Global markets were unnerved this month by a looming October government shutdown in the US, however, the shutdown was pushed out to December by a stop-gap agreement that managed to pass through Congress. A more comprehensive bill will need to be passed before December to avoid the potentially-catastrophic effects that would play out should the US government fail to meet their debt obligations. On the other side of the world fear of Evergrande’s contagion has made the market nervous.

My Alternative Investment Portfolio Performance

Crypto has given impressive returns this month with Bitcoin and Ether close to the all-time high levels.

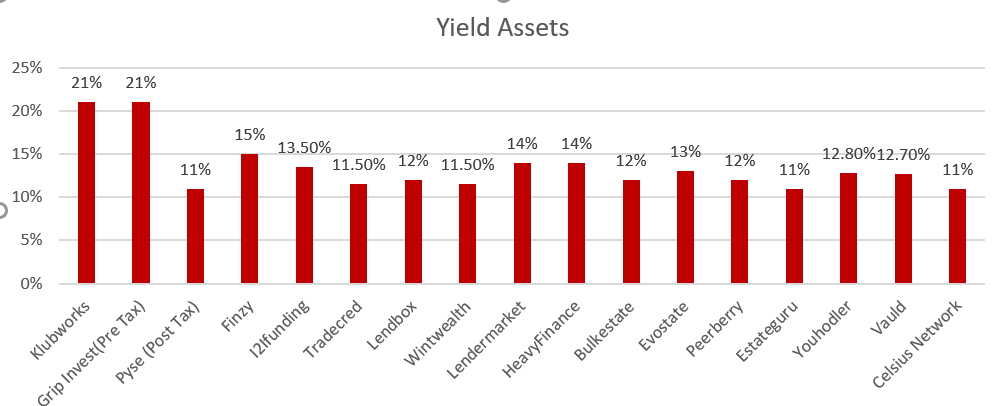

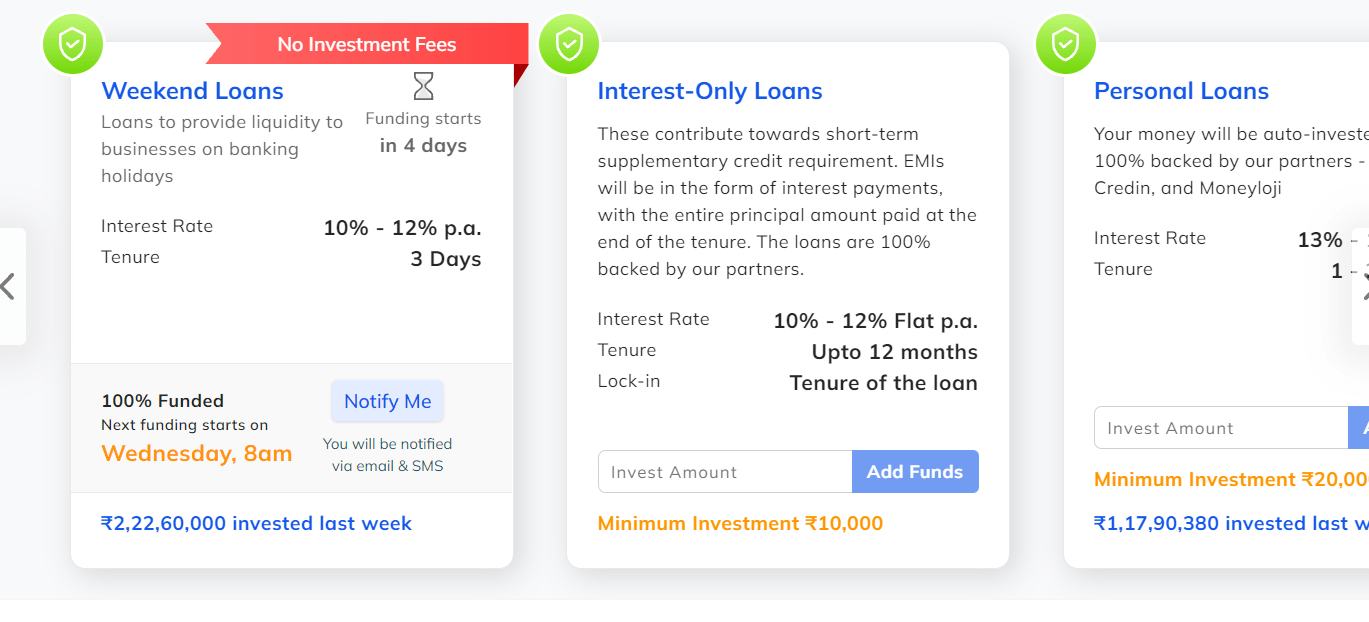

Structured Lending Investment

| Platform | Return | NPA |

| GRIP Invest | 12-13% (post tax) | Nil |

| Klubworks | 22% | Nil |

| GrowFix(Wealth Wint) | 10%-11.00% | Nil |

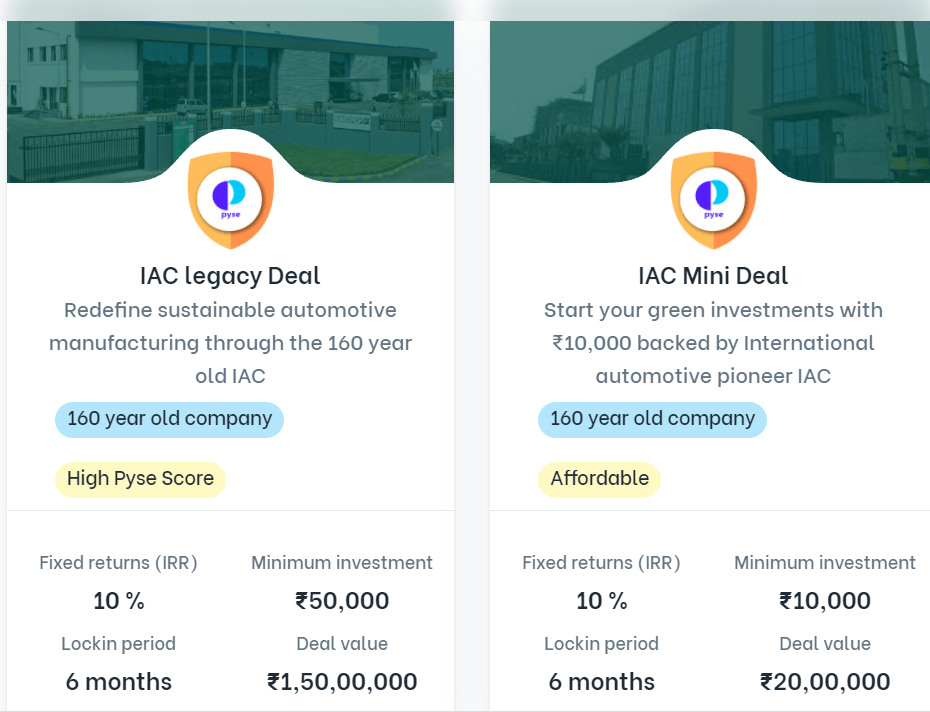

| Pyse | 10%-11%(post tax) | Nil |

- Wealth Wint will be offering senior secured bonds in the future instead of the covered bond as they will be issuing public bonds as the minimum ticket for private issuance in INR 10 lakh now

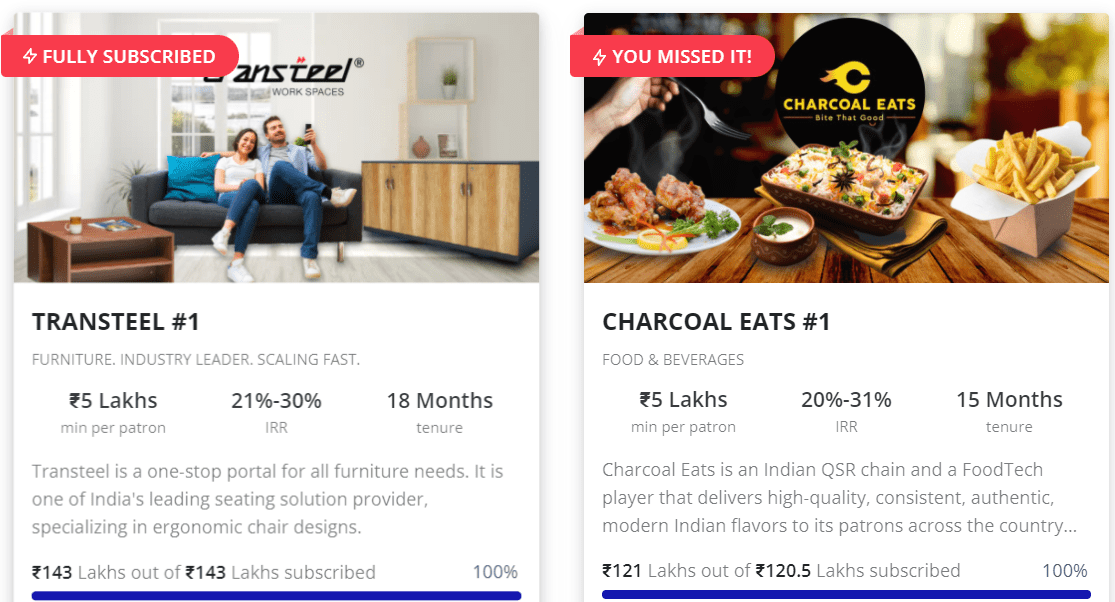

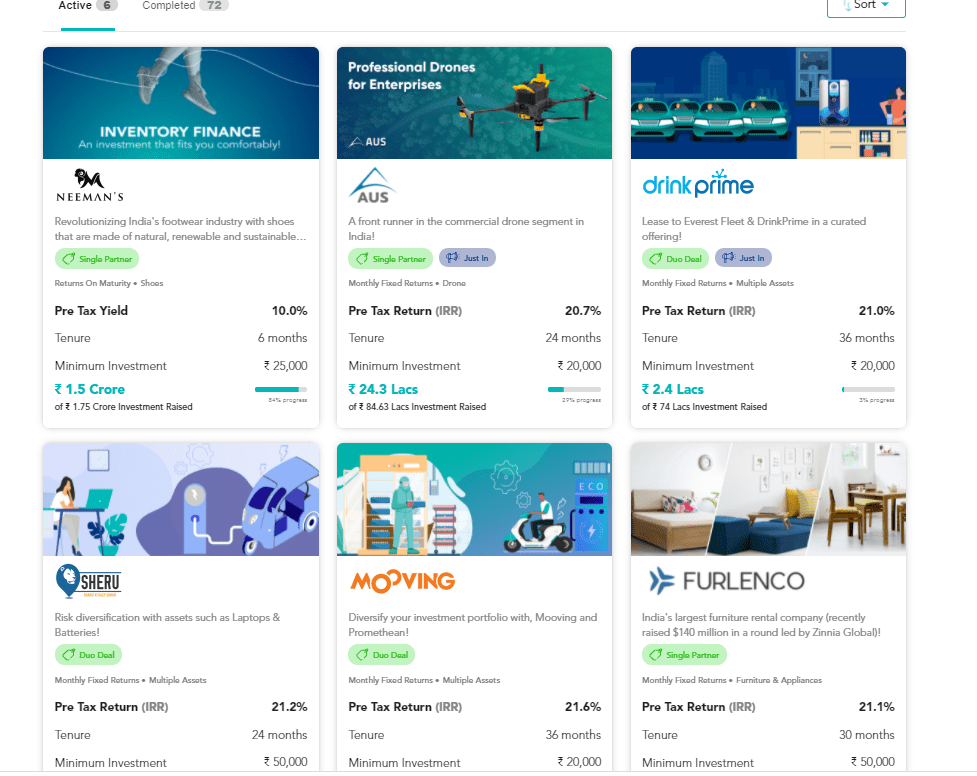

- Grip has come up with Inventory Financing Deals which are short duration

- Klubworks recently got 20 mn USD funding.

- New Pyse deal live in mid-October

- All my cashflow in Klubworks, WintWealth,Pyse and GripInvest are as per plan

New Deals

Invoice Discounting and Settlement Finance

| Platform | Return | NPA |

| TradeCred | 12% | Nil |

| Lendbox(settlement Finance + gold Loans) | 11.9% | Nil |

- TradeCred has now increased deals on platforms and now have UPI also as an option to transfer money

- Lendbox settlement finance returns have been in line with expectations till now. Lendbox is waiving registration fees for all my referred users. Please contact you RM

- Interest Only Loans (gold loans) on Lendbox are performing fine as of now

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(currently paused) | 14% | 4.7% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto based) | 11% | Rental yield |

| Reinvest24 | 11.5% | Rent+capital gain |

- Use Winvesta multicurrency for managing a global portfolio

- Completely Stopped Crowdestor as platform performance is disappointing

International Equity

- Earnings season is around the corner and US stocks have done really well in all reporting seasons since March 2020. This time will be the real test.

- Winvesta is another platform that offers international equities. Check out my video on platform comparison –Winvesta vs Vested

Crypto Lending Investing

| Platform | Return |

| KuCoin | 20%(market dependent 10-60%) |

| Celsius Network | 11.5% |

| BlockFi | 8.6% |

| Youhodler | 12.7% |

| Vauld | 12.6% |

- Kucoin is giving 15-20% yield currently due to bull run

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Youhodler Paxg (Gold backed coin) offering 8.2% yield over gold returns

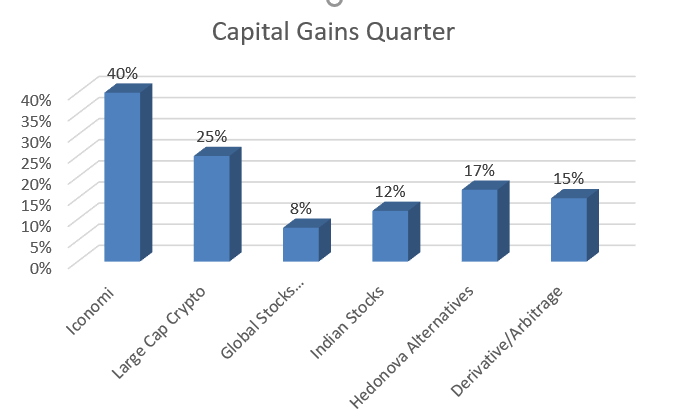

Crypto Investment

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 40% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 5% |

| Bitcoin Trading(Wazirx/Binance) | 20% |

- Bitcoin has given stellar returns along with ethereum and Solana. Have booked some profit to maintain allocation at pre rally levels

- Iconomi fund is doing extremely well!

Current allocation:

- Rupeecircle- 10%

- I2IFunding- 20%

- Finzy- 30%

- Lendbox-30%

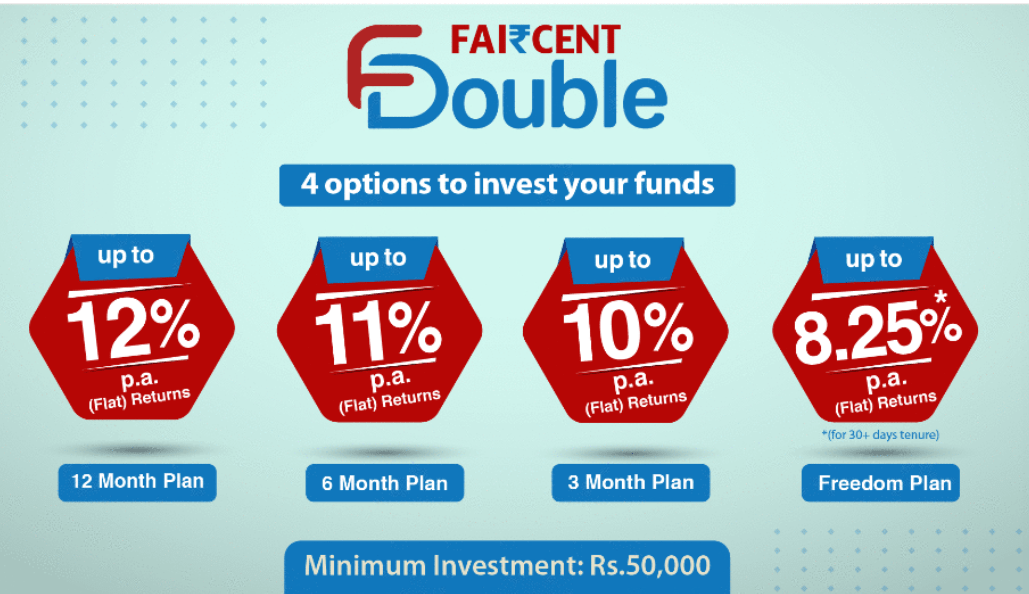

- Faircent-10%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks backed loans,E-Rickshaw backed loans,education loan,NBFC backed loans(Monedo etc) Group loans | 13.7% | 5% |

| Rupeecircle (paused till clarity on new management performance) | Small business/salaried loans to people with own house and low EMI to Earning Ration | 14% | 5.5% |

| FINZY | Prime Borrowers,High Salary ,A category | 14.2% | 3.6% |

| Faircent ( Only SIP Loan) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- FINZY is performing well.

- Have started systematic investment plan loan on Faircent ( Only SIP Loan). Will be covering it in detail soon.

Other Alternative Assets

| Platform | Assets |

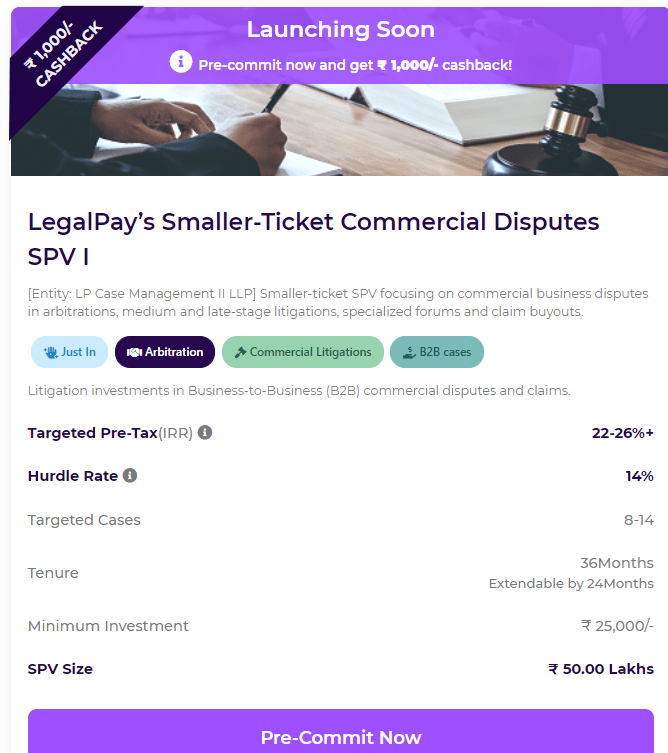

| Legalpay (Promo code FV48G4) | Litigation Funding |

| GoldFinX | GoldMines |

| METEX | Palladium/Platinum |

| Vinovest | Exotic Wines |

- There is an upcoming deal on Legalpay. Prebook and get 1000 cashback! We will get the status of the first investment by January 2022.