Lendbox Introduction

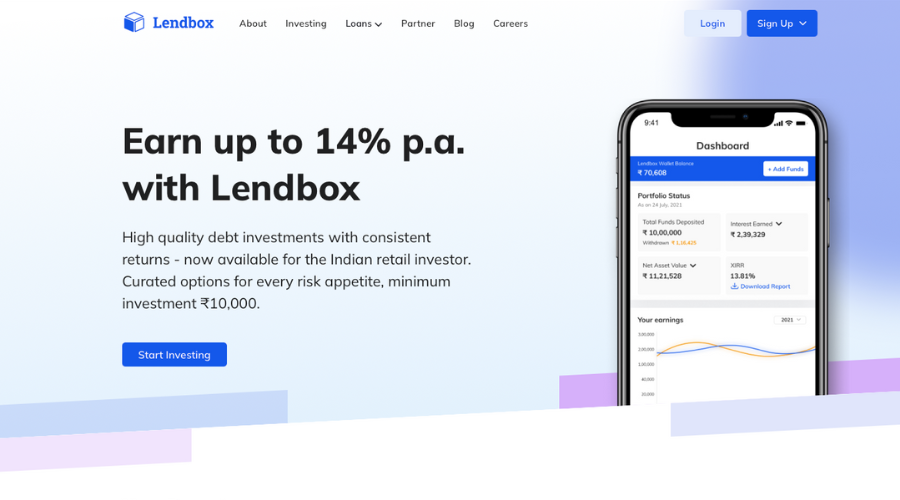

In the ever-evolving world of investment opportunities, new and innovative platforms cater to modern investors’ needs. One such alternative investment option that has emerged as a game changer in the industry is Lendbox. Lendbox offers investors a unique opportunity to invest in alternative investments and diversify their portfolios.

In this review, I will share my two years journey with Lendbox, highlighting its key features, benefits, and the value the platform provides to investors like myself.

What is Lendbox?

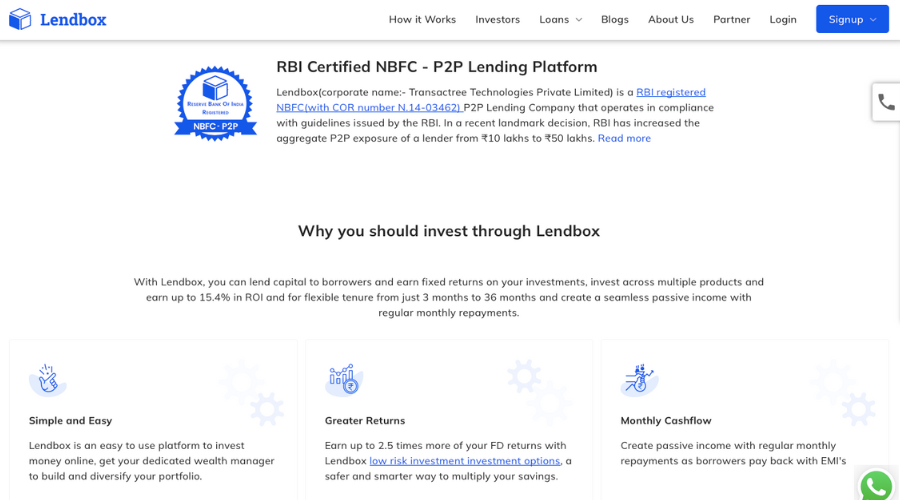

Lendbox is an RBI-licensed NBFC peer-to-peer lending platform in India. Founded in 2017, it is India’s largest P2P lending platform. It enables borrowers to receive funding directly from investors. A retail investor can expect an annual return of 12-20%.

Who Regulates Lendbox?

Lendbox is a registered NBFC P2P lending company by the Reserve Bank of India (RBI). The RBI issued guidelines in 2017 to regulate the P2P lending sector and categorized P2P platforms as non-banking finance companies (NBFCs). The guidelines issued by the RBI safeguards the interest of the lenders and borrowers and make Lendbox a regulated platform.

How Does Lendbox Work?

Lendbox is an online P2P lending platform that connects borrowers and lenders. Its working can be understood with the following points:

- Registration: Lenders and borrowers must first register on Lendbox and provide all the required details.

- Loan Request: The borrowers must create a loan request by mentioning the amount of loan needed, the purpose of the loan, and the repayment period by providing some vital information such as credit history and employment details.

- Loan Listings: Lendbox evaluates borrowers’ profiles and assigns them a credit risk category. Lenders can review and select borrowers based on their goals and risk appetite.

- Loan Funding: Lenders can invest in the loan requested by the borrower, and it allows multiple lenders to fund a single loan which helps diversify the risk among lenders.

- Disbursement: The Platform transfers the amount to the borrower’s account once the loan listing gets fully funded by the lenders.

- Repayment: Borrowers repay the loan in regular installments, including the principal and interest. Lendbox takes care of the collection part from the borrowers and transfers them to the respective lenders.

- Returns: Lenders get their portion of the money with interest. The recovery depends on the terms agreed upon in the loan listing.

Pros of Lendbox

- Screening of the Borrowers: Borrowers undergo a screening process that includes validation against 200 data points and is verified by the lender’s underwriting experts.

- Creates a source of Income: Lenders can create a regular source of income by investing a surplus amount lying idle with them. The return on investment is credited monthly as the borrowers repay the loan amount.

- Diversification: Investors can diversify their investments by investing in P2P lending and get better returns than the traditional investment avenues.

- Security: It is an RBI-registered NBFC P2P company, and Lendbox checks a variety of borrowers’ factors, such as their source of income, credit history, their assets, and online spending pattern, which makes the investment safe.

Cons of Lendbox

- Limited Data: P2P lending platforms are relatively new in the market, and the historical data may be limited, which makes it a little tricky for investors to determine the long-term performance of the platform.

- Less Liquidity: The invested money becomes tied up until the loan amount is repaid. So you can invest for a fixed period, and it is not easy to liquidate the loan amount before the term ends.

- Default Risk: There is always a risk of borrowers defaulting on loan repayment, which can result in a loss of the principal amount and interest.

- Market Risk: The overall condition of the economy and market conditions may affect the repayment capability of the borrowers, such as financial crises and economic downturns, and the repayment capability of the borrowers can affect the investments.

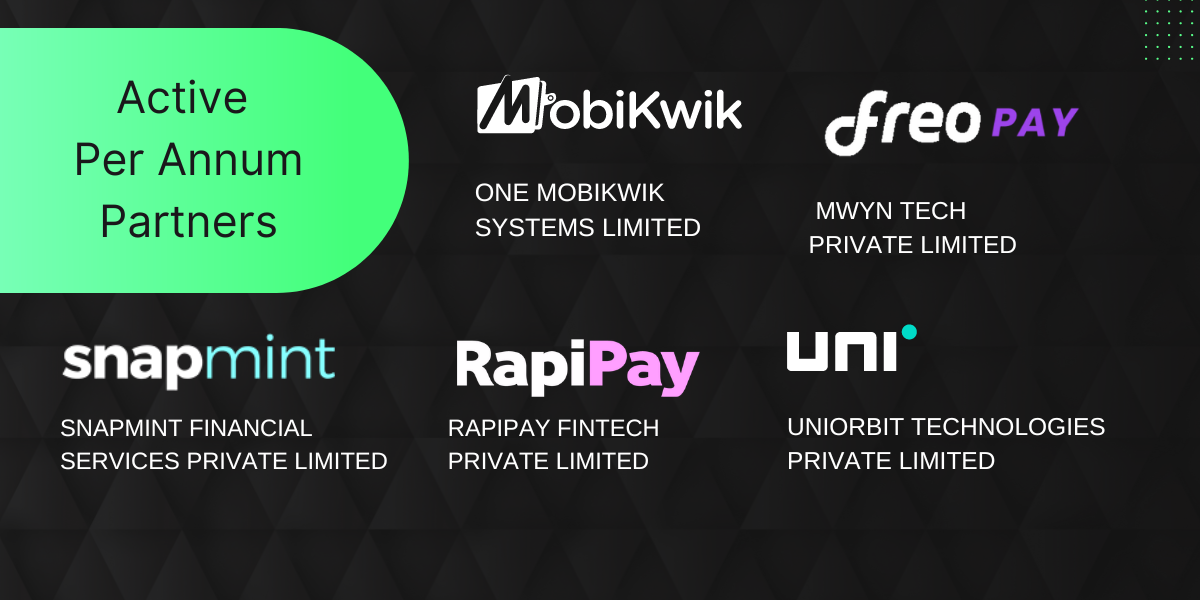

What is Lendbox Per Annum?

Due to the list above constraints, Lendbox came up with a new product in partnership with BNPL companies like Unicards, Freomoney, etc which allows

- Instant Withdrawal Option

- Diversification through splitting the investment amount into parts and giving it to different borrowers

- Lending money to people with a better credit profile sourced through a partner plan and using multiple partners.

To learn more about Per Annum, Read Lendbox Per Annum Review

Lendbox Alternatives

It is always a good idea to split capital between multiple platforms to reduce risk. Some of the platforms investors can explore along with Lendbox are as below

- Faircent: It is one of the leading P2P lending platforms in India. It connects lenders and borrowers at a common platform and offers a variety of personal and business loans where lenders can invest directly in the borrowers and earn interest. The platform uses credit assessment algorithms and risk management tools to evaluate potential borrowers.

- Liquiloans: Another P2P lending platform that connects borrowers and lenders online. One can invest in personal loans, education loans, and business loans. The platform ensures investors’ safety through its credit assessment process and loan monitoring mechanism. It has become popular through Cred Mint Program.

- Capitall Club: It is a new P2P platform in India that allows lenders to fund loans to SME borrowers at 15%. The platform uses advanced algorithms, credit assessment techniques, and alternative data to evaluate the profile of the borrowers.

- India P2P: It is a platform connecting lenders and borrowers directly at a commonplace. It operates under regulatory guidelines set by the Reserve Bank of India (RBI) and provides alternative investment options for investors looking to diversify their investments.

Who Should Invest with Lendbox?

The platform includes some level of risk because the borrowers may default on the loans. Investors with some level of risk tolerance and looking for a source of income can invest through Lendbox. Or investors who are looking to invest for the long term, Lendbox can be an ideal option for long-term investors because it ties up your invested amount till the time the loan amount is repaid by the borrower, which can range from a few months to a few years.

Investors who are looking to invest in shorter-term plans can explore Lenbox Per Annum

Investment Options Available on Lendbox

There are two investment options available on Lendbox:

- Fixed-Term Investment: Your investment will be locked in for the duration of your selection and has the following features-

- Earn up to 11% return per annum.

- Minimum tenure of investments to be 12 months.

- Minimum investment of INR 1 lakh, maximum of INR 50 lakhs.

- 0% investment fee (introductory offer)

- No TDS deduction on withdrawals

- Flexi Investment: This option is for investors who want to access their money sooner in exchange for reduced returns. Your ongoing investments will be sold on the secondary market in this option. It has the following features-

- Earn up to 10 % return per annum.

- No minimum tenure

- Minimum investment of INR 50,000

- No investment fee

- No TDS deduction on withdrawals

Is Lendbox Safe?

Lendbox follows a set of safety measures to ensure the safety of the investors. Here are a few of them:

- Borrower Screening: Lendbox follows a screening process to assess the creditworthiness of potential borrowers by analyzing financial information, credit history, and income.

- Diversification: Investors can diversify across various borrowers, which helps reduce the risk.

- Transparency: Lendbox provides all the relevant information of the borrowers listed on the platform, such as their loan purpose, risk ratings, profile, income, etc.

- RBI registered: Lendbox is an RBI-licensed NBFC peer-to-peer lending platform that ensures investors’ safety.

However, like all investments, it carries a risk that people should be mindful of while deciding to invest.

My Personal Lendbox Investment Experience- 3-Year Review

I have been investing in Lendbox for more than 3 years now. I was not happy with the platform in the older model which was discontinued in 2020 as it required selecting investors and evaluating them on our own.

Since 2021 I have been using the new model. My experience with Lendbox was smooth. My portfolio performance has been close to 11%.

The application is easy and intuitive to use, and it helps a beginner in every step to understand the process of investing in P2P lending.

However, I faced a few issues with the service part, and initially, I was not easily convinced by the investment options, but my overall experience turned out to be good.

Lendbox vs 12 club

As both platforms offer similar features many investors compare both these investment options. I have decided to keep a very small amount in 12 Club compared to Lendbox because

- 12% Club is not a P2P platform but offers this service through Lendenclub andRupeecircle, both platforms where I had a poor experience

- 12% Club primary borrowers are Bharatpe borrowers who are mostly merchants can create a concentration risk for 12 Club investors

Conclusion

I have been keeping some capital on Lendbox for a short duration. As the tax benefit of Debt Mutual funds has gone, p2p lending through good platforms provides a higher Return generating opportunity. Platforms like Lendbox may have various safety measures to ensure safety. However, you should carefully evaluate the potential risks by doing complete research. It is also important to diversify the investment in 3-4 platforms even for shorter duration to safeguard yourself against any black swan events

Frequently Asked Questions (FAQs):

- What is Lendbox?

Lendbox is an RBI-licensed NBFC peer-to-peer lending platform in India. Founded in 2017, it is India’s largest P2P lending platform where lenders can directly fund the borrowers.

- Is Lendbox Safe?

The platform uses different measures to make the platform safe such as screening the borrowers, offering diversification across other borrowers, and providing all the essential information about the borrowers.

- What are the fees associated with Lendbox?

Lendbox charges a disbursement fee ranging from 2% to 6% of the loan amount for the borrower. No fees for lender

- What is the minimum investment amount with Lendbox?

There are two kinds of investment options with Lendbox. With Fixed-Term Investment, the minimum investment amount is INR 1 lakh, and with Flexi Investment, the minimum investment amount is INR 50,000.

- Who should invest with Lendbox?

Investing in P2P platforms is ideal for investors who do not mind taking some risk and also want to invest for the long term with a steady source of income or who are looking for alternatives to the stock market.