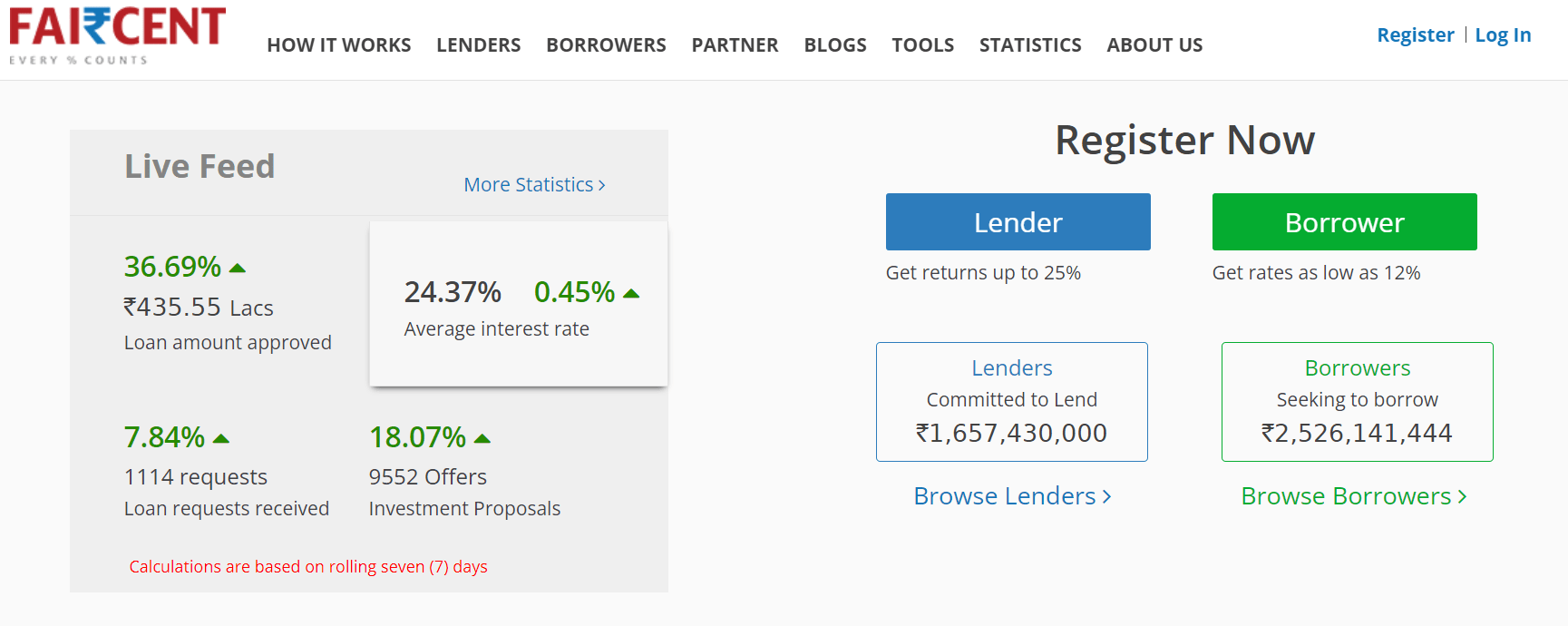

Faircent is one of the oldest P2P lending platforms in India. I was one of the early users of Faircent. Initially, I invested predominantly in term loans with high yields. The NPA for most platforms in the high yield category was high. Over a period of time, I changed my strategy to invest in less risky products with moderate yields which have been more effective. I am doing a Faircent Review for some of their lowest risk products which I Invest in.

Faircent Products

Faircent has 4 types of products

- Term Loan – Loans given to single creditors

- Line of Credit– It enables a borrower to withdraw and repay funds based on an overall credit limit and interest rate approved for the borrower

- Faircent Double – A new product that gives 10-13% fixed returns, where Faircent choose multiple loans on behalf of investors

- Pool Loans– ATM settlement finance, Domestic transfer pooled loans, etc

In this Review, I will only cover Faircent double and Faircent Pool loans

Faircent Pool Loans

In this category I invest in 2 types of loans with an expected return of 11-12%:

- AEPS MicroATM Pool – Through partner organizations Faircent in enabling merchants offering AEPS/Micro ATM services to receive instant settlements in their wallets. The AEPS/micro ATM transactions get stuck in the banking system for a couple of days, this creates a working capital shortfall for small merchants. Through this facility, merchants will get an instant settlement in their wallet (as a loan), the loan gets repaid once the bank settles the transaction. For more information on this product please get in touch with your portfolio manager.

- Domestic Transfer Pool -Merchants/Distributors in the business of domestic money transfer need capital every morning to recharge their wallets. This enables them to carry out transactions during the day. Through partner organizations, Faircent disburses loans to these merchants (directly in their DMT wallet). This ensures easy disbursement and repayment. For more information on this product please get in touch with your portfolio manager

Faircent Double

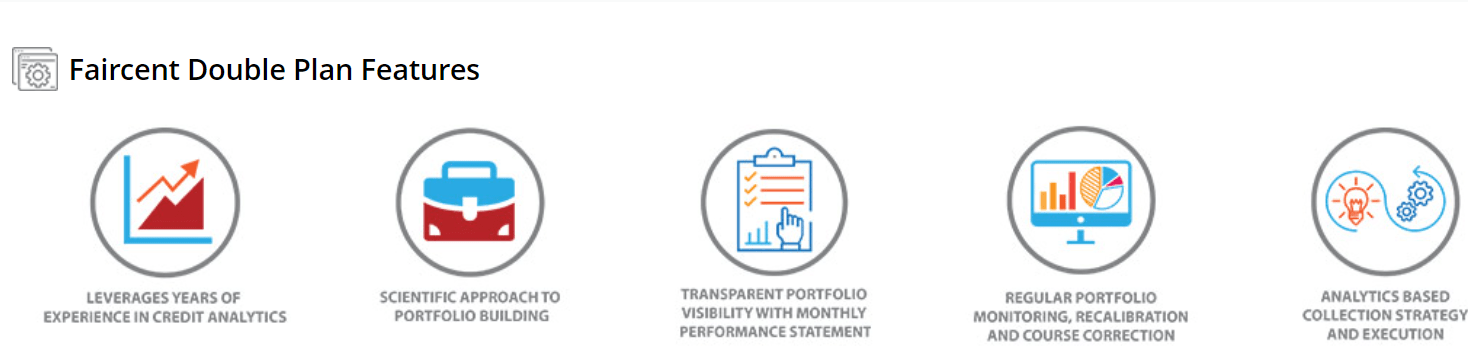

It is a pool product that aims to provide lenders with an investment option that helps them earn stable returns while maintaining the liquidity of funds. Interested lenders pool in their money and authorize Faircent to disburse this into a diverse mix of loans and loan products offered to borrowers who as per Faircent’s algorithms have the repaying capacity to provide aggregate returns of up to 12% p.a

How Does Faircent Double Work?

Funds invested in Faircent Double are consolidated into a pool consisting of loans offered to borrowers (or groups of borrowers) who, as per the algorithms have the repaying capability to provide an aggregate targeted return of up to 12% p.a. to participating lenders. Algorithm-based auto-investing strategies are used to create such a pool of loans. Further, it features regular portfolio monitoring, recalibration, and course correction along with transparent performance updates

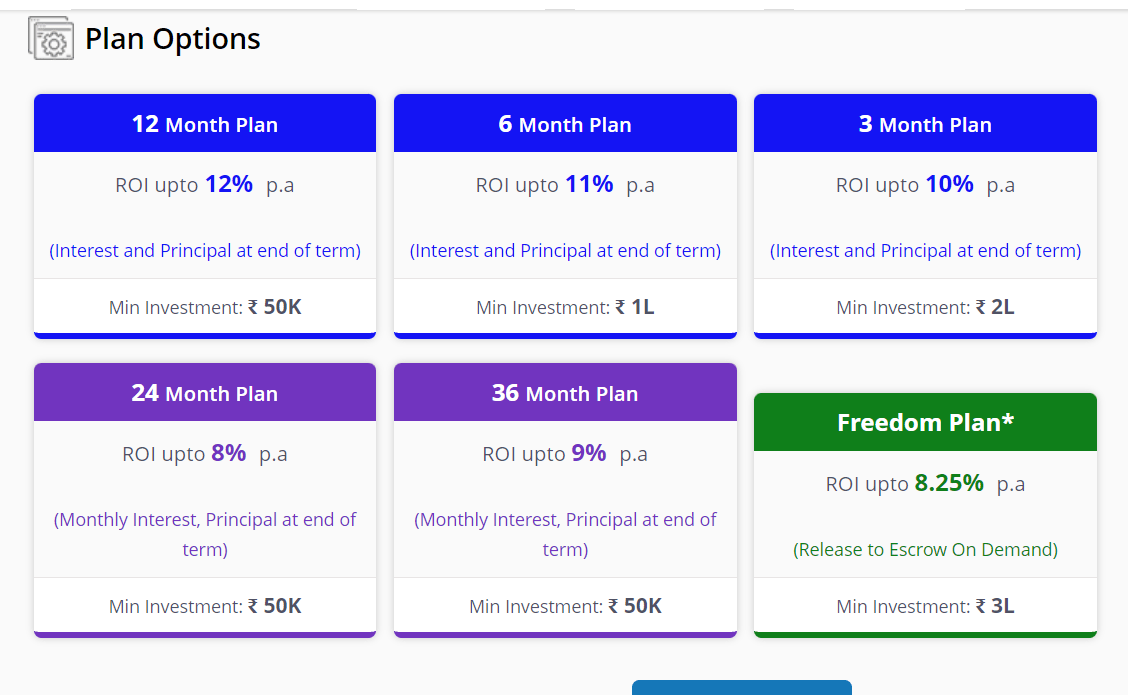

Faircent Double features plans which return the principal and interest at the end of the tenure as well as plans in which the interest is credited on a monthly basis and the principal is returned at the end of the period. Reinvestment of the amount invested takes place based on tenure and terms of the plan chosen by the lender.

Fees

Faircent charges performance-linked processing fees for managing such a pool of loans and the amount of the performance-linked processing fees will be the difference in the returns (i.e. repayment of loans with interest from the borrowers) and that the amount repaid to the lenders. eg. If the net returns post-default are 15% p.a. and the return provided to lenders is 12% p.a., then the Faircent performance-linked processing fees will be 3%. If the net returns post-default (if any) is 9% p.a. and the return on loans to be provided to the lender as per the plan selected is 12% p.a, then the lenders will receive 9% while Faircent fee will be nil.

Past performance

Faircent Double is now one year old and has stable performance. I have tried double along with Micro ATM and pool loans. The experience has been good. Faircent pool is now 3 years old with stable performance

I am not in favor of investing in individual Term loans as I had a bad experience investing in them in 2018. However, the platform has worked on its underwriting through the years. Still, I will stay away from individual loans.

Risk

The biggest risk for any Lending platform is the default. In a pool product risk of individual defaults is somehow mitigated by diversification across borrowers. However, a bigger risk is a systemic failure like a total moratorium imposed by the government can impact some of these loans

How to get started

Use the below link to register on Faircent. Once the KYC is completed you can deploy capital

Faircent RegistrationConclusion

Faircent Pool loans and Double loans can be used to complement Lendbox low-risk loans and Bharatpe 12% Club loans. It’s best to spread the amount across the platforms. It is best to avoid term loans even if the yield seems enticing!