compliant under Section 10(10D) of the Income Tax Act 1969.

Post assignment of policy does the life insured change ?

No. The assignment is a process where the rights & benefits of the policy are completely transferred to the assignee. The life insured remains the same.

Are the returns guaranteed?

The returns are assured in different ways e.g. for non-par policies, these are guaranteed while for participating policies these are linked with PAR fund performance. ULIP policy returns are linked with market performance and

usually much higher.

Nice article ! Very useful and eye-opener when it comes to alternative investment option.

a query – it is mentioned “The life insured remains the same.” – in that case, in an unfortunate event of the demise of the insured person while the policy is still in action, how does it work ? I am assuming the dependent of the insured will get the sum-insured. Is that payment done after deducting the returns for the investor ? And if that’s the case, does that not open door for any litigation as regards to the dependent / nominee raising a legal claim to the amount which [s]he ought to receive as a result of policy ?

one more query: will the sum-insured allowed to take loan against such a policy which is funded by investor ?

No.. this post assignment policy is not eligible for loan

Hi Kumar,

You are right that investor will get his dues with committed IRR till the day of Death of the policy holder. The same is covered in legal agreement which is being submitted to Max along with assignment application.

Hi,

Had a query, appericate for ur kind suggestion, is it safe to invest in policy exchange ? is it legal to transfer existing policy?

Hi Kamlesh, Yes it is legal to transfer existing policy under insurance act 1938. You should however consider the illiquidity of asset and invest as per your target tenor.