The RBI has introduced Floating Rate Bonds in 2020 for a tenure of seven years, popularly known as the RBI 7.15% Bonds, in place of the previous RBI Savings Bonds in 2018 that offered a 7.75% interest rate and were informally called RBI 7.75% Bonds. The new bonds are called floating-rate bonds as the interest rate on these bonds resets every six months.

The RBI Floating Rate Bond interest rate is linked to the prevailing interest rate of the National Savings Certificate (NSC). The NSC rate of interest plus 0.35 percent is used to calculate the interest rate of the RBI Floating Rate Bond. As the current NSC interest rate is 6.8%, the RBI floating rate bond interest rate will be computed as 6.8% + 0.35% = 7.15%. Every six months, the interest is directly attributable and serves as a reliable source of income. However, the government can reset the interest rate after each interest payment.

In the future, if the NSC interest rate increases and decreases, it would affect the RBI Savings Bond interest rate too. All future interest payments would be based only on the reset interest rates, even if one invests now.

Since these are issued by the RBI on behalf of the Government of India, they have a sovereign guarantee, making them a completely risk-free investment option.

Key Features of RBI Floating Rate Bonds

- Eligibility: i) Individual Resident ii) HUF

- Investments: Minimum-Rs 1,000. Maximum-No limit and to be done in Demat form only.

- Entry age: There is no minimum entry age. In the case of minors, floating rate bonds can be purchased by their parents or legal guardians.

- Interest: The RBI Floating Rate Savings Bond interest rate applicable is 7.15% ( paid half-yearly in intervals of Jan. 01 and July 01 every year).

- Nomination: Facilities are available. However, these bonds are not transferable to others and are not tradeable.

- Tenure: 7 years

- Account-holding categories: i) Individual ii) Joint iii) Minor through a guardian.

- Premature Withdrawals: There is no exit option from these bonds before maturity. However, there is some relaxation for senior citizens who buy these bonds: Investors aged between 60 and 70 may encash the bonds after six years. Those aged between 70 and 80 years may do so after five years, and those aged over 80 years may encash their bond after four years.

- Capital and inflation protection: The capital in floating rate bonds is fully protected. Though, there is no inflation protection. Whenever inflation is above the latest interest rate, the deposit earns no real return. However, when inflation is below the current interest rate, it does manage a positive real rate of return.

- Liquidity: These bonds are not listed or traded, and loans cannot be taken against them. The bond is effectively locked in for a tenure of seven years. However, pre-mature encashment is only allowed for senior citizens after a minimum lock-in period, which varies from four to six years depending on the age bracket in which the senior citizen falls.

- Tax implications: These bonds’ interest is fully taxable. The principal investment is not subject to a deduction. These bonds’ interest payments are taxed similarly to other FD interests. This must be included under “Income from other sources,” and the appropriate interest must be paid in accordance with the tax bracket that applies to the individual.

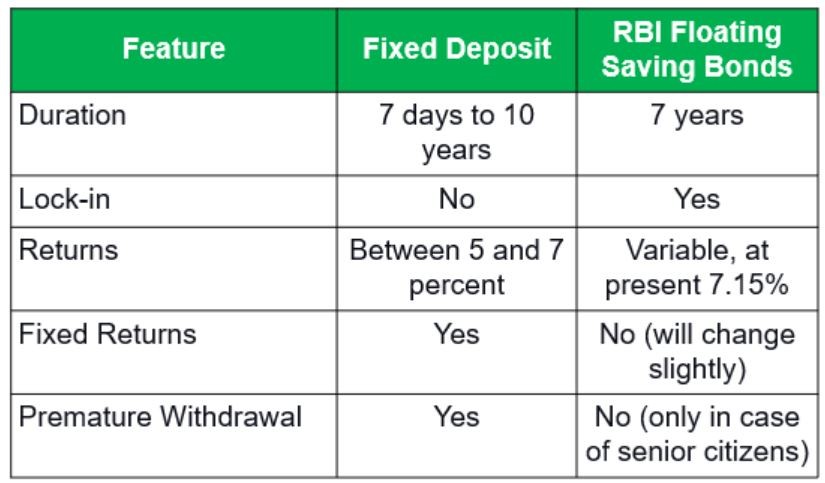

Alternatives to RBI Saving Bonds

- Debt Mutual Funds – Debt mutual funds have better taxation than RBI bonds for 3 years plus tenor but they carry much higher credit risk as well as interest rate risk!

- Bank fixed deposit – Bank fixed deposit can offer up to 7-7.5% for a period of 5-7 years. These carry a higher risk than RBI bonds

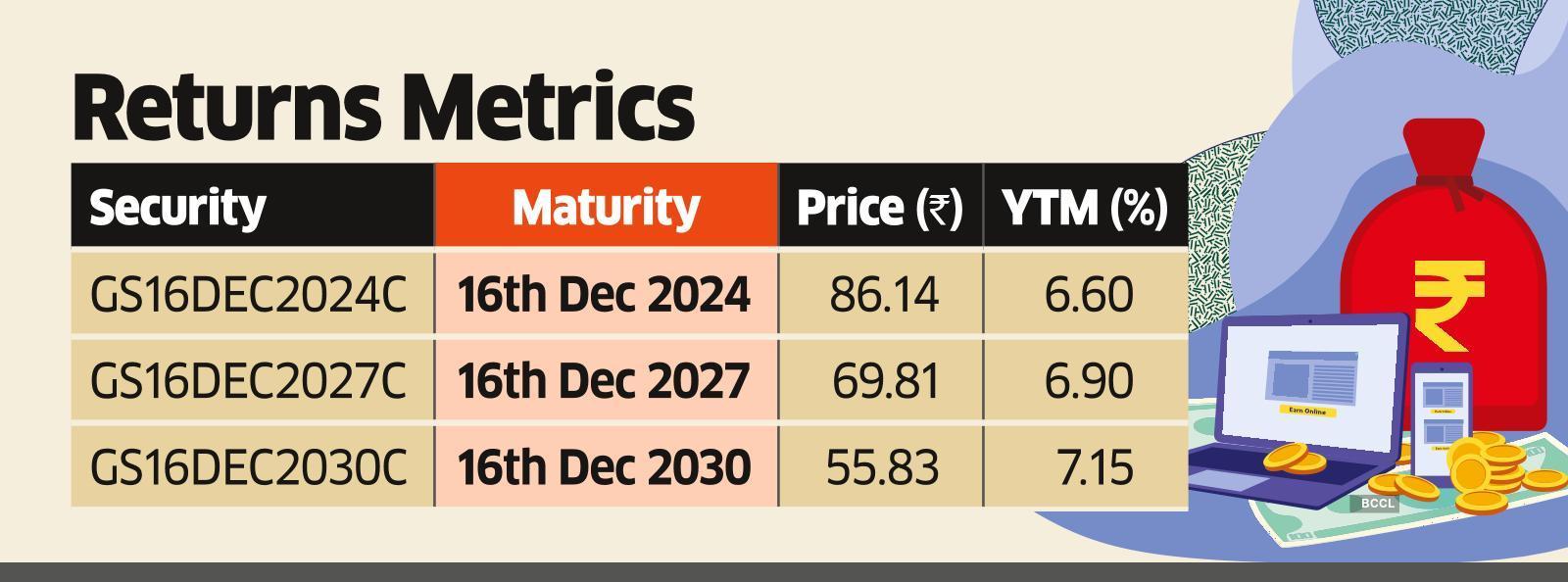

- Bonds – Bonds are available with interest rates ranging from 6% to 13% depending on credit risk and tenor. However one also needs to factor in duration risk while holding long-term bonds. Some Bond ETFs like Bharat Bond can also be considered

- Alternative Investment – Alternative Investments like High Yield Bonds, Leasing, Revenue Based Financing, etc give IRR over 20% but they come with default risks which one needs to understand before investing in them. You can look at the performance of top Alternative Investments before investing.

- STRIPS – STRIPS (Separate Trading of Registered Interest and Principal Securities) are created by separating a standard coupon-bearing bond into its individual coupon and principal components. G-Sec STRIPS lets investors hold and trade the individual interest and principal components of eligible government treasury notes and bonds as separate securities. These are safer than bank deposits.

Advantages of Investing in RBI Floating Rate Saving Bonds

The RBI floating rate savings bond offers a relatively high-interest rate of 7.15%. The interest income from the RBI bond is significantly higher when fixed deposit rates at banks fall below 6%. Additionally, it will always be 0.35% more profitable than its comparison standard, the NSC.

There are significant possible gains if interest rates rise. For example, if one invests in fixed-rate bonds and the interest rate for lending increases since the interest rate remains fixed, the overall estimated returns could decline. A floating-rate bond mitigates this interest rate risk as the interest rate keeps pace with the changing rates.

There are no default risks because this Government of India bond comes with a sovereign guarantee from the Union Government. Your investment is secure, especially compared to other corporate bonds.

Disadvantages of RBI Saving Bonds

Savings in floating rate bonds don’t completely protect against inflation.

While the interest rate is fixed, it will reset every 6 months. In the future, interest rates can always fall. Even if you were to invest today, all your future interest payments would depend on the interest rate announced in the future. Interest cannot be paid on a cumulative basis. Interest would be credited directly to the Demat account holder’s bank account and TDS would be deducted as per the prevailing tax laws while making the interest payment.

Premature withdrawals cannot be made by anyone other than senior citizens, and even they cannot withdraw before the lock-in period, even in case of any emergency.

These bonds are not tradeable, so one cannot sell them on the stock exchange even at a lower rate, making liquidity the main issue. These bonds are neither transferable nor eligible for collateral security with banks or financial institutions.

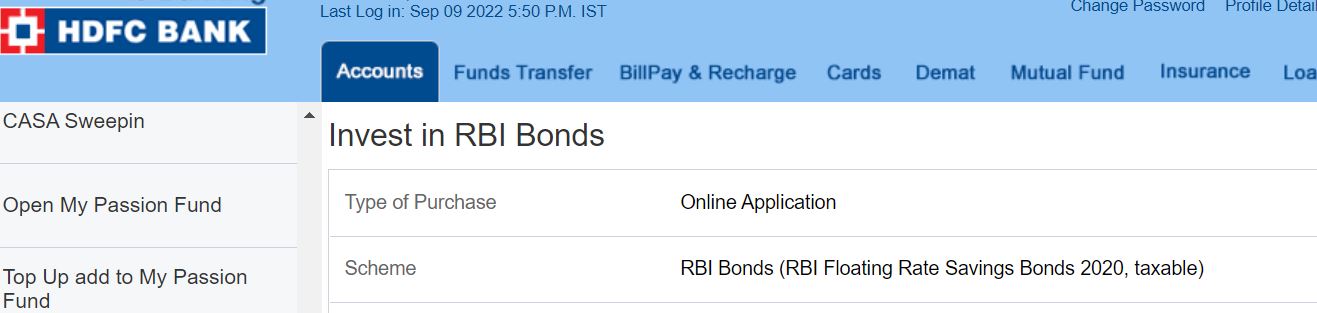

How to invest in RBI Floating Rate Savings Bonds 2022?

These RBI floating rate savings bonds are available to any resident of India. Online investments are available in cash, demand drafts, and checks. These bonds are available in Demat form for holding. They can even be purchased from the branches of SBI, other nationalized banks, and any other bank specified by the RBI.

If you want to invest in these bonds online, you can do so by following these steps.

1) Log in to your Demat account.

2) Navigate to the Bonds/FD tab.

3) Select “RBI Floating Rate Savings Bonds”.

4) Enter the amount of money you wish to invest.

5) Use UPI/NEFT to transfer funds.

6) Complete the transaction.

These bonds would be issued into your Demat account within a week.

Final RBI Floating Rate Savings Bonds Review

RBI floating rate bonds from the RBI can be a valuable addition to your investment mix. These savings bonds are issued by the government of India and are 100% safe investments.

RBI bonds provide a fixed income for 7 years and are a considerable low-risk investment with increasing potential to bring in higher returns. Though the interest rate can reset, one can get a fixed income every 6 months. Banks currently offer FDs with interest rates ranging from 5% to 6%. Hence, the RBI bonds with a high-interest rate of 7.15% are definitely more beneficial.

Unlike some other bonds where there is a maximum investment limit, the RBI bond does not have any maximum limit. Investors have the freedom to invest any amount they wish. An individual can invest as little as Rs 1,000 and get a fixed income.

The RBI Floating Rate Bond has some drawbacks, like the liquidity issue that it is not tradeable and premature withdrawal cannot be done. Investors should weigh out all these pointers before investing in RBI-saving bonds.