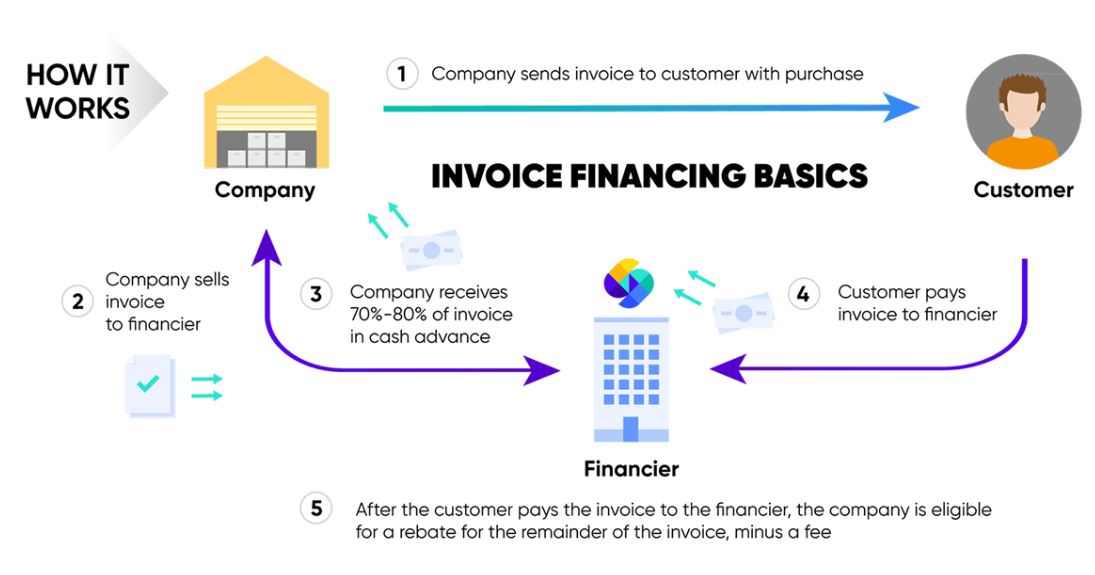

What is invoice discounting?

Invoice discounting is a type of financing that allows businesses to access cash quickly by using unpaid invoices as collateral to avail loan from a third-party investor. The investor will then collect the full amount of the invoice from the customer on the due date, and the business will receive a percentage of the invoice amount as a cash advance.

Purpose of invoice discounting

Invoice discounting can be used to:

- Improve cash flow: By discounting their unpaid invoices, businesses can get the cash they need to pay their bills and expenses on time, which can improve their cash flow and credit score.

- Grow their business: Invoice discounting can free up capital that businesses can use to invest in growth, such as hiring new employees, expanding into new markets, or developing new products or services.

- Meet unexpected expenses: Invoice discounting can provide businesses with a quick source of cash to cover unexpected expenses, such as a natural disaster or a lawsuit.

Example of invoice discounting

XYZ Ltd., a leading manufacturer of widgets, has entered into an invoice discounting arrangement with a receivable financing company to improve its cash flow. Under this arrangement, XYZ Ltd. can sell its unpaid invoices to the receivable financing company for a cash advance of up to 75% of the invoice amount.

For example, if XYZ Ltd. invoices a customer for Rs.100,000, it can use the invoice for an advance of Rs.75,000. XYZ Ltd. will upload the invoice to the receivable financing company’s online portal, and the receivable financing company will collect the full amount of the invoice from the customer on the due date. XYZ Ltd. will then receive the remaining Rs.25,000 from the receivable financing company, minus a small fee.

This arrangement allows XYZ Ltd. to access cash quickly and easily, without having to wait for its customers to pay their invoices. This can be helpful for XYZ Ltd. to meet its expenses and grow its business.

Here is how the invoice discounting process works for XYZ Ltd.:

- XYZ Ltd. invoices a customer for Rs.100,000.

- XYZ Ltd. Use to invoice to take an advance of Rs.75,000 from discounting platform.

- XYZ Ltd. uploads the invoice to the invoice financing company’s online portal.

- The discounting financing company collects the full amount of the invoice from the customer on the due date.

- The discounting financing company sends XYZ Ltd. Rs.25,000, minus a small fee.

The invoice discounting arrangement with the receivable financing company has helped XYZ Ltd. to improve its cash flow and grow its business. This arrangement has also allowed XYZ Ltd. to free up capital that it can use to invest in new products and services.

Benefits of invoice discounting

Invoice discounting offers several benefits for businesses, including:

- Quick access to cash: Invoice discounting can provide businesses with a quick source of cash, which can be essential for meeting urgent financial needs.

- Improved cash flow: By selling their unpaid invoices, businesses can improve their cash flow and credit score. This can make it easier for them to obtain loans and other forms of financing in the future.

- Increased flexibility: Invoice discounting gives businesses more flexibility to manage their cash flow. They can sell invoices as needed to get the cash they need, without having to take out a loan or line of credit.

- Reduced risk: Invoice discounting can help businesses to reduce their risk of bad debts. If the customer does not pay the invoice, the factor will bear the loss.

The benefits of invoice discounting investment for investors

Invoice discounting investment offers a number of benefits for investors, including:

- Attractive returns: Invoice discounting investment can offer attractive returns of 10-20% per annum. This is significantly higher than the returns that investors can typically earn from traditional investments such as fixed deposits and bonds.

- Relatively low risk: The risk of invoice discounting investment is relatively low. This is because the factor bears the risk of the customer defaulting on the invoice. If the customer does not pay the invoice, the factor will bear the loss, not the investor.

- Easy to access: Invoice discounting investment is easy to access. Investors can invest in invoices through online platforms, such as KredX and TradeCred.

- Flexibility: Investors can invest in invoices of different sizes and maturities. This gives investors the flexibility to choose the invoices that they are most comfortable with.

The drawbacks of invoice discounting investment for investors

There are a few drawbacks to invoice discounting investment that investors should be aware of, including:

- Illiquidity: Invoice discounting investment is illiquid. This means that investors may have difficulty selling their investments if they need to access their capital quickly.

- Risk of fraud: There is a risk of fraud in invoice discounting investments. This is because the invoices are sold to investors without being verified by a third party. Investors should only invest in invoices through reputable platforms that have a good track record of fraud prevention.

- Tax implications: Investors should be aware of the tax implications of invoice discounting investment. In India, the interest income earned from invoice discounting investment is taxable as income from other sources.

Is Invoice discounting investment right for you?

Invoice discounting investment can be a good option for investors who are looking for attractive returns with relatively low risk. However, it is important to weigh the benefits and drawbacks of invoice discounting investment before deciding if it is the right option for you. If you are considering invoice discounting investment, you should make sure that you understand the risks involved and that you are comfortable with the illiquidity of the investment.

Best Invoice Discounting Platforms in India

Below is a list of invoice discounting platforms that are available for retail investors to invest. We have used all these platforms and our review is based on actual experience putting our money in these platforms –

Leafround

Leafround is a marketplace run by 2 IIM A alumnus, that connects businesses looking to raise capital and investors who want to invest money and earn regular monthly interest. The platform allows investors in India to invest in invoice discounting. The platforms currently offer Invoice discounting, Asset Leasing and Bonds. The duration of the invoice is from 30 days to 90 days. The minimum ticket starts from INR 20,000.

Features of Leafround

- Easy to use: The invoice discounting process on Leaf Round is simple and easy to use.

- Transparent: Investors can see the details of the invoices they are investing in, including the creditworthiness of the business, the amount of the invoice, and the maturity date.

- Attractive returns: Investors can earn attractive returns of 10-20% per annum.

- Reliable: Leaf Round has been operating since 2021 and has a good track record of providing businesses with access to cash and investors with attractive returns.

- Minimum investment amount: The minimum investment amount on Leaf Round is Rs.50,000.

- Investment duration: The investment duration on Leaf Round is typically short, ranging from 30 to 90 days. This makes it a good option for investors who are looking for short-term investments.

Returns: 11-20% IRR

Detailed Review of the Platform

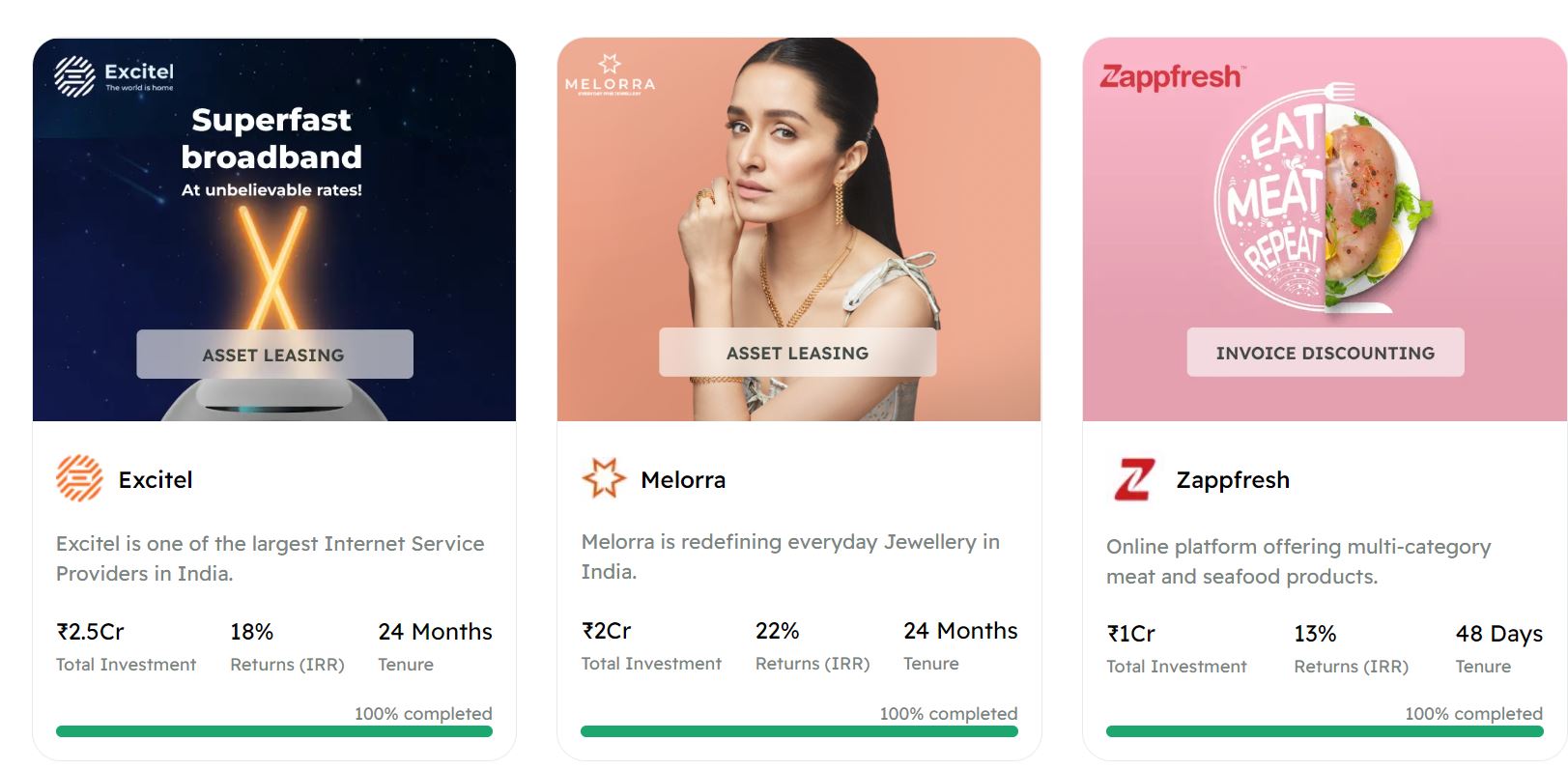

Jiraaf

Jiraaf is an alternative investment platform that allows investors to invest in high-yield fixed-income opportunities that go beyond equities, fixed deposits, real estate, and gold. It was founded in 2021 by Saurav Ghosh and Vineet Agarwal, two investment professionals with decades of experience in corporate finance and real estate, respectively.

Jiraaf offers a variety of investment opportunities, including:

- Invoice discounting: This is a type of financing that allows businesses to access cash quickly by selling their unpaid invoices to a third party, called a factor. Jiraaf partners with leading receivable financing companies to provide investors with the opportunity to invest in invoices from a variety of businesses

- Asset-backed lending: This is a type of financing that allows businesses to access cash by using their assets as collateral. Jiraaf partners with leading asset-backed lenders to provide investors with the opportunity to invest in asset-backed loans.

- Venture debt: This is a type of financing that provides capital to early-stage businesses. Jiraaf partners with leading venture debt funds to provide investors with the opportunity to invest in venture debt.

Jiraaf has already raised over $7.5 million in funding from leading investors, including Accel Partners, Mankekar Family Office, and Aspire Family Office.

Features of Jiraaf

- High yields: Jiraaf offers high yields of 10-20% per annum.

- Diversified portfolio: Jiraaf offers a diversified portfolio of investment opportunities, which can help to reduce risk.

- Investment minimum: The investment minimum on Jiraaf is Rs.100,000, which is relatively low.

- Transparent platform: Jiraaf is a transparent platform that provides investors with detailed information about investment opportunities.

Returns: 10-19% IRR

Detailed Review of the Platform

Tradecred

TradeCred is an invoice discounting platform that allows businesses to access cash quickly and easily by borrowing against their unpaid invoices from investors. It was founded in 2017 by Hardik Shah and Amit Nanavati, two investment professionals with over 10 years of experience in the financial services industry.

Features of Tradecred

- Zero Defaults: The platform boasts of zero defaults to date which highlight the robust credit underwriting followed by Tradecred.

- Instant Liquidity: It offers the option of instant liquidity where the investor can liquidate their investment with a 2-day notice.

- Investment Minimum – Tradecred allows people to invest starting from INR 50,000 making it attractive for retail investors.

Returns – 10-12% IRR

Detailed Review of the Platform

Gripinvest

Grip is a digital investment platform that uses tech-driven methods to provide a smooth investing experience to investors of all kinds. The platform was founded by Nikhil Aggarwal who is a seasoned entrepreneur. The platform has innovative investment products such as invoice discounting, leasing, and bonds. The USP of the platform is that all products are listed on an exchange and are rated by credit agencies. The platform is regulated by SEBI.

Features of Gripinvest

- Diversification: Invoices are pooled together and investors can invest in more than 20 invoices through one investment making it secure.

- Regulated: The platform offers listed and regulated products

- Customer Support – Whatsapp group created by the founder where he himself addresses queries.

Returns – 10-18% IRR

Detailed Review of the Platform

Lendpartnerz

Lend Partnerz is an invoice discounting platform that helps investors earn handsome returns of around 15-18% by investing in the discounting of invoices. The platform uses AI and ML to verify and check the background and repayment capability of vendors who list invoices for discounts on their platform.

The core team of Lend Partnerz includes Shashank Lunkad, Mohit Kokil, and Kshitij Lunkad. They are the CEO, CTO, and legal adviser of the company, respectively. All of them have years of experience in finance and their respective domains. The team also has the backing of several entrepreneurs, and banking and finance experts as their advisors.

Features of Lendpartnerz

- High Yield: Interest rates of up to 16% are offered on some invoice deals

- Strong Companies: The invoices are listed for many blue chip companies making it low risk

- AI analytics: The platform uses analytics to shortlist the vendors

Returns – 12-16% IRR

Detailed Review of the Platform

Kredx

KredX terms itself as a supply chain financing solution provider. For companies and small businesses, it provides financing and cash flow management including Buy Now Pay Later (BNPL Service) for B2B payments, invoice discounting, import-export financing, etc. They have very recently launched KredX Cashback Card in partnership with ICICI Bank for vendor payments which gives cashback/rewards on vendor payments.

KredX started in the year 2015 and has been adding quite a few products for both investors and businesses over the years. The KredX team comprises founders & team members with years of experience in banking, financing, etc. KredX backers include Sequoia, Tiger Global, and Prime Venture Partners.

Features of Kredx

- Deal Volume: Kredx has the maximum number of invoices listed on the platform hence offers a lot of choices for investor

- High Minimum Size: Minimum ticket of INR 3 Lakh is high for many investors

- Oldest Platform: Kredx is in business for the last 8 years and has the most experience in invoice discounting

Returns – 11-13% IRR

Detailed Review of the Platform

Other Invoice Discounting Platforms

We have not covered a few platforms which we feel do not have much credibility or seem very risky such as falconsgrup and invoicetrades

Some platforms which allow investments only to institutions are also not covered. Some of these platforms are

- Flexi loans

- M1xhange

- RXIL

- Invoicemart

Conclusion

Invoice discounting investment is a relatively new investment option in India, but it is growing in popularity. Investors who invest in invoice discounting can earn attractive returns with relatively low risk. However, it is important to weigh the benefits and drawbacks of invoice discounting investment before deciding if it is the right option for you. We prefer to split our capital across different platforms to reduce risk and to choose the best available options for investment. we provide a monthly review of the portfolio and platform on our website randomdimes.com

Sir,

Your have not included leasify in this?

Are you not investing in this after receiving returns on your first investment.

I have only one deal in Leasify. The payout will be around 20th Aug. I dint cover leasify because they have dont have any invoice discounting deals.

I have been investing in this asset class for the last 6 years with TradeCred, Jiraaf and Leafround. There have been no defaults but delays have ranged from 1-14 days.

There is a difference in the way invoice discounting deals are structured among these platforms as per the invoice discounting agreement signed between the investor and the platform.

In TradeCred (TC), the customer (end user) directly credits the payable on the due date in the escrow account maintained by TC. The Borrower has no control over this escrow a/c and the proceeds are distributed by TC to respective investors.

In Jiraaf and Leafround, the customer credits the Borrower on the due date and the Borrower thereafter deposits the monies in the escrow a/c of the platform which distributes it to respective investors.

The Borrower has control over the cashflows received from the customer and may divert it for their liquidity needs/cashflow mismatch in case of Jiraaf and Leafround. Therefore, no comfort can be drawn from the financial & operational credibility of the customer. The investor has to take a call/draw comfort on the Borrower and not the customer.

The security structure of TC is much better than other platforms since they take FD margin, charge on receivables/current assets of Borrower, PG of promoters in certain cases in addition to PDC/UDC which is an unsecured instrument.

However, better payment security mechanisms and security structures have a bearing on pricing and the same deal on Jiraaf may be priced 100-150 bps higher than on TC.

I have also witnessed a lot of fresh invoices of the same Borrower/customer listed on the platform just prior to maturity of a previous invoice which indicates a semblance of debt rollover by the Borrower. In a lot of cases, the Borrower and the Customer are the same, thereby suggesting that the Borrower is directly raising its working capital through the platform and the invoice in question may or may not exist.

Also, in certain cases, the same Borrower might be a Customer for another deal and is helping its vendors/suppliers with access to working capital through the same platform. Supply chain finance working at its best.

This asset class has evolved from high barrier to entry to ease of entry/granularity. Earlier the min. ticket size was 3 lacs which is now 50k-95 k and can even go as low as 10k to attract retail investors who may not understand the credible risk associated with defaults.

I remember the defaults KredX encountered listing invoices raised on customers like Cox & Kings, Future Enterprises in late 2018 when these companies themselves were defaulting with their lenders. There might be contractual disputes between the Borrower and the Customer which can lead to a default such as in the case of BNH Infra in 2019 where Tata Projects was the Customer. Again, the platform was Kredx.

It is important to note that invoice discounting does not involve the time value of money principle with regard to financial debt. Only rights of the Borrower with regard to collection of the invoice are transferred to the investor and no debt is recorded in the books of the Borrower. Hence, investors of this asset class are classified as operational creditors and not financial creditors under IBC. This has been adjudicated by NCLT and NCLAT in several cases involving KredX more recently in the BNH Infra matter in May’23.

The platform has a lot of responsibility to protect investor interest but I think they are probably guided by VCs/lofty valuations to generate more business which may impact their credit decisions and deal structures.

There is also potential conflict of interest/poor governance when invoices of Aris Infra are listed on Jiraaf given that the promoters of Aris Infra is an angel investor in Jiraaf. Let’s Transport is also a similar case in point. Grip Invest goes even further to list their equity round on their platform itself.

An investor should carefully examine the underlying risk associated with the Borrower, Customer and the platform and review the security structure and payment security contour. I believe this asset class should revert to high entry barriers as the avg investor lured with lower ticket sizes may not appreciate the risk associated with the asset class.

All excellent points and fair analysis of invoice discounting platforms in India

I have highlighted these points to the platform too. They said they would be implementing escrow structure in the future to make process more robust. It is best to stick to few borrowers with good history and financials

I also agree to the point that invoice discounting makes more sense for people who have decent networth as minimum ticket is high ,most people do not understand it properly and even if one deal goes bust , a small investor wont have much cushion.

There have been defaults in Kredx in past and is essential that people do not just go by platform rating but do thorough due diligence of deals.

Thanks for taking up the escrow structure with the platforms and sharing the feedback.

You also mentioned asset leasing while reviewing the invoice discounting platforms since most if not all platforms offer asset leasing.

I think asset leasing deals which have an elongated tenor of 18-36 months and cater primarily to early stage startups (Seed to Series B) have a higher risk than invoice discounting deals due to the following reasons:

1. Ability of the business model to deploy equipment’s/assets and generate sufficient cashflows. There could be instances where the demand for the asset has fallen or the product is no longer preferred by the market over such a long tenor.

2. In case demand/cashflow generation is not the issue, then collection efficiency plays an important role from sensitivity point of view to establish debt servicing.

3. Ability of the startup to raise growth capital and maintain going concern status given the early stage business may not be cashflow positive or max. CM 2 positive.

4. Typically, the assets under finance are sold on WDV basis and are charged to the platform. In case the Borrower is unable to pay, then the platform can enforce their security interest and liquidate the assets.

The platforms do not disclose the security cover on the NPV of future receivables vis-a-vis the fund raise and also the security cover on the asset under finance, i.e. whether liquidation/fire sale of the asset is sufficient to repay the investor. Enforcement of security interest and taking possession of the assets under SARFAESI/extant laws is another challenge.

I believe that the IRRs on asset leasing may be a bit misleading since the monthly payout is assumed to be deployed in an asset class yielding similar returns. In certain cases, the IRR is hugely dependent on the buy back of the asset by the Borrower with 70% of the principal being rear ended/balloned at the fag end of the tenor

The going concern status of the platform is also a concern but can still be mitigated, however the robustness and agility of the business model becomes a key sensitivity in evaluating an asset leasing deal as well as the ability of the platform to closely monitor operations and take coercive actions to protect investor interest.

I have so far desisted from long term asset leasing given the aforesaid concerns. I had invested in Furlenco and Rentmojo on TradeCred in 2020-21 but the deal tenor was 6-9 months.

Dear Ashish,

I think most of the points raised by you are fair. I guess the most important factor which is critical for asset leasing is the quality of asset and its secondary market value else it becomes almost like unsecured lending and this higher risk than invoice discounting due to higher tenor.

A simple example , say a firm is being leased a furniture, the liquidation value of asset depends on actual quality of asset in case things go wrong. We all know the value of furniture is totally dependent on the wood and can be either sold for scrap or at decent value. Hence it is paramount that these platforms do thorough analysis of these assets.

Another benefit of a robust asset is that it can be leased to another company incase required.

I also try to avoid assets which I do not understand .

Very detailed view and thanks for sharing your findings. Really helpful while evaluating the platforms.

Thanks Pavan for the kind words!

Can you aware of Incred Money for MLD`s platform

Please some information regarding this alternative investment platform.

I will be reviewing the deal and platform next week . Thanks

what are your views on Tyke I D deals, they have low ticket deals.?

Hi,

I find some of the vendors on Tyke Invoice discounting quite risk (HR agency etc) hence I have avoided investing till now.

“Hence, investors of this asset class are classified as operational creditors and not financial creditors under IBC. This has been adjudicated by NCLT and NCLAT in several cases involving KredX more recently in the BNH Infra matter in May’23.”

What are the implications? Does this mean the investors can’t recover the money in case of bankruptcy?

Hi Pavan,

Invoice investors are operational creditors means they cannot be part of committee of creditors that decide the resolution process and cannot cast their vote .

Their seniority is after these debtors and above equity holders.

I feel most of these vendors are small and if someone defaults due to complete loss they won’t even have sufficient assets that can be monetized , hence the best bet is to have a moderate exposure and due diligence right at the start of the enterprise not just the vendor.