Realt is a disruptive platform in the Real Estate space.Since going online more than a decade ago, the blockchain has been one of the most transformative and disruptive innovations. For once, we have access to a decentralized form of record-keeping that is for the most part protected against unauthorized modifications and fraudulent transactions. However, most blockchain-based platforms revolve around cryptocurrencies. Another major use case of blockchain is Tokenization

Blockchains can also store immutable records of digital tokens, which represent ownership toward a real asset; in this case, real estate. Therefore, you can think of tokenization as the digitalization of deeds, contracts, and certificates (say for equity ownership). By this logic, real estate tokenization is a relevant alternative to paper deeds to property

RealT, is one of a growing number of companies utilizing the technology for the democratization of investments.It is a tokenized real estate investment platform, enabling fractional ownership in real estate on Ethereum.

Problem with Conventional Real Estate

Traditionally speaking, real estate faces a few inefficiencies within the existing market.

- Real-Estate Illiquidity

Illiquidity is the state of an asset that cannot easily be sold or exchanged for cash, without a substantial loss in value. Illiquid assets are difficult to sell quickly, because of a lack of ready and willing buyers to purchase the asset. The lack of potential buyers leads to a larger discrepancy in the bid-ask spread between buyers and sellers, which often forces the purchaser into a “long-term hold” investment strategy for the asset. Numerous different variables contribute to the illiquidity of real estate property.

2) Real Estate Cost

Real Estate is the highest-valued industry in the world. This results in property ownership being prohibitively expensive for the majority of the world’s population. Even the most inexpensive homes often have too high a price for the average person to accept.

But what exactly is asset tokenization?

Today, assets can be represented on a blockchain by a distinctive digital identifier called a token. Tokenization is a method that converts rights to an asset into a digital token, in many ways similar to the traditional process of securitization. Transferring the information from a real-world asset onto the blockchain allows ownership rights to be transmitted and traded on a global and secure digital platform. In the case of RealT, the assets being tokenized are residential properties, but, broadly speaking, any asset can be tokenized, from a valuable piece of art to a precious stone.

The Benefits of Asset Tokenization

The foundation of a token economy offers the potential for a more efficient and fair financial world by greatly reducing the friction involved in the creation, buying, and selling of securities. Features like integrity, robustness, accessibility, and immutability, make blockchain a powerful accounting tool and the process of asset tokenization creates a myriad of advantages, including greater transparency, liquidity, and accessibility as well as faster and cheaper transactions.

Greater Transparency

A security token is capable of having the token holder’s rights and legal responsibilities embedded directly onto the token, along with an immutable record of ownership. This immutable record means that nobody can “erase” your ownership even if it is not registered in a government-run registry. These characteristics promise to add transparency by tracking and recording the history of the asset every single time it changes hands.

Increased Liquidity

Tokenization of assets will create a more liquid world and could drastically change the dynamics of global trade. Tokenizing assets – especially private securities or typically illiquid assets such as real estate – enables them to be more easily traded on a secondary market of the issuer’s choice

Globalization

When tokenization of assets reaches the mainstream, the global trade of (previously) illiquid physical assets could become an everyday reality. As assets become increasingly tokenized, global trade becomes less difficult, and an opportunity for developing new markets for previously underutilized, illiquid assets opens up.

Reduced Barriers To Entry

Importantly, tokenization could open up investment of assets to a much wider audience – thanks to reduced minimum investment amounts and periods. Tokens are highly divisible

Turning The Real Estate Sector On Its Head Through Asset Tokenization

The benefits of asset tokenization most clearly apply to asset classes that are typically considered illiquid and can benefit from improved transparency, efficiencies, and lower minimum investments. The real estate industry is particularly pertinent when considering the possibility of tokenization. Imagine you want to invest in real estate, but you want to start small and incrementally increase your investment.

Perhaps you wish to begin by investing in a $100,000 apartment; tokenization means the value of the apartment can be broken into, for example, 100 tokens (the number is totally arbitrary). In this scenario, each token represents a 0.01% share of the apartment and when you buy one token, you actually buy 0.01% of the ownership in the asset. Buy 50 tokens and you own 50% of the asset; buy all 100 and you have complete ownership of the asset.

The inherent immutability of a public ledger ensures that once you buy tokens, your ownership of the asset cannot be manipulated or tampered with, it is indisputable. Rather than requiring very large investments, or tying up your money for extended periods of time, tokenization permits you to invest in whatever asset you are interested in and easily trade the token at your discretion.

The ability to freely choose where you invest will open up a new era of much greater personalization and customization in investment. At RealT, we are proud to help build the infrastructure to support the growth of a new token economy.

You should understand though REALT is blockchain-based platform it is not a cryptocurrency like bitcoin but is a token with real estate backing

How Does ReaLT Work?

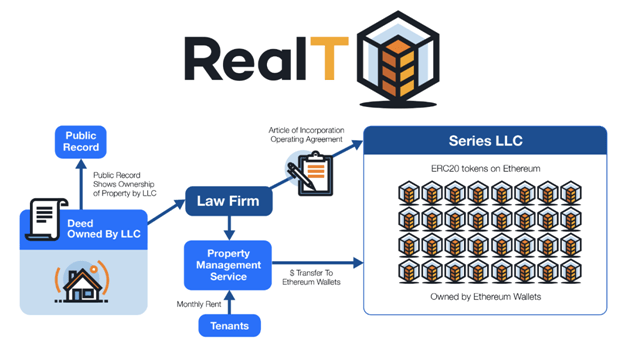

RealT is a system for tokenizing property ownership in the United States, retaining all legal rights and protections that are provided by traditional ownership of real estate.

RealT is a series LLC, a unique form of an LLC that allows for unlimited segregation of membership interests, assets, and operations into independent series. With that in mind, each series of the series LLC is treated as a separate entity. Because the purpose of the LLC Series is to own a single property, the LLC can be abstracted away, effectively taking ownership of RealT tokens of the underlying property.

Importantly, through the services of a property management company, each property can be maintained with minimal engagement from token holders despite having full legal rights over the property.

Getting Started with ReaLT

Step 1) Create Wallet

RealT is a platform that works with Ethereum based Wallets which means you need to register in a wallet like Metamask

It is a free secure wallet where you can store any ERC20 token which includes RealT token

Step 2) You Register using the below Link

RealT LINK FREE

While registering you provide the address of the netmask wallet where you will receive your RealT token as well as all future rental yield.

Step 3) Now you are all Set to buy

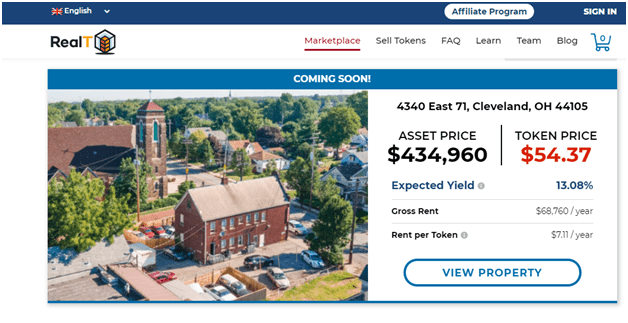

Choose your property. You can start as low as Dollar 50 !!

Pay using your metamask wallet. You will receive the token immediately and start earning rent from the next day

Step 4) You can sell your token within 24 hours once you decide

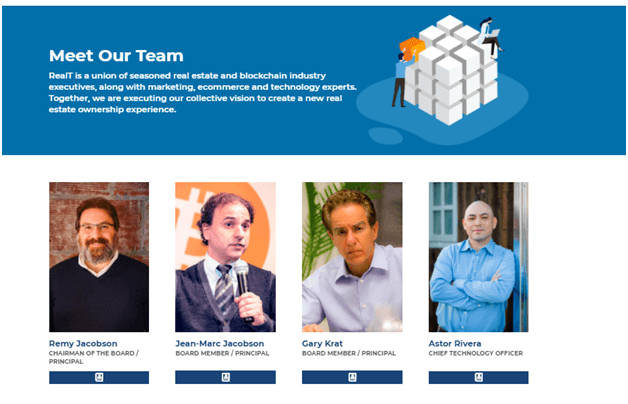

ReaLT Management

Founded in 2019, RealT is made up of a team of seasoned real estate and blockchain industry executives. RealT has three main board members: Remy Jacobson, Jean-Marc Jacobson, and Gary Krat. REALT has a very strong team with deep expertise in real estate as well as blockchain technology which is essential for platform of such nature

Historical Performance

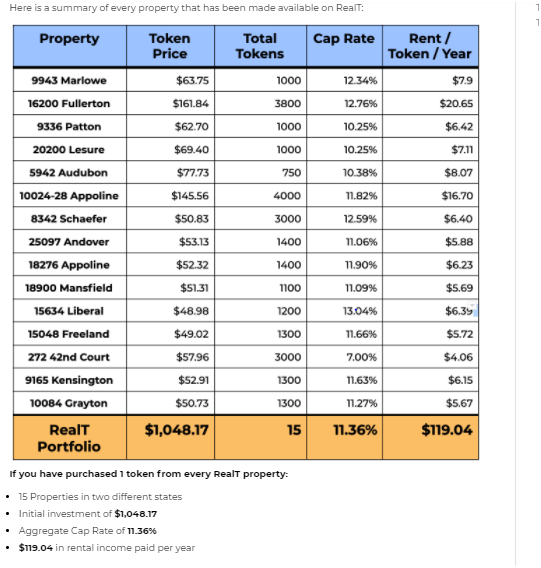

What if I Owned One Token of Every RealT Property?

RealT has recently passed $2,000,000 in Real Estate tokenized on Ethereum! In light of this milestone, they had shared a summary of the aggregate RealT portfolio.

RealT offers highly curated properties that look for aggressive growth in both rental income and capital appreciation. Because these properties are fractionalized into many different units, it’s easy to construct a diversified real estate portfolio! Some of these properties are reaching their 1-year birthday of being tokenized and available on Ethereum

If you had purchased one token of every RealT property, what would your real estate portfolio look like?

RealT’s first property, 9943 Marlowe, has reached its 1-year birthday of the first property ever to be tokenized as ERC20 tokens on Ethereum, and has paid its owners rental income consistently ever since inception.

Fullerton, Audubon, and Patton are close to their 1-year birthday as well, with the same level of consistency!

Investing in Section 8 with COVID-19

RealT specializes in investing in section-8 real estate properties. Section-8 properties are properties that are eligible for government-assisted living for low-income families. Many of RealT’s properties are recently renovated and brought up to section-8 standards in order to produce more and better housing for local communities.

Because of its curation of section-8 properties, RealT’s curation of real estate properties during the COVID-19 pandemic has proven to be a strong choice. Dependable, stable investments that returned 11.36% Y/Y in the last 12 months are few and far between, especially as the greater world seems to be going through a period of significant transition.

Of the 15 properties on the RealT platform, only one has had a tenant move out and vacate the property, causing a temporary loss in rental income. All other properties have maintained tenancy and timely rental payments, even in this time of uncertainty.

Conclusion

This platform is great for blockchain-savvy people. On one hand, you can start with only 50-60 USD on other hand you can sell the property whenever you wish. In the current scenario 10%+ yield on a real asset is a good investment

People who do not want to invest huge amount in real estate will find this platform very useful!