2 Year Review of my Investment on Grip Invest, which I started in 2020 when I was one of the first investors on the platform. Over a period of time, I have invested in multiple deals and also know people who have done the same. The platform has since then done close to 50 deals. I have added Grip Invest (get early access benefits using the link ) with my other alternative investment portfolio

Leasing Finance is one of the unexplored territories for retail investors though it is a very basic form of investment. Ancient clay tablets from 2000 B.C. Sumer records the leasing of farm implements. Ancient Phoenicians leased ships using very specific residual assumptions, thus making equipment leasing the world’s oldest form of finance. Banking, in contrast, began during the Roman Empire in about 700 B.C., and compound interest did not exist as a concept until well into the second millennium.

Today, all types of personal property can be leased, including equipment used in transportation, manufacturing, mining, and medical applications, as well as software and even intellectual property and artwork. And where would commercial real estate be without leasing?

My Article on What is Grip Invest?

What is Grip Invest?

Grip Invest BonusGrip is an online investment platform that prioritizes the needs of its investors and leverages technology to provide a seamless investing experience. The platform is committed to offering risk-adjusted investment options that are diversified and not solely tied to the stock market. This approach to investing enables Grip to help investors, regardless of their investment size, create wealth through non-traditional investment opportunities.

What is Alternative Investment Fund (AIF)?

An alternative Investment Fund is a privately pooled fund different from conventional investment options. These funds collect funds from investors, including Indians and foreigners, for investing. These funds invest in financial instruments other than stocks, bonds, or cash. Venture capital, private equity, or hedge funds are included in AIFs. These investment options are non-market linked.

How is Grip Different from AIF?

Alternative Investment Funds (AIFs) have three categories, each of which has different regulations. Typically, AIFs require a minimum investment of Rs. 1 Crore, making it difficult for retail investors to enter this investment option. But Grip allows retail investors to invest in startups with a small investment size.

Who regulates Grip?

Some opportunities in Grip come under the Companies Act only. Other opportunities like venture capital and Real estate come under SEBI.These investment options come under Category-1 of alternative investment license. They are governed by the Securities and Exchange Board of India (SEBI), which includes start-up equity financing and commercial real estate lease products. The provisions govern other lease financing products under the Companies Act. Bonds are regulated by SEBI and RBI.

Recently grip has changed its structure and all the listed opportunities are regulated by SEBI

How does Grip Invest Work?

Grip Invest is a marketplace that provides lease financing and asset rentals to retail investors. It generates rental income from users who lease its assets, which may include a fleet of cars, medical equipment, furniture, or pre-leased commercial real estate. Although Grip owns the assets, the financial investment is made in the name of investors who earn an income from the lease. Grip offers various lease-backed investment products with different durations – short-term (5-6 months), medium-term (12-24 months), or long-term (5 years or more). If the lessee fails to deliver the agreed rental, Grip can sell the asset to recover money for its investors.

Grip also allows retail investors to invest in start-up equity financing through its online platform, with a minimum ticket size of Rs. 20,000.

Investors earn money through rental income generated from Grip’s assets, which is distributed among them. The annualized pretax income ranges from 11% to 22%, depending on the type of lease and tenure. For instance, leasing three-wheeler vehicles can yield up to 20-22% annualized returns. Each deal is closed at different times, and returns are paid out on a monthly basis, with the first return being received in 30-45 days. The return may be taxed at the marginal income tax rate applicable to investors. Grip retains 1-3% of rental income as its own income, with the remaining income passed on to investors. Investors, both residents, and NRIs, must complete their KYC formalities before investing

Pros of Grip Invest:

- Registered Users: Grip has grown to 2.5 lakh users and manages investments worth over Rs. 500 Crores in two years.

- Regulatory Bodies: Grip is governed by regulatory bodies, and the platform is official.

- Personal Details: Personal data such as PAN and Aadhar are safe with Grip.

- Simple Process: Creating an account and making your first investment is very easy in Grip.

- Regular Interest: Investors can earn interest every month through the investment options available in the app.

- Non-Market Linked: The USP of Grip Invest is that the investments are not linked to the stock market, which is a great way to diversify your portfolio.

- Best Returns: Grip Invest selects companies ideal for providing good returns to investors. Moreover, Grip Invest takes 7.5%- 15% of the lease in the form of a security deposit from the companies.

Cons of Grip Invest:

- Less Awareness: In India, people are not very much aware of non-market linked investment options, and there are chances that you invest in assets you don’t have complete knowledge of.

- Lock-In Period: You cannot withdraw money before the maturity of the product as there is no liquidity.

- Risk Involved: Investors may lose their money if the company to whom the asset is leased defaults and assets can’t be monetized.

- Investing in Startups: Investing in startups can be risky sometimes, and the ROI can be between 50%- 100%, but sometimes you may get around 8% returns. Moreover, there is no guarantee of investment for returns.

Who should invest with Gripinvest?

Grip allows retail investors with a minimum investment of Rs. 10,000 for leasing or inventory-based products. Leases have a tenure of 2-3 years, while inventory has a tenure of 6 months. Commercial Real Estate provides quarterly returns but requires a minimum investment of Rs. 1,00,000. However, investors must understand all the risks involved with the assets, do complete research before investing, and remember never to put all your eggs in one basket.

Investment Options Available on Gripinvest

- Corporate Bonds:

- These are the instruments through which the companies raise debts from investors.

- The bond issuer provides periodic interest payments and the principal amount on maturity in exchange for the investment amount.

- The returns are higher than Fixed Deposits and vary from company to company.

2. Leases:

- It is a contractual agreement calling for the lessee (user) to pay the lessor (owner) regular payments in exchange for using an asset over a fixed period. Some investments, such as vehicles, furniture, and equipment, are leased.

- Companies use these assets to scale faster. As a result, it has a pre-tax IRR of 19-21%.

3. Inventory Finance:

- Companies maintain an inventory of raw materials and finished goods as a part of their production cycle.

- With Inventory Finance, companies can raise capital against their inventories, and the investors receive fixed returns as the inventory is sold.

- It has a Pre- Tax Yield of 10-12%

4. Startup Equity:

- You can be a shareholder in a VC-backed, early-age startup.

- Grip has tied up with registered AIFs to avail of startup equity investing. You can invest in niches such as Electric Mobility, Furniture, Consumer Electronics etc.

5. Commercial Real Estate:

- You can invest in Commercial Properties for as low as Rs. 1,00,000.

- You can get a 12-13% Pre- pre-tax Internal Rate of Return (IRR).

Is Grip Invest Safe?

My 3 Year of experience has been excellent in terms of performance. The IRR has been north of 12% post-tax without any delay. My overall experience can be captured through.

- My Personal Grip Invest 2-year review

- Details of My Grip Invest Portfolio

My Personal Grip Invest 3-year Review

I started investing in 2020 when it was just launched and have completed 3 years. I have been happy with the way they have navigated macroeconomic challenges and the risks they managed.

Assets

Equipment Leasing Deals with assets such as Ebikes, Charging Station, Kitchen Racks, Water purifiers, Embroidery machines, home decor, Ambulance

Tenor

Monthly Payment with a maturity of 21-36 Months. Few deals have Liquidity after the lockdown period

Partner Details

Fast-growing companies in B2B and B2C space.Most companies with a recent round of funding.

Deal Frequency/Structure and Size

The deal is structured as an LLP which means that the investor does not have to pay any tax on the cash flow. Almost Every week new deals with minimum tickets between INR 20k to INR 50K.Sometimes combo deals with multiple assets are also available.

Risk Management

What is the most stable investment? Basically, something that can provide consistent cash flow with limited risk. How does Grip Invest manage risk?

- Comprehensive due diligence at the time of onboarding the partner involves getting comfort on the liquidity, promoter, industry analysis, credit profile, and marquee investors amongst other things.

- Security measures to protect against the risk like escrow mechanism, the charge on revenue, upfront security deposit, PDCs, etc.

- Evaluation of the business performance of our partners on a monthly basis as we take monthly updates from them. Also, the Portfolio exposure is into fast-growing industries with known brands, a strong client base, and relatively low risk amongst several other factors.

Funding

It secured its first round of equity funding in a round led by Anicut Angel Fund with participation from Gemba Capital and well-known angel investors such as Anupam Mittal, Sunjay Kapur, and Maninder Gulati.

Grip Invest raised Rs 21 crore Series A funding round led by Venture Highway and Endiya Partners in 2021

Details of My Grip Invest Portfolio

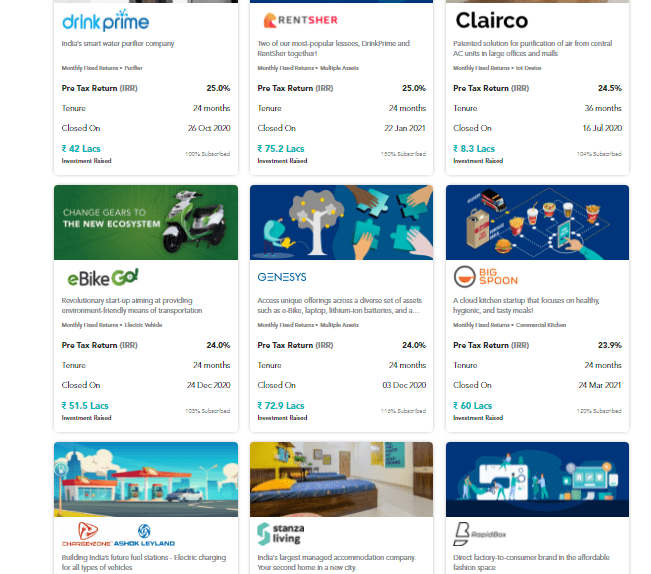

GripInvest BonusAll my deals are performing as expected. Currently zero delinquency /delay. Some of the top deals Invested by me and my friends were

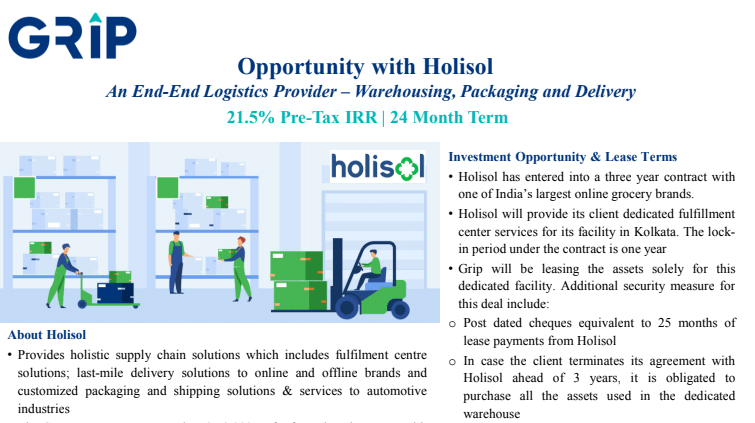

Holisol

The opportunity involves leasing out storage racks, steel frames, and IT equipment to the company on a lease

Charge+Zone

Funds procured under leasing transactions were used to deploy charging stations and power infrastructure for Ashok Leyland

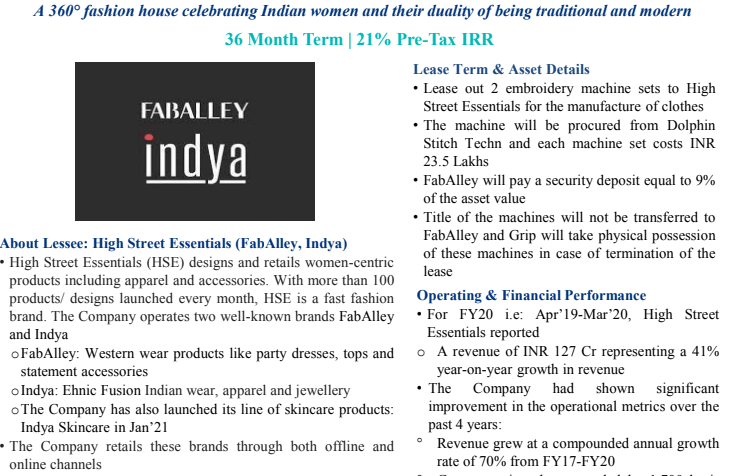

Fab Alley

Embroidery machine set for manufacturing of clothes

Furlenco

The Investment was for leasing Home Decor and Home appliances to Furlenco

How to Invest in Grip Invest?

To start, add a MaxButton via the Block Settings on the right.

I follow the below points to analyze investment opportunities with Grip Invest

- Google information about the brand; like the latest funding, promoters, growth prospects

- Check the financials to see if it has adequate liquidity, good cashflows, and an uptrend in growth.

- Prefer B2B deals and shorter tenor investment

- If you are investing from an account with a lower tax rate, you can choose to invest INR 2.5 Lakhs and get a pre-tax return directly.

Conclusion

My 3-year experience has been good with all cash flow on time. Of course, the risk is higher than bank FD but considering the return, it is worth putting a small part of your portfolio. You can check out monthly portfolio reviews on randomdimes.com. They have now created SEBI-regulated products which adds a lot of comfort in the fact that they have long-term vision.

Frequently Asked Questions FAQ on GRIP

- Who can Invest in GripInvest?

Grip provides investment options for individuals who are at least 18 years of age and possess a valid PAN and Aadhaar card. These investment options offer benefits such as a 20%+ IRR, pre-agreed rental income, and ownership of the asset. Before listing investment options, Grip follows strict due diligence and risk mitigation processes. However, investors should be aware that returns are not guaranteed and exercise discretion when investing.

- Can NRI Invest in GRIP?

Yes NRI can invest in GRIP from the NRO account. While they are able to accept investment amounts from NRO accounts, they are currently unable to receive investments from NRE accounts due to distinct compliance obligations from RBI. Nonetheless, they plan to extend our services in the future, which would allow them to receive investments from either account.

- What is the minimum amount for investment in Grip?

GRIP allows one to invest from INR 20,000 however each asset class may have a different minimum requirement which would be highlighted in asset details

- How are the investments taxed in Grip?

Investors in leasing transactions via Grip become partners in a Limited Liability Partnership (LLP). Any person who earns income/profit by being a partner in an LLP is required to file ITR-3. .

- What is LeaseX on Grip Invest?

LeaseX is an investment opportunity for lease financing that takes the form of a Securitized Debt Instrument (SDI). This fixed-income instrument is designed to be traded and issued in accordance with SEBI regulations. Grip offers lease rentals backed SDIs through LeaseX, which are rated by credit rating agencies and listed on the National Stock Exchange (NSE) in a dematerialized form. Investors receive fixed monthly payouts linked to rental payments made by either a single or a diverse pool of leasing partners. To minimize risk, all cash flows are managed by a SEBI-registered trust that employs an escrow mechanism to protect receivables. Additionally, the rentals are supported by a bank guarantee.

I would like to challenge the basic premise of this article as it is misleading investors. Any retunr received (principle + interest) is treated as salary earned by investor (treated as partner in LLP) for pre tax deals. as a result, one will lose principle if you fall in 30% tax bracket. Would like to be challenged but initial understanding basis annual tax document shared by Grip + clarification provided by relationship manager suggest this.

Hi Amit,

I agree the Pre taxation issue I had to face recently. As 90% of my exposure on GRip was post tax it dint bother much.

Now GRIPinvest has changed the structure and made it a listed product rather than LLP.

For pre tax investment I feel Leafround is better as they bifurcate between Principal and Interest and tax is paid only on interest.

https://randomdimes.com/leafround-review-lease-equipments-and-earn-upto-25-irr/

do you still invest with grip? As you mentioned, with the changed structure do you still find the returns favourable?

Hi Gautam,

Yes I do invest on Grip, If you are in 30% tax bracket the new structure has no impact. Post tax returns are higher. Also i like the securitization product as it is embedded diversification !