Bharatpe has recently come up with 12% Club Interest Account Product called 12% Club. The interest rate is decent considering the traditional products these days offer 3-4%. Review of the platform :

- 12% Club Product Features

- BharatPe business Analysis

- Risk and Reward of the Product

- Comparison with Cred and other Interest Products

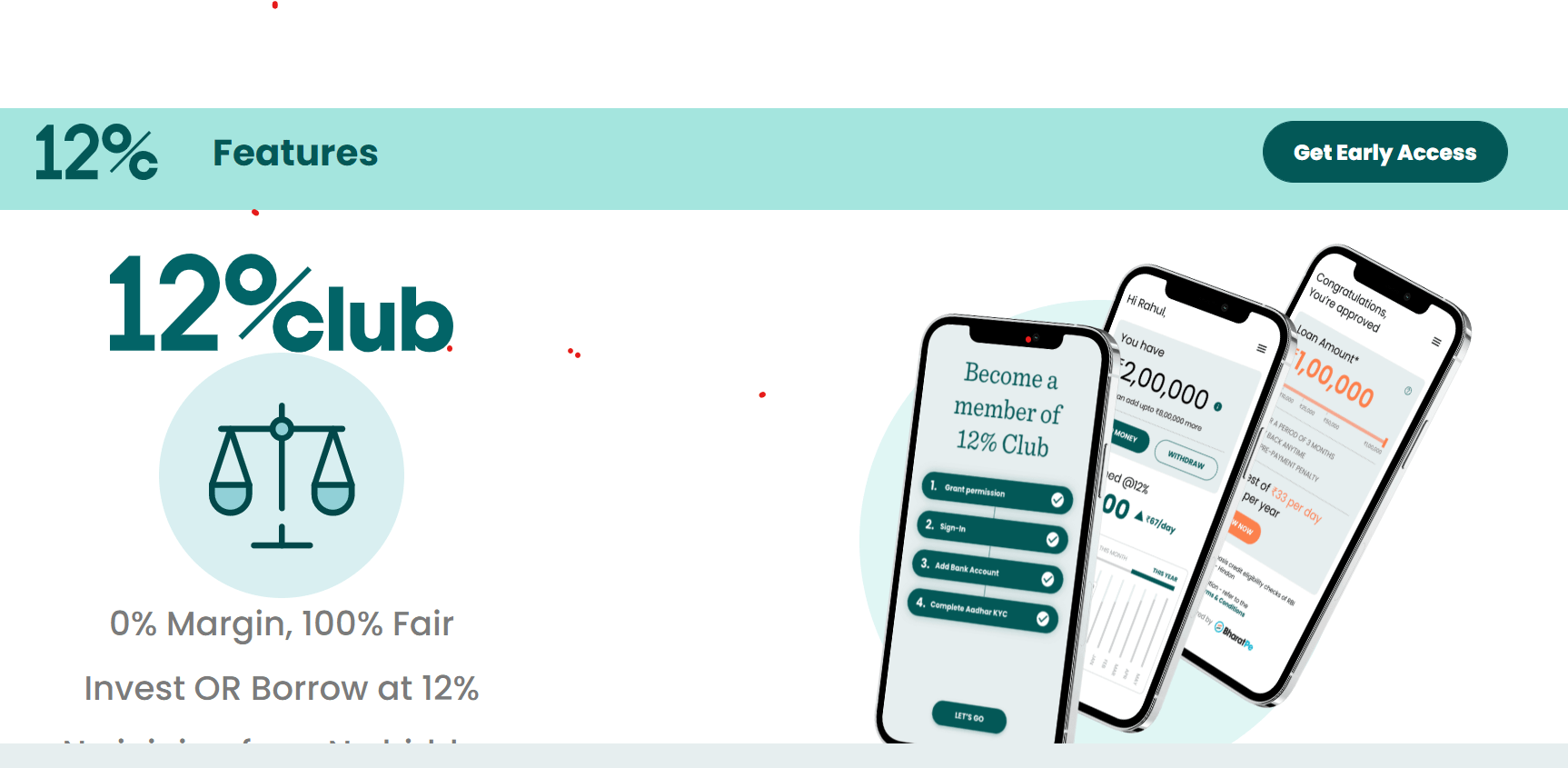

12% Club Product Features

Salient features of the product are

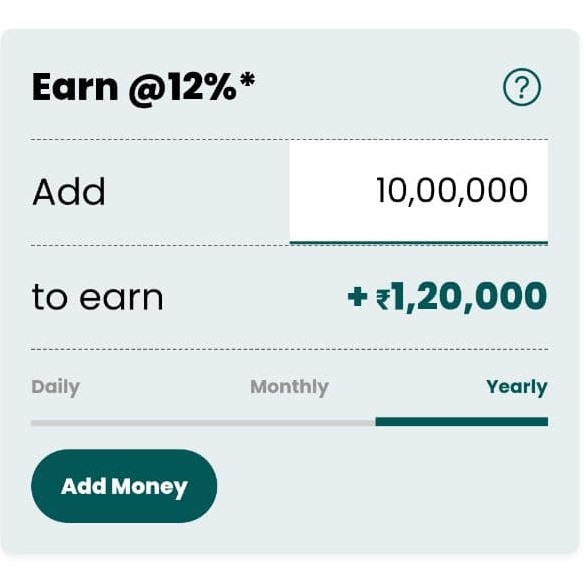

- The product has a yield of 12% per Annum

- It provides daily Interest Credit which means Annualized yield based on daily reinvestment = (1+12%/365)^365 = 12.7%

- Till now no defaults have been seen on the older Merchant Lending product

- The Borrowers are the merchant using Bharatpe till now.

- Maximum Investment INR 10 Lakh

BharatPe Business Analysis

The Business Model followed by BharatPe is as below

- Bharatpe Onboarded Merchants :Margin of a Retailer is between 8-10% on most products. One of the big problem faced by such Kirana shops was digital channel charged fees and took away part of margin.No payment gateway or wallet was taking less than 1.5% commission. Moreover, awareness of the UPI system was practically zero. Bharatpe used this opportunity to create a USP with zero comission.

- BharatPe Provides Credit : Shopkeepers need money to purchase the items from distributors. Hence there is always a money requirement gap between purchasing and selling good. Most shopkeeper end up taking money from unorganized market. Bharatpe filled this gap by providing credit at low cost

- Bharatpe Data Analysis :The kind of transactions a shopkeeper does, their usage of other products on the platform, etc.—which gives them an insight into the business’s cash flow. This is then analyzed in tandem with the merchant’s loan history and credit score to make a loan offer. For a willing shopkeeper, the fintech firm’s NBFC partner processes the loan and credits the merchant’s account in a few days. All digital, hassle-free, and, perhaps most importantly for the shopkeeper, collateral-free.

- Default Risk : BharatPe, says its repayment rate is 96%, among the best in the market. That’s because instead of requiring the merchant to pay the daily instalments, it deducts the amount from the QR transactions amount before the bank settlement each day. So a merchant run a risk of being blacklisted if it tries to default.

- Now with 12% Club they are entering in P2P lending and also targeting consumer loan rather than just merchant loans.

12% Club Product Risk and Reward

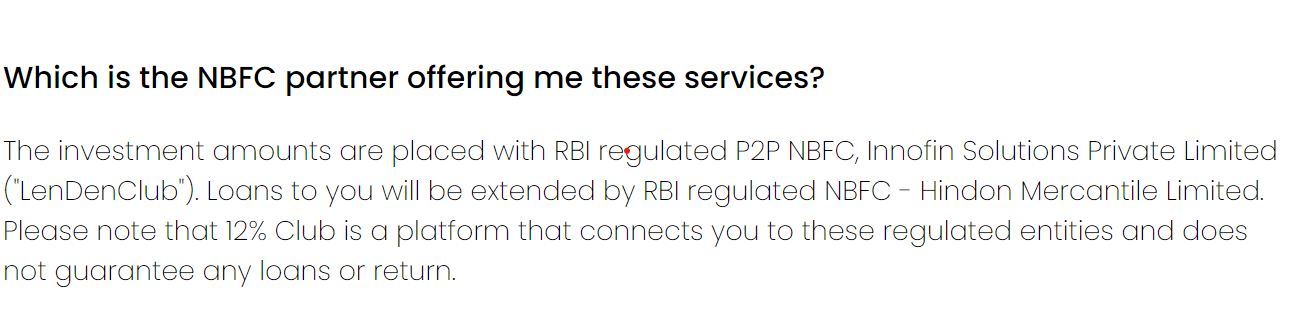

Bharatpe is lending through tie up with Lendenclub. The reason for this is that they do not have NBFC license to disburse loans. I have used Lendenclub in the past and was not happy with the performance. However a big difference here is that the pool of borrowers is vetted by Bharatpe hence default risk is unlike Lendenclub existing pool.

The investment is done through Lendenclub while disbursement through Hindon Mercantile as Bharatpe cannot lend or borrow

In terms of Returns/Reward Chart the product is not bad as yields are high while bharatpe borrower pool is better than fresh borrower for other lending. Till now I have been getting daily interest in my account.

One thing needs to seen that will Bharatpe stick to its Merchant borrowers or also target new pool of borrowers. The risk of that has been not tested yet.

The platform allows instant withdrawal for investors which in my experience has been seamless. Though people should be cognizant that they run a risk of asset liability mismatch and instant withdrawal might not be a guarantee! They do not take any responsibility for defaults

CRED Mint vs 12% Club

Recently, Cred had also launched CRED Mint – in partnership with Liquiloans (RBI-registered P2P NBFC) – to help its members earn interest of up to 9 per cent per annum by investing between Rs 1-10 lakh.

Cred is the competitor for bharatpe and offering 9% for investors. Comparison of Bharatpe with Cred shows that Bharat pe product is superior to Cred.

- BharatPe provided lending to its merchants who do daily business with them and Bharatpe has a large transaction data history of the borrower with them. Cred provides loan to all people with High CIBIL score which is no guarantee for repayment. It is yet to be seen that if Bharatpe forays into new borrower segment.

- There is substantial difference in yield i.e. 3% between the two which gives Bharatpe more cushion for absorbing defaults.

- BharatPe product has been tested for quite some time compared to Cred which is a new product.

- Defaulting on Bharatepe loan means Merchant borrower gets blacklisted from the ecosystem.

12% Club Investment Process and Amount

Registration is super simple. Just use the link 12% Club . Add your bank and complete the KYC.

Even though the product might look safe it is advised not to put more than 5% of Networth in this product as BharatPe does not provided any guarantee and incase defaults are high loss of capital is possible.

Some money from Liquid fund can be allocated to this product

Conclusion

Bharatpe 12% club is a good option for people looking to park money while getting high yield. People should use it to compliment other alternative platform like Finzy , GrowFix ,Klubworks and TradeCred .

There are certain risk such as Lockdown moratorium scenario which can impact the complete ecosystem .It is also to be seen that Bharatpe sticks to its Merchant borrowers which are time tested or ventures into a new segment.

It is suggested that investment should be started with small capital for few months. I will publish monthly performance in my report.

Currently they are not accepting any further investment.

They have also capped the maximum investment to 1 Lakh per individual

Hi,

12% Club had reduced investment interest rate b/w 9-10% only. now seems not worthy to invest in 12% Club ?

Hi Kamlesh,

Agreed now there are better options than 12 club like 13karat, lendbox