How many times have you fantasized the idea of early retirement planning ?Looking for the best Retirement plan is a common topic in lot of whatsapp groups, blogs and Youtube videos.The Idea sounds drool worthy but it’s more complex than a binary event

What is The Early Retirement Planning Problem?

You work for 40-50 years of your life but can live 30-40 years after that. The biggest problem to solve is : “not to run out of money”.

William Sharpe who won the Nobel Prize for the CAPM model called it the hardest problem in finance. You can find many financial models asking you to invest aggresively in the early years then change bond and equity allocation after a point. They seem to be so precise about a problem which has so much uncertainty and variables beyond our control.

We can break the problem into two parts :

- Quantitative factors

- Qualitative factors

Retirement Planning Quantitative factors

When can a person retire depends on how much has he earned and how much can he save which is dependent on many factors.

Earning Rate and Acceleration

This factor is one of the most important determining how much you can accumulate over the next few years or decade. People who are able to get good salaries ,good switches, inheritance can quickly start Retirement investment early. It is quite common people who are able to get better jobs early in their career are able to use it go get higher pays /hike/bonus subsequently due to higher base affect which become a positive reinforcement. A big factor is privilege behind it which we unknowingly ignore

Inflation and Investment Return

Its important that your assets yield a return better than inflation . Most retirement pension fund fail at this.A well diversified Portfolio is important. Inflation can impact the true value of your corpus .In extreme scenario like Argentina/Argentina it killed the power of money completely.

Even In India inflation has over a period made everything pricier.No wonder why our parents keep complaining how expensive everything is now!

Retirement Age

Every year you delay retirement has a double impact. You increase savings that can grow AND you don’t withdraw return-generating assets.

Savings

A rupee saved is another source of big difference. You not only reduce the expense but you reduce the compounding of that expense. Or you can say that a rupee saved is also extra rupees in the future due to compounding.

This is the most interesting factor because it’s high impact and insofar as you can control your expenses, it’s the factor you can steer the best. In contrast to, say, inflation. Good luck understanding inflation never mind controlling it. A minimalist lifestyle is the key.

In one of my posts I had shown how much impact saving and earning can have as compared to investing.

Most of these terms are impossible to forecast. The problem suffers from copious amount of assumptions and speculation which make it the case of garbage inputs and garbage output if you try to derive a magical number.

Early Retirement Planning Qualitative Factor

Ironically lot of people who had retired work after that and a common reason they give is that they like to feel engaged and want something to dedicate the time.

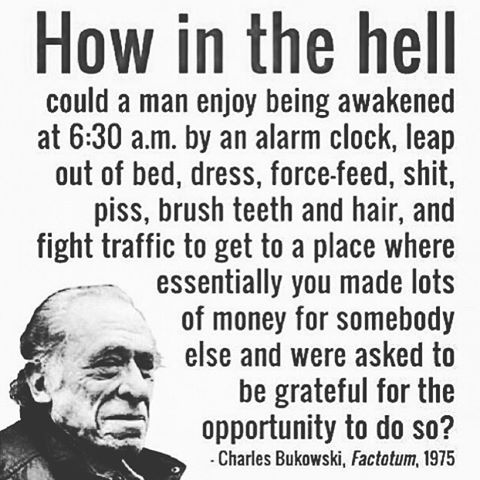

Anyway its ludicrous to think that on one future date of your retirement day you become a different person who starts gardening all day or play golf .The reality is your retired future is spent worrying about new things. Your health. Your fixed income. The dream of retirement is sold like snake oil!

The problem is that in our career we are always worried about lot of things all the time which do not matter in the long run like

- Performance appraisals

- Portfolio Annual Returns

- Not learning developing skills all the time

Sustainable Life

The idea that you can work until you are 75 or 80 is liberating if you can do it on your terms. If you can take a break for a year sometimes. If you can work 4 days a week, or from wherever you want.

Also if you actually enjoy bringing your uniqueness to the job to be done. The definition of a sustainable life is one you actually want to sustain. Nobody wants to run forever on a treadmill being scared they might trip someday.

In a Harvard survey of 100 newly retired professionals it was found that the things that made them happiest in retirement were quite simple: not using an alarm clock, the ability to pursue a hobby, not needing to commute and the flexibility to spend time with family.

The pursuit of The Number is a complete distraction. In fact, it’s worse. It’s sending you on a wild goose hunt in the wrong direction – taking precious mind space away from you finding the intersection of 50 weekly hours pursuing interesting work, with good people, while retaining basic life flexibility.

Conclusion

Getting to a precise sacrosanct number for retirement is not possible as many factors are not in our control. The more important question is to introspect that what does early retirement even mean. The goal should be to maximize the amount of wealth you can accumulate to achieve financial freedom while gravitating towards a sustainable life.