Lot of people are aware of P2P as an asset class to invest for high Returns. One of the drawbacks of P2P is that the loans are unsecured and in case of default there is no collateral to sell. The high yield is thus the cost of taking risk of defaults. For more conservative Investors, who are happy with slightly lower yields but a secured collateral have option of investing in real estate crowdfunding and SME loans with collateral. There are 3 reasons for these investments:

- Secured Lending is safer and incase of default the collateral is sold to retrieve the money,adding it with my unsecured lending portfolio will make it more robust

- Investing and Returns would be in Euro and any Euro appreciation over the years will add to the returns.

- Until now there was no way to invest small amount in real estate.

Real estate crowdfunding is a relatively new way to invest, and it can certainly be an exciting way to put your money to work on single-property commercial real estate deals.

In the world of real estate crowdfunding, there are hundreds of possible investment variations. But they can all be divided into two main baskets: debt and equity

DEBT BASED REAL ESTATE CROWDFUNDING

Under this form of peer-to-peer lending, investors lend money to property development projects rather than assuming partial ownership. The usual maturity periods on debt issued this way can range from 6 months to 18 months, but longer periods are sometimes available. The debt sponsor typically pays a stated fixed rate of interest over the lifetime of the debt and repays the principal at maturity. Nothing prohibits sponsors from issuing more esoteric debt instruments, such as floating-rate and zero-coupon bonds.

Investments are secured by the underlying property, and in the case of bankruptcy or default, lenders have priority in receiving liquidation payments. Real estate debt investing typically involves lower risk and lower returns than potentially available from real estate equity investing. The investment fee depends on the sponsor and is usually deducted from the interest payments. The types of properties involved in debt crowdfunding include single homes, multi-family homes and apartment.

Top Platform for Debt Real Estate CrowdFunding:

- EstateGuru (get 0.5% cashback using the link)

Founded in 2013, EstateGuru earns our top spot as the best real estate crowdfunding platform in Europe by offering clients a complete package of property investing tools coupled with high levels of security for your money.

As the leading real estate crowdfunding platform in Europe, EstateGuru boasts a user base of over 55,000+ members and more than 1,500+ funded loans. Since inception, the company has continued to perform above expectations with zero capital loss of client funds and above-industry-average interest rates while maintaining an unmatched deal throughput.

EstateGuru offers around 12% interest on secured property loans, with a minimum investment amount of only €50 and zero-to-low fees charged for its services. As such, the platform has proven an excellent source of stable income to investors from short-term loans, while giving the borrowers funds to grow and expand.

Expected Yield 11-12% , Loan to Value is close to 50-60% which is excellent

EQUITY BASED REAL ESTATE INVESTMENT:

You can think about real estate equity investments as a similar action to buying stock in one of your favorite companies, or better yet, as buying an investment property of your own.

Once you contribute your money, you become a stakeholder. If you own an investment property and it brings in rental income and eventually sells for more than you paid for it, you get to keep the money. Similarly, when you invest in a crowdfunding opportunity as an equity investor, you are entitled to a proportional share of the potential returns and cash flows of the project.

Major difference between REIT and this is that these are not traded hence no impact of sharemarket volatility.You can expect 6-7% rental yield plus capital appreciation of 5-6% in long term

As such we do not have any pure equity real estate platform ,but platform which provide a mix of equity as well as debt options:

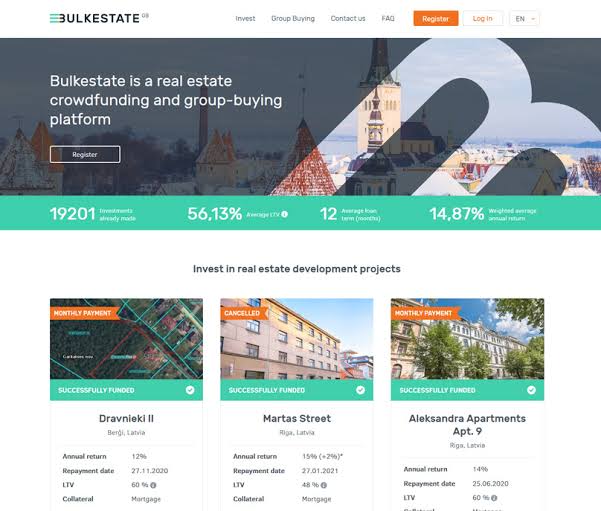

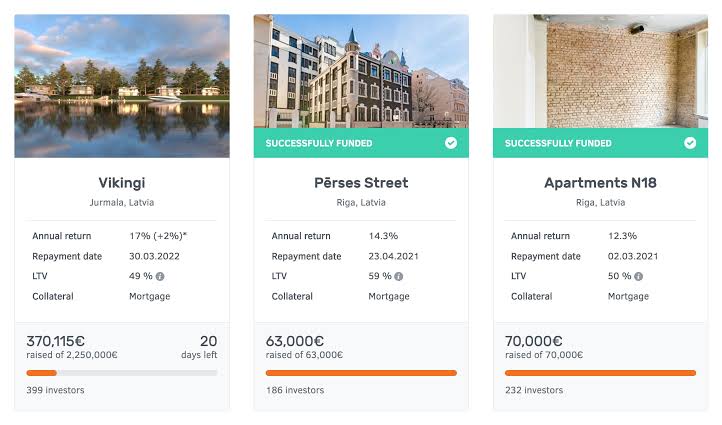

Thanks to its unique focus and local anchoring in Riga, Latvia, Bulkestate has created an excellent all-round platform for investing in the Baltic real estate market. Key highlights include low minimum investment of €50, industry-leading returns, attractive loan-to-value ratings, and segregated escrow accounts for investors’ funds. Finally, most projects have a quick turn-around time of only 12 months and are secured by way of a legal charge over the borrower’s assets.

The LTV (loan-to-value ratio) is usually around 60%. The loans are secured by first-rank mortgage, which makes them rather safe. In addition, the valuation of the property is provided by an independent firm; for example, for the recent project “Kr. Valdemāra Apartment No.34a”, it was appraised by Ober Haus, a large real-estate company.

Besides in-house experts, Bulkestate partners with local real estate professionals to handle all property-related issues. Better yet, Bulkestate charges no fees to investors, and large accounts can enjoy up 1% bonus on their investments.

Good part is it has higher yield Debt opportunities than EstateGuru which can go upto 16-17%, but the Loan to Value is slightly higher ,approx 60-70% which means in case of default you have less cushion compared to EstateGuru.

Another great feature in this platform is bulk buying of property.

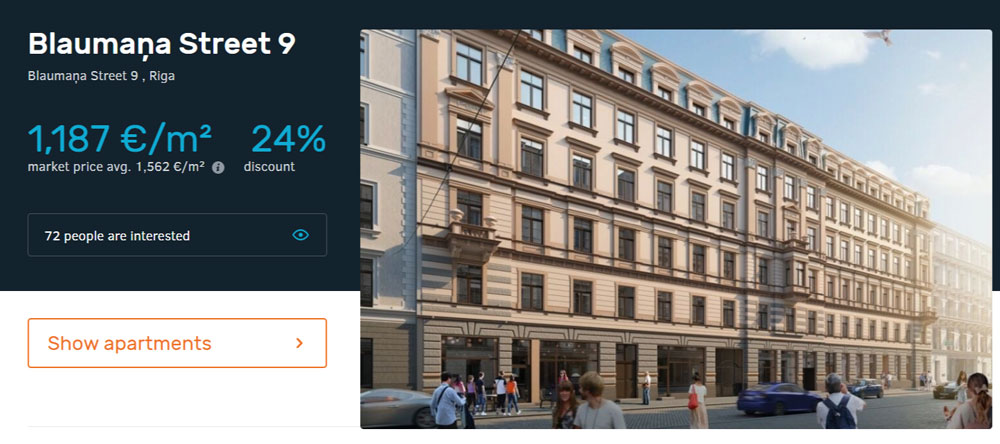

The Bulkestate platform, as the name implies, enables real estate investment project crowdfunding and apartment bulk-deals for a price lower than the market value.

What is perhaps more interesting and eye-catching due to its novelty is the group buying facility. This consists of structuring group buying deals to acquire small size (such as one apartment) real estate at wholesale prices (sales price of an entire building). I like the idea a lot and look forward to how this section developers. You can sell the properties later at profit

2) Evostate : Evostate is the first real estate crowdfunding aggregator, or platform of all platforms in other words.

Evostate sources and aggregates real estate investment opportunities from over 10 countries. Investors can easily access deal-flow from close to 20 platforms and make cross-border investments hassle-free. As a consequence, all projects are listed in the English language, which isn’t the case with most platforms as well as most of the documents.

The Evostate service is completely free to investors and Evostate makes money by charging a commission to partner platforms.

Evostate statistics

- 15 Partner platforms

- 12 Million EUR In investment opportunities

- 8 Countries with active investments

Having a single account with EvoEstate enables you to invest across multiple platforms without the hassle of signing up to each of them.

Consequently, this enables you to easily diversify across multiple countries.

At this moment, EvoEstate has already financed deals from 8 countries, including the United States, which is quite uncommon on European investing platforms.

BUY-TO-LET

In these kinds of investments, you earn money from the rental income of the property.

This type of investment tends to generate the lowest returns, however many investors find them very attractive. The reason is that they are the most stable kind of investment. Investing in buy to let is like owning a small part of a property.

For a low amount of risk, investors can expect 3-6% of annual returns as well as probably capital appreciation over time. Capital appreciation is generated by the increased value of the property which, depending on the location, ranges between 2-4% annually.

Such an investment can yield investors a total of 10% annual returns, but you have to be patient and hold the property until the duration of the project. Most of the buy-to-let investments have a duration up to 5 years, but the originators do not disclose the exact dates, as they intend to sell when they will be able to generate the highest capital appreciation. The best part is that when investing in buy to let properties through Evostate you don’t have to limit yourself to just one property but instead you can own parts of property across all of Europe without the hassle of managing them yourself.

FIXED-INTEREST DEVELOPMENT AND BUSINESS LOANS

When investing in fixed-interest loans investors take on the role of the bank, providing financing for real estate development companies. This investment type has underlying assets – real estate collateral, which in case of default could potentially protect investors’ principal investment.

Investors can expect to earn 8-13% interest annually investing in fixed-interest loans, but loans have higher risks involved compared to the buy to let projects. This is because they are more likely to default during a recession when the market cools off and developments struggle to find buyers.

EQUITY PROJECTS

With this type of investment, investors become co-owners of the business, therefore investors can expect to earn between 14-30% annually.

However, like the business owner, investors don’t only participate in the gains but also in losses, therefore there is a risk that investors could even lose principal.

Equity projects can also be sub-categorised

- New developments – you participate not only in the upside but also in the potential downside, however, the potential returns are much higher.

- Auction products – where a property has been bought in an auction for a below-market price.

- Private investment funds’ deals

SME INVESTING

Crowdestor (5$ and get 0.5% cashback using the link) is the top platform in terms of Business crowdfunding with yields upto 24%

Crowdestor is a business crowdfunding platform based in Riga, and that focuses on financing business, real estate, transports, and startup projects. For investors, it translates in returns from 12%, and it’s not unusual to see returns up to 18% on the platform. Most of the deals you will find on the platform are in Latvia, especially in the region

As for all Peer-to-Peer Lending & real estate crowdfunding platform, there are risks coming with investing in Crowdestor . The main risk is that a project you invested in goes to default, which can result in a loss of part of your capital. However, there are ways to significantly reduce the risk.

The first thing is to always diversify, by spreading your investment on as many projects as possible on the platform. This way, even if one project defaults, your overall yield won’t suffer that much.

The other thing is that the Crowdestor team is really focused on the question of securities & buyback guarantees. First, each project comes with one or several assets as security, for example, a piece of real estate or money from the borrower himself. Then, the team at Crowdestor have built a Buyback Fund, which will be used to provide a buyback guarantee to pay the rest of the capital in case one loans defaults.

I will rate this platform more speculative than Estateguru hence you should expect some defaults therefore you get high yields to compensate for it.

The diversity of the financed businesses is one of Crowdestor’s great strengths. Here’s a sample of the borrowers :

- A drum school

- An hotel

- Several forestry exploitation

- A construction company

- A mobile game development studio

- A warehouse

- Several hostels

I will be publishing Monthly performance of my International Portfolio soon

How to Invest?

All these platforms require a European bank account to get started.European bank account come with an IBAN numbers(just like IFSC code in India). The process to get started is

- Register on the platform using the link to get joining bonus

- Crowdestor @ 15% Euro Returns (5$ and get 0.5% cashback using the link)

- Evostate @ 11% Euro Returns (get 0.5% cashback using the link)

- EstateGuru (get 0.5% cashback using the link)

- Bulkestate @ 13% (0.5% cashback using Link)

- Setup a virtual IBAN account

Best way is register on “CONTOMOBILE”mobile app. It’s a Lithuania based bank which provided free virtual account.

https://i.contomobile.com/public/login

Once you have registered you can see your IBAN Number which you can add to all the platforms.

- Transferring Euro to your IBAN account.

You need to to transfer EURO to your IBAN using any Indian bank’s remittance facility

From your contomobile you can transfer 1 euro to each platform and your account details will be mapped. After that you can fund whichever platform as and when you want.

Other Options for Investment include P2P with buyback guarantee

Conclusion: If you diversify across top performing Secured Lending Platform you achieve around 11-13% returns in EURO which is excellent in these low interest rate environment. One time registration and money transfer process is slightly cumbersome but is worth the efforts to get an access to asset class not available for Indian retail Investors

Hi Rohan,

The investments to be made abroad are more complex now, as Binance does not allow Euro withdrawals for SEPA transfer. I want to know what are the other ways to circumvent the situation at hand.

Request you to do a follow on this, with more details including other costs such as Swift Fees, Currency Conversion Fee details in case of banks, and comparison of different methods, similar to the detailed one found in the Crypto comparison table. This will help out and give a clear picture.

Thank you

Great Query! I am using a Multicurrency account for the Europe investments.You can use Winvesta

https://randomdimes.com/winvesta-multi-currency-account-review/ as it’s an Indian platform with good support. you can transfer the money you want for foreign investment to Winvesta through Remittance using DbS etc

I suggest using banks(DBS,IDFC etc have low rates) for these transfers over services like Instarem as the latter transfer has restriction for end use as per RBI FEMA guidelines

I will do a follow up post of comparison soon!

Hi Rohan,

can you please make in details article on Instarem.

Like to know –

How one can transfer funds to Instarem from his bank account in India.

Will it be a regular transfer (NEFT/RTGS/UPI) from our saving accounts or bank will treat it as wire transfer and charge us accordingly ? (if it happens then transferring funds directly from bank to our sepa account or through instarem will be one and same)

Also as you mentioned about crypto transfer then what will be the total cost we have to pay, since here the funds are going from 4 channels and 2 conversions (considering each channel and conversion may have their own charges)

eg. a) bank account >> b) wazirx >> conversion to USDT >> c) Binance >> USDT to Euro conversion >> d) Contomobile app

so which is more cheaper – 1) Wire transfer 2) Instrarem or 3) Crypto.

HI Yash,

This is a very old post. I did some research. If you want to transfer money from India you need to follow the below action:

1) If transfer is for investment use Bank remit to transfer to IBAN ( as they provide a5 form which is to be filled for investment purpose transfer)

2) for any other purpose you can use instarem to transfer to IBAN

Using crypto to transfer doesn’t make much sense these days due to high tether rate + TDS + crypto exchange fees and other hassles.