YouHodler is a swiss based crypto lending platform launched in 2019 .It is a crypto-fiat financial service where you can earn guaranteed returns of 12% on depositing funds .It is a member of the BlockChain Association and the Financial Commission, which adds credibility .YouHodler Multi HODL provides a great opportunity to make profit from Bitcoin

I have covered in great detail in past on the various platforms to earn interest on stablecoins.

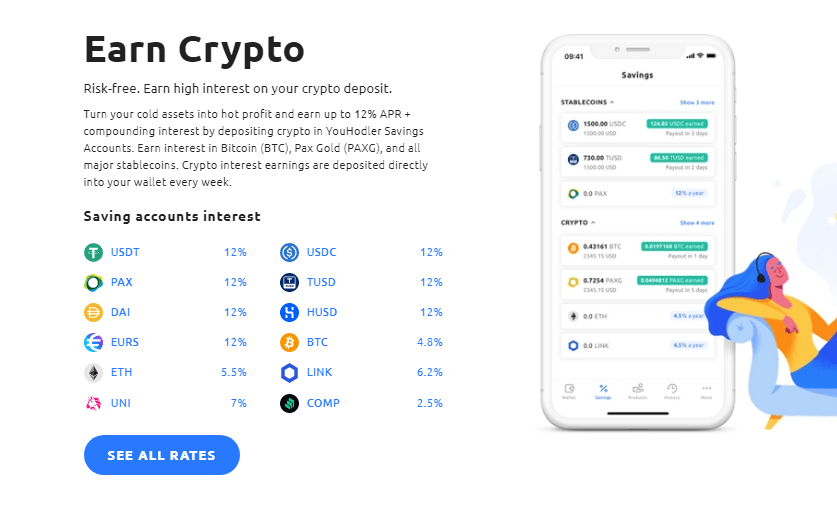

YouHodler Saving Account Features

- 12% Interest on various stablecoins like Tether(USDT),USDC, PAX,DAI etc

- Minimum amount of 100 USD depending on which currency you are choosing .

- Weekly Payment of Interest

- Pooled Insurance of 150 Million Dollars

- Tie up with Ledger to keep crypto in cold wallets

- No withdrawal Fees

I have been using YouHodler for last 12months along with Celsius Network (which gives 11% interest) .Based on that, I can say it has performed well. Above all, I din’t face issues even during market crash .People can split the capital across both of them

Which Stablecoin to Deposit in YouHodler ?

Interest on all stablecoins is 12%.How to choose the best stablecoin?

Tether is most popular stable coin in the world. Most centralized exchanges use Tether for transactions. The audit for Tether has never happened. Risk of it not being 100% backed by USD is possible.

USDC and DAI have market caps of $2.8 billion and $610 million, respectively. Circle is the issuer of USDC while DAI is a decentralized currency . USDC has been audited in past and Circle is a regulated company.

Other audited stablecoins include Paxos standard token (PAX), Binance USD (BUSD) and Huobi (HUSD) . In addition , regulators have also approved them.

From the list of available stablecoins on YouHodler, USDC or PAX should be preferred.

YouHodler barbell strategy using Multi HODL

The Barbell Strategy involves leaving the majority of one’s assets in safe, stable and profitable investments . After that ,we keep a smaller portion aside for riskier and potentially more profitable market actions. Therefore with this strategy, it’s easier to manage risk and protect your portfolio from massive loss.

We should keep atleast 70% of capital in safe YouHodler saving account. We can use the rest 30% for trading.

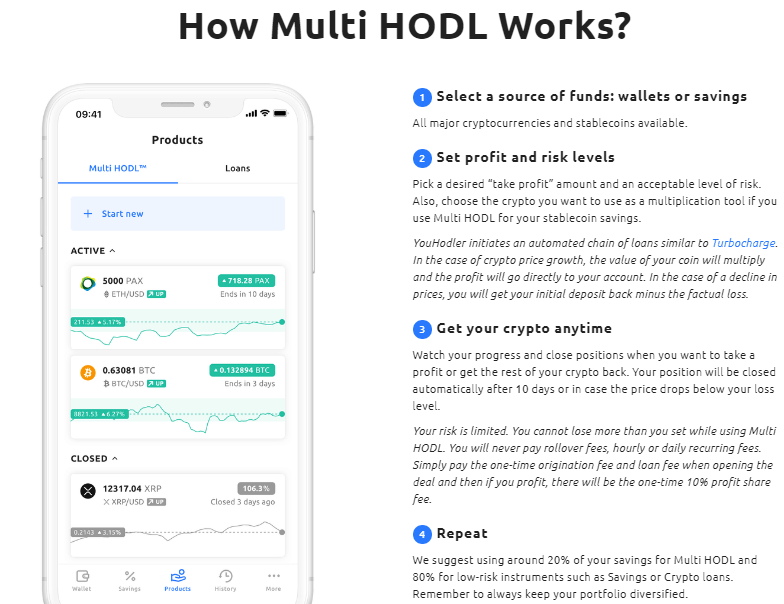

How does YouHodler Multi HODL Work ?

Example of Multi HODL Trade

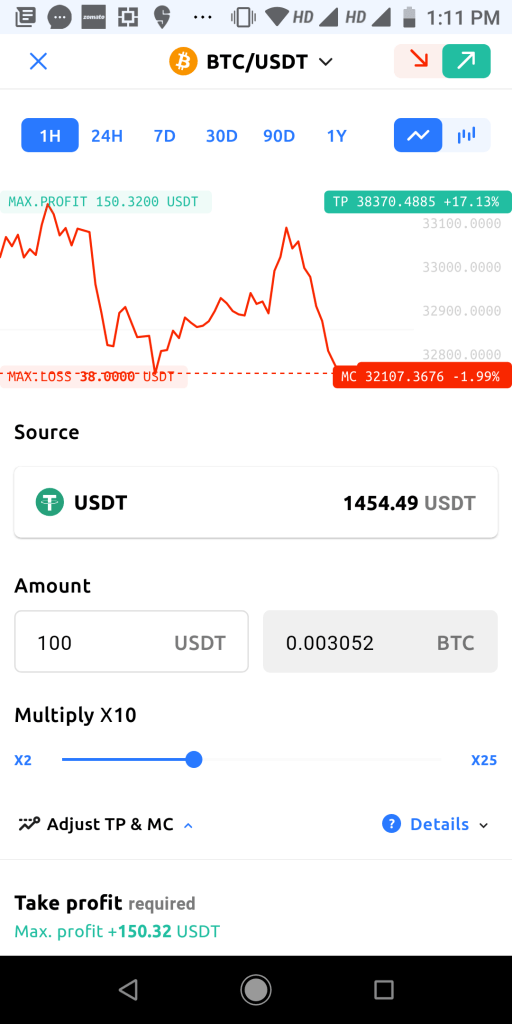

Let’s say that at current Bitcoin price of 30000 . You feel there is a lot of upside momentum but do not wish to risk a lot of capital. In Bitcoin unlike stock market most of the movement is sentiment driven . Also,before any mean reversion the momentum makes market rally in one direction. Volume changes help gauge the changing momentum.

We can use Multi HODL Strategy to profit from market volatility .If I have 1000 USD I can choose 100 USD for Multi HODL and the rest of the amount will keep earning 12%.

Multiplier means the amount of leverage we wish to take. If you choose 10X means you have now exposure to 10*100 USD = 1000 USD.

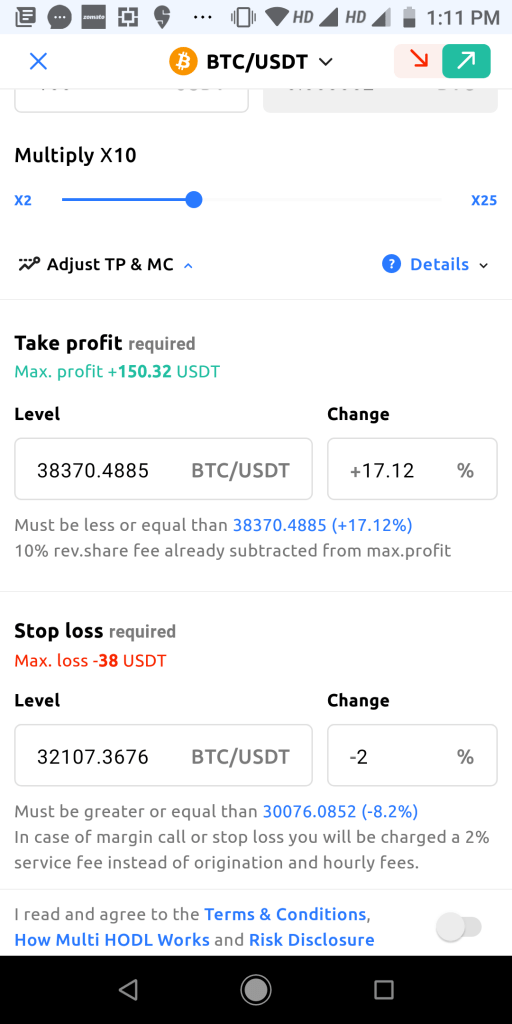

It is imperative that we have an entry and exit point in mind. You can select profit booking level and stop loss for trade. This is important for cryptocurreny because market are volatile and open 24/7 which makes it impossible to monitor continuously.

In other Bitcoin future trading platform sudden spike or fall can cause losses. Multi HODL provides peace of mind by creating a rule based strategy.

If i decide I want profit booking at 17% and stop loss at 2% I will fix the parameters .Now if market goes up 17% I will make ~ 150USD after interest cost etc and if it falls max loss is 38 USD . Making such continuous trades when you have momentum backing you really helps. Even if one fourth of the time you are right youl will end up making profit.

How much position to take each time in Multi HODL?

Kelly’s Criterian is one of my favorite theory for investing and trading . Kelly’ Criterion has an interesting background. It was proposed by John Kelly in the 50’s while working for AT&T’s Bell Laboratories.It was created to help with networking issues . However, the same theory was adopted by professional gamblers to identify the optimal bet size. This soon found its way to the stock markets as well. Therefore now there are many professional traders and investors who use Kelly’s Criterion for bet sizing.

In layman’s term the theory says to increase bet size when probability of win is high and lower bet when probability is low .Eg After March crash you should have increased bet size and now when market has peaked reduce your bet size on equity.

For detailed mathematical explanation :Kelly Criterian

Conclusion

YouHodler provides an opportunity to earn 12% on your capital.It also allows to take calculated risk to generate high return using momentum trades. YouHodler can be used in combination with other interest providing accounts like Celsius and Vauld.