Have you ever taken a home loan or a vehicle loan. Do you know that your lender can sell your loan to a different entity? This is called securitization.

Securitisation helps get funds to companies so they can lend more. It also helps investors earn returns. So, it expands credit access for things like houses while giving people returns on investment.

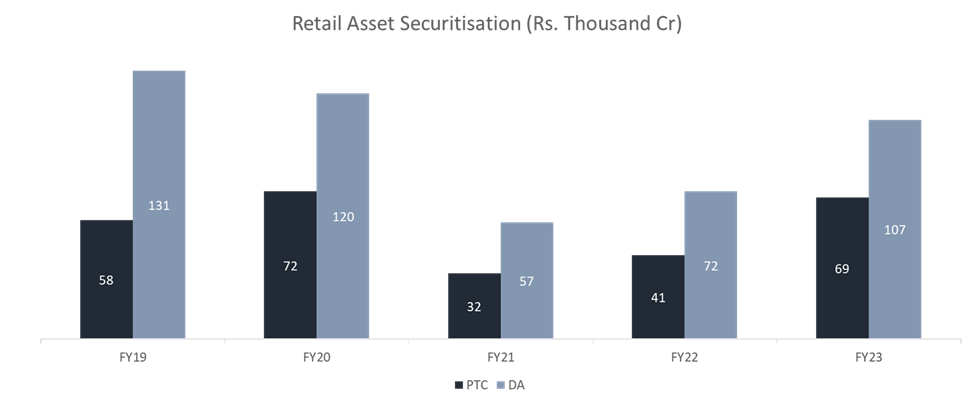

Securitisation is growing fast in India. It reached 1.8 lakh crore rupees in 2023. This article explains securitisation in simple terms. We discuss why it matters in India. And how it can boost lending and financial access. Understanding securitisation gives you a better view of India’s credit markets.

What is Securitisation?

Securitisation is when loans are bundled together and sold to investors as securities.

- Let’s say a bank gives out 100 home loans of Rs 10 lakhs each. That’s Rs 1000 crores of loans.

- The bank puts all these loans together into one big bundle or pool. Then, it sells this pool to investors as a security, like a bond.

- The investors who buy this security can earn interest as the loan borrowers repay every month. The bank gets money now to give out new loans.

- So, securitisation turns illiquid loans into tradable securities. This generates capital so the bank can lend more. It also gives investors a fixed income.

That’s securitisation in simple terms! Pooling loans, selling them as securities, funding more lending and returns for investors.

History Of Securitisation In India

Securitisation began to gain traction in India during the early 1990s, primarily to provide financial companies with a means to privately sell their loan portfolios. It wasn’t until 1996 that securitisation activities really took off, and from that point onwards, the volumes involved in securitisation transactions grew substantially year after year. This period of growth continued until approximately 2005.

In 2006, the Reserve Bank of India (RBI) introduced a set of stringent guidelines that imposed specific rules regarding the capital relief offered to banks through Pass Through Certificate (PTC) transactions.

Consequently, after these 2006 guidelines were implemented, banks became less inclined to use the PTC route for securitisation. As a result, the volumes of securitisation conducted through PTCs saw a significant reduction compared to the levels observed in 2005. This shift in preference marked a notable change in the securitisation landscape in India.

Securitisation Growth in India

As of the end of March 2022, India’s external debt reached US$ 620.7 billion. This marked a notable increase of US$ 47.1 billion compared to its level at the end of March 2021 when it was at US$ 570 billion. Additionally, it had experienced a previous increase of US$ 11.6 billion over its level at the end of March 2020.

These figures reflect the significant scale and growth of securitisation in the financial market.

What’s Behind the Recent Surge in India’s Securitization Market?

The securitization market in India has shown significant growth recently. In the first quarter of the financial year 2023-24, the volume of securitized assets increased by about 60% compared to the previous year, reaching INR 55,000 crore. This is the highest ever recorded for the first quarter of a financial year, as reported by CRISIL Ratings.

India’s securitization market faced challenges due to the COVID-19 pandemic but has made a strong recovery. It’s expected that the total volume of securitized assets in the financial year 2022-23 will be around INR 1.9 lakh crore, which is close to the levels seen before the pandemic. This growth indicates a robust turnaround in the securitization market in India.

What Are Securitization Debt Instruments (SDIs) and How Do They Work?

Imagine a bank or a mortgage lender that has given out many loans to different people. These loans represent promises from borrowers to repay the money they borrowed, along with some extra money (interest). Now, the bank or lender can take a whole bunch of these loans and bundle them together into a single package.

This bundle of loans is transformed into something known as “securitization debt instruments” (SDIs). These SDIs can be thought of as pieces of paper or digital records that say, “I own a part of all these loans in the bundle.” People, often investors, can buy these SDIs.

How It All Works

When you purchase one of these SDIs, you’re not just lending money to one person; instead, you’re essentially spreading the risk and reward across many loans. Here’s how it works:

- Shared Risk and Reward: By investing in SDIs, you become a part-owner of multiple loans. If the borrowers pay back their loans with interest, you receive a portion of that interest as your profit. This can be a source of income for you.

- Risk Factor: However, there’s a catch. Some loans in the bundle might be risky. If borrowers can’t repay their loans, you might end up losing some of your money. This is because the loans in the bundle carry different levels of risk.

- Example: Picture it like a group of friends coming together to make a pizza. Each friend chips in some money to buy the pizza ingredients. Together, they make the pizza. When the pizza is ready, they all share it. If the pizza is delicious and people are willing to pay for it, they all make money. But if the pizza isn’t popular and they can’t sell it, they might lose some of the money they initially put in to buy the ingredients.

In essence, securitization debt instruments allow you to spread your investments across multiple loans, which can be less risky than putting all your money into one loan. It’s a way for companies to get money from investors, and for investors, it’s a chance to potentially earn profits from these loans.

So, next time you hear about securitization debt instruments, remember that they share the risk and reward of many loans by turning them into tradable pieces that investors can buy. It’s a way for companies to get money from investors, and for investors to potentially make money from these loans.

Benefits of securitisation for issuers and investors

Below are the main benefits of securitisation for issuers and investors:

For issuers (like Non-Bank Financial Companies):

- Get money now to give new loans

- Move loans off the balance sheet

- Lower reserve requirements

- Reduce risk by passing loan defaults to investors

- Lower funding costs than deposits or debt

- Generate fee income by servicing the loans

For investors:

- Get fixed returns better than bank FD

- Diversification into loans not just bonds

- Access to retail borrowers difficult directly

- Secured against assets like houses, vehicles

- Can buy parts of bundles to limit risk

- Rating agencies assess security risk level

So issuers can lend more at lower costs. And investors get higher safe returns from retail loans. Securitisation expands options for both.

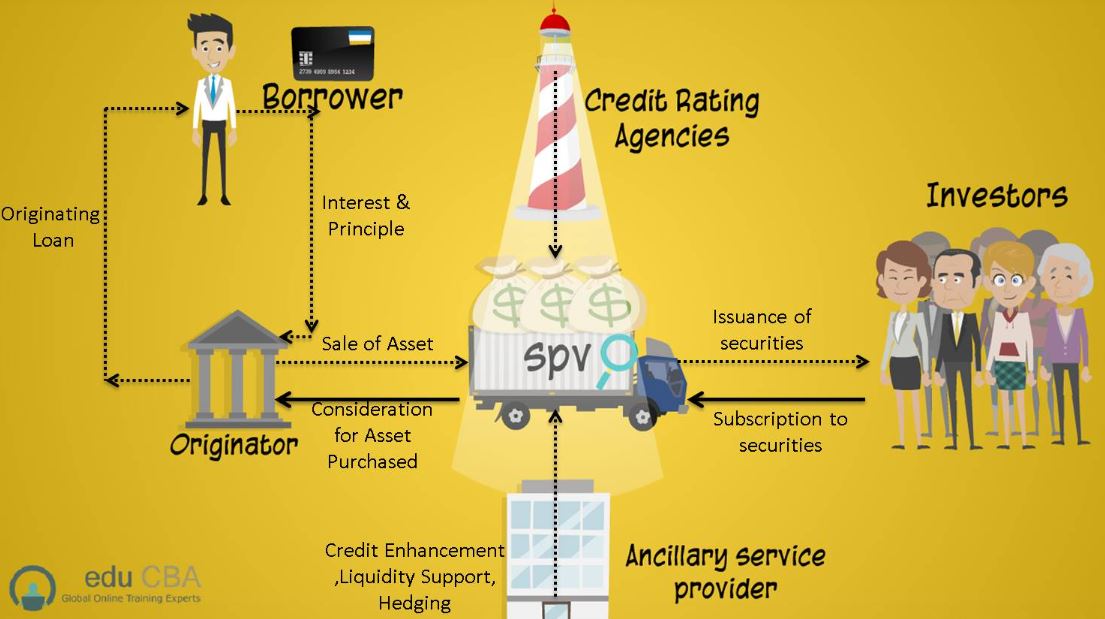

How does Securitisation work?

Here’s how it works:

Step 1: Pooling of Loans or Assets Let’s say a company has given out a lot of vehicle loans. They group these loans into something called a “pool.”

Step 2: Creating Securities The company then creates securities, often known as bonds or pass-through certificates. These securities represent a part of the loans in the pool.

Step 3: Selling to Investors The company sells these securities to investors. These investors could be individuals, other banks, or even big investment firms.

Step 4: Regular Payments Now, those who bought these securities start receiving regular payments from the borrowers who took the loans. These payments include the loan principal and interest.

Example: Let’s say you have a vehicle loan, and your monthly payment goes to the lender. If your loan is part of this securitisation process, your monthly payment goes to the investors who bought the securities. So, the money you pay on your loan doesn’t stay with the lender; it goes to the investors who own parts of your loan.

This process helps companies because they get cash to make more loans. It also benefits investors who earn money from the payments made by borrowers.

However, for this process to work well, borrowers must continue making their payments on time. If there are problems, like a lot of people missing their payments, it can lead to losses for investors. Therefore, securitisation works best when the economy is stable, and people can afford to repay their loans.

In India, securitisation has gained importance in the financial sector because it allows financial institutions to manage risks and make more credit available to people and businesses. It also provides an opportunity for investors to diversify their investments and earn returns.

How Does Securitisation Benefit Lenders, Investors, and the Economy?

Securitisation offers several benefits to lenders, investors, and the overall economy:

- For Lenders (Banks and Financial Institutions):

- Capital Release: When lenders securitize their loans, they can free up capital that was tied to those loans. This capital can then be used to make more loans, promoting further lending and growth.

- Risk Management: Lenders can transfer some of the risks associated with loans to investors. This helps them reduce their exposure to potential losses if borrowers default on their loans.

- Enhanced Liquidity: By selling loans as securities, lenders can quickly convert illiquid loans into tradable assets. This provides them with more liquidity and flexibility in their operations.

- For Investors:

- Diversification: Investors can buy securities backed by various loans, such as mortgages, auto loans, or credit card debt. This diversification reduces their risk by spreading their investments across different types of loans.

- Steady Income: Investors receive regular payments from the borrowers, including both principal and interest. This provides a steady income stream, which can be attractive, especially for those looking for reliable returns.

- Default Protection: Unlike bonds where default risk of issuer is there in securitisation SPV is bankruptcy remote hence even if the company defaults your investment is not impacted.

- For the Economy:

- Increased Credit Availability: Securitisation encourages more lending by freeing up capital for banks. This, in turn, makes credit more accessible to individuals and businesses, fostering economic growth.

- Risk Sharing: By distributing risk among various investors, securitisation promotes financial stability. In the event of economic downturns or widespread loan defaults, the impact is spread across many investors rather than concentrated on a single lender.

- Investor Participation: It attracts investors to participate in the financial sector, helping channel funds to different parts of the economy. This can lead to investment in various industries and projects, further stimulating economic development.

Overall, securitisation plays a crucial role in supporting lending, investment, and economic expansion. However, borrowers must continue to make their payments on time for the system to work effectively. Economic stability is essential for the success of securitisation.

Why do companies go for securitisation?

Companies engage in securitisation for various reasons, and it involves taking the debts they are owed and turning them into something tradable for investors. Let’s break it down in simple terms:

- Turning Debts into Cash: Imagine you’re a company, and you’ve sold goods or services to customers who owe you money. This money is like a promise, but you might need cash right now for various reasons, like growing your business or paying bills. Securitization allows you to turn these promises (debts) into immediate cash.

- Getting Out of the Debt Business: Once you’ve sold your debts (like money owed by customers) to investors, you’re no longer responsible for collecting it. You don’t have to worry about whether your customers will pay you back because someone else now owns those debts.

- Reducing Risk: Companies often have lots of debts from different customers. By securitizing these debts, you can spread the risk. If one customer doesn’t pay, it doesn’t hurt you as much because you’ve already received your money when you sold the debts.

- Lowering Interest Costs: When companies securitize their debts, they can often get lower interest rates on the money they receive from investors than they would from traditional bank loans. This can save them money in the long run.

- Unlocking Capital: Securitization can free up capital that was tied up in the debts. This capital can then be used for new investments, expanding the business, or other important needs.

- Diversifying Income Streams: By turning debts into securities that investors buy, companies can create new income streams. They receive money from the sale of these securities and no longer have to rely solely on customer payments for their income.

In a nutshell, securitisation helps companies get cash quickly by selling their owed money to investors, reduces the risk of not getting paid, and can even save them money in the process. It’s a financial tool that allows companies to manage their finances more effectively.

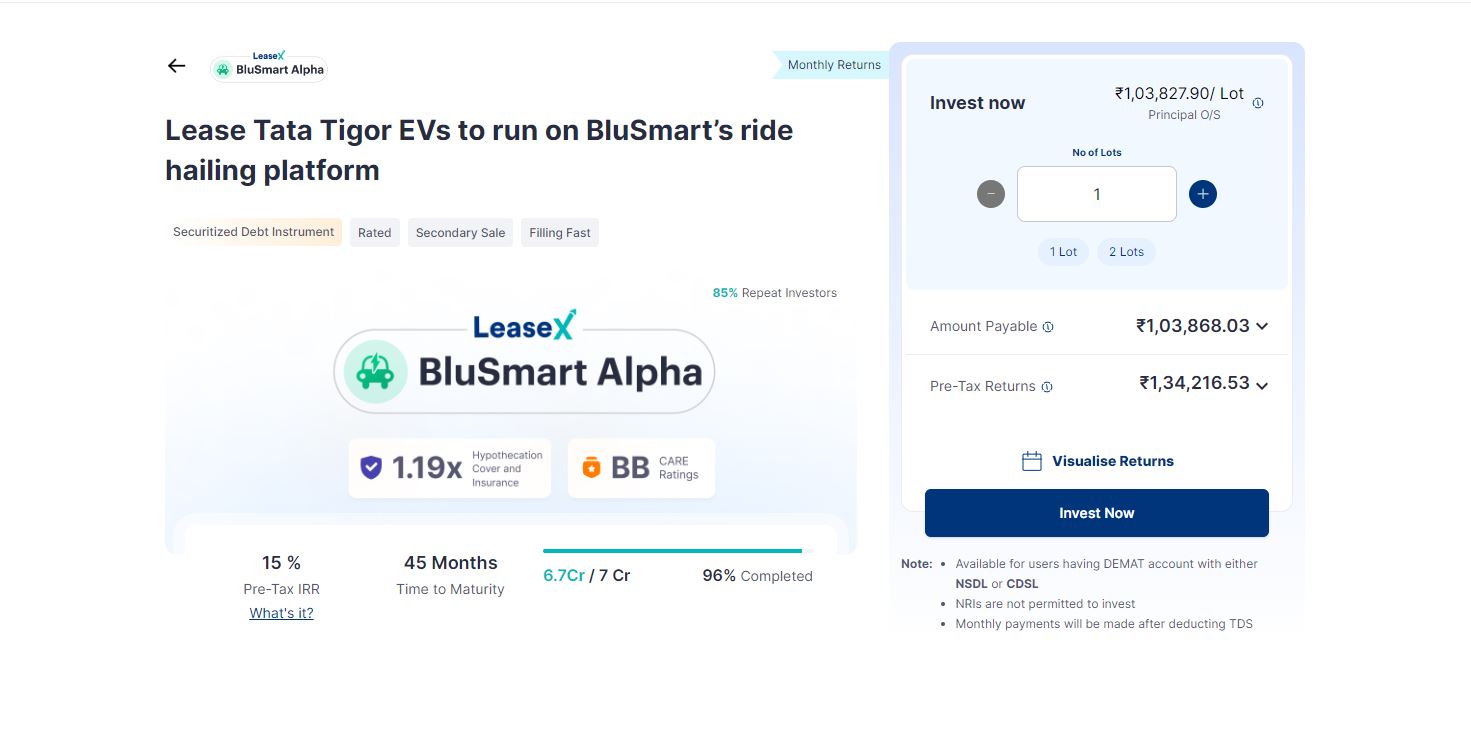

Making Investing Accessible to All through Securitisation with Grip Invest

Grip, a fintech company, is changing the game when it comes to investing in bonds, loans, and invoices. In the past, regular people like you and me often stayed away from investing in things like these because it required a lot of money and seemed quite complicated. But Grip is working to change that by making it easier for everyone to get into the capital market. Here’s how they’re doing it. Some of the innovative products are BondX, InvoiceX, LoanX and LeaseX.

In BondX, by pooling investment-grade bonds together and splitting them into smaller pieces, Grip is allowing access to get more people invested. Similarly, Invoicex and LoanX are providing securitization of Invoice discounting and loans to investors

Grip has also partnered with credit rating agencies such as CARE, ICRA, CRISIL, and India Ratings to validate the bond issues independently.

By reducing the minimum investment amount and modernizing access, Grip is opening up fixed-income products previously out of reach of retail investors. The innovative SDIs on Grip have made access to these prominent opportunities easy for retail investors.

Benefit of Grip SDI

- Fractional Investing: Grip is taking a unique approach called “fractional investing.” This means they’re breaking down big bonds into smaller pieces, like dividing a big pizza into smaller slices. This way, even if you don’t have a ton of money, you can still invest in these smaller slices of investment assets. It’s a bit like saying, “Hey, you don’t need to buy the whole pizza; you can get just a slice.”

- Diversification: Investing in bonds can be a smart way to make money, but it’s even smarter when you don’t put all your money in one place. Grip helps you do this by letting you invest in small bits of lots of different bonds. So, your money isn’t tied up in just one bond, which can be risky. It’s like spreading your bets to reduce the chances of losing.

- Streamlined Process: Grip has made the whole process of investing in bonds much quicker and easier. They’ve built a digital platform that gets rid of the slow and inefficient parts. This means you can do your research, choose bonds, and manage your investments online, all in one place.

- Trust and Transparency: Grip cares about your trust. They’re very careful about the bonds they offer to investors. They put each bond through a tough evaluation to make sure it’s a good choice. Plus, they’ve teamed up with credit rating agencies to check the bonds independently. This means you can feel more confident that the bonds you’re investing in are reliable.

- Reduced Minimum Investment: In the past, you needed a lot of money to get into the world of bonds. Grip has changed that. They’ve lowered the minimum amount you need to start investing. So, even if you don’t have a huge pile of money, you can still get involved.

- Bankruptcy Proof Structure: Insulation from the credit risk of the issuer and the only risk is the pool of loans for loan securitisation product

Grip is making it possible for everyday people to tap into the world of bonds and fixed-income investments that used to be mostly for big institutions or very wealthy individuals. They’re doing it by making the process simpler, more accessible, and safer. This way, more people can have a chance to grow their money.

We have been investing with Grip for 3 years. We have shared our detailed experience below

My Experience using Gripinvest

Credit Enhancement in Securitization

Securitization transactions rely on various safety nets, known as credit enhancements, to reassure investors and earn higher credit ratings. These layers fall into two categories: internal and external.

Internal Safeguards:

- Excess Interest Spread (EIS):The excess spread percentage is the difference between the interest rate received on a pool of financial assets, such as loans or mortgages, and the interest rate paid to investors of asset-backed securities backed by those assets. Imagine a buffer – the interest earned on the underlying assets exceeds what investors receive. This extra padding mitigates potential shortfalls.

- Overcollateralization (OC): Under the overcollateralization method, the face value of the underlying loan pool is larger than the par value of the issued security. So even if some of the payments from the underlying loans are late or default, the transaction may still pay principal and interest payments. Think of it as extra security blankets. Additional loan receivables are set aside, boosting investor confidence in repayments.

- Junior/Subordinate Tranches: These layers take the first hit if there are any payment disruptions. Senior tranche holders get paid first, offering them extra peace of mind.

External Support:

- Cash Collateral: A safety deposit box, essentially. Fixed deposits backed by banks give investors another layer of assurance.

- Corporate Guarantee: In some cases, a third party, like a strong company, steps in to guarantee a portion of the repayments.

Grip SDI Structure Risk Management

There are multiple ways Grip reduces the risk of the loan pool

- Choosing a strong loan pool that has a low risk of default

- Taking Fixed deposits etc to reduce default impact

- Taking Excess Interest Spread

- Overcollateralization up to 120-150% of security value.

Investors should go through these details before investing

Conclusion

Securitisation is like a financial puzzle that benefits lenders, investors, and the entire economy. It helps companies by giving them more money to make loans and lowers their risks. For investors, it’s a way to earn steady money from the loans people take. And for the economy, it makes loans more available and spreads out risks.

But there’s a catch. For this system to work well, borrowers must keep repaying their loans on time. If lots of people can’t pay, it causes problems for investors. So, it’s best when the economy is doing well and people can afford their loans.

In India, securitisation has become important because it helps banks manage risks and lend more money to people and businesses. It also gives investors a chance to make money by investing in different types of loans. So, securitisation is like a financial tool that keeps the wheels of the economy turning.

Platforms like Grip have been able to innovate structures to allow retail investors to get access to this asset class. Investors should review the product and evaluate the risk mitigations like credit enhancement before committing capital.

You have not mentioned about the security package (cash collateral, over collateralisation, excess interest spread) that come with the Grip LoanX deals. The security package reduces the risk to a certain extent

Hi Gopal, Excellent points on how credit enhancement can reduce risk . I have updated the post with these details