After the market crash of 2020, the financial year 2021-2022 was one of the best times for the capital markets. The market witnessed 51 IPOs which raised a whopping amount of Rs. 1,20,670 Crores from the public. In other words, it can be said that it was the worst time for the investors. Where some investors tried their luck in IPOs and received a handsome return of 50-100% on listing gains, a massive wealth erosion was witnessed in some of the stocks listed. Thirty-two newly listed stores between 2021-22 added around Rs. 34,327 Crores to investors’ wealth, 19 stocks fell below the issue price and wiped out Rs. 24,582 Crore. The period also witnessed some IPOs, such as Paytm, which was one of the most significant issues to date in the Indian stock market; it was also the most prominent wealth destructor as it crashed 75% from the issue price after it listed. According to the experts, just one in ten IPOs makes money, and the rest destroy investors’ wealth. Before the IPOs are issued to the public, the shares are traded in an unofficial market known as unlisted shares.

IPO is the last stage of company growth. Large institutional investors, High Networth Individuals, etc these days invest much before IPO and are able to offload their shares at exorbitant valuations during IPO. Therefore people who are able to find good opportunities in the unlisted market can achieve better returns in their portfolios.

Today, more people are interested in unlisted shares; individuals have more disposable income and want to explore other investment options rather than conventional sources.

What are Unlisted Shares?

Unlisted shares belong to the company and are not listed on the stock exchange yet. These shares, called OTC securities, can be traded via the over-the-counter (OTC) market. Trading in unlisted shares is not illegal, just that they are not regulated by the Securities and Exchange Board of India (SEBI). New companies may not fulfill the requirements to list on the stock exchange, such as listing fees, market capitalization, etc. and that’s why they are traded in an unofficial market. However, they offer enormous opportunities for investors.

How to Invest in Unlisted shares

- Broker: Commonly, stock brokers deal in listed stocks, but you may have yet to hear that many brokers also deal in unlisted stocks. India is seeing a boost in brokers dealing in unlisted shares because of the increase in the startup culture. Also, many wealth management firms provide buying and selling of unlisted shares.

- Directly from the Promoter: In many cases, the investor can approach the company directly to invest in the company’s shares that are raising funds.

- Employees of the Organization: Many companies provide unlisted shares to the employees working in the organization, allowing the employees to own shares in the firm. This may lead to a boost in their productivity level and decrease employee turnover. This can be a way for the investors to own unlisted shares of the company.

Best Platform for Unlisted Shares In India

We explored many platforms in India which offer unlisted shares. We compared the prices of shares and the reliability of the platform. The platform which we plan to use for our investment is Altius Investech. The platform has been operational for more than 3 years and has done some large deals. The customer support is also good.

You can register on Altius using the below link to get better deals. Go to the Signup page and complete your registration process

Taxes on Unlisted shares

SEBI does not regulate unlisted shares and it works differently from the listed shares. However, they are not exempted from taxes—unlisted shares sold within two years, or twenty-four months, a short-term capital gain is applicable on the payments, and they are taxed at a marginal tax rate. And if they are sold after 24 months, a long-term capital gain is applicable of 20%, and the investor also gets the advantage of indexation. The profits generated from the unlisted shares are determined per the Fair Market Value (FMV) until they are listed on the stock exchange. If the unlisted shares get listed on the stock market, they are considered equity shares only and are taxed the same as listed ones, which are 10% for long-term capital gain and 15% for short-term capital gains.

Example of Unlisted Shares

Below is a list of some of the most popular unlisted shares available to buy

NSE Shares – Analysis

NSE is one of the few unlisted shares we intend to invest in as the valuation seems fair and the business model is robust

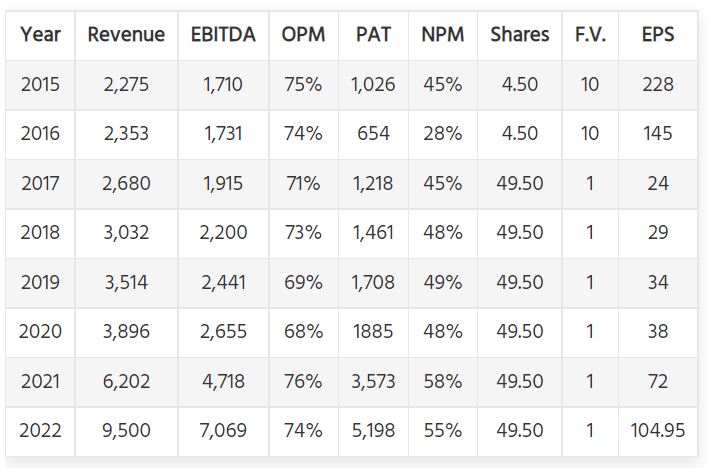

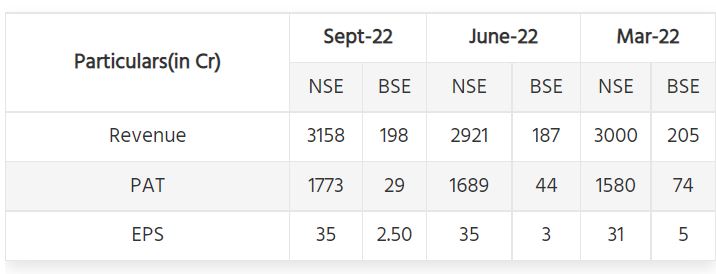

In India, two major stock exchanges are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). While the BSE is already listed on the stock exchange. BSE has less than a 10% market share and is trading at similar PE and has much lower revenue growth. NSE has seen an increase in revenue in the last three years, which has increased to Rs. 9500 Crore in FY22 from Rs. 3896 Crore in FY20, and the EBITDA increased to Rs. 7069 crores from Rs 2655 crore in the same period. Moreover, NSE has higher liquidity than BSE, bringing better opportunities for investors and indicating that more buyers and sellers are available for the stock. NSE uses modern technology and an electronic trading system, making it the country’s most preferred stock exchange.

Some Data points on NSE Unlisted Shares

How to buy NSE Shares?

Buying NSE shares can take up to 3-4 months as all deals are approved by NSE.

Step 1 – Register on Unlisted Zone

Step 2 – Either connect with RM or ping us on Telegram for the best price

Step 3- Operation Process as below which you need to take up with the platform

- You provide the Required Documents to be submitted to NSE for Name Clearance

- CML (Client Master List)

- Pan Card

- Cancel Cheque

- Aadhaar Card

4 Stamp Paper of Rs.500 (Article Undertaking) For Buyer & Seller Agreement.

- First Party: stamp paper of Rs 500

- Second Party: Not Applicable

- 50% Advance at the time of booking of shares And the remaining 50% once you got the Name Approval from the NSE Board for share transfer.

- Your documentation for NSE shares will start the very next day once you book your shares, After transferring 50% of the Consideration Amount.

Advantages of Investing in Unlisted Shares:

- Diversification: Investors are well aware of investing their money and the importance of diversification these days. The more one diversifies, the lowers the risk of the portfolio. Let’s say you have a bunch of volatile stocks in your portfolio; you may minimize the risk by investing in some fundamentally strong unlisted solid stocks.

- Undervaluation: Unlisted stocks are less liquid than those listed, making them undervalued. The volume of investors is less in the case of unlisted shares, which can be an excellent opportunity to invest in undervalued stocks.

- Negotiation: As mentioned, the numbers of buyers and sellers are limited for unlisted shares, which is why it allows the investor to negotiate the price while buying or selling them.

- Less Volatile: Unlisted shares are less liquid, and fewer buyers and sellers are available, making them less volatile than the listed shares.

Things to Consider Before Investing in Unlisted Shares:

- Study the numbers: Before investing in the company’s unlisted shares, you must do fundamental research about the company. Investing in unlisted shares can be lucrative, but it is recommended that you know the company’s fundamentals.

- Reliable Broker: Unlisted shares are not regulated by SEBI. Hence it is essential that you invest in them through a reliable broker.

- Less Liquid: These shares are less liquid since fewer participants are available. Ensure you invest excess cash in unlisted shares rather than going all in.

- Brokerage: The shares can be traded with the help of a broker or directly through the promoters. If you are investing in unlisted shares through brokers, selecting a broker with minimum brokerage fees is essential.

- Exit Route- Many companies do not have IPO for years and you may get stuck holding the shares and selling them via an unlisted market may be the only way

Wrapping Up

Unlisted shares can be highly lucrative if you invest in the right company, as it can provide a whopping return. However, it comes at the cost of liquidity. One needs to understand the risk such as low liquidity before taking a plunge. Detailed due diligence should be done before investing in any stock as there can be capital erosion in bad investments. I will update my investment in my monthly portfolio