This year started with increased volatility due to Adani Fiasco and Indian Budget. Adani Group chairman Gautam Adani has lost around half of his personal fortune due to the ongoing rout in the value of Adani Group stocks on Dalal Street. 100 Bn USD of his personal wealth has been eroded which makes the FTX crash look like chump change.

We avoid single-stock exposure and had no material exposure to the Adani group. Many retail investors lost a huge amount of money. One reason for that is most people invested in these stocks out of FOMO when they were already 7-8X up which is generally a bad strategy. Smart people made money in the long rally, and some made it in the crash but FOMO investors were left with empty bags.

On the budget front lot of detrimental rules where created for overseas investing including crypto which will make everyone focus on investing within India.

Alternative Investment Portfolio Performance

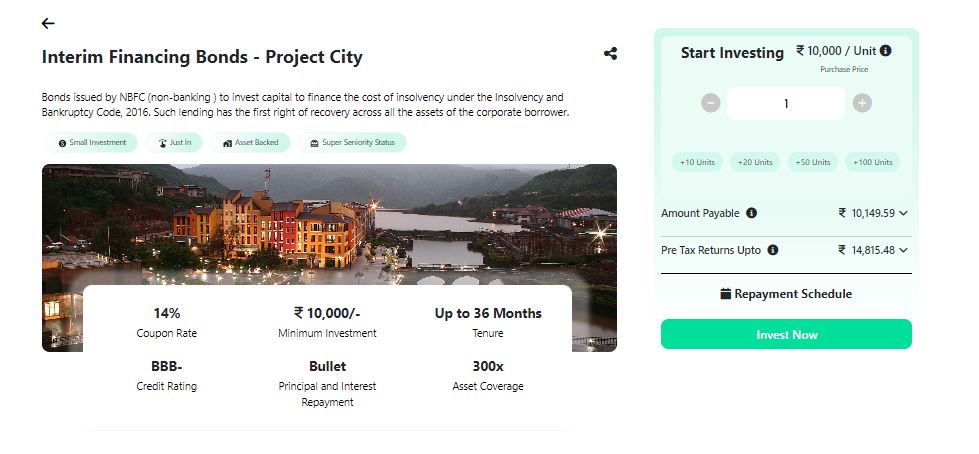

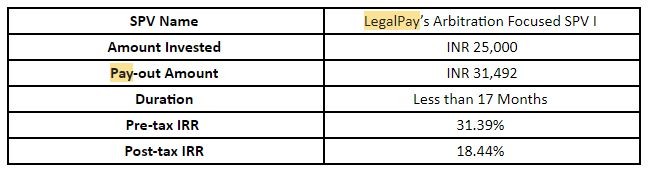

This month I received money from my Legalpay (Promo code FV48G4 ). Now two of my Legalpay opportunities have closed and the performance has been really good with IRR north of 18%!! I would be investing in the upcoming opportunities also

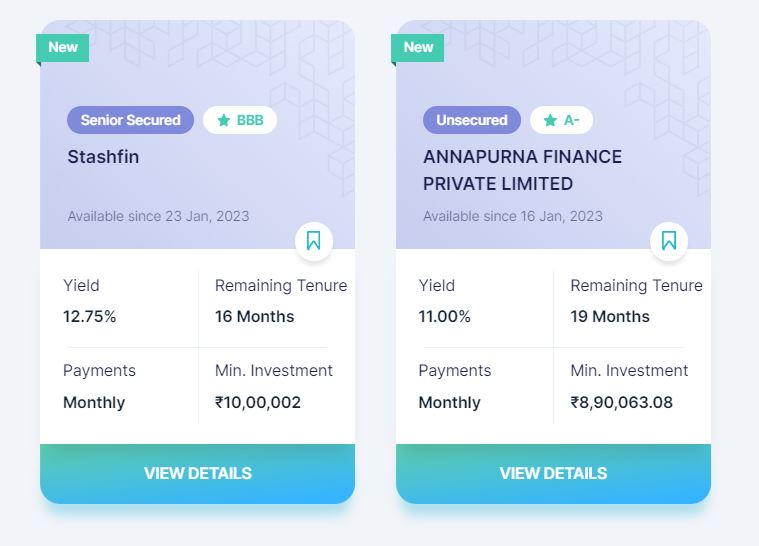

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 12%(Post-Tax) | 0% |

| Klubworks | 15-17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12.5-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post-Tax) | 2 deals closed successfully |

| Growpital | 16%(Tax-Free) | Blended Yield across Plans |

| Leafround | 18% | New (8 Payments) |

| Altifi | 12.50% | 0% |

- Growpital has been doing well currently. Founders had an AMA session. Looking forward to them appointing an Auditor

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are as per schedule.

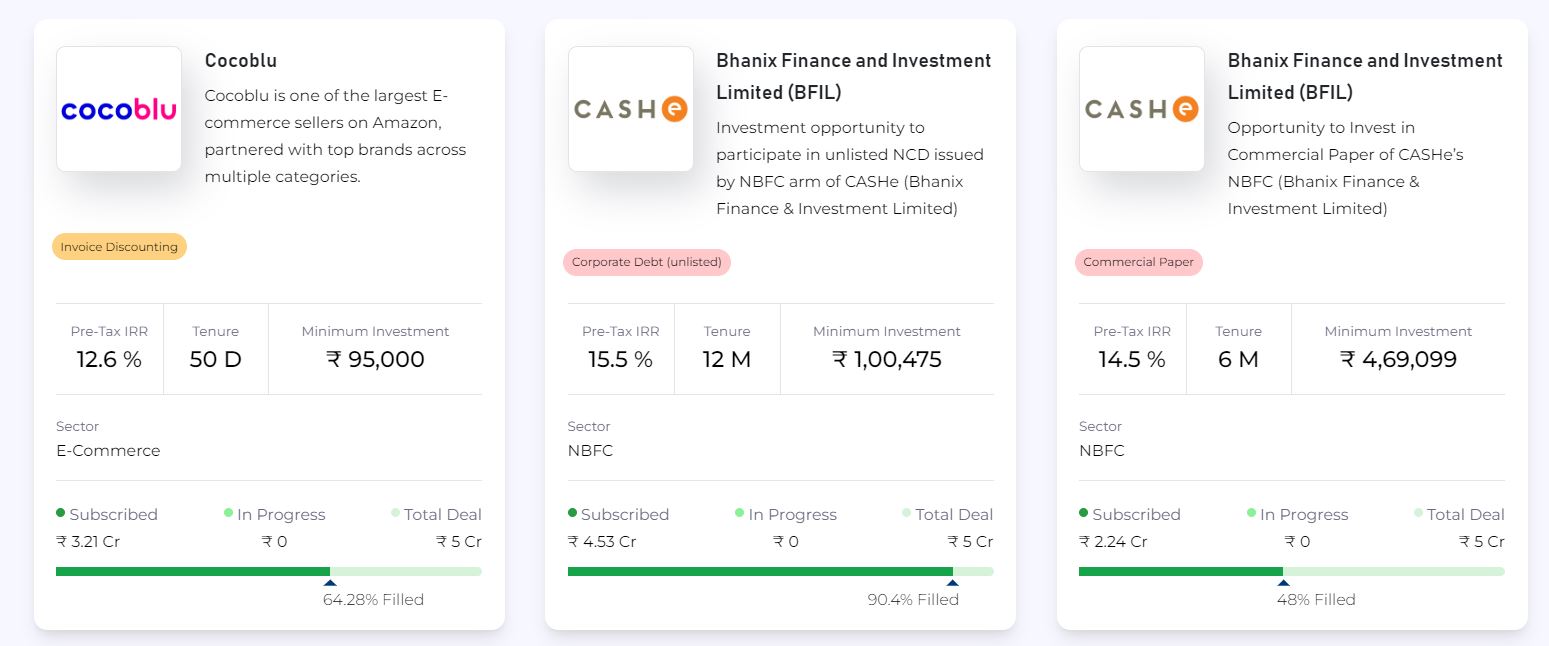

- Added 3 invoice discounting deals on Jiraaf. Invested in Bhanix Finance and Investment Limited (BFIL) Commercial paper at 14.5%

- Invested in 1 more Leasing deal on Gripinvest at 22% PreTax and 1 invoice on Leafround

- GripInvest Leasex deal can be accessed at INR 5 lakhs now

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations.

- Using Liquiloans to park short term capital

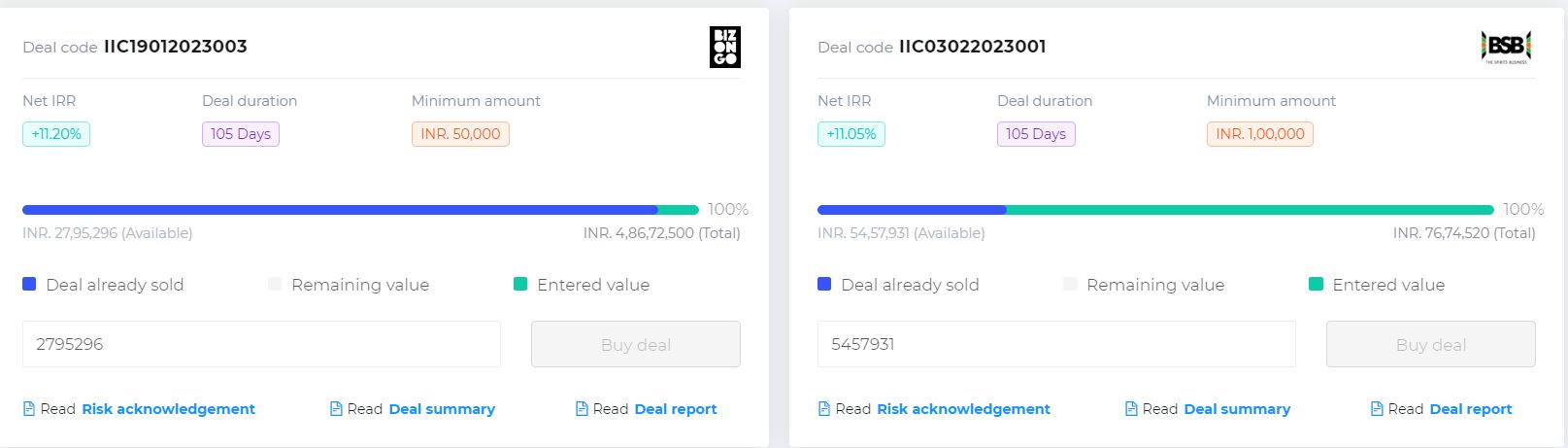

- Have done a Bizongo deal on Tradecred. Always compared Net Yield when comparing deals between Tradecred and Kredx

Crypto Investing

2023 has surprisingly been really good for Crypto till now as Bitcoin Ethereum and the top cryptocurrencies made a sharp rebound. I will be soon sharing a post on how people can buy and use cold wallets!

I will no longer be investing through international platforms as the new rule after budget makes it compulsory to do a TDS for every transaction. International investors can continue their investments.

I will be investing through Indian exchanges and putting in Cold wallet with minimal trading.

P2P Investment

Current allocation:

- India P2P – 50%

- 12Club – 5%

- I2IFunding- 25%

- Finzy-15%

- Faircent Pool Loan -5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.75% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 17% | <1% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistent for more than 6 months now. I have added capital in the aggressive plan only. Shifting some capital from I2Ifunding as very few loans there

- Writing off my Lendenclub exposure as I don’t have many expectations from the platform.

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

IndiaP2P Performance

International Real Estate and P2P

The budget introduced a 20 percent tax collection at source (TCS) for money sent out of India using the Liberalised Remittances Scheme (LRS). This will make foreign investment really unpractical for Indian investors hence people should avoid new investments going forward

Equity Market

PreIPO Stocks

A sharp correction stock market might bring some pre-IPO stocks to an attractive level. Below are the current prices of popular stocks

Listed Stocks

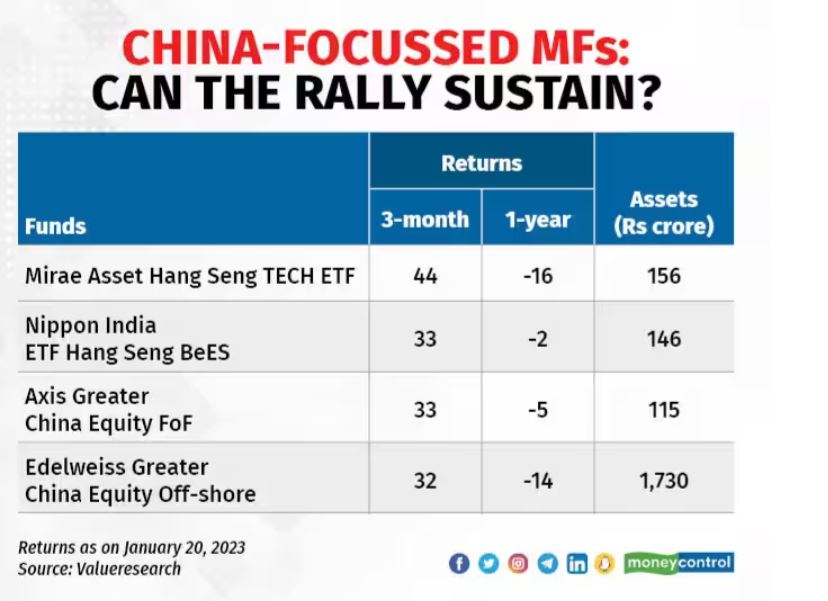

My investments in Hangseng Tech, S&P 500, and Nasdaq are doing extremely well with Hangseng tech being up 50% from my investment level in 4 months.

Pharma and IT are yet to perform. I may look into small and midcaps investment in a staggered manner

Other Alternative Investment Assets and Platform Updates

Growpital Investment – Growpital has been making good progress. If the performance stays consistent I will add more capital in 2023.

Growpital(Promo code GROWRDIMES)

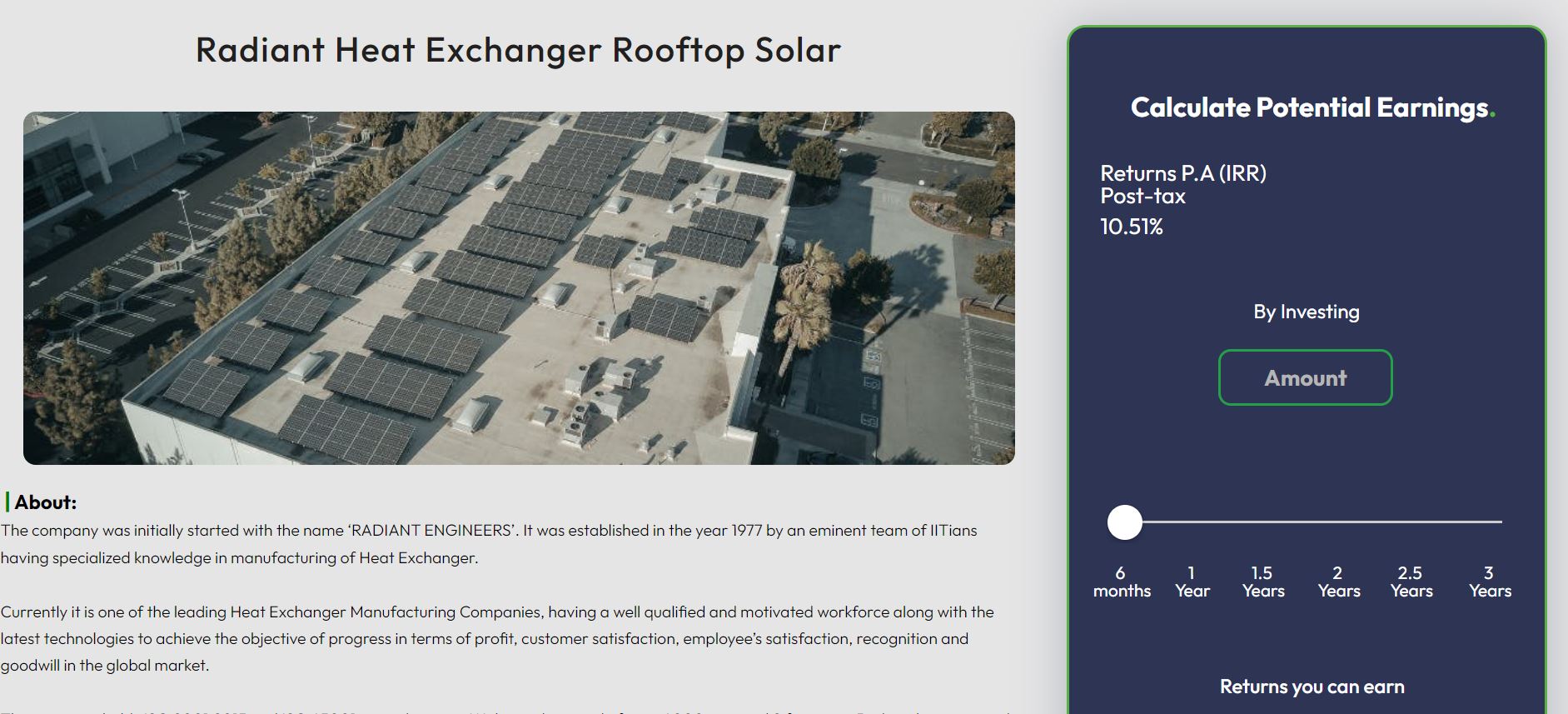

Sustvest Investment – There is a new opportunity on Sustvest. Returns will be approx 11% tax Free hence look attractive.

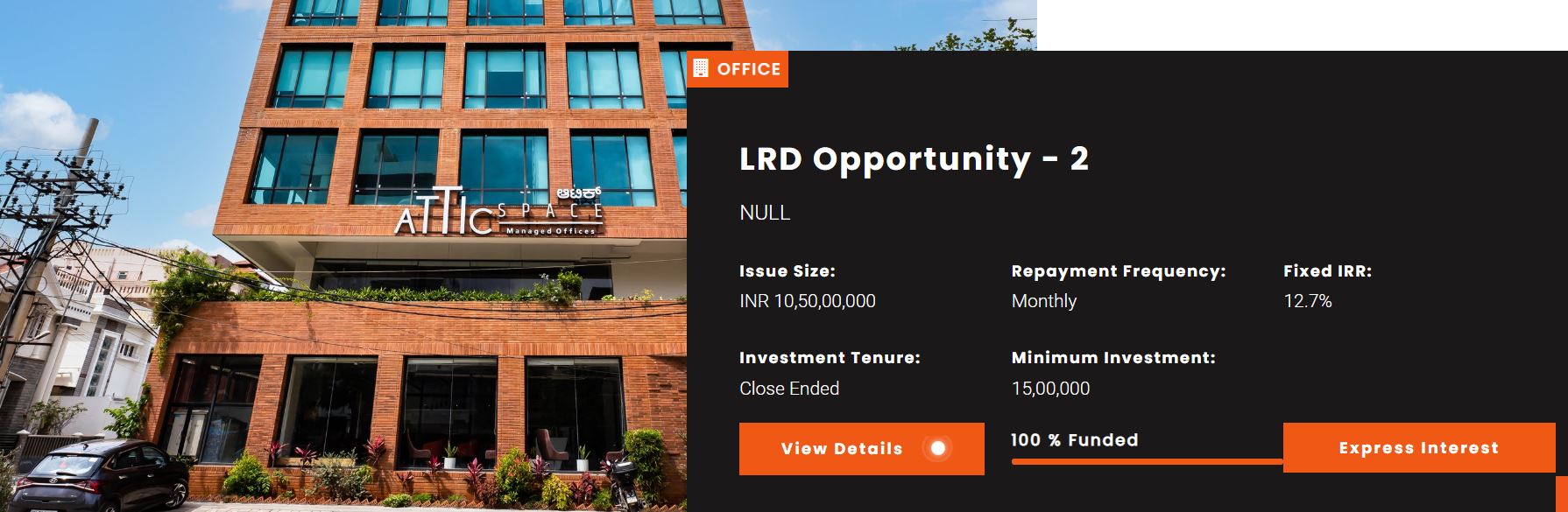

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 11 cashflows on time. The current Lease rental opportunity looks interesting for people who want monthly income

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 11.00 |

hi, I want to know like how you invest as personal account or any company account on all these alternative funds.Which is beneficial

If you have a company account and pay a tax of 25% then it might be beneficial if you are taxed at a higher level on a personal account. For investments that are tax free, it doesn’t matter