P2P investments have grown a lot in the last few years. With an extremely vast financial industry in India, comprising commercial banks, fintech start-ups, NBFCs, cooperatives, and so on, it is one of the fastest-growing sectors in the economy. The growth of the financial sector in India at present is nearly 8.5% per year. This satisfactory growth rate suggests a stable economy. Contributing to maintaining this stable economy are companies and people investing millions of rupees for personal and financial purposes.

Even though India has emerged as the world’s fifth largest economy, the country is rich, but its population is poor; quotes Nitin Gadkari, the Union Minister. Unemployment, starvation, inflation, and innumerable other problems serve this poor population.

What is LenDenClub?

Investing money in property, shares, and fixed interest puts your good money to work to potentially earn a better return over time, unlike simply saving your money. Here is where LenDenClub comes into action – they invest your money. In this era of low return rates and high market volatility, people are always on the lookout for the high-yielding product. LenDenClub is a P2P (Peer-To-Peer) lending platform certified by the RBI. Peer-to-Peer Lending is a form of financial technology that allows people to lend and borrow money without going through a bank, the platform enables all transactions. This platform provides an opportunity to money lenders or investors looking for comparatively high returns with potential borrowers who are looking for short-term personal loans.

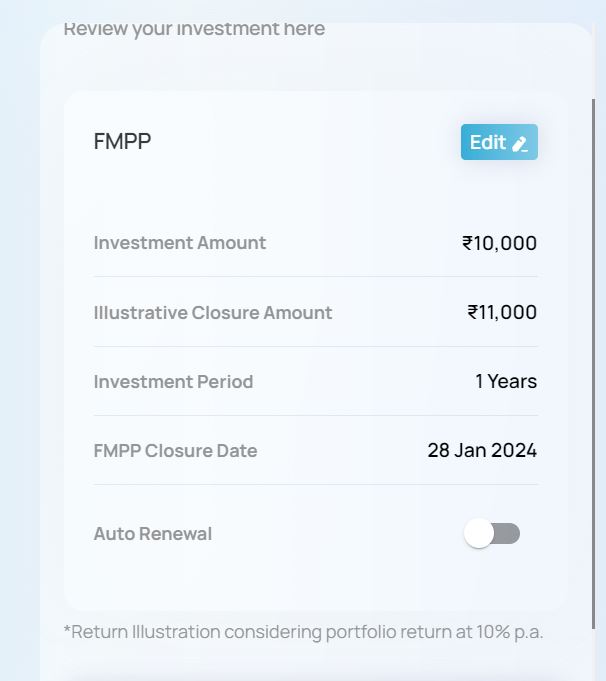

FMPP (Fractional Matchmaking Peer-to-Peer Plan) is a non-market linked investment alternative that makes your capital immune to market volatility. This FMPP plan they follow takes the invested money and funds multiple potential borrowers who will further invest the money and give back high returns. The money repaid by the borrowers is at an estimated average of 18% (according to the last 3 months; Sept., Oct., and Nov. 2022) – out of which 4% is a deducted default and 2% are platform charges. This comes down to an estimate of 12% returns p.a. which is comparably higher than other reputed sources.

Lendenclub Business Model

With more than 20 lakh investors and 60 lakh borrowers, LenDenClub is the leading new-age lending platform that claims to return 10-12% to investors p.a. The product comes with 5 annual tenures, 1 year being the minimum and 5 maximum. One can choose to invest any amount of money ranging from Rs.10,000 to Rs. 5 lakhs. After investing desired capital, the capital is distributed among multiple borrowers via LenDenClub’s AI feature.

The platform claims that borrowers are very meticulously chosen and are evaluated on more than 200 parameters which include their personal, financial, and social details to make them potential and trustworthy borrowers of the company. The platform algorithm connects a particular lender to multiple borrowers. Once the selected borrowers are given loans by the lender, they are integrated into LenDenClub’s automated dashboard ensuring repayments in a timely manner. According to them the advanced AI diversifies and balances the investor portfolio in such a way that the yield at the end of a 1-year tenure plan is more than 10%.

The LenDenClub’s transaction processes are safeguarded by an Escrow Account managed by ICICI trusteeship. The escrow account acts as a third party that safely transacts money between the lender and borrower. Monthly and annual reports of the escrow accounts are provided to the lender in adherence to the RBI mandate.

Lendenclub Risk?

Even though FMPP does not directly depend on market volatility, this does not mean it is not subject to risks. The most common risk a lender (i.e. investor) can face is NPA (Non-Performing Assets). As much as they try to prevent it, every company or institution is prone to a substantial amount of NPAs. According to LenDenClub NPA has been around 2-6%. If a borrower is not able to return the amount of money borrowed, the lender can end up getting lesser returns. As quoted by Parijat Garg, a digital lending consultant, “Higher the returns, higher the risk.”

Customer Feedback

The reviews of the users who have lent or borrowed from LenDenClub contradict each other. While some say they have been getting double-digit returns consistently for several annual tenures, others say that the loan default rate is getting worse and no efforts have been seen to recover it by the team. Many technical issues have been identified with the platform which have been raised by multiple users.

My Experience using Lendenclub

I have used Lendenclub from 2018 to 2020 and the performance was poor! The NPA level was close to 30-40% and no efforts were shown to collect the money. It seemed that the platform did not have any team to manage collections and post covid most capital was lost for investors.

They have even removed the portfolio performance for past loans and considered everything as a write-off without providing any explanation to investors. This makes the platform unreliable, to say the least.

The Platform has tried to rebrand itself and has come up with a new product that offers a fixed return of up to 12% where you have to lock your capital for 1- 5 years. The amount of lock-in period and returns for such unsecured investment is too low and people can rather go for secured bonds offering higher yields. Adding words like AI to make the product look more savvy doesn’t add much value.

LenDenClub Alternatives

Over the past few years, after the global economy took a deep plunge because of COVID-19, businesses have learned their lesson when it comes to overcoming their losses. Alternative Investments have gained popularity very quickly among investors in the financial industry as it offers higher return rates compared to other avenues. Some top alternatives for lendenclub are :

- Lendbox: It is one of the oldest p2p lending companies in India, Lendbox promises a whopping return of 24% a. It also has an instant liquidity plan in partnership with Unicards with returns of up to 11.5%

- Altifi: Altifi is a platform backed by Northern Arc that specializes in high-yield bonds and tax-efficient instruments like MLD which can give post-tax 11%+ returns

- Jiraaf: Jiraaf is another platform that has a variety of investment options ranging from invoice discounting to high-yield bonds

- IndiaP2P: It is a woman focussed p2p which has gained popularity and has been consistently providing 18% returns to its investors.

For a more comprehensive list of Alternative Investments in India, you can check out the below link

Conclusion

Although lendenclub promises an attractive return, we cannot overlook the security offered by mutual funds, bank fixed deposits, and investing in equity. P2P lending hits two birds with one stone by giving high returns to lenders as well as lending money to borrowers in need of a loan.

Considering the dubious record of the platform in the past and a very average offering this platform does not look like a great place to park money and investors can consider other alternatives which have a better track record.

Please share your referral code for LendenClub.

I am not using Lendenclub anymore and not referring others for the same due to poor experience

Use ful article! Well written.

Also one can consider CRED also as one of the option ( serious investors only) as the minimum amount is 1 lakh.

Please share your experience with cred as well.

Hi, Cred basically offers lending through Liquiloans. I already have an account on Liquiloans and performance is good. It is better to use Liquiloans as it has a diversified borrower base directly and you get more control over the portfolio.

https://www.liquiloans.com/investor/register/BJetQ5LN

P2P lending is beneficial for the platforms and loan defaulters, tried 4 different platforms and none of them could beat FD returns due to NPAs. The 3rd party guarantees some platforms offer are also worth nothing, they also simply default.

Based on my experience platform which allows investors to choose borrowers, performs poorly as the investor does not have sufficient information to make the correct decision.

The platform which does its own underwriting is doing better. Some platforms where performance is good are:

1) Lendbox per annum

2) Indiap2p

3) Liquiloans

I too have used Lendenclub from 2018 to 2020 based on your blog and lost most of my capital! In my case the NPA level was close to 50-60% and no efforts by the platform owners were shown to collect the money. As you mentioned the platform did not have any team to manage collections and post covid most capital was lost for most of the investors.

The trust once lost its lost forever…

Agreed, lendenclub and Rupeecircle both platform performance has gone south . They have not even made an effort to connect with lenders or share the progress or efforts they have made to collect the repayment

Similar experience, invested in P2P through LenDenClub and saw more write-offs than recovery. I managed to withdraw my invested amount at some point. The returns I was supposed to receive was moved to FMPP, just watching without expectations.