India has witnessed a surge in investment technology, or “invest-tech,” platforms that empower individuals to explore opportunities beyond traditional avenues. Recent times have seen a notable rise in platforms facilitating investments in unconventional assets like invoice discounting and asset leasing, offering a fresh perspective on how money can work for us. These platforms aim to democratize finance, allowing people to engage with investments that were once reserved for institutions and high-net-worth individuals.

In this post, we will read about Tapinvest- a platform that provides access to investment opportunities like invoice discounting, asset leasing, and NCDs. While it’s not a newcomer to the scene, Tap Invest has transformed, shedding its old identity as Leaf Round. Let us understand what has changed along with other details like how it works, team & funding raised, and investment opportunities available- followed by our Tap Invest review- whether it is worth giving this platform a try or not- considering many other options are also available in the market.

We have already covered a detailed Leafround review in the past and also share our 2-year experience

What is Tap Invest?

Tap Invest, formerly known as Leaf Round, positions itself as India’s premier Fixed Income Investment Platform. The platform focuses on facilitating investments in fixed-income instruments, particularly- asset leasing and invoice discounting.

While it’s not a newcomer in this space, Tap Invest has transformed, shedding its old identity as Leaf Round. I have personally been investing in Leaf Round (and now subsequently Tap Invest) for close to 2 years now and will detail my experience later in the post.

How Tap Invest Works?

Tap Invest is a platform where you find various fixed income-generating investment opportunities like invoice discounting, equipment leasing, etc. All you need to do is register on the platform as an investor, browse the available opportunities, and invest in the ones you like. You need to complete KYC before you start investing in deals.

Tap Invest & Leaf Round- Connection Between the Two

As mentioned previously in the article, Tap Invest was already in the market for the last 1-2 years as ‘Leaf Round’. They have recently rebranded. It is not clear why they had to take up the rebranding exercise. My best guess is that they had to do so to make the brand name sound related to their domain- alts & investments. Frankly, the name Leaf Round sounded quite weird for an invest-tech platform and this rebranding exercise is a welcome change.

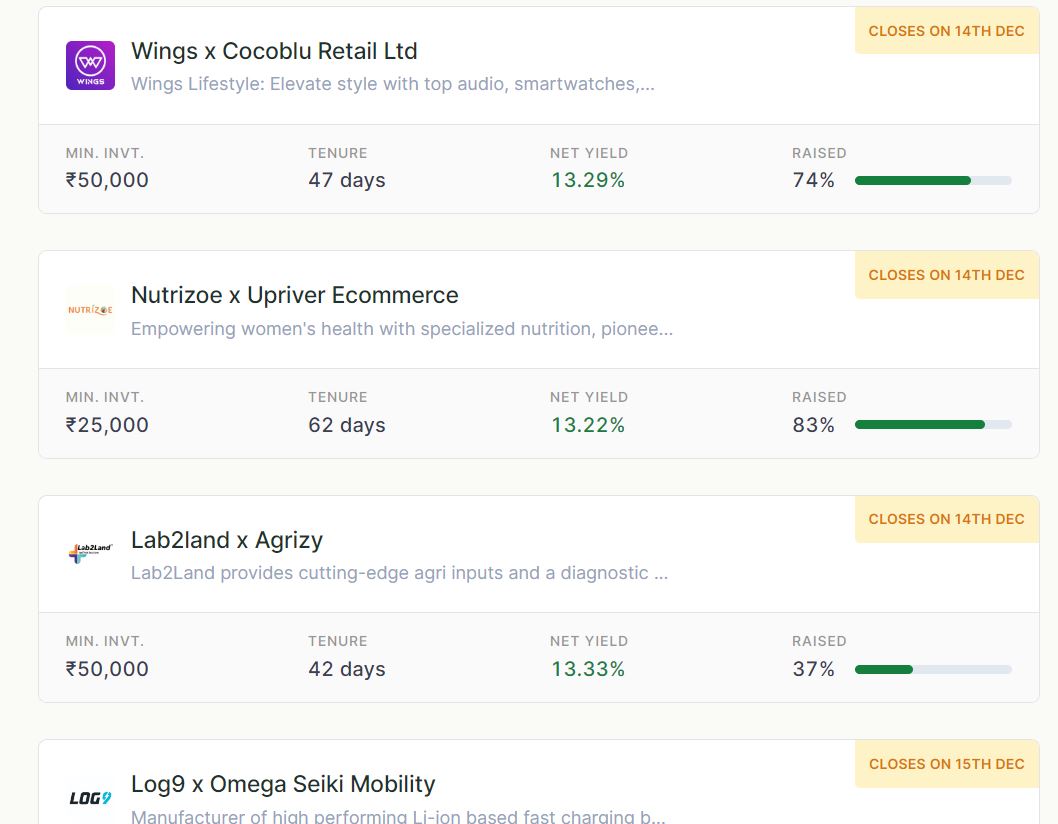

Tap Invest- Invoice Discounting

For newbies, invoice discounting is a financial practice where a business sells its unpaid invoices to a third party for immediate cash. Instead of waiting for customers to pay, the business receives a percentage of the invoice amount upfront from the invoice discounting provider. The provider, in turn, collects the full invoice amount directly from the customers. Once the customers pay, the remaining amount, minus a fee for the service, is released to the business. This helps businesses improve their cash flow and meet immediate financial needs without waiting for the regular payment cycle.

Tap Invest has invoices of various vendors raised on bluechip companies. The usual yield ranges from 11-15% with minimum investment per invoice ranging from Rs.50000 and tenure starting from 30 months.

One thing that’s good at Tap Invest is that the invoice discounting deals don’t get subscribed fast (compared to other platforms where they get filled in minutes) leaving ample room for investors to invest in them.

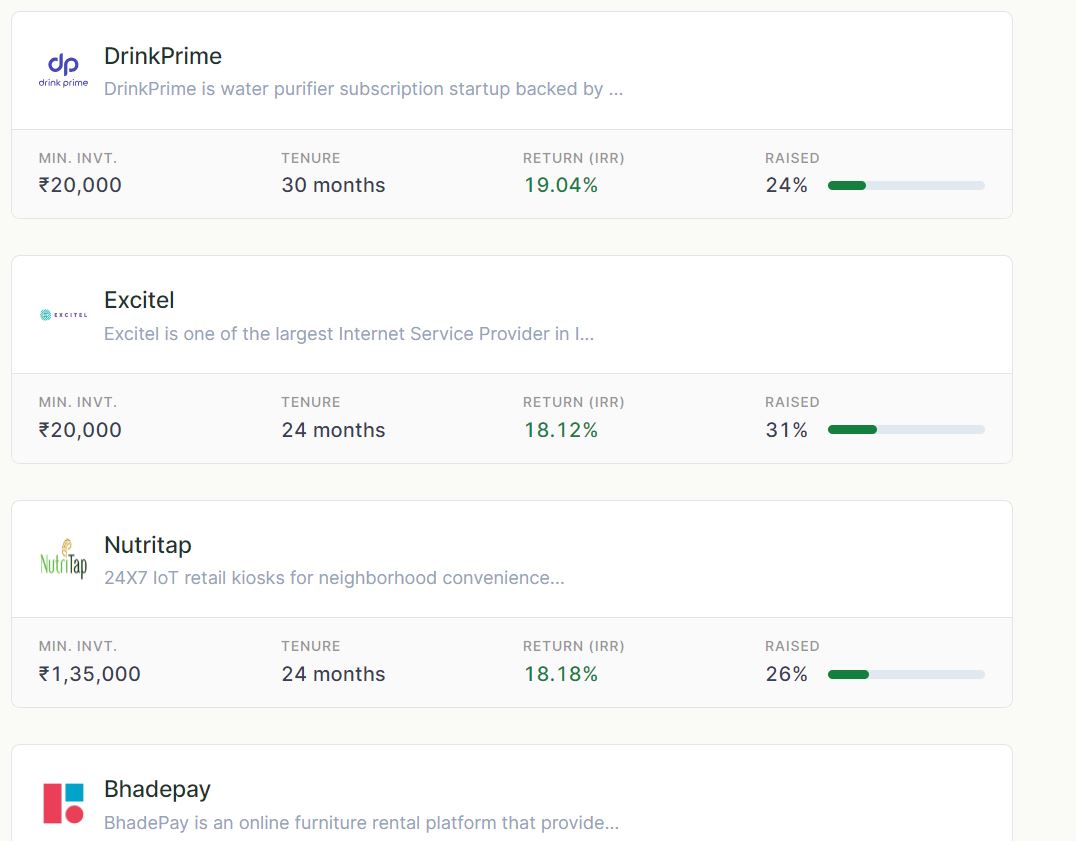

Tap Invest- Asset Leasing

Asset leasing is the lending of assets, such as equipment or machinery, to others in exchange for regular payments. As an investor, you essentially become the landlord of these assets. The businesses or individuals leasing the assets pay you a fee for using them, and this provides you with a steady stream of income.

These deals are available from time to time (though the frequency has decreased a bit since the start- in the beginning, it used to be a platform for asset leasing deals only- invoice discounting was launched a few months back).

You can make a decent fixed monthly income by renting out assets like laptops, vending machines, furniture, etc to companies through Tap Invest.

Tap Invest Bonds

The platform also provides access to high-yield bonds through its partner. Some of the bonds available in the past include Bizongo, BluSmart, and pocketly with yields from 13-16%

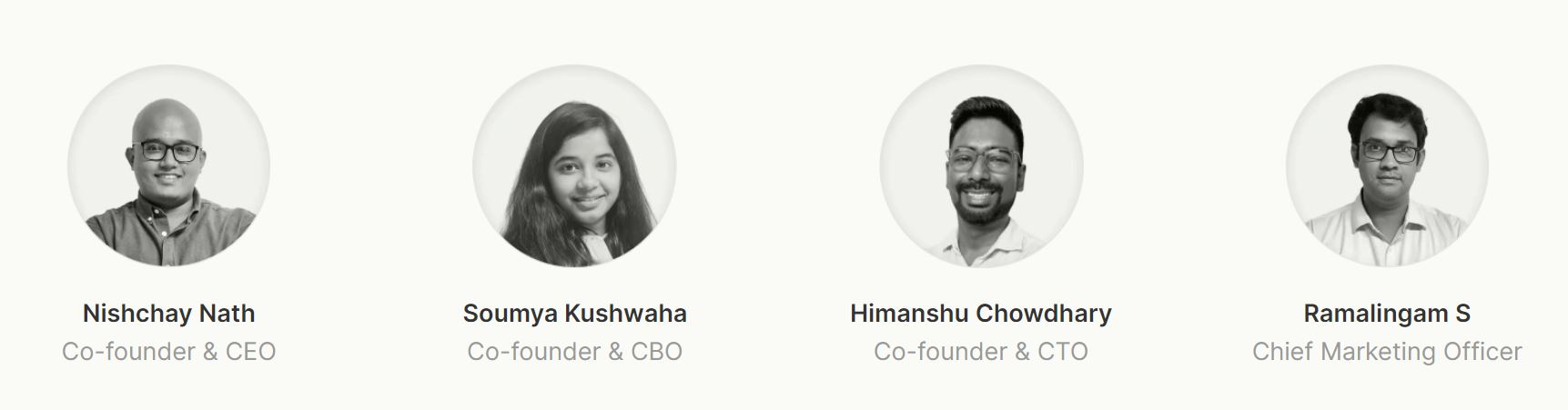

Tap Invest Team

The team behind Tap Invest comprises individuals with impressive credentials and diverse professional backgrounds. Founded by Nishchay Nath, an alumnus of IIT Kharagpur and IIM Ahmedabad, who previously worked at True North, a prominent private equity firm in India, Soumya Kushwaha, an alumnus of IIM Ahmedabad and a former McKinsey professional & Himanshu Chowdhary, an IIT Kharagpur alumnus with prior experience at Media.net and Games24x7. The rest of the team is also highly experienced in their respective domains.

Tap Invest Funding

Leaf Round raised $300K in pre-seed funding in around April 2022 from micro VC firm Upsparks, Superb Capital, and senior business leaders from McKinsey, Bain, Barclays, Adobe, etc.

They have recently raised the seed round of $2 Mn led by Turbostart. Snow Leopard Ventures along with angel investors like Kunal Shah and Kashyap Shah have also participated in the round. Existing investors Upsparks and Superb Capital also participated in this round. With this latest funding round announcement, they also unveiled the rebranding to Tap Invest.

Tap Invest Alternatives

Many alternatives in the market have invoice discounting and asset leasing deals. Mentioning some of them below:

AltGraaf (Jiraaf)

One of the most popular alternative investment platforms in India has both types of deals available on its platforms- which Tap Invest offers- invoice discounting and asset leasing. It has a constant flow of invoice discounting deals on its platform and also comes up with asset leasing deals from companies like Everest which manages Uber vehicle fleet.

Grip Invest

This is another famous alternative investment platform in India that has invoice discounting (called InvoiceX) & asset leasing deals on its platform. Grip follows a slightly different approach for InvoiceX where it pools together multiple invoices of different vendors into an RBI-compliant, credit-rated instrument- reducing risk & allowing investors to take exposure in loans backed by invoice discounting proceeds.

Tradecred

One of the first invoice discounting platforms in India. The deals get subscribed in a matter of minutes so one needs to be proactive.

Randomdimes Investment Experience 2 Years

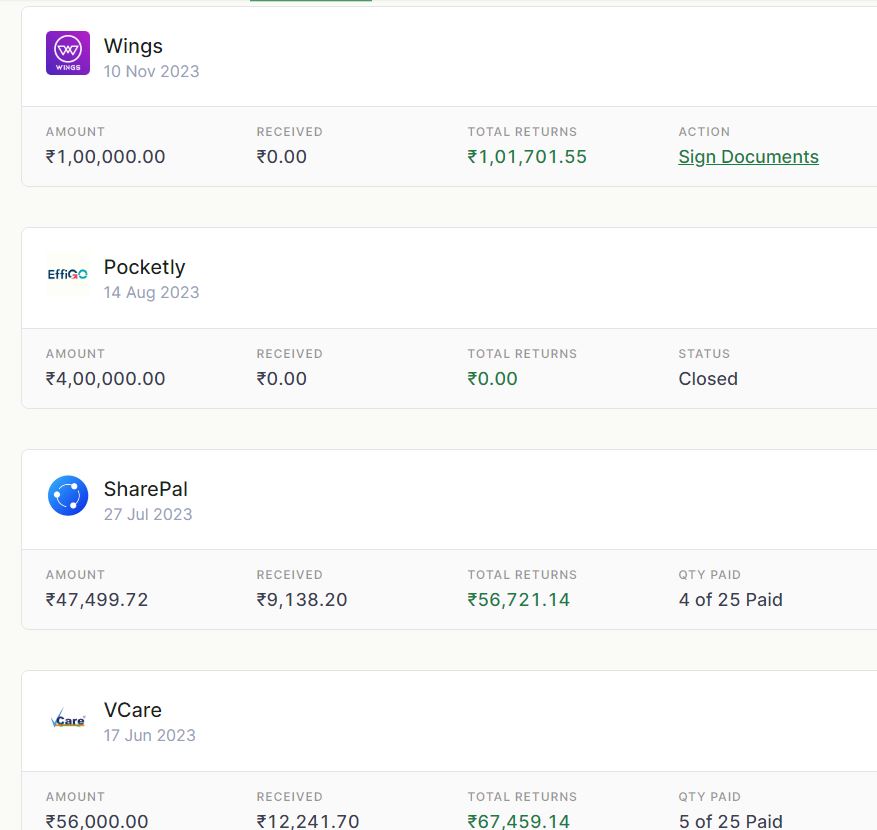

We have been one of the earliest investors to explore Tapinvest. We have participated in more than 20-25 deals in the past 2 years without facing any loss. Some of the deals that we participated in :

- Saveo

- Nutritap

- Log9

- Blusmart

- Bizongo

- Effigo

The customer service is prompt and the founders are cooperative in answering queries raised by RD community members.

Conclusion

In conclusion, Tap Invest stands as a promising force in India’s investment landscape, providing a secure and intelligent platform for individuals to explore fixed-income opportunities. With a dynamic team led by founders with impressive backgrounds in finance, technology, and strategy, Tap Invest inspires confidence in its mission to democratize finance and empower investors.

The deal flow at the moment is decent (especially for invoice discounting deals) and the best part is most of them are unique (not available on other platforms) and don’t get subscribed in a jiffy. In case you are into invoice discount & asset leasing investing, it makes sense to sign up to get access to unique deals and spread your risk across platforms & vendors.

Frequently Asked Questions on Tap Invest

What investment opportunities does Tap Invest offer?

Tap Invest predominantly offers opportunities in asset leasing and invoice discounting. Asset leasing involves renting out valuable equipment or machinery, while invoice discounting allows investors to participate in financing by purchasing accounts receivable at a discount.

Is Tap Invest safe?

Yes, it is a safe platform to invest. I am saying this considering my own experience & reviews from customers online & in my network, studying the background of founders, teams, VC’s backing them, etc. However, please do proper due diligence on a deal-to-deal basis to avoid associated risks.

What are the Tap Invest reviews from customers?

Customer reviews can provide valuable insights. The overall sentiment from customers looking at Tap Invest reviews on social media, YouTube, Google & our RD community seems to be positive. I have been investing in tap Invest deals for a long time, and my experience has been excellent to date.

Can I withdraw my investments before maturity?

Generally, there is no option to withdraw money before maturity. In invoice and asset leasing deals, you will ideally have to find an investor who will give you an exit by buying into your share- which doesn’t seem to be possible on the platform. The terms of withdrawal depend on the specific investment opportunity. Most investments may have lock-in periods, while others (like bonds & NCDs) may allow for early withdrawal under certain conditions. Investors should carefully review the terms of each investment.

Yes. It’s safe. I am investing since the last one year and have received with interest on promised dates. Another one is tyke which is very similar .

Thanks to you I have invested in many platforms you have mentioned.

But one of them is Indiap2p. My payment is delayed by one month after finishing one year. So would like to know your opinion on that website.

Hi Shashi,

My experience with Tap invest has been positive till date however like all platforms each deal has unique risk which we need to analyze.

I have never used Tyke as I am not very confident with the deal flow. Indiap2p payments have been on time. My total npa is <0.5% . For p2p you should focus on total npa percentage and not individual delay as ticket size is smaller.

i have been using Tapinvest from last 7-8 months in both invoice discounting and asset leasing . my experience is smoth till now there are other platforms but tapinvest have less coupon amount . seems safe till now

Thanks for your feedback on Tapinvest. Platform is genuine but please do due diligence of each deal before investing.

I HAVE BEEN USING TAPINVEST FROM MORETHAN 20MONTHS IN INVOICE DISCOUNTING. MY EXPERIENCE IS SMOTH TILL NOW.

Thanks for the feedback on Tapinvest