Most new investors tend to look for the best investment options, and mutual funds have been considered to be one of the trending investment options. However, many new and beginner investors keep looking for the safest mutual funds.

But wait, is there something called the “safest mutual funds in India” ? For that matter, all mutual funds are safe, and all of them come with volatility. You cannot negate or stay away from volatility if you invest in a mutual fund. Mutual funds are safer investments if you understand them properly. Investing in a longer horizon is the right option.

Why is it important to consider safety in investments?

So, why safety in many matters is important? Well, creating a safety culture is always a practical option. Managing personal finance is an important aspect when it comes to achieving financial stability. After all, you do not want to lose your hard-earned money and would want to invest it in a channel that is safer and free from the volatility of any nature.

A safety net in investments can help secure your funds and offers you a powerful cushion for a longer period. That apart, it would also help you earn decently enough on your investment.

If you are wary of investing in other volatile investment options that are dependent on market conditions, Mutual Funds can be a good alternative for ensuring safety in your money matters.

Safety in Mutual Funds – Are all AMCs equal in terms of safety?

Before investing in mutual funds, you may want to ensure that Mutual funds are safe. Mutual Funds are highly regulated by the authorities. If you are looking to invest in the safest mutual funds, you will find that all funds are safe. The mutual funds are managed by AMCs or Asset Management companies, and these companies themselves are governed by regulatory authorities.

As you would have gathered by now, mutual funds are managed by AMCs or Asset Management Companies. An Asset management company is a firm that pools investments from investors like you and me and invests it in different investment options such as equities, debt, real estate, and gold, to name a few. A single AMC can handle multiple funds that may have different investment options. An AMC is generally run by a fund manager who sets an investment objective, evaluates the market risks involved, if any, and then arrives at the right investment strategy.

How does an AMC run mutual funds?

Do remember that when you invest with an AMC, you are actually investing in a fund managed by the AMC. The returns of the fund would be market linked and will be dependent on the performance of the fund. A fund that is managed well can assure better returns.

The AMC will charge you a small fee called a fund management fee. This is the source of revenue generation for the AMC in question. When picking an AMC, it is advisable to check the reputation of the AMC. That should explain why investors prefer funds managed by well-known AMCs.

Having said that, the AMCs are governed by regulatory guidelines and authorities. They operate as per the set guidelines and are never akin to any other fly-by-night operators.

Some of the advantages that AMCs offer can include

- Your assets and investments are managed by professionals.

- You get an opportunity to invest in a diversified portfolio even when you are not a financial expert yourself.

- You gain access to improvised investment options.

Asset Management companies are governed by rules set up by the regulator. All the AMCs in India are regulated by the Securities and Exchange of India (SEBI). The AMCs are also passively regulated by the Association of Mutual Funds of India (AMFI). These should help protect the interests of the investors. Every AMC is expected to comply with the rules and risk management guidelines set by both SEBI and AMFI.

How to select the safest mutual funds in India?

One of the toughest reasons why you are lost for choice is the huge number of options available to you. More than 40 AMCs and over 1000 funds have been why it is difficult to pick the right mutual fund that ideally meets your expectations and requirements.

The risk involved in a mutual investment fund can be dependent on the type of mutual fund that you are looking to invest in. The primary considerations in this context would be to choose between Equity Funds and Debt Funds.

Equity Funds – These funds invest in equity stocks and shares of different companies. They can be quite a high risk but can assure you better returns. They are linked to markets and can have high volatility.

Debt Funds – The Debt funds invest in the debt instruments such as company debentures, government bonds, and other fixed-income assets. They are generally considered safer. They can assure you fixed returns, but the rate of earning may be lower. Also, these funds do not deduct tax at source.

Apart, you also have Money Market funds that invest in liquid instruments such as T-Bills, CPs, etc. They are the safest options and provide you with immediate and moderate returns. Balanced or Hybrid funds are the ones that invest in mixed assets. They can be a combination of all three options. The funds can have risks and return well balanced.

If you are investing in an equity fund that assures you high returns, there are a few considerations that are handy enough to provide you with the best safety options. Large caps or Blue chip funds can be a good choice as they invest in large-cap stocks, which means the investment would be on well-established companies and thus are a better option than the mid-cap or small-cap investment options. It may be advisable to go with an investment horizon of at least five years.

You can also choose bonds if you have a better understanding of risk

What happens to your money if any mutual fund shuts down?

That is the million-dollar question that most new investors will have in their minds when investing in mutual funds. Even I had this doubt, and that is exactly what prompted me to undertake this journey into understanding what mutual funds are and how to invest in them.

So, what happens if a mutual fund shuts down? How would I get my money back? You need not worry. SEBI has specific guidelines for a host of scenarios in which a mutual fund may shut down. Your money will remain safe and will be remitted back to you. Before any mutual fund can shut down, they need to approach SEBI for approval for shutting down. In some cases, SEBI itself may order shutting down a fund house and diverting the funds to another house. In any of the cases, investors will get back their money based on the last NAV before the fund house was shut down.

If the fund house merges with another house or is acquired, the mutual fund may continue with the existing format or may even be merged with the other schemes the new fund house is managing. Both these cases – AMC mergers and scheme mergers need SEBI approval. In such cases, the investors can decide to continue with the investments or exit from the investment. On exit, you have NOT levied any load.

SEBI has strict rules that prevent a Mutual fund operator from converting the assets into cash and running away. In essence, your funds in the mutual fund remain safe in any of the mutual funds that you may decide to invest in.

The Franklin Templeton fiasco – A case in point that may need attention

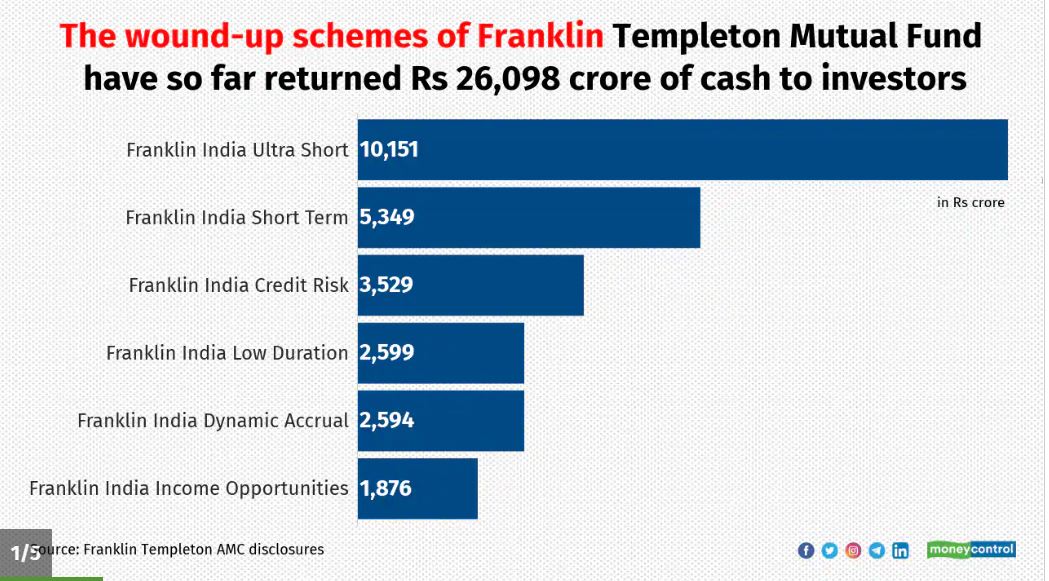

Franklin Templeton is a name that perhaps brings shudders in mutual fund investors’ minds. The fiasco that happened in 2020 on April 23 was what shook the world of mutual funds. The Franklin Templeton Mutual Fund, the 9th largest mutual fund house decided to wind up 6 of its debt schemes.

The reason was simple. COVID was declared a pandemic in March 2020 and the lockdown caused further severe issues. The debt markets simply froze as the equity markets fell by 37%. With the massive redemptions and liquid portfolios, Franklin decided that it can not encash most of the securities in its portfolio.

The government and judiciary sprung into action and SBI was appointed as the administrator. The liquidation of the assets and returning the money to the investors was entrusted to the SBI Mutual fund, but there was no deadline. This helped avoid the fire sale of instruments. A distress sale would have resulted in lower price realizations which would have caused further fiasco.

A few takeaways from this fiasco and the subsequent corrective actions can be summed up as –

- You need to learn to diversify your portfolio. Both across funds, fund categories, and AMCs

- SEBI used to have provisions for shutting down the MFs, but the provisions used to be very vague. The revised guidelines make it mandatory to avail the approval of investors before a mutual fund can be shut down.

One thing is clear that is evident from the Franklin Templeton fiasco. It assured the investors that the Mutual Fund is a powerful and robust investment option. There are solid frameworks from SEBI that can take care of investor interests.

The Takeaway

Well, if you are still wondering about the safest mutual funds in India, we reiterate that there are no specific safest mutual funds as such, and all the available mutual funds are safe. They are efficiently governed by the rules and regulations formulated by the authorities, and there is no need to be worried in any way about your investments.

Every mutual fund is safe, and there is no chance for any fraud as they are managed by highly experienced financial experts and professionals. You can be assured that NO ONE WILL RUN WITH YOUR MONEY.