Why should investors know about REITs in India ?

Infrastructure and real estate are crucial to the growth of any developing economy, and India is no exception. A well-planned and executed infrastructure system is a key driver for holistic development and attracts foreign investments, which, in turn, contributes to the capital base needed for sustainable economic growth. The real estate sector, closely linked to infrastructure, receives regular support from the government to ensure continued progress.

As the corporate environment develops, demand for office space and accommodation increases, further boosting the real estate sector’s growth. However, due to a lack of public funds, the sector requires additional financing channels. This is where Real Estate Investment Trusts (REITs) come into play, providing a much-needed source of financing. By investing in REITs, investors can participate in the growth of the real estate sector while enjoying the benefits of a diversified portfolio, making REITs a potentially attractive investment option.

Real Estate Investment Trusts (REITs) have emerged as a popular investment option in India in recent years, with investors looking to diversify their portfolios and gain exposure to the real estate sector. In this article, we will cover the existing REITs and InvITs in India, their current yield and price, and the new REIT being launched.

What are REITs in India?

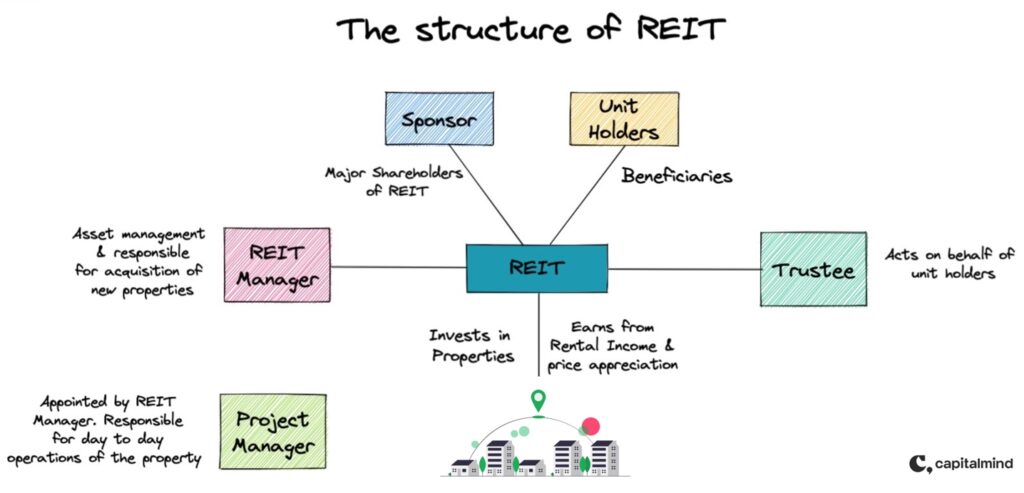

REIT stands for Real Estate Investment Trust. It is a type of investment vehicle that allows investors to pool their money to invest in a portfolio of income-producing real estate properties, such as office buildings, hotels, shopping malls, or apartment complexes.

REITs provide investors with an opportunity to invest in real estate without directly owning the physical properties. They operate like mutual funds, but instead of investing in stocks or bonds, they invest in a diversified portfolio of real estate assets.

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. Therefore, they offer investors a relatively stable source of income, making them an attractive investment option for those seeking regular income streams.

REITs can be publicly traded on stock exchanges, providing investors with the opportunity to buy and sell them like other stocks. Private REITs, on the other hand, are not publicly traded and are usually available only to high-net-worth investors.

In summary, REITs are a way for investors to participate in the real estate market without owning and managing physical properties. They offer the potential for regular income and diversification, making them an attractive investment option for many investors.

Performance of REITs in India

REITs were first introduced in India in 2019 and are relatively new compared to other countries where REITs have been around for much longer. The performance of REITs in India has been mixed since their introduction, with some REITs performing better than others.

In general, the Indian REIT market has faced some challenges in terms of the limited supply of high-quality commercial real estate assets that meet the eligibility criteria for REITs. The COVID-19 pandemic has also affected the performance of REITs in India, with a decline in occupancy rates and rental incomes in some cases.

However, despite these challenges, some REITs in India have performed well. For example, Embassy REIT, the first REIT to be listed in India, has shown consistent growth in terms of rental income and distribution to unit holders since its inception. Other REITs, such as Mindspace Business Parks REIT and Brookfield India REIT, have also shown promising growth.

Existing REITs and INVITs in India

Currently, there are three REITs listed in India – Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust. These REITs have raised over INR 25,000 crore in total and have given investors returns ranging from 7% to 10% in the last year. The yields on these REITs are in the range of 6% to 8%, which is higher than the yields offered by traditional investment options such as fixed deposits and bonds.

Apart from REITs, there are also Infrastructure Investment Trusts (InvITs) that invest in infrastructure assets such as roads, power transmission, and gas pipelines. Some of the InvITs listed in India are IRB InvIT Fund, India Grid Trust, and IndiGrid InvIT Fund.

Nifty REIT and INVIT Index

The Nifty REITs and InvITs Index is a benchmark index that tracks the performance of publicly listed and traded Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) on the National Stock Exchange (NSE) in India. It is created and maintained by NSE Indices, a subsidiary of NSE Index Services.

The index comprises a basket of securities representing REITs and InvITs in India. The securities included in the index are selected based on a set of eligibility criteria such as free-float market capitalization, liquidity, and other factors. The weights of the securities within the index are determined based on their free-float market capitalization.

The weights of securities within the index are based on their free-float market capitalization subject to a security cap of 33% each. The average weight of the top 3 securities is capped at 72%.

The Nifty REITs and InvITs Index has a base date of July 1, 2019, and a base value of 1,000. The index will be reviewed and rebalanced on a quarterly basis.

Criteria for REITs

Here are the criteria for a company to qualify as a REIT: Must distribute 90% of income to investors as dividends At least 80% of investments must be in income-generating properties No more than 10% of investments can be in properties under construction Must have a minimum asset base of Rs 500 crores NAVs must be updated twice annually. Conclusion

Current Yield and Price

Embassy Office Parks REIT, which is the largest REIT in India, currently offers a yield of around 6%. Its share price has remained relatively stable over the past year, with a slight increase from INR 340 per share to INR 355 per share.

Mindspace Business Parks REIT offers a higher yield of around 7.5%, with a share price of around INR 360 per share. Brookfield India Real Estate Trust, which was listed in February 2021, currently offers a yield of around 8%.

Among the InvITs, India Grid Trust is currently offering a yield of around 10%, while IRB InvIT Fund and IndiGrid InvIT Fund offer yields in the range of 7% to 8%. These InvITs have seen moderate growth in their share prices over the past year, with India Grid Trust seeing a significant increase from around INR 95 per share to INR 150 per share.

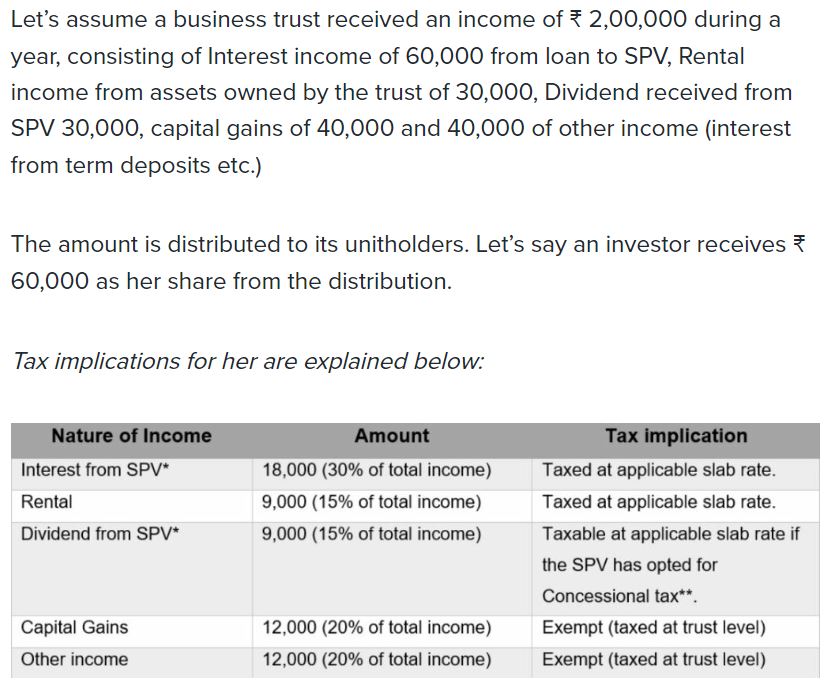

Taxation of REIT in India?

REITs are treated as pass-through entities for tax purposes. This means that the income earned by the REIT is not taxed at the trust level, but is instead taxed in the hands of the unit holders. The unit holders are required to pay tax on the income they receive from the REIT at their individual tax rates.

Income from the sale of REIT units

- Capital gains from the sale of Indian REIT units are subject to short-term capital gains tax at 15% if held for less than one year.

- Units held for more than three years (36 months) are subject to LTCG tax at 10% if they result in an income over Rs.1 lakh.

Additional points on taxation:

- Interest income from REITs is taxable.

- Dividend income from REITs is taxable depending on the REIT’s special tax concession status.

- If a special tax concession has been obtained, dividend income is taxable in the hands of the investor.

- If not, dividend income is not taxable.

- Income from amortization of SPV debt is not taxable in the hands of the investor.

Prior to the Finance Act 2023, the loan repayment component of the distributed income from trusts was not specifically taxed in India. However, the Budget proposed that such income should be treated as “income from other sources” of the unitholders, which attracts tax at slab rates of an individual. If this proposal had been implemented, the post-tax distribution yield from these trusts would have come down by 100 basis points.

However, after receiving concerns from the industry, the Finance Bill 2023 has made amendments to this proposal. The loan repayment component now needs to be reduced from the cost of acquisition at the time of the sale of the unit by the investor. This means that the loan repayment component will be taxed as capital gains at the time of the sale of units.

The capital gains tax treatment for the loan repayment component is only applicable until the total of the such amount distributed by a Reit/InvIT does not exceed its issue price. Any distribution that an investor receives in the form of loan repayment, irrespective of the holding period, will be considered as income from other sources, which attracts tax at the slab rate in the year of receipt of such income, if the total of the such amount distributed by a Reit/InvIT exceeds its issue price.

Investors can know whether the Reit/InvIT distributed loan repayment in excess of its issue price through disclosures from the companies. Industry players are still unsure of how, what, and when such details must be disclosed by trusts and are awaiting clarity from the government. However, industry experts believe that investors need not worry about it much, as it would take a minimum of 15-20 years for the existing trusts before the total amount paid as loan repayment exceeds its issue price.

Let’s say you buy a unit of a REIT at an issue price of ₹500. During the course of your holding period, the REIT distributes ₹50 as “loan repayment” to you.

Later on, you sell your unit in the secondary market at a price of ₹700.

To calculate your capital gains tax liability, you would first need to adjust your cost of acquisition for the amount of the loan repayment. In this case, you would subtract ₹50 from the purchase price of ₹500, giving you an adjusted cost of acquisition of ₹450.

Then, you would calculate your capital gains by subtracting the adjusted cost of acquisition from the sale price. In this case, your capital gains would be ₹250 (₹700 sale price – ₹450 adjusted cost of acquisition).

Assuming you held the unit for at least 36 months, the capital gains tax rate would be 10%. So, your capital gains tax liability would be ₹25 (10% of ₹250).

It’s important to note that this capital gains tax treatment for the loan repayment component only applies until the total amount of loan repayment distributed by the REIT does not exceed its issue price. Once the total amount of loan repayment exceeds the issue price, any further loan repayment distributions will be taxed as income from other sources at the individual’s slab rate.

Advantages and Disadvantages of REITs in India

There are several advantages and disadvantages to consider before investing in REITs. Here are some of the main ones:

Advantages:

- Diversification: REITs provide investors with exposure to a diversified portfolio of real estate assets, which can help reduce investment risk.

- Passive income: REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends, which can provide a stable and consistent source of passive income.

- Liquidity: Unlike physical real estate investments, REITs are traded on stock exchanges, making them a more liquid investment option that can be easily bought or sold.

- Professional management: REITs are managed by experienced professionals who have the expertise to identify, acquire, and manage real estate assets, which can help maximize returns.

Disadvantages:

- Volatility: REITs can be subject to market fluctuations and volatility, which can affect the value of the investment.

- Interest rate risk: REITs can be sensitive to changes in interest rates, which can affect the cost of capital and impact the returns of the investment.

- No control: As a passive investor, you have no control over the management of the real estate assets held by the REIT, which means that you have to trust the decisions made by the management team.

- Taxes: REIT dividends are subject to taxation, and depending on the tax laws in your country, you may have to pay additional taxes on your investment returns.

New REIT being launched

The Nexus Select Trust is a real estate investment trust (REIT) sponsored by Blackstone Group, which is one of the world’s largest alternative investment firms. The REIT primarily invests in commercial real estate assets across India.

The REIT has recently launched an initial public offering (IPO) worth Rs. 4,000 crore ($533 million). The IPO includes a fresh issue of Rs. 1,600 crores ($213 million) and an offer for sale (OFS) of Rs. 2,400 crores ($320 million) by the sponsor, Blackstone, and other existing unit holders.

The proceeds from the IPO will be used to repay debt, purchase new assets, and for general corporate purposes. The REIT has a diversified portfolio of commercial properties across the country, including office buildings, IT parks, and industrial warehouses. The Nexus Select Trust IPO is expected to bring in significant investments into the Indian commercial real estate market.

How to Invest in REITs in India?

Investing in REITs in India is similar to investing in other types of securities, such as stocks or mutual funds. Here are the steps to invest in REITs in India:

- Open a Demat account: A Demat account is necessary to invest in REITs. You can open a Demat account with any registered Depository Participant (DP) in India.

- Choose a REIT: There are several REITs listed on Indian stock exchanges. You can choose a REIT based on your investment goals and risk tolerance.

- Place an order: Once you have selected a REIT, you can place an order to buy the units of the REIT through your broker or trading account.

- Make the payment: After placing the order, you need to make the payment for the units you have purchased.

- Receive the units: Once the payment is made, you will receive the units of the REIT in your Demat account.

- Monitor your investment: It is important to monitor the performance of your REIT investment regularly to ensure that it aligns with your investment goals.

Alternatives to REITs in India

While REITs can be a good investments there are various investment options which can be considered to diversify portfolio such as :

- Grip: Grip Invest allows you to invest in leases, inventory, commercial real estate, or start-up equity. It enables the investor to support beyond traditional investments such as Bank Fixed Deposits (FDs), Gold, etc. Expected Returns upto 20%

- Leaf Round: Leaf Round allows you to invest in tangible assets such as EVs, home appliances, furniture, and electronics that can be bought and put on the lease. Once you invest in these assets, you become the owner of the assets, and then you can quickly lease out these assets and earn rent from them monthly or quarterly. Expected returns upto 22%

- Jiraaf: The platform offers to invest in lease-based investment options and enables investing in invoice discounting, corporate debt, and other instruments. Expected Returns upto 18%

Conclusion

REITs and InvITs have become popular investment options in India, offering investors exposure to the real estate and infrastructure sectors. Existing REITs and InvITs have offered yields in the range of 6% to 10% and have seen moderate growth in their share prices over the past year. The launch of a new REIT along with favorable taxation can further boost investors’ sentiment towards this asset class.

Frequently Asked Questions on REITs in India

- Who can invest in REITs in India?

REITs in India are open to both domestic and foreign investors. However, there are certain eligibility criteria for investing in REITs, such as a minimum investment amount and a maximum number of investors for a particular REIT.

- What are the risks associated with investing in REITs in India?

Some of the risks associated with investing in REITs in India include fluctuations in rental income, changes in interest rates, changes in real estate market conditions, and liquidity risk. Investors should carefully assess these risks before investing in REITs.

- How are REITs regulated in India?

REITs in India are regulated by SEBI, which has laid down various regulations for their formation, management, and operation. SEBI also monitors the compliance of REITs with these regulations and takes action against any violations.

- How are REITs different from other types of real estate investments?

REITs are different from other types of real estate investments in several ways. Firstly, they offer a low entry barrier, allowing small investors to invest in large-scale real estate assets. Secondly, they offer regular income in the form of dividends, unlike other real estate investments that may require active management. Thirdly, REITs are more liquid than other real estate investments since they can be bought and sold like stocks.

- How is the dividend distribution policy of REITs in India determined?

The dividend distribution policy of REITs in India is determined by the REIT manager and approved by the REIT trustee. The policy outlines the percentage of rental income that will be distributed to investors and the frequency of distribution, which is usually quarterly.

- What is the minimum investment amount required to invest in REITs in India?

The minimum investment amount required to invest in REITs in India varies from one REIT to another. SEBI has set a minimum subscription size of Rs. 50,000 for public issues of REITs, and the minimum trading lot size on the stock exchange is one unit.

- Can REITs invest in under-construction assets in India?

REITs in India are not allowed to invest in under-construction assets. However, they can invest in completed and revenue-generating real estate assets, including those under construction, as long as they generate rental income.

- Can REITs invest in foreign real estate assets?

SEBI has allowed Indian REITs to invest up to 20% of their assets in foreign real estate assets. However, such investments must comply with the foreign investment regulations of the Reserve Bank of India.

- How are REITs rated in India?

Credit rating agencies in India rate REITs based on factors such as the quality of the underlying assets, occupancy levels, rental income, and the financial strength of the REIT manager. The rating provides an assessment of the creditworthiness of the REIT and its ability to service its debt obligations.

- How are the returns on REITs in India taxed?

The returns on REITs in India are taxed differently for residents and non-residents. For residents, the dividend income from REITs is taxed as per the individual’s income tax slab, while the capital gains on the sale of REIT units held for less than three years are taxed at the individual’s income tax rate. For non-residents, the dividend income is subject to withholding tax at a rate of 20%, while the capital gains are taxed at a flat rate of 10%.