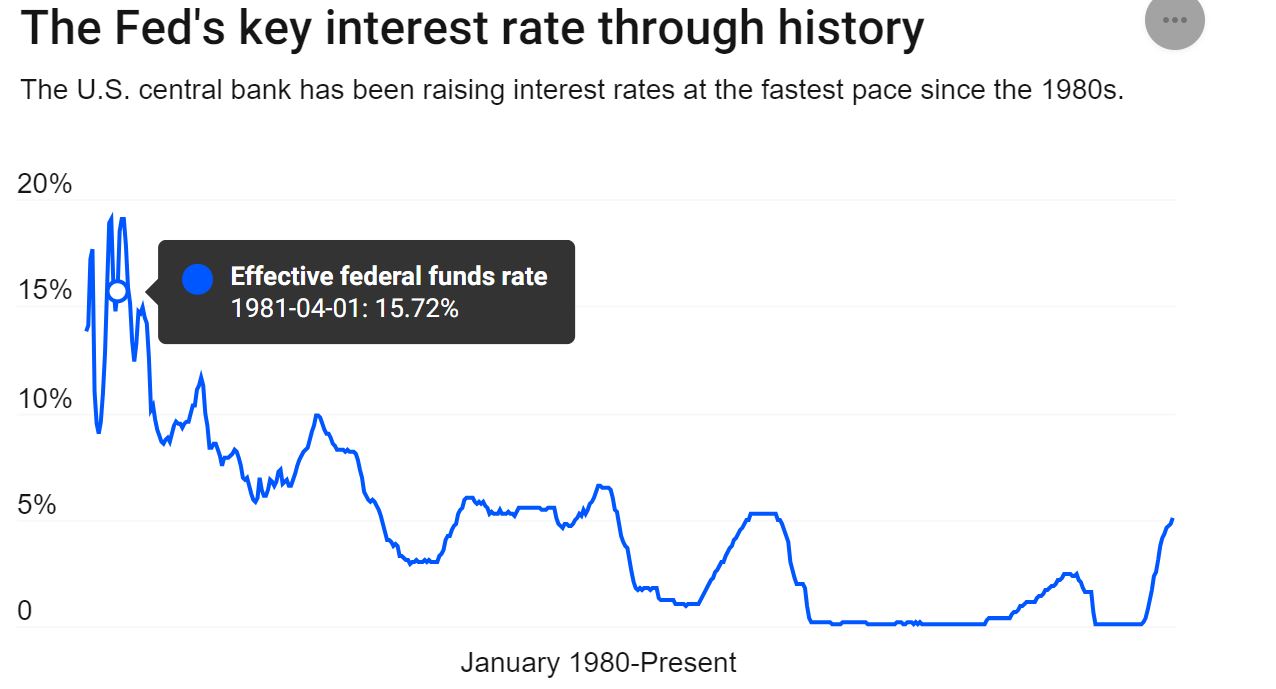

This month equity and crypto assets have been on steroids. This has been an investors’ market where they have enjoyed higher yields on debt investments and equity gains. Generally, a higher rate is associated with lower equity performance but this has not happened till now.

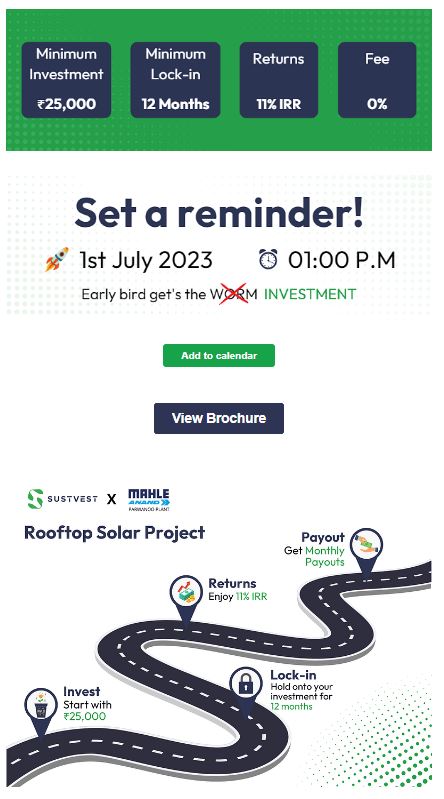

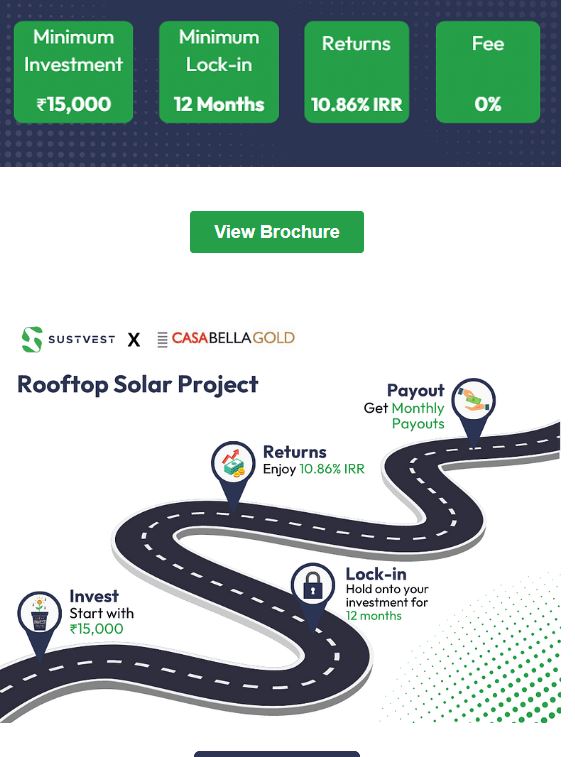

On the Alternative Investment front, we can see a lot of existing platforms working on their structure to make them more palatable to regulatory bodies. This has been the repercussion of SEBI’s notice to Growpital. For instance, Now Sustvest would be issuing Listed debt instead of the LLP model.

We will try to cover these changes and also interview the founders on the efforts being made from their end to make it a win-win situation for all the stakeholders.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

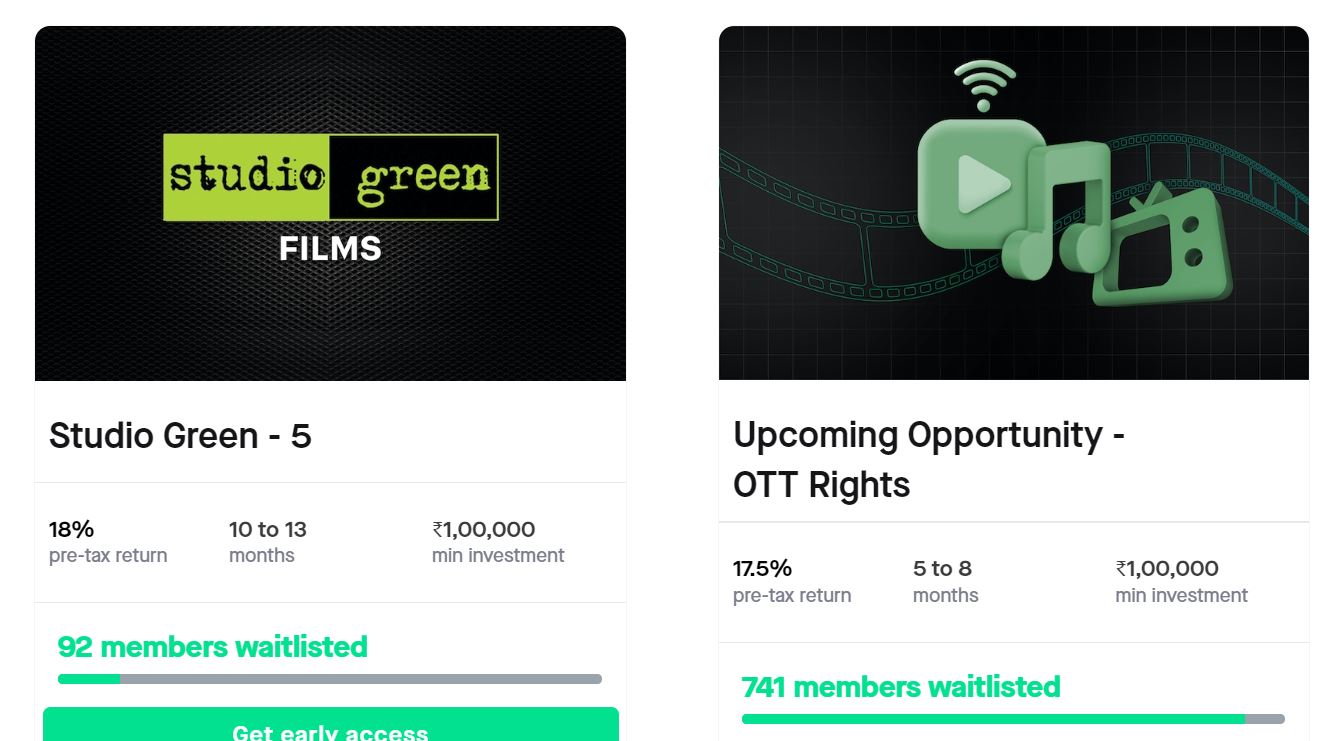

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key updates on the delays from last time

- Growpital SEBI Order

- Altgraaf Delay

- Klub Tagz Delay

Growpital SEBI Order

Growpital has submitted all the documents SEBI had requested them. They conducted an AMA session on 2nd Feb. They reiterated the same thing that SEBI has still not provided a final verdict and due diligence is going on.

I hope if we could salvage the principal portion it would be a big win as there are multiple questions that only time can reveal

- How long with SEBI take to unfreeze the accounts?

- Will Growpital get a green signal on having no misappropriation of funds?

At this point I feel we are better off if they diverted the funds in hard assets and SEBI freeze can help to recover that because if they were doing the agriculture business this freeze will be really detrimental for the business operations and it will be hard to get back our principal.

Altgraaf Arzoo Delay

Below are the timelines of Altgraaf communication

- The Arzoo Invoice Discounting transaction faced delays on the AltGraaf platform. AltGraaf is in communication with all relevant parties. It is anticipated that the transaction will be finalized by December 20, 2023, inclusive of additional interest.

- On December 20, investors were notified that Arzooo would make an immediate payment of 25% of the principal, with the remaining principal and interest to follow at a later date.

- Subsequently, on December 26, investors received correspondence indicating that 14.4% of the outstanding balance would be disbursed by January 12, 2024, bringing the total distributed principal to 35.8%.

- However, on January 12, 2024, investors were informed that the expected payment release was delayed due to complications between Arzooo and the bank. No definite timeline was provided, and legal proceedings were mentioned.

- On February 9, 2024, it was communicated that Arzoo had received $3 million from existing investors, prompting the immediate distribution of funds to AltGraaf. AltGraaf subsequently dispersed 10.4% to existing investors, with an additional 6.2% scheduled for distribution by the following Friday. Following these repayments, investors would have received 37.4% of the principal amount.

Further updates from AltGraaf will be shared with investors as they become available.

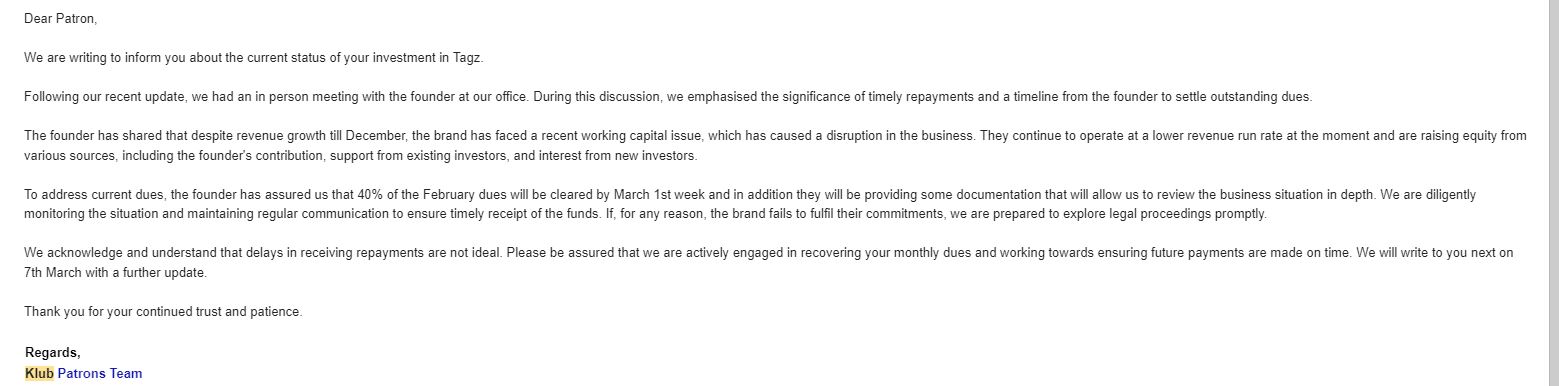

Klub Tagz Delay

This month I faced my first delay in my Klub investment since the time I had started investing them. They have communicated the money would be paid in 2 tranches in the upcoming months.

Alternative Investment Portfolio Updates

This month I added a new platform for angel investing- Inflection Point Ventures. It is important to understand that though Angel investing can be very lucrative it comes with its own risk and should be a part of the portfolio for sophisticated and large investors only as it requires a lot of diversification and ticket is higher than conventional investments.

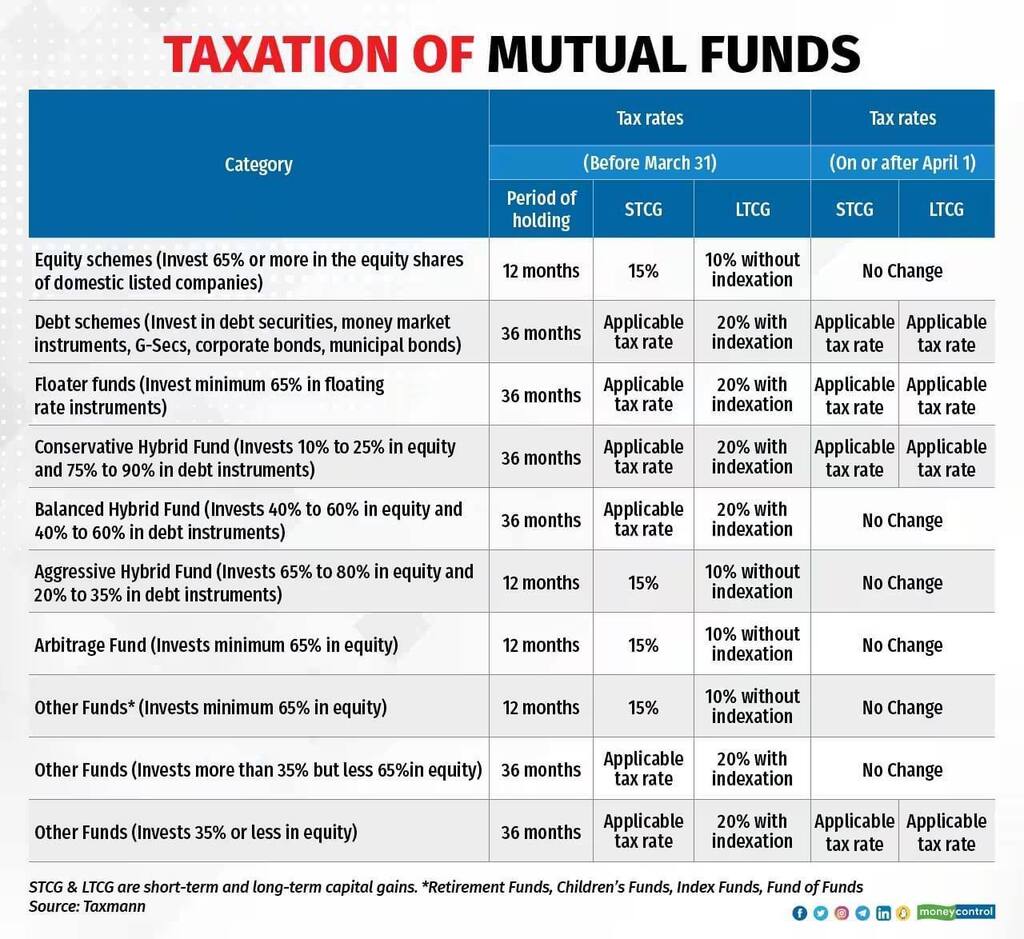

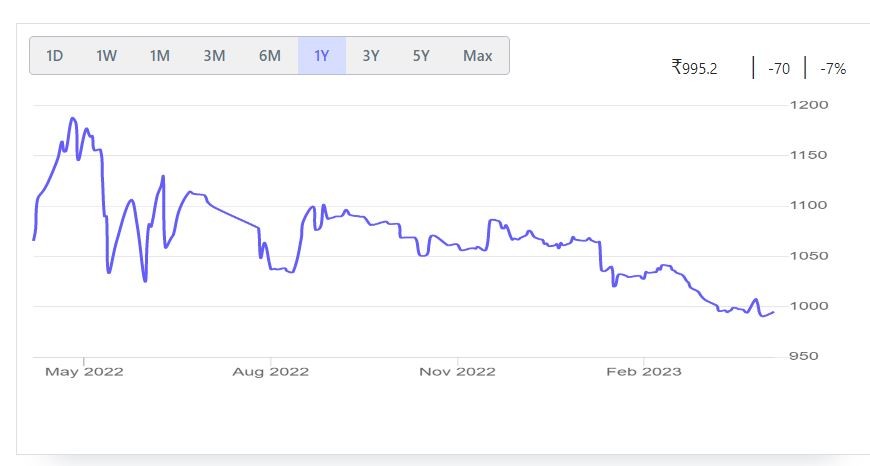

We also invested in Long Duration Funds that I will also pledge to get the trading margin as it is considered as cash equivalent by Exchange. Investors can target double-digit returns with minimum credit risk through these. To understand in detail go through our article

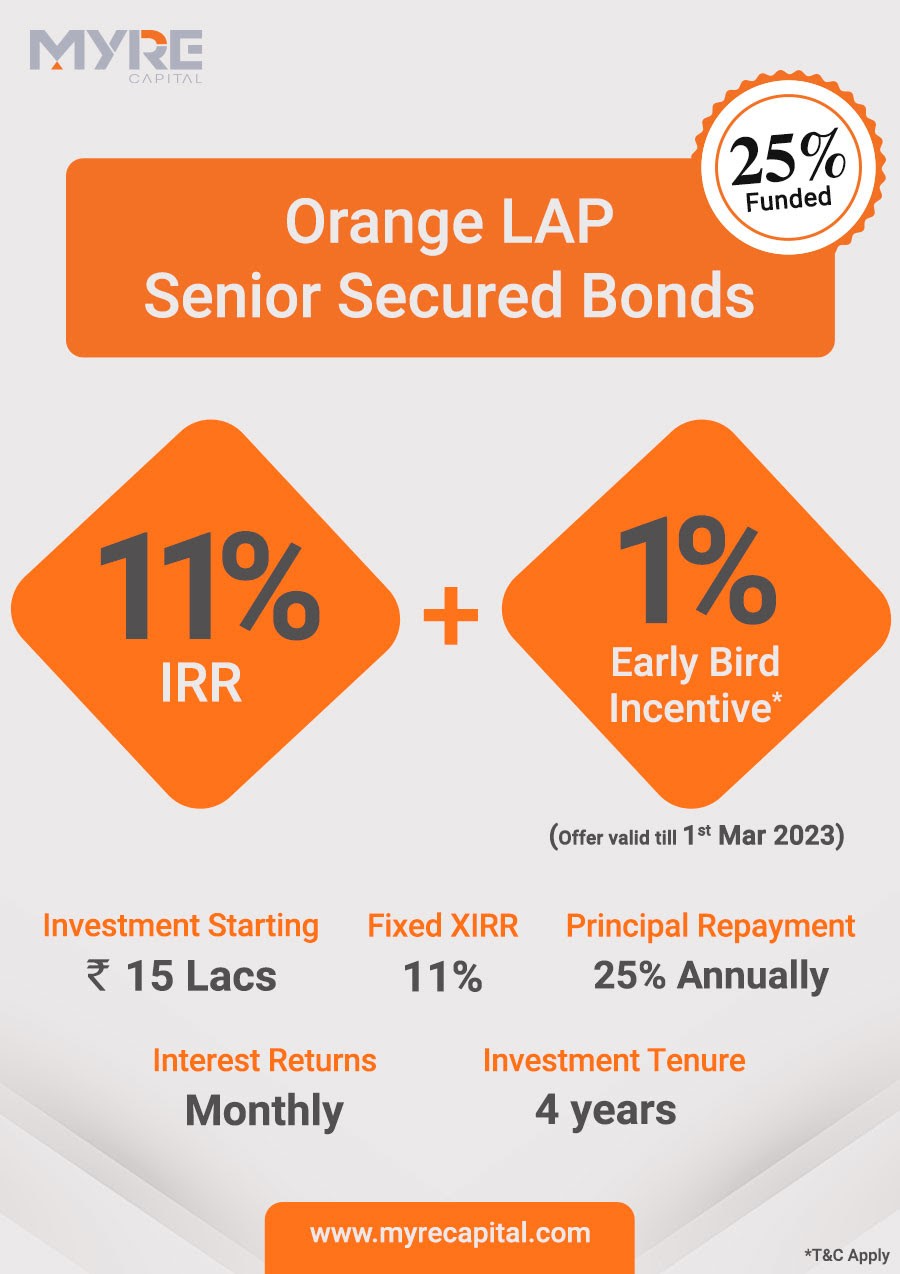

Lending Investment

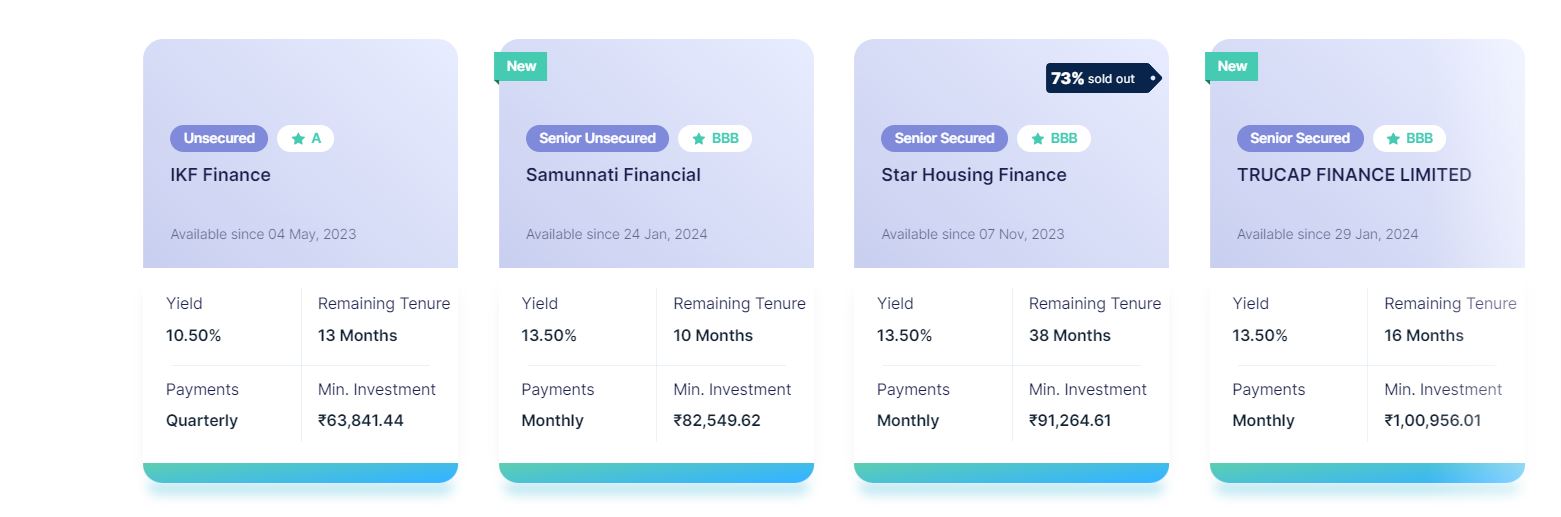

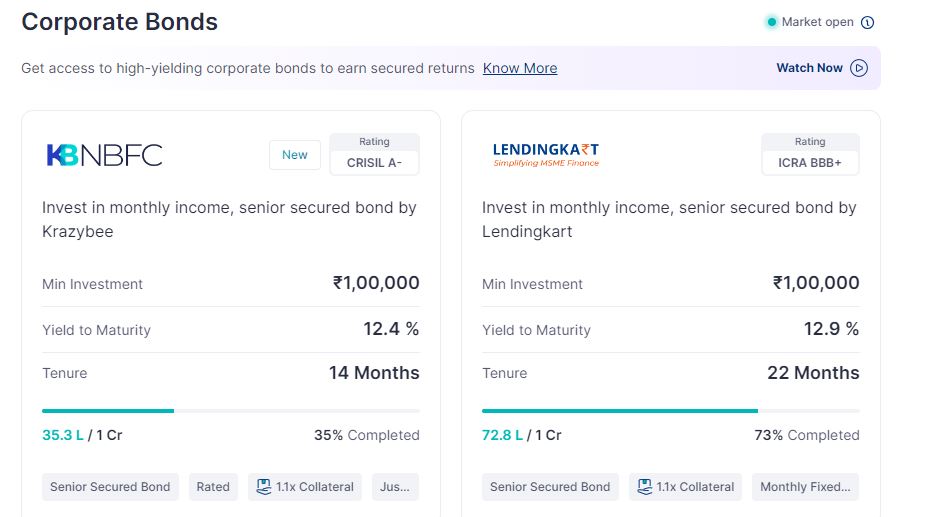

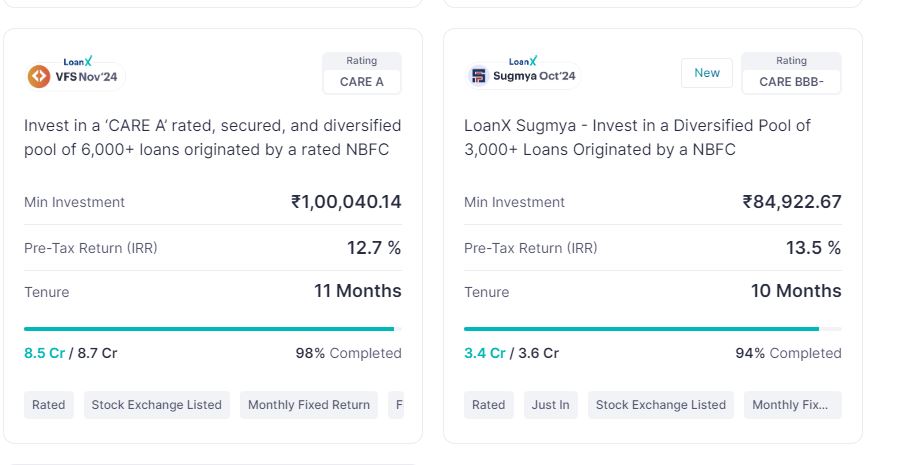

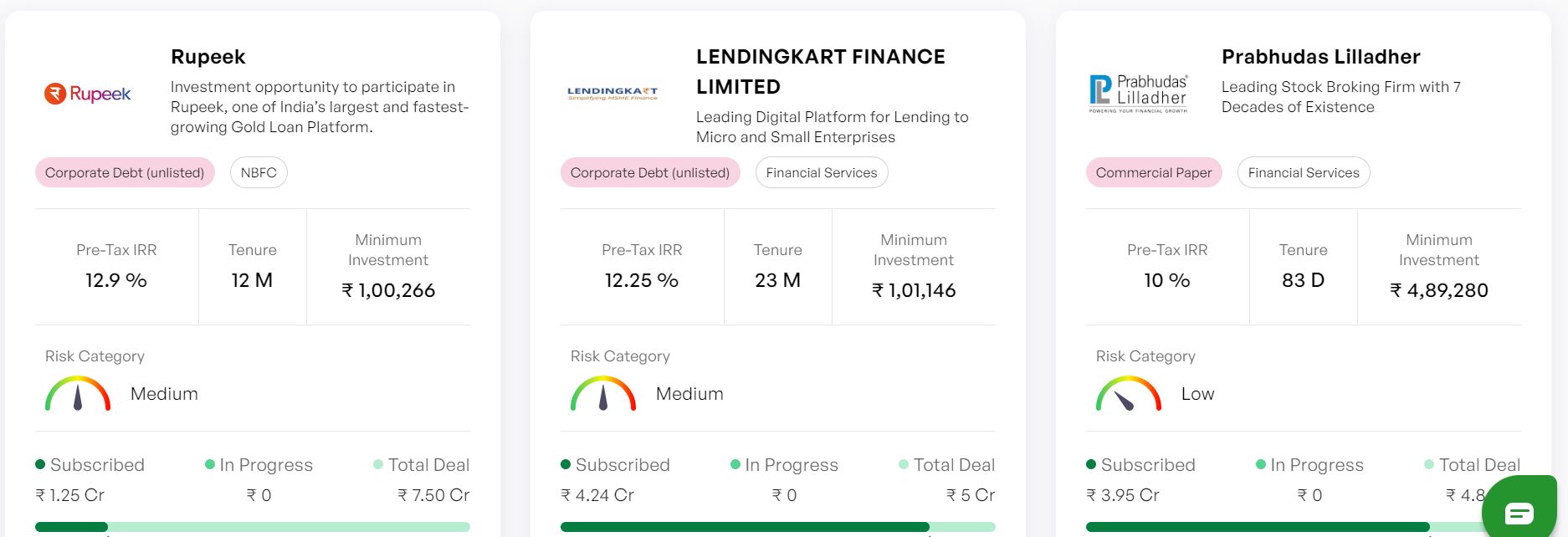

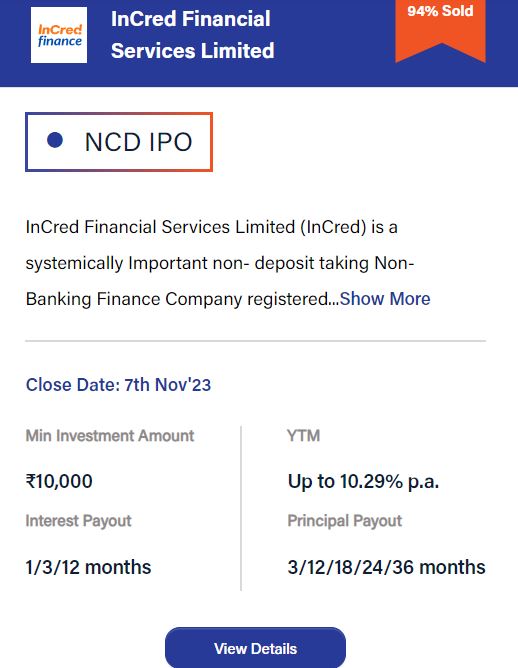

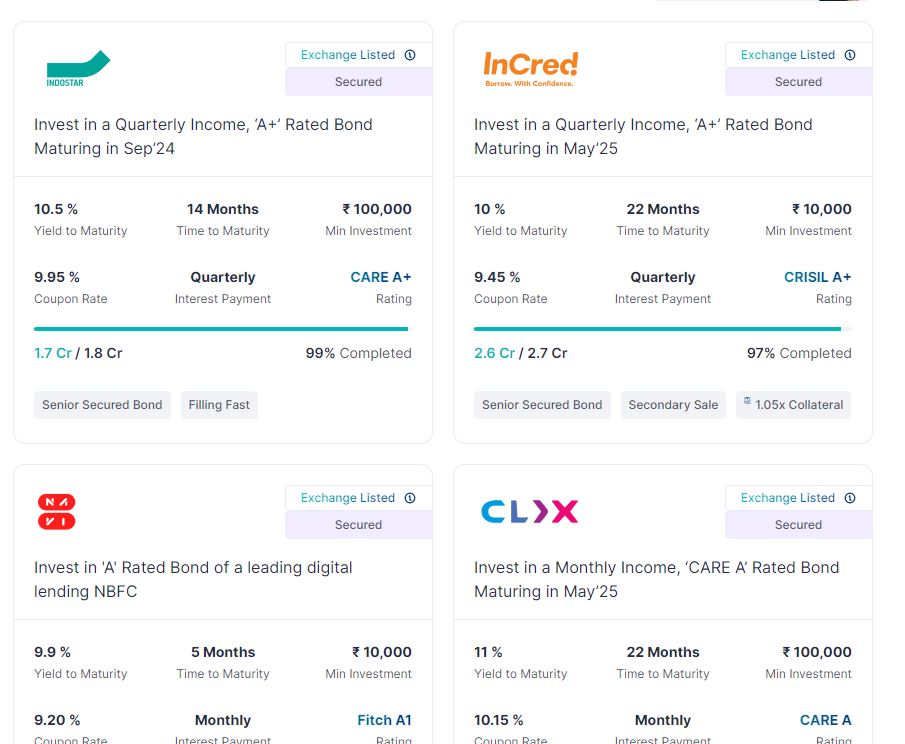

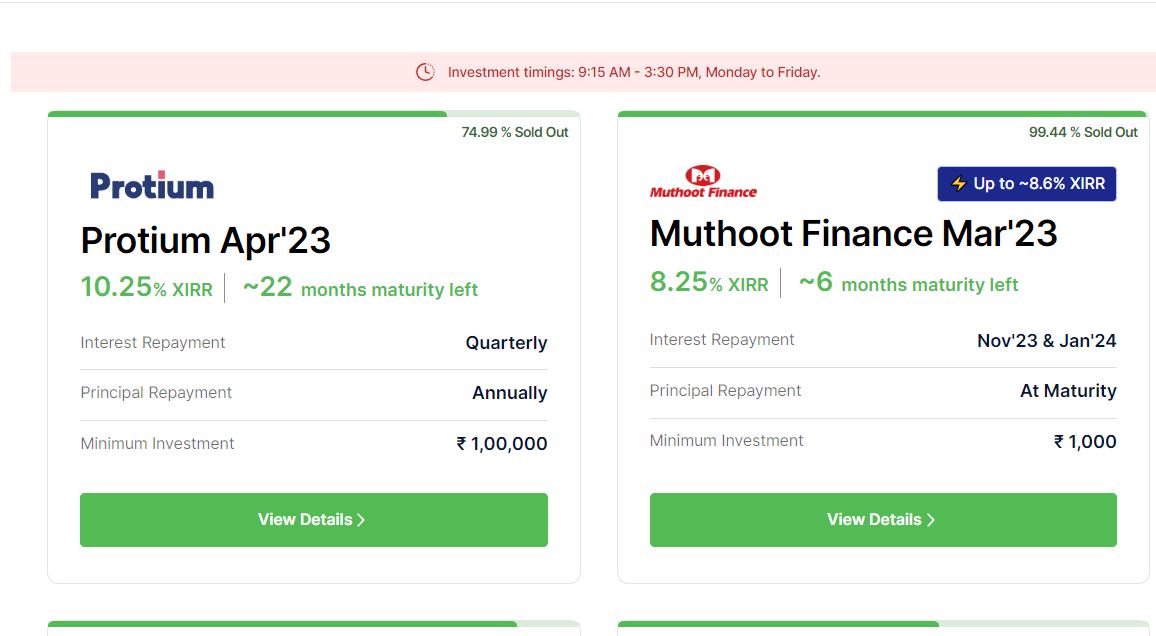

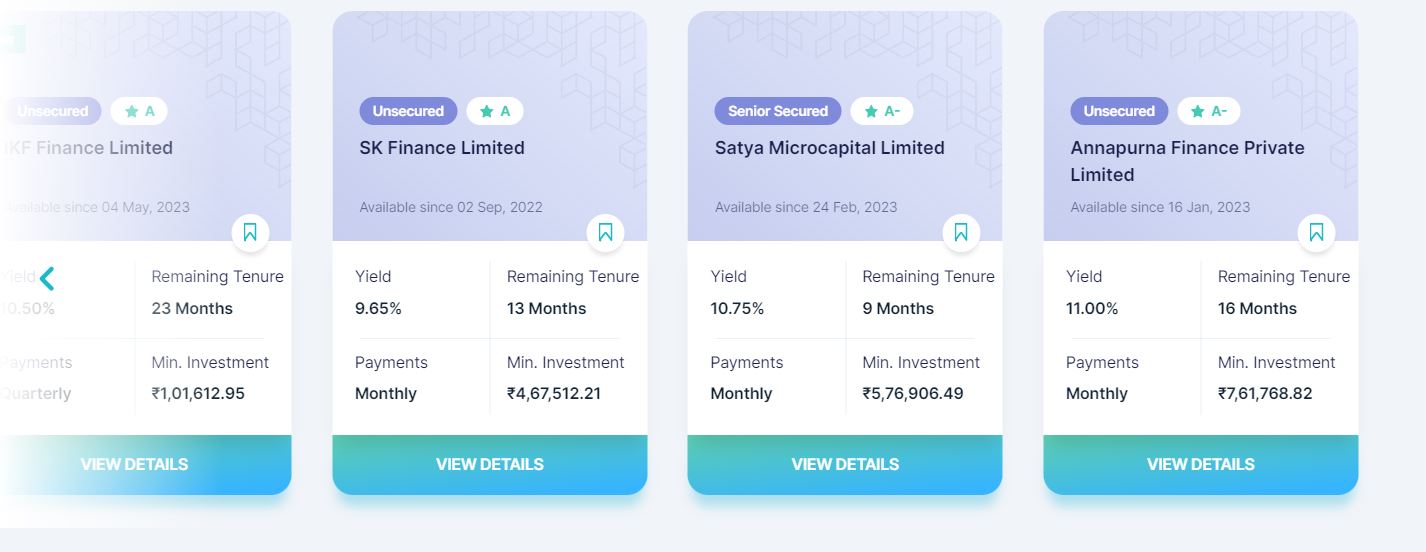

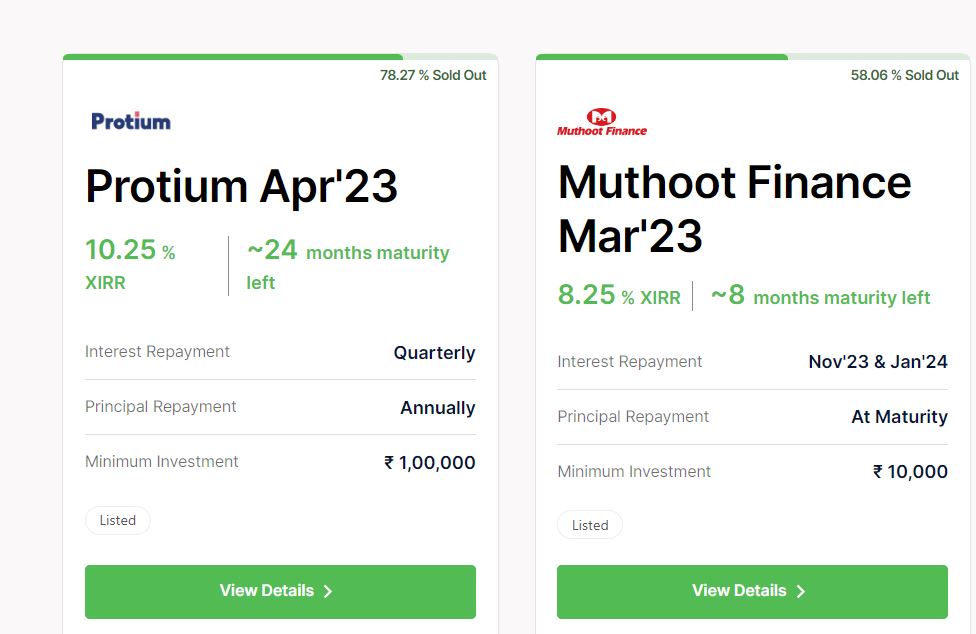

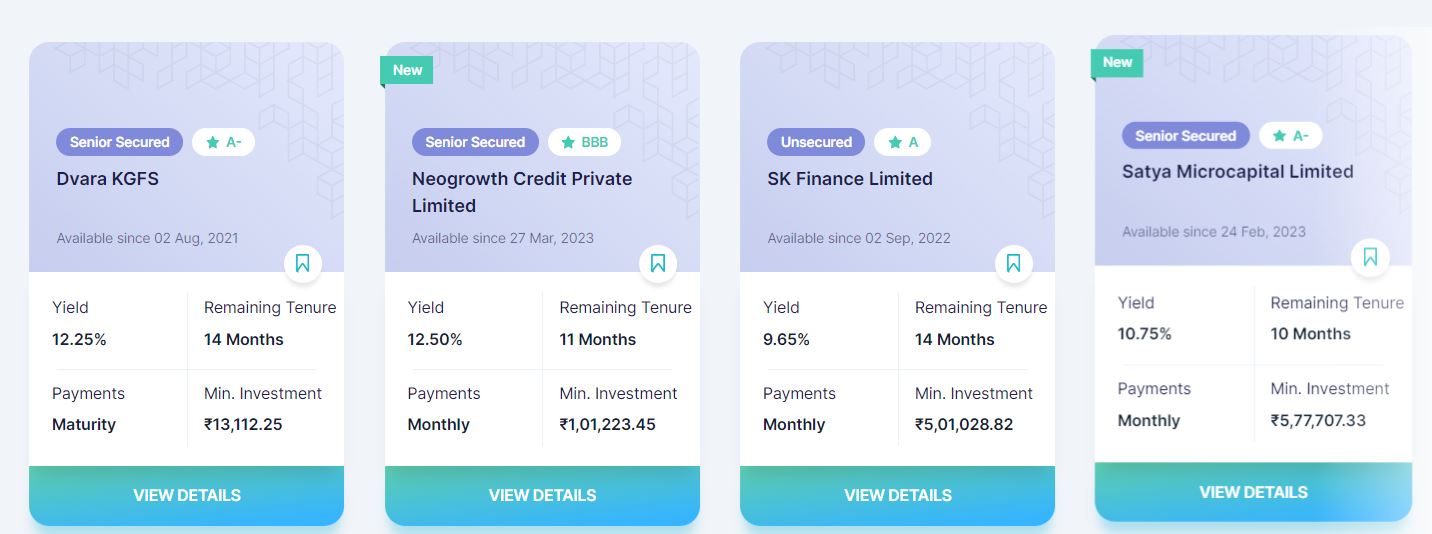

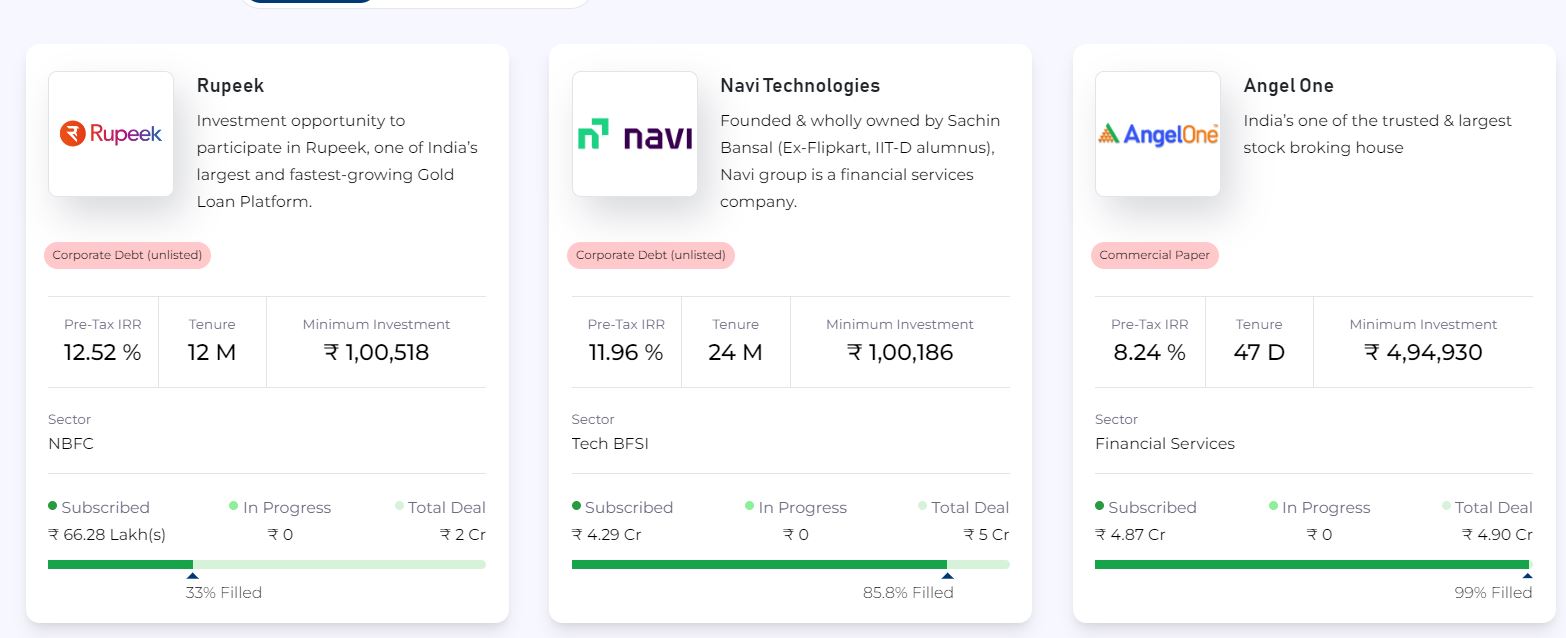

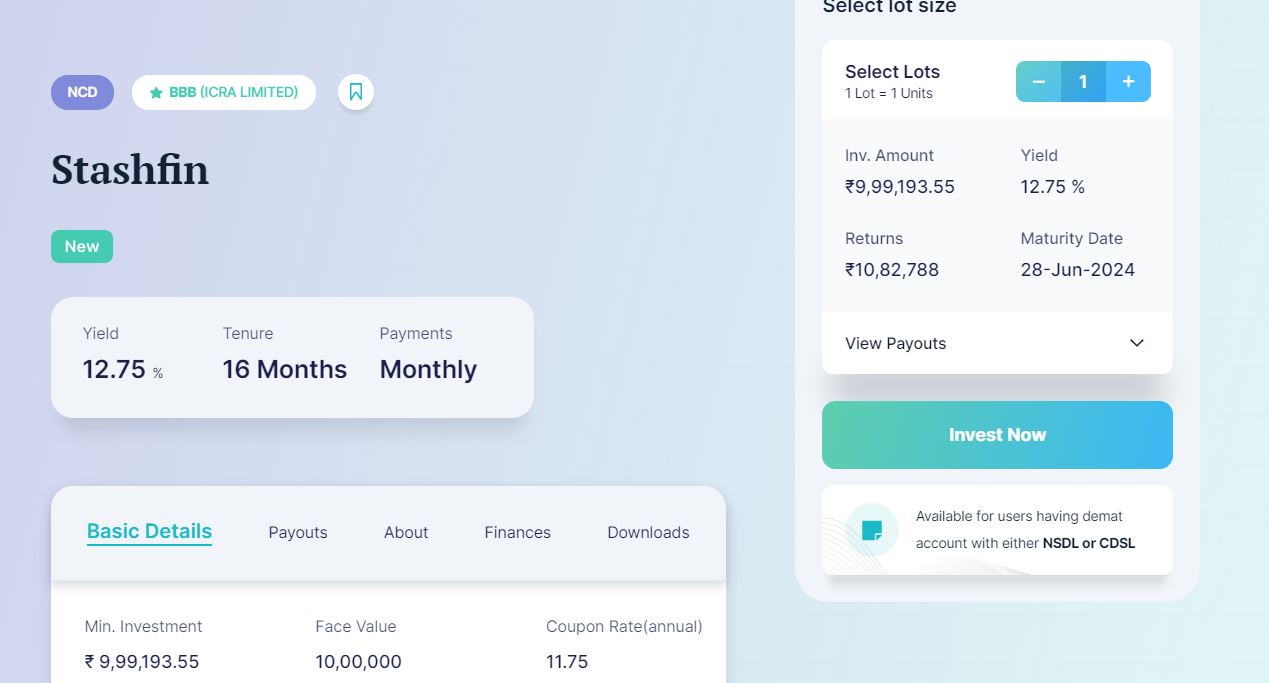

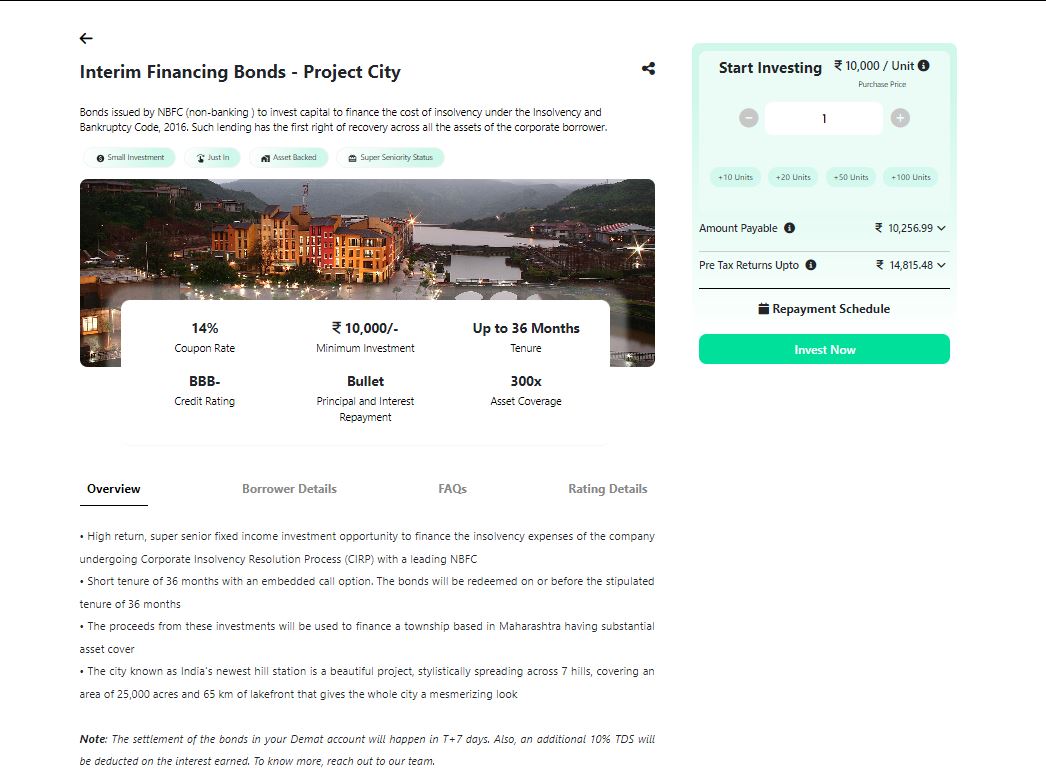

The focus has been on short-term high-yield bonds of companies with good balance sheets. Some of the names we have invested in this month are:

- Samunnati Finance -13.5%

- Trucap -13.5%

- Krazybee -12.7%

- Lendingkart – 12.9%

- Akara Capital-13.3%

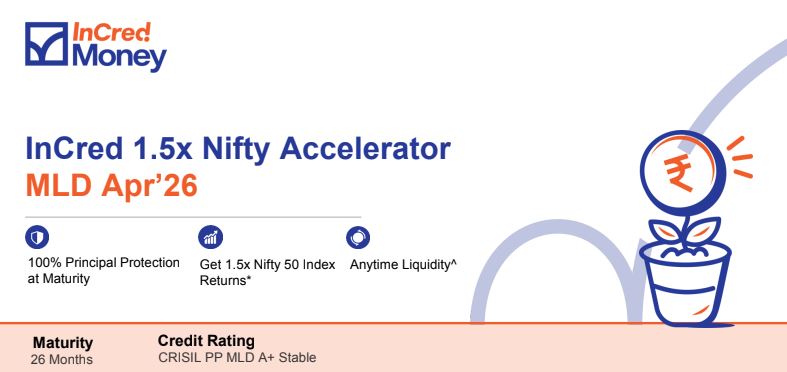

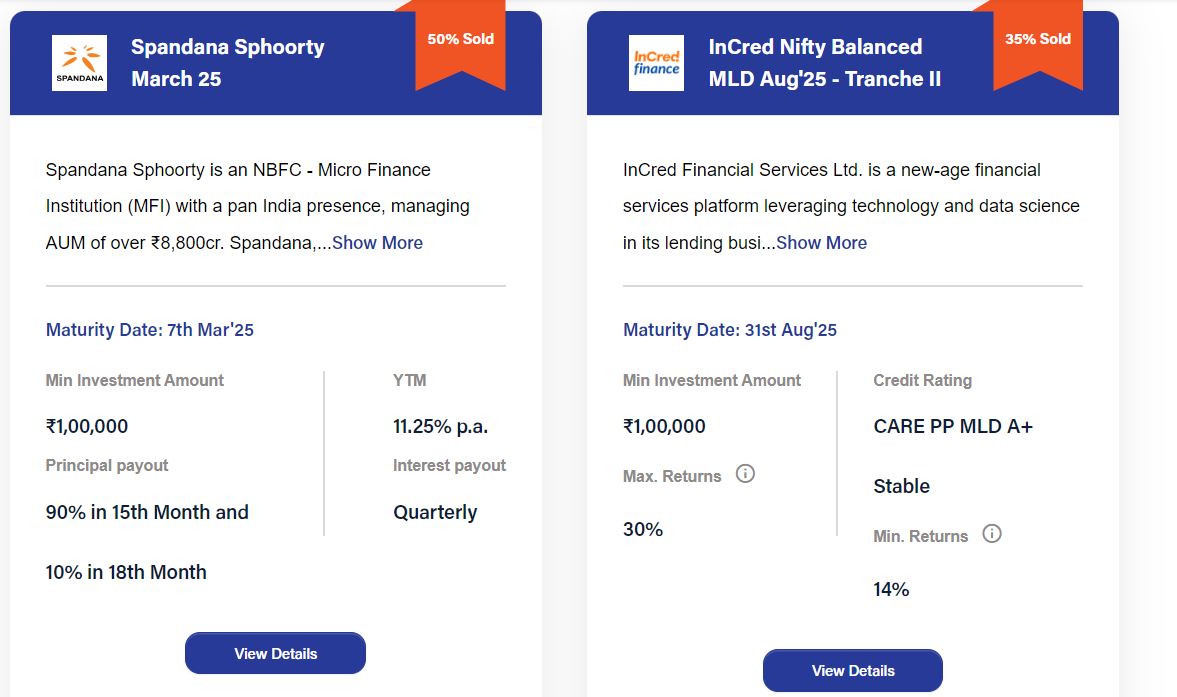

Incred MLD is another decent option for people looking to participate in equity.

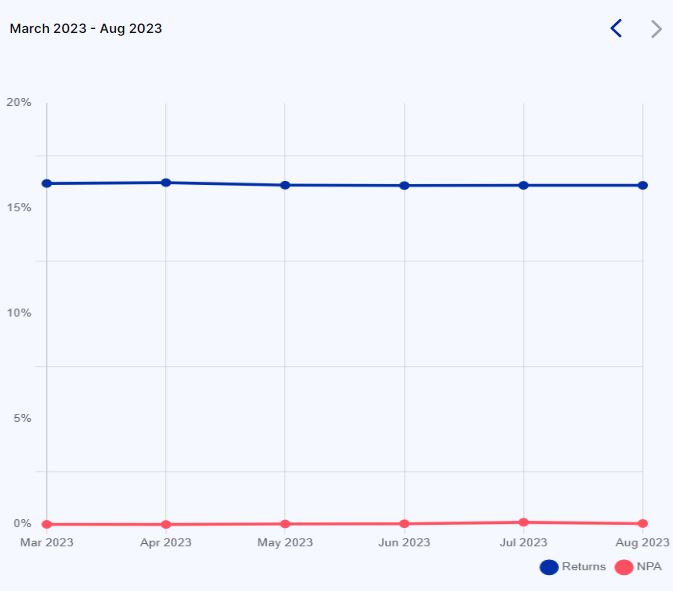

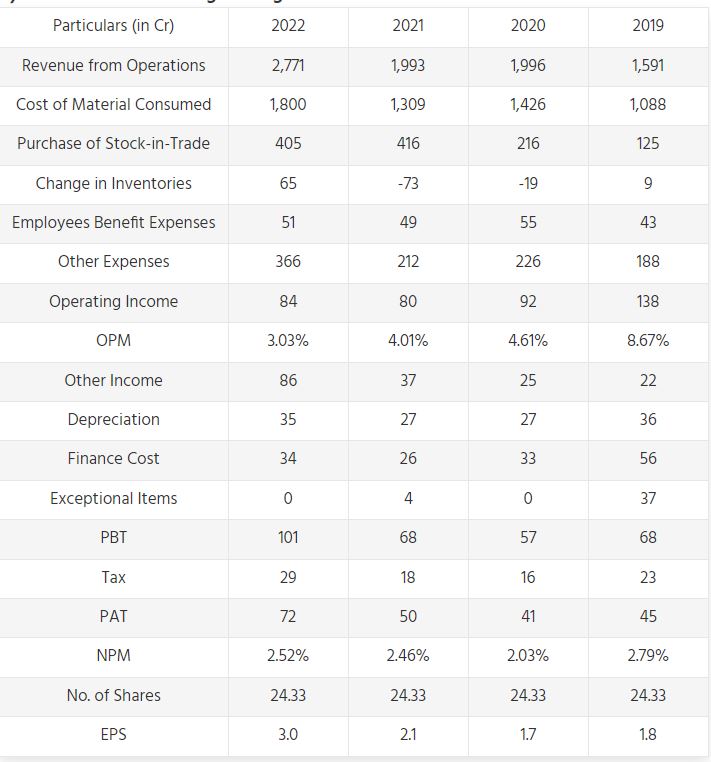

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.00% | 0.90% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

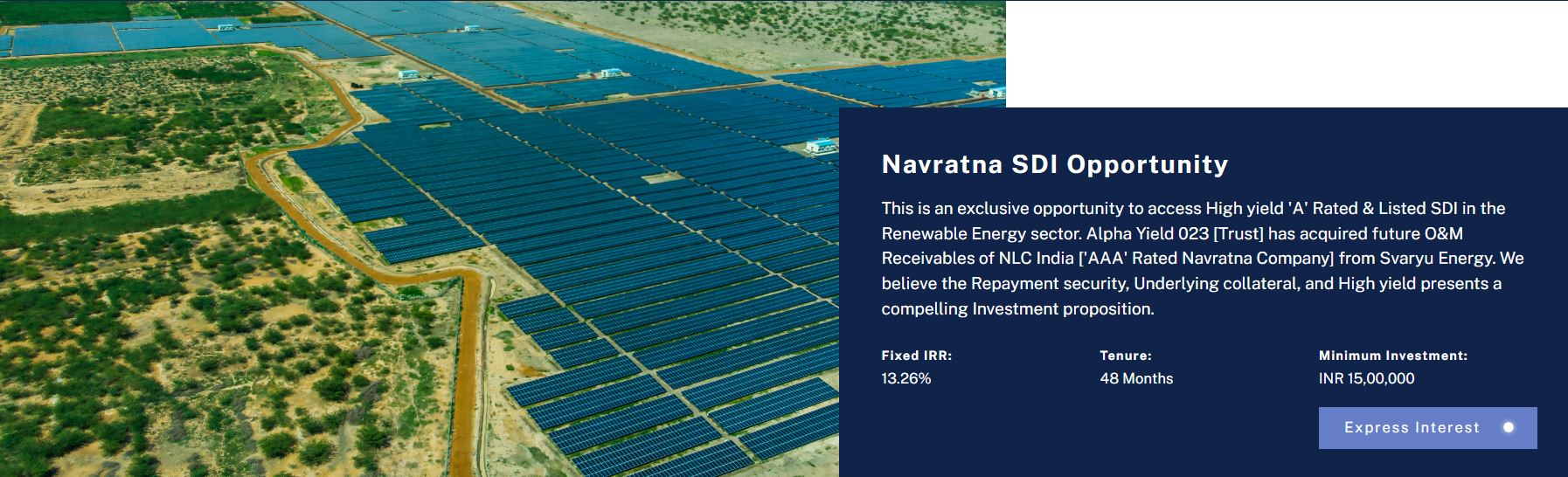

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | SEBI Pause | SEBI Pause | N.A. |

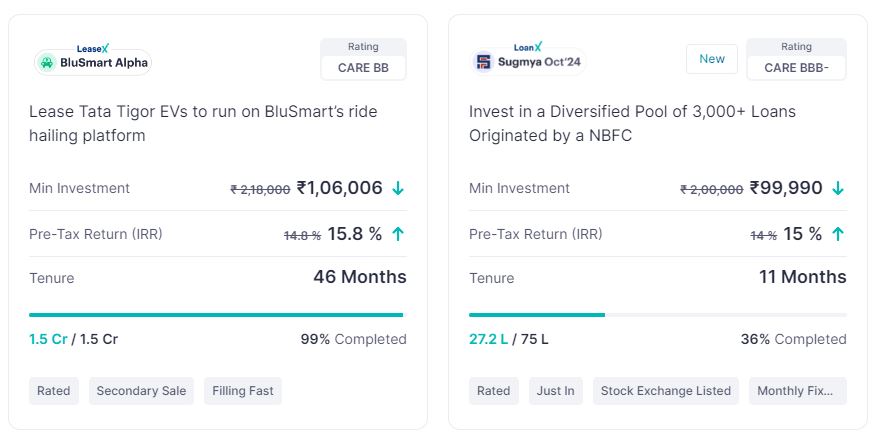

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

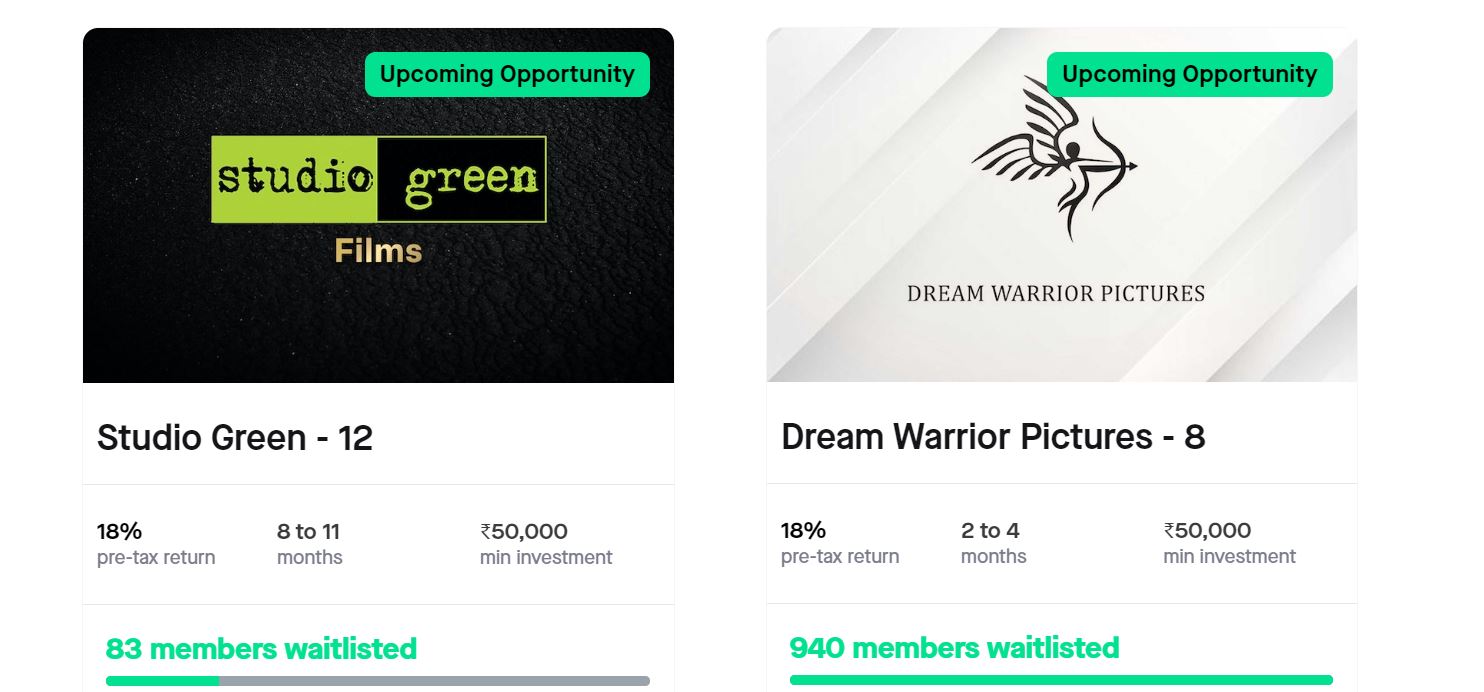

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

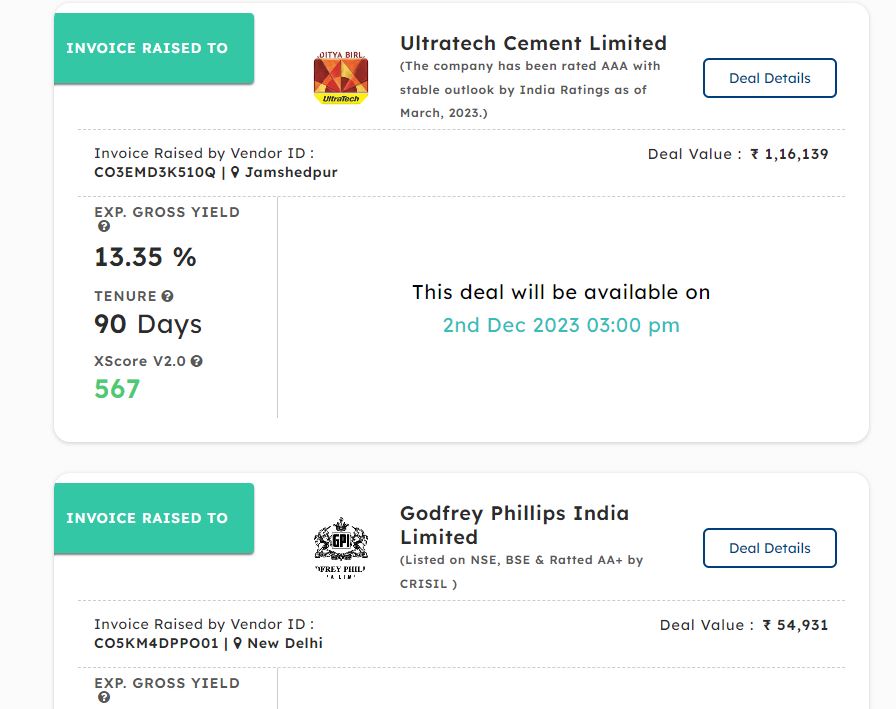

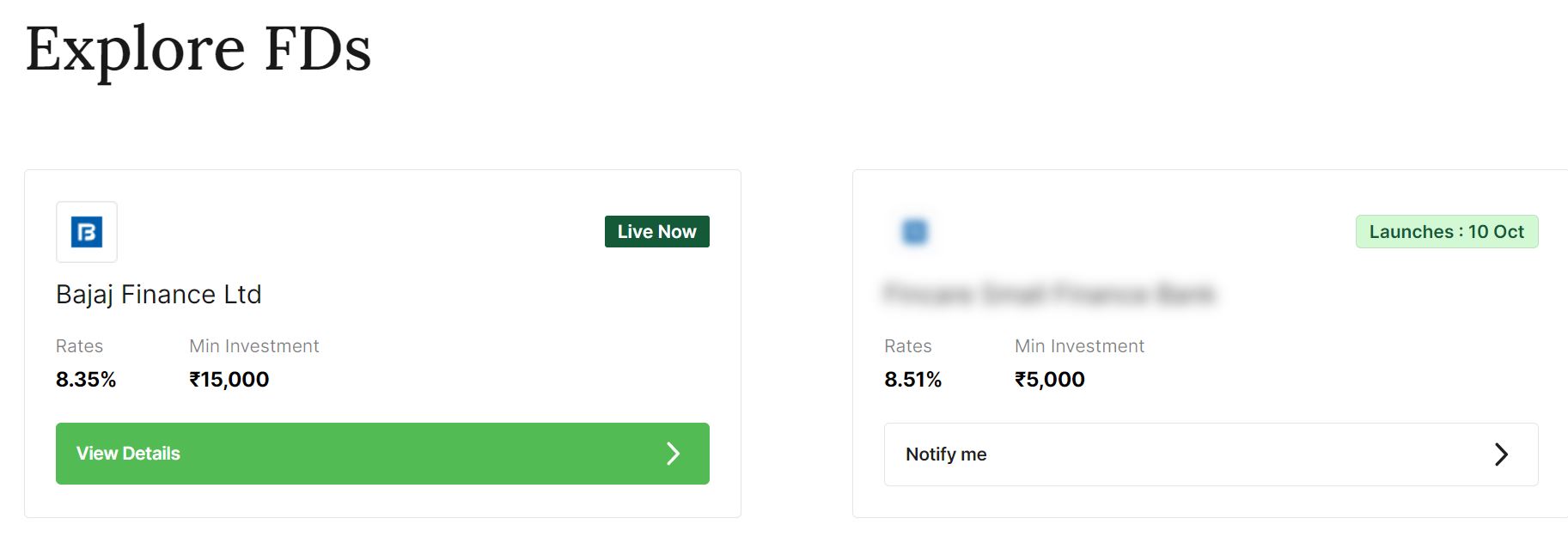

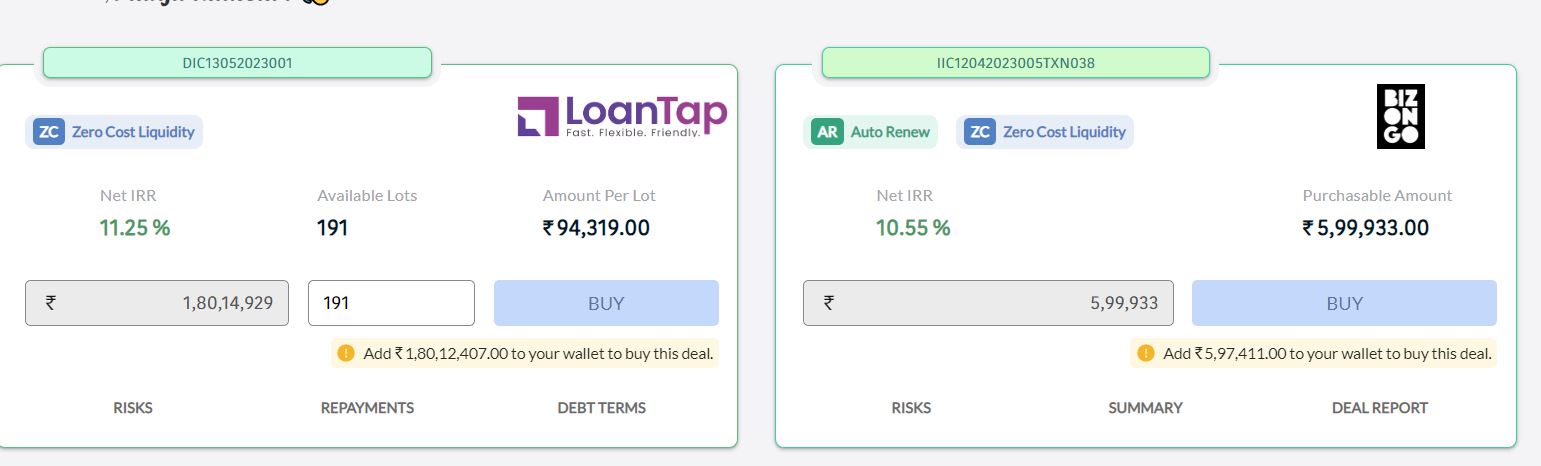

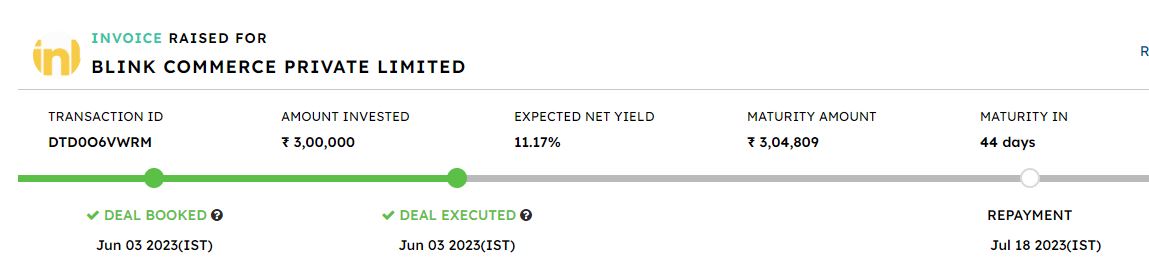

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Liquid Fund Substitute) | 9% | 0% | 0% |

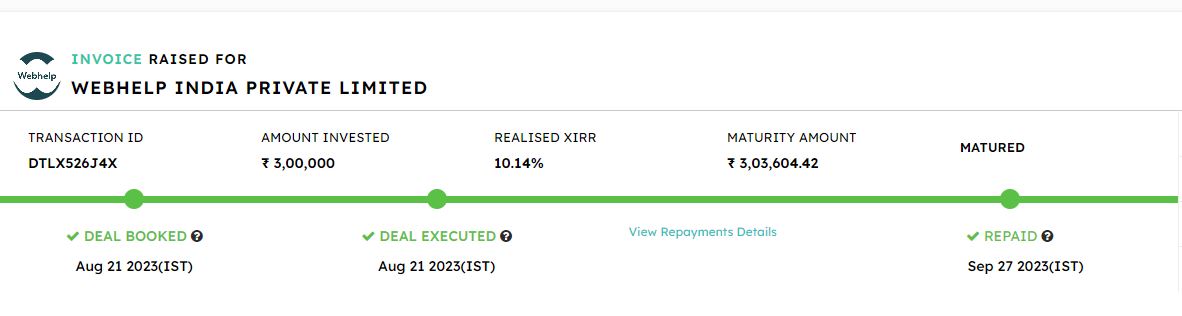

| Tradecred | 11.50% | 0% | 0% |

| Lendbox (Per Annum Liquid Fund Substitute) | 11.50% | 0% | 0% |

| Lendzpartners | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

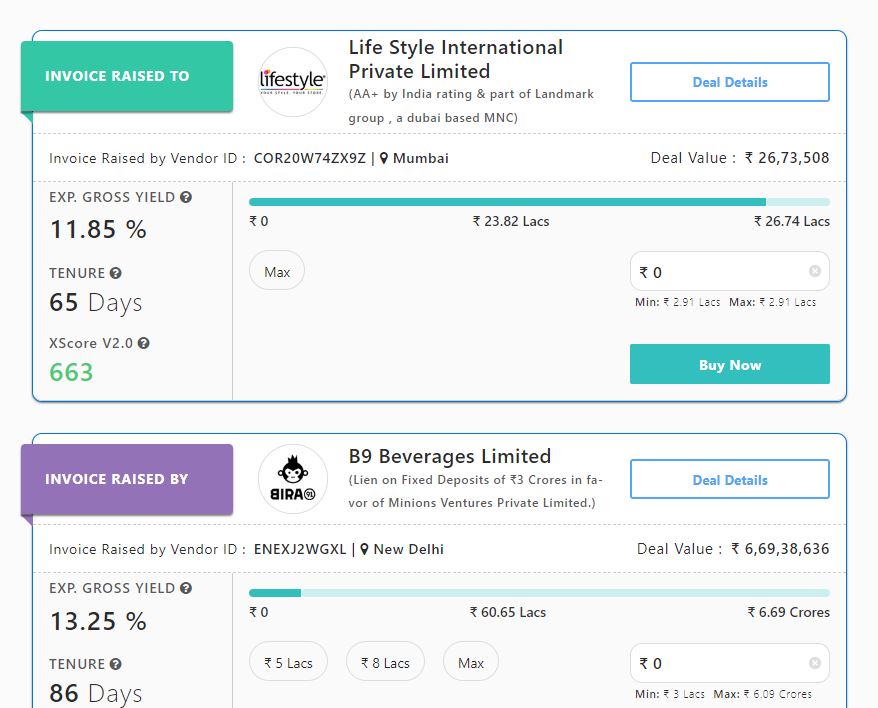

| KredX | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

- Lendbox Per Annum returns are as per expectations with seamless liquidity. Current yield 11.69%

- Have taken out money most capital from Liquiloans as yields are too low!

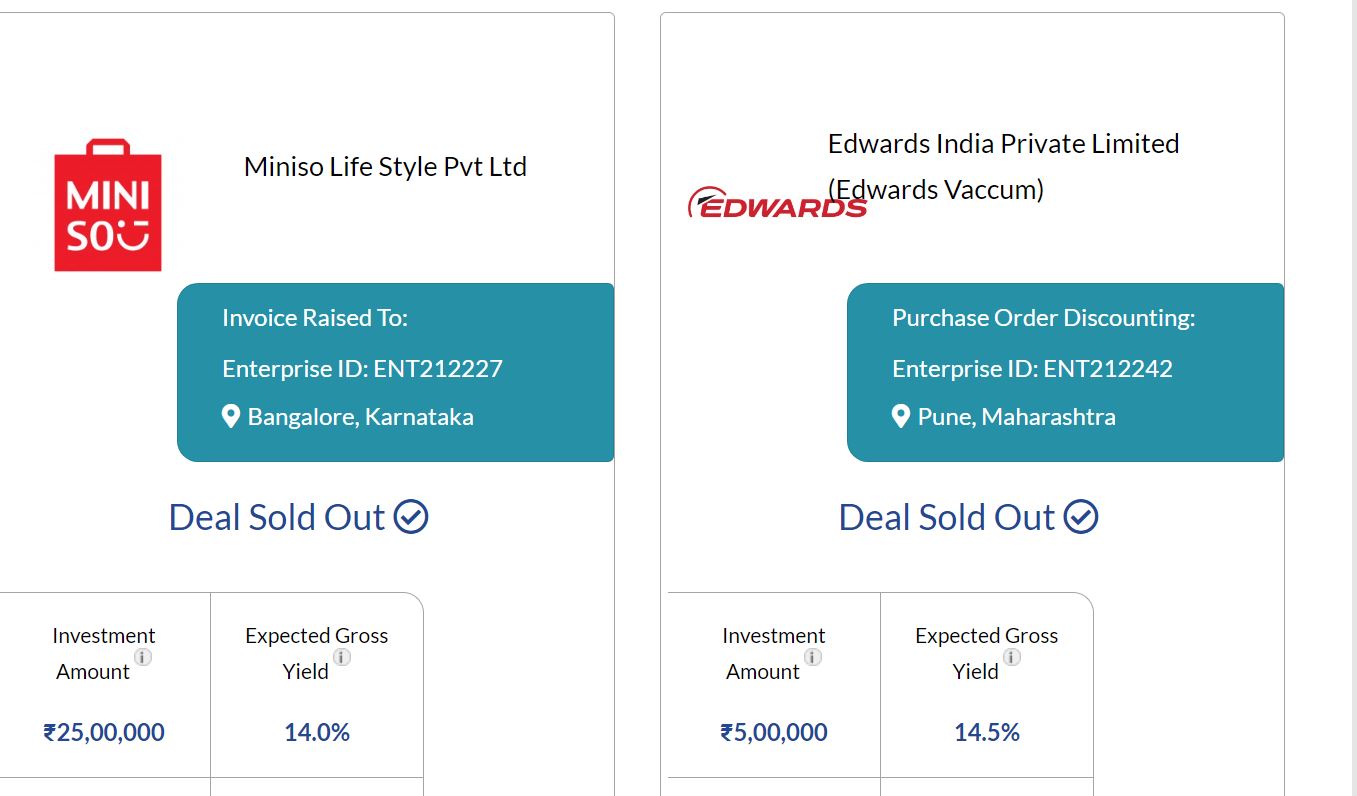

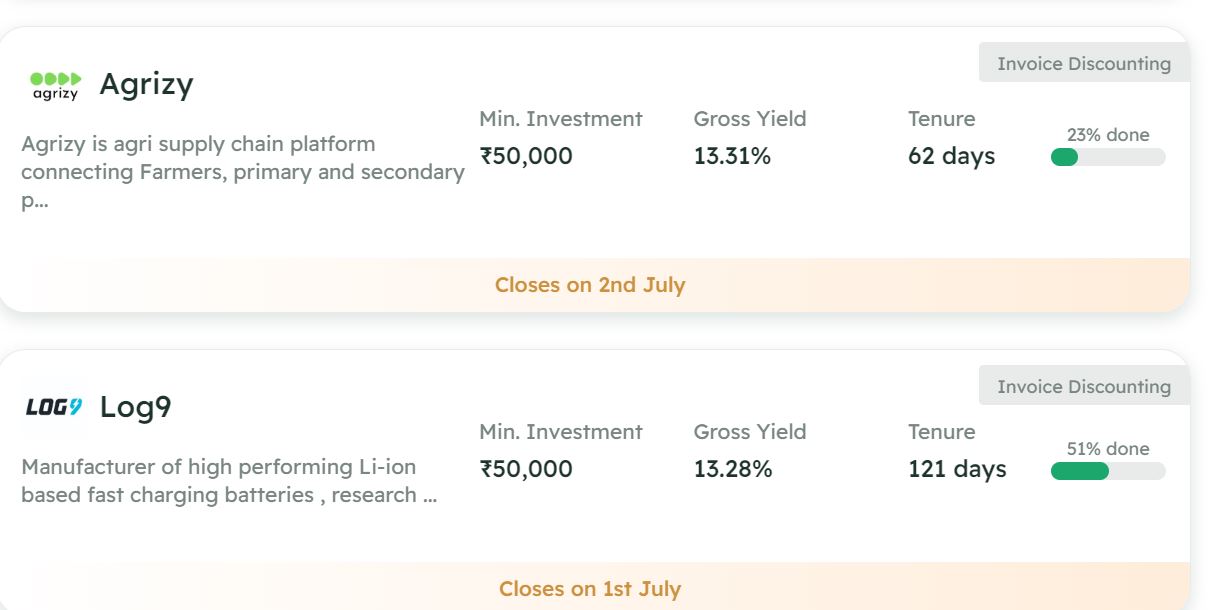

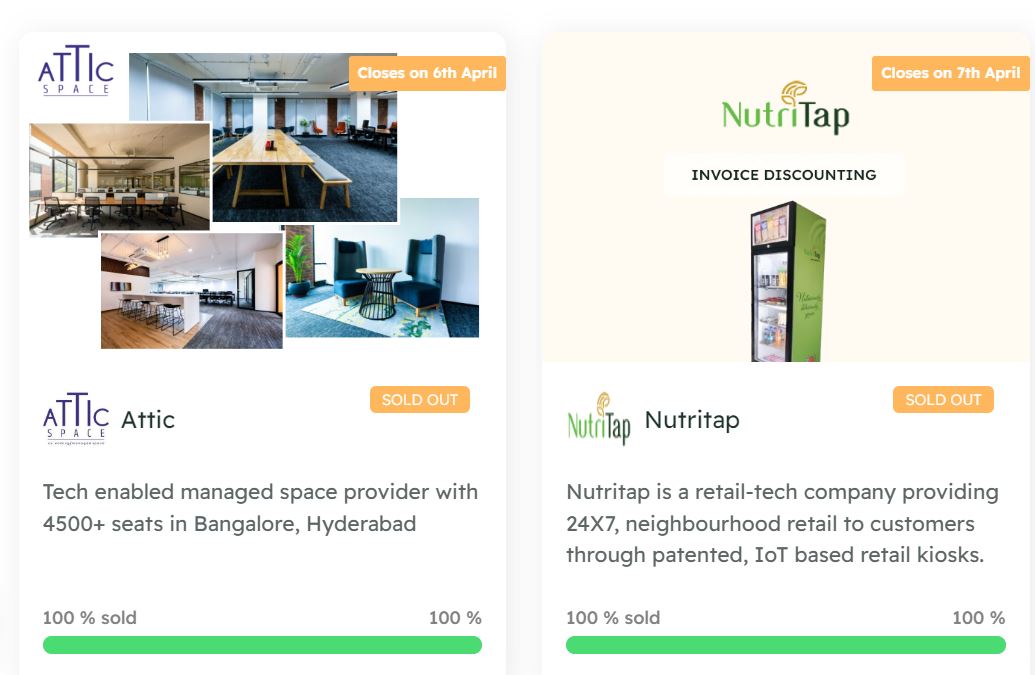

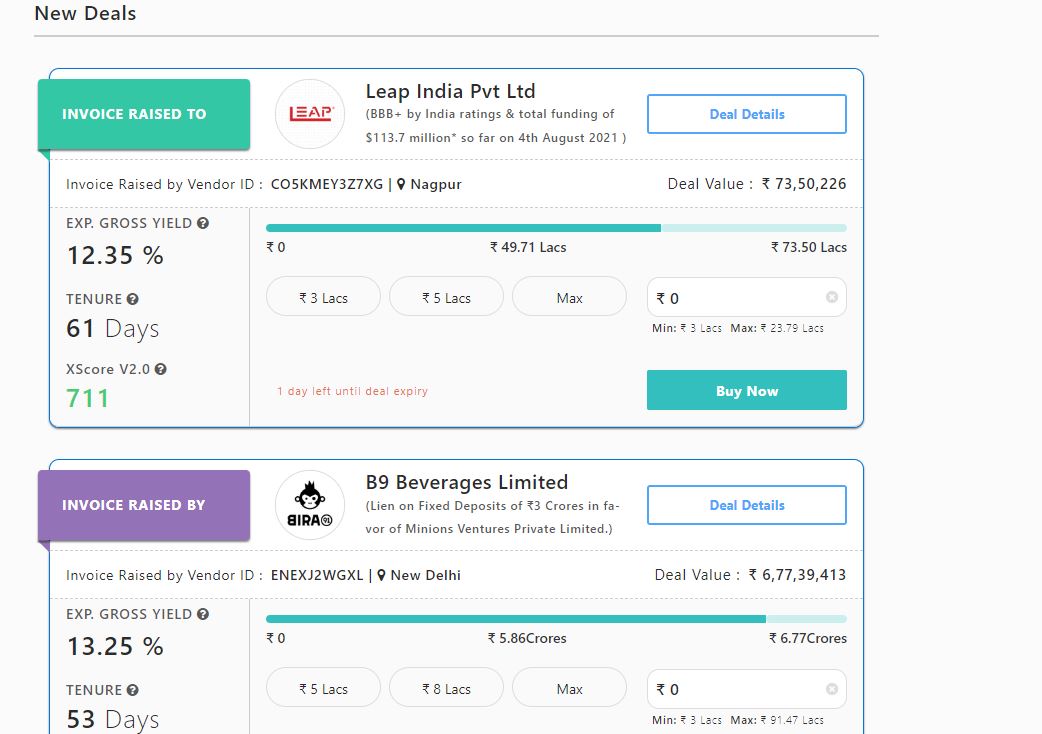

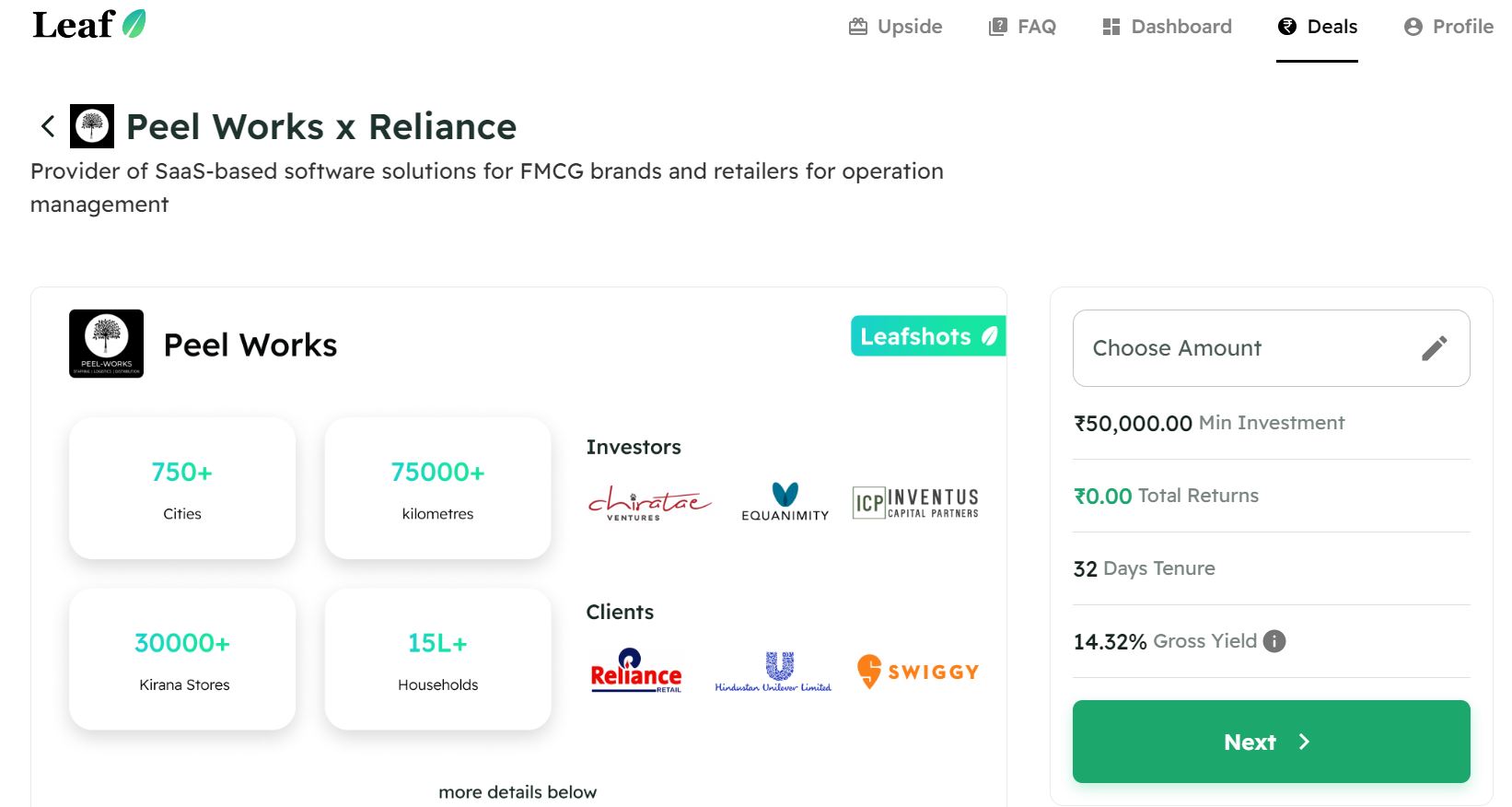

- Invested in Log9 on Tapinvest and Wonderchef, Amazon on Kredx

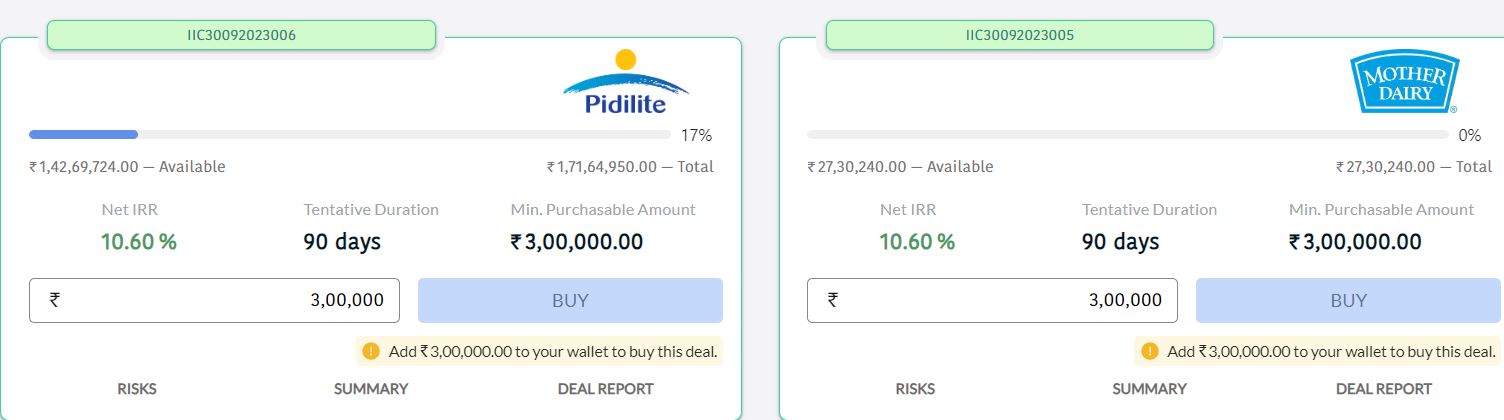

We would be focussing on only a few names in invoice discounting as do not want to take risks of new enterprises or vendors.

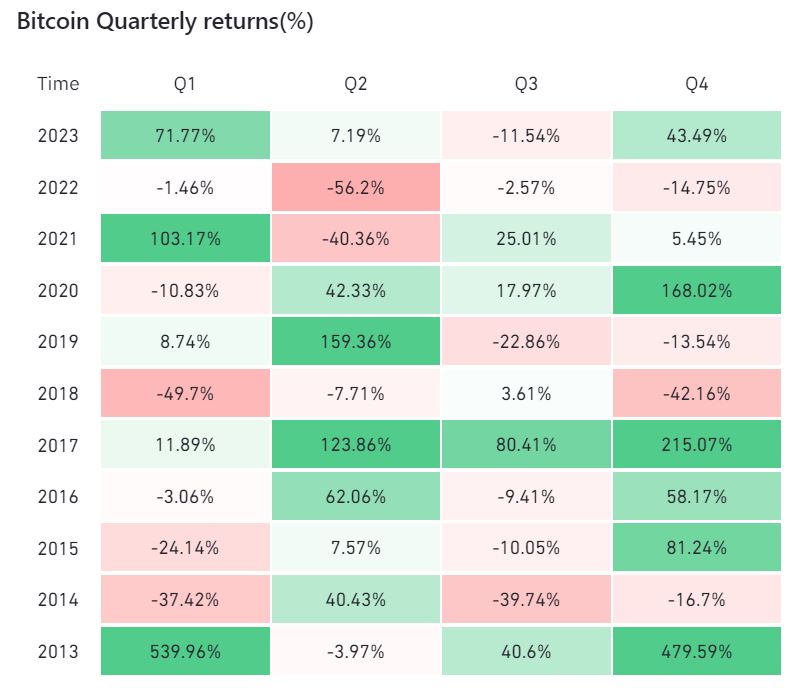

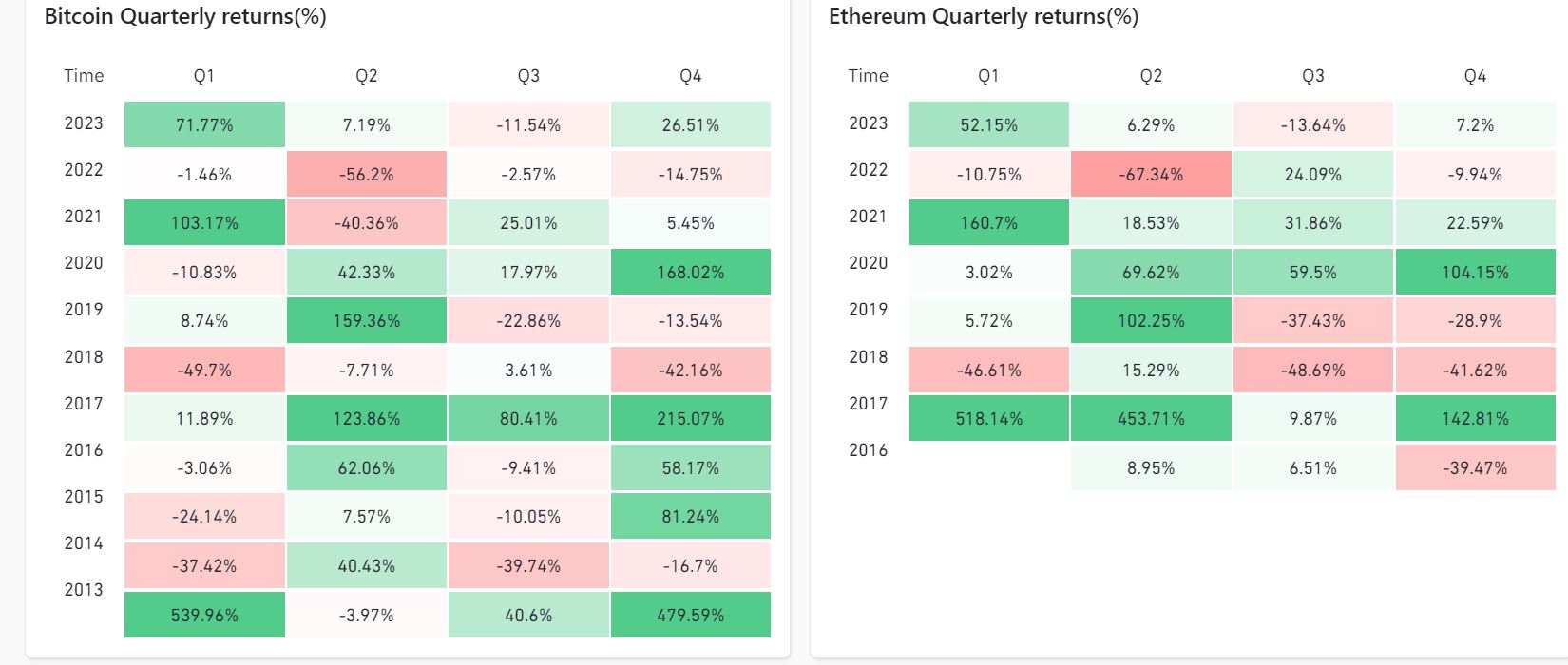

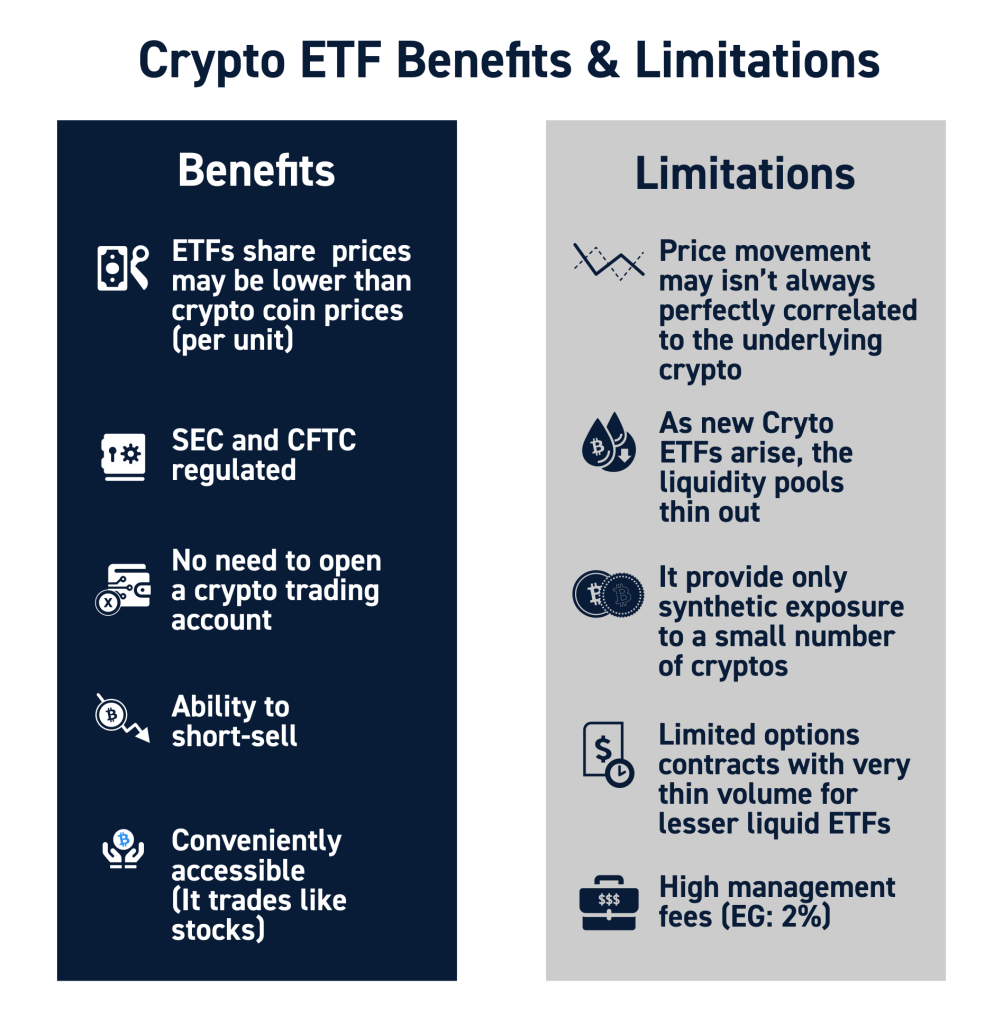

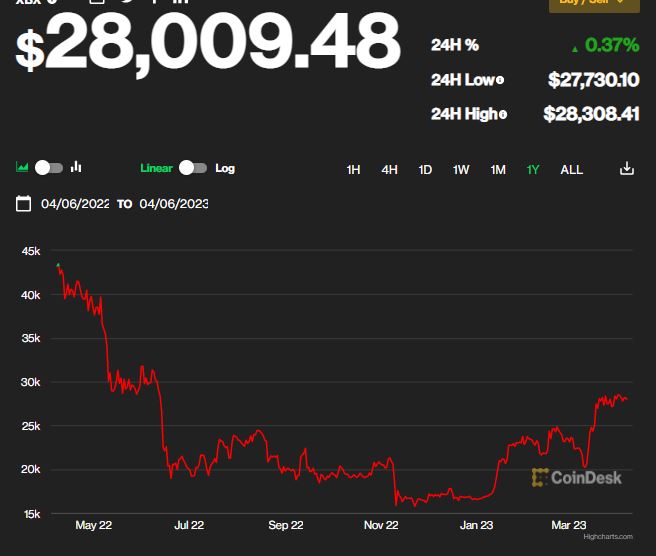

Crypto Investing

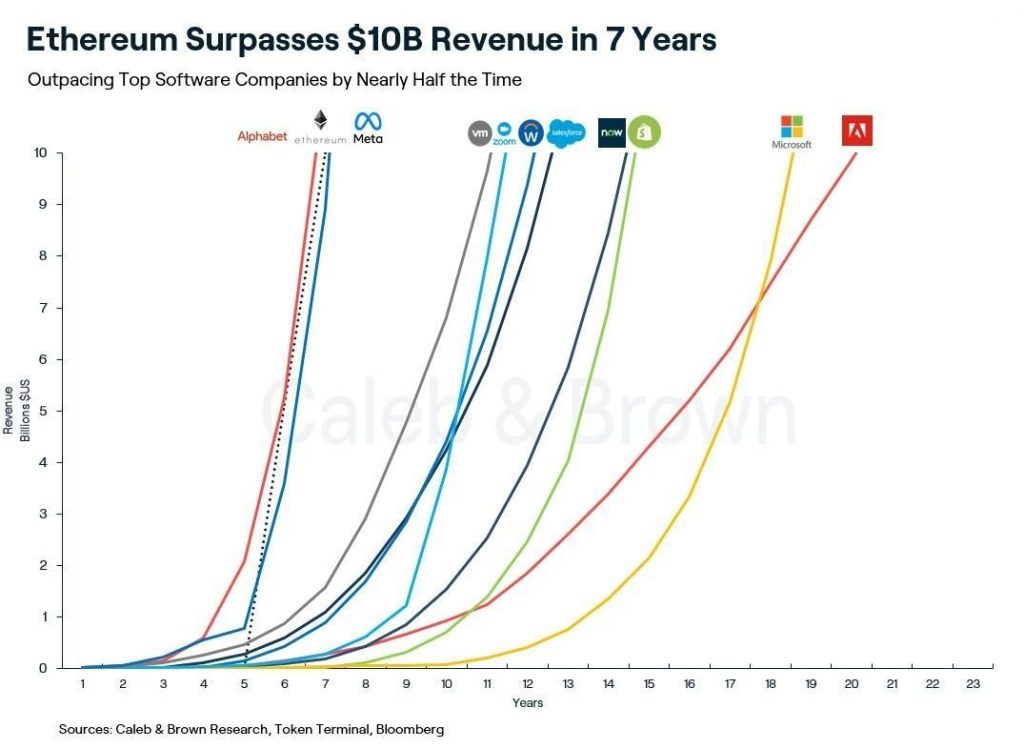

The Bitcoin ETF approval has started a fresh rally in the crypto market. A record $520 million stampeded into BlackRock Inc.’s Bitcoin ETF in a single day. Year to date, Bitcoin is up more than 45%, making it a top performer among any kind of asset even after surging last year.

Investing after the crash has been a good move. We feel the rally might sustain and 2024 will continue to be a good year. At these levels, we are not adding new capital but shuffling the portfolio, booking profit in some and replacing them with others that have not moved much.

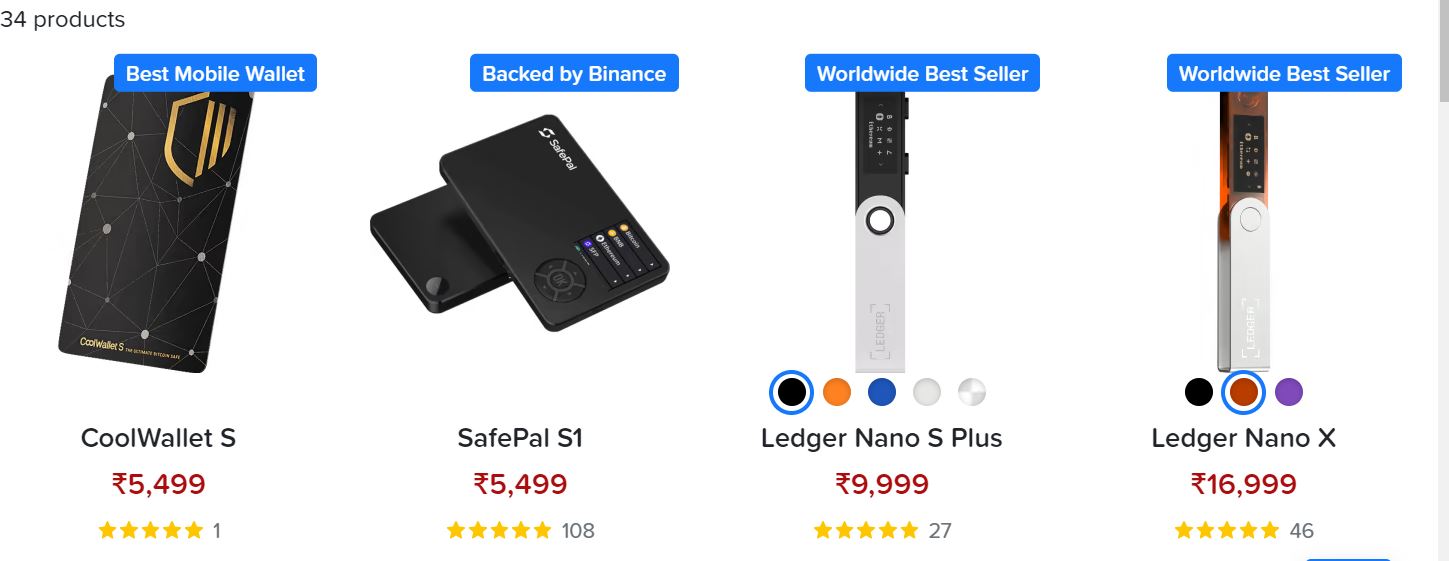

You can buy Hardware Wallets on Etherbit

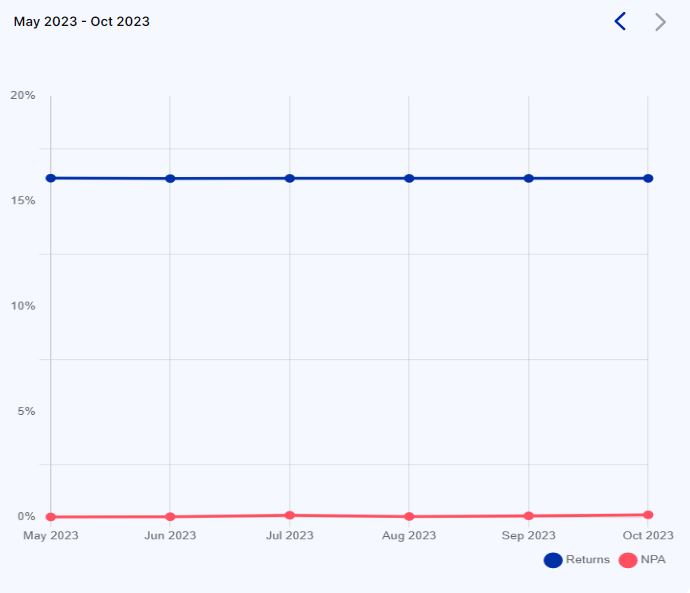

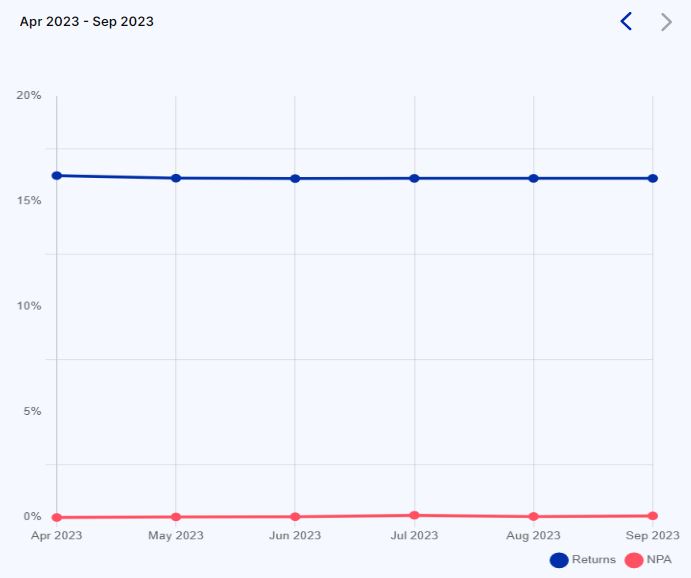

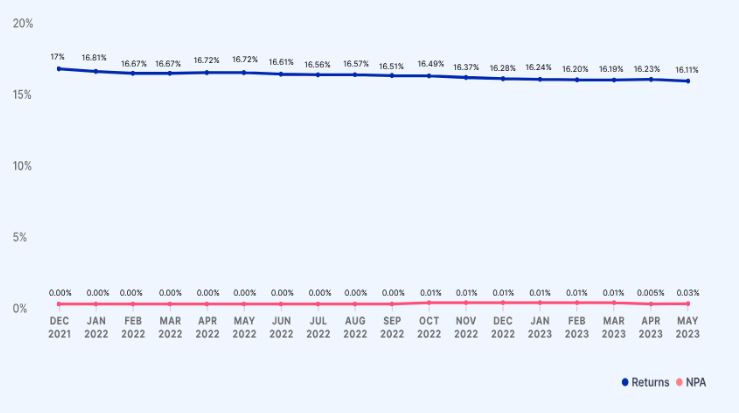

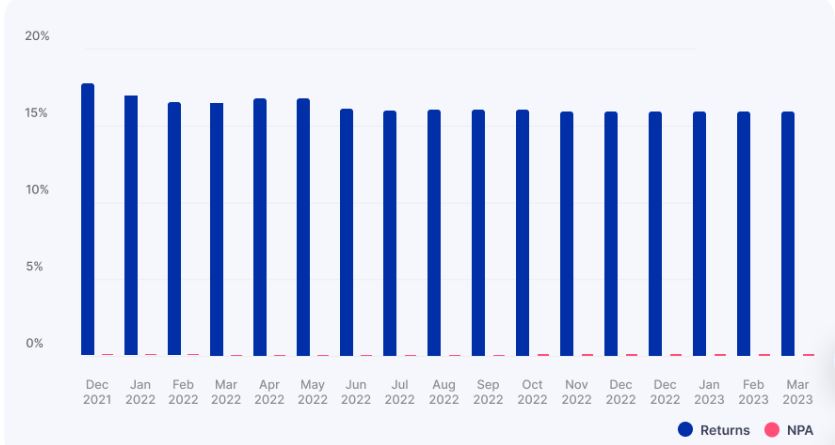

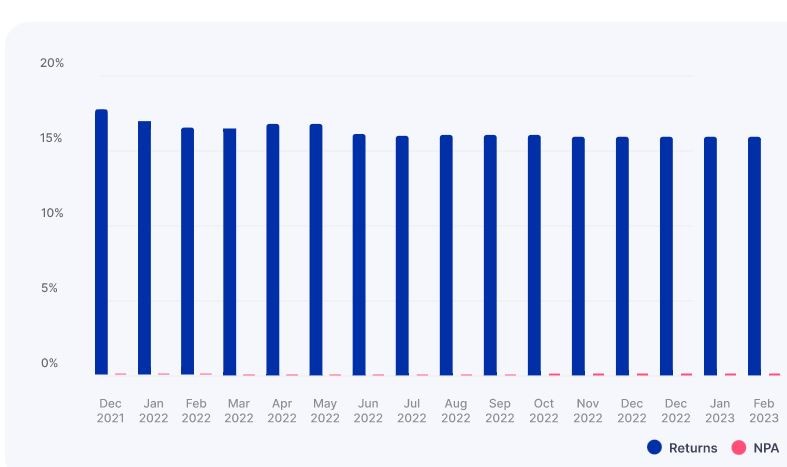

P2P Investment

Current allocation:

- India P2P – 50%

- I2IFunding- 20%

- Finzy-10%

- Faircent Pool Loan -15%

- 13 Karat – 5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.5% | 4.8% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 3.7% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- I Have completely stopped 12Club now as the yields are not attractive anymore.

- There was delay in repayment for some IndiaP2P investors due to collection delay in south India because of floods.

- I2Ifunding (get 50% off) has again started doing more volume. I have deployed some capital. I have been using the platform since 2017 and is the only platform that was able to get investors positive returns after Covid! Will be doing a 5 year review soon and try to have an interview with the founder.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing fine. Not adding more capital at the moment.

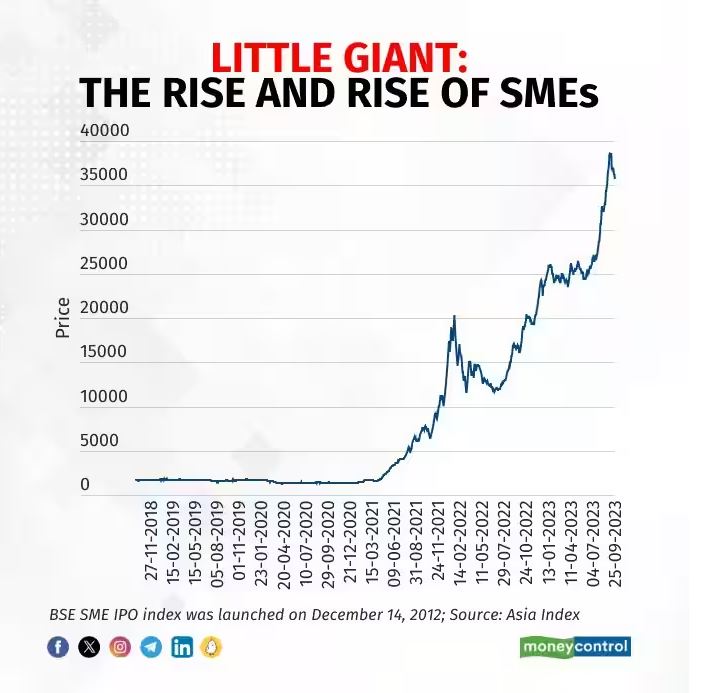

Equity Market

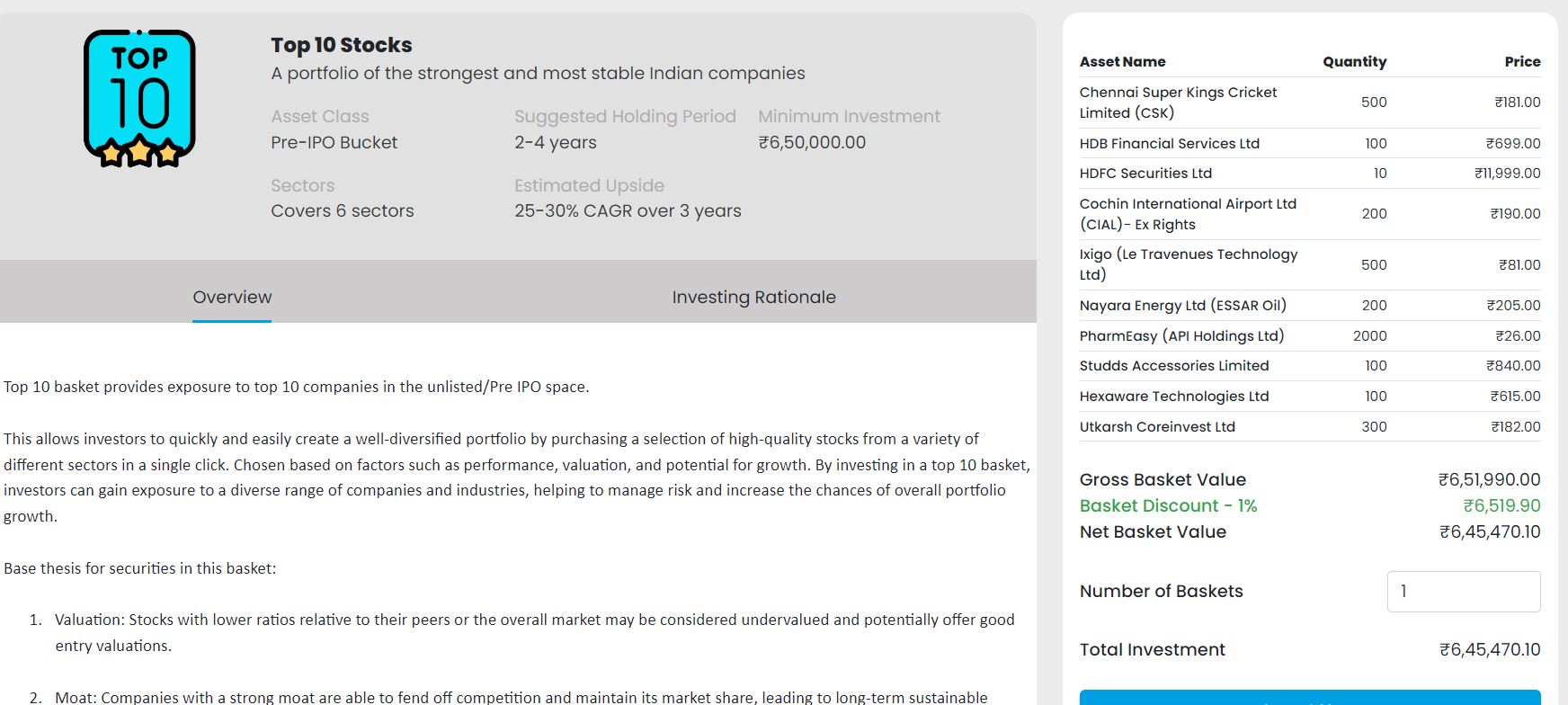

PreIPO Stocks

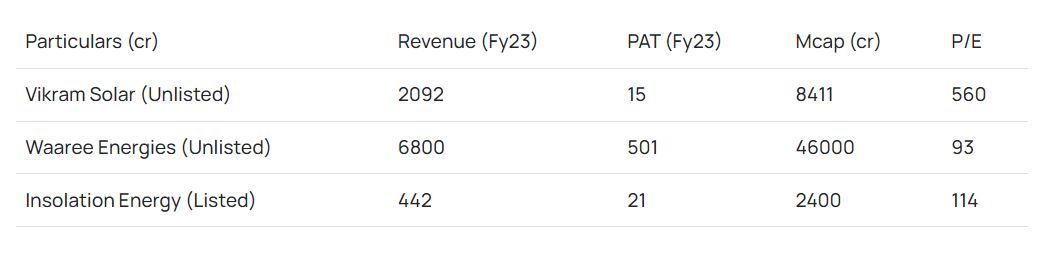

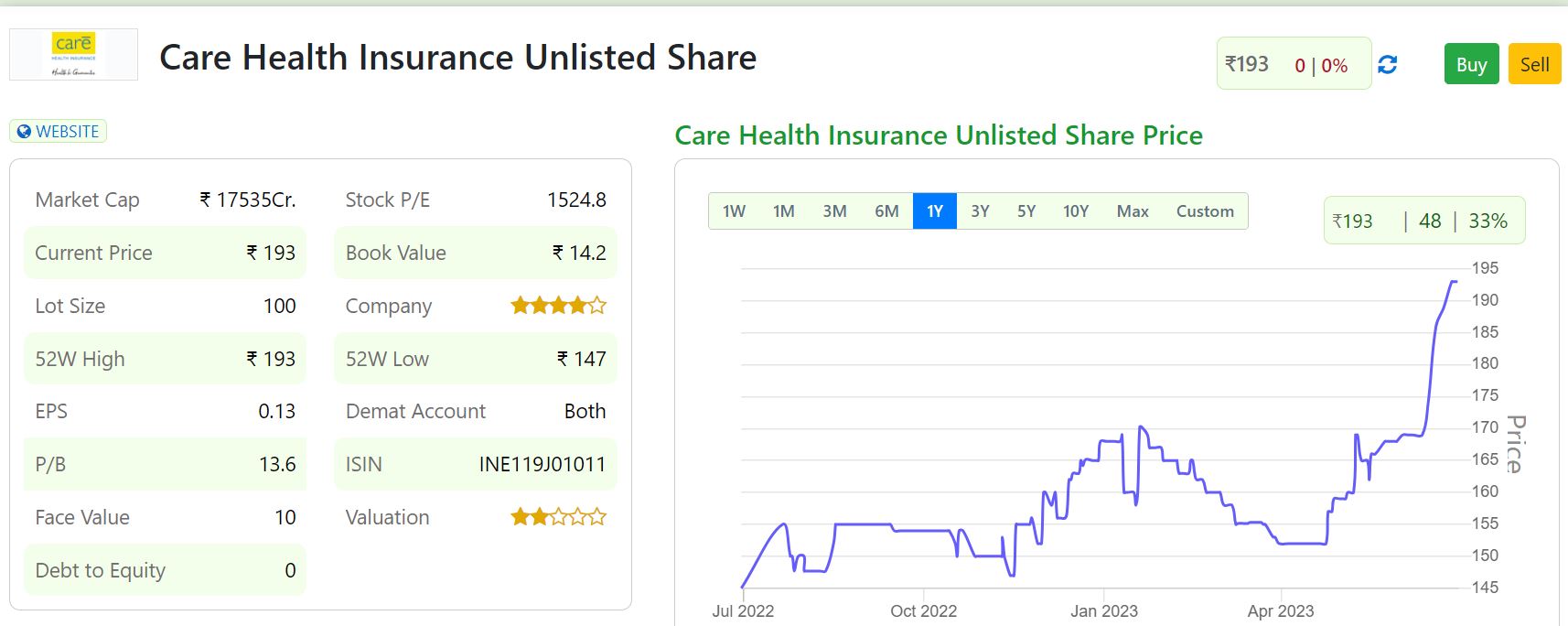

We have added a new unlisted stock – Vikram Solar to our portfolio. The stock has a similar business model as Waree but is significantly cheaper than it. Vikram Solar Limited is an Indian company based in Kolkata. It is one of the largest solar module manufacturers in India (by capacity), with 3.5 GW module manufacturing capacity annually, and the second-largest solar energy company in India by revenue. The company’s primary business focus is manufacturing solar PV modules, and also carrying out engineering procurement and construction services and operation and maintenance of solar power plants. We have been able to source the stock at less than 200 Rs which is lower than other online platforms

The major risks associated with this stock are

- High Debt

- Inconsistent profitability

Listed Stocks

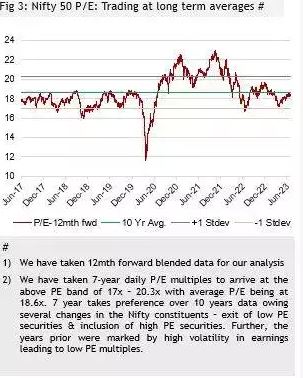

The broad market has been in continuous bull mode with almost all sectors giving excellent returns. US markets have also been doing extremely well. The only market that has underperformed is China however it would be a high-risk investment bet to allocate large capital there. We would be adding some allocation there with a 5-year view. Nvidia is now worth the same as the whole Chinese stock market as defined by Hong Kong-listed H-shares.

The MSCI India Index trades at a 157% premium over the China gauge on valuations based on forward earnings estimates, just 3 percentage points short of the record reached in October 2022, according to data compiled by Bloomberg.

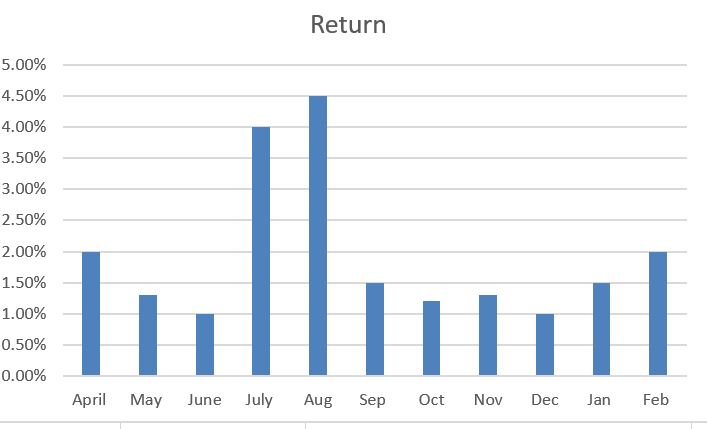

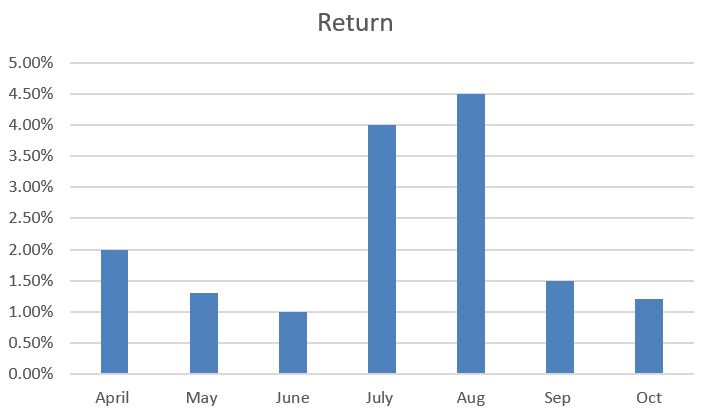

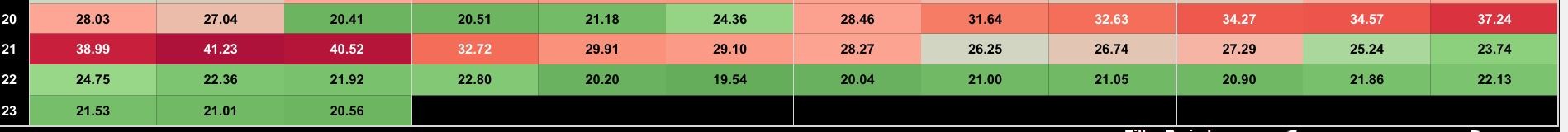

Algo Trading

Our Algo and Manual Option trading gave a 2% return in Feb. The high premium due to the upcoming elections has been beneficial to us as risk-reward has become favorable in option selling however market behaviour has become more erratic with multiple intraday spikes hence risk management is a key to making sustainable profits.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

It is evident from returns that’s hard to predict the distribution of returns as that is the function of market behavior. On an annualized basis 20-30% is a decent target.

Investors with INR 30+ Lakh deployable capital can reach out to inquire on more sophisticated algos

Other Alternative Investment Assets and Platform Updates

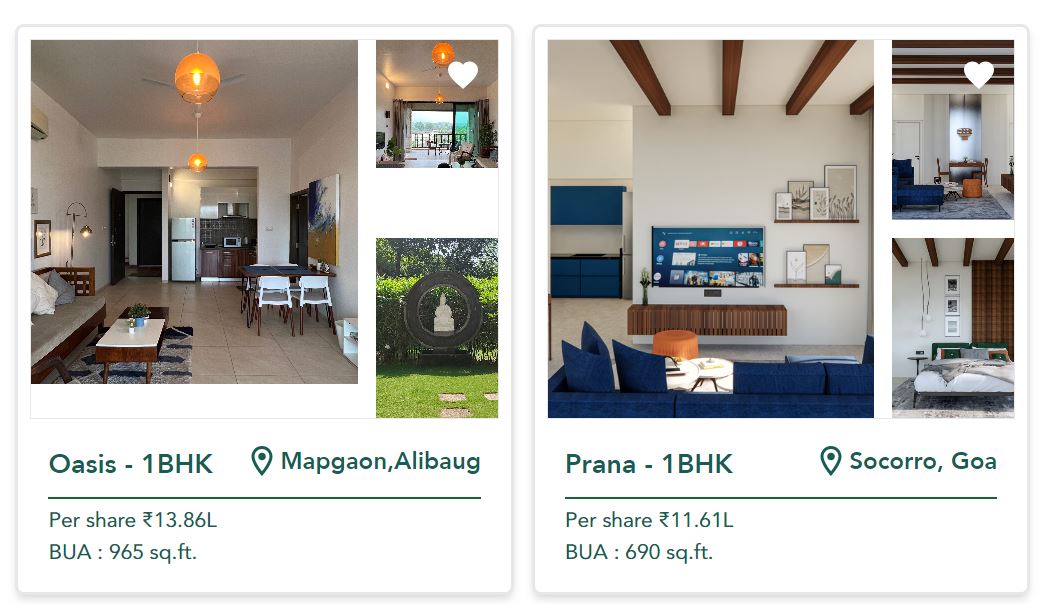

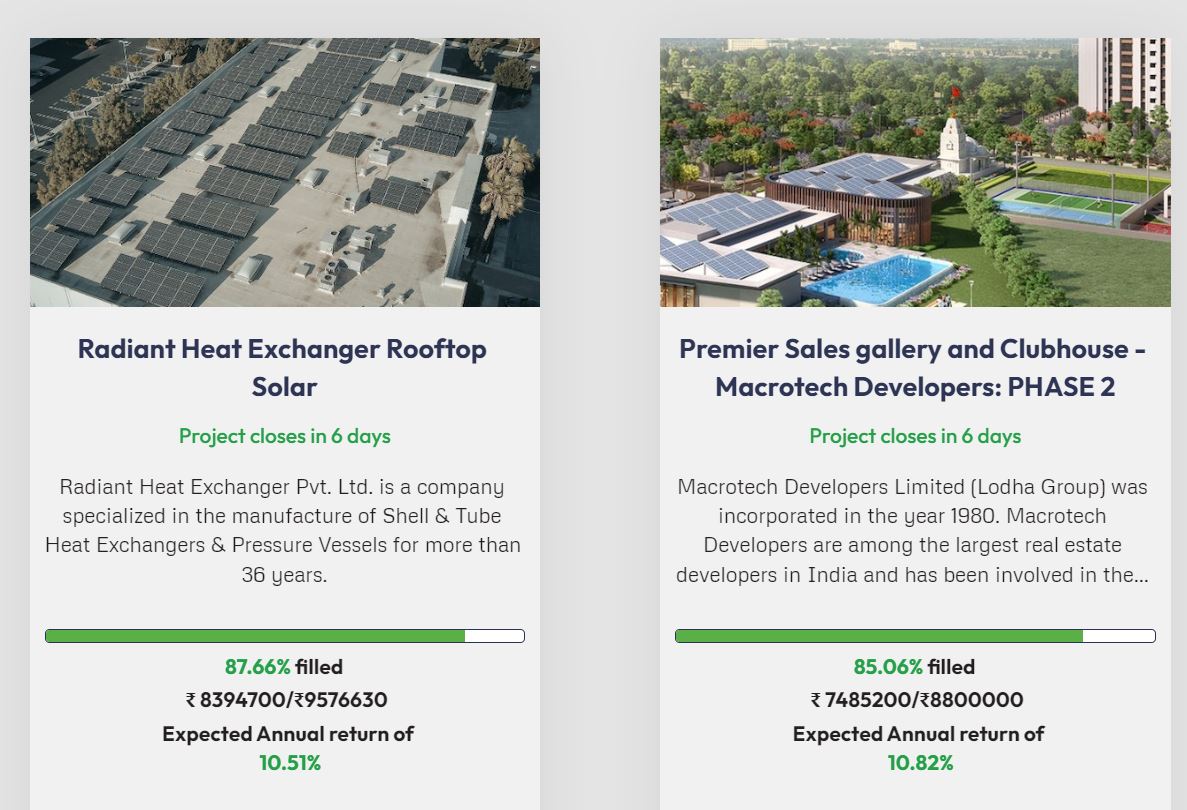

ALTDRX – My current investment in ALT DRX has been deployed in prime land assets. I am looking at a window of 18-24 months to target 15%+ IRR in the investments. They are planning to launch a couple of more properties this month.

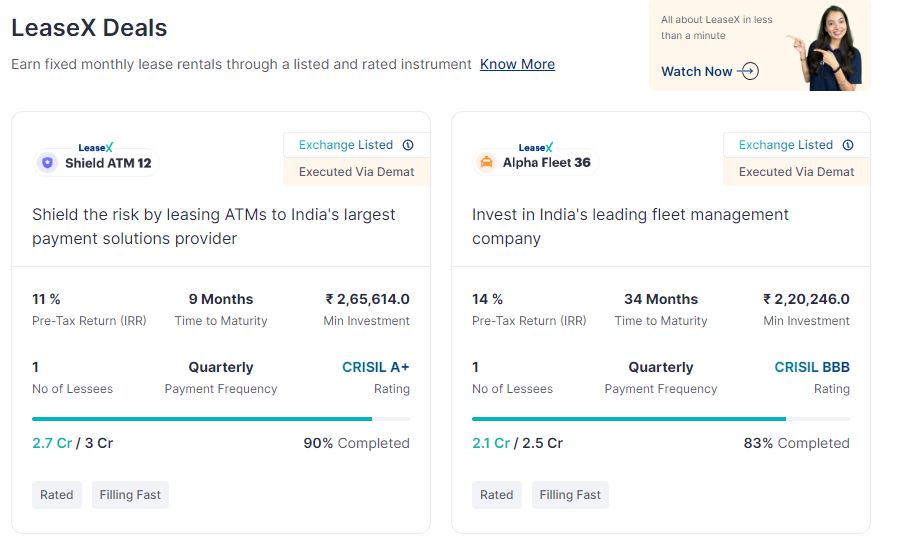

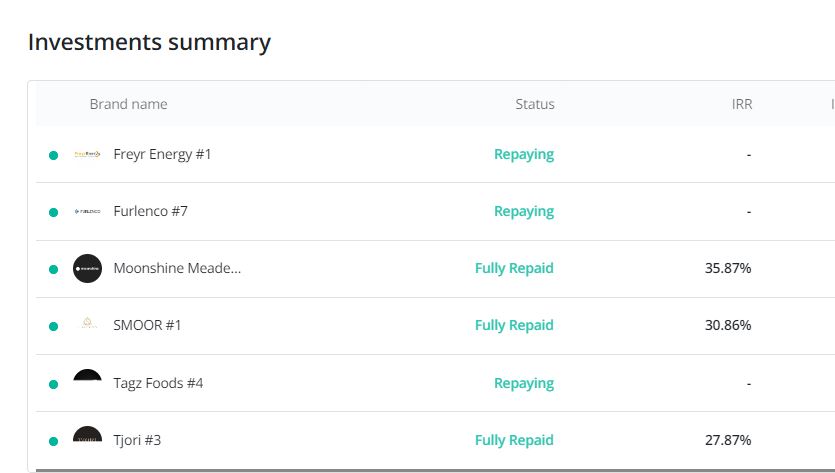

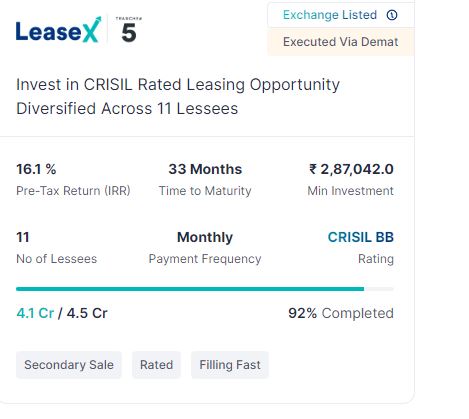

Leasify Investment – Leasify generally has low volume as they are bootstrapped hence I do not expect to see many deals on the platform for a couple of months. The current deals are doing fine.

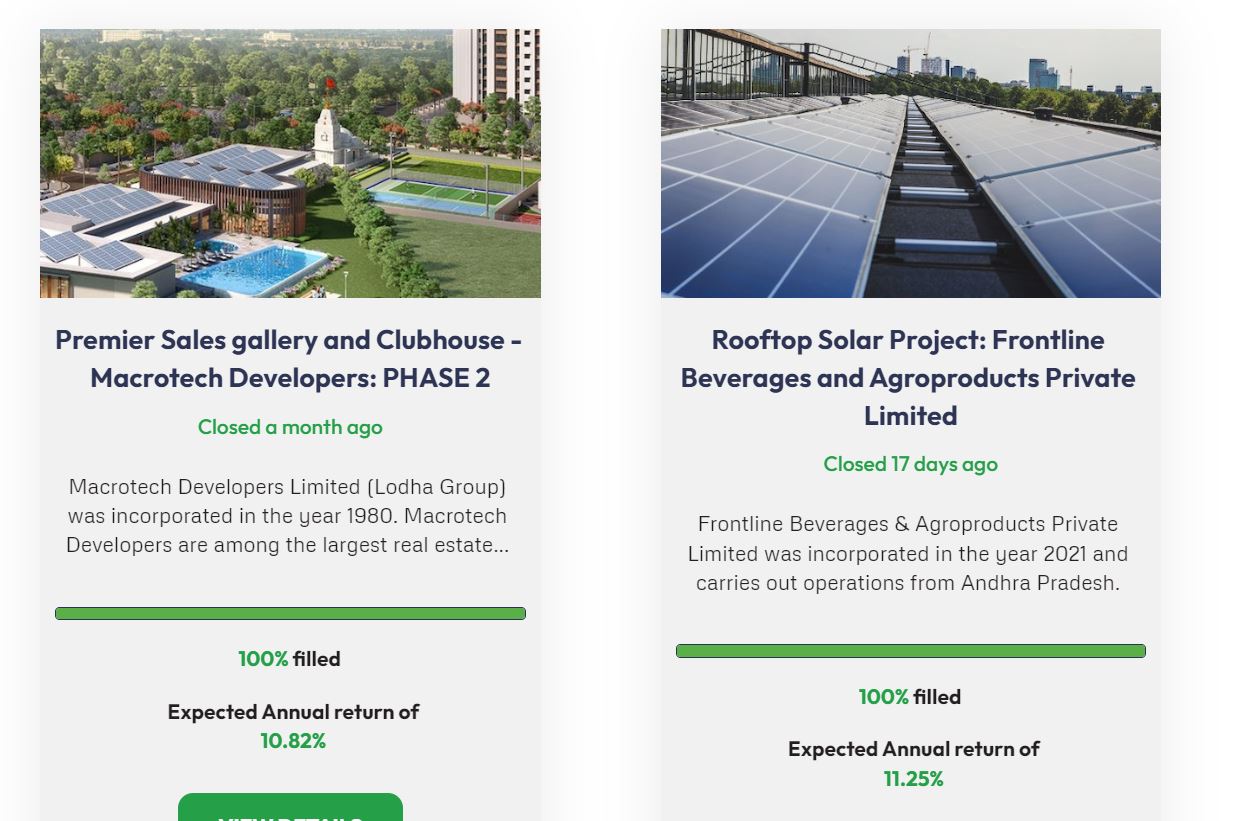

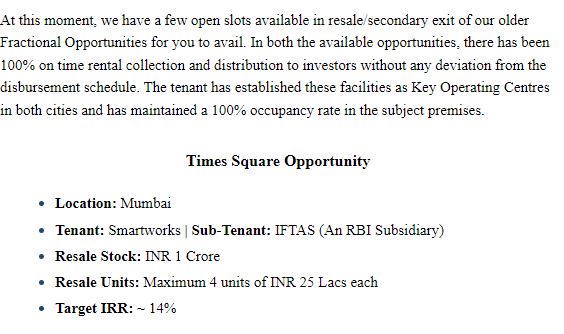

Wisex- My investment in Wisex has been performing as expected. It is more than 2 years since I made my first investment in Times Square Property Mumbai through Wisex. I expect an exit this year in my investment

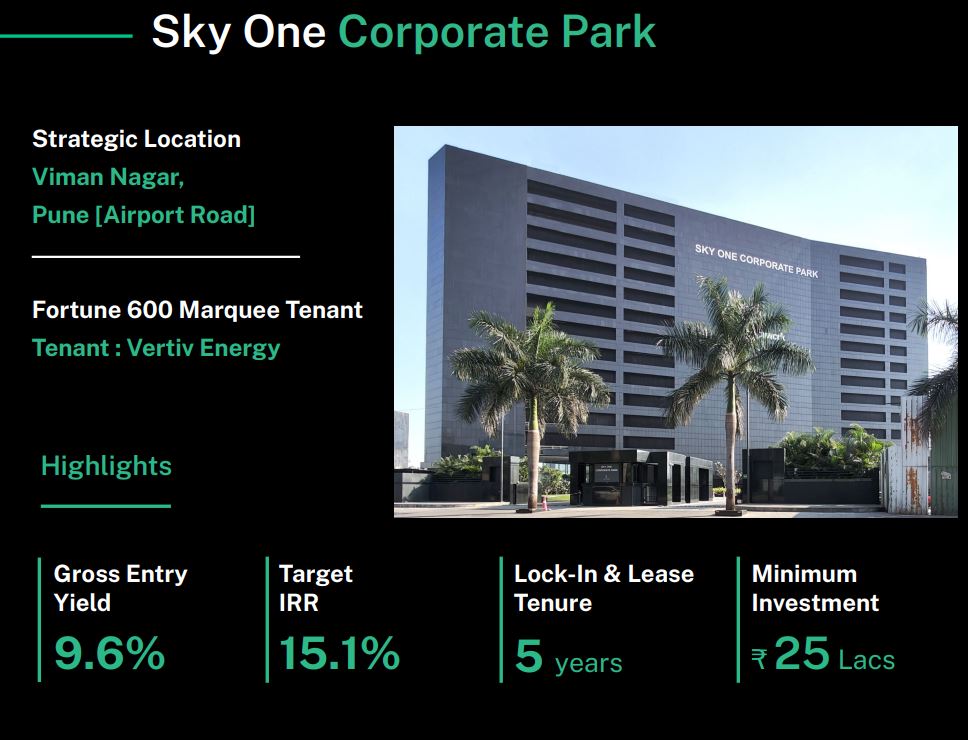

They have a fractional Real Estate deal in Pune that has a decent yield

Flagged Alternative Investment Platforms

Have added “My Cloud Particle” to the list of “Flagged” platforms. The platform has not provided much information on the deals, or the risk and mentions guaranteed returns. There is hardly any information on the business model or team members’ background data.

If there are other platforms that you feel might be too risky to invest , please do comment and we will explore and add them to the list