With advancements in technology, many fintech companies are coming up in India which aim to help retailers gain access to alternative investment avenues which were earlier not accessible to them.

One such popular category of alternative investment which seems to be picking up with a lot of early-stage companies coming up and getting decent traction from investors is equipment leasing or financing equipment.

In this post, we will explore Leafround- which is a marketplace for leasing. Investors can buy and rent out assets to businesses in exchange for monthly rentals or payments. Let us explore this platform in detail in this Leafround review.

What is Leafround?

Leafround is a marketplace that connects businesses looking to lease equipment for their operations and investors who want to invest money and earn regular monthly interest.

The salient feature of Leafround which makes it stand out from other leasing companies is that Leafround does not create SPV which means you get the Pre-tax IRR for your investments which are substantially higher than post-tax SPV returns.

How does Leafround Work?

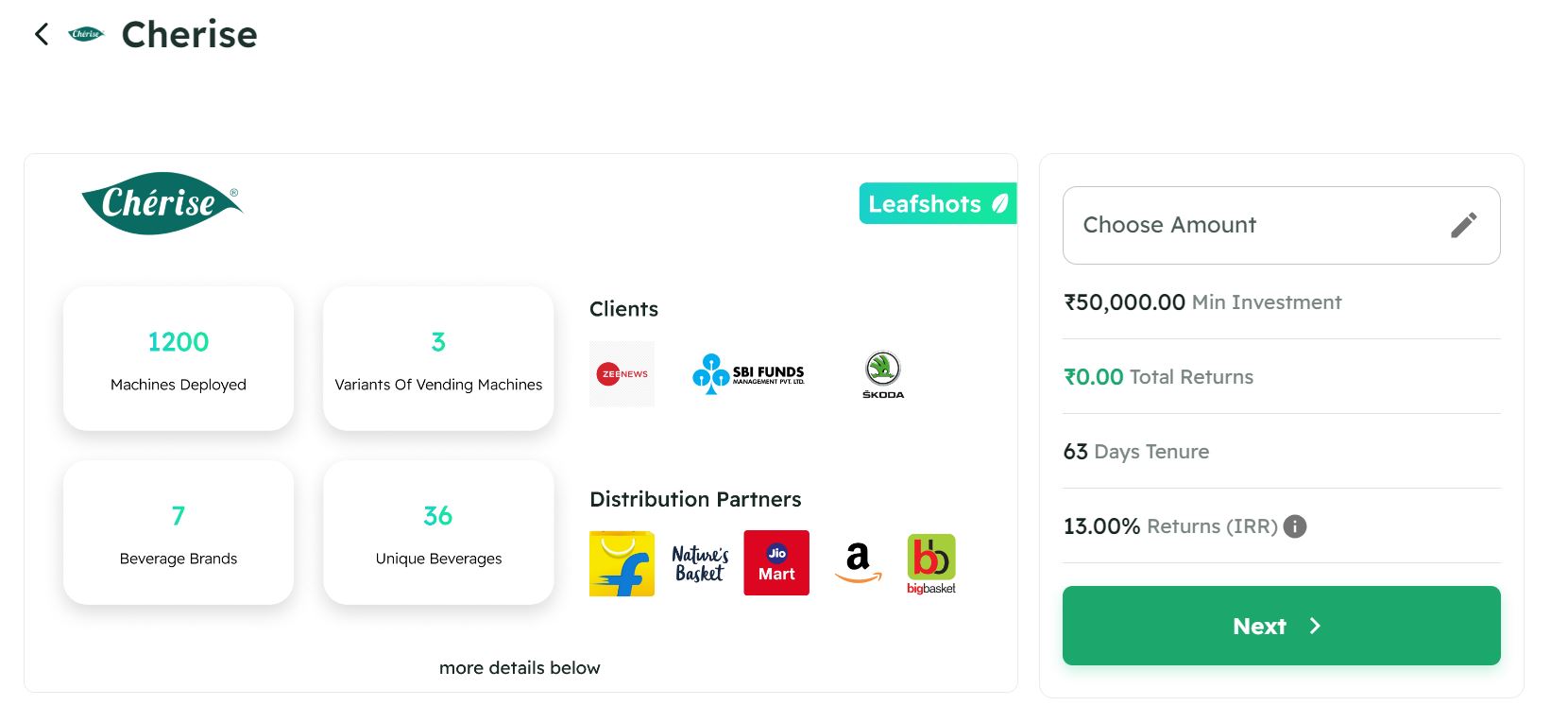

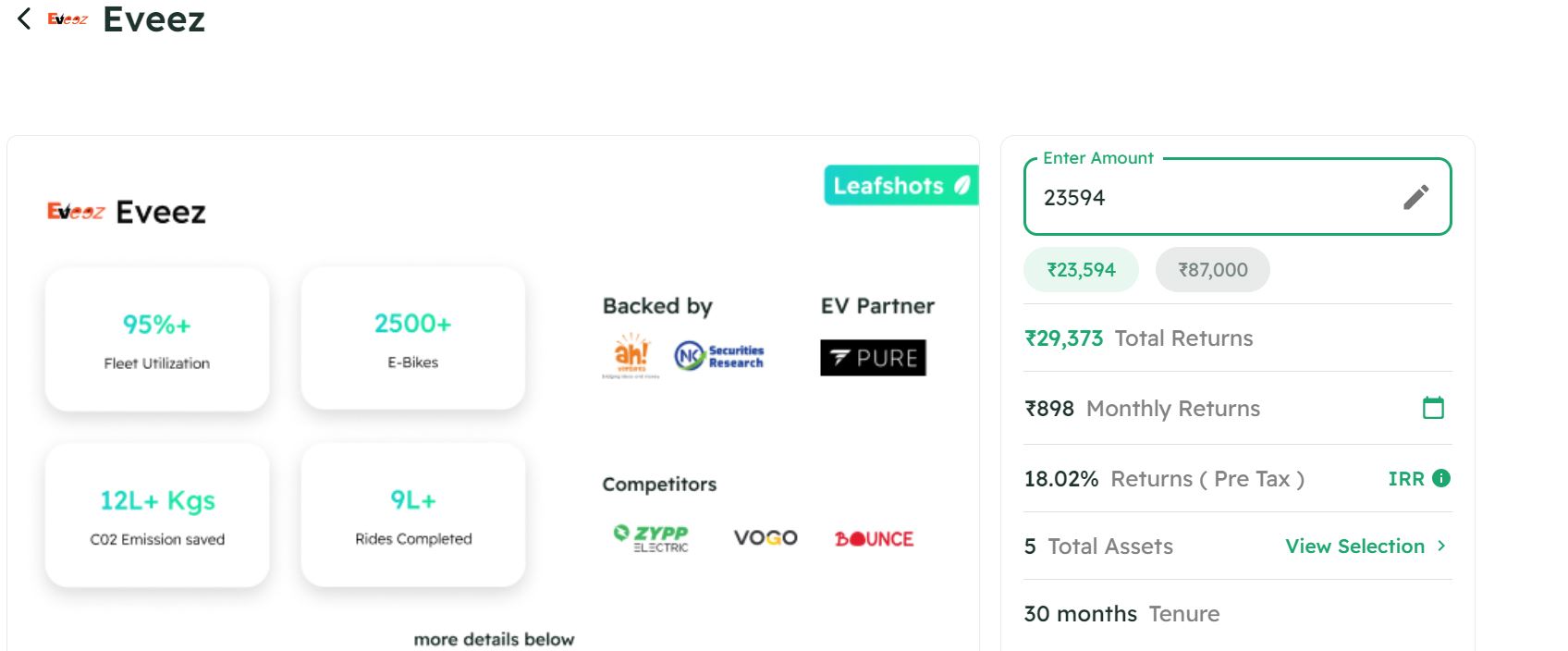

- The platform scrutinizes & lists companies that want to purchase equipment or assets for their businesses. Each listing is called a ‘Deal’, which details the business to whom the assets would be leased, details of the asset being leased, payout structure, etc.

- Interested investors commit money to buy assets and invest money in the deal of their choice.

- Assets are purchased and leased out to the business with proper legal structures like agreements in place.

- The company pays monthly installments for assets leased out to them which are paid out to investors in proportion to their individual investments.

- At the end of the tenure, the assets are repurchased by Leafround from the investors, and the money generated is paid out to the investors.

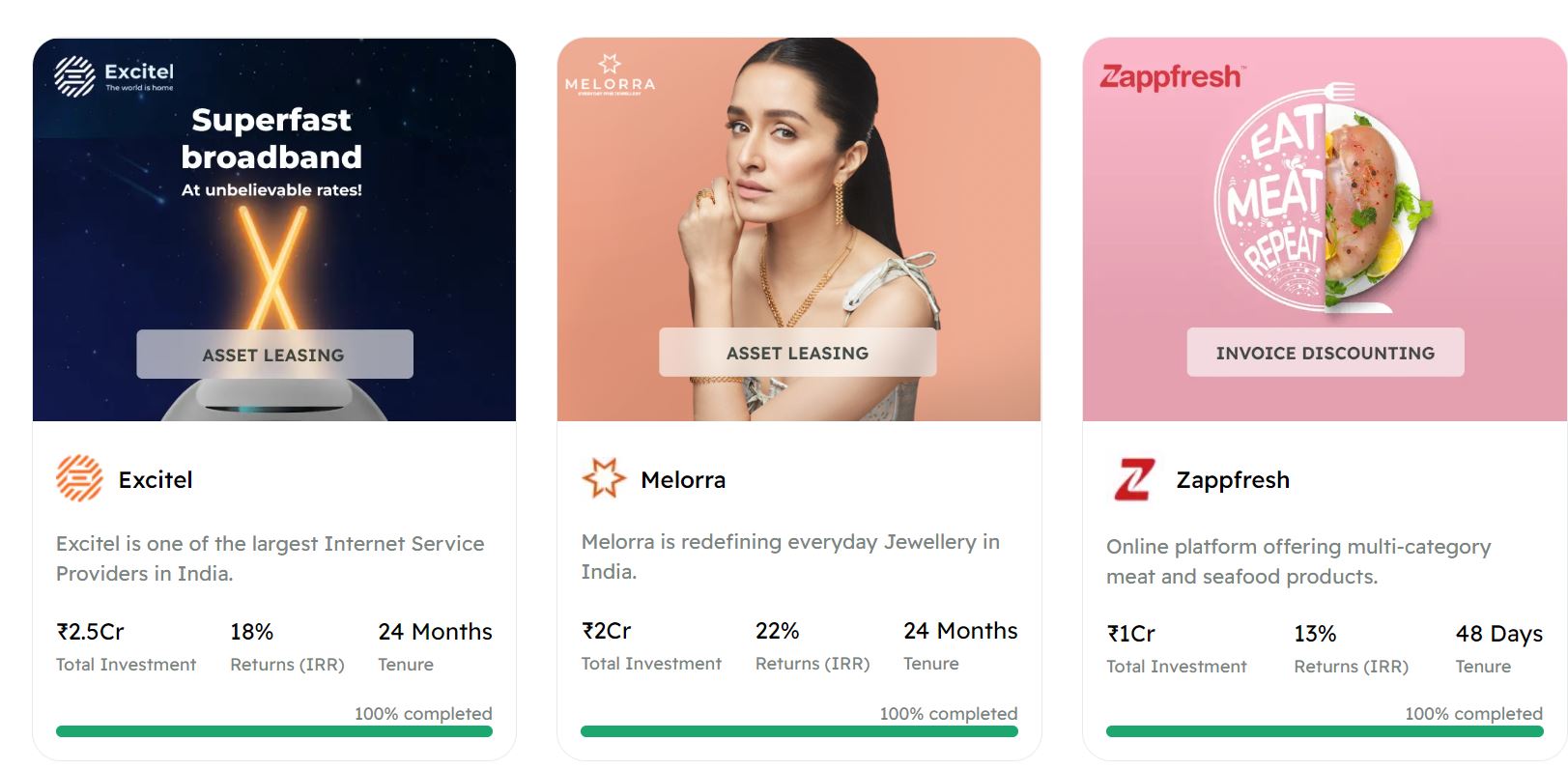

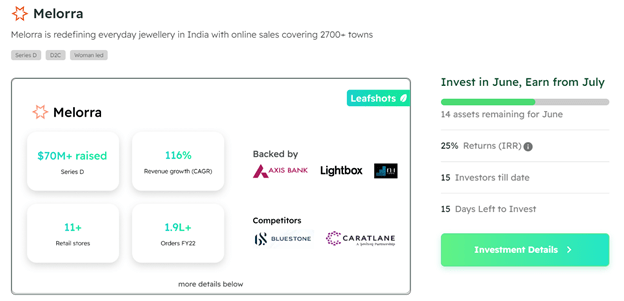

For example, currently, one deal listed on Leafround is Melorra- a jewelry brand. Melorra is looking to lease the following 3 types of assets from Leaf round:

- Mac Book Pro 14” – MKGP3HN/A

- Laptop-I Mac Pro 16’’ – MKGP3HN/A

- Apple Macbook Pro 14’’ – MKGP3HN/A

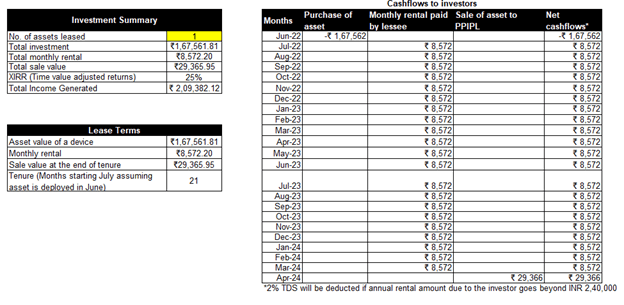

Let us consider the first asset- Mac Book Pro 14” – MKGP3HN/A. The cost of the laptop is ₹1,67,562 inclusive of GST and shipping. The payout structure for this asset is as follows:

As you can make out from the above chart, investors will receive Rs.8572 per month per asset as rent for a duration of 21 months. In April 2024, when the lease gets over, Leaf will take physical possession of the asset and the company will pay Rs.29,366 for this laptop. If we calculate, we can earn 25% IRR on our investment for this particular deal & asset.

In case the company not being able to meet the required amount, Leaf has tied up with Toqri, which is a liquidator of assets. While leasing out these assets the repurchase price is checked with Toqri to ensure a smooth exit process if required

Type of Deals on Leafround

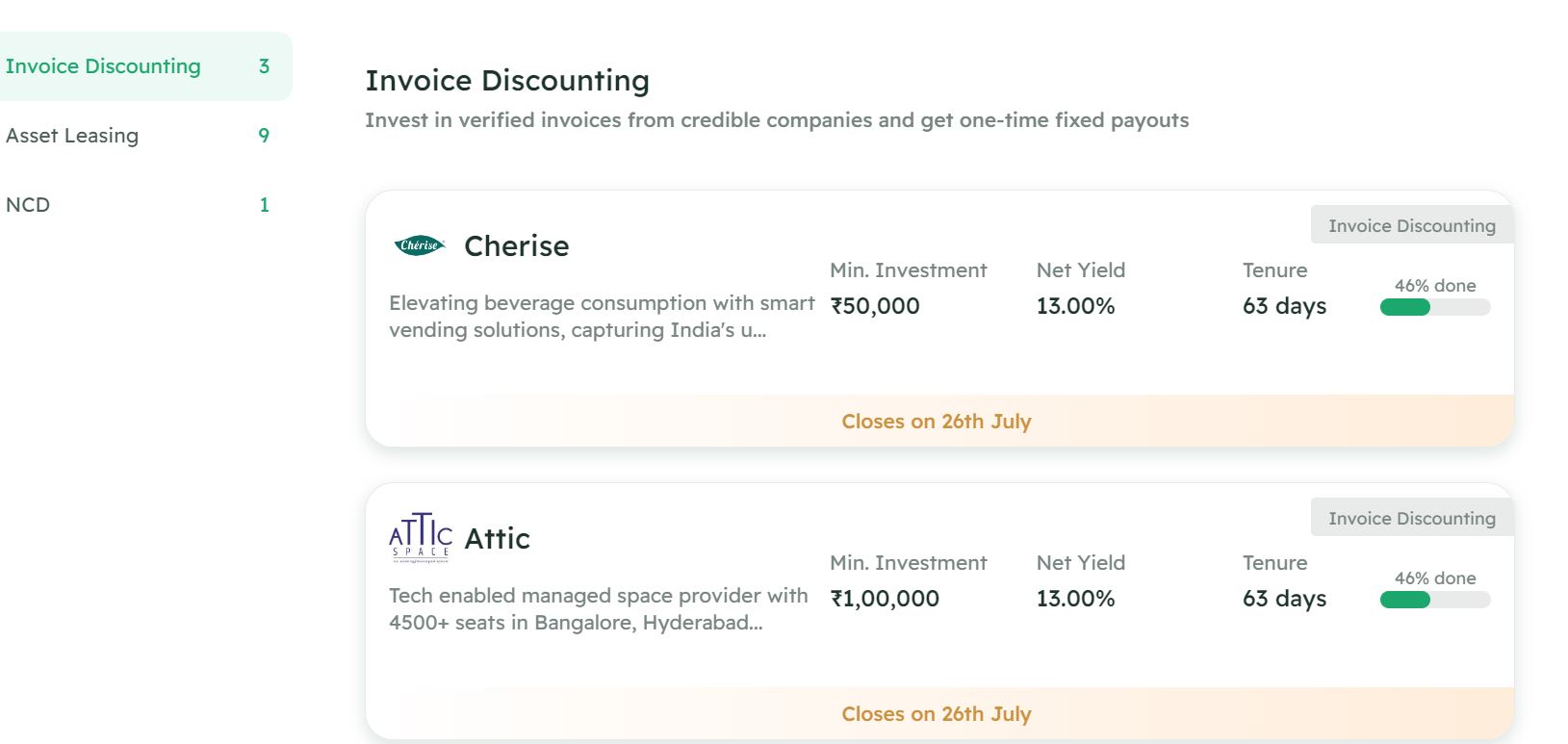

Leafround started with asset leasing but now offers multiple assets such as:

- Invoice discounting

- Asset Leasing

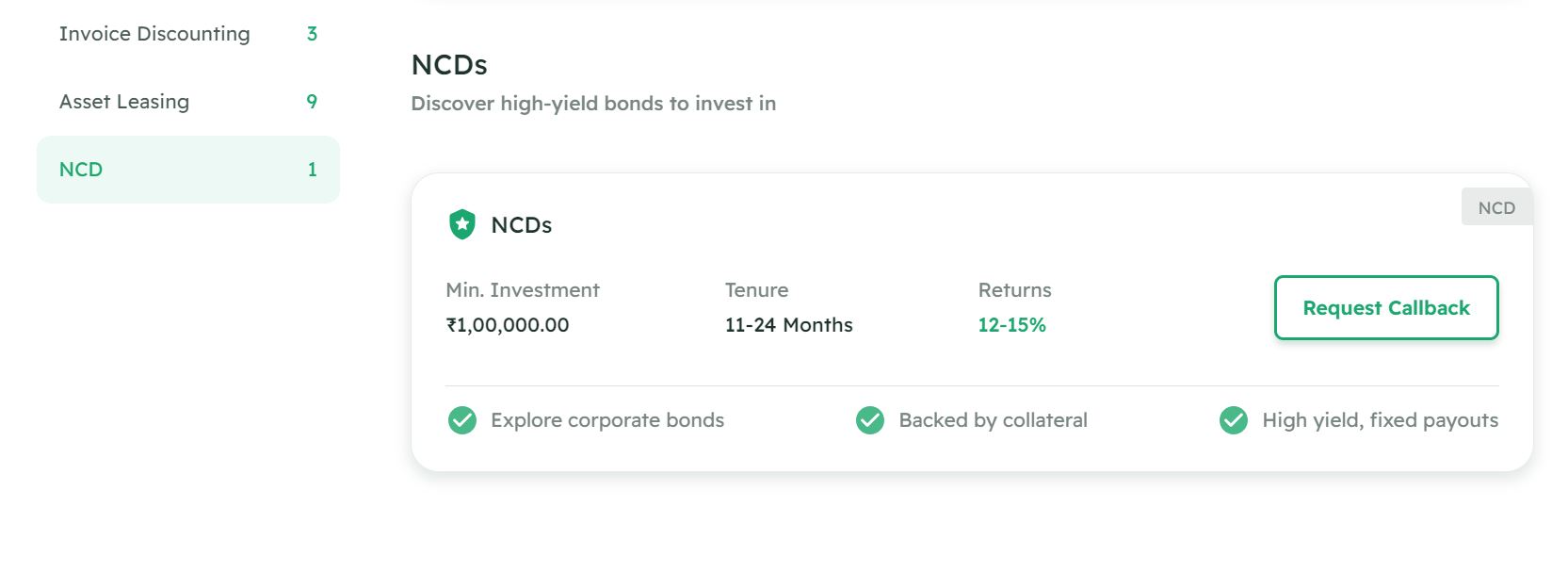

- High Yield NCd

Potential Risk Factors

Like any other investments, investments with Leafround are also not completely risk-free.

- The business leasing the equipment needs to make the monthly lease payments on time as mentioned in the agreement and the term sheet.

- Details mentioned in the deal are as per the information shared by the business.

- There might be platform risk- since Leafround is an important mediator between the business and the investor, there might be problems recovering money or disposing of assets if Leafround shuts down.

How to register & invest with Leafround?

- Click Here to register as an investor on Leafround (you can also use code RANDOMDIMES while registering)

- Once signed up and your account verified, complete KYC online using PAN.

- Check available deals, select the deal of your choice, and invest!

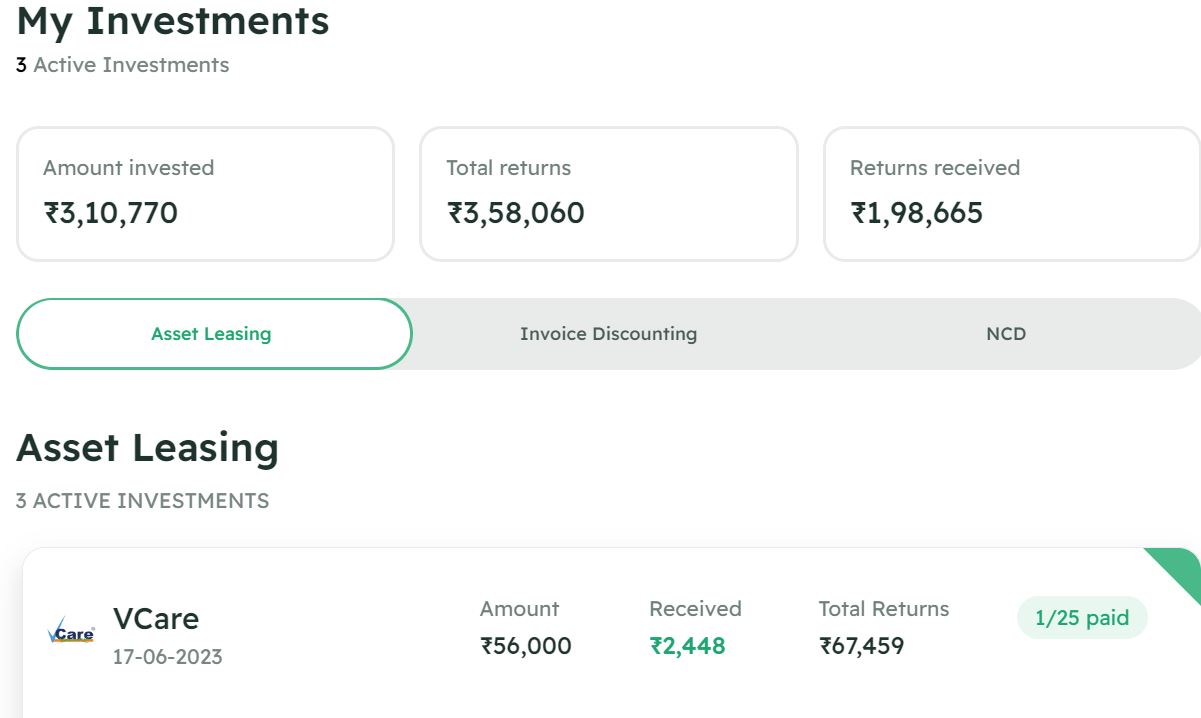

- Track your investments & returns via their dashboard.

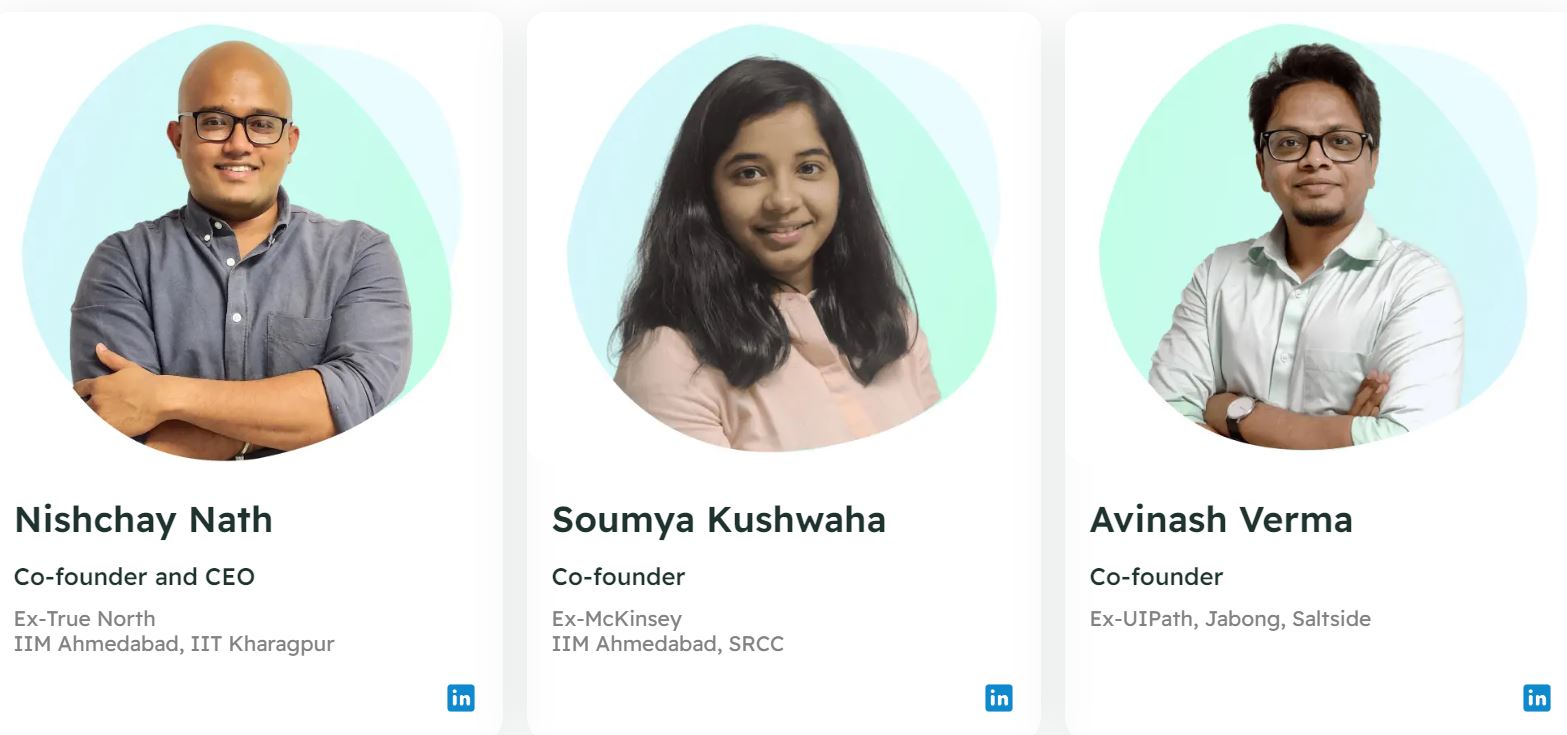

Leafround Founding Team

Leafround was founded by Nishchay Nath, Soumya Kushwaha, and Avinash Verma. All of them have studied at premier institutes and have worked with leading names like True North, McKinsey, etc. Apart from the founders, the remaining team is also highly experienced in their respective domains.

Leafround Funding

Leafround has raised a pre-seed round of $300K from micro VC firm Upsparks, Superb Capital, and senior business leaders from McKinsey, Bain, Barclays, and Adobe. The company intends to use this funding to build a robust product, improve awareness, and hire the right people.

Features of Leaf Round

1. Invest in Robust assets with Low Minimum Ticket

As the platform does due diligence on each deal, you can have confidence in the listed assets on Leaf Round. The Leaf Round team analyses the assets’ business models and offerings before listing them on the forum. All the assets have lower risks because they are tested before listing, and you can buy these assets and earn a steady income from them.

Once the asset is listed on the platform, you can invest in the particular investment. But you must be eligible for funding and should be above 18 years of age and have a PAN Card and an AADHAR card. You can check details about the product in the description, such as monthly rent, the company’s past performance, and current demand, and you can inquire about the asset. The minimum investment amount on Leaf Round is as low as INR 5,000, so you can pay and enjoy monthly returns.

2. Monthly Returns

Typically in all the investment options, you have to wait a few times to earn interest and get the principal amount. But with Leaf Round, you can expect to receive your returns in one month. And once you invest in an asset class, you receive rent every month on the 20th. The best thing is that the amount is credited directly to your bank account, so you do not have to withdraw these funds manually.

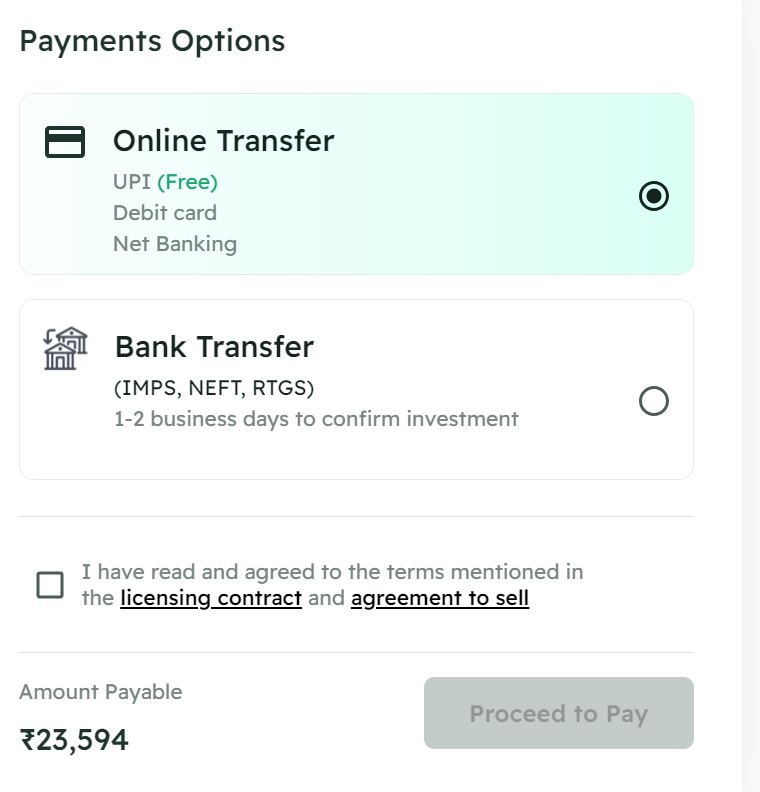

3. Easy-to-Use Platform

In many cases, people are not sure about using the platform and whether they will be able to invest themselves. But Leaf Round removes this barrier by providing an easy-to-use platform to log in with your account and pick up a suitable deal. Here, you can select the mode of payment, such as bank transfer and UPI.

4. Buyback of the Assets

Leaf Round includes a buyback date when the company will buy the assets. In this way, you get extra safety because, along with the rent, you also get the depreciated value of the investment. But you should keep in mind that there can be discrepancies in such offers because buybacks are the deals set in the future which means the outcome is not pre-determined, and the value can be changed significantly based on the market conditions.

5. Transparent Platform

The platform provides you with complete transparency by giving insights about the assets. You can easily access all the information about the asset class before investing, including details about the assets, buyback details, depreciation cost, etc.

6. Thorough Reports

Once you start investing through Leaf Round, you can see the reports in the section, such as total returns, invested amount, and details related to your assets. It also provides information on the investment’s maturity and the future rent you will be earning.

7. Invoice Discounting and NCD

Leafround offers NCD and invoice discounting also which are debt instruments and have tenors ranging from 1 month to 36 months and can offer upto 17% IRR on invested capital

How Does Leaf Round Stand Out Among Its Competitors?

One of Leaf Round’s close competitors is Grip Invest, which offers similar services to investors but does not offer a minimum investment amount of less than INR 10,000. On the other hand, Leaf Round allows you to invest a minimum of INR 5,000. Moreover, Leaf Round also provides an in-depth analysis of your investments, future payments, and events not provided by Grip Invest, which makes it different from the competitors.

Should You Invest Through Leaf Round?

You should keep in mind the following points before investing through Leaf Round:

- Leaf Round makes a risk sheet with more than 70 financial and non-financial metrics that help analyze the business model.

- The platform regularly updates the risk sheet every three months to analyze the financials and operations of the listed companies. The team also screens the asset shown on the platform for its resale value, expected life, and other factors.

- To increase the chances of returns, all the details are supported by legal contracts that assist in securing the monthly rent, and if there are chances of failure of the asset, the Leaf Round team has an operational capacity through their partners to reclaim and liquidate the asset which reduces the risk of loss of capital of the investors.

How to Buy an Asset on Leaf Round?

You can make your investments easily on Leaf Rounds. You can follow the below-mentioned steps:

Step 1: You can make your account on the platform, or if you are already a user, log in using your login credentials.

Step 2: Once you sign up on the platform, you will be redirected to the dashboard where you can check your investments.

Step 3: You can complete any pending payments from this section also.

Step 4: Click ‘Deals’ if you want to invest.

Step 5: You can see all the deals available on Leaf Round, and the live button shows all the deals available for investment in real-time.

Step 6: Click on any of the deals to learn more about it, and you can read everything about the investment in this section, such as the working of the assets, its offerings, etc.

Step 7: Click ‘Investment details’ to proceed with the deal.

Step 8: You will be able to see the details of the deal on this page, from the IRR to the total returns and the period of the deal, and you will be able to read all the terms and conditions of the contract on this page.

Step 9: You can edit the number of assets from the ‘+’ button, but you cannot reduce it below a limit fixed by Leaf.

Step 10: Accept the statement and proceed to Pay’ once you analyze everything.

Step 11: You can pay using various payment options on the platform, select the suitable one and make the payment, and see the deal and the investment in your Dashboard.

Step 12: You can monitor your investment from the dashboard and earn monthly returns from Leaf Round.

Leafround Alternatives

Leafround is primarily in the business of equipment/asset leasing. There are already a few platforms in India that are into this segment- some dedicatedly to this segment whereas others offer different types of alternative investment options. Some of the alternatives are as follows:

-

Grip Invest

Grip Invest is a platform that lists equipment leasing, inventory-based financing, and commercial real estate investing deals on it. It has a constant flow of new deals and has been one of the pioneers in this space in India. The minimum amount to invest is Rs.10000 and you can get an average IRR of 12-15%+ depending on which deals you invest in.

-

Pyse

Pyse lets you invest in green and clean energy resources like solar panels and energy systems which are used to generate power that is sold to enterprises. They have some reputed clients like Tata Communications, Dmart, etc. The minimum investment is Rs.5000 and you can expect 10-12% post-tax IRR.

-

Jiraaf

This new but fast-growing alternative investment opportunity listing platform is backed by Sequoia and other popular angel investors. Apart from invoice discounting, corporate debt, and other instruments, it has equipment lease-based investment options on its platform. The minimum investment is slightly higher at Rs.100000 per deal but might vary depending on the deals.

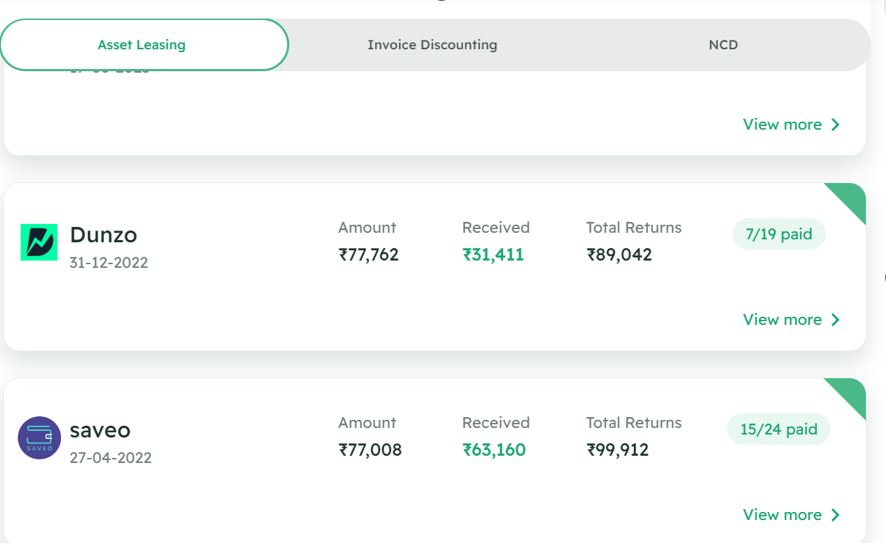

My Leafround 1 Year Investment Experience

I made my first investment more than 1 Year year back. The onboarding process and user experience were commendable. To date, I have invested in more than 8 assets and the performance has been as per my expectations. The returns have been over 15% on the portfolio.

Points to keep in Mind while Investing:

- Check the past performance of the listed deal

- Research details of the Issuer before investing

- Spread investment across multiple deals to avoid concentration risk

Conclusion

I hope you would have got a complete overview of the platform in this Leafround review. The platform seems to have a constant flow of good deals, the IRR is pretty decent (upwards of 20% for most deals) and the asset class is such that it is not too risky (since underlying assets back it). You are able to get Pre-tax returns, unlike on other platforms. The team is quite strong and seems to be well-qualified. Considering these factors, you can consider investing in this platform and allocate a small section of your portfolio to this asset class.

The platform is definitely promising and I have personally invested a part of my portfolio with them to test the platform.

FAQ on Leafround

- What is Leasing?

Leasing is a contractual agreement between two parties: the lessor (the owner of the asset) and the lessee (the user of the asset). Under a lease agreement, the lessor allows the lessee to use the asset for a specified period of time in exchange for regular payments, known as lease rent. The ownership of the asset remains with the lessor throughout the lease term.

For example, you could purchase laptops and lease them to Melorra through the Leaf Round platform. In this case, you would be the lessor and Melorra would be the lessee. You would own the laptops, but Melorra would be able to use them for a specified period of time in exchange for regular monthly payments.

Here are some of the benefits of leasing:

- It can be a more cost-effective way to acquire assets than buying them outright.

- It can provide businesses with flexibility, as they can lease assets for a specific period of time and then return them at the end of the lease term.

- It can help businesses to improve their cash flow, as they do not have to make a large upfront payment for the asset.

- Who owns assets in Leasing ?

Investors who purchase assets own them for a specified period of time, known as the tenure period. At the end of the tenure period, the assets are repurchased by the original owner or a new owner at a pre-agreed price. The Investor owns the assets in its individual capacity and directly leases it to the Company without any entity involved in between. No structure is required as there is no pooling of money.

- How does money flow work in Leafround?

After a successful payment for a deal by an investor, the money is collected in a collection escrow account, which is managed by a third party, Purple Petal Pvt Ltd. The money is then settled with the company or user of the asset. Rent is collected automatically through eNACH mandate from the company or user of the asset a few days before it is due to be paid to the investors or owners of the asset.

- What is Invoice Discounting?

Invoice discounting, also known as invoice financing, is a short-term financing option that allows businesses to borrow money against the value of their unpaid invoices. This can be a helpful way to improve cash flow and meet immediate financial needs.

To illustrate how invoice discounting works, let’s say a battery manufacturer sells its products to an automobile company. The manufacturer invoices the automobile company for the batteries, but the customer does not have to pay the invoice for 90 days. In the meantime, the battery manufacturer has already spent money to purchase materials and manufacture the batteries. This can tie up a significant amount of working capital.

If the battery manufacturer needs access to cash before the customer pays the invoice, it can approach a financing company that specializes in invoice discounting. The financing company will advance the battery manufacturer a percentage of the invoice amount, minus a fee. The battery manufacturer then pays the financing company back when the customer pays the invoice.

Leaf Round is a platform that allows investors to finance invoices through invoice discounting. This means that you can invest in the receivables of companies, such as the battery manufacturer in our example. When the customer pays the invoice, you earn interest on your investment.

Here are some of the benefits of invoice discounting:

- It can improve cash flow and help businesses meet immediate financial needs.

- It can free up working capital so that businesses can invest in growth.

- It can provide businesses with access to credit even if they have a poor credit history.

Hi,

TDS of 10% is been shown in the investment.

1) Do we get the amount into bank post 10% deduction on rent amount?

Hi Prakash, TDS is applicable only for investments where cashflow is more than INR 2.4 lakh per year. Excitel is an exception. So for most investment, there will be no TDS.

I came to know about 2 other sites which are in asset leasing and they are offering good returns

– rentnap (washingmachine,fridge,tv)

– exomobility (electric two/three wheelers)

Could you review about them?

Thanks

Hi Ananth, will explore these 2 companies in detail. For Exomobility I understand they deploy the leased bikes to their fleet. I feel that has a concentration risk and I would be wary of deploying a larger amount.

in leafround is it good to invest in prozo ?

Hi Subhrajeet, I have not invested in this deal. but Dunzo I had explored as it was a more known brand

Check how old the company is and its cashflow and wether making a profit or not. I have invested in prozo

I think Prozo raised INR 76 Crores in April 2022. I recently invested in Dunzo

sir, i am a student so if i get return from leafround then do i have to file itr and pay tax?

If your income is less than INR 2.5 Lakh no need to take benefit of depreciation etc as no tax

Like you said some leasing providing companies provide SPV which take care of taxation and this one doesn’t. What are advantages and disadvantages of that?

Hi Leafround use a direct ownership model where you actually buy assets and rent out. Hence you pay all the taxes but this means you get complete returns from the asset and can take benefit like depreciation and presumptive income declaration.

In LLP the tax is directly paid by the LLP and you do not pay any taxes but overall yields are lower and is also unfavourable for people in low income tax regime.

LLP can be beneficial when asset size is large as direct ownership is not possible