The Chinese stock market, once a firebrand of global growth, has entered a period of uncertainty. After years of meteoric rise, economic headwinds and regulatory crackdowns have cast a shadow over the future. Over the past three years, about $6 trillion — equivalent to roughly twice Britain’s annual economic output — has been wiped off the value of Chinese and Hong Kong stocks.

Yet, amidst the turbulence, hidden opportunities shimmer for investors brave enough to invest in the Chinese market. This article delves into the complexities of the Chinese market, dissects its economic challenges, and explores avenues for Indian investors to participate in its potential future rebound.

Understanding China’s Economic Malaise

The once-unstoppable locomotive of the Chinese economy sputters. Real estate woes, demographic shifts, and a rigid regulatory environment have dampened growth. The property sector, a cornerstone of China’s financial fabric, grapples with an ever-growing debt bubble and falling demand. This has cascading effects, impacting household wealth and consumer confidence. Additionally, China’s aging population throws a wrench in its future growth equation, shrinking the workforce and increasing social security burdens.

Furthermore, the Chinese government’s “Common Prosperity” initiative, aimed at reducing income inequality, has sent shivers through industries like technology and education, with increased scrutiny and tighter regulations. This policy shift, while laudable in its social goals, has created anxiety among foreign investors concerned about regulatory overreach and market unpredictability.

Key Issues with China’s Economy

Some of the key issues with China’s economy are:

Real Estate Crisis

- Massive debt bubble: Overly leveraged developers face defaults, impacting investment and consumer confidence.

- Falling demand: Declining population growth and oversupply lead to stagnant property sales.

- Domino effect: Property sector woes hurt related industries like construction and steel.

Demographic Challenges

- Aging population: Shrinking workforce and rising social security burdens hamper long-term growth.

- Low birth rate: Decreasing the number of young consumers undermines domestic consumption.

Regulatory Crackdown

- “Common Prosperity” initiative: Increased scrutiny and regulations in tech and education dampen investor sentiment.

- Unpredictability: Fear of regulatory overreach creates uncertainty for businesses and foreign investors.

Other challenges

- Global economic slowdown: Weakening global demand impacts China’s export-oriented economy.

- Geopolitical tensions: Trade wars and international disputes add uncertainty and risk.

Why China Still Lures Investors

Despite the current malaise, China retains its magnetic pull for investors. Its sheer size and potential, with a vast domestic market and a burgeoning middle class, are too alluring to ignore. Furthermore, the government’s commitment to infrastructure development and technological advancements continues to offer fertile ground for specific sectors. Renewable energy, electric vehicles, and healthcare are just a few areas teeming with possibilities.

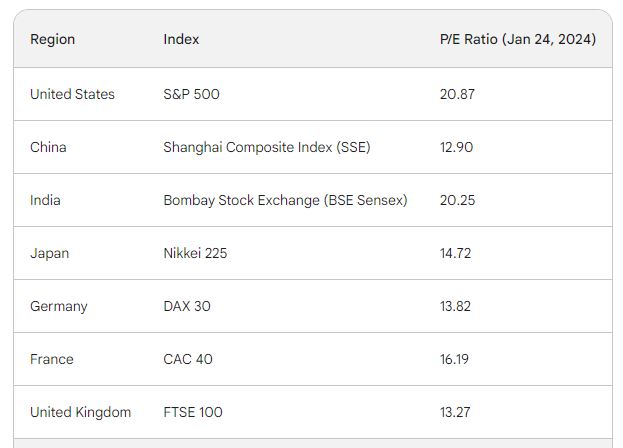

Additionally, the recent market correction has made some Chinese stocks incredibly attractive from a valuation standpoint. With price-to-earnings ratios lower than historical averages, long-term investors may find bargain hunting opportunities in select companies.

Risks and Cautions for Indian Investors

Venturing into the Chinese market demands caution. Currency fluctuations, geopolitical tensions, and the ever-present risk of government intervention can lead to volatility and unpredictable outcomes. Investors must meticulously research individual companies and sectors, understanding the specific risks involved before committing capital. Additionally, navigating the intricacies of Chinese financial regulations and tax laws requires expert guidance.

The Future of the Chinese Market and Implications for Indian Investors

The future of the Chinese market remains shrouded in some uncertainty. The government’s ability to manage the real estate crisis and navigate its ambitious social reforms will play a crucial role in determining the speed and trajectory of the economic recovery. However, China’s long-term growth potential remains undeniable. For Indian investors with a sound risk appetite and a long-term perspective, the Chinese market, despite its current tremors, might just offer the right melody for a profitable waltz.

China stock Market Valuation

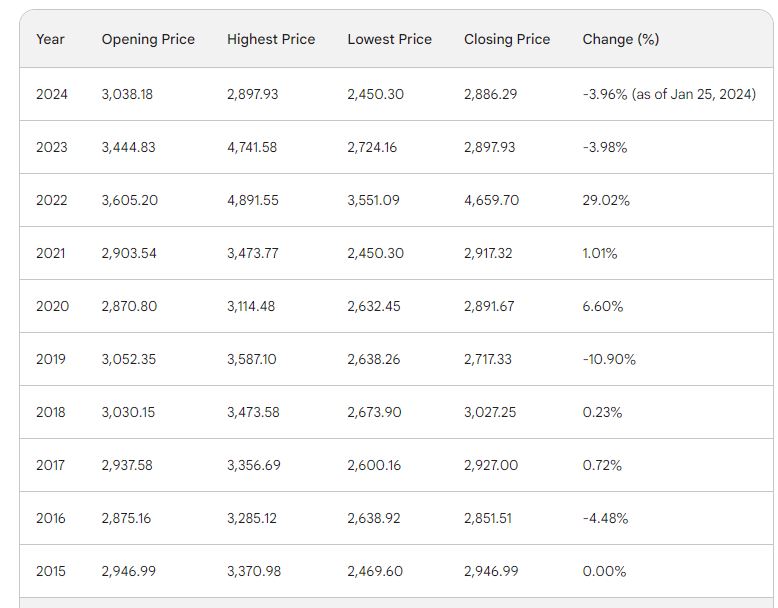

China has underperformed most countries in last 5-10 years . The PE ratio is all time low .

Below is a comparison of China market with other top economies.

How Indian Investors Can Access the Chinese Market

For Indian investors eager to tap into the potential of the Chinese market, several avenues exist.

- Mutual Funds: Numerous India-based mutual funds invest in Chinese companies, offering investors diversified exposure without directly navigating the Chinese market’s complexities.

- Exchange Traded Funds (ETFs): Several China-focused ETFs trade on Indian exchanges, allowing investors to track specific indices or sectors within the Chinese market.

- Qualified Foreign Institutional Investor (QFII) Scheme: This scheme allows eligible Indian investors to directly invest in China’s A-shares market, though it involves navigating stricter regulations and higher minimum investment requirements.

- Hong Kong Stock Exchange (HKEX): Many Chinese companies, particularly internet giants, are listed on the HKEX, accessible to Indian investors through their brokers.

China Focussed Mutual Funds and ETFs

Below is the list of China-focused Mutual Funds in India

Hong Kong-Focused ETFs in India

Several exchange-traded funds (ETFs) in India offer exposure to the Hong Kong stock market. These ETFs track different indices or themes within the Hong Kong market, allowing investors to diversify their portfolios and potentially benefit from the region’s growth.

Here are some popular Hong Kong-focused ETFs available in India:

- Motilal Oswal Hang Seng TECH ETF

- This ETF tracks the Hang Seng TECH Index, which comprises the 30 largest technology companies listed on the Hong Kong Stock Exchange.

- It provides exposure to leading Hong Kong tech giants like Alibaba, Tencent, and Meituan.

- Expense ratio: 0.50%

- Nippon India ETF Hang Seng BeES-Growth

- This ETF tracks the Hang Seng China Enterprises Index, which includes the 50 largest companies listed on the Hong Kong Stock Exchange that are incorporated in mainland China.

- It offers exposure to a broad range of sectors, including financials, technology, and consumer staples.

- Expense ratio: 0.72%

- Mirae Asset Hang Seng TECH ETF

- Like the Motilal Oswal Hang Seng TECH ETF, this ETF also tracks the Hang Seng TECH Index.

- It provides an alternative option for investors seeking exposure to Hong Kong’s tech sector.

- Expense ratio: 0.30%

- Invesco India Nifty China ETF

- This ETF tracks the Nifty China Index, which comprises the 50 largest Chinese companies listed on the HKEX and Shanghai Stock Exchange.

- It offers diversified exposure to both Hong Kong and mainland China equities.

- Expense ratio: 0.15%

Factors to Consider Before Investing

- Investment Objective: Align the ETF’s focus with your overall investment goals and risk tolerance. Tech-focused ETFs might be riskier than those tracking broader indices.

- Expense Ratio: Choose an ETF with a lower expense ratio to maximize your returns.

- Liquidity: Ensure the ETF has sufficient trading volume to buy and sell units easily.

- Underlying Index: Understand the composition and historical performance of the index the ETF tracks.

In conclusion

The Chinese stock market presents a complex dance of risks and rewards. While current economic challenges have dimmed its shine, the potential for future growth and untapped opportunities remain enticing. Indian investors can access this market through various avenues, but caution and proper research are essential to navigate its intricacies. By understanding the economic landscape, carefully assessing individual companies, and approaching the market with a prudent long-term view, Indian investors might just find themselves in tune with the rhythm of the Dragon’s Dance.

If you are looking beyond stock market to achieve 10-20% IRR below are some options to diversify your portfolio

Hi, there is a concerning report from SEBI about Growpital platform. Do you have any more update on it? Can we expect to get our invested money back from Growpital?

Hi Kandarp, I have covered it in detail in my portfolio review. We are awaiting growpital’s response to SEBI!