Is there a mid-point where we can get a decent yield at reasonably low risk? The solution is corporate bonds. Until now it was very difficult for retail investors to buy corporate bonds from the exchange due to less liquidity. Treasury and HNI are able to buy these from their brokers. It’s better to choose a few and credible names than to put money in a fund with multiple risky credits! Now it is possible to buy and trade corporate bonds for retails investors using a fintech platform called GoldenPi! In this GoldenPi review, we will provide you all details about this platform.

Why Corporate Bonds on Golden Pi?

- The yields are higher than most FD and you can choose the borrower you want to invest in

- You can sell the bond earlier for liquidity or as a trading call

There are 3 ways to make returns from your bond investment:

- Hold the bond till maturity and earn interest

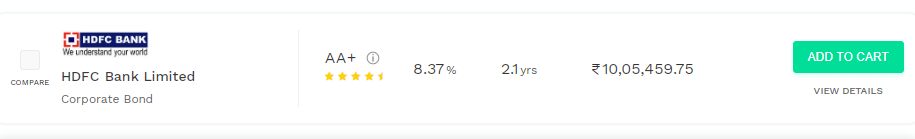

- Hold the bond and when the market stabilizes or when interest rate dips sell the bond at lower yield and book profit i.e say HDFC 2 year bond trading at 8% today. In 3 months it might trade at 7%, hence your bond portfolio (Market Value is negatively correlated to Interest )will make money which you can capitalize by selling the bond in exchange to someone who is willing to buy or sell it on the Golden PI platform.

- Carry Return: This is an interesting aspect lot of people are unaware of.

For a similar bond, risk is higher for a longer tenor hence higher return. Carry is a form of reward for holding long-dated security. A 2-year HDFC bond might be yielding 8% and a 1 year 7%.

If you hold 2-year HDFC 8% for 1 year you will get 1% extra as it has to yield 7% after 1 year hence you end making close to 9% instead of 8%

How to buy Goldenpi corporate bonds?

Buying bonds on GoldenPi is very simple. You need to simply register on the platform and buy the bonds. There are no charges for buying bonds and they are delivered to your Demat account just like shares.

Click Here to Register on Goldenpi

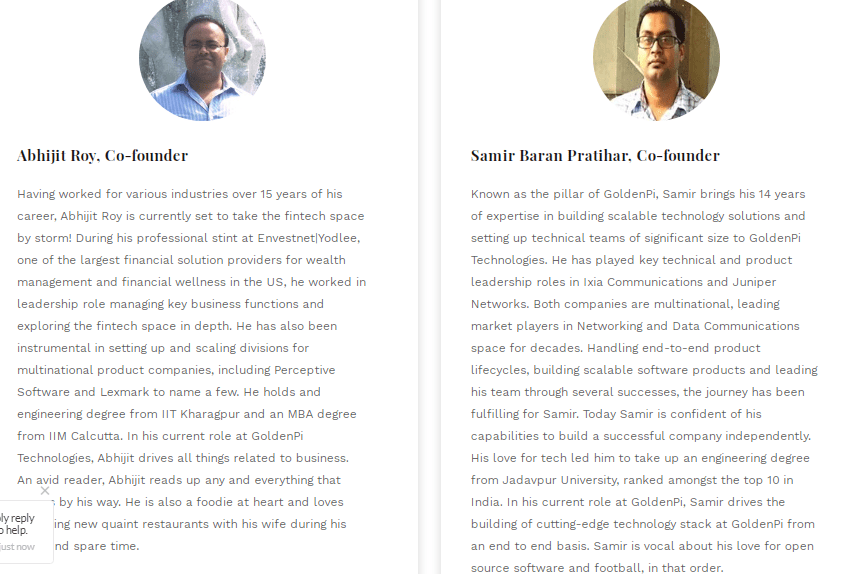

GoldenPi Founding Team

Which bonds to buy?

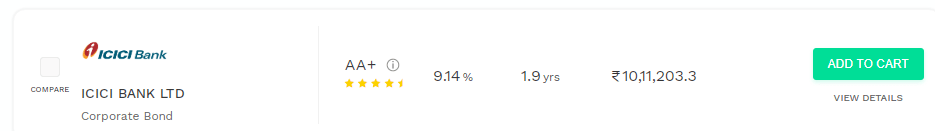

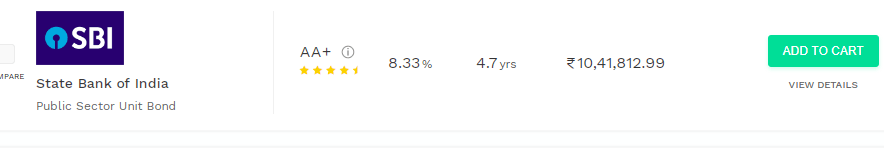

In these tough times it’s paramount you buy the safest of the names. Some of the best names you can consider buying are:

As of now, Golden Pi doesn’t charge the customers for any transaction

- Are there any Golden Pi alternatives in the Indian market?

There are alternative Investment Platform which have high yield instruments but in the corporate bond space Golden Pi is the largest and most trusted player.

- Is the platform Golden Pi by Zerodha?

Golden Pi is backed by Zerodha Founder’s Venture capital arm Rainmatter. Rainmatter is a financial technology focussed fund and incubator set up by Zerodha

Conclusion

In this GoldenPi review, we have tried to cover all aspect. Corporate bonds are a good substitute for FD provided you choose good names and are not looking for very high liquidity!

They have UP Power secured bonds listed at discount. The returns are pretty good. What are your views about those bonds? The secured nature makes them quite stable despite bad financial state of the discom, but I am not able the understand the rationale behind the discounted price.

Theoretically they are backed by UP government they will make good incase of shortage of money to pay creditors. Only risk is under exceptional circumstances when the government fails to pay!Seems improbable but cant be ruled out .As the company is loss making people are doubting the credit worthiness

Here is an interesting article

https://economictimes.indiatimes.com/markets/stocks/news/dhfl-exposure-may-dent-uppcl-bonds-but-impact-credit-neutral-ind-ra/articleshow/71984188.cms?from=mdr

How can we sell bonds before maturity that are bought from Goldenpi? I understand that when we buy from Goldenpi the bond will be credited to demat account. If I need to sell these bonds does Goldenpi provide option to sell in secondary market?

yes they do. You have to provide a DIS slip from broker to them which will enable to bonds from your demat to someone else. some broker like Angel provide E-DIS too

!

Thanks, will try it

how to value the bond and measure the risk to ensure a good investment

So there are 2 type of risk :credit and market

CRedit you can evaluate by checking the fundamentals of the issuer, any adverse news ,Asset liability profile etc

Market risk= change in price due to interest,more relevant for longer tenor bonds

To price a bond you can calculate Yield to maturity.If you feel uncomfortable doing the maths just google yTM calculator.will give the current yield of the bond

Thanks alot.It would be great if you can advise how to evaluate credit risk precisely and assses chances of default.For instance,lets say shri ram transport finance.

well it require studying the company in detail ,think of yourself as a lender,but a good place to start is

1) Annual Report: check financials like DEBT/Equity,profitability, capital adequacy ratio,interest coverage ratio etc.

2)check latest rating rational of credit agency: eg

for SRTF crisil rating rationale is available publically

https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/Shriram_Transport_Finance_Company_Limited_March_06_2020_RR.html