Why do people invest in alternative Investments? Living in today’s world, everybody wants financial security. Investing is more than just building up your portfolio to save you from a rainy day. One of the main reasons people invest is inflation. The inflation rate over the last decade (2012) in India averaged 6.04% reaching an all-time high of 12.17% in November 2013 according to Trading Economics. Everybody wants to insulate themselves from the rising cost of living, which is increasing every day. Investing helps create a safety cushion to fall into when petrol, food, goods, and services prices increase at a shocking rate. Investing not only generates savings but if done wisely can also be an additional income option. The return on investments can be used as a source of regular extra income for day-to-day living.

As India continues to march towards becoming an economic powerhouse, investors are looking for opportunities outside the traditional system to back their portfolio and safeguard it from future financial downturns, like the major one in 2020 (COVID-19). The global alternative investment market size was valued at $6.62 billion in 2021. The alternative investment market’s CAGR (Compound Annual Growth Rate) is anticipated to increase at a rate of 6.3% from 2022 to 2028. The market is being driven by the increasing acceptance rate of alternative investments.

What are alternative investments?

When people think of investing, they mostly think of traditional investment options – namely stocks, bonds, or cash. Alternative investments are asset classes that don’t fall into any particular investment category. They can include private equity, commodities, real estate, derivative contracts, futures and options, hedge funds, art and antiques, gold, or basically any type of investment. These schemes offer a higher return rate compared to conventional options. Alternative investment strategies are typically active, return-seeking strategies that also have a higher risk ratio, unlike traditional long-term investment options with low return rates and low-risk factors. Even under difficult market conditions, alternative investments can offer fascinating opportunities for investors to diversify their portfolios, mitigate the effects of market volatility, and achieve their long-term investment goals.

Some characteristics of alternative investments are:

- Independent of market fluctuations. They don’t depend on the stock As we all know, everybody’s portfolio suffered during the COVID-19 pandemic due to the drastic fall in the global markets. But portfolios that had some amount of alternative investments did not suffer as much.

- Lack of Volatility. People who trade in the stock market may look at this in a negative way, but lack of volatility is what gives higher returns.

- Strong income. With high risk comes higher returns. Although alternative investments may have a higher risk than traditional options, they provide way higher returns.

History of alternative investments

Although ‘alternative investments’ is a relatively modern term, investments in these assets are not so modern. Some of the earliest examples of alternative investments can be traced back to the 1800s when individuals made trades during the Industrial Revolution. They rose to prominence during the 20th century, notably when the nations began to rebuild their economy following the two World Wars.

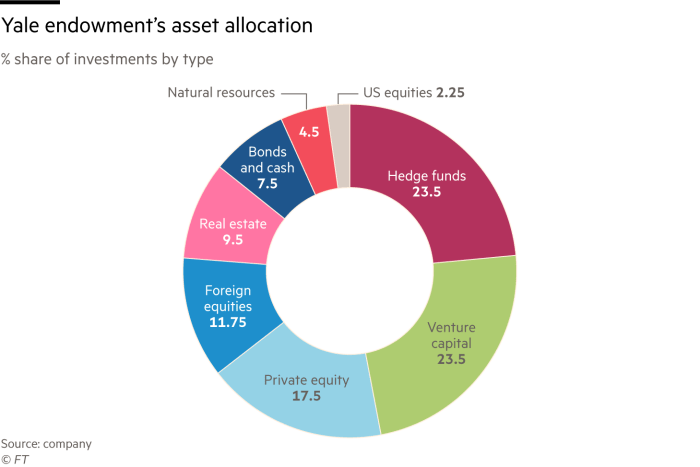

The Yale Endowment

Yale University had invested primarily in traditional investments such as stocks, bonds, and cash, but in 1985 when the position of Yale’s chief investment officer, David Swensen changed, in the 35 years that Swensen oversaw the Endowment, it grew by approximately $40 billion. In 1985, Yale’s endowment was worth only $1 billion, and alternative asset classes accounted for only 11%. The endowment faced a 10% chance of a disruptive drop. Seeing this, Swensen suggested that the endowment should diversify from traditional assets to modern ones, i.e., alternative investments with lower risk and raise return. This asset allocation philosophy was successful and became known as the Yale Endowment Model.

Alternative investments in India

With increased interest rates, market volatility and fluctuations, and a lack of faith in publicly listed assets and stocks, people are turning to alternative investments as a profitable investment avenue which proved itself by rising with lesser damage during the global pandemic in 2020. Alternative investments are the new go-to for people in India as it is slowly gaining the popularity it deserves. Also, it is a fantastic entry point for those who wish to start investing.

The top 10 alternative investment platforms in India that you can use to diversify your investments are:

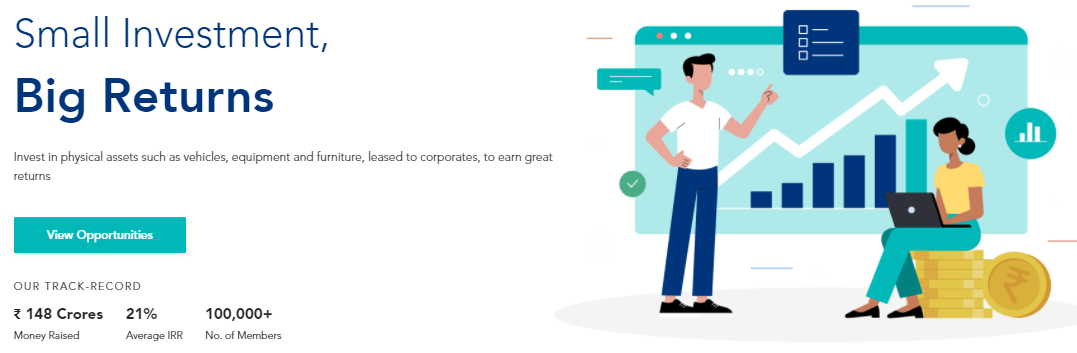

1. Grip Invest

Everybody wants to invest and earn good returns, but the uncertainty of the market holds us back. Grip Invest is a platform where you can invest if you are looking for stable cash flow. Gripinvest provides an opportunity to invest in Leasing, Inventory finance, Bonds, Real Estate, and Startups. A contrasting feature of Grip Invest is that it is not directly linked to the market and it evaluates the risk on your behalf and ensures you receive a good return rate. The most captivating thing about Grip Invest is that out of over 2.5 million users, the default rate is 0% and it is one of the most trusted and used alternative investment platforms in India.

Pros:

- The annual return rate ranges between 8% to 21% with a minimum investment amount of Rs. 10,000 on financing products and Rs. 2,00,000 to enter the equity segment.

- Before being listed, the company goes through many rigorous checks to ensure the investors’ money is not wasted.

- The investments at Grip are independent of market

Cons:

- Each opportunity has a specific risk that you need to analyze.

- Once you invest, your funds are locked in for 24 months, and won’t be able to withdraw it before 2 years.

2. Jiraaf

Jiraaf is a fintech platform that also provides alternative investment solutions. It claims to outperform fixed deposits where return rates are concerned. Jiraaf is the first platform to provide Indians with fixed-income instruments like leases, covered bonds, inventory finance, non-convertible debentures, and invoice discounting. Although Jiraaf is slightly riskier, the overall returns are worth it.

Pros:

- With an average return rate of up to 17-18%, it can account for a post-tax return of up to 11-12% yearly, which is pretty decent for fixed-income products.

- As of now, there has been a 0% default

- It offers 3 products: invoice discounting, lease and inventory finance, and NCDs (non-convertible debentures). There is a spectrum of products you can invest in depending on the risk you are willing to

Cons:

- The extra return comes with higher risk. Jiraaf is a comparatively riskier platform to invest in than bank FDs since it deals with High fixed-income products.

3. TradeCred

TradeCred is an invoice discounting platform in which all the amount is managed by an escrow account. Like Grip Invest, it also claims to have a 0% default rate. An average of 12% annual returns would make it a formidable choice. The minimum investment amount is Rs. 50,000.

Pros:

- It is managed by an escrow account by ICICI Bank, to enhance security.

- It has a long history and many vendors and enterprises have done multiple transactions which gives credibility

Cons:

- The minimum investment can be out of reach for some investors who are just starting out.

4. IndiaP2P

IndiaP2P is a peer-to-peer lending (P2P) platform certified by the Reserve Bank of India and all the transactions are made through an escrow. It focuses mostly on women borrowers. Its unique mechanism diversifies your investment which is designed to reduce risk without compromising on returns. With up to 18% return p.a., the platform offers high-risk-adjusted returns.

Pros:

- Its most significant quality is that you can start by investing just Rs. 5000 which is a very helpful feature for all investors who are starting

- It provides returns of up to 18% per annum which is a very high return rate compared to others in the market.

- It is certified and regulated by the RBI.

Cons:

- They do not provide any insurance or guarantee.

5. Leaf Round

Leaf Round claims to be India’s first marketplace for asset leasing. They offer investment options in tangible assets like EVs, home appliances, and electronic devices that can be bought and put on the lease. It is a very unique concept that is not seen on many platforms. It allows you to purchase and own assets, and the rest will be taken care of by them. They diversify your portfolio which is not directly linked to the market and give stable returns.

Pros:

- They promote leasing as their main investment option and have one of the highest return rates of up to 30% per annum.

- They provide monthly payouts which most platforms don’t usually do.

- They allow you to invest as low as Rs. 5,000.

Cons:

- There may even be a circumstance when the business is unable to make the required monthly rent payments.

6. Growpital

Growpital is an agriculture-investment-based alternative investment platform. As the agriculture sector is growing rapidly, Growpital allows you to invest in growing crops ranging from just Rs. 5,000 to Rs. 10,00,000 per unit and get returns ranging from 12 to 18%. It claims to be better than investing in mutual funds and provides higher returns of up to 17% per annum Tax-Free and gives payouts quarterly. This is completely independent of market volatility as farmland faces only one-third of the volatility of the stock market.

Pros:

- The returns are not correlated to other asset classes.

- Growpital offers an opportunity to own a fraction of agriculture asset classes along with earning tax-free returns of up to 17%.

Cons:

- Performance can depend on environmental factors like weather and crop.

7. Klubworks

Klubworks is India’s first revenue-based financing platform. It funds unique projects like cloud kitchens, D2C businesses, subscription companies, gaming companies, SaaS companies, and local businesses. You can start investing at just Rs. 2,50,000 with returns of 20-27%. It chooses high cash-generating business sectors like fashion, lifestyle, interest, etc. The cash flow of the investors depends on the revenue of these local businesses.

Pros:

- You can get up to 20-27% IRR

- They diversify your portfolio by investing in high-return small businesses and fast-rising companies.

Cons:

- The minimum investment value is very high which doesn’t allow most customers to invest.

8. KredX

KredX is an invoice discounting platform that allows you to invest in invoices of companies like Infosys, Dunzo , Zetwerk ,Bira etc

Pros:

- Allows investors to diversify their investments across multiple invoices

- Easy and quick registration within a matter of minutes.

Cons:

- There have been instances of defaults in the past.

9. AltiFi

It is a platform that allows individual customers to buy high-yield corporate Bonds. The return rates range from 8% to 13% post-tax.

Pros:

- Strong risk management strategies.

- As little as Rs. 10,000 can be used to start investing, which is a manageable sum for new investors.

- Swift customer service to address any issues

Cons:

- Some good bonds have higher minimum investment requirements.

10. LendBox

LendBox is a renowned P2P Lending platform that is licensed by the RBI. It launched in 2017 and quickly made its way up to being the leading P2P Lending platform. It is a unique concept platform that connects investors eager to lend money with interested borrowers via an internet platform. LendBox has teamed up with a few reputable organizations which ensure investors with low-risk investing opportunities. An annual return of about 11% can be expected.

Pros:

- No hidden fees are included in transactions.

- Full transparency in transactions between the investors and the borrower

- The registration process is simple, quick, and free.

Cons:

- Although P2P lending is now slowly rising, it may be a little riskier than alternative investing.

- The minimum investment amount is Rs.50,000 which may bother a few

Conclusion

Observing the rising interest in alternative investments, platforms like GripInvest, Jiraaf, and TradeCred are a great place to start your investing journey. These investment platforms have trusted feedback and stay true to what they claim to do. But, putting all your eggs in a basket is always a risky thing to do, so make sure you start with a little amount and learn about asset classes to fully understand the risk of each opportunity.

pl also consider Wint Wealth-an excellent and transparent platform for fixed income instruments.

I have been using wintwealth. Please find below a detailed review

https://randomdimes.com/wint-wealth-review/

I have never come cross deals offering 17% -18% erturns in Jiraff so far. Typically arounf 11 -13.5 %. Can you please clarify ?

Hi Murthi , Most deals are in the range of 11-14% however few deals with high returns include; venture debt and infra debt around 16-18% and few leasing deals similar to Grip with Pretax 18-20% have been listed in the past

How do you track all your alternate investments portfolio and check if claimed amount at the time of investment received?

I have prepared an excel. Will share it with everyone this month

Waiting for the excel 🙂

Hi Samesh,

Will share the excel soon ! 🙂