2024 has started with a tumultuous note for both the conventional as well as Alternative investment markets. A couple of platforms were impacted by delays while Growpital was asked to stop operations by SEBI and respond to its queries.

In this monthly post rather than providing updates on my portfolio and deals I have invested in this month, our focus would be on the ongoing delays and defaults and even more crucial topic on how to avoid large setbacks in the investment journey.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

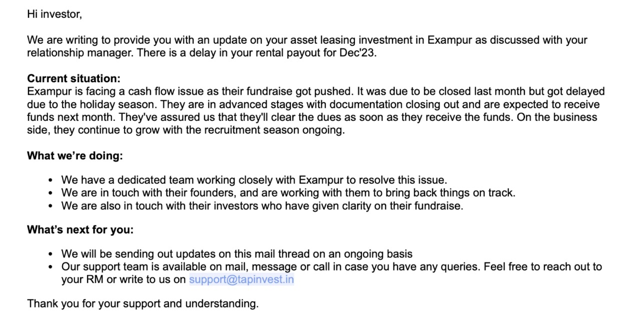

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - Partial Recovery expected through SAT order |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated - New funding to be raised |

| Tapinvest | Melorra Asset Leasing | Early Asset Buyback | -Resolution ( Final Payoff Pending) |

| Gripinvest | Bigspoon | Partial Repayment | - 25% asset recovery pending. |

| kredx | Multiple deals | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc |

| Klub | Tagz | Delay | - 60% Pending Principle to be repaid |

Currently below are the key ongoing delays

- Growpital SEBI Order

- Altgraaf Arzoo delay

- Tapinvest Exampur delay

- Grip Bigspoon delay

Growpital SEBI Order

Growpital a platform that provides Managed Agriculture Farms has been in the news since they got a notice from SEBI. They had recently crossed INR 100 Cr in AUM.Below is the summary of the issue

- Securities and Exchange Board of India (SEBI) has issued a notice, barring the company from collecting money from new partners and investors or diverting any funds collected until further orders.

- According to the regulations, any investments of more than Rs 100 crore pooled together with a promise of a return and managed by a different party come under the purview of CIS regulations.

- In India, some of the Collective Income Schemes under regulated licenses are Mutual funds, AIFs, Invits, PMS etc.

- “I am of the view that under the guise of an LLP, the designated partners…are sponsoring a pooled investment scheme. With the promise of assured returns, retail investors are being attracted to become ‘partners’ in the LLP, by making a ‘contribution’ to the capital of the LLP, observed Amarjeet Singh, a Sebi whole-time director who authored the judgment.

- CIS must comply with some norms such as 1) Not promising guaranteed returns 2) Quarterly financials etc.

SEBI is generally wary of scams in farmland-focused investment schemes and has taken a pre-emptive strike to reduce any risk before it snowballs into something larger. Growpital has been given 21 days to respond and after that, a due diligence process would take place to ensure no wrongdoing done apart from regulation breach.

Below are links to some of the information available on the issue.

https://finshots.in/archive/sebi-cracks-the-whip-on-an-agri-investment-startup/

The Founders of Growpital have updated the community WhatsApp group that they are working on their response to SEBI and have requested to unfreeze the account to manage the business.

Based on my understanding some of the outcomes for investors can be

- Positive Outcome – SEBI does not find any major red flags in corporate governance and instructs the platform to make changes in the structure. They can fill up the gaps and continue operations.

- Neutral Outcome – SEBI asks the platform to ramp down within a time frame and return the capital even if they don’t find any red flags in corporate governance

- Negative Outcome – SEBI finds significant red flags with the governance, including misappropriation of funds, and proceeds to recover as much as possible.

In the first 2 scenario, most investors should get most if not complete capital though the time for the process can be long. However, in the 3rd scenario, there can be significant capital erosion. For the time being, investors can wait for the next development.

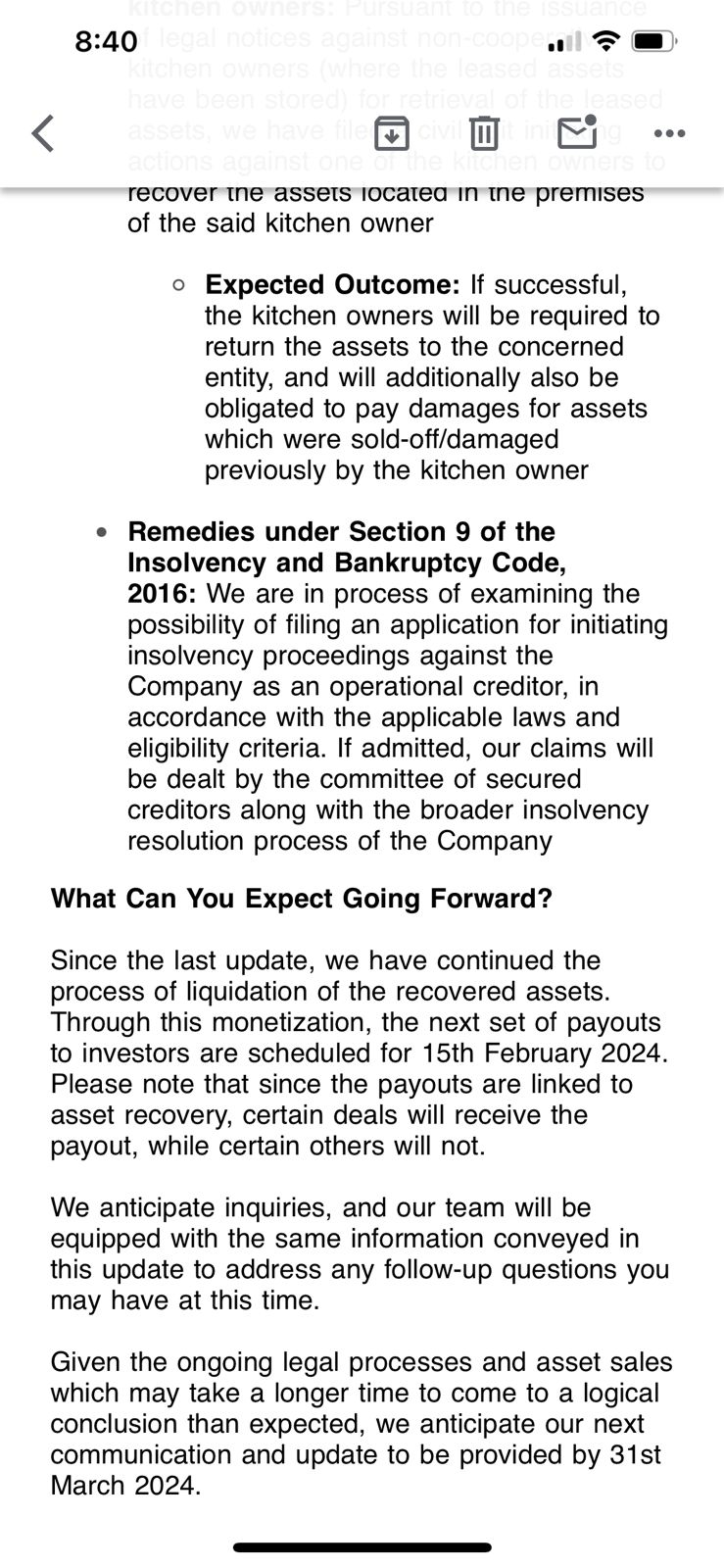

Arzoo Delay Jiraaf

The invoice discounting deal on Altgraaf has been delayed for approximately a month now. Based on the update shared by the platform, the Liquidity crunch has been the reason for this. Arzoo has recently raised funds from existing investors and Altgraaf believes they can resolve the issue at the earliest.

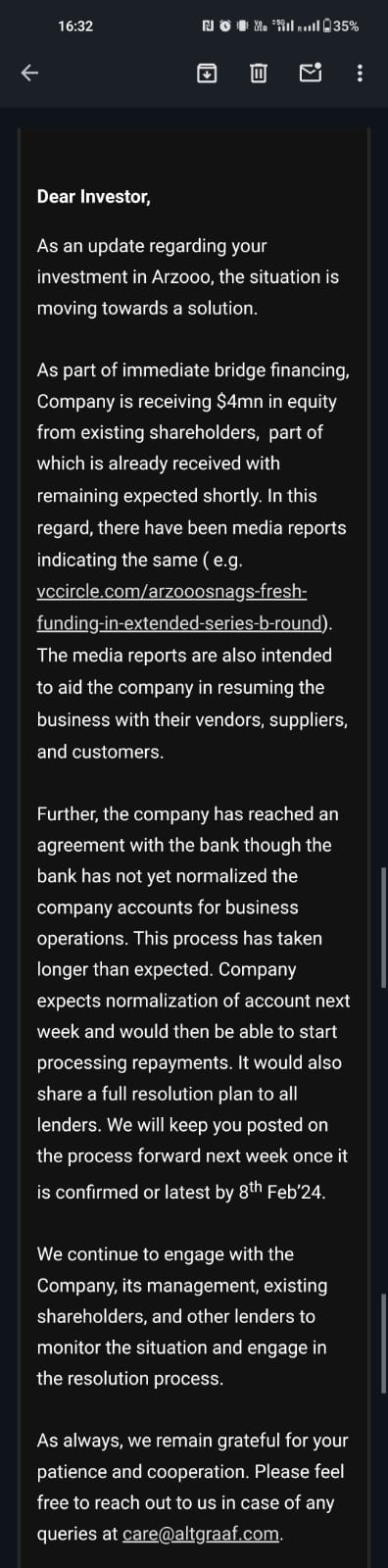

Tapinvest Exampur Delay

Tapinvest is facing some delay in repayment of the Exampur asset leasing deal as the startup is closing its fundraising and may take a few more weeks as per the latest statement by Tapinvest.

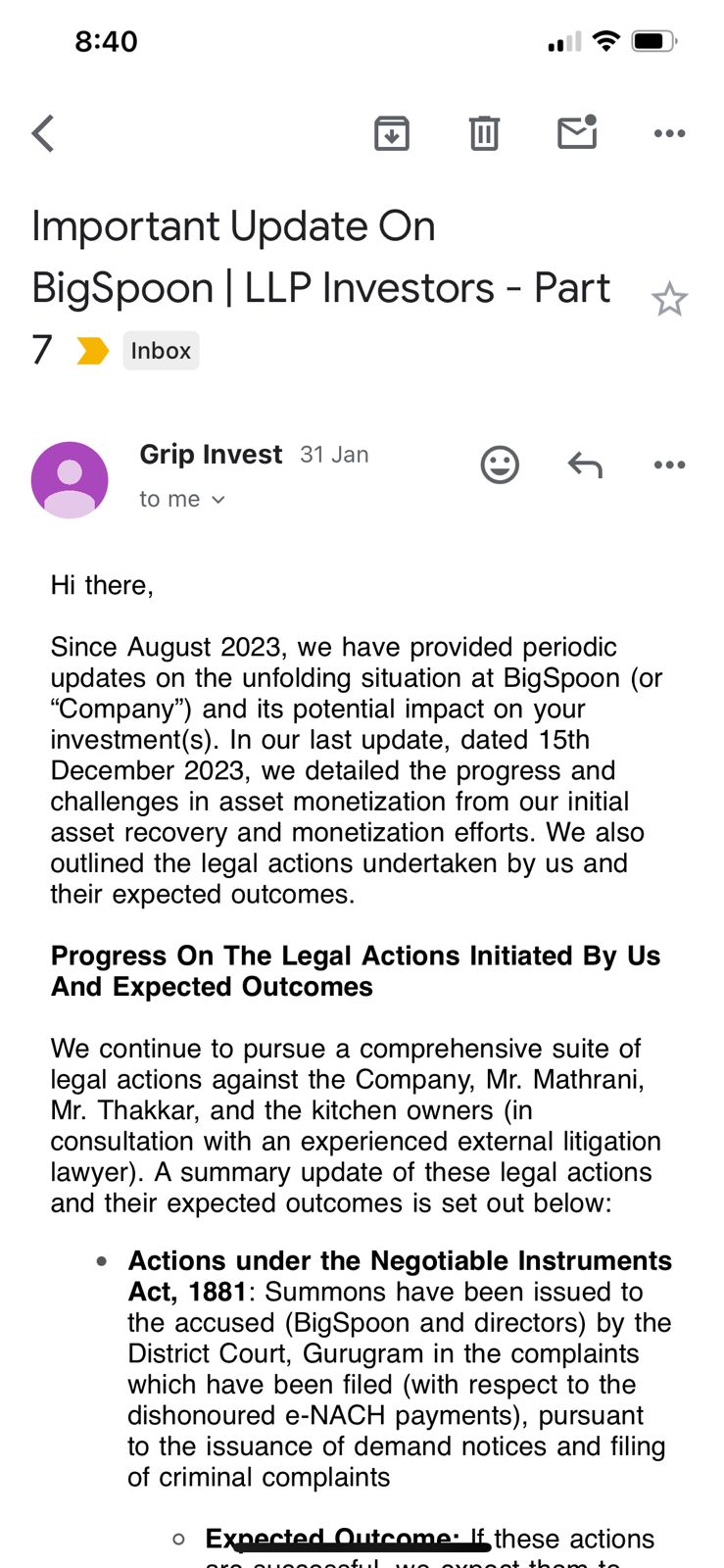

Gripinvest Bigspoon Default

Bigsoon had defaulted on its leasing rental obligation to Grip. The founder had absconded creating a lot of confusion. Grip has been able to retrieve partial repayment. They are trying to recover the assets that were leased and sell them. Grip has seamlessly communicated the development and has handled the issue pretty well.

How to invest in Alternative Investments?

Out of the above 4 deals, my capital is only stuck in Growpital. I had faced a delay in the Bira deal on Kredx during COVID-19 but still been using Kredx. I have lost capital in Lendenclub and Rupeecircle during COVID-19 and stopped using these 2 platforms. Defaults and capital loss are inevitable parts of the investment journey despite our best due diligence efforts.

However, when I construct a portfolio I factor in such scenarios and create provisions for write-off in the worst-case scenario. So how do I create a portfolio and where do Alternative Investments fit in?

Investors should not look at alternatives in isolation but as a part of the overall portfolio. The total inflow for an investor can be the below form

- Salary or Business Income

- Equity Capital gains

- Real Estate Gains

- Fixed Income Returns (Arbitrage Funds, Rental Yield, Liquid Funds etc)

- Alternative Investments

- Trading Activities

Salary or Business income will provide the largest portion for most people while Equity and Real Estate gains will boost networth in the long run. An investor wants to maximize wealth hence he would want to focus on Salary by giving maximum time and putting money in Equity /Real Estate for maximum gains.

The challenge investors will face is that both Equity and Real Estate are long-term investments that bring 2 problems

- Market Volatility

- Low Cash Flow

Not everybody is comfortable taking 10-15% drawdown in their portfolio hence they try to diversify into fixed-income assets that reduce overall portfolio volatility and give decent cashflow.

What are the Options for Cashflow?

Some of the Cashflow investments can be

| Instrument | Returns |

| Liquid Fund | 7% |

| Arbitrage Fund | 7.50% |

| FD | 7-8% |

| Gsec | 7% |

| Trading | 10-25% |

| Alternative Investment | 10-20% |

Now an investor can choose to invest all his low volatility assets in Liquid Funds/Arbitrage to get 7.5% but a more aggressive investors wants to boost his fixed asset returns by engaging in Trading or Alternative Investments etc .

Let’s consider 2 scenarios

a) INR 50 Lakhs Fixed Assets

b) INR 5 Crore Fixed assets

If alternates can increase portfolio yield by 3% that’s INR 15 Lakh a year in case 2 while only 15k in case one. Hence if someone has substantial capital they choose Alternatives to boost portfolio returns.

If someone invest in 15% return bearing 100 deals with INR 1 lakh capital even 2-3 defaults a year are not a challenge but if someone invest INR 50 lakh in one deal they run a huge risk. Hence the biggest risk for investor is over committing in a deal!

Diversification of Investments and Platform Risk

Many investors know but are not able to understand portfolio diversification. Investors should always ensure

- They do no invest more than 5% in one deal (unless it is a real estate ,as diversification is tough beyond an extent).

- Try to spread across platforms to reduce impact of platform deal management.

- Understand Deal based vs Business based platform and do not invest more than 5-7% in one business platform, eg – Vauld, Growpital were managing a business hence you cannot diversify within that platform but Grip invest for eg is a deal based platform and you can spread risk within multiple deals.

- If you do not have sufficient capital then invest in platform where even low capital can be diversified such as India P2P

Recent Cases of Portfolio Diversification

I invested in Growpital in 2022 to test the platforms and repayment was on time.

Investors need to understand that when we invest in a platform like Growpital it is not same as investing in a bond deal or an invoice deal .In this case you are betting on active management of the platform . This is akin to equity allocation to a high dividend stock (albeit with less transparency) hence the higher returns.

The portfolio allocation to these products should be in line with risk appetite for such equity investments. In the growpital group some people had invested 30-40% of Networth in the platform that makes it extremely risky and susceptible to any adverse impact on the platform business. I had heard similar stories for Vauld were people had put their life saving in Vauld only to see it getting eroded.

Diversification is the only hedge against such events no matter how attractive an investment looks. If your portfolio is highly vulnerable to one bad event then that event can happen anytime!

Flagged Alternative Investment Platforms

I have also created a new section in the Website “Flagged” that contains the table of platforms I am avoiding due to bad past performance or being skeptical about their structure. Request all to comment and add platforms based on your diligence and research. I feel many platforms have mushroomed under the guise of alternative investment and may be fraud or ponzi schemes hence it is important to do more research before deploying capital.

I am happy that you are flagging out platforms that need to be ‘flagged’ out. I have some exposure to Growpital, and the Arzooo fiasco and I also had the same bad experience on LendenClub and had to exit (had an 18% erosion of capital).

Hi Akshay,

Thanks for the feedback.I plan to keep the flagged category updated to incorporate any changes.

Have also started covering delays etc in more detail in monthly portfolio review

I have invested indirectly in Growpital via asset leasing on Tap Invest since my bank accounts have been frozen even though my money is struck. But since assets are in my name, what can be the future course of action?

Hi Akash,

SEBI will be providing the next steps for the platform and the appropriate recourse can be taken at that time because currently they have to provide audit of their assets and liabilities to the regulator before any asset is allowed to be released.