Investing can be a tricky business. We’ve all experienced the frustration of holding onto a stock too long as it underperforms or missing out on a hot investment opportunity that could have delivered big returns. This is where Univest aims to shake up the status quo. With its use of artificial intelligence (AI), Univest provides investors with data-driven insights that help optimize investment decisions and maximize profits.

In this Univest review, we’ll take an in-depth look at how this robo-advisor utilizes technology to simplify investing across stocks, cryptocurrencies, real estate, and more. With dynamic adjustments to recommendations and automated rebalancing, Univest promises to help investors like myself exit underperforming positions quickly while capturing promising new opportunities.

As an investment solution built on emerging technologies like predictive analytics and sentiment mining, Univest brings some unique capabilities to the table. However, it also faces stiff competition from established players with significant head starts in terms of brand, scale, and features.

Our goal is to provide an unbiased and comprehensive view of Univest’s strengths and weaknesses for investors evaluating new platforms. We aim to cut through the hype and objectively benchmark Univest against alternatives based on capabilities, value proposition, and overall user experience. Whether its innovations set it apart or still need refinement, our transparent analysis covers it all.

Does it deliver on its claims? Let’s find out.

What is Univest?

Univest is a one-stop investment platform trusted by over 400,000 users to optimize their portfolios. Founded in March 2022 by Pranit Arora and Avneet Dhamija, Univest utilizes artificial intelligence (AI) to help investors exit underperforming stocks in a timely manner. It also suggests new investment ideas aligned with each user’s preferences and risk profile.

In March 2023, Univest raised $1.5 million in a Seed funding round led by US-based Trinity Media Group. Other notable investors include industry leaders from McKinsey, Reliance, Tata AIA, Raheja Group, OYO, and Canada’s Envision Learning. Repeat investors also participated, demonstrating continued confidence in Univest’s offerings. With this new capital injection, the company aims to develop its AI-powered platform further and make smart investing even more accessible.

Features of Univest

It’s important to note that Univest offers a regular plan, providing investors with various features and tools to optimize their investments. In this section, we’ll talk about the standout features that Univest has to offer.

- Free Portfolio Analysis

I really appreciate the free portfolio analysis they provide. It gives me an objective third-party assessment of my current investments. Within minutes of uploading my portfolio, Univest’s AI algorithms generated a detailed report evaluating my asset allocation, risk exposure, and projected returns.

The analysis highlighted underperforming assets and recommended alternatives better aligned with my risk tolerance. With this data-driven insight, I’m able to make more informed decisions about rebalancing my portfolio.

The free analysis also sets Univest apart from other platforms that charge for this service. It’s a useful tool I can run as often as needed to optimize my investment strategy over time.

- Buy-Sell-Hold insights

Univest uses AI algorithms to analyze stocks and assign clear buy, sell, or hold recommendations. This data-driven guidance helps users make informed investment decisions.

A similar stock rating feature is offered by platforms like Smallcase and Fyers. Smallcase provides a Momentum Meter that rates momentum stocks to buy, hold, or drop. Fyers designates stocks as buy, sell, and hold through its automated Score investment tool.

Like Univest, these platforms are powered by quantitative models and algorithms. However, Univest claims to incorporate more data sources like news, technical indicators, and macro factors into its analysis. Its machine learning capabilities also enable more adaptive, predictive ratings.

That said, the underlying logic behind Univest’s ratings is proprietary and not fully disclosed. Platforms like Zerodha offer more transparency – its buy/sell indicators on Kite show the exact technical reasons behind each stock rating.

-

Profitable Picks

Univest uses AI to generate personalized stock ideas tailored to each user’s investment goals, risk tolerance, and preferences. The platform’s algorithms analyze market data to identify stocks with the potential for high returns that align with the user’s interests.

This AI-powered stock recommendation capability is also offered by other platforms like Upstox and INDmoney. Upstox Ideas provides a daily watchlist of stocks curated for users based on their selected themes and filters. INDmoney generates a shortlist of stocks and equity mutual funds suited to users’ risk profiles.

The key difference for Univest is the level of personalization and predictive power its algorithms enable. It claims to more precisely match stocks to each individual user by assessing their full portfolio and overall investment strategy. Univest also says its machine learning models can better forecast the upside potential for recommended ideas.

However, some aspects, like the data sources considered and the weightings applied, remain opaque. Platforms such as ET Money are more transparent about the parameters behind stock suggestions. So, while Univest delivers personalized stock ideas, the underlying AI is a black box versus other platforms’ clearer methodologies.

-

Capitalizing on Alternative Assets

One of Univest’s features is recommending alternative assets like real estate and cryptocurrency for higher upside potential. Its algorithms evaluate opportunities across markets to surface ones with the highest expected returns tailored to each user’s risk appetite.

This capability to uncover high-yield investments beyond just stocks and mutual funds is also offered by some competitors. For example, Groww provides access to high interest-yielding bonds, foreign stocks, REITs, and more for portfolio diversification. Upstox highlights IPOs, futures, and options with strong profit potential for high-risk investors.

The differentiator for Univest is the use of predictive analytics and sentiment analysis to forecast expected returns. It claims its AI models can better predict the performance of speculative assets compared to manual screening. However, some platforms like INDWealth provide more transparency into the methodology for how deals are evaluated and returns projected.

In summary, while not completely unique, Univest applies advanced analytics to identify untapped high-return investments aligned to user risk profiles. However, the lack of transparency into its AI is a limitation compared to other Indian platforms with clearer processes.

-

Leveraging Insider Knowledge

Univest offers market commentary and stock analysis from industry veterans like former hedge fund managers and Wall Street analysts. This provides users with experienced perspectives to inform investment decisions.

The concept of expert insights is common across investing platforms. For example, ET Money provides market wrap articles authored by research team experts. Groww features video explainers and blog posts from ex-Wall Street traders on topics like IPO analysis.

However, Univest claims to differentiate with truly exclusive content direct from professionals versus reported/edited insights. It also says its experts are more high-profile – like actual Wall Street fund managers rather than just stock traders.

However, some other platforms offer direct access to investment managers as well. Smallcase has professional managers who create and run investor portfolios based on their strategy. So, while Univest provides unique perspectives from financial veterans, a few competitors offer direct portfolio advice from professional investors, too.

-

Informed Trading Decisions

Univest provides users with complimentary morning market reports to help inform daily trading decisions. These reports contain a recap and analysis of global markets, stock/sector commentary, and technical indicator forecasts.

Daily market insights and commentary are commonly offered across investing apps. For instance, Groww sends a morning market update email with top news, trends, and stock ideas to watch. Upstox provides an Opening Bell report analyzing global cues, index targets, and trade setups.

The key aspects that Univest emphasizes are the technical indicator forecasts like predicted support/resistance levels in its reports. It also aims to provide more personalized stock commentary tailored to users’ watchlists and portfolios.

However, some platforms like Smallcase also offer personalized morning briefings aligned to users’ holdings. And established brokers like Zerodha have in-house technical/fundamental research teams that produce detailed daily reports comparable to Univest.

So, while Univest provides useful free morning insights, the value proposition around personalized, predictive analysis is not completely unique.

Direct vs. Regular Mutual Funds: Unveiling the Fee Difference

When it comes to mutual funds, one crucial distinction that can impact your returns is the choice between “Direct” and “Regular” mutual funds. These two options affect the fees you pay for managing your investments, and it’s essential to understand the difference.

Direct Mutual Funds

Direct mutual funds are like a DIY (do-it-yourself) approach to investing. In this option, you deal directly with the mutual fund company, bypassing intermediaries like brokers or financial advisors. As a result, direct mutual funds typically have lower expense ratios, which means you pay fewer fees.

Investors who opt for direct mutual funds enjoy a more cost-effective way to grow their wealth. The reduced fees can lead to more substantial returns over time, as a smaller portion of your investment is spent on expenses.

Regular Mutual Funds

On the other hand, regular mutual funds involve intermediaries, like financial advisors or distributors, who help you invest in these funds. While this can offer a level of guidance and assistance, it comes at a cost. Regular mutual funds typically have higher expense ratios due to the commissions paid to these intermediaries.

Investors in regular mutual funds may find that a significant portion of their returns is eaten up by these additional fees. This can impact the overall growth of your investment, especially over the long term.

Univest is Regular

Univest, as an investment platform, falls into the category of “Regular” mutual funds. It operates with a structure that includes fees, which are associated with managing and providing its services to users. While Univest offers a range of valuable features, including portfolio analysis and investment recommendations, it does have costs associated with its use.

In comparison to direct mutual funds, which are more cost-effective due to lower expense ratios, regular mutual funds like Univest may involve higher fees. However, these fees can vary depending on the specific services provided by the platform and are important to consider when evaluating the overall value of your investment.

Pros and Cons of Using the Univest Platform

Pros

- Univest consolidates investing across stocks, crypto, real estate, and more in one easy-to-use platform.

- Users get access to insights, commentary, and reports from industry veterans to inform investment decisions.

- It’s free to sign up and start using Univest’s features.

- Morning reports and notifications keep users up-to-date on market moves to seize trading opportunities.

- Users can easily share Univest updates and insights with friends via social media and messaging apps.

Cons

- Some planned features are not yet available as Univest continues improving the platform.

- The website design is clean but lacks some expected tools and customization options.

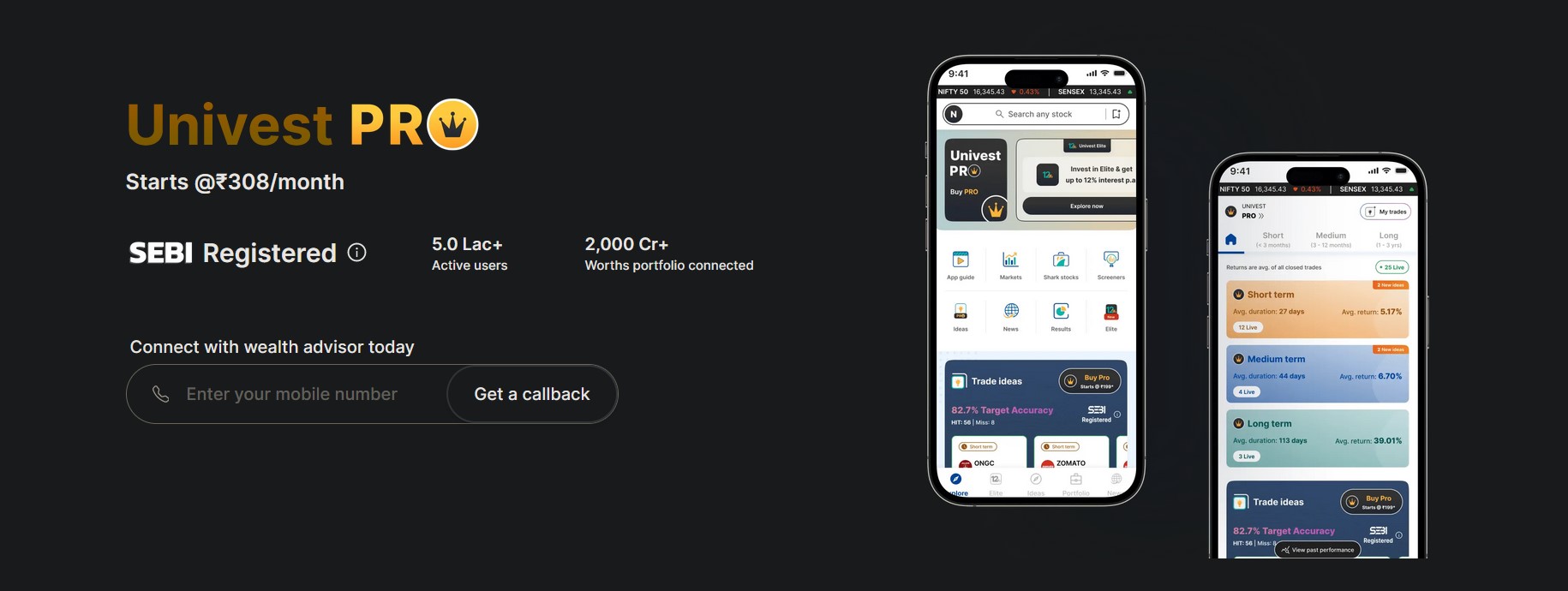

Univest Pro

For 308 INR per month, Univest users can upgrade to PRO status on the platform. This unlocks additional benefits tailored for active investors looking to maximize returns.

As a PRO member, you get access to exclusive trade ideas and premium screeners powered by Univest’s proprietary algorithms. There are new screeners added every month to identify promising investment opportunities.

With over 5 lakh active users and 2,000 crore worth of portfolios connected on the platform, Univest has quickly emerged as a top investing solution. The PRO subscription takes its capabilities even further with premium insights and resources for savvy investors.

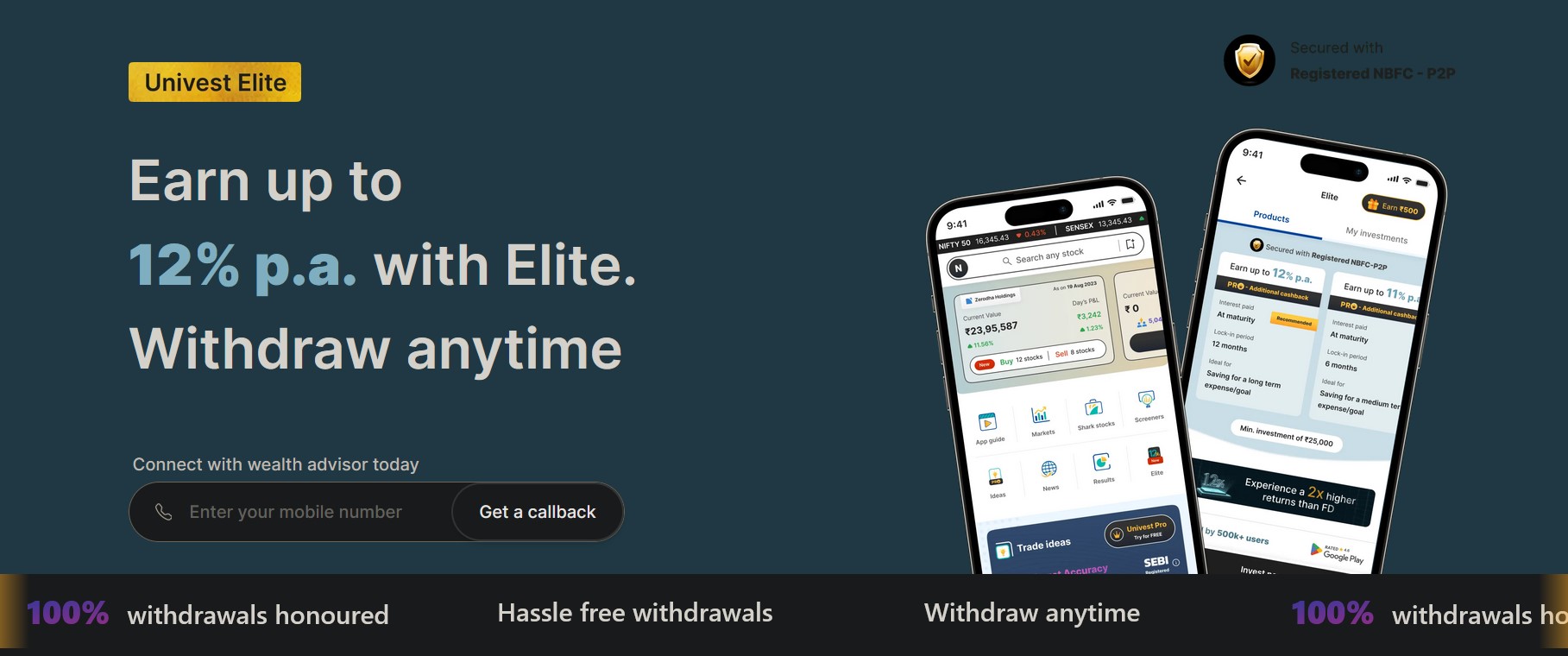

Univest Elite

For investors looking for alternatives beyond market-linked returns, Univest offers the Elite program. This provides access to a portfolio of fixed-income assets that aim to generate annual returns of up to 12%.

The minimum investment to get started is just ₹25,000. Univest sources and vets exclusive deals in real estate, private debt, and other alternative assets. By investing through Elite, users can diversify into these potentially high-yielding opportunities.

The returns are not linked to volatile market conditions. Investors can choose to withdraw their principal and accrued returns anytime with no lock-in. Elite offers the stability of fixed income coupled with higher yields than traditional options like FDs or debt funds. This unique program opens up new avenues for portfolio growth.

Are Univest Pro and Univest Elite worth it?

Univest’s core investing features and insights do seem to require a paid subscription to fully access. Key tools like trade ideas, screeners, and portfolio analysis are locked for free users, which limits the platform’s usefulness.

While paid premium features are common in the investment app landscape, Univest is still a new entrant building user trust. Providing at least some complimentary access to premium tools for a trial period could help demonstrate value to prospective users.

The current free trial of 5 key features is quite limited.The costs of ₹308 per month for Pro or a minimum ₹25,000 for Elite may feel steep for some retail investors, especially amid economic uncertainty.

However, the Pro tools Univest offers, like smart screeners, curated ideas, and 12% returns on alternative assets, could justify the pricing for active investors and traders. Those leveraging the platform extensively may find value exceeding the subscription costs.

But more casual users or buy-and-hold investors may not require such premium services very frequently. The free version lacks standout insights or resources to attract this segment either.

Limiting even fundamental trade tips to paid subscribers misses an opportunity to demonstrate value to potential new users evaluating the platform. It also makes the free experience feel quite bare compared to competitors.

As we pointed out, no one will likely pay hundreds per month just for basic stock names alone when that is commonly free elsewhere. Univest may need to provide some trading guidance or actionable insights accessible without payment to drive sign-ups and engagement.

Univest Alternatives

Below competitors have already gained significant user bases thanks to robust product offerings and intuitive experiences catering to diverse investment needs. Univest faces stiff competition from these established, well-funded players in the investing app space. Here are some top alternative investing platforms that Univest competes against:

-

Zerodha (Kite)

Zerodha’s Kite platform is the leading stock investment app known for its robust tools, competitive pricing, and smooth user experience. Key features include:

- Commission-free equity investing, derivatives trading

- Advanced charts with over 100 indicators & patterns

- Research reports & recommendations from qualified analysts

- Pre-IPO investments, mutual funds, bonds, and ETFs are also available

-

Upstox

Upstox is quickly gaining traction thanks to its low brokerage, fast account opening, and powerful charting capabilities. Key features:

- Proprietary RUNE Charts with customizable overlays & indicators

- Margin against shares, IPO funding, and other advanced order types

- Video-based learning resources and analysis from in-house experts

- Intuitive dashboard for tracking portfolio, news, and research in one place

-

Groww

Groww makes investing accessible through simple UX, engaging content, and a diverse product mix. Key features:

- Invests in stocks, ETFs, IPOs, gold, and a wide range of mutual funds

- Learning center with videos/articles tailored to different investor levels

- Automated tools like SIP investments and portfolio rebalancing

- Comprehensive research and recommendations from the research team

These leading competitors offer robust analysis, trading capabilities, and investment options catering to every investor type – setting a high bar for platforms like Univest seeking to gain market share.

Final Take

Univest aims to differentiate itself by leveraging AI and alternative assets for optimized investing. However, in the competitive Indian investment space, the platform faces challenges stacking up against established players.

Many of Univest’s core features, like stock analysis, recommendations, and market insights, are offered for free by top fintech rivals like Zerodha, Upstox, and Groww. These apps provide robust tools, transparent methodologies, and engaging content driven by strong in-house research.

Univest’s niche offerings, like crypto access and fixed-income products, could appeal to certain user segments. However, its paid subscriptions and lack of standout free features make user acquisition and retention difficult compared to category leaders.

While innovative in parts, Univest ultimately does not yet provide enough differentiated value to gain significant market share. Its AI and alternative assets angle, while promising, needs further development to be compelling against free offerings from dominant investment platforms. Significant product and marketing investment will be required for Univest to compete with deeply entrenched rivals in the space.

In summary, while the platform shows potential, the competitive landscape poses challenges to growth. Univest has room to improve in terms of features and user experience to gain footing against India’s top investment apps catering to every type of investor.

FAQs on Univest

Here are some FAQs about Univest:

- What is Univest, and how does it work?

Univest is an investment platform that uses artificial intelligence (AI) to assist users in managing their investments. It helps you make smart investment choices and optimize your portfolio by suggesting when to exit underperforming stocks and offering new investment ideas.

- Who founded Univest, and when was it established?

Univest was founded in March 2022 by Pranit Arora and Avneet Dhamija.

- How can Univest’s AI help me with my investments?

Univest’s AI analyzes market data to identify underperforming stocks and suggests personalized investment ideas that align with your preferences and risk profile, ultimately helping you make more informed investment decisions.

- What types of investments can I make on Univest?

Univest offers a range of investment opportunities across various asset classes, including stocks, bonds, and other financial instruments.

- Is Univest suitable for both experienced and new investors?

Yes, Univest is designed to cater to the needs of both experienced investors and those who are new to investing. It provides tools and guidance to benefit investors at all levels of expertise. - How do I sign up for an account on Univest?

To create an account, visit the Univest website or mobile app, and follow the registration process, which typically involves providing your personal and financial information.

- What is the minimum investment amount required to get started?

The minimum investment amount can vary, but Univest typically offers a range of investment options to accommodate various budget sizes.

- Are there any fees or charges associated with using Univest?

Univest may charge fees for its services, which can include management fees or transaction fees. It’s essential to review the platform’s fee structure before investing.

- Can I access Univest on my mobile device?

Yes, Univest typically provides a mobile app, allowing you to manage your investments and access your portfolio conveniently from your mobile device.

- Is my personal and financial information secure on Univest?

Univest takes security seriously and implements measures to protect your personal and financial information. This often includes encryption and other security protocols to safeguard your data. Be sure to review Univest’s privacy and security policies for specific details.

If you want to explore options beyond conventional investments with 12-30% returns check the below list –

fake people. don’t invest with their recommendations specially in futures.

every future trade is an loss making Trade suggested by univest

Hi Mukesh,

If they were that good probably they would be investors not giving tips for free 🙂