What are Alternative Investments?

An alternative investment is a financial asset that does not fall into the general definition of conventional investment categories. In India, most investors have become savvy about mutual funds and the stock market in the last 10 years. However, there are assets that go beyond these categories and have the ability to provide good returns

Why should you invest in Alternative Assets?

When an investor develops their portfolio they choose investments based on efficiency, aiming to earn a maximum return for minimum risk. Alternative assets are often attractive because of the high returns they can generate, and the opportunity they provide to diversify an investment portfolio away from traditional investments, which consequently reduces overall portfolio risk. The major reason people invest in alternatives are:

-

- Lower Volatility

- Enhanced Returns

- Broad Diversification

- Regular Cashflows

How to Create an Alternative Investment Portfolio?

Most people invest randomly in deals across multiple platforms based on limited knowledge. Before making any investment, it is paramount that the investor focuses on the below aspects

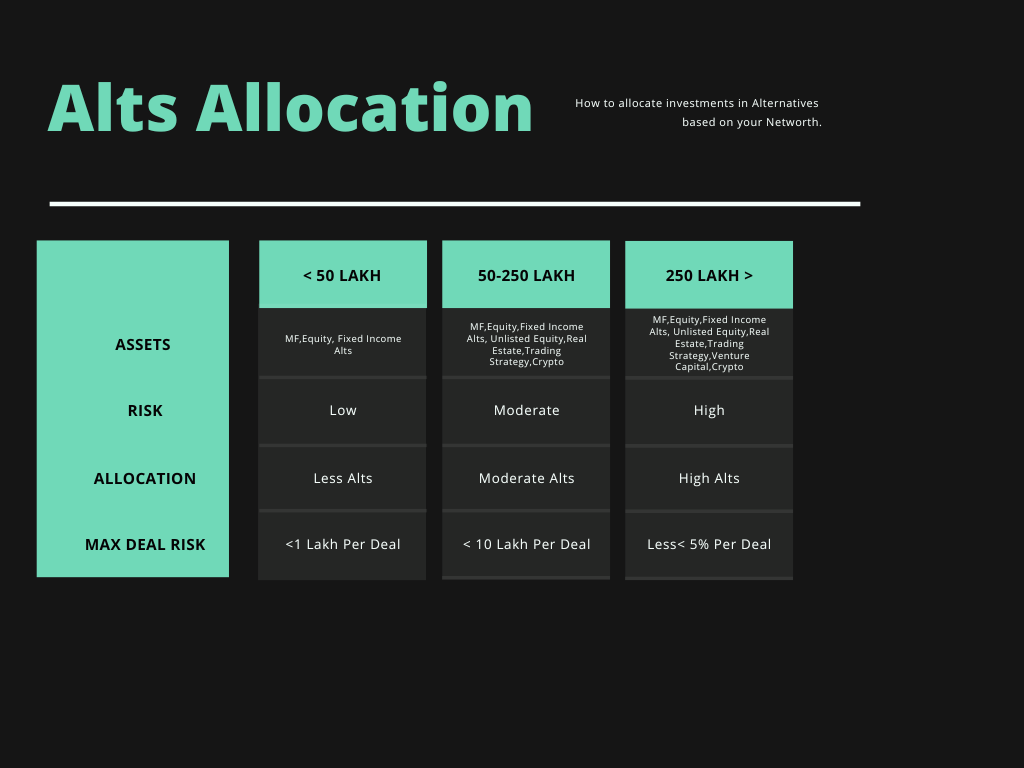

Networth and Tax– A strong portfolio is a combination of high-quality equity and debt funds that provide the basis for tax-optimized long-turn returns. However, a large allocation to Equity may produce high volatility. Similarly, shorter-dated fixed-income products like FD and liquid funds generate poor tax-adjusted returns. However, the allocation to a platform should be based on Networth. Someone with a large networth may not want high equity exposure and can choose a combination of alternative investments. It is also important that post-tax returns be compared with instruments of similar maturity with lower risk

Cashflow Requirement – Investor cant take out money from long-term equity holding. Many investors’ monthly cash flow to meet expenses or for their monthly Mutual funds’ SIP. Alternatives can help you to get a stable cash flow. Products like invoice discounting, Leasing, etc can give monthly cash flow and help to maintain liquidity.

Example – If an Individual has a 1 crore portfolio and has 50/50 Debt- Equity preference, he can put a part of his debt investment in 3 years plus an instrument like Bharat bond ETF, etc which can give a 7% post-tax yield. For short-term investment instead of doing FD or debt funds, he can choose alternatives that give periodic cashflow or have short maturity and yield 10%+

Risk appetite– People should be cognizant of the risk in each product before making any significant investments. Some products like Crypto, Venture capital, and Trading Strategies have higher returns but also come with higher volatility. Hence exposure should be done based on the investor’s risk profile.

Example- Cryptocurrency can give very high returns but they go through cycles where investors can have a drawdown of up to 50-70% of their portfolio hence allocation should be done based on risk appetite

Yield-based vs Capital Gain– Split between long-term capital gain assets vs short-term lending assets have to be decided. A good allocation helps to grow the long-term corpus while maintaining a healthy level of portfolio liquidity for income and financial security.

What are the best Alternative Investment Platforms to get started?

Type of Platforms

-

- Income Generating Platform – Platforms that have a fixed yield and are primarily used to generate income or park money

- Unlisted Equity and Venture Investing-Platforms which provide access to early-stage/late-stage companies before they are listed on an exchange.M

- Managed Trading Platforms- Trading strategies managed by top traders which can generate a return on your available margin.

- Real Estate Platform– Platforms to invest in commercial real Estate/ Land to generate income or capital appreciation.

- International investment – Platform to invest in foreign equity and alternative assets.

List of Some Platforms you can explore

| Platform | Description | Minimum Investment | Avg Returns | Detailed Review |

|---|---|---|---|---|

| Jiraaf(Altgraaf) | All in one platform for Alternative Investment Opportunities-corporate bonds, invoice discounting, asset leasing, etc. | Rs.100000 | 12-20% | Jiraaf( Altgraaf) Review |

| TradeCred | Invest in invoices of bluechip companies | Rs.50000 | 12-13% | TradeCred Review |

| Tapinvest | Platform to Invest in Pre-Tax leasing, Invoice Discounting | Rs 50,000 | 12-20% | Tapinvest(LeafRound )Review |

| Grip Invest | Invest in physical assets like Ebikes, equipment's leased to startups and large companies | Rs.20000 | 12-13% (Tax Exempted) | Grip Invest Review |

| Wint Wealth | Invest in Covered Bonds offered by various regulated companies | Rs.10000 | 10-11% | Wint Wealth Review |

| Altifi | Invest in High Yield Bonds | Rs.5000 | 10-13% | Altifi Review |

| Klubworks | Revenue based financing to popular and funded Indian startups | Rs.250000 | 17-24% | Klubworks Review |

| Lendbox | P2P Loans, Invoice Discounting, Settlement Financing Opportunities | Rs.10000 | 10-14% | Lendbox Review |

Drop us a message on info@ranomdimes.com or click on the below WhatsApp icon if you want to have a 10 Min free review of the various platform performance.