One Mysterious Shiba Inu (SHIB) Coin Investor Wallet Appreciated From $8,000 To $4.8 Billion

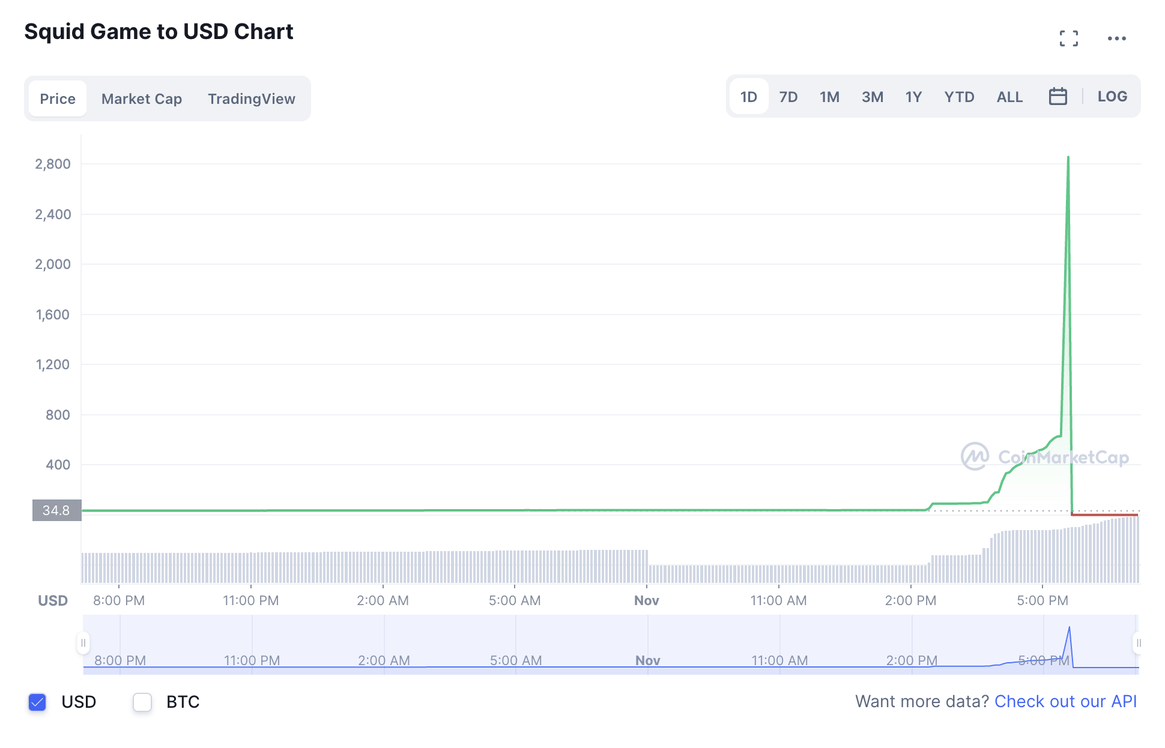

On the other hand “Squid token” based on the squid games turned out to be a rug pull scam.A ‘rug pull’ in crypto occurs when the creators of a project take off with investor’ funds

Squid Token is inspired by the famous Netflix Series “Squid Game”.” Sicne its inception, the cryptocurrency jumped in value and on October 29, surged by 2,400 per cent in last 24 hours to reach the value of $4.32 – and for the next few days, it kept surging. Until, 1st November. Early on Monday morning, a Twitter user pointed out that the developers of the Squid Game project had “rug pulled” SQUID holders. The prices for SQUID, went down nearly 99.99% to $0.002541

My Alternative Investment Portfolio Performance

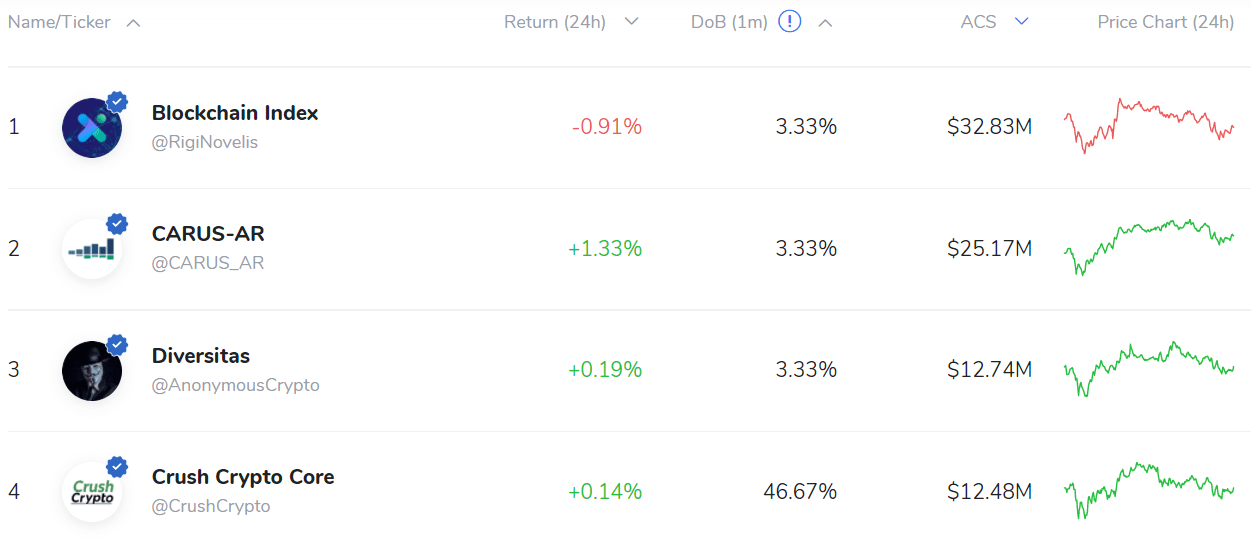

This month all platforms with exposure to crypto viz. Iconomi did well.

Structured Lending Investment

| Platform | Return | NPA |

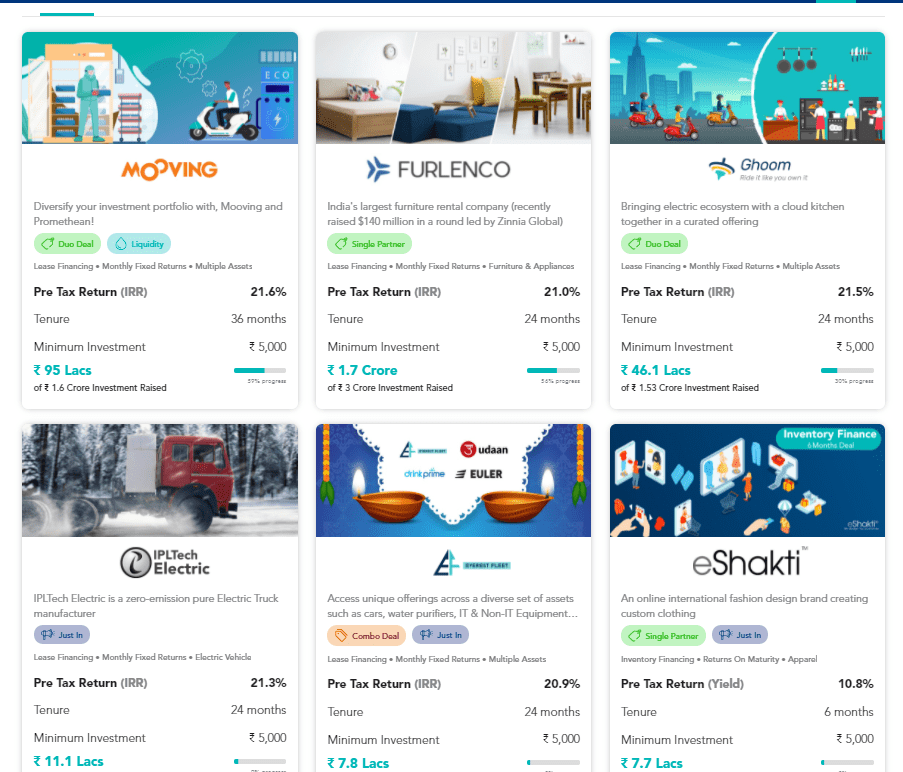

| GRIP Invest | 12-13% (post tax) | Nil |

| Klubworks | 20-23% | Nil |

| GrowFix(Wealth Wint) | 10%-11.00% | Nil |

| Pyse | 10%-11%(post tax) | Nil |

- Wealth Wint next issuance is planned in Novemeber end with INR 10k minimum investment

- Grip has been consistently coming up with deals every week without fail.Recently started 5k minimum deals too.

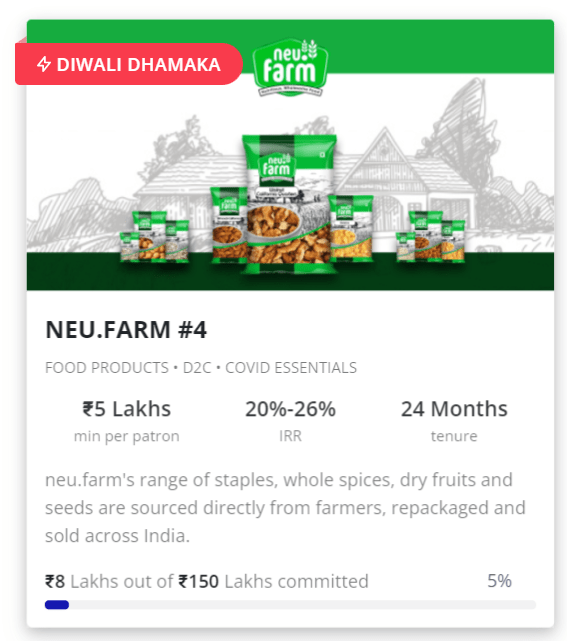

- Klubworks had few new deals including Bewakoof etc

- Pyse had launched the Tata deal this month.More deals expected this month

- All my cashflow in Klubworks, WintWealth,Pyse and GripInvest are as per plan.

- In Klub of more than 70 deals they have offered ,one deal has delay in payment till date

New Deals

Invoice Discounting and Settlement Finance

| Platform | Return | NPA |

| TradeCred | 12% | Nil |

| Lendbox(settlement Finance + gold Loans +) | 11.7% | Nil |

- TradeCred recntly listed many new deals as Diwali season has lot of financing requirements

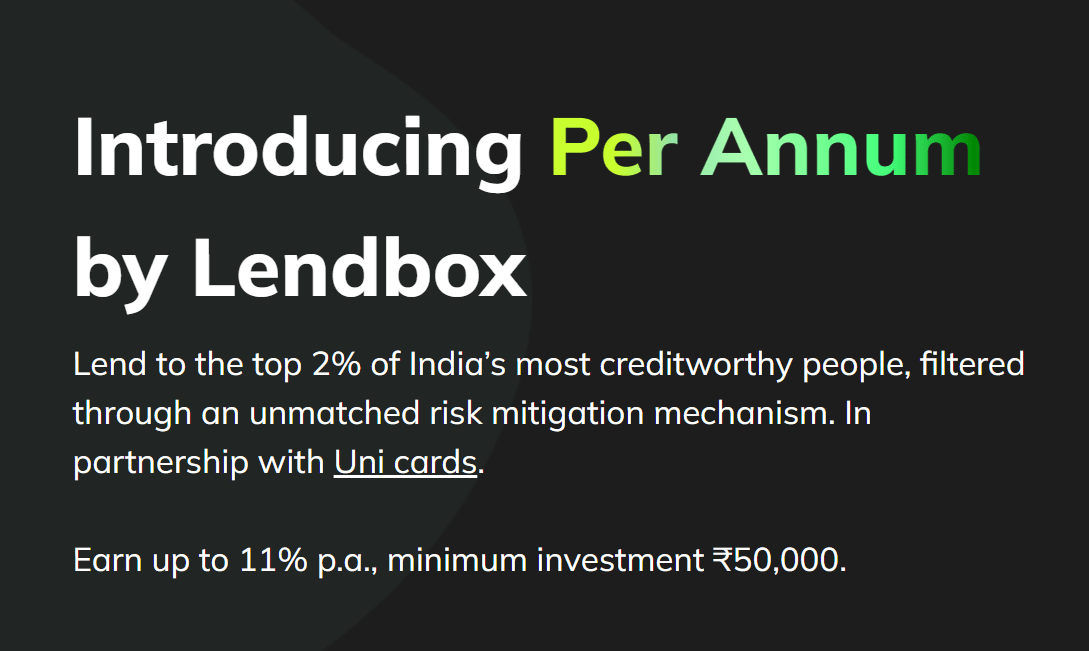

- Lendbox settlement finance returns have been in line with expectations till now. Lendbox has recently launched an interesting product Per Annum which has very cibil score borrowers

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 12% | |

| Crowdestor(Stopped) | 14% | 4.7% |

| EstateGuru | 11% | – |

| PeerBerry | 10.50% | – |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 12% | – |

| Lendermarket | 14% | |

| RealT US High Yield Property(crypto based) | 11% | Rental yield |

| Reinvest24 | 11.5% | Rent+capital gain |

- Use Winvesta multicurrency for managing a global portfolio

- Reinvest24 is doing great. Will be doing a post on the platform performance very soon

International Equity

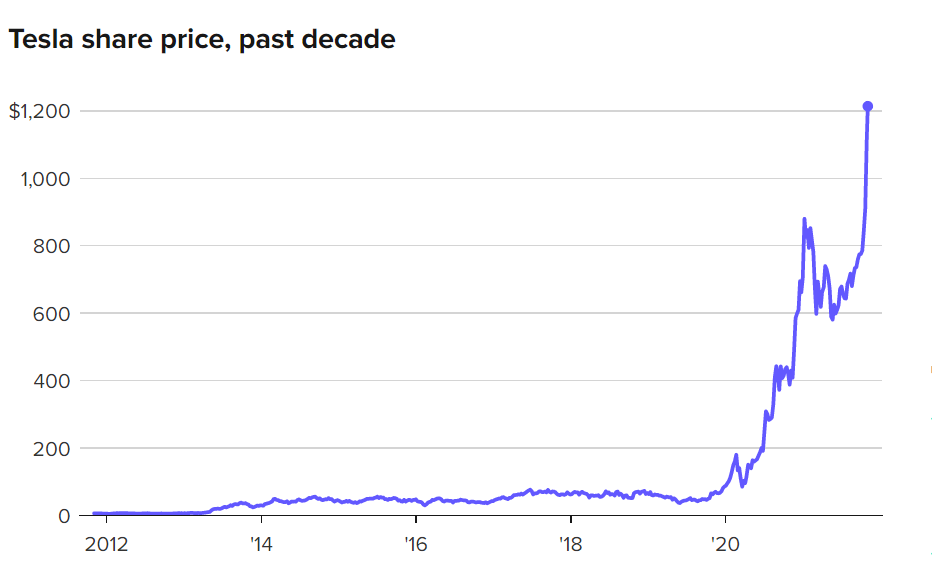

- Tesla hit a $1 trillion market cap on Monday following news that Hertz is ordering 100,000 vehicles to build out its electric vehicle rental fleet by the end of 2022.The company joins trillion-dollar market cap companies like Apple, Amazon and Microsoft.

- Volatility in US bonds is surging in stark contrast to the relatively placid run for equities, leading some analysts to warn over the danger that central banks trigger a spasm of volatility in Wall Street’s stock market

Crypto Lending Investing

| Platform | Return |

| KuCoin | 20%(market dependent 10-60%) |

| Celsius Network | 11.5% |

| BlockFi | 8.6% |

| Youhodler | 12.7% |

| Vauld | 12.6% |

- Kucoin is giving 15-20% yield currently due to bull run

- Celsius is offering 40$ for depositing USDT (code 133908fe3e)

- Youhodler Paxg (Gold backed coin) offering 8.2% yield over gold returns

Crypto Investment

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 45% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 3% |

| Bitcoin Trading(Wazirx/Binance) | 10% |

- I have my investment split across 2 Iconomi funds :1) Crush Crypto Core and 2) Carus-AR ,both have done phenomenolly well

P2P Investment

Current allocation:

- Rupeecircle- 5%

- I2IFunding- 20%

- Finzy- 25%

- Lendbox-30%

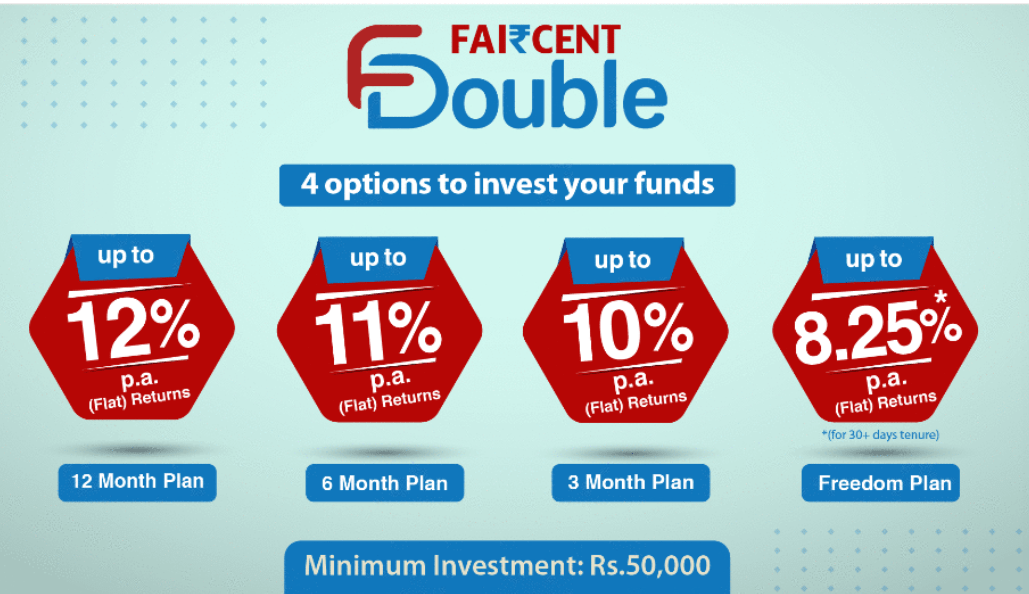

- Faircent-20%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Cooperative banks backed loans,E-Rickshaw backed loans,education loan,NBFC backed loans(Monedo etc) Group loans | 13.7% | 5% |

| Rupeecircle (paused till clarity on new management performance) | Small business/salaried loans to people with own house and low EMI to Earning Ration | 14% | 5.5% |

| FINZY | Prime Borrowers,High Salary ,A category | 14.2% | 3.6% |

| Faircent ( Only Pool Loans) | Only Systematic Investment plan with 12% Interest | 12% | 0% |

- FINZY is performing well and has recieved a 2 Mn USD Funding which will enable them to improve the performance further.

- Systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

Other Alternative Assets

| Platform | Assets |

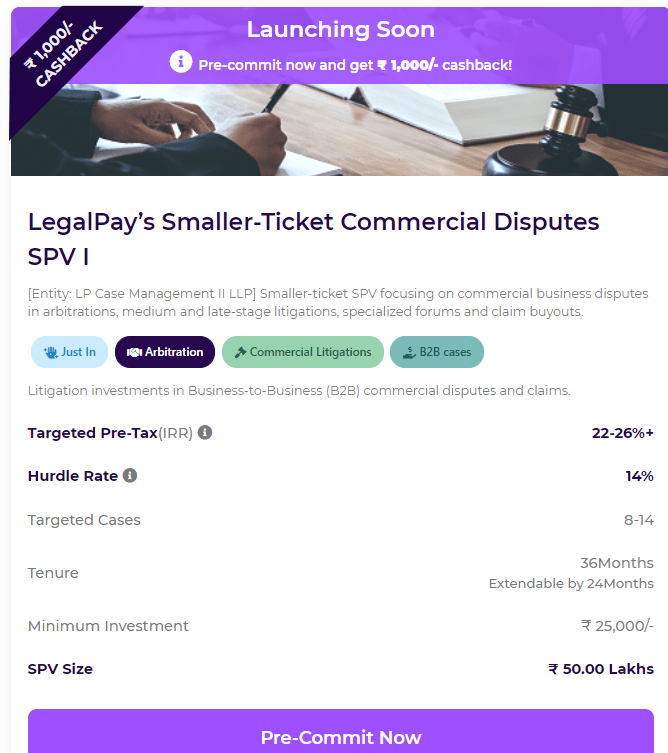

| Legalpay (Promo code FV48G4) | Litigation Funding |

| GoldFinX | GoldMines |

| METEX | Palladium/Platinum |

| Vinovest | Exotic Wines |

- There is an upcoming deal on Legalpay. Prebook and get 1000 cashback! We will get the status of the first investment by January 2022.

- I got a Diwali gift from Legal Pay as token for Investment!