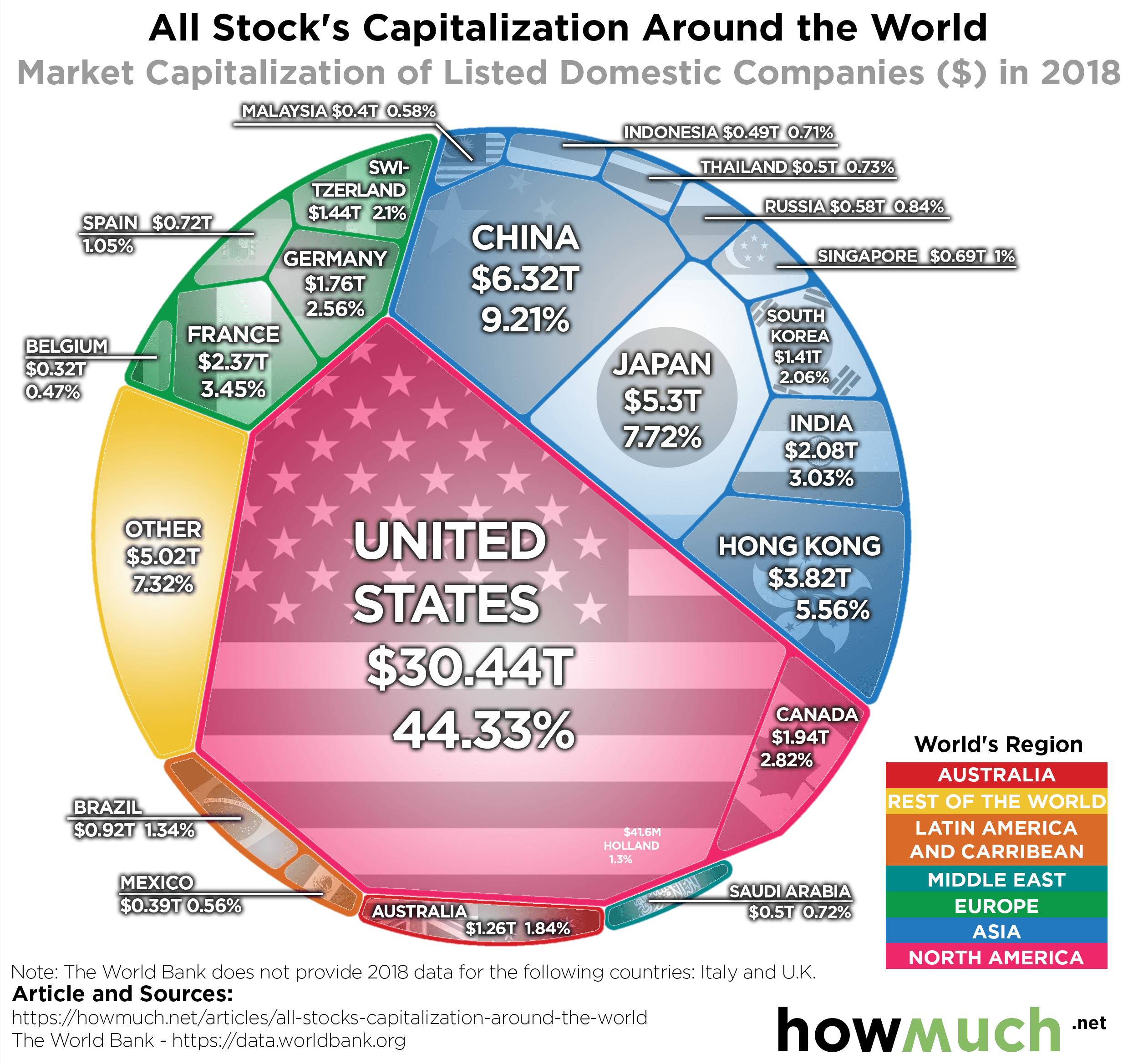

India’s equity market may be large for us but if we compare it to global markets it’s a small part of the pie. Investors across the world are participating in the global equity market through International ETF.

Global Equity Exchange Traded Funds (ETFs) are investment vehicles that allow domestic investors to gain exposure to international indices. These ETFs can be bought and sold continuously at market prices on the National Stock Exchange’s cash market, just like any other form of the corporate stock.

ETFs are passive investment vehicles that invest in securities in the same proportion as the underlying index and are based on indices. An ETF’s holdings are completely transparent due to its index mirroring property. Furthermore, due to their unique structure and creation mechanism, ETFs have much lower expense ratios as compared to mutual funds.

ETFs, or exchange-traded funds investing in international stocks, have seen increased investor interest recently since the Securities and Exchange Board of India stopped mutual funds from investing in overseas stocks in February.

Why choose International ETF in India?

Exchange-traded funds (ETFs) that are globally oriented offer an easy way to geographically diversify a portfolio. Investors looking for exposure to the global recovery should consider ETFs that invest in companies from a broad range of countries, considering the numerous benefits of building a globally diversified portfolio for every Indian investor. International investment also helps to reduce the risk of future domestic instability or turmoil which can be seen in countries like Srilanka and Argentina. Moreover, some of the largest and most innovative companies are listed in the US, and having exposure to them can benefit the investor.

In India, most International ETFs are mostly fund-of-funds (FoFs) that take money from Indian investors and invest in ETFs listed on foreign exchanges.

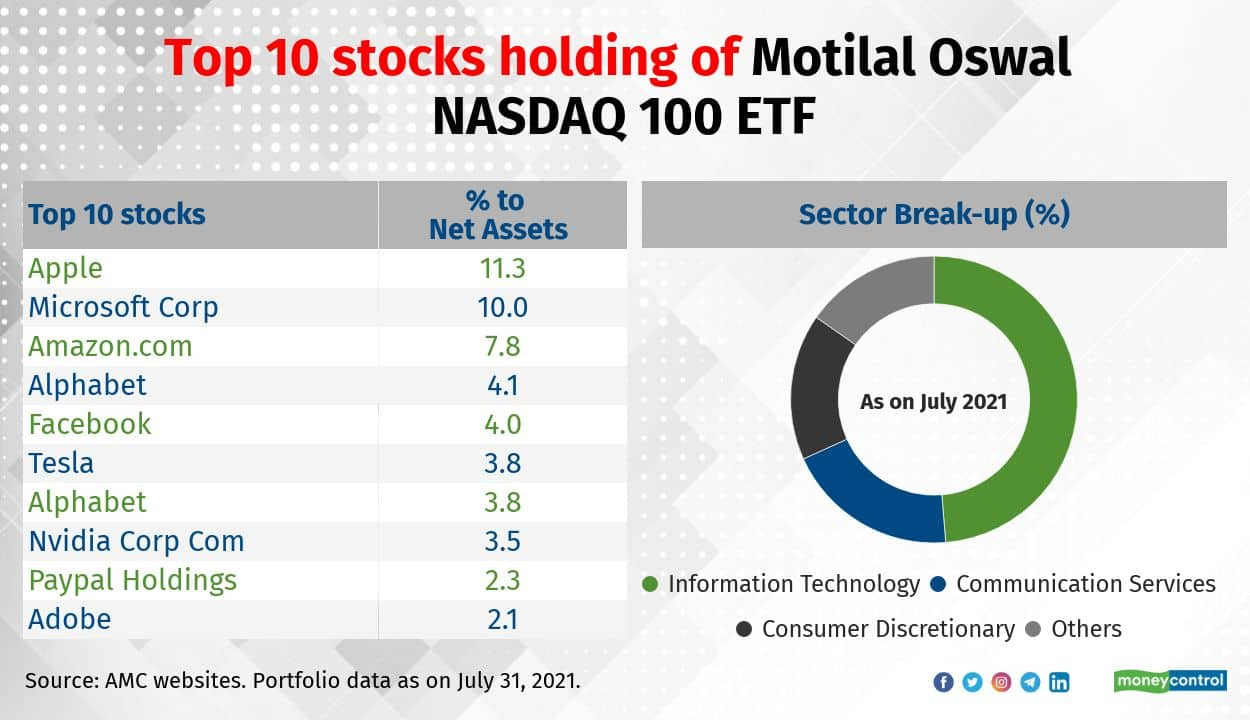

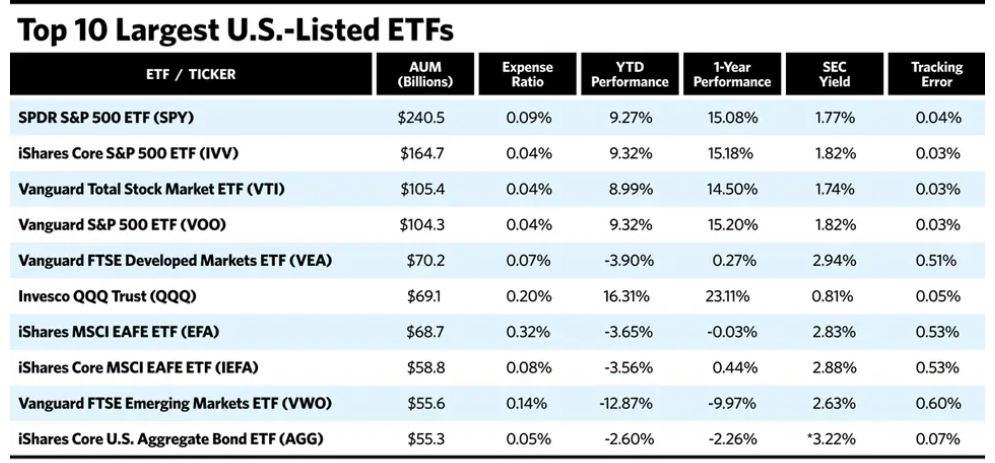

Most ETF FoFs open for a subscription right now invest in the Nasdaq 100 index, an index focused on tech stocks. Ideally, you should invest in a broader index like the S&P 100 or S&P 500. Only Navi currently offers FoF that invests in the Vanguard Total Stock Market ETF and Nasdaq 100, which gives exposure to more than 4,000 stocks.

Additionally, investors may purchase shares of foreign ETFs managed by Indian fund houses. They offer ETFs to Indian investors and directly purchase foreign stocks. These funds include the Motilal Oswal S&P 500 Index Fund and the Mirae Asset NYSE FANG+ ETF.

Exchange-traded funds (ETFs) that are globally oriented offer an easy way to geographically diversify a portfolio. Investors looking for exposure to the global recovery should consider ETFs that invest in companies from a broad range of different countries, considering the numerous benefits of building a globally diversified portfolio for every Indian investor.

How can Indian investors buy global ETFs from India?

Unlike mutual funds, ETF units are traded on the stock exchange during trading hours. So, one can buy and sell ETF units the way one buys stocks at any time when the exchanges are open. ETF trading is open to anyone with a Demat account at any brokerage firm. There are several ETFs available that allow access to the Nasdaq and other leading global indices.

After opening an international brokerage account in accordance with the RBI’s LRS requirements, and when the accounts are set up, you can buy US stocks or ETFs across sectors and themes to diversify your domestic portfolio from anywhere in India.

You can open a foreign broker account in India on apps like Stockal, Vested Finance, and Winvesta, amongst others.

Vested

Vested is one of the first platforms to offer international stock investments. There is no transaction fees for purchasing stocks and ETFs. They also provide access to Over the counter (OTC) deals that are not available in other platforms. Eg- BTC trust Grayscale offering

Stockal

Stockal is another platform that can boast a great range of international ETFs. The platform has good customer support and a hassle-free USD transfer process.

Winvesta

The salient feature of Winvesta is that it has a multi-currency account along with a foreign brokerage account which means that you can use winvesta to manage your other international investments and outflows

Detailed comparison of top International stock investing platforms – Fees and Performance of Top international platforms

TOP INTERNATIONAL ETFs IN INDIA ONE CAN INVEST IN

SPDR Portfolio Developed World(SPDW)

SPDW, a large-cap fund that tracks the S&P Developed which focuses almost exclusively on developed countries outside of the United States, measures the index as market-capitalization-weighted. SPDW is one of the cheapest global investing ETFs available.

SPY is the best-known and oldest ETF and typically tops the rankings for the largest AUM and greatest trading volumes. It tracks the S&P 500 Index. Microsoft, Apple, Amazon, JPMorgan, Facebook, and Alphabet (Google) are some of the biggest companies in the Index. The annual expense ratio of SPY is only 0.10%.

iShares Core MSCI ETF (IXUS)

IXUS tracks the MSCI ACWI ex USA IMI index, a developed international index with emerging companies spanning the market capitalization spectrum. Financials, industrials, and information technology (IT) stocks are the largest portions of the portfolio. The fund’s holdings are well-distributed geographically. In a single fund, the ETF offers a way to access both emerging and developed markets. Investors who don’t want to complicate their portfolio by buying several ex-U.S. funds might want to concentrate on IXUS.

Vanguard FTSE Emerging Markets ETF (VWO)

VWO, a large cap fund follows the FTSE Emerging Markets All Cap China A Inclusion Index. Companies in emerging markets are included in the market capitalization-weighted index. The cheapest broad-based emerging markets fund, VWO is one of the world’s biggest and most liquid ETFs and invests in countries like Brazil, China, South Africa, and Taiwan. Together with SPDW above, it provides broad exposure to global security while minimizing costs.

Vanguard BND ETF

This provides broad exposure to US investment-grade, cost-efficient bonds. This may be an ideal ETF for diversifying the risks of stocks in a portfolio and providing a reliable long-term USD income stream. Investors looking to add bonds to their portfolio for risk reduction can use the BND ETF. The annual expense ratio of Vanguard BND ETF is only 0.035%.

GLD SPDR ETF (GOLD)

GLD offers investors an innovative, relatively cost-efficient, and secure way to access the gold market and diversify any portfolio. The SPDR® Gold Shares, which debuted on the New York Stock Exchange in November 2004 and have been traded on NYSE Arca since December 13, 2007, is the world’s largest physically backed gold exchange-traded fund (ETF). With extremely tight bids and offers and a modest annual expense ratio of 0.40%, this is the most efficient way to invest in gold for Indian investors. This can also provide the benefit of dollar appreciation against the rupee along with gold returns.

Honorable Mentions:

QQQ Powershares ETF

QQQ tracks the NASDAQ 100, which provides access to innovative companies like Microsoft, Google, Tesla, Starbucks, Netflix, eBay, and Intel. Because of its heavy weighting in technology stocks, QQQ has outperformed SPY in 9 of the last 10 years (2010-2019). The QQQ has an annual expense ratio of 0.20%.

EWU iShares ETF

EWU keeps track of the MSCI United Kingdom Index, which gives users access to big and medium-sized businesses in the UK. It also provides diversification from technology and an attractive GBP dividend yield of 4.40%. The annual expense ratio is 0.47%. If the UK is a possible educational destination for your family, this ETF needs consideration in your portfolio.

Conclusion

Internation ETF investing in India is gradually becoming popular. It offers a great way to reduce country-specific risk and participate in the world economy. However one must factor in the cost and fees associated with these platforms before getting started. The amount of investment should justify the FX transaction fees. Investors who are looking for smaller investments should focus on Indian-listed International ETFs and mutual funds with global allocation.

You missed adding Vanguard Total Markets ETFs which you can invest via Navi Fund of Fund.

Hi Shravan,

I have mentioned Vanguard Total market FOF . Another fund that I can add is Nasdaq 100 Navi FOF.